Syncracy: Application project revenues surpass most infrastructure, heralding the arrival of a new era led by applications

TechFlow Selected TechFlow Selected

Syncracy: Application project revenues surpass most infrastructure, heralding the arrival of a new era led by applications

The era of applications has arrived, and blockchain will therefore generate a more powerful non-sovereign digital store of value than ever before.

Author: Ryan Watkins

Translation: TechFlow

It is commonly believed that beyond Bitcoin and stablecoins, there are no other valuable applications in the industry. The last cycle’s momentum was said to be purely speculative, with little progress since the 2022 crash. The sector is now oversaturated with infrastructure that lacks real usage, and venture capitalists who funded this infrastructure may face losses due to poor capital allocation.

The latter part of this view holds some truth—markets are beginning to punish blind infrastructure investments, and long-term winners are emerging from the crypto economy’s foundation. However, the first part—that there are few applications relative to infrastructure and minimal progress since the last cycle—proves inaccurate when we examine the data.

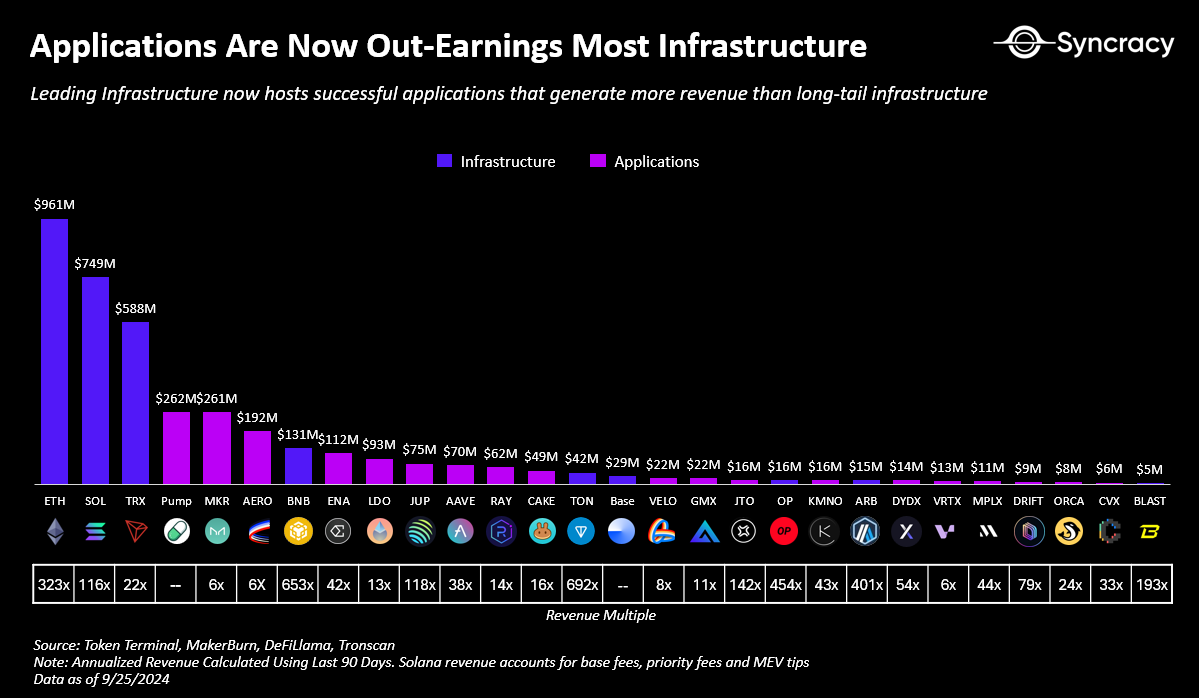

In fact, the era of applications has already arrived. Many apps now generate more revenue than infrastructure layers. Leading platforms like Ethereum and Solana host numerous applications generating tens or even hundreds of millions in annual revenue, growing at triple-digit percentages. Yet despite these impressive figures, applications trade at valuations far below infrastructure, whose average revenue multiples are around 300 times higher than those of apps. While foundational assets at the core of smart contract ecosystems—such as ETH and SOL—may retain a premium as stores of value, non-monetary infrastructure assets like L2 tokens could see their multiples compress over time.

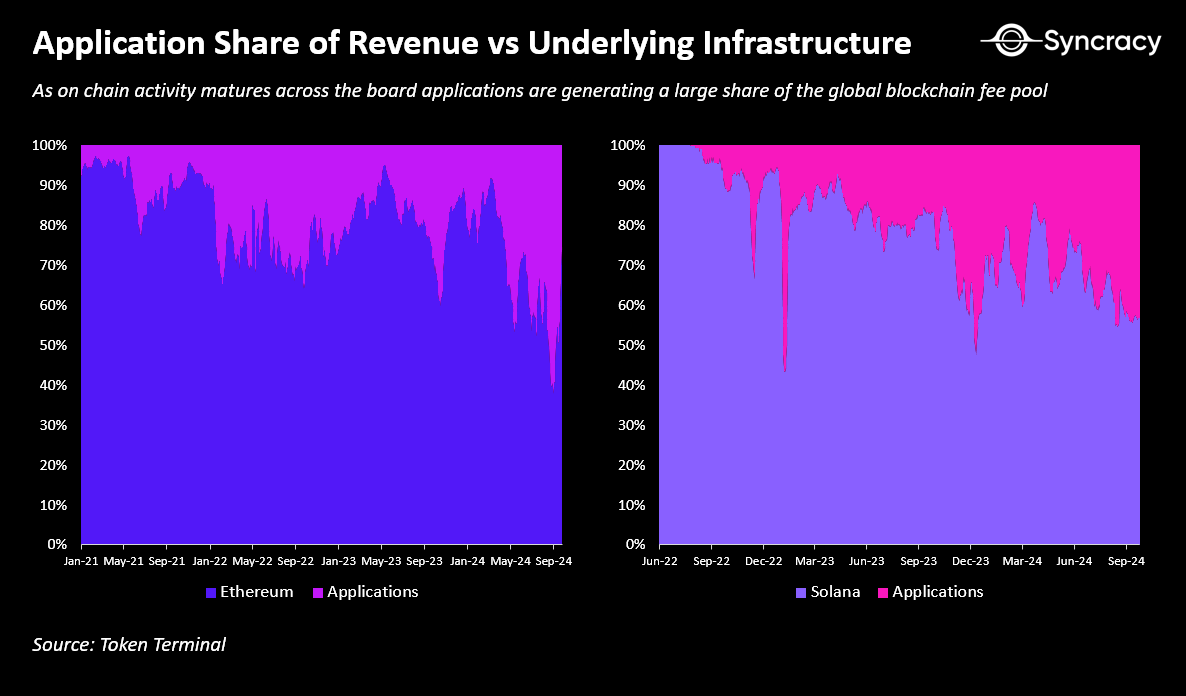

Applications are capturing a growing share of total global blockchain fees and out-earning most infrastructure assets—a potential turning point for future trends. Data from Ethereum and Solana, two dominant application ecosystems, already show apps gradually taking market share from underlying platforms in terms of revenue. As applications compete for larger economic stakes and vertically integrate to gain better control over user experience, this trend may accelerate. Even Solana apps—proud of Solana’s synchronous composability—are moving parts of their operations off-chain, leveraging secondlayers and sidechains for scalability.

The Rise of Fat Applications

Is the rollapp hypothesis inevitable? As applications strive to overcome the limitations of a single global state machine in efficiently processing all on-chain transactions, modularization across blockchains appears inevitable. For example, despite its strong performance, Solana began hitting bottlenecks in April this year when just a few million users were trading memecoins daily. While Firedancer may help, it remains unclear whether it can boost performance by an order of magnitude to support billions of daily active users, let alone AI agents and enterprises. As previously noted, Solana's modularization has already begun.

The key question is how extensive this shift will be—and how many applications ultimately move operations off-chain. Running the entire global financial system on a single server—the basic assumption behind any monolithic blockchain—would require full nodes to operate in hyperscale data centers, making independent verification of chain integrity nearly impossible for end users. This undermines a fundamental property of globally scalable blockchains: ensuring clear property rights and resistance to manipulation and attacks. In contrast, rollups allow applications to distribute bandwidth demands across independent sets of sequencers while preserving end-user verifiability via data availability sampling on the base layer. Moreover, as applications scale and build deeper relationships with users, they may demand maximum flexibility from their underlying infrastructure to better serve user needs.

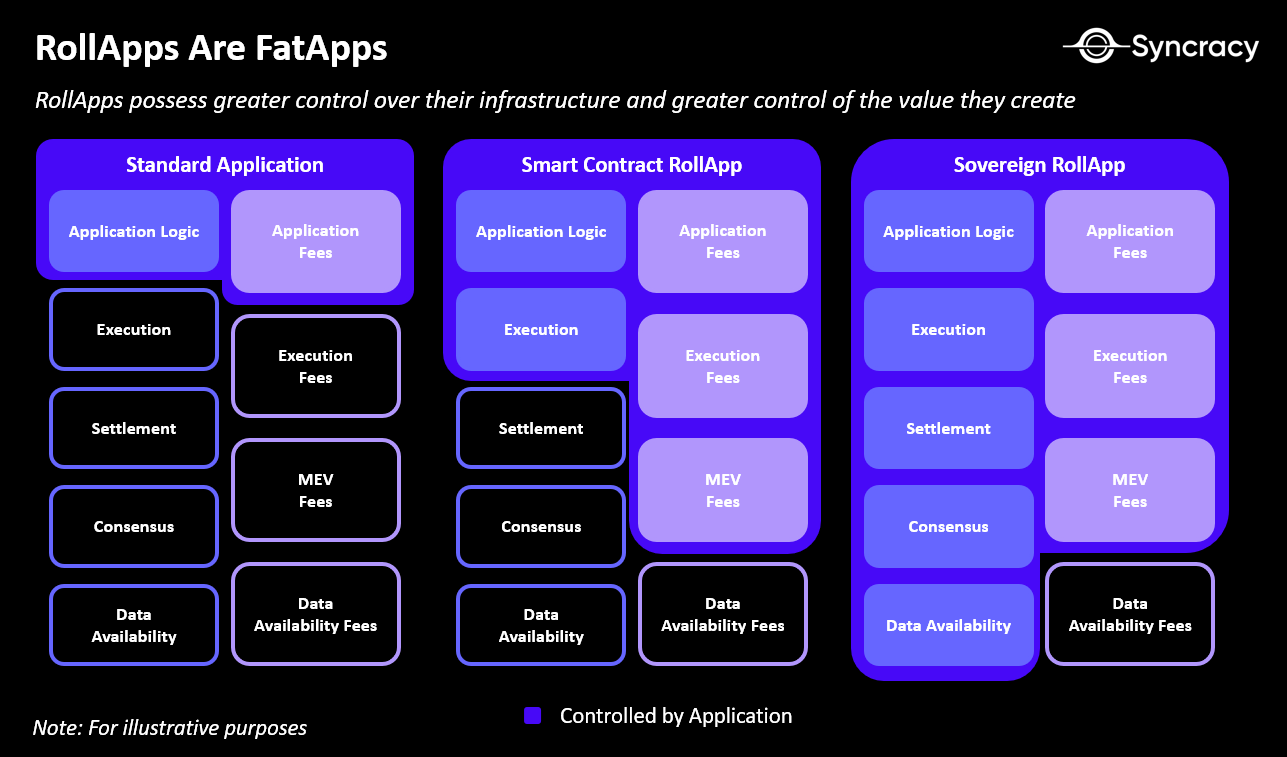

This is already happening on Ethereum, the most mature on-chain economy. Leading apps such as Uniswap, Aave, and Maker are actively building their own rollups. These applications are not only pursuing scalability but also driving features like custom execution environments, alternative economic models (e.g., native yield), enhanced access controls (e.g., permissioned deployments), and customized transaction ordering mechanisms. Through these efforts, apps enhance user value, reduce operational costs, and gain greater economic control over their foundational infrastructure. Chain abstraction and smart wallets will make this app-centric world increasingly seamless, gradually reducing friction between different blockspace environments.

In the short term, next-generation data availability providers like Celestia and Eigen will be critical enablers of this trend, offering applications greater scale, interoperability, and flexibility while ensuring low-cost verifiability. In the long run, however, every blockchain aspiring to underpin the global financial system must expand bandwidth and data availability while maintaining low-cost end-user verification. Solana, although conceptually monolithic, already has teams working on light client validation, zk compression, and data availability sampling to achieve exactly this.

The focus isn’t on specific scaling technologies or blockchain architectures. Token extensions, coprocessors, and ephemeral rollups are sufficient to enable monolithic chains to scale and offer customization to apps without breaking atomic composability. Regardless, the trajectory points toward applications continuing to pursue greater economic control and technical flexibility. It seems inevitable that applications will capture more value than their underlying infrastructure.

The Future of Value Capture in Blockchain

The next key question is: as applications gain increasing economic control in the coming years, how will value be distributed between apps and infrastructure? Will this shift become a tipping point where apps exert influence comparable to infrastructure in the years ahead? According to Syncracy, while apps will gradually capture a larger share of global blockchain fees, infrastructure (L1s) may still generate outsized returns for a select few participants.

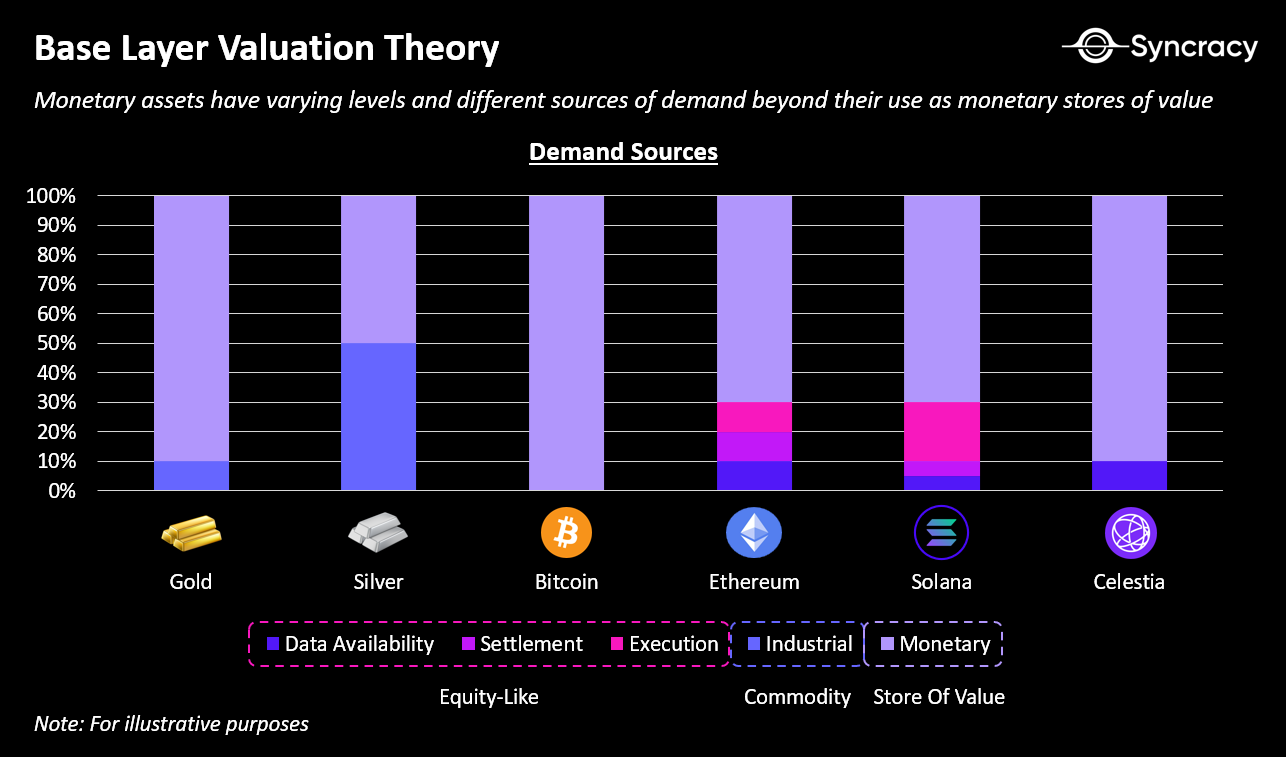

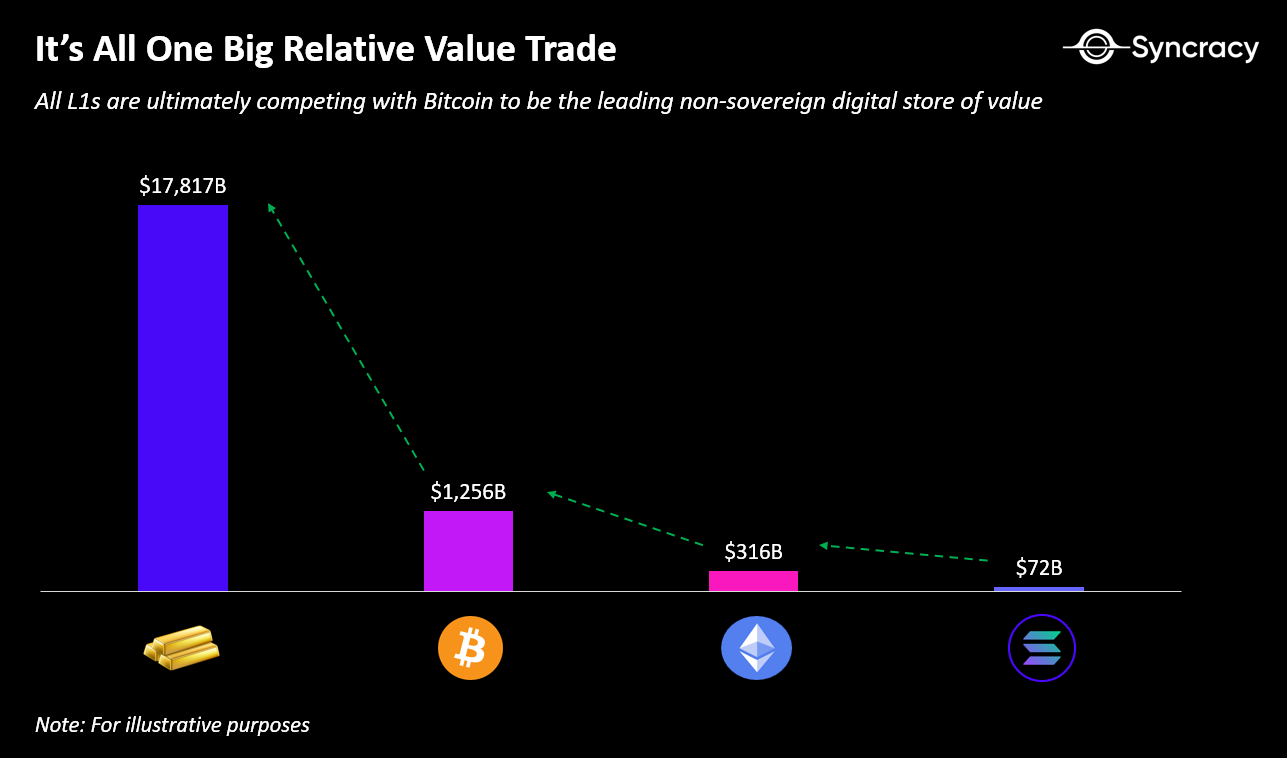

The core argument here is that in the long run, base-layer assets like BTC, ETH, and SOL will compete as non-sovereign digital stores of value—the largest market in crypto. While Bitcoin is often compared to gold and other L1 assets likened to equities, this distinction is largely narrative. At their core, all native blockchain assets share key traits: they are non-sovereign, resistant to seizure, and capable of cross-border digital transfer—features essential for any blockchain aiming to establish a digital economy independent of state control.

The main difference lies in global adoption strategy. Bitcoin directly challenges central banks by aiming to replace fiat currencies and become the dominant global store of value. In contrast, L1s like Ethereum and Solana aim to build parallel economies in cyberspace, creating organic demand for ETH and SOL as these economies grow. This is already happening. Beyond serving as mediums of exchange (for gas fees) and units of account (for NFT pricing), ETH and SOL have become primary stores of value within their respective economies. As proof-of-stake assets, they directly capture fees and maximum extractable value (MEV) generated by on-chain activity, offering the lowest counterparty risk and serving as the highest-quality collateral on-chain. By comparison, BTC, as a proof-of-work asset, offers no staking or fee yields and operates purely as a commodity money.

While the strategy of building parallel economies is highly ambitious, it may prove easier in practice than direct competition with national economies. Indeed, Ethereum and Solana’s approach mirrors historical paths nations have taken to secure reserve currency status: first build economic influence, then encourage others to use your currency for trade and investment.

Take MEV as an example—it is unlikely to become large enough to sustain current valuations, and its share of on-chain activity is expected to decline over time as more value is absorbed by applications. The closest analogue to MEV in traditional finance is high-frequency trading (HFT), which generates estimated global revenues between $10 billion and $20 billion. Furthermore, current blockchains may be capturing excessive MEV today; as wallet infrastructure and order routing improve, MEV revenues may shrink, especially as apps work to internalize and minimize MEV. Can we really expect MEV revenues on a single blockchain to surpass the entire global HFT industry, with all profits going to validators?

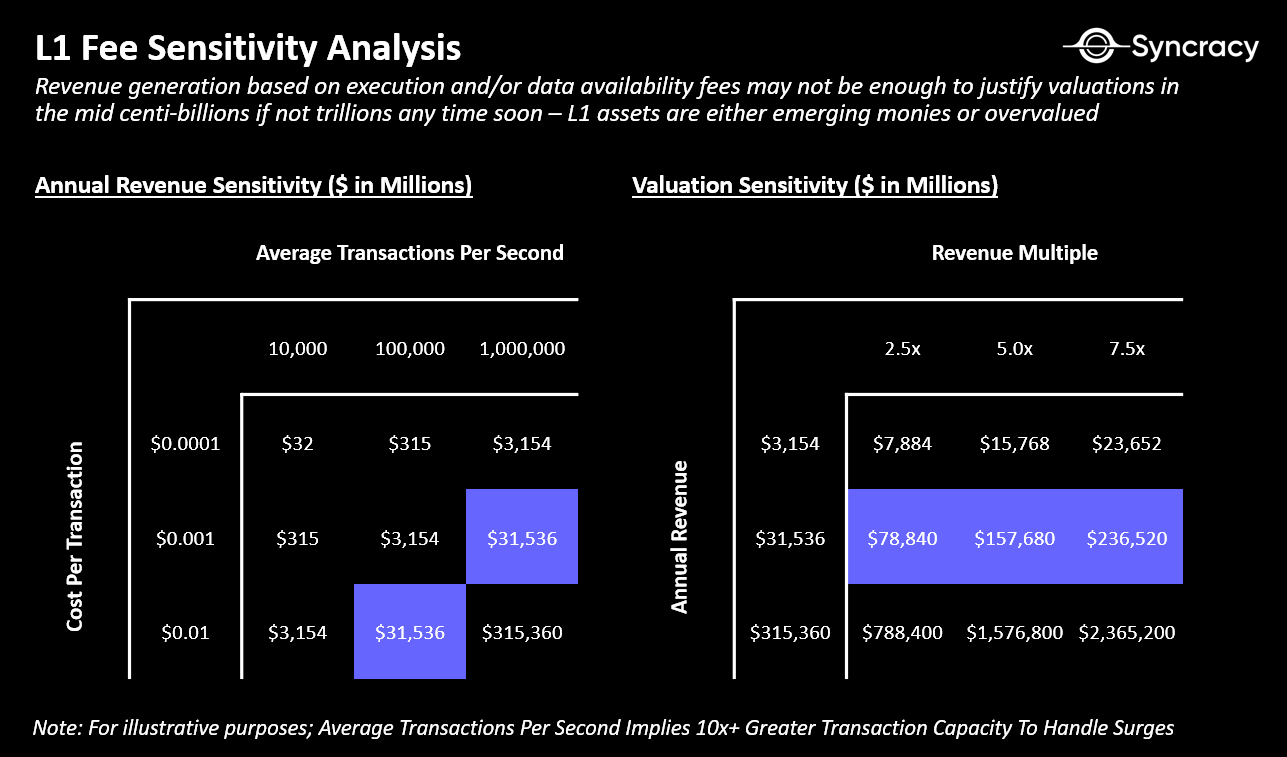

Likewise, while execution and data availability fees are attractive revenue streams, they may still fall short of supporting billion- or trillion-dollar valuations. Achieving that would require exponential growth in transaction volume while keeping fees low enough to drive mass adoption—a process that could take a decade.

Note: Visa’s processing capacity reaches up to 65,000 tps, though average throughput is typically around 2,000 tps.

So how do blockchains provide enough value to pay validators for their essential services? Blockchains can offer a permanent, tax-like subsidy through monetary inflation. Over time, asset holders lose a small portion of their wealth to subsidize validators who produce abundant blockspace—space that delivers value to applications and drives appreciation in the blockchain’s native asset.

Another, more pessimistic view is worth considering: perhaps blockchain valuations should be based on fees, but as applications gain more economic control, these fees may not sustainably support high valuations. This scenario is not unprecedented—during the 1990s internet boom, telecom companies attracted massive infrastructure investment, only for many to become commoditized. While firms like AT&T and Verizon adapted and survived, most value shifted to applications built atop their infrastructure—Google, Amazon, and Facebook. A similar pattern may unfold in crypto: blockchains provide the infrastructure, but application layers capture disproportionate value. However, in crypto’s early stage, this remains a grand relative-value contest—BTC wants to surpass gold, ETH aims to surpass BTC, and SOL targets ETH.

The App Era, the Crypto Era

Overall, the crypto economy is undergoing a major transformation—from speculative experiments to revenue-generating businesses and vibrant on-chain economies. These shifts are giving native blockchain assets genuine monetary value. While current activity may seem small, it is growing exponentially as systems scale and user experiences improve. At Syncracy, we believe that in several years, looking back at this period will feel amusing—why would anyone have doubted the value of this space when so many key trends were already evident?

The app era has arrived, and blockchain will thereby produce stronger non-sovereign digital stores of value than ever before.

Special thanks to Chris Burniske, Logan Jastremski, Mason Nystrom, Jonathan Moore, Rui Shang, and Kel Eleje for feedback and discussion.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News