In-Depth Analysis of World Liberty Financial's Value: A New Option Amid Trump's Campaign Funding Disadvantage

TechFlow Selected TechFlow Selected

In-Depth Analysis of World Liberty Financial's Value: A New Option Amid Trump's Campaign Funding Disadvantage

Investing in WLFI tokens is essentially a bet on Trump's election victory, akin to a political donation.

Author: Web3Mario

Abstract: First of all, happy Mid-Autumn Festival to everyone. During the holiday, I came across an interesting topic and decided to look into World Liberty Financial—a DeFi project deeply involving members of the Trump family—which has drawn significant attention recently. On September 17, during a Twitter Space session, further details were revealed, including WLFI token allocation and the project's vision. Donald Trump himself spent considerable time expressing strong optimism about the crypto space. So how should we assess the value of a project that seems far removed from typical "Web3 ethos"? After some research and reflection, I’d like to share my thoughts. In short, I believe the core value of World Liberty Financial lies in creating a new fundraising channel to alleviate Trump’s financial disadvantage in his 2024 presidential campaign. Investing in the WLFI token is essentially a bet on Trump’s election—functioning as political donation.

Negative Co-Founders and Vague Roadmap Make World Liberty Financial Controversial

Many articles have already introduced the background of this project; here’s a quick recap. Since its announcement, the project has been controversial, with criticism focusing on three main aspects:

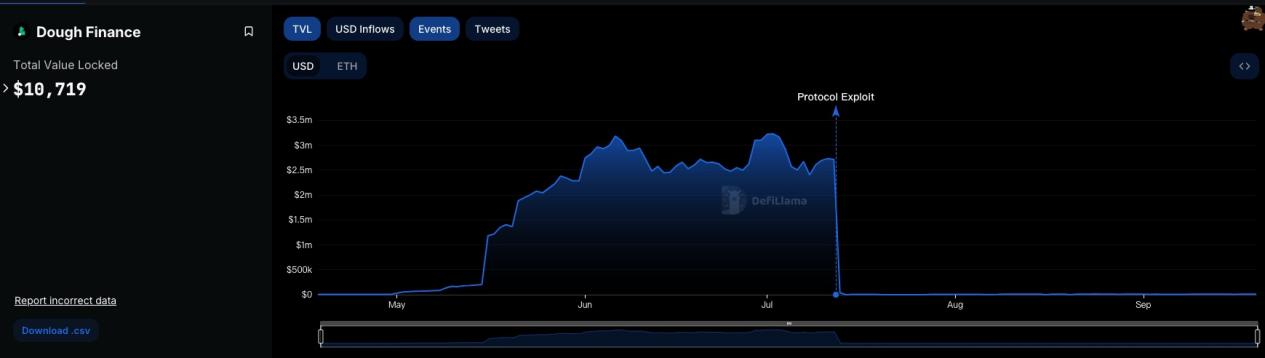

Negative Background of Co-Founders: The two key Trump family members involved—Eric Trump and Donald Trump Jr.—have little experience in the crypto industry. Their professional backgrounds are primarily in real estate. As such, most observers assume the actual operators are co-founders Zachary Folkman and Chase Herro. During the live session, Trump mentioned that Herro and Folkman were introduced to his sons through Steve Witkoff, a real estate investor. Prior to this, the duo launched a DeFi lending project called Dough Finance in April 2024, which suffered a flash loan attack on July 12, losing over $1.8 million, and has since become inactive. Beyond this, their professional histories don’t resemble those of typical tech or finance entrepreneurs. Folkman’s most notable prior project was “Data Hotter Girls,” a dating advice workshop, while Herro has a criminal record.

Unclear Product Roadmap: Despite aggressive but vague promotion by the Trump family over the past month, promising broad ambitions, the project has yet to release any concrete or detailed plans. During the Twitter Space, Folkman suggested the project does not aim to create new financial instruments but rather improve DeFi usability. During a fireside chat, Donald Trump Jr. shared his family’s experience of being “de-banked”—a term referring to individuals or companies facing difficulties accessing credit from traditional financial institutions. It’s clear the project will initially focus on lending, but this information still fails to convince many people of its vision or business logic.

Centralized WLFI Tokenomics: In the same session, Folkman outlined the WLFI token distribution: 20% allocated to the founding team (including the Trump family), 17% for user rewards, and the remaining 63% available for public purchase. This allocation sharply contrasts with typical Web3 projects. Most tokens are concentrated in the hands of the team and whales, with minimal incentives directed toward broader community participation.

So why would the Trump family strongly back such an unconvincing project, especially at this sensitive moment close to the election? The answer, I believe, is clear: to open a new fundraising channel and mitigate Trump’s financial disadvantage in the 2024 campaign. Thus, investing in WLFI is less about protocol utility and more about betting on Trump’s victory—it’s political donation in crypto form.

Trump’s Campaign Funding Is at a Clear Disadvantage, Prompting Demand for More Flexible Fundraising Channels

The U.S. federal government consists of three branches: legislative, judicial, and executive. The executive branch fills positions via appointment, hiring, or examination. The legislative branch—Congress—is composed of the Senate and House of Representatives, whose members are elected. The judicial branch sits between them, with varying rules across states. During his presidency, Trump appointed over 200 federal judges, significantly shifting the ideological balance of the federal judiciary—this explains his ability to push back against legal challenges earlier this year.

Elections are essentially political spectacles requiring massive spending on outreach to gain voter support, spanning both online and offline channels. Given that campaigning effectively begins a year before Election Day—much longer than movie releases or concerts—the capital required is orders of magnitude greater. Budgets typically increase as the election nears, accelerating expenditure.

Because Congress holds legislative power, political-business interest groups naturally emerge. Large entrepreneurs often fund politicians in hopes they’ll advance favorable legislation if elected. These contributions are known as political donations. To prevent excessive rent-seeking and outright corruption, U.S. laws regulate these activities. One such mechanism is the “527 organization,” a tax-exempt entity designed specifically to raise funds supporting candidates. There are various subtypes with different rules regarding donation size and usage.

Typically, a politician’s fundraising fluctuates based on performance or unexpected events, as donors contribute in stages. A poor debate performance or sudden scandal can undermine donor confidence and halt contributions. Therefore, fundraising trends closely reflect a candidate’s electoral momentum.

With this context, let’s compare the 2024 fundraising efforts of Trump and Harris. The gap manifests in two key areas: total funding and spending efficiency.

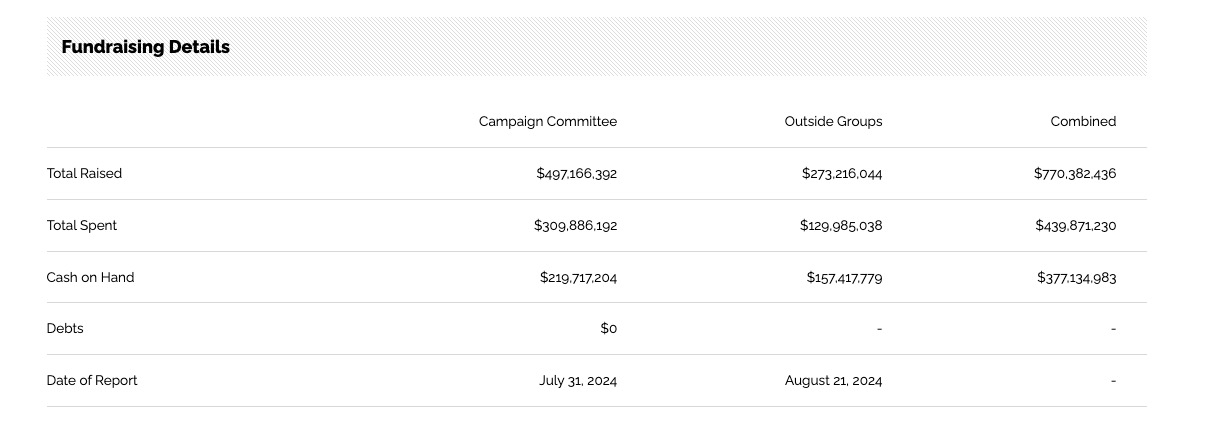

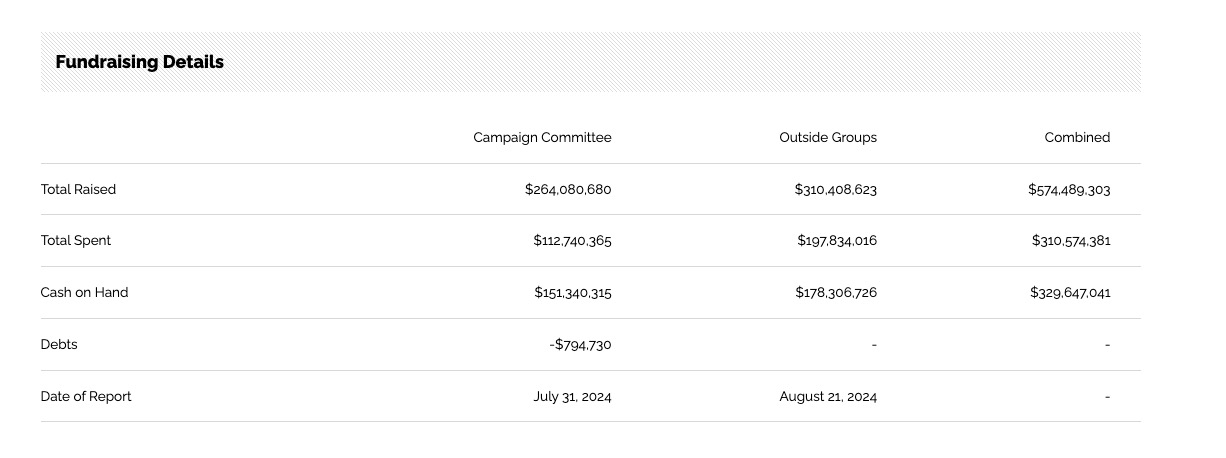

In terms of total funds raised, Democrats have consistently outpaced Republicans, a trend that intensified after Harris became the official nominee. Democratic support appears consolidated behind this relatively inexperienced candidate. To date, Harris’ campaign has raised $770 million, spending $440 million. Trump’s team has raised $570 million, spending $310 million. Whether measuring remaining cash reserves or money already spent, Trump faces a clear financial disadvantage. This helps explain why, despite surviving an assassination attempt and forcing Biden’s exit, Trump’s momentum has continued to wane. Following last week’s first presidential debate, Harris clearly outperformed Trump in rhetorical skill, raising $50 million within 24 hours—a testament to her formidable fundraising power.

The composition of their donor bases also reveals telling differences. After Biden attracted billionaires like Michael Bloomberg and LinkedIn co-founder Reid Hoffman, Harris gained backing from several high-profile figures, including Hoffman, Netflix co-founder Reed Hastings, former Meta COO Sheryl Sandberg, and philanthropist Melinda French Gates. On July 31, over 100 venture capitalists signed a letter endorsing Harris and pledging support, including Mark Cuban, Vinod Khosla, and Chris Sacca. Trump’s core supporters include banker Timothy Mellon, WWE executive Linda McMahon, energy executive Kelcy Warren, ABC Supply founder Diane Hendricks, oil magnate Timothy Dunn, conservative donors Richard and Elizabeth Uihlein, and Tesla CEO Elon Musk. Notably, Harris’ backers are largely from emerging tech industries, while Trump’s base remains rooted in traditional sectors. Online outreach favors Harris—but thanks to Musk’s ownership of X (formerly Twitter), Trump now has a powerful platform to counter this imbalance. His digital campaign will undoubtedly center around X.

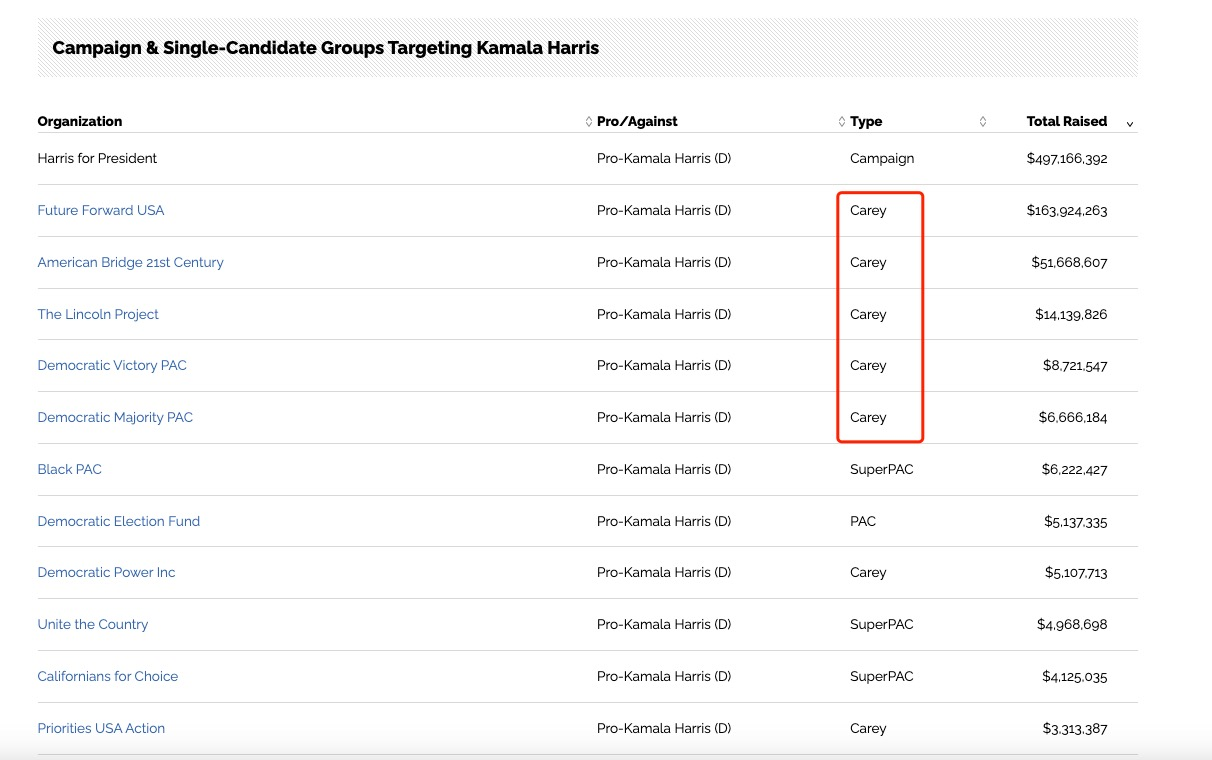

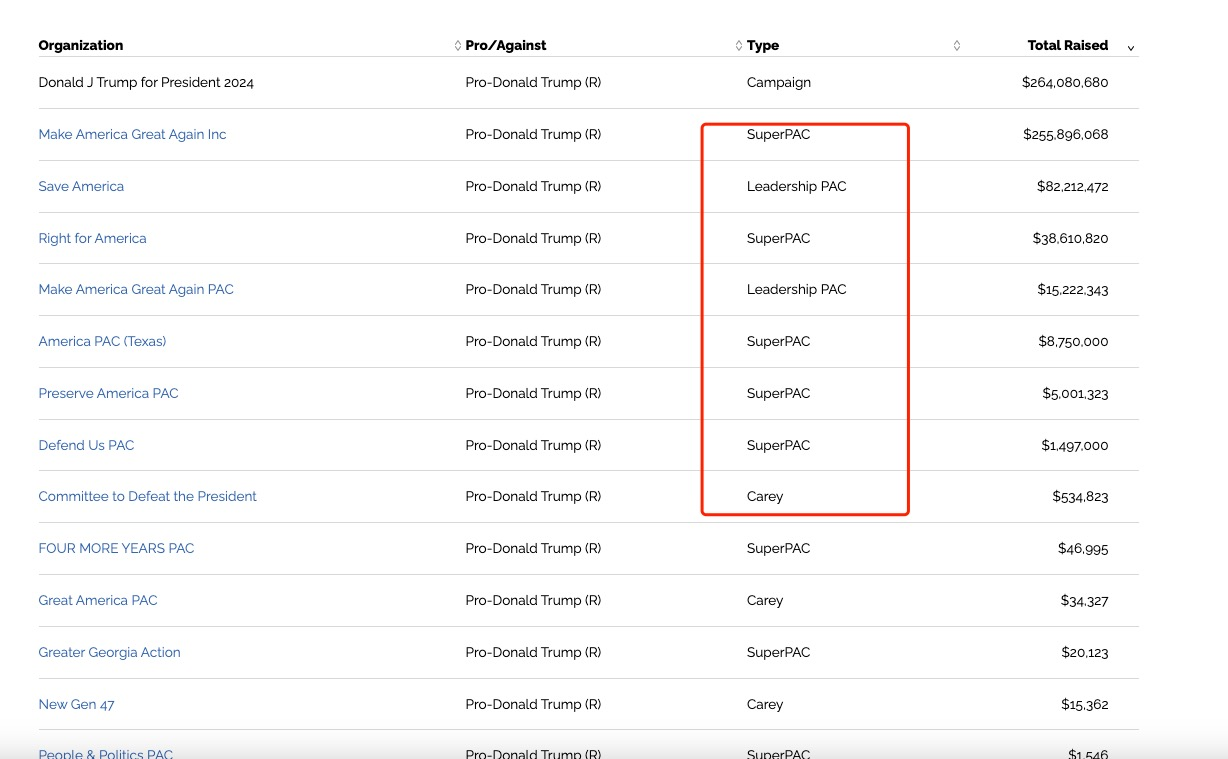

Looking at specific funding vehicles, Harris primarily uses the Carey Committee, while Trump relies on Super PACs. Both fall under the umbrella of 527 organizations and allow unlimited donations. However, the Carey Committee offers greater flexibility with two separate accounts: one for traditional, regulated contributions (directly to candidates/parties) and another for unrestricted independent expenditures (ads, campaigns). In contrast, Super PACs cannot coordinate directly with candidate campaigns or donate directly to them. This structural difference significantly reduces Trump’s fund utilization efficiency compared to Harris.

This may challenge the common perception that Trump, as a wealthy businessman, holds a financial edge. The reality is the opposite: Harris currently enjoys a clear funding advantage—and it’s widening. Under these circumstances, launching a half-baked crypto project becomes understandable: it’s an attempt to tap into more flexible, alternative fundraising streams. It also serves as a tangible gesture to appease pro-crypto voters. Taking such risks is deemed worthwhile. Moreover, announcing early that WLFI will comply with Regulation D for fundraising helps contain legal exposure—this is the key safeguard.

For Trump’s team, there are multiple ways to benefit beyond direct ICO proceeds. One intriguing possibility is leveraging the lending platform to cash out. Recall Donald Trump Jr.’s comments about the family’s de-banking struggles. If World Liberty Financial launches successfully and attracts deposits, the team could use their large holdings of WLFI tokens as collateral to borrow real fiat currency without heavily impacting the token’s secondary market price—similar to what Curve’s founder did. This could indeed help address their liquidity constraints.

Taking all this into account, I see no reason to doubt the project’s launch. Investing in WLFI is not about decentralized finance innovation—it’s a proxy bet on Trump winning, equivalent to making a political donation. This model will likely resonate with many crypto-affluent individuals. The project’s long-term viability hinges entirely on the election outcome. If Trump wins, this resource-driven initiative will easily find direction and purpose. If he loses, overwhelmed by ongoing legal battles, the Trump family will likely abandon it altogether. As retail investors, we must remain cautious and discerning about these dynamics.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News