Lightspark co-founder: What does World's entry into the US market mean for Web3?

TechFlow Selected TechFlow Selected

Lightspark co-founder: What does World's entry into the US market mean for Web3?

You can't launch a top-tier, truly global crypto wallet without relying on existing infrastructure.

Author: Christian Catalini, Co-founder of Lightspark and MIT Cryptoeconomics Lab

Translation: Luffy, Foresight News

A few weeks ago, Alex Blania of World (formerly Worldcoin) unveiled the company's latest plans to a group of crypto insiders. The fact that the company chose the relatively favorable U.S. regulatory environment for its debut is notable in itself, but the real turning point lies in World’s push into mainstream markets—an indication that cryptocurrency is moving beyond early adopters and into everyday commerce.

There's no denying that World is making a bold bet: convincing Americans to trade iris scans for a cryptographically secured "I am human" credential is no easy task—regardless of privacy safeguards—and may even be premature. Yet the team has quietly reduced the risks of this plan across multiple dimensions in recent years (details below).

What lessons can founders and developers of crypto projects learn from World’s evolution?

Build Real Utility First, Then Use Tokens to Amplify Appeal

World once heavily relied on crypto tokens to drive user adoption. But this strategy—often seen as Bitcoin’s success formula and endlessly copied—completely reverses cause and effect. As World discovered during its early rollout, it also led to unintended consequences: privacy advocates and others criticized that excessive incentives masked the need for genuine utility among early users.

Bitcoin gained traction because it introduced a neutral, fixed-supply asset outside central bank control. True, mining rewards and expectations of soaring prices attracted speculators, followed by institutional investors and some sovereign nations. But long-term builders were drawn to its disruptive potential as a new type of asset and payment system—not merely as a get-rich-quick scheme. Since then, we’ve seen thousands of Bitcoin clones attempt the same playbook, most now lying dead in the graveyard of failed crypto projects.

Cryptocurrency cannot bypass basic economic laws. Like any startup, crypto projects must first build real utility, then use tokens to accelerate adoption or fix market failures within their ecosystem. In short, while economists may enjoy playing engineer, their ideas only shine when a project already has inherent appeal.

Blania (World co-founder Alex Blania) frames World’s “proof-of-personhood” system as a solution for areas like dating, gaming, and credit—where bots are already mingling with humans—and explains why submitting an iris scan might be a worthwhile gamble.

It’s no surprise that World, co-founded and chaired by OpenAI’s Sam Altman, is tackling this problem. As AI grows more sophisticated, the need for a reliable, cryptographically secure method of verifying human identity will become critical. World may be ahead of this curve, but it’s addressing a massive societal challenge we’ll all soon face.

Navigate the 'Reverse Integration' of Crypto Infrastructure

In crypto’s early days, we were all swept up in the hype. When I designed Bitcoin experiments at MIT, I genuinely believed cryptocurrencies would transform payments and financial services within just a few years. A decade later, we’re only just getting started.

Delivering real utility beyond crypto bubbles means matching the user experience consumers and businesses expect from traditional solutions. Yes, this requires bridging old and new infrastructures—a compromise that may seem entirely illogical to crypto purists.

You can’t skip the awkward phase where old and new infrastructures overlap. Andreas Antonopoulos calls this “infrastructure reverse compatibility.” Imagine using a 56k modem over analog phone lines in the 1990s, or the first cars bumping along gravel roads built for horse-drawn carriages.

This is when the new technology is truly at a disadvantage, limiting it to narrow, point solutions rather than systemic transformation. For a similar perspective in AI, see research by Ajay Agrawal, Avi Goldfarb, and Joshua Gans (https://www.youtube.com/watch?v=aRoicN4k5LI). Before a technology can truly shine, entire ecosystems must shift and adapt.

The early version of World tried to skip this reverse integration phase by putting tokens at the core. Today’s reboot flips that logic: it adopts an infrastructure-first approach and launches with real utility.

You still can’t launch a world-class, truly global wallet without attaching to legacy infrastructure. Moving money in and out needs to feel effortless—like the magic PayPal delivered when online payments were still unstable. That seamless flow is essential for any crypto wallet to go mainstream.

This is precisely why World App’s integrations with Stripe and Visa are so compelling—they bring familiarity, trust, and immediate utility from day one. This backward compatibility also allows existing players to participate, enabling them to track new entrants and actively launch competing services.

The same dynamic is bringing cryptocurrency into the backend of cross-border payments for businesses and consumers. Long-term, the technology may take center stage, but for now it must coexist with traditional infrastructure to drive adoption and eliminate friction. Many crypto concepts only shine at scale—but without user-friendly entry points, they stall before reaching that threshold.

Crypto Success Depends on Exceptional Execution

Like any new technology, widespread adoption of cryptocurrency is far from guaranteed. More specifically, decentralization—the core principle of crypto—is anything but certain.

The success of stablecoins shows that demand for connecting crypto with traditional systems creates useful tools, but it also risks reintroducing centralized control and closed networks into what should be an open financial system. I’m betting open architectures will win; otherwise, what’s the point? But entrenched players have incentives to stop it.

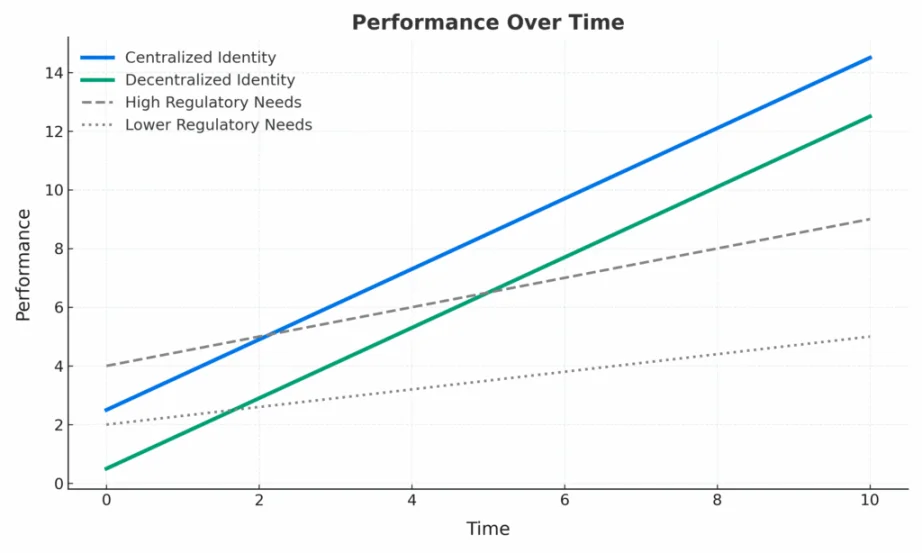

Blania and his team are betting that consumers will value decentralized control over their data, and that businesses will build better experiences on top of it. I’ve previously written about the challenges decentralized identity faces in disrupting the status quo, and how centralized players start with clear advantages in user experience and functionality. To surpass incumbents, World must first convince users to entrust it with their biometric data. With the U.S. launch underway, we’ll soon see whether the team has struck the right balance between trust and convenience.

A gentler onboarding path is imaginable: offering an immediately useful benefit before asking for an iris scan—a familiar verification badge that unlocks extra features in apps users already love. Of course, this trade-off results in weaker authentication, vulnerable to abuse.

Blania may be right that, in an endless cat-and-mouse game with AI, high-grade biometrics will be the only reliable proof of personhood. Still, he could have eased users into it rather than demanding iris scans on day one. AirDrop chasers might line up for tokens, but once subsidies end, that incentive vanishes. Sustainable momentum grows when you deliver tangible daily value—and that’s where the real potential lies. World App’s payment experience, combined with frictionless global on- and off-ramps, may well be the key to achieving this.

As aggressive rollout plans move forward, we’ll soon see whether crypto can break into the mainstream—especially if World can prove that crypto means both privacy and convenience. Apple achieved this by saving a few seconds every time Face ID unlocks a phone; Clear did it by guiding travelers to shorter TSA lines. World needs to deliver that same “wow” moment the very first time a user taps pay.

Conclusion

No matter the outcome of World’s experiment, I hope more crypto teams shift focus from tokenomics and price movements toward building products people use every day. Because this unglamorous pivot is exactly the bridge the crypto industry must cross to earn a place in the mainstream.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News