Ethereum's dilemma: user numbers have been declining since 2021, and it needs to reclaim pricing power in its collaboration with L2s

TechFlow Selected TechFlow Selected

Ethereum's dilemma: user numbers have been declining since 2021, and it needs to reclaim pricing power in its collaboration with L2s

Ethereum's L2 roadmap has succeeded in scaling, but this is only half the success.

Author: 0xLouisT

Translation: TechFlow

-

"God laughs at people who complain about the consequences while cherishing the causes." – Bossuet

In recent months, criticism of Ethereum's L2s has gained momentum—but it’s misdirected. Many blame L2s for Ethereum’s underperformance, claiming the scaling strategy has failed. As ETH’s value declines, holders are searching for scapegoats, yet we’re overlooking the real issue—we bear partial responsibility for some of the root causes.

Causal Analysis

Let’s examine the consequences people are complaining about—these are clear enough:

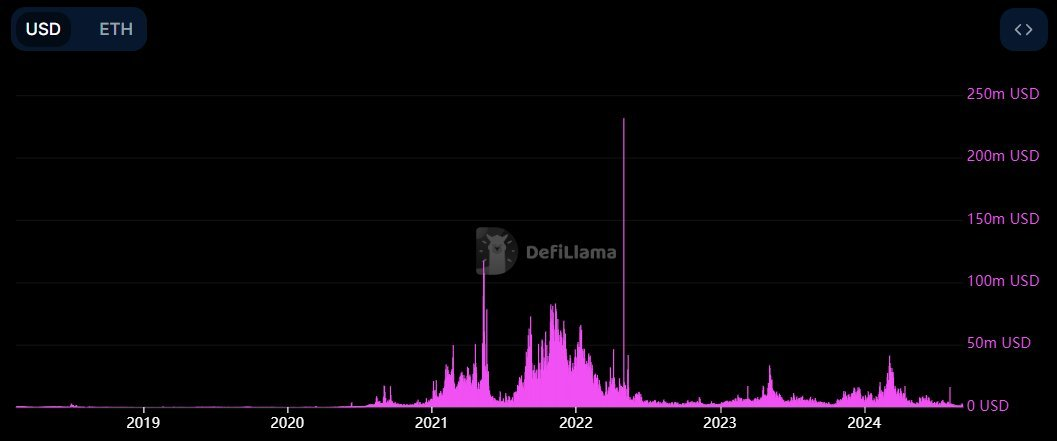

1. Drastic Decline in ETH Revenue: Ethereum is responsible, due to its scaling roadmap. However, this doesn’t mean failure. Ethereum’s scaling plan aims to grow user numbers by 100x through lower fees and higher throughput. The goal was to reduce transaction costs on L2s by 100x—and that target has been achieved. Yet despite these fee reductions, user activity hasn't grown as expected; instead, it has steadily declined since 2021. Even with fees reduced 100x, if accompanied by a 100x increase in activity, revenue would naturally stabilize and ETH’s income could return to prior levels. Therefore, we need to grow Ethereum’s user base by 100x.

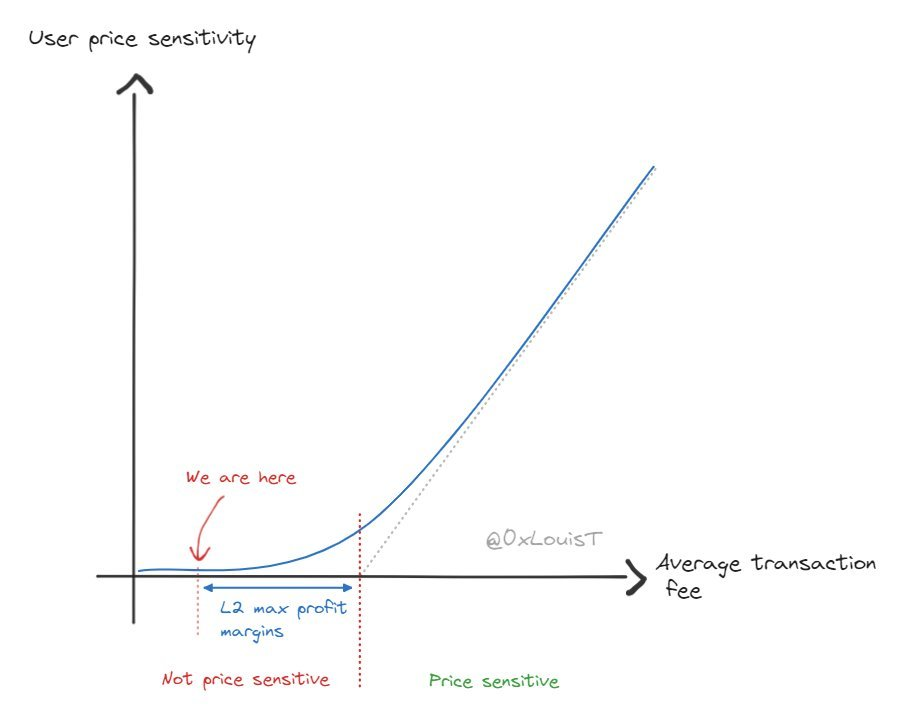

2. Impact of L2s on L1: Indeed, L2s can set their own fees, and when those fees are just cents or a few dollars, users tend to be price-insensitive. This mechanism is flawed because it allows L2s to capture high margins from user fees. –> Ethereum needs to reclaim pricing power.

3. L2s Have Failed to Attract Sufficient Users: L2s were never intended to single-handedly drive a 100x growth in user numbers; they are tools to enable growth, not the primary engine. We need to reignite interest in Web3. –> We need to grow Ethereum’s user base by 100x.

How Do We Solve These Issues?

We’ve now identified two key problems fueling the ongoing debate around L2s:

1. We Need to Grow Ethereum’s User Base by 100x

Simply lowering transaction fees won’t restore demand for ETH block space. The crucial question is: how do we achieve 100x user growth? While there’s no definitive answer, several factors may be critical. In my view:

-

We must attract users through new innovations and use cases.

-

A bull market will significantly boost demand for ETH block space: price shapes sentiment. Imagine if ETH reached $10,000—we wouldn’t be having this conversation today.

2. Ethereum Needs to Reclaim Pricing Power

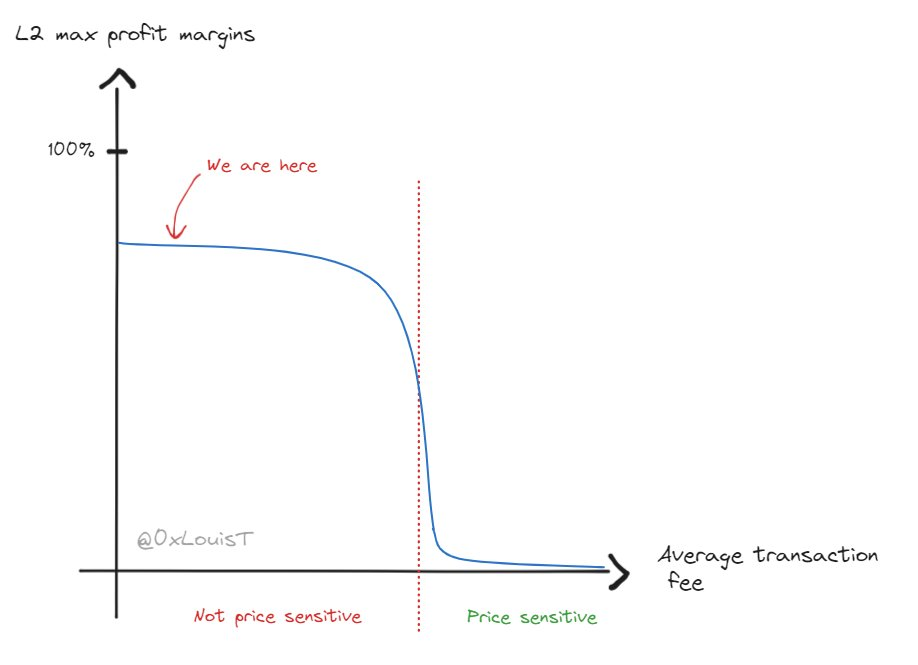

Although ETH still holds ultimate pricing authority, the current state resembles a car stuck in low gear. If L2s are capturing large profits from user fees, it suggests Ethereum’s base pricing may be too low. The root issue lies in the network-wide fee structure being set too low. When fees are only a few dollars or cents, users typically don’t care. But as overall L2 activity grows, fees will gradually rise until they reach a threshold where users start paying attention (as shown below).

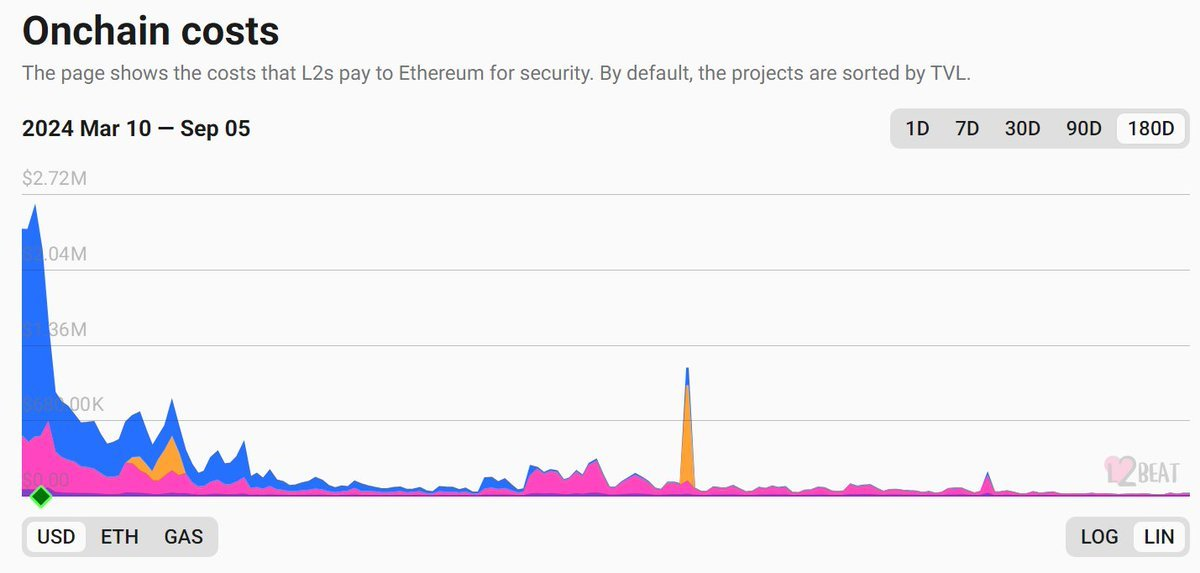

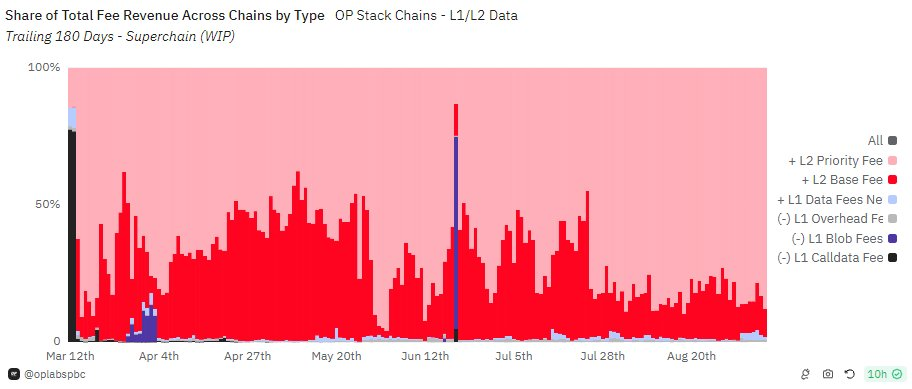

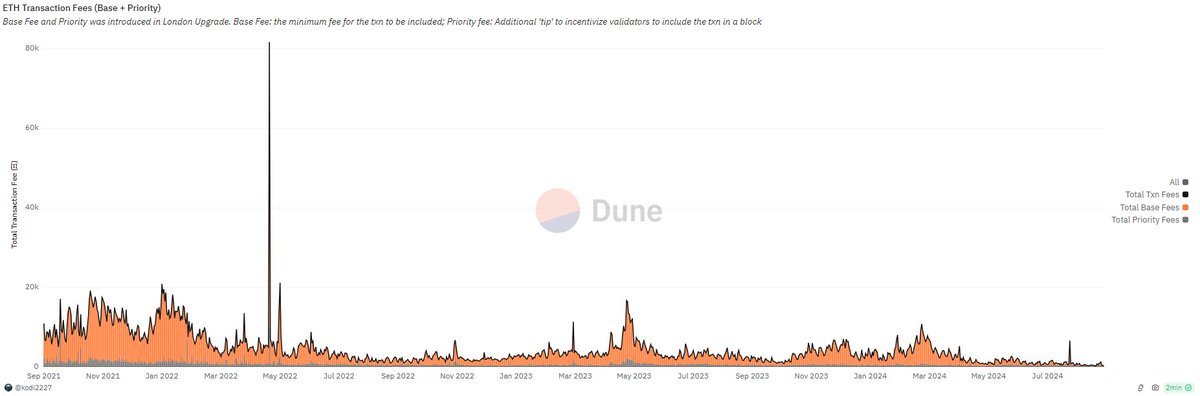

Currently, the base fee on L2s is too low relative to priority fees (see chart below). Ideally, the ratio between base and priority fees should increase, approaching levels seen on Ethereum L1 over the past few years (shown below).

At that point, L2s would face intense price competition, reducing their margins to remain competitive on fees. This is precisely when ETH begins to reclaim pricing power (as illustrated below).

The conclusion is clear: Ethereum’s scaling plan did not anticipate operating at such low user volumes. To regain pricing control over L2s, ETH must grow its user base to 100 times current levels. The network wasn’t designed for such low utilization.

Two Visions That Aren’t Mutually Exclusive

Finally, let’s consider two major visions often cited by Ethereum holders:

1. ETH as Sound Money: Since EIP-1559, ETH has entered a deflationary state, aligning with its vision as sound money. However, the emergence of L2s—which drastically reduce transaction fees—has weakened this narrative, making it less convincing and lacking consensus.

2. ETH as a Scalable Computing Network: The scalability roadmap shifts ETH’s vision toward becoming a cheap, scalable computing layer, prioritizing scalability over deflation and monetary soundness.

At first glance, these two visions appear incompatible—but they aren’t. Both depend on demand: if activity surges 100x, the resulting fee increases could push ETH back into deflation. Ethereum can simultaneously fulfill both visions—sound money and scalable computation. The key is increased activity.

In short: Ethereum’s L2 roadmap has succeeded in scaling—but only halfway. Blaming L2s, the technology, or even Vitalik for ETH’s income and price performance is misguided. The real challenge is growing the user base 100x; without it, ETH risks losing relevance.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News