Analyzing the Underlying Logic of the Current Market Decline: A Tech Sector Deleveraging Wave Triggered by Nvidia's Slowing Growth

TechFlow Selected TechFlow Selected

Analyzing the Underlying Logic of the Current Market Decline: A Tech Sector Deleveraging Wave Triggered by Nvidia's Slowing Growth

NVIDIA, the core driver of this bull market, has begun experiencing valuation de-leveraging, prompting capital to accelerate deleveraging in the tech stock sector to mitigate risks.

Author: @Web3Mario

Summary: Last week, risk assets faced certain pressures. Especially after the release of key U.S. data such as August's non-farm payroll and unemployment rate on Friday, markets saw a significant pullback. However, while the data missed expectations slightly, it wasn't particularly bad. Therefore, we need to dig deeper into what actually happened. Over the weekend, I summarized some relevant logic and insights, which I’d like to share. Overall, the core reason behind this downturn appears on the surface to be the “weaker-than-expected rebound” in U.S. non-farm employment data, which has somewhat heightened concerns about a potential U.S. recession. But fundamentally, it was triggered by NVIDIA’s Q2 earnings report showing a slowdown in growth. As the primary engine driving this bull market, NVIDIA began devaluing its valuation multiple, prompting capital to accelerate deleveraging across the tech sector to mitigate risks.

U.S. Non-Farm Data Below Expectations, But Not Terrible

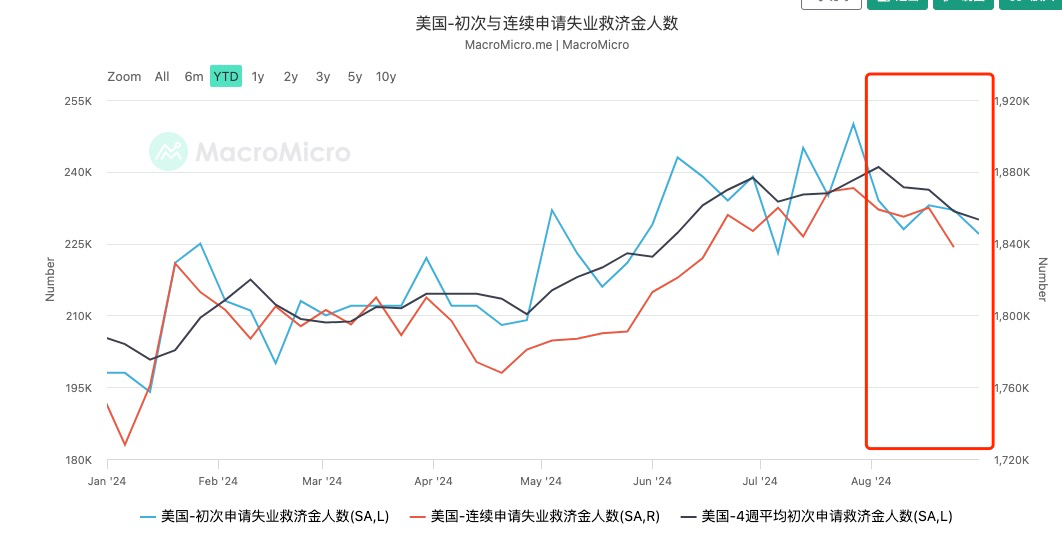

First, let’s briefly review the changes in non-farm payrolls and unemployment rate that contributed to Friday’s crypto market decline. The U.S. added 142,000 jobs in August, up from 89,000 in July—indicating improvement in the labor market—though still short of the expected 165,000. Meanwhile, the unemployment rate declined slightly from 4.3% in July to 4.2%, in line with market expectations.

In previous articles, I’ve already analyzed how these trends could be anticipated through weekly initial jobless claims. Throughout August, both initial claims and continuing claims showed a downward trend, indicating solid recovery in the labor market. Therefore, I remain skeptical of the narrative that the non-farm data sparked severe fears of an economic downturn. The resulting drop in crypto markets was likely just a catalyst triggering feedback within an ongoing deleveraging cycle.

Given that this data doesn’t seem especially alarming, why did it trigger such volatility in crypto markets? In my view, the fundamental reason lies in deleveraging prompted by NVIDIA’s slowing revenue growth revealed in its Q2 earnings.

Slowing Earnings Growth Fails to Meet Capital Expectations: NVIDIA Begins Devaluation, Tech Sector Deleveraging Accelerates

The core driver of this bull market has been the AI sector led by companies like NVIDIA. On August 29, NVIDIA released its Q2 2024 financial results. While growth remained positive, the report triggered sell-offs due to sharply decelerating EPS (earnings per share) growth, sparking panic and leading the market to revalue the stock downward. Let me briefly explain the underlying logic: stock prices reflect market valuations based on financial metrics, forecasts, and information used to assess a company’s worth. The goal of valuation is to determine whether a stock is fairly priced relative to its earning potential or asset base. One basic method is the price-to-earnings ratio (P/E), comparing a stock’s price to its EPS. Since a stock’s intrinsic value stems largely from dividend rights, P/E essentially measures how many years it would take to recoup your investment purely through dividends.

This also explains why high-growth tech sectors typically command higher P/E ratios—investors tolerate premium valuations because they expect accelerating future earnings growth. This forward-looking discount is reflected in higher stock prices.

With this background in mind, let’s examine what NVIDIA’s latest earnings reveal. At its core, the sharp deceleration in EPS growth has raised concerns about overvaluation. The chart below clearly illustrates this: the top half shows NVIDIA’s stock price, while the bottom tracks year-over-year EPS growth. It’s evident that Q2 EPS growth slowed significantly compared to Q1, and the downward trend is intensifying.

Recall that over the past six months, there’s been widespread debate about whether NVIDIA’s stock was overvalued. Ahead of each quarterly report, price volatility emerged—but each time, NVIDIA silenced critics with strong, above-expectation growth, bringing its P/E ratio back toward reasonable levels. This created a kind of market inertia: even as NVIDIA rose to become the world’s most valuable company, sky-high growth expectations persisted. This persistence was partly due to the current restrictive interest rate environment, under which most industries face pressure. Thus, this rare growth outlier naturally attracted capital seeking shelter from high rates. But this quarter’s performance failed to meet increasingly elevated expectations—it didn’t pull the P/E ratio back down to around 46, a level perceived as fair. This suggests the stock may be overpriced, prompting the market to cut its valuation. Indeed, after fully digesting the August 29 earnings, NVIDIA’s stock plunged when trading resumed on September 3 (after Labor Day), adjusting its P/E ratio to approximately 46. Whether further declines will occur depends on institutional outlooks. For now, sentiment remains relatively optimistic, with no strong bearish signals emerging.

As previously discussed, the Japanese yen served as a critical source of cheap leverage funding under high-interest-rate conditions, especially given Japan’s semiconductor industry ties to NVIDIA. During NVIDIA’s rise, yen-denominated leveraged positions played a key role. Now, with valuation corrections underway, we can observe that despite repeated assurances from the Bank of Japan, markets have effectively restarted deleveraging to reduce risk exposure. Starting September 3, USD/JPY rapidly fell from 147 to 142, approaching the年初 low of 140.

The yen’s rapid appreciation increases the cost of leveraged funds, squeezing arbitrage profits and further fueling deleveraging—a dangerous negative feedback loop we must watch closely.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News