Bull Market Boring? Five High-Yield Stablecoins to Keep Your Funds Working

TechFlow Selected TechFlow Selected

Bull Market Boring? Five High-Yield Stablecoins to Keep Your Funds Working

Holding some stablecoins might be a good choice while waiting for better opportunities.

Author: The Black Swan

Translation: TechFlow

Last week we had some "false" hope, feeling like we were out of the woods, but this week has brought disappointment once again.

Today, let's look at several stablecoins you can hold—each generating yield in different ways.

Holding certain stablecoins might be a smart move while waiting for better opportunities. Below are the five best-yielding stablecoins right now (perfect for this dull "bull market").

Introduction

The current market has left many people disappointed. Some have chosen to exit, while others remain pessimistic, discussing politics and other non-crypto topics. Your social media feeds are filled with discussions unrelated to cryptocurrency.

At times like these, crypto enthusiasts often rest and recharge by hunting for the best protocols—especially providing liquidity (LP) with stablecoins so they can deploy capital when the market finally turns bullish. Here are five leading stablecoins and how to maximize their yields:

USDe

USDe is one of the fastest-growing synthetic stablecoins, surpassing $3.5 billion in market cap within just 8 months—thanks to its airdrop potential and unique yield opportunities for holders. Despite a 14% supply reduction since June, likely due to bearish sentiment:

Adoption of USDe continues to rise rapidly. Highlights include native deployments on Solana and Scroll, as well as partnerships with projects like Securitize (an RWA platform backed by Blackrock). Thus, despite price declines, adoption keeps growing.

If you want to maximize your USDe yield, here are some of the best farms I’ve found:

-

Bybit recently integrated USDe. Users can earn up to 20% APR daily on each USDe held, and trading USDe as collateral for derivatives incurs no fees on USDe/USDT or USDe/USDC spot pairs. Check yesterday’s exact APR on Bybit’s savings page.

-

Infinex (founded by Synthetix creator Kain, with over $25M in funding) offers up to 20x USDe rewards daily. If you swap USDC to USDe within the app, you get an additional 20x reward plus a 200x bonus.

-

Deposit USDe into the pool program via Kinto (the safest L2 with $5M raised) to receive 20x rewards and a 5% Kinto mining boost, with no deposit fees. If you deposit the staked version (sUSDe), you’ll earn 17% APY, a 5% Kinto mining boost, and 5x rewards from Ethena.

-

PendleIntern provides a detailed guide explaining how to achieve up to 55% APY by purchasing PT-sUSDE, including breakdowns of yield sources and associated risks.

-

Depositing USDe into Gearbox earns you up to 180x rewards, while the staked version (sUSDe) earns up to 45x.

-

You can trade the USDe/FRAX pair on Morphoblue ($69M+ raised), in collaboration with Contango ($4M raised from investors like Coinbase Ventures), earning 20x rewards per USDe held (up to 15x leverage), while farming two tokenless protocols.

-

Depositing USDe into Origami earns up to 155x rewards and 10x Origami points, with up to 7x leverage available on both USDe and its staked version (sUSDe).

-

Users who stake at least 25 USDe in the Binance Web3 Wallet will share equally in a $12,000 daily reward pool, enjoy a 50% boost on rewards, and receive 4% USDe staking yield (subject to change). The campaign ends on August 29.

USD0 (Usual Money)

USD0 is a decentralized real-world asset (RWA) stablecoin that redistributes value and power back to its ecosystem—setting it apart from stablecoins like USDC and USDT, which offer no value accrual to holders. Currently, USD0 lags behind Blast L2’s USDB in development.

There is currently an ongoing campaign where users earn daily “Pills” to claim 7.5% of the total $Usual supply. A TGE is expected in Q4. Below are some top farms to maximize your Pill yield:

1/ Depositing funds into Origami earns 15x Pills rewards and 10x Origami points. Combined with lending liquidity via Morpho, it’s like a three-in-one Lego set.

2/ PendleIntern’s analysis shows that depositing on Pendle can yield up to 38.3% returns.

3/ Swapping USDT to USD0 or staking USD0-USDT LP on PancakeSwap allows you to farm Pills while collecting trading fees.

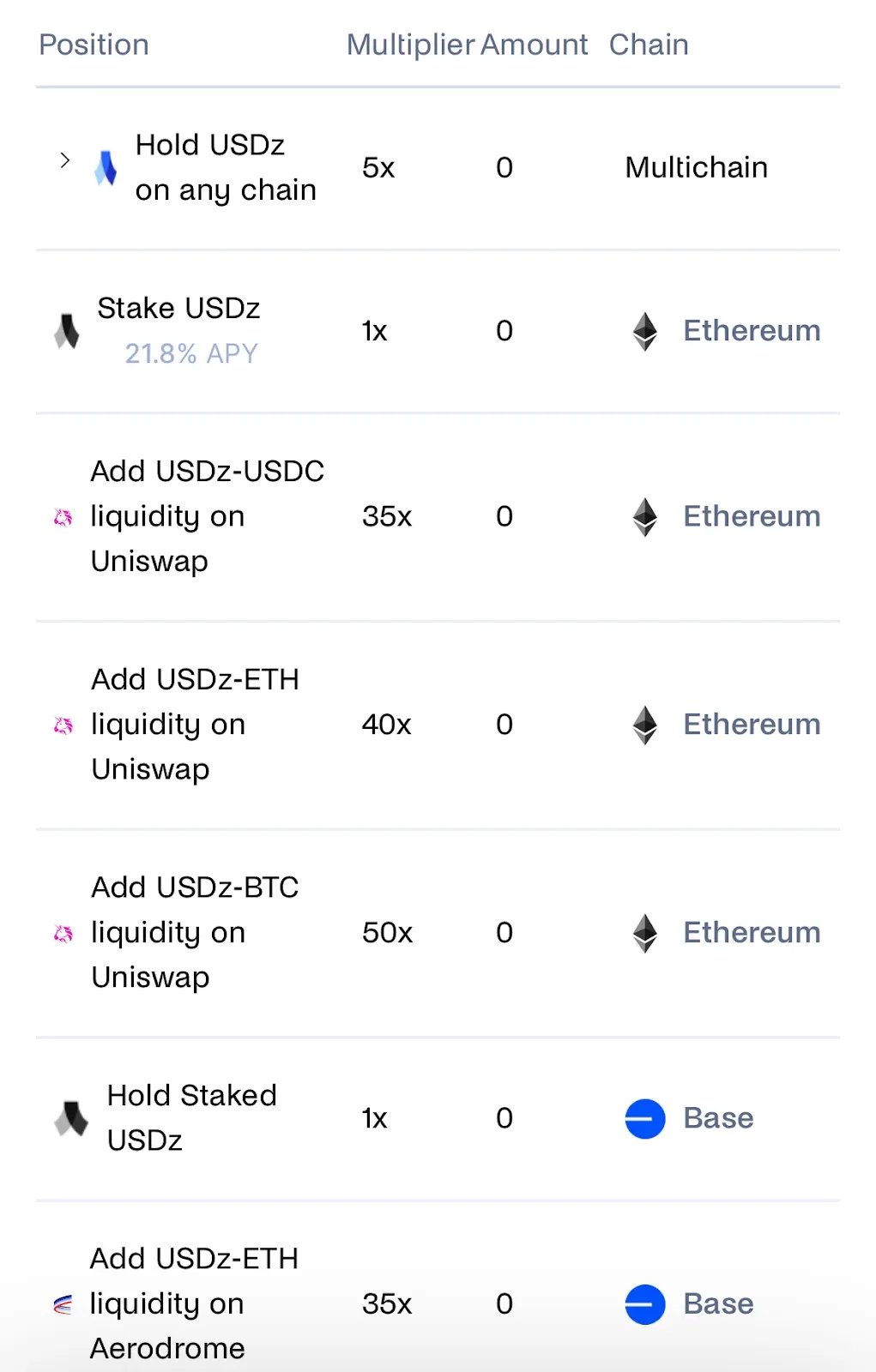

USDz

USDz is a dollar-pegged stablecoin backed by tokenized real-world assets (RWA), enabling users to diversify their portfolios away from crypto price volatility and tap into yield from the $7 trillion private credit market—reportedly undergoing a major upgrade.

Season 1 focuses on holding USDz or providing liquidity to earn redeemable points, expected to launch in Q4.

Multiplier bonuses vary across different pools.

At the time of writing, the highest-multiplier pool is providing liquidity to the USDz-BTC pool (ETH) on Uniswap. For lower fees, consider depositing into Hyperlock (Blast) for a 35x boost, or farming the USDz-ETH Aerodrome LP (Base) for the same multiplier, while engaging with both L2 ecosystems early.

Deusd

Deusd (Decentralized Dollar) is a fully collateralized synthetic USD powered by the Elixir Network. It is minted using stETH and sDAI, with deposited collateral used to short ETH, creating a delta-neutral position. It functions similarly to USDe but operates on the Elixir Network. A 10-week campaign is currently underway to bootstrap Deusd liquidity, rewarding users based on contribution.

Here are the best farms to boost your rewards:

1/ Stake your Deusd/FRAX LP tokens for up to 5x reward multipliers.

2/ Provide liquidity to the sdeUSD/deUSDon Balancer pool for a 5x reward boost.

3/ Stake deUSD-USDC or deUSD-USDT on Ethereum to earn $CAKE and up to 134% APY (note: APY decreases as liquidity grows).

4/ Deposit into Abracadabra to earn up to 29.5x reward boosts, depending on your leverage level.

USDM

USDM is the first prudently regulated, yield-generating stablecoin. Its underlying assets are U.S. Treasuries, which also generate yield. Currently, USDM ranks as the 30th largest stablecoin, surpassing others like Circle’s EURC.

Ways to maximize yield while holding USDM:

1/ Use Contango on Dolomite to perform wUSDM/USDT long-short trades, earning 5% APR plus Arb rewards, while interacting with two tokenless protocols for future airdrops.

2/ The wUSDM pool on Morpho Blue currently offers 5% APR plus additional Morpho rewards, while establishing your on-chain presence on Base (three-in-one?).

Dyad

Dyad aims to surpass existing stablecoins in capital efficiency through a unique model. Its strength lies in deploying three assets: $DYAD (the stablecoin), Note (DYAD NFT, dNFT), and $KEROSENE (tokenized excess collateral). Notes (dNFTs) act as tickets into the Dyad ecosystem, tracking user activity via XP metadata. The more XP your Notes accumulate, the higher your yield. $KEROSENE can be earned by providing liquidity in exclusive pools reserved for Note NFT holders. Kerosene serves purposes beyond just yield generation.

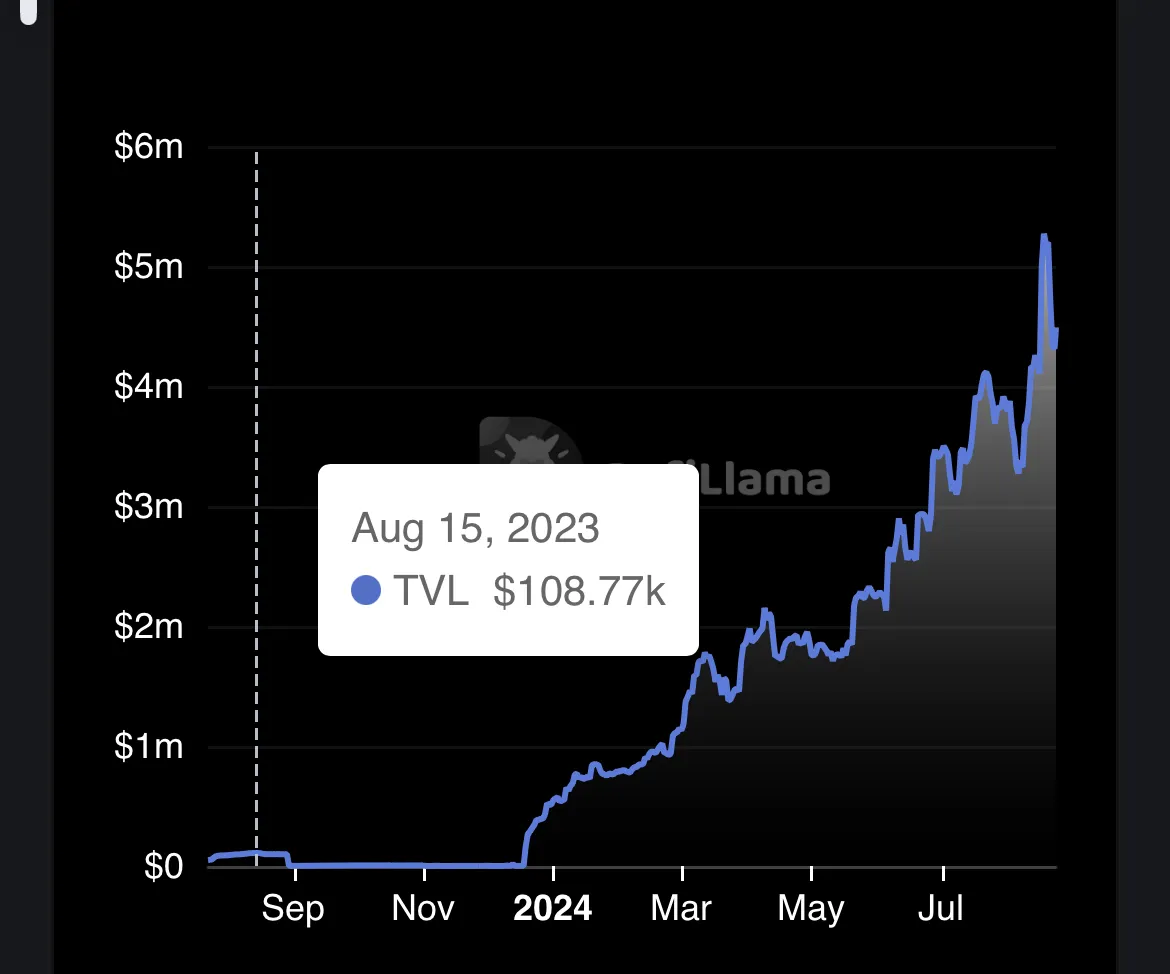

Together, these mechanisms make Dyad the most capital-efficient stablecoin. Since launch, Dyad has seen significant growth, with TVL (total value locked) steadily rising.

Currently, providing liquidity to the USDC-DYAD pair yields over 80% APR. Supported collaterals include $wstETH, $tBTC, and $sUSDe.

See below:

Alright. That’s all for today.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News