Aave: The Core Pillar of Decentralized Finance and On-Chain Economy

TechFlow Selected TechFlow Selected

Aave: The Core Pillar of Decentralized Finance and On-Chain Economy

This article will analyze the reasons behind Aave's strong price performance from multiple aspects, including its data metrics, token economics, and future developments.

Author: Arthur_0x

Translation: Nicky, Foresight News

Aave is the largest and most battle-tested lending protocol to date

As the undisputed leader in on-chain lending, Aave possesses an exceptionally strong and hard-to-displace moat. We believe that as a frontrunner in one of the most critical sectors within cryptocurrency, Aave is significantly undervalued—and its substantial future growth potential remains underappreciated by the market.

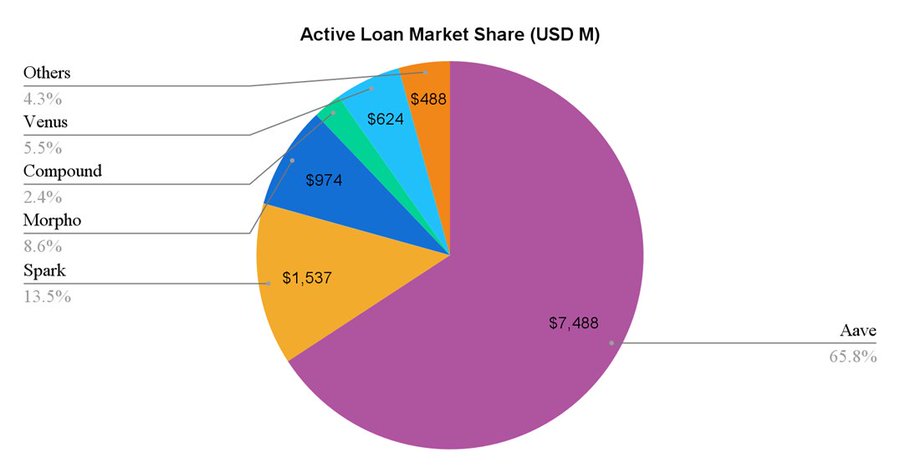

Aave launched on Ethereum’s mainnet in January 2020 and has now operated steadily for five years. During this time, it has become one of the most resilient protocols in decentralized finance (DeFi) and lending. This achievement is best illustrated by Aave being the largest lending protocol today, with active loans totaling $7.5 billion—five times greater than Spark, the second-largest protocol.

Data as of August 5, 2024

Aave's metrics continue to grow and have surpassed previous cycle highs

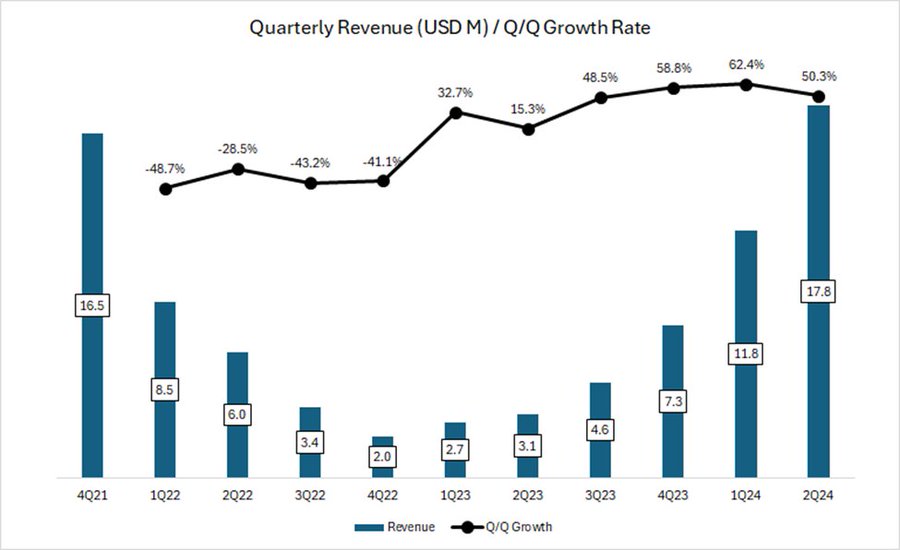

Aave is among the few DeFi protocols whose performance has exceeded its 2021 bull market levels. For example, Aave’s quarterly revenue has already surpassed its peak during Q4 2021—the height of the last bull run. Even more impressively, while the market entered a consolidation phase from November 2022 to October 2023, Aave’s revenue growth not only held steady but accelerated. In Q1 and Q2 of 2024, amid gradual market recovery, Aave maintained robust momentum, achieving quarter-on-quarter growth rates between 50% and 60%.

Source: Token Terminal

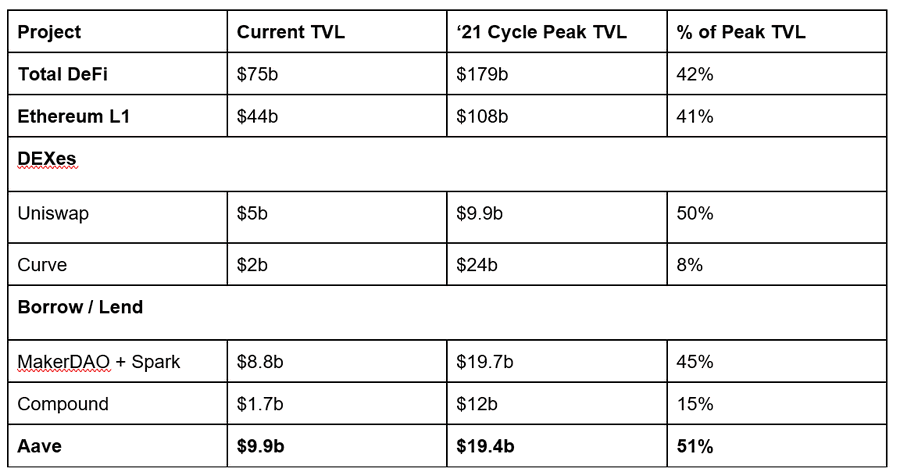

Year-to-date, Aave’s total value locked (TVL) has nearly doubled—driven both by increased deposits and rising prices of core collateral assets like WBTC and ETH. As a result, Aave’s TVL has recovered to 51% of its 2021 cycle peak, demonstrating exceptional resilience compared to other top-tier DeFi protocols.

Data as of August 5, 2024

Aave’s superior profitability underscores strong product-market fit

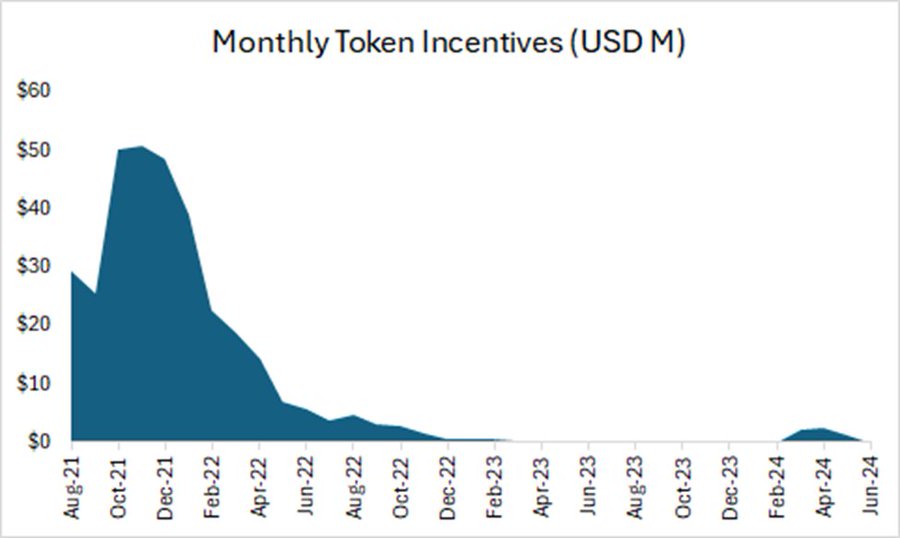

In the previous cycle, when multiple smart contract platforms such as Polygon, Avalanche, and Fantom spent heavily on token incentives to attract users and liquidity, Aave reached its revenue peak. This led to unsustainable spikes in speculative capital and leverage, which inflated revenue figures across most protocols at the time.

Today, token incentives on major chains have dried up, and Aave’s own incentives have been reduced to negligible levels.

Source: Token Terminal

The recent growth in Aave’s metrics has been organic and sustainable, primarily driven by a resurgence in market speculation, leading to higher active loan volumes and borrowing rates.

Moreover, Aave has demonstrated the ability to strengthen its fundamentals even during periods of reduced speculation. For instance, during the broad collapse of global risk assets in early August this year, Aave still delivered strong revenue—thanks to fees collected from liquidations triggered during loan repayments. This highlights Aave’s capacity to withstand market volatility across different collateral types and blockchains.

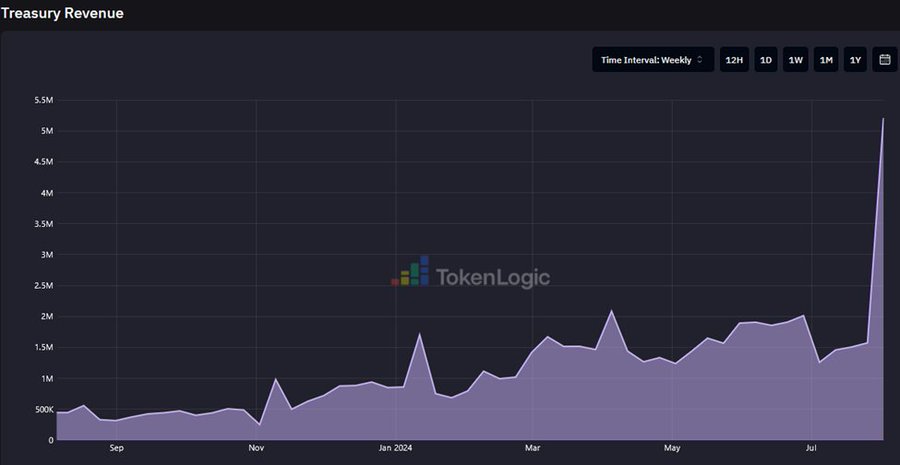

Data as of August 5, 2024, Source: TokenLogic

Despite strong fundamental recovery, Aave’s market valuation is at a three-year low.

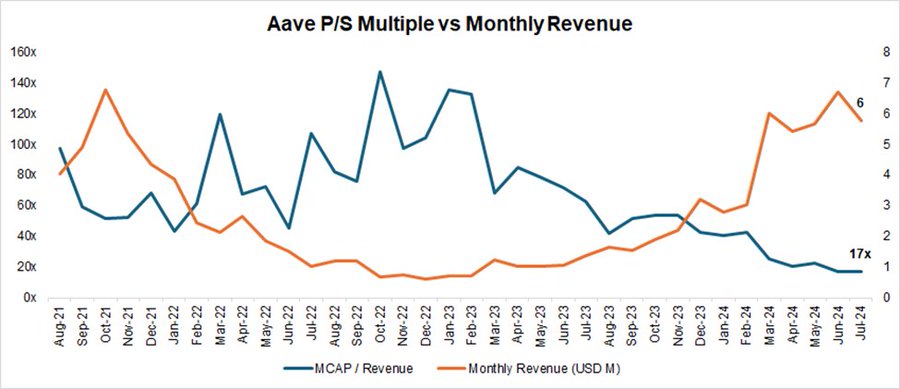

Despite robust metric recovery over recent months, Aave’s price-to-sales (P/S) ratio remains depressed at 17x—down to a three-year low, far below its three-year median of 62x.

Source: Coingecko, Token Terminal

Aave is poised to expand its dominance in decentralized lending

Aave’s competitive moat consists of four key pillars:

-

Proven security track record: Most new lending protocols suffer security incidents within their first year of operation. Aave, however, has operated smoothly without any major smart contract-level breaches. The platform’s strong risk management and unblemished security history are often primary considerations for DeFi users when choosing a lending platform—especially large whales managing significant capital.

-

Bilateral network effects: DeFi lending is a classic two-sided market, with depositors and borrowers forming supply and demand. Growth on one side fuels growth on the other, making it increasingly difficult for new entrants to catch up. Moreover, greater overall liquidity enables smoother inflows and outflows, attracting larger institutional-grade participants who further drive platform growth.

-

Superior DAO governance: Aave operates fully under DAO governance. Compared to centralized teams, DAO-based governance enables more transparent disclosures and deeper community discussions on key decisions. Additionally, Aave’s DAO includes high-caliber professional institutions such as risk management providers, market makers, third-party developers, and financial consultants—diverse participation that fosters more active governance engagement.

-

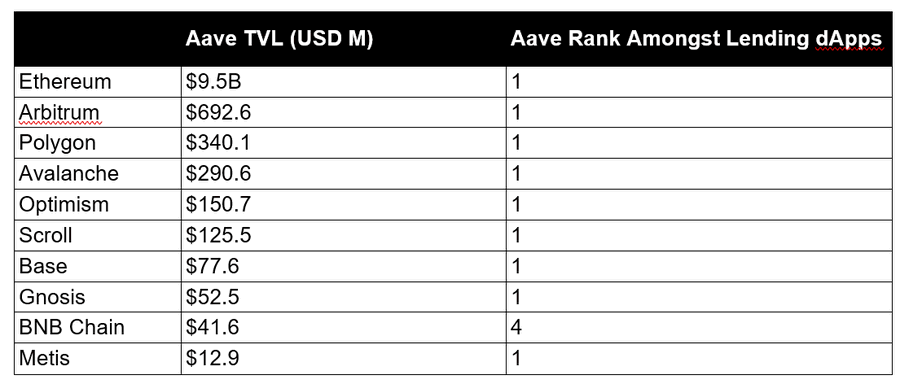

Strategic positioning in a multi-chain ecosystem: Aave is deployed across nearly all major EVM L1/L2 chains and leads in TVL on every chain except BNB Chain. With the upcoming Aave V4, cross-chain liquidity will be unified, amplifying this advantage. See chart below:

Data as of August 5, 2024, Source: DeFiLlama

Improving AAVE tokenomics to enhance value accrual and eliminate haircut risks

The Aave Chan Initiative recently proposed a reform of AAVE tokenomics aimed at increasing utility through a revenue-sharing mechanism.

The first major change is eliminating the risk of severe AAVE token haircuts during activation of the safety module.

-

Currently, stakers of AAVE (stkAAVE, $228M TVL) and AAVE/ETH Balancer LP tokens (stkABPT, $99M TVL) face the risk of token haircuts to cover shortfalls during shortfall events.

-

However, stkAAVE and stkABPT lack correlation with the collateral assets accumulating bad debt, making them suboptimal forms of coverage. In such events, forced selling of AAVE can create a negative feedback loop, reducing coverage further.

-

Under the new Umbrella Safety Module, stkAAVE and stkABPT will be replaced by stk aTokens beginning with aUSDC and awETH. Providers of aUSDC and awETH can choose to stake their assets and earn additional yield (in AAVE, GHO, or protocol revenue) on top of borrower interest. These staked assets may be slashed and burned during shortfall events.

-

This arrangement benefits both platform users and AAVE holders.

In addition, new demand drivers for AAVE will be introduced via a revenue-sharing mechanism.

Introduction of Anti-GHO

Currently, stkAAVE holders receive a 3% discount when minting or borrowing GHO.

This will be replaced by a new “anti-GHO” token generated linearly by stkAAVE holders who mint GHO, proportional to the interest accrued by all GHO borrowers.

Users can claim Anti-GHO and use it in two ways:

-

Burn Anti-GHO to mint GHO for free debt repayment.

-

Deposit into the GHO Safety Module as stkGHO.

This aligns stkAAVE holders with GHO borrowers and marks the first step in a broader revenue-sharing strategy.

Burning and distribution plan

Aave will allow redistribution of net excess protocol revenue to token stakers, subject to the following conditions:

-

Aave Collector net holdings must cover 2 years of service providers’ average recurring costs over the past 30 days.

-

Aave protocol’s 90-day annualized revenue must reach 150% of year-to-date protocol expenses, including AAVE acquisition budget and aWETH/aUSDC Umbrella budgets.

-

We expect Aave to begin consistently repurchasing eight-digit amounts of AAVE, with this figure likely to grow as the protocol expands.

Furthermore, AAVE is nearly fully diluted, with no significant future supply unlocks—an important contrast to many newly launched tokens that suffer sharp post-TGE price declines due to initially low circulating supply and high fully diluted valuations (FDV).

Aave is positioned for significant future growth

Aave has multiple growth catalysts and is well-positioned to benefit from the long-term expansion of crypto as an asset class. Fundamentally, Aave’s revenue can grow in several ways:

Aave v4

Aave V4 aims to significantly enhance functionality and position the protocol to onboard the next billion users into decentralized finance (DeFi). First, Aave will focus on transforming user interaction with DeFi by building a unified liquidity layer. By enabling seamless access to liquidity across multiple networks—including EVM and eventually non-EVM chains—Aave will eliminate the complexity of cross-chain conversions in lending. The unified liquidity layer will also heavily leverage account abstraction and smart accounts, allowing users to manage multiple positions across isolated assets.

Second, Aave will increase platform accessibility by expanding to new chains and introducing new asset classes. In June, the Aave community approved deployment on zkSync—marking Aave’s 13th blockchain. Then in July, the Aptos Foundation proposed deploying Aave on Aptos. If passed, this would mark Aave’s first expansion onto a non-EVM network, further solidifying its status as the true multi-chain DeFi leader. Additionally, Aave plans to explore integration of RWA-based products built around GHO—potentially bridging traditional finance with DeFi, attracting institutional investors, and bringing substantial new capital into the Aave ecosystem.

These developments culminate in the creation of the Aave Network—a central hub for stakeholders to interact with the protocol. GHO will serve as a fee payment instrument, while AAVE becomes the primary staking asset for decentralized validators. Given that the Aave Network is expected to be developed as an L1 or L2 solution, we anticipate the market will revalue its token accordingly to reflect this additional infrastructure layer.

Aave’s growth is positively correlated with BTC and ETH as asset classes

The launch of spot Bitcoin and Ethereum ETFs this year represents a watershed moment for crypto adoption in traditional finance, offering investors a regulated and familiar way to gain exposure to digital assets without the complexities of direct custody. By lowering entry barriers, these ETFs are expected to attract significant capital from both institutional and retail investors, accelerating the integration of digital assets into mainstream portfolios.

This broader growth in the crypto market is highly favorable for Aave, as over 75% of its asset base consists of non-stable assets—primarily BTC and ETH derivatives. Therefore, Aave’s total value locked (TVL) and revenue growth are directly tied to the performance of these assets.

Aave’s growth is linked to stablecoin supply expansion

We also anticipate Aave benefiting from the growth of the stablecoin market. As global central banks signal a shift toward rate cuts, the opportunity cost for yield-seeking investors decreases. This could prompt capital to flow from traditional finance (TradFi) yield instruments into DeFi stablecoin staking for higher returns. Additionally, during bull markets, higher risk appetite is likely to increase stablecoin borrowing utilization on platforms like Aave.

Final thoughts

To reiterate, we remain highly optimistic about Aave’s leadership position in the vast and growing decentralized lending market. We’ve outlined the key drivers underpinning its future growth and detailed how each can further expand its trajectory.

Given Aave’s strong network effects—driven by token liquidity and composability—it will continue capturing market share. The upcoming tokenomic upgrades aim to further strengthen protocol security and enhance value capture.

Over the past few years, the market has treated all DeFi protocols as a homogeneous group, pricing them as if their growth potential were limited. This is evident in the divergence between Aave’s rising TVL and revenue growth versus its compressing valuation multiples. We believe this disconnect between valuation and fundamentals won’t persist for long, and AAVE now presents one of the most attractive risk-adjusted investment opportunities in the entire cryptocurrency space.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News