Cellula: A Game of Cultivating Life, Finding the Optimal Solution for Asset Issuance and Distribution?

TechFlow Selected TechFlow Selected

Cellula: A Game of Cultivating Life, Finding the Optimal Solution for Asset Issuance and Distribution?

This article will introduce how Cellula, through its unique vPoW+ gamified mining mechanism and sophisticated economic model design, achieves fair asset distribution and liquidity guidance, transforming perceptions of asset distribution in the crypto world.

Written by: TechFlow

Unequal distribution has long been a challenge in human society, and the crypto world is no exception. The once-promising cryptocurrency space is increasingly turning into a new game of the "Matthew Effect."

Looking back at the development of the crypto world, mining initially seemed equally accessible to everyone when Bitcoin first emerged. However, with the rise of ASIC miners and large-scale mining farms, mining quickly became professionalized and industrialized, pushing out ordinary participants. Over the past decade, whether it was ICOs, the DeFi boom driven by smart contracts, or trends like GameFi, NFTs, and inscriptions—each new wealth distribution mechanism appears briefly as an era of "inclusivity," only to eventually fall under the control of large capital.

Not even staking, initial DEX offerings (IDO), or lottery-style distributions—methods that appear “fair”—have remained immune. These have also turned into exclusive games for whales, where victory is no longer determined by diligence, opportunity, or effort, but by raw capital dominance.

In response to this increasingly chaotic environment, Cellula, a gamified asset issuance protocol, proposes a refreshing idea: combining the fairness principles of Bitcoin mining with modern gamification mechanisms to create a new model for asset distribution.

In April this year, Cellula, incubated by Binance Labs, announced a $2 million Pre-Seed funding round led by OKX Ventures and SevenX Ventures, with participation from Mask Network, Foresight Ventures, and other institutions.

This article will explore how Cellula, backed by numerous leading organizations, leverages its unique vPoW + gamified mining mechanism and sophisticated economic design to achieve fair asset distribution and liquidity guidance—redefining how we think about asset allocation in the crypto world.

From PoW to vPoW: Advancing Fair Distribution

First, it’s important to clarify that although gamification serves as the entry point for reinventing asset distribution, Cellula is not limited to being just another blockchain game. Instead, it is a Programmable Incentive Layer.

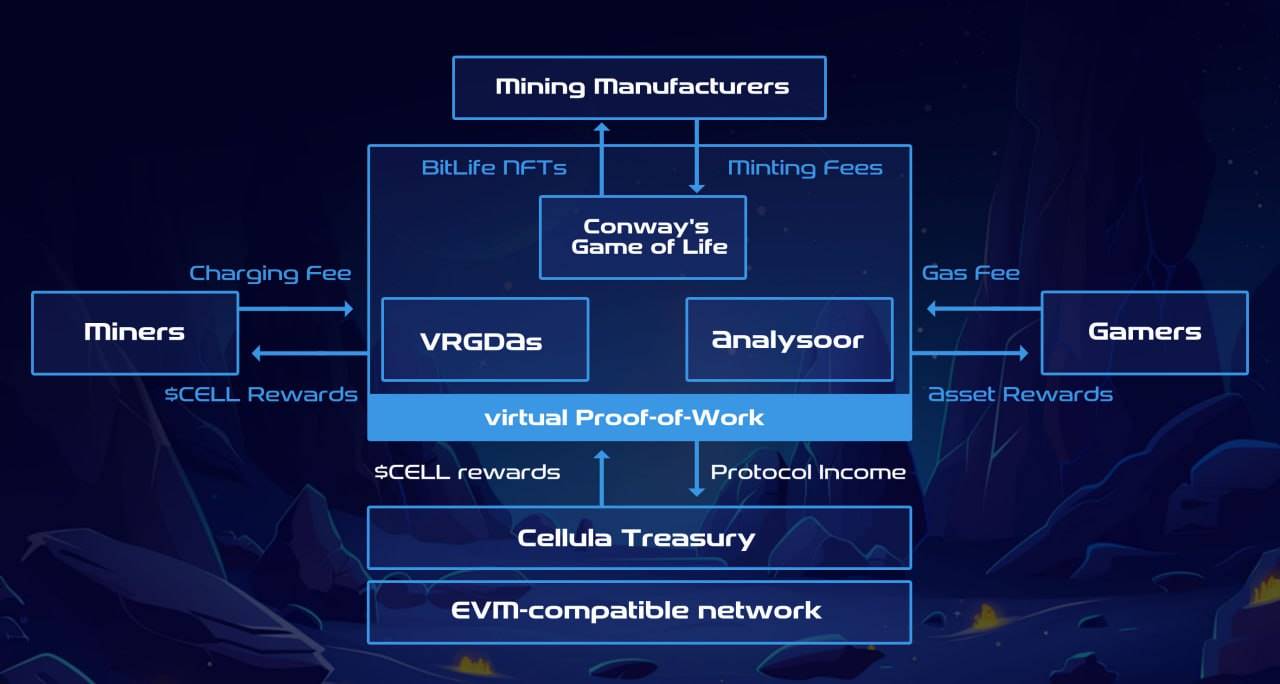

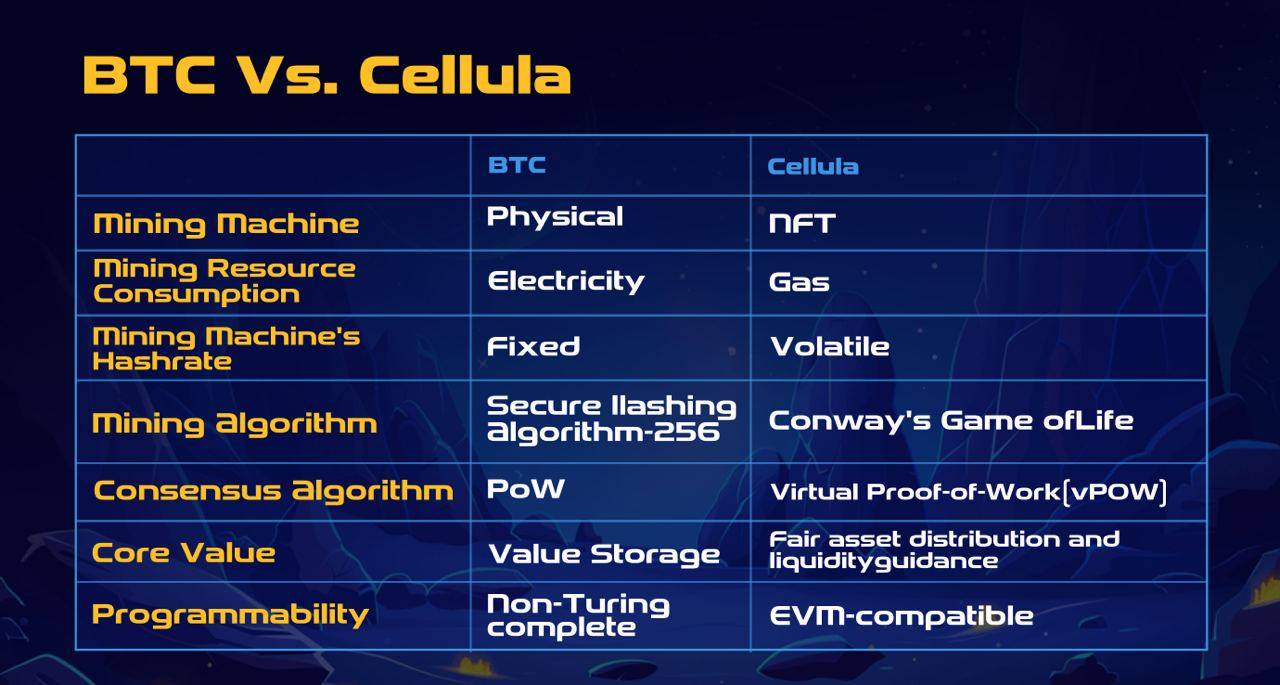

As mentioned earlier, Cellula reintroduces Bitcoin’s Proof-of-Work (PoW) mechanism onto EVM-compatible networks, creating a new paradigm for asset and liquidity distribution through permissionless virtual Proof-of-Work (vPoW) combined with a competitive, gamified issuance system (BitLife). This makes Cellula fundamentally distinct from other crypto platforms.

Unlike Bitcoin’s rigid, energy-intensive PoW mining, Cellula, as an innovative programmable incentive layer, integrates Conway’s Game of Life, variable-rate GDA algorithms, and game theory principles to build a dynamic, programmable incentive system called vPoW.

The core innovation of vPoW lies in virtualizing the physical mining hardware used in traditional PoW, creating a software-simulated “virtual computing power” system. Within this system, the virtual mining device is known as BitLife, whose mining process and state evolve according to the rules of Conway’s Game of Life.

Conway’s Rules: The Survival Code of BitLife

Conway’s Game of Life is a Turing-complete cellular automaton composed of four simple rules. Its deeply nested evolutionary logic means that future states are entirely determined by the initial configuration, requiring no further human intervention.

In Cellula, Conway’s Game of Life simulates the genetic code of on-chain digital life forms. Block height acts as “time,” and as time (i.e., block height) progresses, the genetic types of digital lifeforms (BitLife) continuously evolve.

From the user’s perspective, each BitLife can be understood as a virtual mining device—similar to a miner in a traditional PoW network. Unlike physical miners, however, BitLife’s computing power dynamically changes based on the lifecycle of living cells governed by Conway’s rules. The operational status of BitLife is determined by these rules, with the number of active cells representing current computing power or hash rate. Each new block may bring changes to a BitLife’s state.

To keep BitLife active, users must periodically “charge” it. This charging process is not only essential for maintaining “computing power,” but also a key way users engage with the ecosystem. Each charge represents a contribution to the network and an opportunity to participate in new asset issuance.

To put it simply, “charging” is the mining activity within Cellula, and it is precisely during this process that Cellula’s consensus algorithm Analysoor plays a critical role.

Analysoor Consensus: Fairness, Fairness, and More Fairness

Analysoor is the first Fair Launch protocol on Solana, designed specifically to ensure fairness and randomness in asset distribution.

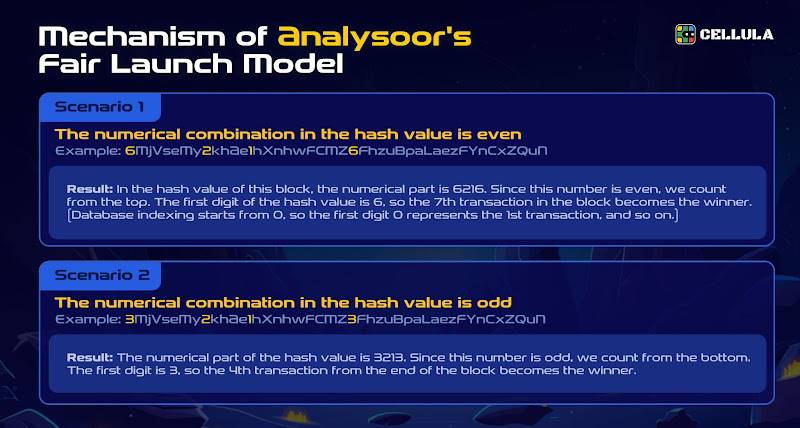

In the Analysoor Fair Launch model, there are no pre-sales, no whitelists, no insider allocations, and no gas-price bidding wars. Instead, every user faces the same fixed participation cost. Each time a user initiates a “participation” action (e.g., charging), it is equivalent to purchasing one fair “lottery ticket.” Then, the randomly generated hash of that block determines which transaction (ticket) becomes the winning one.

Understanding Analysoor makes it easy to see how it integrates with Cellula’s vPoW:

When a user charges their BitLife, it's akin to entering a lottery hosted by Cellula. The Analysoor algorithm takes the hash of the latest block and applies Analysoor(0,1) as a random block reward mechanism. This random number determines which user’s charging transaction wins the jackpot, granting them additional rewards in newly issued assets.

Notably, the entry barrier for each draw is merely a 5-minute charging duration. This extremely low threshold prevents “capital dominance,” ensuring every user has an equal chance of winning regardless of size—effectively eliminating early advantages or the “rich get richer” problem.

Additionally, the Analysoor algorithm ensures that electricity costs (transaction fees) during the launch phase do not go to project teams or miners, but are instead fully redirected toward adding liquidity, feeding back into the ecosystem and accelerating a virtuous cycle.

A Multi-Faceted Economic Model

A robust economic model is key to sustaining long-term community vitality in any crypto project. Cellula has developed a comprehensive plan in this regard.

Cellula’s economy revolves around three core components: the $CELL token, BitLife, and BitCell, forming a self-sustaining economic loop.

Diverse Token Utilities

Charging Mining

Unlike traditional pre-mining or ICOs, Cellula opts for a fairer, more decentralized method of token distribution—mining $CELL tokens through continuous BitLife “charging” activities across the ecosystem.

When users purchase a BitLife (i.e., a Cellula miner) and perform charging (mining), they earn energy points every five minutes based on their current share of total computing power (the system generates 101,962.08 energy points every 5 minutes). Additionally, they have a chance to win extra block rewards via the Analysoor Fair Launch algorithm. Since BitLife’s computing power fluctuates with block height, mining rewards are dynamically adjusted accordingly.

Similar to BTC mining, users need to spend $CELL tokens to buy BitLife and pay a certain amount of $CELL to charge it, keeping the mining process active. This “mine-with-tokens” consumption mechanism creates sustained demand for $CELL within the ecosystem.

Staking Rewards

As a core asset in the Cellula ecosystem, users can stake $CELL alongside BitCell NFTs in Staking Pools created exclusively by BitCell NFT holders.

There is no minimum requirement for $CELL holdings—any user can join a Staking Pool and participate in Staking Pool collaboration: the more $CELL tokens in a pool, the higher the staking reward percentage earned by the BitCell NFTs in that pool.

The distributed $CELL rewards are allocated among the Staking Pool owner, BitCell NFT stakers, and $CELL stakers, according to the pool’s specific distribution rules set by the pool owner.

As the project evolves, the use cases for $CELL will continue to expand. In the future, $CELL will serve as a governance token, allowing holders to vote on key ecosystem decisions. It will also grant access to Fair Launches of new assets within the Cellula ecosystem.

Early Airdrop Distribution

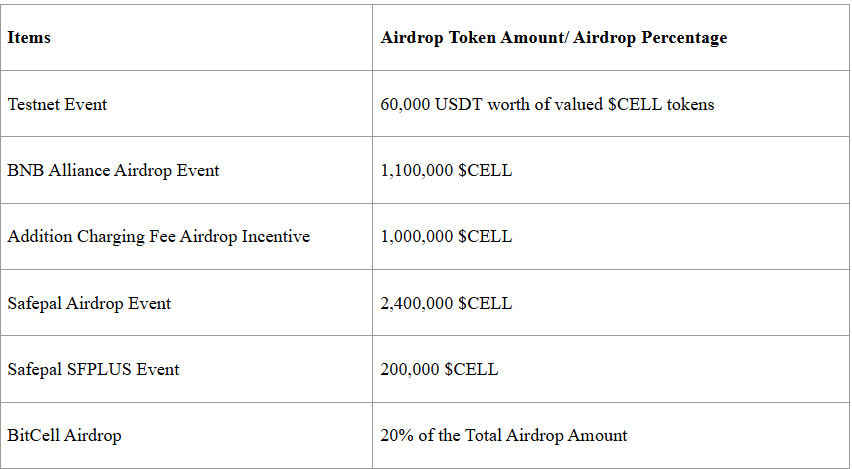

Prior to TGE (Token Generation Event), users can obtain $CELL through three pre-distribution methods:

-

Charging Mining: Charge BitLife to mine; the system generates 101,962.08 energy points every 5 minutes, distributed among users based on their BitLife’s current computing power share.

-

Tasks & Invitations: Complete tasks and invite friends to earn Life Points, which can be redeemed for 0.5% of the total $CELL supply.

-

Airdrop Campaigns: Participate in joint airdrop events to receive various allocations of $CELL tokens (see image below).

Participation Guide: How to Get Started with Cellula Mining

From its unique vPoW mechanism and commitment to fair distribution, we’ve seen that Cellula offers a fun yet equitable mining experience. So how can individual users get involved?

Obtain Your Own BitLife

BitLife, the virtual mining device, is a participant’s core asset. Currently, there are three main ways to acquire BitLife: DIY assembly, store purchase, and manufacturer purchase. Each method has distinct characteristics, benefits, and risks, catering to different user types.

DIY Assembly: A Playground for Enthusiasts

Similar to building your own PC, players can rent BitCells from the workbench to create a unique BitLife. Different BitCell combinations produce varying power curves. This means identical investments can yield mining devices with different efficiencies, requiring experimentation and strategic planning.

Purchase from Store: Flexible Market Options

If you prefer not to assemble manually, you can directly buy player-created BitLifes from the in-game store. You can choose based on desired compute duration and performance. All BitLifes are priced independently using the Variable Rate GDA algorithm: prices surge exponentially if many are minted in a short time; conversely, prices drop exponentially when oversupply meets weak demand.

Purchase from Miner Manufacturers: Controlled, Professional Production

Just as Bitcoin’s evolution gave rise to specialized ASIC manufacturers, Cellula introduces the role of miner manufacturers into its ecosystem. Before TGE, the minting of 3×3 genotype BitLifes (a type of Cellula miner) will cease, forcing users who wish to mine to trade BitLifes on the NFT secondary market.

Meanwhile, Cellula allows select users to become miner manufacturers through a strict准入 mechanism (based on criteria such as token staking amount and community influence). These manufacturers can produce 4×4 genotype BitLifes, with production limits tied to their staked token quantity. Users can then purchase BitLifes directly from these authorized manufacturers.

Charging Your BitLife

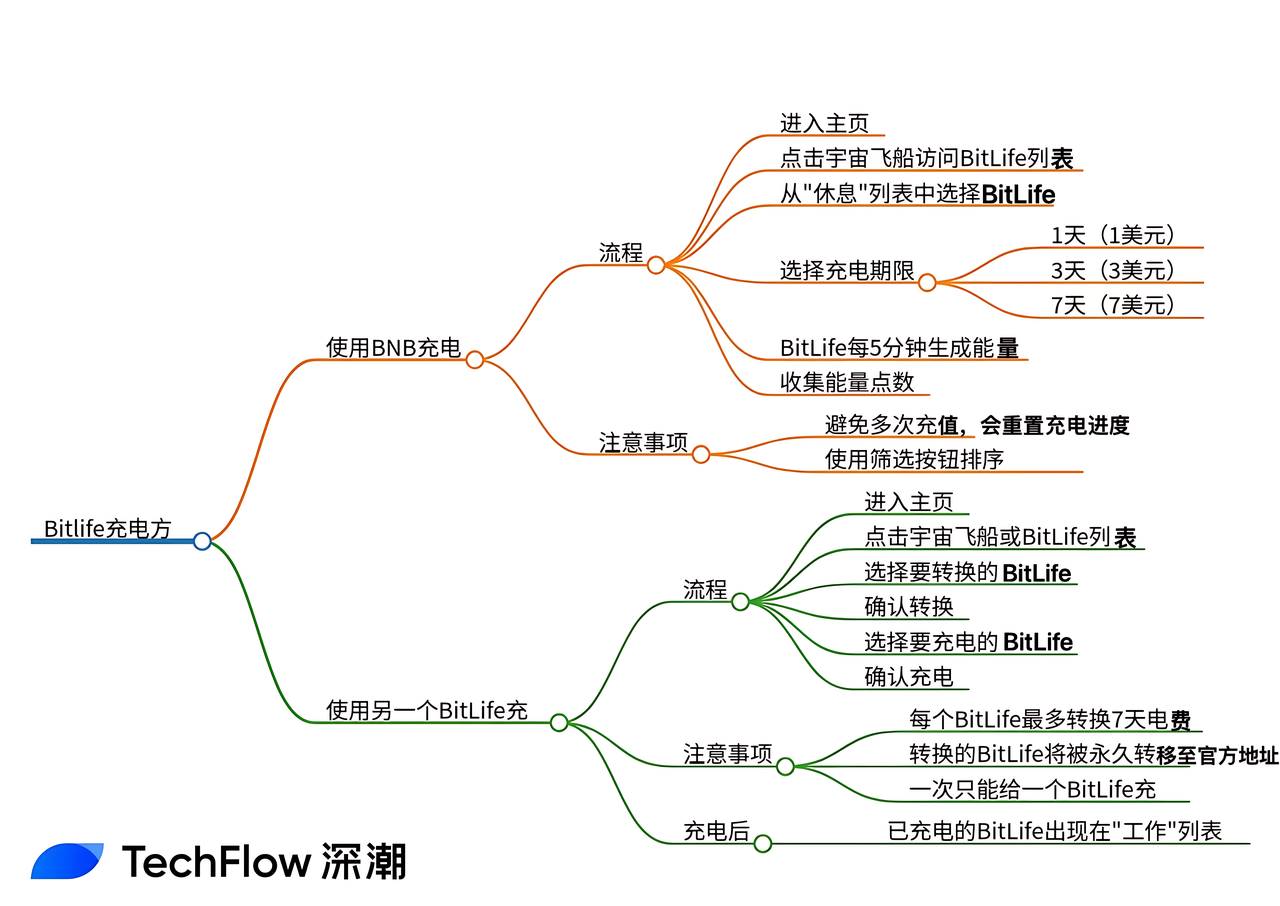

Prior to TGE, charging can be done primarily via BNB top-up or using another BitLife as a “battery.”

Using BNB to Charge

Users can choose charging durations of 1 day, 3 days, or 7 days for their BitLife, costing $1, $3, or $7 respectively. Each recharge increases the BitLife’s charge progress.

Once charged, the BitLife follows the vPoW mechanism, generating electricity every 5 minutes and earning energy points.

Using Another BitLife as a Battery

Leveraging its programmable foundation, a BitLife can itself be converted into a battery to charge another BitLife. Each BitLife produces a different amount of usable power, up to a maximum of 7 days’ worth.

A single BitLife can only charge another once. Once converted into a battery, it is permanently transferred to the official address and cannot be recovered.

Conclusion

From its vPoW + gamified asset distribution design to its rich user participation mechanisms, it’s clear that Cellula does not merely copy and tweak Bitcoin’s mining model. Instead, it uses Bitcoin’s entire mining ecosystem as inspiration to build its own self-sustaining cycle—demonstrating a genuine commitment to transforming distribution models.

Yet, with great innovation comes great responsibility. In this ambitious overhaul of asset distribution, Cellula must balance fairness with development efficiency, and gameplay enjoyment with economic sustainability. Ultimately, its success will be measured by market adoption and user support.

Will this shift—from an oligarchic game to one of universal participation—deliver real change? We’ll have to wait and see.

Learn More:

Cellula Official Website: https://www.cellula.life/

Cellula Twitter: https://twitter.com/cellulalifegame

Game Homepage:

https://twitter.com/cellulalifegame

Cellula Whitepaper:

https://cellulalifegame.gitbook.io/cellula

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News