Fueling Meme PVP: A New Business Pivot for This Generation of DeFi

TechFlow Selected TechFlow Selected

Fueling Meme PVP: A New Business Pivot for This Generation of DeFi

Where attention goes, flow follows.

By TechFlow

From innovation drought to rampant speculation, the market has gradually fallen into an awkward situation.

Meme coins dominate Solana, Pump.fun's revenue keeps rising, and launching tokens has never been more direct or easier...

As a result, the crypto market is increasingly evolving into a brutal "player-versus-player" (PvP) game. In this zero-sum game, participants aren't aiming to create value but rather to extract gains from one another. Behind every winner lies at least one loser.

Everyone becomes merely an acceptor and participant in the current state of crypto, not a changer; meanwhile, sharper players have turned to doing business as “enablers”:

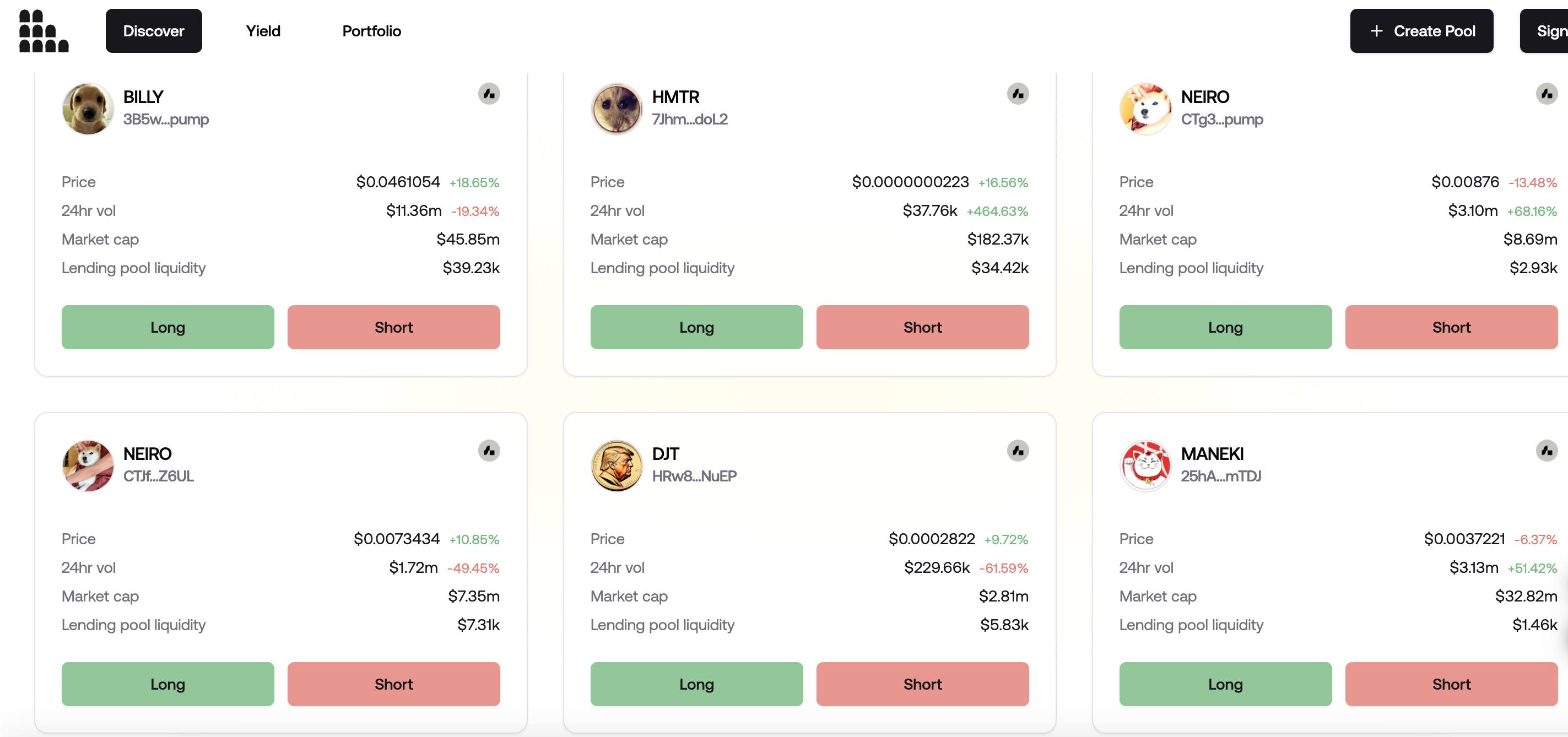

For instance, yesterday saw the emergence of a platform called The Arena on the Solana ecosystem, whose business is strikingly “aligned” with today’s market conditions — allowing users to go long, short, or hedge any newly emerging Solana token directly on-chain.

The name of the platform itself—Arena, meaning a fighting arena—bluntly reveals the essence of its business, further amplifying PvP dynamics beyond spot trading into leveraged, cutthroat combat.

Behind The Arena lies the well-known DeFi protocol Marginfi, which provides the lending pools that enable The Arena’s long and short mechanics to function smoothly.

PvP Arena: Marginfi Supplies the Lending Pools

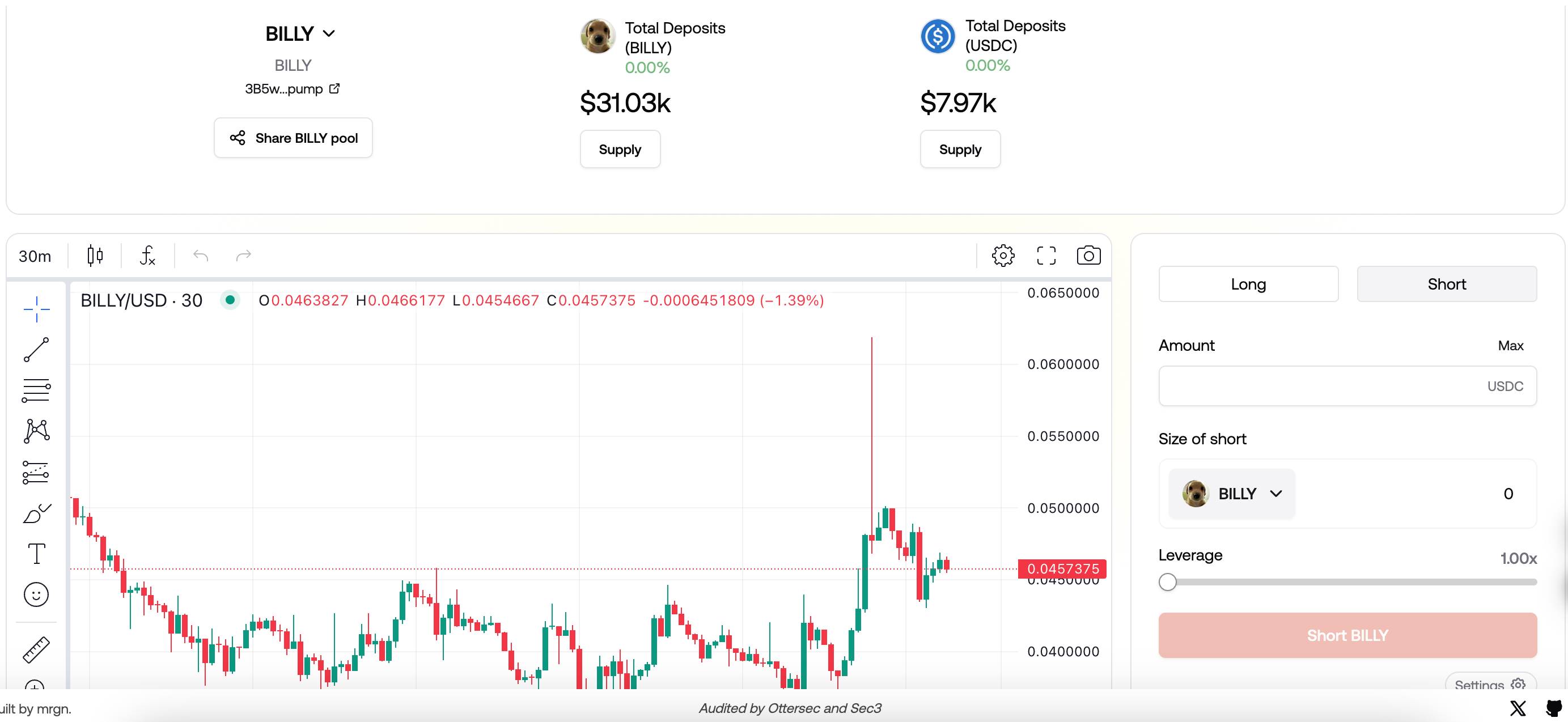

How does The Arena work?

Simply put, The Arena is a trading platform built on isolated lending pools, allowing users to leverage long or short positions on new tokens launched on Solana.

Users can create audited, open-source lending pools without impermanent loss.

The Arena emphasizes its focus on new tokens on Solana. As they note, Solana generates vast numbers of new tokens daily, yet traditional traders have very limited options for interacting with them.

What does an “isolated lending pool” mean?

In plain terms, it means each token has its own dedicated pool instead of using AMM-style paired pools like Uniswap. Additionally, funds in these pools are over-collateralized—meaning more assets are deposited than borrowed—to ensure security.

These lending pools are powered by the decentralized lending protocol marginfi, which provides the necessary DeFi infrastructure.

Let’s use a more intuitive analogy to understand how this works:

Imagine The Arena as a special “game hall” containing many different “game rooms,” each representing a specific token.

Suppose there’s a new coin called DOGEE. Inside the DOGEE “game room”:

You can become a “room owner” by depositing your DOGEE or other accepted tokens (like USDC) into this room.

Your reward: When others use this room, they pay you fees (interest).

Your risk: If someone borrows DOGEE and fails to repay, you may lose part of your deposited assets.

Why become a room owner? The answer is earning interest—similar to depositing money in a bank, but potentially with higher returns.

Others can come to “play games” (trade), going long or short on DOGEE.

How exactly do these loans work?

Imagine The Arena has a “magic box” that enables instant borrowing and repayment of tokens.

The process of going long on DOGEE looks like this:

-

A trader deposits collateral (e.g., USDC) into the game room and borrows USDC from the “magic box.”

-

They immediately use the borrowed USDC to buy more DOGEE.

-

If DOGEE’s price rises, they profit.

-

Finally, they sell some DOGEE to repay the borrowed USDC and pay associated fees.

Shorting DOGEE follows a similar logic and won’t be repeated here.

When users trade on The Arena, the actual lending operations are executed through Marginfi, including access to Marginfi’s flash loans, enabling borrowing and repayment within a single transaction.

If The Arena represents the leveraged PvP game, then Marginfi functions as the underlying game engine. You only need to focus on the game interface (The Arena), without needing to understand how the engine (Marginfi) works.

DeFi Fuels the Fire, Trading Never Stops

In ancient Rome, arenas were where gladiators fought to the death while spectators cheered from the sidelines.

In the crypto market, projects like The Arena intensify meme-driven PvP battles. The platforms themselves profit from transaction fees, while underlying DeFi protocols like Marginfi benefit by activating their lending businesses and generating additional revenue.

Charging “table fees” is inevitably a no-lose business—the life or death of degens fighting on stage is hardly a top concern.

Much like cigarette warnings, signs saying “Leverage is risky” stand at the entrance of the arena—but will they stop degens from rushing in?

Not coincidentally, we previously covered in “Decoding dumpy.fun: Solend’s New Product After Rebranding, Allowing Meme Coin Shorting” that dumpy.fun, named as a counterpart to Pump.fun, also enables shorting meme coins, backed by the DeFi protocol Solend.

It’s easy to see that one direction of DeFi’s business transformation today involves fueling PvP activity.

The more frequent the trading, the greater their income. But by empowering such PvP platforms, are veteran DeFi builders exacerbating market speculation?

This question likely has no definitive answer.

But “where attention goes, liquidity follows; where liquidity flows, opportunity arises; where opportunity exists, attention gathers.” Within this self-reinforcing cycle of crypto markets, encouraging speculation and accelerating volatility has become an almost instinctive, profitable optimal strategy that protocols and developers find hard to resist.

Trading never stops, battles grow fiercer.

Manage risks wisely, and watch the market rise and fall.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News