The reasons behind NVIDIA's breakthrough to a $4 trillion valuation

TechFlow Selected TechFlow Selected

The reasons behind NVIDIA's breakthrough to a $4 trillion valuation

NVIDIA is not just a great company, but also an investment opportunity with potentially high returns.

By RockFlow

Key Takeaways

① NVIDIA benefits from a holistic ecosystem network effect: CUDA, installed base, system-level integration, optimization, and more—each advantage reinforcing the others to form a powerful technological moat.

② NVIDIA has delivered revenue above expectations for six consecutive quarters. What surprises the market is that despite raising guidance every quarter, it still finds ways to further outperform by wide margins, continually delighting investors.

③ In the past, internet giants building business moats with new technologies focused primarily on growth. But for AI, falling behind even slightly could mean losing their entire business foundation. Their decision-making today isn't about calculating returns or profitability—it's driven by fear of absolute loss. Buying NVIDIA chips is essentially buying insurance, with zero price elasticity.

④ In the long run, tech giants will continue seeking alternative high-performance GPU sources or internal solutions to reduce dependence on NVIDIA. Most likely, these efforts will gradually erode—but not replace—NVIDIA’s dominant position in AI.

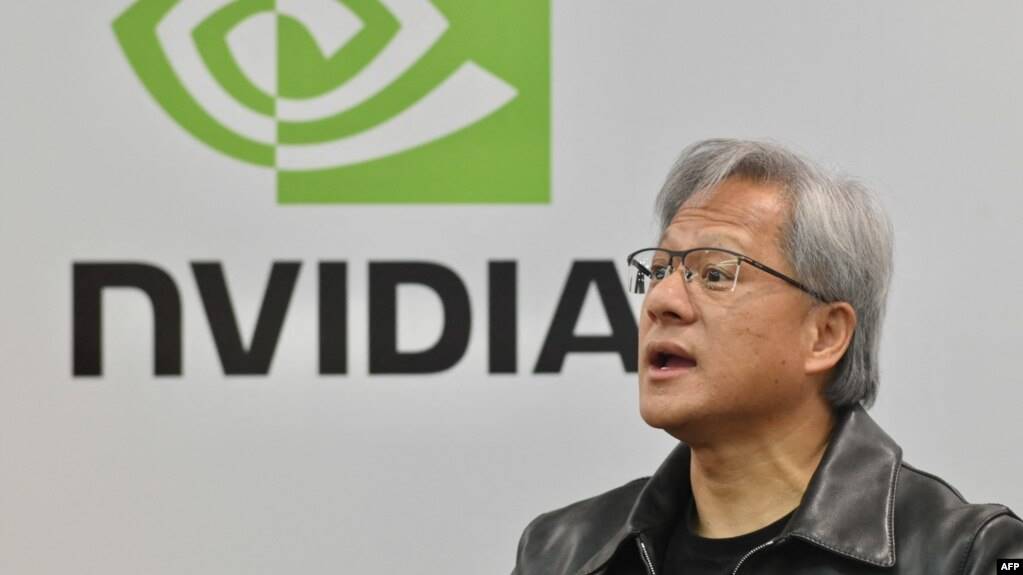

Every so often, a star company emerges—its stock surging over years attracts immense attention, while sharp volatility sparks fierce debate. This time it’s NVIDIA, the global chip giant powering AI, whose share price has soared nearly 50-fold over five years, now ranking among the top three most valuable companies globally alongside Microsoft and Apple.

In a recent “Crossroads” podcast conversation, when asked whether NVIDIA’s stock has a bubble, RockFlow founder Vakee shared her view—she does not believe there is a bubble. A forward P/E of 40x is well within a reasonable range for such a leading company.

The recent pullback in semiconductor stocks—including broader U.S. market corrections due to prior overheating—is consistent with normal market dynamics. Additionally, stronger rate-cut expectations increased risk appetite, prompting capital rotation from large-cap leaders into more aggressive small caps—a typical sector rotation. Furthermore, tightened U.S. export controls and geopolitical tensions weeks ago contributed to declines in chip stocks like NVIDIA, but again, these are standard market reactions.

As for the severe volatility in U.S. markets over the past one to two weeks, this was mainly triggered by weak labor market data, lackluster earnings surprises from major tech firms, yen carry trade unwinding, and potential Middle East conflicts. However, setting aside these external factors, focusing solely on NVIDIA as an investment, we believe that given our medium- to long-term bullish outlook on AI (which may well be the biggest transformative opportunity of our generation), this industry leader remains fundamentally undervalued and free of any bubble.

NVIDIA’s performance over the past year has been outstanding: approximately 90% market share in AI chips, annual revenue exceeding $60 billion, net profit margin over 50%. Over the past five years, its compound annual revenue growth rate has reached 64%, far outpacing all other S&P 500 companies.

RockFlow’s research team provided a detailed analysis of the company’s development journey and investment value in an article published last year—In the Battle of Large AI Models, Can NVIDIA Have the Last Laugh?

This article aims to address what we believe is still underappreciated by the market: NVIDIA’s true moat, and why we believe it is not only an exceptional company but also a compelling investment with substantial return potential.

1. Beyond CUDA: What Is NVIDIA’s Real Moat?

Investors bullish on NVIDIA believe they are betting on its future. When factoring in NVIDIA’s higher expected growth, it is not more expensive than other tech giants.

But here lies a challenge: the further out earnings estimates go, the greater the uncertainty. Microsoft and Apple are mature enterprises earning stable revenues from established customer bases. NVIDIA, however, serves a newer yet highly promising market, leading to significantly wider disagreement among investors regarding its prospects compared to Microsoft or Apple.

For years, NVIDIA has been known as the premier producer of gaming graphics cards. With the rise of cryptocurrency mining, GPUs—the core of graphics cards—became increasingly popular. NVIDIA-designed GPUs are highly optimized for "parallel processing," breaking down complex computational problems and distributing them simultaneously across thousands of processor cores, solving issues faster and more efficiently than traditional computing methods.

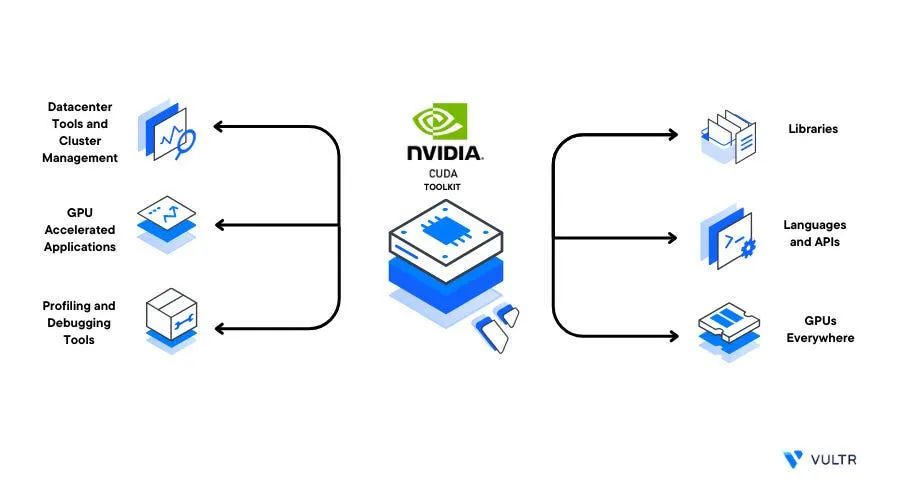

Beyond designing the world’s most advanced GPUs, NVIDIA created a programming model and parallel computing platform—Compute Unified Device Architecture (CUDA)—that has become the industry standard, making it easier for developers to harness the power of NVIDIA GPUs.

Yet NVIDIA’s strengths extend far beyond just the widely praised CUDA platform. The RockFlow research team believes NVIDIA benefits from a comprehensive ecosystem network effect: CUDA, installed base, system-level integration, optimization, proactive adoption of cutting-edge bandwidth and networking solutions—all reinforcing each other to build a formidable technological barrier.

First, consider the installed base. CUDA’s decades-long head start creates strong network effects: its vast user base incentivizes frameworks and developers to target it, which in turn attracts more users. NVIDIA has massive user bases in gaming, professional visualization, and data centers. This scale provides steady revenue streams, rich product feedback, and enables sustained R&D investment to maintain technological leadership.

Second, system-level integration capability. NVIDIA doesn’t just sell GPU hardware—it offers a full software stack, from drivers and development tools to optimized libraries, forming a complete vertical ecosystem. This vertical integration allows system-level optimization, delivering superior performance and user experience.

On optimization, NVIDIA excels at both hardware and software levels. On the hardware side, continuous improvements in GPU architecture boost performance and energy efficiency. On the software side, driver and library optimizations fully unlock hardware potential. System-level innovations—such as multi-GPU collaboration and GPU direct memory access—further enhance overall performance.

To tackle bandwidth and networking bottlenecks, NVIDIA has pursued multiple strategies. It introduced technologies to improve data transfer efficiency between GPUs and CPUs, the most important being NVLink. NVLink connects multiple GPUs via high-bandwidth links, dramatically improving AI computation efficiency. This keeps NVIDIA dominant in autonomous driving and AI computing. Additionally, its strategic bets on InfiniBand, acquisition of Mellanox, and the development of NVIDIA Spectrum-X for Ethernet platforms reflect NVIDIA’s proactive networking strategy.

The RockFlow research team believes that for today’s NVIDIA, its massive installed base fuels ongoing GPU design optimization with real-world data and insights. Meanwhile, system-level integration strengthens user stickiness, expanding the installed base further. Combined with continuous iteration of advanced bandwidth and networking solutions, these elements create a virtuous cycle that maintains NVIDIA’s leadership in GPUs and accelerated computing.

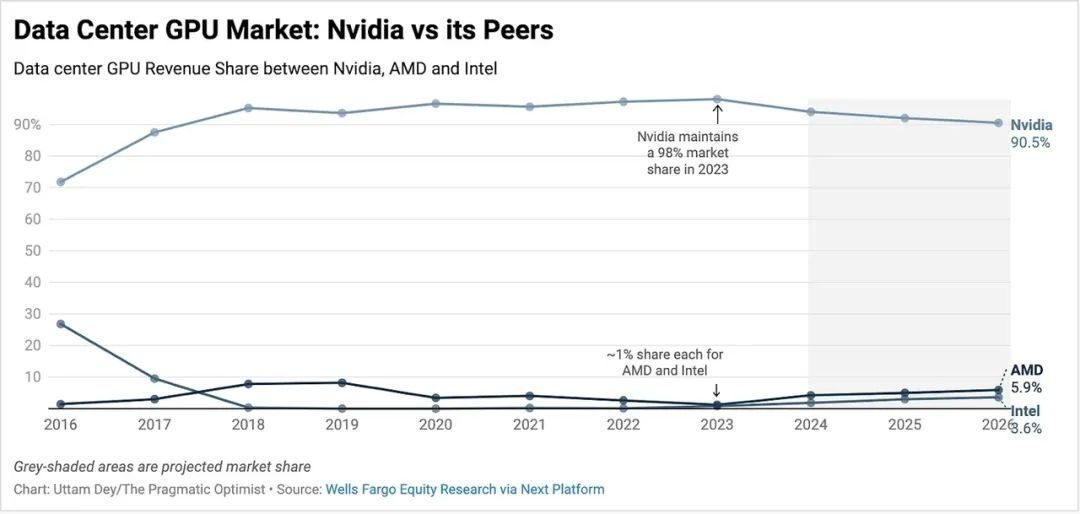

Therefore, even though competitors like AMD and Intel offer similar GPU products—sometimes at lower prices—NVIDIA still holds an overwhelming lead in the AI chip market.

Estimates show NVIDIA has consistently held over 90% of the data center GPU market for the past seven years. In 2023, its share reached 98%. All large-scale data centers and large model training rely heavily on NVIDIA-developed GPUs.

In the long term, NVIDIA may find it difficult to maintain its current market share entirely. But as the data center GPU and broader AI chip markets grow, its moat will ensure it captures the majority of orders. NVIDIA is poised to remain a key player throughout this new industrial revolution, sustaining healthy, positive long-term growth.

2. NVIDIA’s Earnings Miracle: Repeatedly Raising Guidance—And Still Surprising

Two months ago, after NVIDIA reported first-quarter results, its stock jumped 10% the next day, then surged further, briefly surpassing Microsoft to become the world’s most valuable company.

Last quarter, NVIDIA’s financials were as follows:

Revenue rose 18% sequentially to $26 billion—$1.5 billion above expectations. Data center revenue grew 23% to $22.6 billion, becoming the largest and fastest-growing segment.

How dramatic is this growth? As shown below:

In fact, NVIDIA has exceeded revenue expectations for six consecutive quarters. What astonishes the market is that despite raising forecasts every quarter, it continues to find ways to outperform significantly, repeatedly surprising investors. At the same time, profit margins in NVIDIA’s chip business have expanded substantially.

During the subsequent earnings call, Jensen Huang stated:

“The next industrial revolution has begun. Companies and countries are partnering with NVIDIA to transition trillions of dollars’ worth of traditional data centers to accelerated computing and build new data centers—AI factories—to produce a new commodity: AI.”

Looking at the two core phases of AI systems: Training—where AI learns from vast datasets, developing intelligence and pattern recognition. NVIDIA’s powerful GPUs dominate this phase. Inference—where AI applies its knowledge to real-world tasks and decisions. Despite fiercer competition, NVIDIA is making significant progress.

Inference workloads contributed about 40% of NVIDIA’s data center revenue over the past year. Market consensus now holds that as more generative AI applications emerge, inference could become a massive market, generating solid returns for NVIDIA’s customers.

Currently, NVIDIA categorizes its customers into three main groups:

-

Cloud service providers (CSPs) account for nearly half of data center revenue. All major players—Amazon, Microsoft, Google—are NVIDIA customers;

-

Enterprise clients drive strong sequential growth. Tesla, for example, expanded its AI training cluster to 35,000 H100 GPUs, using them for FSD v12;

-

Consumer-facing companies are another key segment. Meta trained Llama 3 on a cluster of 24,000 H100 GPUs and plans to use 240,000 GPUs—ten times the compute of Llama 3—for the next-generation multimodal Llama 4.

NVIDIA management also highlighted several strategic directions during the call:

On data centers, they noted:

“As generative AI integrates into more consumer-facing internet applications, we expect continued growth opportunities. Inference scales with increasing model complexity, user counts, and queries per user, driving ever-greater demand for AI computing.”

Additionally, NVIDIA expressed strong confidence in the concept of “sovereign AI”:

“Sovereign AI refers to a nation’s ability to produce AI using its own infrastructure, data, workforce, and commercial networks. AI’s importance has captured every country’s attention. Major nations will prioritize control over AI technology. We believe sovereign AI will generate billions in revenue this year.”

Regarding U.S. export restrictions, the new H200 and Blackwell architectures, Jensen Huang also provided updates. Subsequent weeks of rising stock prices clearly reflected market endorsement of his vision and confidence in AI’s long-term trajectory.

3. The Biggest Challenge: Still Self-Development by Tech Giants

As discussed earlier, NVIDIA’s network effects built around the CUDA ecosystem represent a textbook case of a company creating a complete technological ecosystem. Its massive success stems not just from superior chip performance, but from its integrated hardware and software network positioning it firmly at the center of the generative AI wave.

However, its strategy of bundling proprietary software with hardware has drawn strong criticism from customers and competitors alike—and regulators are increasingly scrutinizing its dominant market share with antitrust investigations.

Currently, NVIDIA faces competition from AMD and other chipmakers, including Qualcomm and Intel. These companies are fundamentally chip designers, mostly relying on the same foundry—TSMC—for manufacturing.

AMD and Intel have launched their own data center GPUs aiming to reclaim market share from NVIDIA’s H100/H200. Intel introduced the Gaudi3 AI accelerator chip, while AMD launched the MI300 series. 2024 may mark the first year NVIDIA cedes a small portion of market share to AMD, with Intel also regaining a minor share.

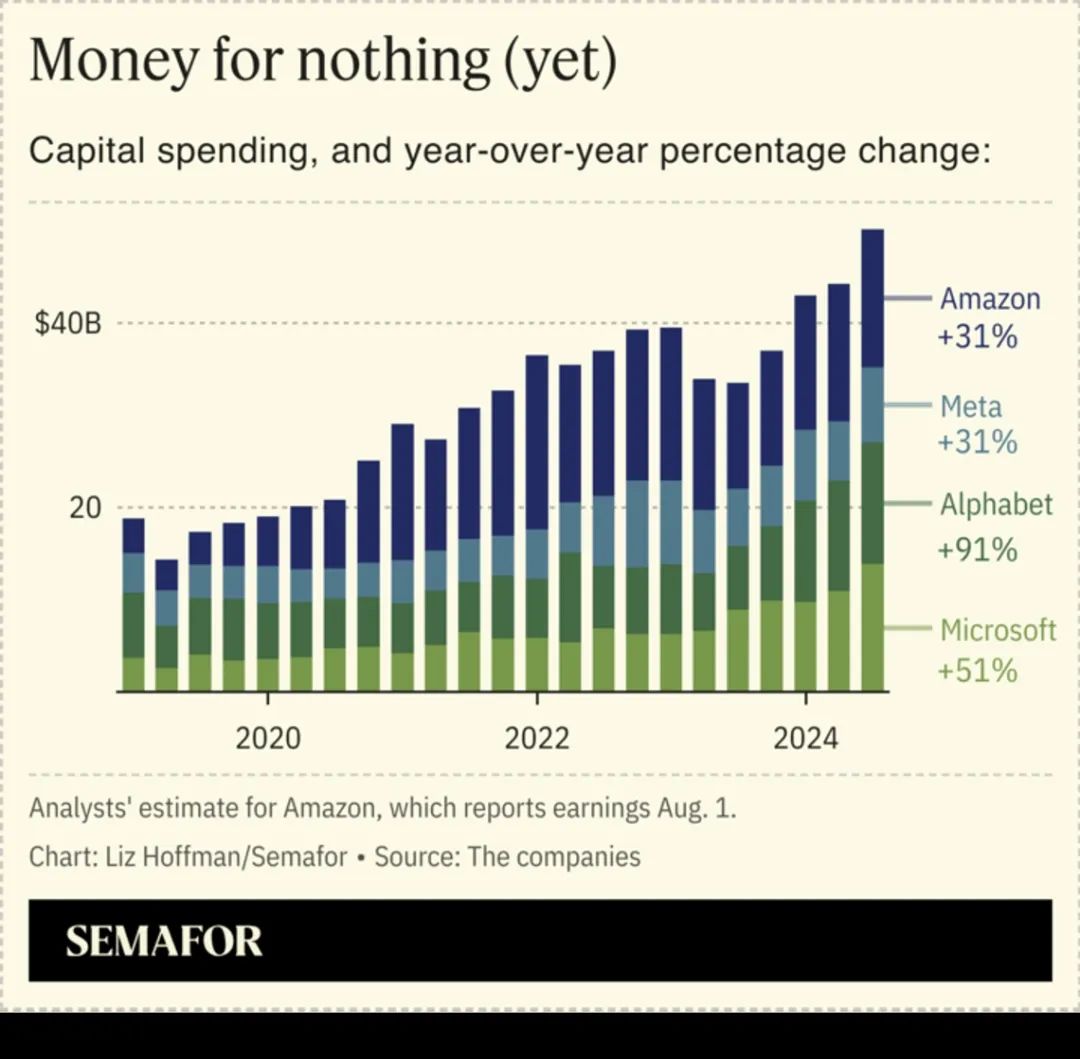

One figure explains the intensity of this competition: according to the latest quarterly reports, Microsoft, Google, and Meta collectively spent over $40 billion on capital expenditures in Q2 2024—with the majority allocated to AI.

With so many giants investing heavily, might executives someday slow AI spending if ROI calculations suggest diminishing returns?

We believe this is almost impossible. Previously, internet giants evaluating new technologies focused on growth—whether it would accelerate business. But generative AI brings a fundamental shift: for these giants, falling behind even slightly could jeopardize their entire business. Thus, the current AI arms race resembles buying medicine. When a technology determines survival versus collapse, companies stop debating cost details.

This isn’t hyperbole. Search, for instance, could be completely transformed by AI. Whether Google or Baidu, their decision-making is no longer about weighing profits or returns—it’s about avoiding catastrophic loss. Buying NVIDIA chips is essentially purchasing insurance—there is no price elasticity in such scenarios.

Because high-performance chips are so critical, while spending enormous capital, tech giants are also determined to develop alternatives or self-built solutions. Facing NVIDIA’s comprehensive CUDA ecosystem, other companies—virtually all competitors—are collaborating to build open alternatives to break NVIDIA’s monopoly over AI software and hardware.

Intel, Google, ARM, Qualcomm, Samsung, and others are jointly developing new software suites enabling code to run on machines with any chip. OpenAI is also contributing, releasing an open-source language allowing researchers without CUDA experience to write GPU code. Similarly, the open-source PyTorch Foundation, incubated by Meta, is pursuing comparable goals.

These companies are also working to replace NVIDIA’s proprietary hardware, developing new solutions for connecting multiple AI chips within and across servers. Intel, Microsoft, Meta, AMD, Broadcom, and others aim to set new industry standards for this critical data center connectivity technology. The clash between proprietary and open approaches mirrors the Apple vs. Android dynamic in smartphones—and as we’ve seen, both closed and open visions can produce winners.

In the long run, tech giants will continue searching for high-performance GPU alternatives or internal solutions to reduce reliance on NVIDIA. Most likely, these efforts will gradually weaken—but not displace—NVIDIA’s dominance in AI.

4. Conclusion

Over the past few years, NVIDIA’s chips have elevated the company’s profitability to unprecedented levels. The RockFlow research team maintains a long-term bullish stance on NVIDIA. Earlier, when Vakee, RockFlow’s founder, was asked on the Crossroads podcast whether there are any signs NVIDIA could be vulnerable to competitors, her answer was clear—there are no such signals.

NVIDIA’s advantage today isn’t just one product or pure GPU hardware superiority. It has built core competencies within a complex ecosystem, making it extremely difficult to breach. Its strengths go beyond CUDA—they include massive user numbers, a vast installed base, end-to-end system integration, and continuous optimization capabilities. These advantages reinforce each other, ensuring its competitive moat remains prominent.

Facing potential ecosystem challenges, NVIDIA spares no effort in addressing them—making acquisitions where needed, investing aggressively. This relentless investment—in hardware, system integration, and solving bandwidth and networking issues—continuously raises its own barriers. This virtuous cycle solidifies its leading position.

Therefore, we believe NVIDIA can sustain its previous growth momentum and unlock even greater value over the long term.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News