Decoding Daylight: The DePIN Protocol for Decentralized Energy Sharing Backed by a16z with $9 Million

TechFlow Selected TechFlow Selected

Decoding Daylight: The DePIN Protocol for Decentralized Energy Sharing Backed by a16z with $9 Million

Daylight is building a decentralized protocol that allows users to connect their energy devices to the Daylight app and earn rewards.

By TechFlow

With new projects constantly emerging in the market, those capable of delivering practical utility are increasingly attracting capital attention.

Yesterday, Daylight, a startup focused on DePIN and energy sharing, announced a $9 million Series A funding round led by a16z. Other investors include Framework Ventures, Lattice Fund, Escape Velocity, and Lerer Hippeau.

Notably, according to The Block, this startup began fundraising in April and completed the entire process within 10 days—a clear signal of strong investor confidence in its business model.

The Series A round brings Daylight’s total funding to $13 million. Previously, the company raised $4 million in seed funding during the summer of 2022.

So, what exactly makes Daylight stand out?

DePIN and Decentralized Grids

What does Daylight actually do?

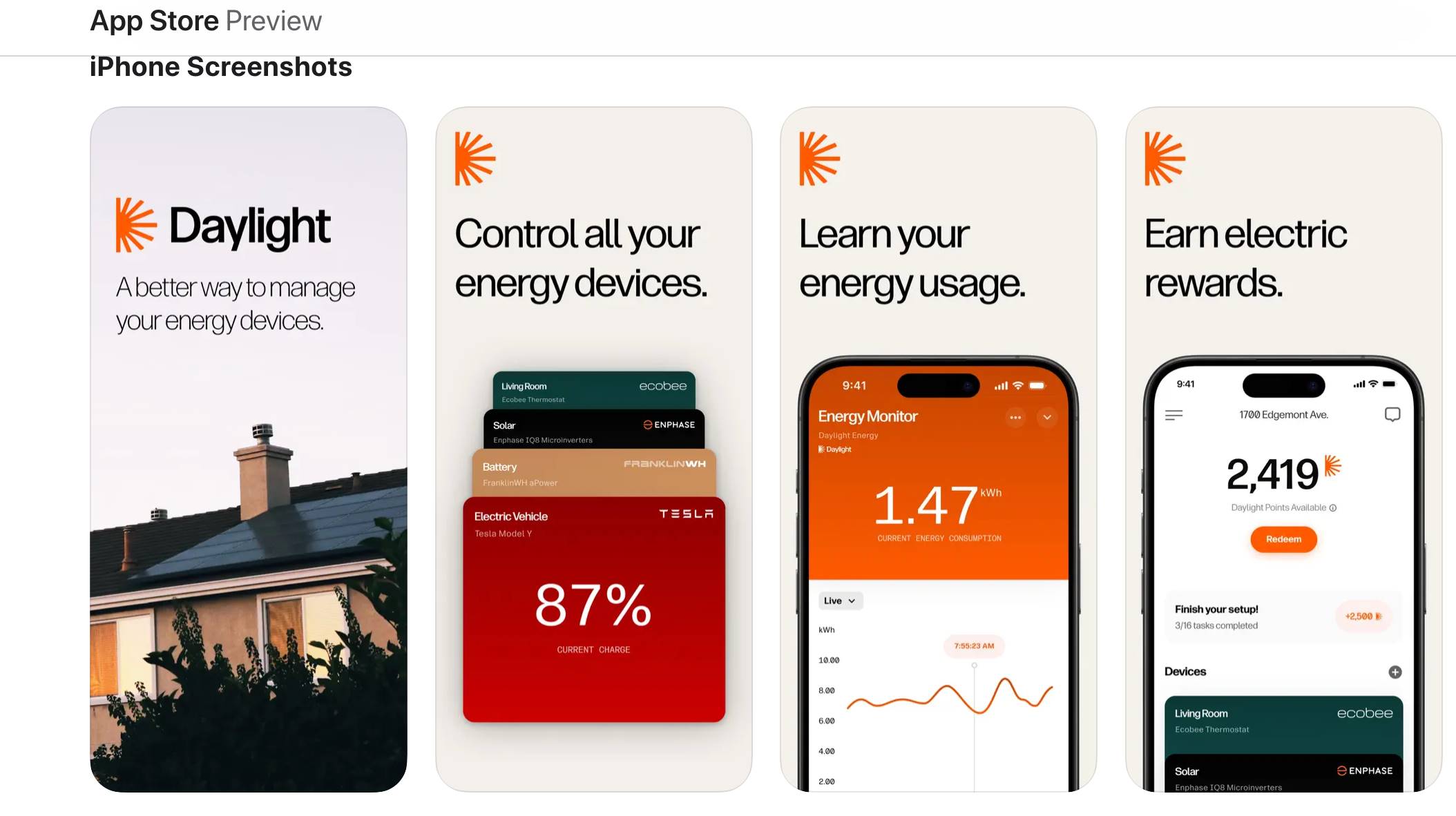

In short, Daylight is building a decentralized protocol that allows users to connect their energy devices—such as thermostats, batteries, electric vehicles, and solar inverters—to the Daylight app and earn rewards.

Users can also access the Daylight marketplace to upgrade their home or building with energy solutions such as solar panels, EV chargers, heat pumps, and water heaters. According to Daylight, the marketplace is currently active in New York, New Jersey, and Pennsylvania, with plans to expand soon to Texas and California.

From a business perspective, this aligns with the concept of DePIN and decentralized power grids.

The traditional power model relies on large centralized power plants distributing electricity through extensive transmission and distribution networks to end users.

However, with rising electricity demand driven by AI and electrification, coupled with the intermittent nature of renewable energy sources, power supply has become increasingly unstable. This leads to fragile, unreliable grids and uncertain pathways for meeting future energy needs.

Distributed energy resources (DERs) can be networked together to simulate larger power plants and improve grid reliability. Daylight is building a new energy market solution from the ground up—starting at individual homes.

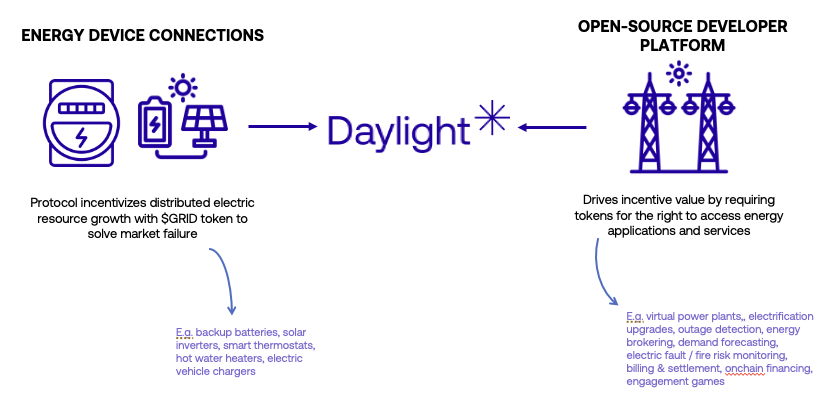

The diagram above clearly illustrates Daylight’s business model:

-

Energy Supply Side: The Daylight protocol incentivizes users to connect various distributed energy resources, such as backup batteries, solar panels, smart thermostats, water heaters, and EV chargers, using GRID tokens as rewards.

-

Energy Demand Side: Daylight provides an open-source developer platform enabling developers to build energy-related applications and services—such as virtual power plants, electrification upgrade tools, outage detection systems, energy trading platforms, and demand forecasting tools. Developers must use tokens to access these services.

-

The Daylight platform acts as a bridge between these two sides, using smart contracts and blockchain technology to enable direct interaction between energy producers and consumers.

Combining Software Apps with Physical Energy Hardware

What products does Daylight offer to users today?

According to its official website, the Daylight ecosystem consists of three core components:

-

Daylight App: Allows users to connect their energy devices and earn rewards.

-

Daylight Marketplace: A simplified and standardized marketplace for homeowners and small businesses to acquire distributed energy devices.

-

Daylight Protocol: An on-chain platform for distributed energy capacity and energy data, using token incentives to balance supply and demand.

Interestingly, the Daylight marketplace isn’t just a virtual trading platform—it involves physically installing energy hardware in users’ homes.

The project leverages a curated network of local contractors and installers to modernize residential energy systems. Specifically, it first assesses a homeowner’s current energy usage, then provides professional recommendations for upgrades, followed by dispatching technicians for installation.

Currently, this service is popular in certain U.S. states. While direct experience may be limited, it’s reasonable to assume that once installed, these devices can be linked to the Daylight app, allowing users to contribute energy or share data via DePIN mechanisms to earn token rewards.

Additionally, the Daylight app is already available on major app stores. Users can easily download it, connect their energy devices, and begin “DePIN mining.”

It should be noted that the app currently connects to the testnet of the Daylight protocol, meaning the rewards are not yet official tokens. The official mainnet launch date will be announced by the project team in due course.

A Professional "Electrician Team": Install First, Scale Later

Public information indicates that Daylight was founded in 2022 and has been operating for some time.

Working quietly behind the scenes, they’ve now gained widespread recognition following their recent funding round.

Regan Bozman, a partner at Lattice Fund (one of the Series A investors), posted that Daylight has done little marketing so far. Instead, the team has spent time building real-world operations—specifically, offering energy upgrade services to homeowners, including solar installations, battery systems, and insulation.

They’ve partnered with energy companies serving tens of thousands of households to validate the feasibility of their hardware-based approach.

Unlike most crypto projects, DePIN initiatives are more hardware-intensive, carrying a heavier asset footprint. Daylight’s hands-on involvement in device installation makes its business model even more tangible—and demands a highly skilled “electrician team.”

Looking at the founder’s background, Udit Patel is a professional in the Northeast power markets, with extensive working knowledge of electricity and natural gas markets.

LinkedIn shows that Udit is essentially an “electrical engineering expert,” having worked across various energy-related companies since graduation—from market compliance and regulatory investigations to generator performance, cost accounting, and settlements. His progression from engineer to consultant reflects deep industry alignment.

This might explain why top-tier VCs like a16z are drawn to the project—many crypto ventures are too abstract. Founders with hands-on technical expertise and real-world industry experience tend to inspire greater trust and credibility.

We’re also seeing a broader trend: the crypto space is saturated with infrastructure projects—many led by high-profile teams—but actual market demand remains limited.

Projects targeting real-world, physical industries like energy are standing out precisely because they offer tangible utility amid the sea of digital infrastructure.

Ultimately, the utility of crypto projects shouldn’t be limited to trading and speculation. Long-term sustainability depends on delivering value across real-world sectors.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News