Deep Dive into the Imperfect Present and Bright Future of DePIN

TechFlow Selected TechFlow Selected

Deep Dive into the Imperfect Present and Bright Future of DePIN

This report provides an in-depth exploration of the concept, current state, challenges, and future of DePIN (Decentralized Physical Infrastructure Networks).

Originally published by Compound, authored by Knower and Smac

Published: September 12, 2024

Approx. 50,000 words | Reading time ~20 minutes

Editor's Note

Why is this report worth reading?

-

DePIN (Decentralized Physical Infrastructure Networks) explores how decentralized technologies can build and manage real-world physical infrastructure, potentially disrupting numerous traditional industries. Understanding DePIN is crucial for grasping the future of Web3.

-

This report systematically breaks down DePIN into six major subcategories—from telecommunications and energy to computing, decentralized AI, data and services—providing a comprehensive ecosystem map. Each section includes real operational data from leading projects, revealing their scale, user growth, and business models.

-

Rather than blindly promoting DePIN’s potential, the report clearly identifies current challenges, particularly the “imperfect reality” such as sustainability issues in token economics, practical barriers when competing with centralized giants, and the impact of emerging technologies like 6G, photonic computing, and distributed training. This balanced perspective helps readers assess the field more rationally.

To help you quickly grasp the key points, we've summarized this research report.

Additionally, DePINone Labs has translated and organized the full text, highlighting its core content for easy reference and sharing.

TL;DR Key Takeaways

This report provides an in-depth exploration of DePIN (Decentralized Physical Infrastructure Networks), covering its concept, current state, challenges, and future outlook.

DePIN aims to reshape the construction and management of traditional physical infrastructure through blockchain and decentralized incentives, achieving higher resource utilization, transparency, and resilient ownership. The report emphasizes that true disruption lies in solving high-cost, inefficient centralized models—not merely in "decentralization" itself.

The report categorizes the DePIN landscape into six main subfields:

-

Telecom & Connectivity: From DeWi to fixed wireless and public WiFi, analyzing projects like Helium, Karrier, Really, Andrena, Althea, Dabba, and WiCrypt, including their technological approaches and market positioning.

-

Energy: Covering distributed energy resources (DER), virtual power plants (VPP), and on-chain financing platforms, with business models and regulatory challenges discussed for protocols like Daylight, SCRFUL, Plural Energy, Glow, StarPower, and Power Ledger.

-

Compute, Storage & Bandwidth: Exploring decentralized compute markets such as Akash, Fluence, IONet, Hyperbolic, Render, and Livepeer, along with storage networks like Jackal, Arweave, and Filecoin, comparing their performance and differences.

-

Decentralized AI: Reviewing projects like Prime Intellect, Bittensor, Gensyn, Prodia, Ritual, and Grass, examining the convergence of decentralized training, validation, and data layers.

-

Data Capture & Management: Highlighting the market value and monetization challenges of content distribution, mapping, localization, and climate/weather data.

-

Services: Showcasing innovative use cases using crypto incentives to drive real-world behaviors, including Dimo, PuffPaw, Heale, Silencio, Blackbird, and Shaga.

While DePIN shows immense potential and is considered one of the most sustainably investable areas in crypto, it remains in early development, facing numerous “imperfect” real-world challenges such as token economic model difficulties, genuine demand and adoption, supply-demand imbalance, competition, and regulation.

Despite these hurdles, the report maintains an optimistic view (“bright future”) about DePIN’s long-term potential.

Future progress hinges on solving tokenomic sustainability, focusing on meaningful real-world problems, and potentially finding breakthroughs in innovative fields such as environmental monitoring, biometric data, or personal data sharing (e.g., bioacoustics, eDNA, sleep/dream data)—pointing toward new directions for innovation.

— — Full Report Below — —

A deep dive into the emerging field of decentralized physical infrastructure.

Today, everyone in the crypto industry is familiar with Decentralized Physical Infrastructure Networks (DePIN). They represent a potential paradigm shift in how critical infrastructure is built, maintained, and monetized. At its core, DePIN leverages blockchain and decentralized networks to create, manage, and scale physical infrastructure without relying on any central entity. This approach ushers in a new era of open, transparent, community-driven growth and ownership, aligning incentives across all participants.

While these ideals are important, for such decentralized networks to reach their full potential, they must build compelling products and solve meaningful problems. The true significance of DePIN lies in its ability to disrupt traditional models plagued by high costs and inefficiencies. We're all too familiar with slow-moving centralized institutions, often characterized by monopolistic or oligopolistic practices. DePIN can disrupt this status quo, ultimately creating more resilient and adaptable infrastructure capable of rapidly responding to evolving demands and technological advances.

Although we usually avoid creating market maps—as they tend to lag behind our investment stage at Compound—in this case, we found many existing analyses overly complexified the vertical. For us, at the highest level, we see DePIN through six distinct subcategories (click each to jump to the relevant section):

-

Telecom & Connectivity

-

Energy

-

Compute, Storage & Bandwidth

-

Decentralized AI

-

Data Capture & Management

-

Services

One of the most common criticisms of cryptocurrency is the tired call for more “real-world use cases.”

Frankly, this is an outdated and uninformed argument—but it will likely persist regardless. Especially in the West—where crypto applications are already taken for granted—we’d all benefit from more accessible use cases that demonstrate the technology’s potential. In this regard, DePIN stands out—it’s arguably the best example of how crypto incentives can generate tangible real-world utility, enabling individuals to build and participate in physical networks previously thought impossible. While most crypto projects today rely entirely on software success, DePIN emphasizes tangible hardware in the physical world. Narratives and storytelling are essential components of every tech wave, whether we like it or not, and the entire crypto industry needs to tell the story of DePIN more effectively.

Despite a few industry leaders (like Helium, Hivemapper, and Livepeer), DePIN still faces many unresolved questions as it matures. Its core value proposition is disrupting traditional infrastructure provision and management models. By implementing crypto incentives, DePIN can achieve:

-

Higher resource utilization

-

Greater transparency

-

Democratized infrastructure building and ownership

-

Fewer single points of failure

-

Higher efficiency

Theoretically, all of these should lead to more resilient real-world infrastructure.

We believe another core value proposition of DePIN is its ability to completely disrupt existing business models through cryptoeconomic design. While skeptics may cynically dismiss certain DePIN projects as weak businesses reliant on artificial token incentives, this report will emphasize that in some cases, introducing blockchain can significantly improve existing models—or even introduce entirely new ones.

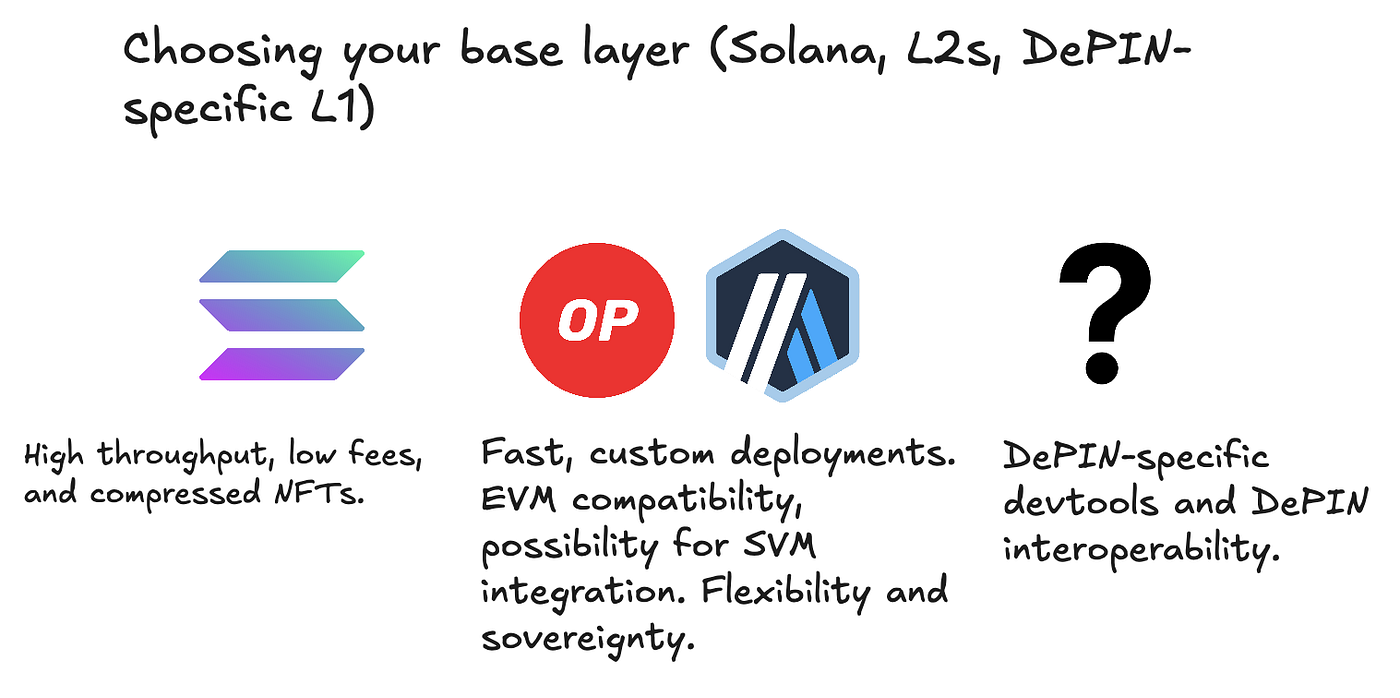

While we have our own views, we mostly sidestep the ongoing debate about where these networks should be built: Solana has become a focal point for the DePIN ecosystem, yet regardless of the chosen base layer, trade-offs are inevitable.

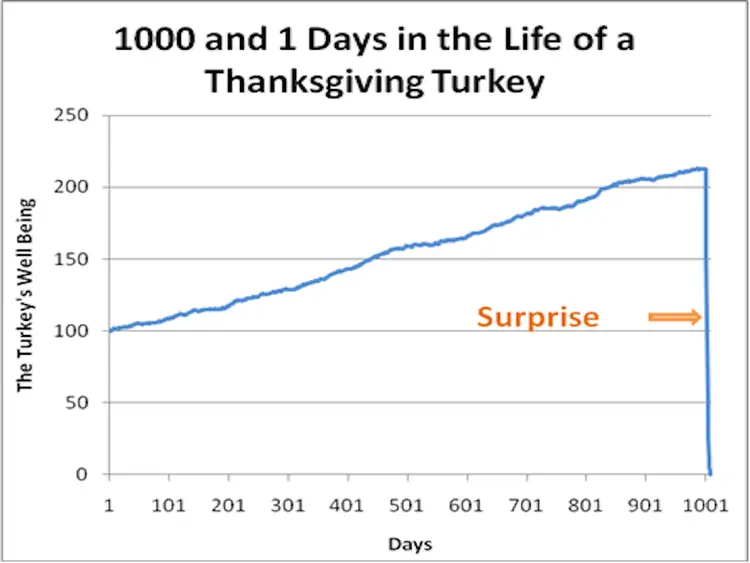

Like all network types, DePIN development must focus on two core dimensions: demand and supply. Arguably, validating demand is (almost) always harder. The intuitive explanation is that token incentive models naturally map more easily to the supply side. If you already own a car or idle GPU cycles, adding a dashcam or offering spare compute incurs almost no additional cost—there’s minimal friction.

But on the demand side, the product or platform must deliver real value to paying users. Otherwise, demand will never form or devolve into speculative capital. To illustrate: Helium Mobile’s demand-side consists of users seeking better cellular plans. Hivemapper’s supply-side comprises individual contributors earning tokens by providing high-precision map data. Importantly, both cases are highly intuitive.

When discussing supply and demand, we must delve into the core element underpinning all DePIN activity: token incentives.

You cannot discuss supply and demand without expanding on the core component driving all DePIN activity: token incentives. A report this summer from 1kx detailed the cost structures of multiple DePIN projects and assessed the sustainability of these systems. The key takeaway: aligning rewards with operating costs and demand growth is difficult—let alone creating a universal model across all DePIN projects. Generalizations don’t work, especially in such diverse real-world economic verticals. The complexity of the markets these networks aim to reshape makes them both exciting and challenging.

While there are variations among project models, in most cases, a DePIN project’s cost structure stems from: a) determining node operator participation costs; b) assessing network node operational efficiency; c) examining differences in project accounting mechanisms.

This report is absolutely worth reading, but it offers one important insight: you cannot generalize tokenomics, nor assume one project’s failure to maintain proper token incentives invalidates others. More importantly, you cannot dismiss the entire DePIN space based solely on token economics. Even in DeFi, after years of experimentation, we still lack a sustainable token model that rewards new users while continuously incentivizing existing capital. The capital expenditure (CapEx) reduction brought by traditional DePIN models not only makes launching networks and operations easier but also gives them a competitive edge over traditional models in system architecture (we’ll explore this throughout).

We believe a frequently overlooked point is the true meaning of network effects.

We often refer to these systems as networks, sometimes conflating them with network effect principles. Ideally, a DePIN network starts with one side (usually supply), then demand grows, attracting more supply and creating an exponential value loop. But simply having a two-sided market doesn't equate to network effects.

So, do existing businesses possess specific attributes making DePIN an attractive disruptive model? We believe DePIN models show unique advantages when at least one of the following conditions is met:

-

High cost or cumbersome processes for a single provider to scale infrastructure

-

Opportunities to improve supply-demand matching efficiency

-

Ability to accelerate the path to low-cost end-states by leveraging idle assets

To clarify the report structure, we’ll organize the discussion by the six categories mentioned earlier. Each section covers core concepts or problems, existing teams’ solutions, our views on industry durability, and remaining challenges. If you want direct access to our internal thoughts, the final section discusses some DePIN innovation ideas we’d love to co-build.

Telecom & Connectivity

The modern telecom industry developed primarily in the 1990s, when wired technology was rapidly overtaken by wireless. Mobile phones, wireless computers, and wireless internet were just entering broader retail markets. Today, telecom is massive and complex, managing everything from satellites and wired distribution to wireless carriers and sensitive communication infrastructure.

Everyone knows some of the biggest players: AT&T, China Mobile, Comcast, Deutsche Telekom, and Verizon. In scale terms, the traditional wireless industry generates over $1.5 trillion in global annual revenue across three main areas (mobile, fixed broadband, and WiFi). Let’s briefly distinguish these:

-

Mobile communications connects people—whenever you make a phone call, you’re using mobile infrastructure.

-

Fixed broadband refers to high-speed internet services delivered via fixed connections (typically cable, fiber, DSL, or satellite) to homes and businesses, offering more stable, faster, and sometimes unlimited data connections.

-

The WiFi industry manages the most widely used connectivity protocol, enabling everyone to access the internet and communicate.

About two years ago, the EV3 team shared a post detailing the state of existing telecom companies.

"With $265 billion in productive physical assets (radio equipment, cell towers, etc.), telecom companies generate $315 billion in service revenue annually. That’s a 1.2x asset turnover rate—quite impressive!"

Yet these companies require hundreds of thousands of employees and billions in resources to keep managing this growing infrastructure. We encourage reading the full post, as it further explores how these firms pay taxes, upgrade infrastructure, manage licenses, and stay operational. It’s a difficult-to-manage and unsustainable model.

Recently, Citrini Research revealed some pressing issues faced by incumbent telecom giants. They detail the financial states of many such companies, painting a worrying picture: over-optimistic forecasts (attributed to pandemic-era expectations) led many to accumulate vast inventories that are hard to deploy. Specifically, after the Fiber-to-the-Home (FTTH) consumer connection boom, balance sheets are filled with large amounts of unused fiber optic cables. The problem is there’s nowhere to offload this inventory. Citrini further notes that demand has shifted from individual connections to "shared campus and metro networks to deploy inventory and support new tech booms."

Telecom providers won’t be able to roll out new supply fast enough—the demand growth has reached a pace they can’t match. DePIN can fill this supply gap. This creates a unique opportunity for decentralized wireless (DeWi) projects to scale networks faster than existing operators while meeting rising demand for wired and wireless infrastructure. Citrini specifically highlights demand for fiber networks and WiFi hotspots. While decentralized deployment of fiber nodes hasn’t been deeply explored, WiFi hotspot implementation is now feasible and already underway.

We’ve mentioned the three pillars of wireless technology—now let’s dive deeper into each and compare their decentralized models with today’s telecom industry.

Mobile Wireless

Mobile wireless is perhaps the best-known subfield within DeWi. In this context, it refers to decentralized networks providing cellular connectivity (i.e., 4G and 5G) through distributed node networks. Today, the traditional mobile wireless industry relies on a network of cell towers providing coverage for specific geographic areas. Each tower communicates with mobile devices via radio frequencies and connects to the wider network through backhaul infrastructure (fiber optics). The core network handles all switching, routing, and data services—a centralized provider linking cell towers to the internet and other networks.

Infrastructure construction is capital-intensive, and deploying 5G requires denser networks—especially in urban areas—meaning more towers. Rural and remote areas often lack coverage due to fewer potential users and lower ROI, making expansion challenging.

Beyond high upfront costs, continuous maintenance is required. Repairs, software updates, upgrades for new tech (like 5G), and in high-density areas, network congestion lowering service quality—all necessitate ongoing investment in optimization and capacity upgrades. Incidentally, this is something operators should’ve anticipated long ago.

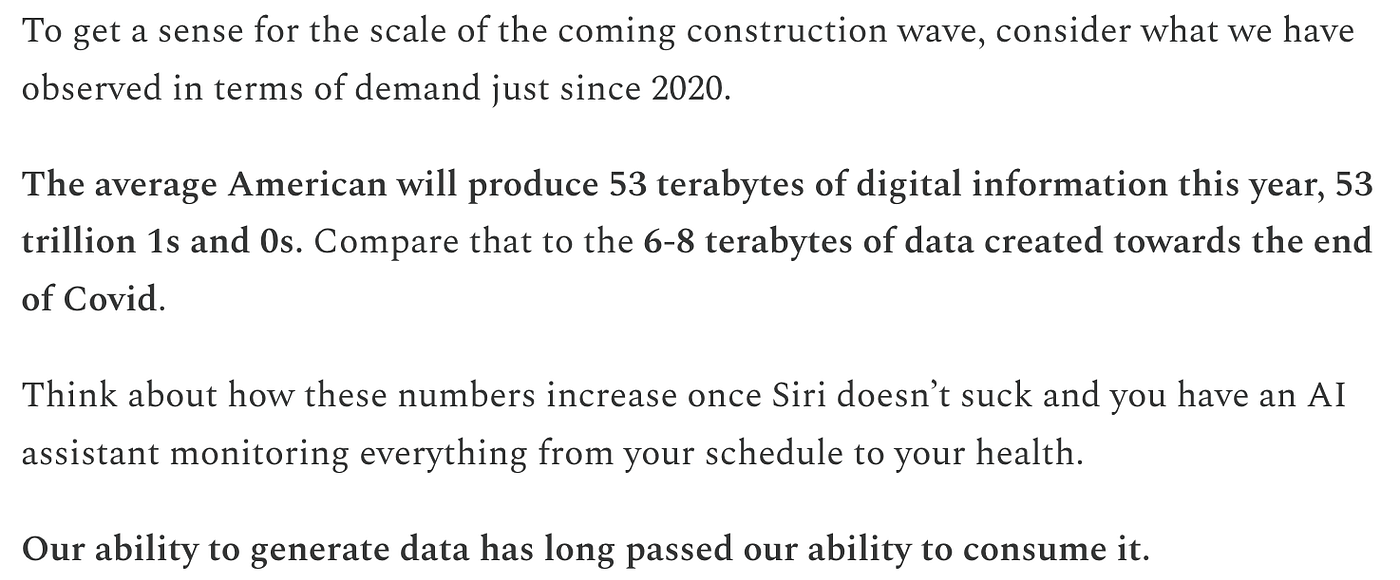

Data-driven market prospects and infinite growth potential drove spectrum costs from $25–30 billion in the 2G era to $100 billion in 3G. Rising capital costs fueled core infrastructure enhancements and expanded mobile networks to cover over half the world’s population by 2010. Although 3G saw rapid user growth, rising costs began to outpace revenue gains. While the BlackBerry defined 3G, the iPhone clearly dominated and shaped 4G.

These two technologies (4G and the iPhone) brought the internet to handheld devices. Data usage grew vertically—from less than 50MB per month per device in 2010 to 4GB by the end of the 4G era. The issue: while data revenue rose, it fell far short of offsetting steep declines in traditional voice and SMS revenue (down ~35% annually between 2010–2015). Meanwhile, operators spent over $1.6 trillion on spectrum, core network upgrades, and infrastructure expansion to meet endless demands for capacity and coverage.

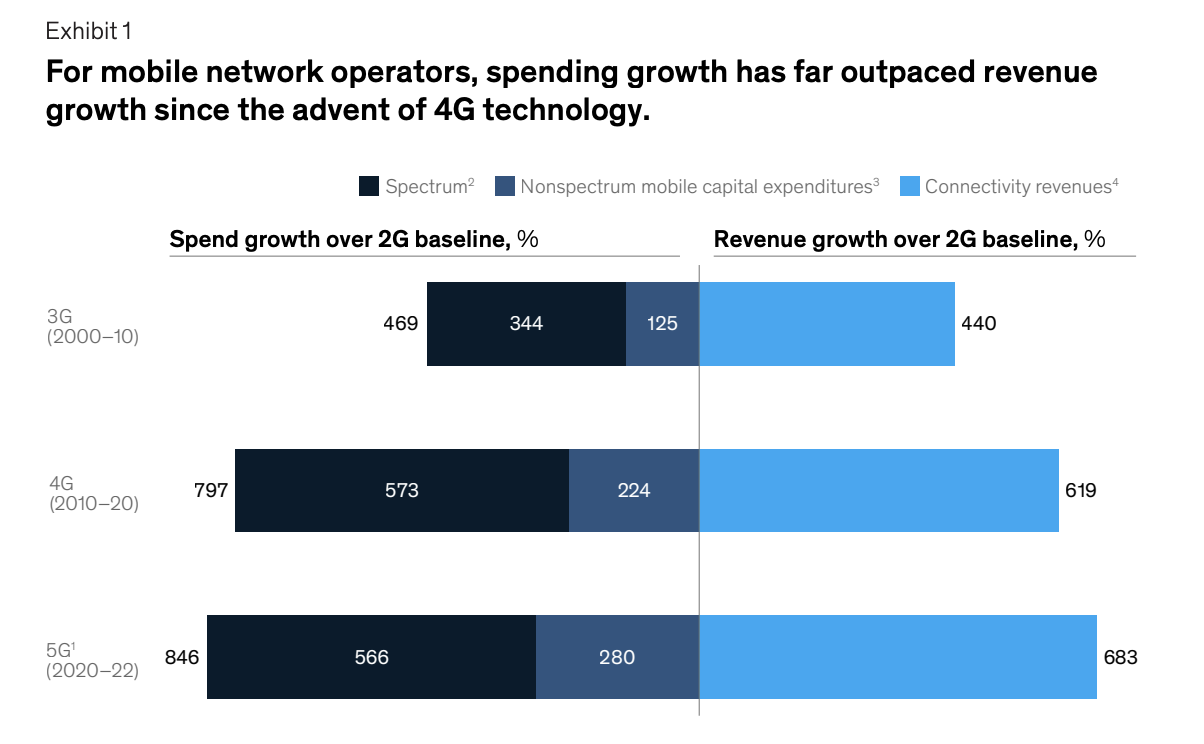

Helium is most commonly associated with the decentralized wireless space—and rightfully so. Founded over a decade ago, Helium initially aimed to create a decentralized wireless network for IoT (Internet of Things). The goal was to build a global network allowing low-power devices to wirelessly connect to the internet, enabling wide-ranging applications. While the network grew, the IoT market itself showed limitations in scale and economic potential. In response, Helium expanded into mobile telecom, leveraging its existing infrastructure to target more profitable, data-intensive markets. Ultimately, Helium announced Helium Mobile, a new initiative to build a decentralized mobile network—clearly aligned with Helium’s broader vision of a decentralized wireless ecosystem. Today, Helium’s coverage network includes over 1 million hotspots, serving over 108,000 mobile users.

Helium’s IoT platform focuses on connecting low-power, low-range devices to support niche networks like smart cities or environmental monitoring. The platform runs on LoRaWAN (Long Range Wide Area Network) protocol, designed to connect battery-powered devices to regional, national, or global networks. LoRaWAN standards typically support bidirectional communication, enabling parties to send and receive messages.

The IoT network comprises devices like vehicles and appliances connected via sensors and software, enabling communication, management, and data storage. Helium’s IoT platform was formed around the idea that many applications would need broad coverage with low data rates. While individuals could launch hotspots anywhere at relatively low cost, most appliances only need to occasionally send data—making running traditional infrastructure capital-inefficient.

By combining LoRaWAN with Helium’s decentralized network, capital expenditures can now be reduced and network coverage expanded. Helium has approved over 16 different types of hotspots for operation, each quite affordable.

The Helium Mobile plan was created as an alternative to traditional wireless providers. Initially, the team built a decentralized mobile network coexisting with legacy cellular networks, introducing the MVNO (Mobile Virtual Network Operator) model. Helium can provide seamless coverage by partnering with existing carriers while using its own network for extra capacity and lower costs. This hybrid approach allows Helium to offer competitive mobile services while scaling its decentralized network. Helium Mobile is compatible with existing 5G infrastructure, offering a low-cost platform for smartphones, tablets, and other high-speed mobile devices.

Verizon and AT&T each have over 110 million users, charging $60–90/month for individual plans and $100–160 for family plans. In contrast, Helium Mobile offers an unlimited plan for $20/month. How is this possible?

This is thanks to one of DePIN’s core advantages: drastically reduced capital expenditures. Traditional telecoms must build and maintain all infrastructure themselves. In turn, they pass part of these costs onto customers through higher monthly fees. By introducing token incentives, teams like Helium can solve the bootstrap problem and shift CapEx to its network of hotspot operators.

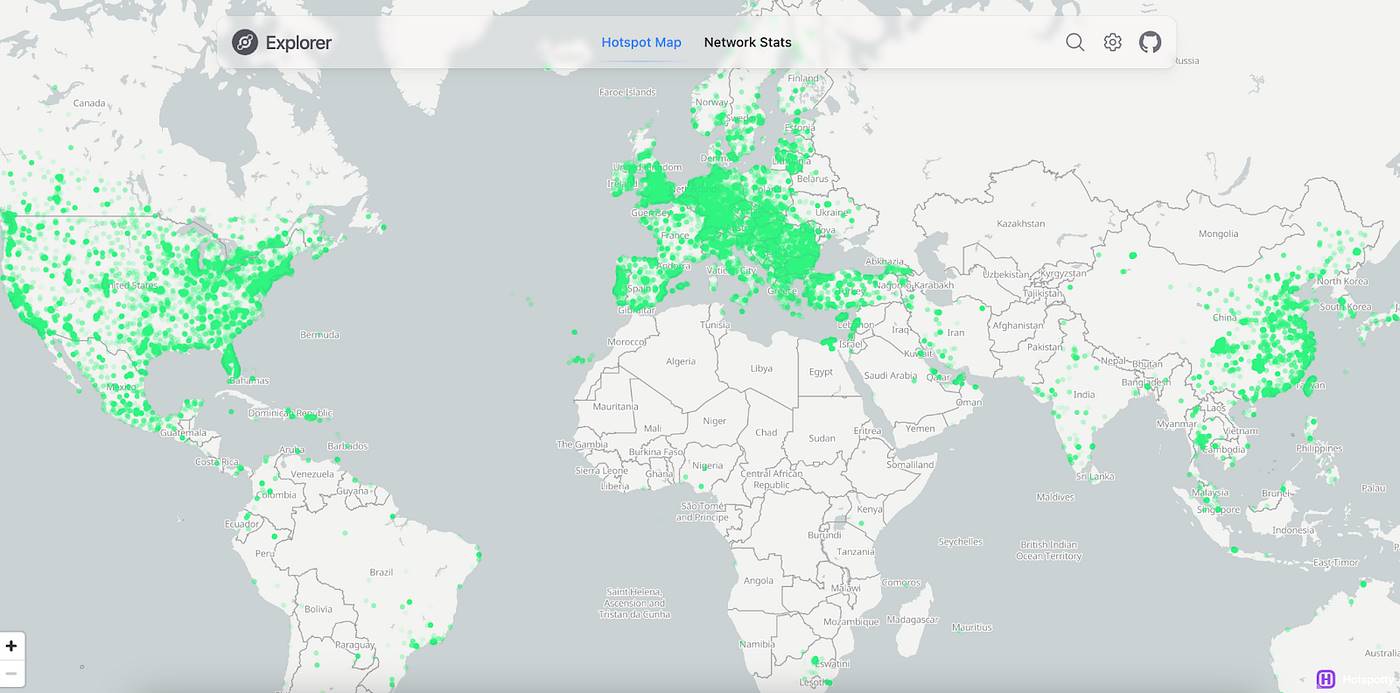

As noted in the report’s introduction, these DePIN teams ultimately need to deliver products and services with real demand. In Helium’s case, we see meaningful progress with the world’s largest mobile operators. Their recent partnership with Telefonica expands Telefonica’s coverage and enables mobile data offloading to the Helium network.

Regarding offloading, rough calculations suggest significant revenue potential. Assuming mobile users consume about 17GB of data monthly, if Helium’s carrier offloading service captures ~5% of data usage from large operators, that could generate over $50 million in revenue. There are many assumptions here, but we’re in the early stages of these protocols—if customer conversion or offloading rates were higher, revenues could grow substantially.

Helium is a prime example of the scalability power of decentralized networks. A project like this wouldn’t have been possible ten years ago. Bitcoin was too niche then to convince people to set up mining rigs at home, let alone hotspots for a very nascent sector in crypto. Helium’s current and future success is a net positive for the entire field—provided it can gain market appeal relative to traditional competitors.

Next, Helium will focus on expanding coverage and uniquely target regions where coverage most frequently switches to T-Mobile. This is another subtle benefit of the token model—when Helium collects data on the most common coverage drop zones, it can incentivize those closest to these areas, quickly targeting high-density but uncovered regions.

Other companies in the DePIN mobile space are developing their own innovative solutions: Karrier One and Really are two examples.

Karrier One calls itself the world’s first carrier-grade, decentralized 5G network, combining traditional telecom infrastructure with blockchain technology. Karrier’s approach closely resembles Helium’s—individuals in the network can set up nodes, similar to Blinq Network’s PC-400 and PC-400i cellular radios (running on Sui).

Karrier’s hardware is similar to Helium’s, but its software and GTM (go-to-market) strategy differ. Helium aims for near-global coverage, while Karrier initially targets underserved or remote areas. Their software enables sending/receiving payments via SIM-linked phone numbers, going beyond banking systems.

In their own words, Karrier can create “a virtual phone number for all your web3 notifications, payments, logins, permissions, and more”—dubbed KarrierKNS. This makes Karrier potentially more suitable for communities lacking robust banking infrastructure, while Helium might appeal more to individuals in developed regions wanting cheaper phone plans.

Karrier’s network architecture consists of base nodes, gateway nodes, and operator nodes. Base nodes handle authentication and blockchain maintenance, gateway nodes manage end-user wireless access, and operator nodes provide traditional telecom modules. All run atop Sui smart contracts managed by the Karrier One DAO (KONE DAO) for internal review. Their use of blockchain technology follows these principles:

-

Smart contracts over authority and bureaucracy

-

Blockchain grants users control and privacy over their data while maintaining transparency

-

Karrier One’s tokenomics pave the way for shared success among network participants

Compared to Helium, Karrier is clearly in earlier stages, but there can be more than one successful DeWi protocol. How many exactly remains to be seen, though we often see MVNOs (Mobile Virtual Network Operators) in traditional telecom sell for valuations around a billion dollars. The telecom industry clearly has some degree of oligopoly, with players like Verizon and AT&T. Where Karrier might succeed is by providing banking services to the unbanked through its KarrierKNS program, while Helium gradually erodes traditional telecom market share. A related note is Karrier’s emphasis on future adaptability to accommodate 5G, edge computing, and further tech advances. What this means technically is beyond this report’s scope, but it’s an interesting position compared to traditional telcos’ cautious stance on 6G investments.

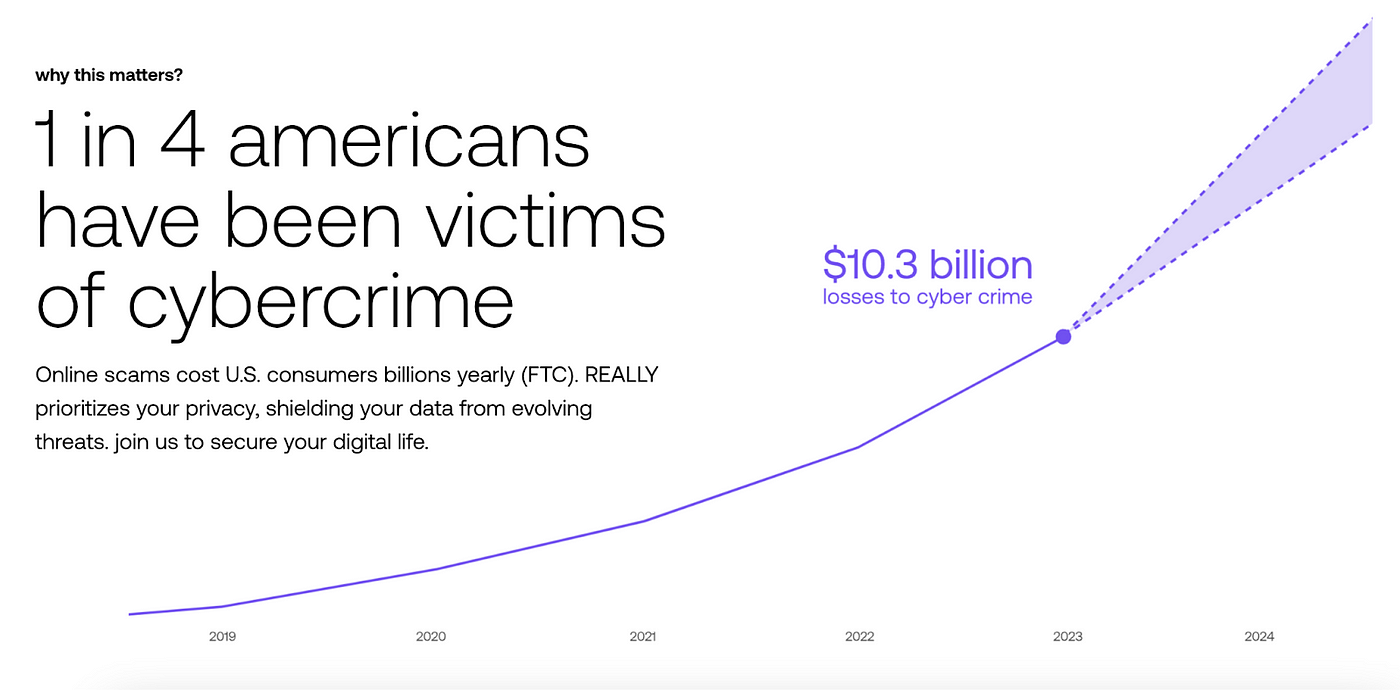

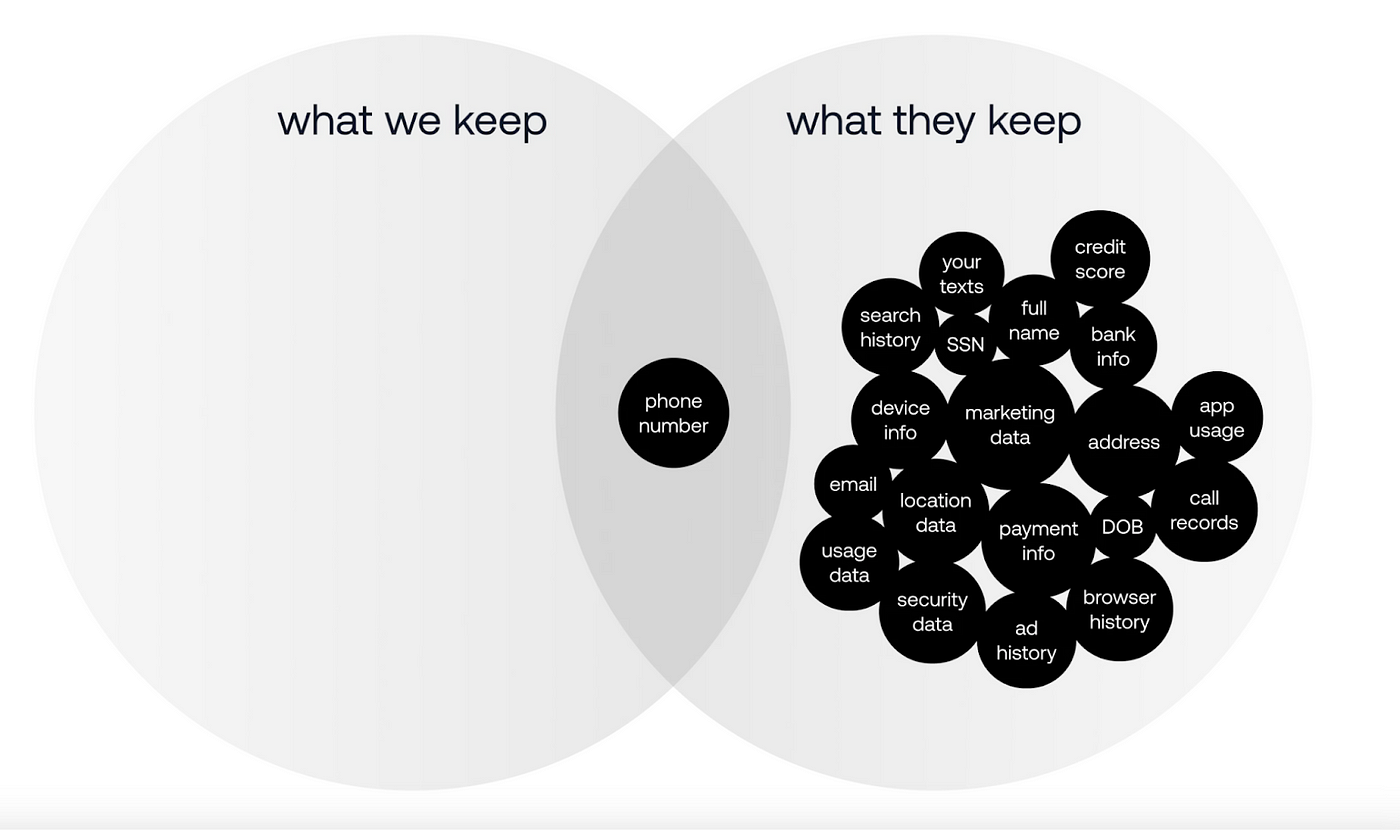

Really is the world’s first fully encrypted, privacy-focused wireless carrier, where users participate in network building by deploying small cellular radio devices globally. The project’s core lies in ensuring privacy for all transmitted data—traditional mobile subscribers don’t truly own their data, making Really a pioneer in user-first telecom.

Really cites data showing that 1 in 4 Americans have suffered cybercrime. Data breaches are massive and worsening over time. With the proliferation of IoT devices—smart fridges, cars, door locks, household robots—the attack surface is rapidly expanding.

Beyond that, true anonymity online is rare today. Registering a new account anywhere increasingly requires disclosing personal information. Most companies are known for hoovering up massive user data, and with AI advancements, this collection will only intensify.

Traditional telecom relies on large cell towers, which naturally create geographical gaps in coverage. Really addresses this by deploying these small “base stations” in participants’ homes.

Their mobile plans offer complete identity protection and monitoring, including a proprietary security suite (anti-worm, anti-ransomware), SIM swap protection, and insurance. Really first aims to offer protective, customized mobile plans. Their unlimited plan is currently priced at $129/month, including unlimited data, calls, and texts, free calls to over 175 countries, end-to-end encryption, and VIP concierge services via the Really VIP program. This borrows from a private healthcare-like business model, as more consumers seek custom services unavailable from traditional providers.

This approach to the DePIN mobile space is indeed unique, differentiating through functionality and privacy rather than cost. It’s too early to draw strong conclusions, but as a general strategy—building differentiation on a core principle not yet widely accepted (here, privacy and encryption’s importance)—is a viable way to carve out space in a competitive market.

It’s easy to argue that mobile wireless is the most promising DePIN segment. Smartphones are ubiquitous. The rise of eSIMs benefits the industry with lower switching costs—users no longer need physical SIM cards. This allows storing multiple carrier services on a single eSIM, more convenient for frequent travelers. This trend should continue. Assuming so, mobile DePIN’s rationale for leveraging—and possibly breaking through via—eSIM advancements becomes even stronger.

While smartphones and other mobile devices are powerful sensing endpoints, they face unique challenges:

-

Continuous data collection raises privacy concerns and drains device batteries

-

User-provided data typically has low retention

-

Data mining attracts certain users, causing unexpected dataset biases

-

Airdrop speculators make it hard to distinguish real users from fake traffic

-

Defensive dynamics can lead to vicious competition over token rewards

These aren’t insurmountable. First, offering an “opt-out” or complete data deletion option could attract skeptical users. Simply providing an exit option itself is a strong trust signal. We’ve also seen large-scale crackdowns on airdrop speculators—LayerZero being the most visible public example.

Notably, mobile wireless has the highest revenue per GB in telecom. Continuous device connectivity gives operators stronger pricing power than fixed broadband or WiFi. Additionally, continued improvements in standards like 5G bring faster speeds and higher performance, reinforcing this pricing advantage.

So what comes after 5G? Yes… 6G.

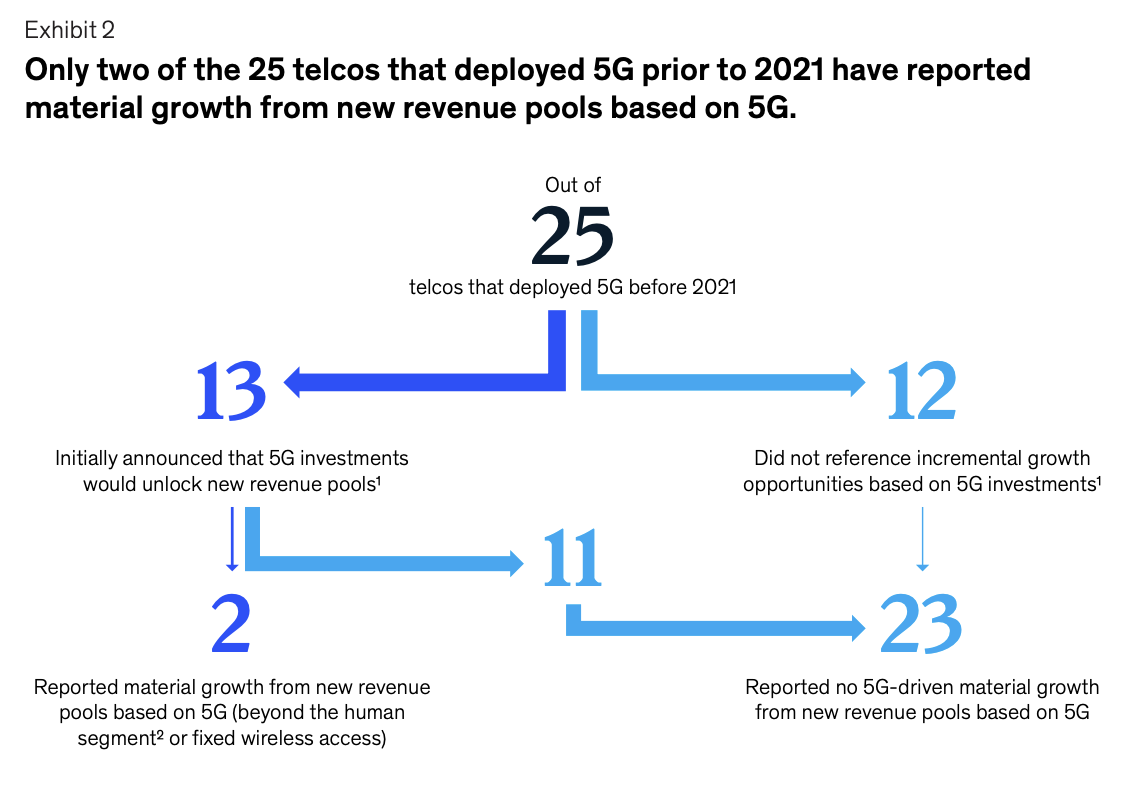

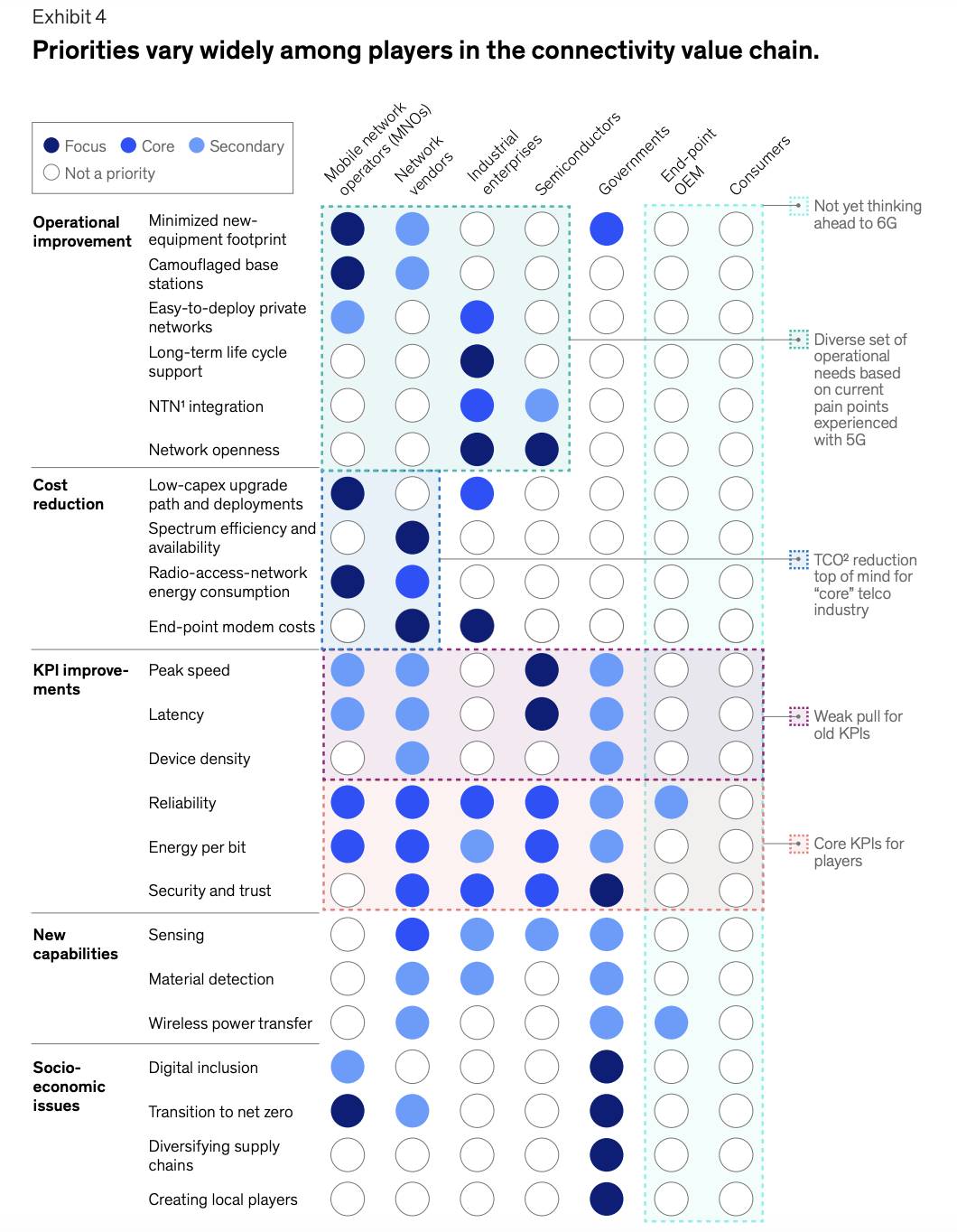

6G promises instant communication between intelligent devices and supports widespread adoption of next-gen wearables. While it’s premature to discuss details, it’s essentially a performance-boosted upgrade of 5G. Interestingly, one key challenge for 6G is coordinating consensus among existing stakeholders. Currently, telecom equipment makers, governments, mobile operators, semiconductor manufacturers, and device vendors lack unified agreement on 6G’s goals, features, and requirements. The chart below (though complex) shows the only consensus among parties is skepticism about how 6G can create value on existing infrastructure.

Understanding where these stakeholders disagree—and which groups are most likely to “win” amid controversy—is crucial for grasping industry direction. This is why we find DePIN particularly attractive—we see seasoned professionals from other tech sectors bringing their expertise to solve these problems. While studying these dynamics requires more work, winning in this massive market promises extraordinary returns.

Fixed Wireless

As the name suggests, fixed wireless refers to high-speed internet services provided via fixed connections, typically using cable, fiber, DSL, or satellite technology. Compared to mobile networks, fixed broadband delivers more stable and faster data connections. It can be broken down into:

Fiber optics

-

Transmits light signals through glass or plastic fibers

-

Offers ultra-low latency connections exceeding 1Gbps

-

Ideal for online gaming, video conferencing, and cloud apps

-

The gold standard and most forward-looking for fixed broadband

-

Expensive to lay in sparsely populated areas

Cables

-

Uses coaxial cables (originally laid for TV) to deliver internet

-

Modern systems often use a hybrid fiber-coaxial backbone

-

Theoretical speeds up to 1Gbps, but real-world performance affected during peak hours

-

Latency lower than fiber, performance drops under high traffic

-

With DOCSIS 4.0, theoretical speeds up to 10Gbps, approaching fiber performance

DSL

-

Delivers internet via traditional copper telephone lines

-

One of the oldest forms of broadband

-

Typical speeds 5–100Mbps, higher latency

-

Gradually being phased out

Satellites

-

Provides internet via Earth-orbiting satellites

-

Traditional geostationary satellites vs. emerging Low Earth Orbit (LEO) satellites reshaping the field

-

LEO speeds 50–250Mbps, latency 20–40ms

-

Geostationary satellites suffer high latency due to distance; LEO significantly improves this

-

Global coverage

-

Huge growth potential in areas lacking ground infrastructure

-

In suburban areas with existing fiber/cable, mainly serves as supplementary

Due to switching difficulties (installation costs, downtime) and inherent bundling (cable internet with TV), fixed broadband currently enjoys higher user stickiness and retention.

The outlook appears optimistic, but rests on several debatable assumptions. The most tangible high-impact threat comes from 5G and future 6G technology—multi-gigabit speeds and low latency rivaling fiber, with added mobility and ease of deployment. Mass abandonment of fixed services is likely, especially in suburban areas.

Another potential (though longer-term) threat is LEO satellite broadband. While Starlink and Project Kuiper remain expensive and underperforming today, removing data caps and lowering costs could make them formidable challengers to fixed broadband long-term.

Ignoring these two threats risks subscriber loss for builders in this space (especially fiber, cable, and DSL providers).

Fixed internet earns only one-tenth the revenue per GB compared to mobile wireless—how do these companies profit? The core business model relies on monthly subscriptions, tiered services, and custom enterprise solutions. They charge enterprises premium prices for custom solutions (e.g., hedge funds competing for better underground cable locations), higher speeds, and bundled services (TV, internet, phone). Major U.S. suppliers include Comcast (Xfinity), Charter Spectrum, AT&T, Verizon, and CenturyLink, with Vodafone, BT, and Deutsche Telekom internationally. While Comcast and Charter dominate the U.S. fixed broadband market, fiber providers like AT&T and Verizon are aggressively capturing share by rolling out FTTH.

Fixed internet uses Point-to-Multipoint (PtMP) technology, where a single central node (base station) connects multiple end nodes (users) via a shared medium. In fixed wireless, this means a central antenna sends signals to multiple receivers. Early PtMP faced challenges: interference from same-band devices causing signal degradation and performance drops, plus limited bandwidth due to its shared nature—speeds decline as more users join.

Today, advanced modulation schemes (OFDM, MIMO) and higher frequency bands (mmWave) have improved PtMP efficiency, supporting larger bandwidth and more users. But mmWave signals remain prone to attenuation—rain, foliage, and physical obstacles significantly degrade performance. Fixed internet continues evolving, leaving room for new DePIN entrants with unique solutions.

Andrena and Althea are two better-known companies in the DePIN fixed wireless space. Andrena offers high-speed networks for multi-dwelling units (MDUs) at competitive prices, with a unique go-to-market strategy minimizing customer installation needs. As mentioned, fixed internet users are sticky due to switching costs and difficulty migrating physical infrastructure.

Andrena uses Fixed Wireless Access (FWA) technology to deliver broadband via wireless signals instead of cables. FWA has much lower deployment costs than wired broadband, scales faster, but is more susceptible to interference, environmental impacts, and performance fluctuations. The company deploys antennas on rooftops to cover wide areas—apartment buildings, office complexes, and other high-density locations. Basic packages start at $25/month for 100Mbps and $40/month for 200Mbps, averaging ~30% cheaper than Verizon or AT&T. By partnering with real estate companies and property owners through revenue-sharing agreements, antenna deployment accelerates—owners gain income while offering tenants high-speed internet as a value-added service. Andrena initially targets markets in New York, Florida, New Jersey, Pennsylvania, and Connecticut.

Recently, Andrena announced a decentralized protocol called Dawn. Previously, the company operated like a traditional firm, merely promoting decentralization. Dawn connects buyers and sellers of network services via a Chrome extension, theoretically letting individuals become their own ISPs. The key question is where value accumulates—does it flow to entities like labs, or truly back to the token?

Dylan Bane at Messari pointed out in a deep report that broadband faces a trilemma similar to blockchain’s—but for broadband, the trade-off lies in service delivery methods. Technologies like coaxial, fiber, DSL, and satellite occupy different quadrants of “best performance but worst scalability” or “worst security but best performance,” etc.

Note that this reflects a static current state—we care more about future trajectories. What matters isn’t where these technologies sit today, but their potential movement toward the top-right corner of the matrix. This will determine startup strategies and success.

It’s biased to place fiber at the bottom of scalability—while deployment is costly, dense populations already have fiber deployed. Though hard to expand into new areas, fiber has firmly captured suburban markets.

Dawn’s core idea is that recent advances in wireless technology enable enterprises to compete with fiber providers at lower cost. Their whitepaper highlights multi-gigabit capacity, mechanical beamforming, and high-frequency unlicensed spectrum as key breakthroughs, defining the Dawn protocol as:

Directly connecting users to internet exchange points without trusted intermediaries

Minimizing the hundredfold price gap between wholesale and retail network pricing

Eliminating dependence on a single network path by integrating home nodes

The Dawn network consists of bandwidth nodes, distribution nodes, and end users, matching bandwidth demand and supply through a trustless protocol. Its goal is to build a device network while remaining vendor-neutral. Most DePIN projects face challenges filtering quality suppliers, users jumping to external platforms, and hardware deployment in homes—Dawn chose 60GHz mmWave and 6GHz bands precisely for their short-range communication and high-bandwidth transmission capabilities.

The project uses the Solana blockchain to manage service contracts, which record agreements between network nodes and end users. The protocol introduces three mechanisms—Proof of Bandwidth (PoB), Proof of Service (PoS), and Proof of Location (PoL)—to coordinate participant transactions. While PoB isn’t novel, Dawn aims to use tokenomics to achieve sustainable, scalable home ISP operations. The PoL mechanism (detailed later) acts as a digital credential for user identity and real-time location.

Dawn introduces a new mechanism called “medallions”—essentially stakable accounting units whose holders earn a 12% cut of chain-based revenue from high-value zones. These medallions act as gateways to the Dawn network—assuming decentralized broadband takes off and eventually disrupts traditional operators, the 12% revenue share for medallion holders would be extremely valuable.

Leveraging relationships with Andrena’s existing customer base, Dawn’s initial deployment will cover over 3 million households, expected to generate over $1 million in Annual Recurring Revenue (ARR). The system is designed so early participants can stake medallions and share in the ongoing revenue generated by network expansion.

Althea

Althea positions itself slightly differently, aiming to be a payment layer supporting infrastructure and network connectivity. It’s a Layer 1 blockchain providing dedicated blockspace for Layer 2 networks, supporting machine-to-machine (M2M) micropayments and contract-backed earnings, while maintaining hardware compatibility. Sounds complicated… what does this mean? And how does it relate to fixed wireless?

Essentially, Althea is a protocol allowing anyone to install equipment, operate a decentralized ISP, and earn tokens. Its core idea is enabling direct peer-to-peer buying and selling of bandwidth, bypassing middlemen in traditional fixed network providers. Althea achieves this using specialized intermediary nodes that directly connect the decentralized network to the broader internet via Internet Exchange Points (IXPs) or commercial-grade connections from traditional ISPs.

So, what are Internet Exchange Points (IXPs)?

IXPs are physical infrastructures enabling multiple ISPs to interconnect and exchange traffic directly. Instead of routing through third-party networks, IXP participants exchange traffic directly, reducing costs. The core principle of IXPs is facilitating “peering” agreements between networks:

-

Public Peering: Achieved via IXP’s shared infrastructure—multiple networks connect to a public switch, enabling broad traffic exchange among many participants.

-

Private Peering: A direct, dedicated link between two networks within the same data center or IXP facility, typically used for exchanging large volumes of traffic between two specific networks.

Since networks connect directly, IXPs typically offer lower latency and higher speeds than traditional ISP routing. Fewer hops mean packets reach destinations faster. Most consumers still get internet through ISPs rather than directly from IXPs, mainly due to “last-mile” connectivity, device compatibility, and network architecture design.

One advantage of DePIN is lowering costs during early operations and maintaining this principle throughout the project lifecycle. In Althea’s system, nodes can adjust costs based on verifiable supply-demand dynamics, making it a real price discovery mechanism in the fixed internet market.

Althea allows participants to tokenize funds and infrastructure on-chain, termed “Liquid Infrastructure.” This model offers transparent ownership and lets users invest early—everyone on Althea can become a major stakeholder and influence project direction. Althea L1 provides fast finality, low-cost settlements, integrated EVM, and lightweight client verification (detailed later). Its flexible architecture supports various DePIN-related network builds, functioning more like a settlement layer or aggregator for micro-networks—similar to L1/L2 chains focused on RWA or DeFi ecosystems.

Althea’s core technical innovation draws from two papers: Chapin & Kunzinger (2006) and Chrobozek & Schinazi (2021), enabling nodes in the network to autonomously meter and settle via micropayments through its blockchain architecture. This innovation, known as Border Gateway Protocol (BGP), is the core of its operations. Roles in the Althea network include:

User Nodes: Installed by individuals, similar to traditional ISP routers/modems but operating independently of any ISP. These nodes provide WiFi and LAN connectivity for devices on the Althea network.

Intermediary Nodes: Installed by connectivity service providers who profit by forwarding internet traffic. These nodes require finer placement for better line-of-sight reception.

Gateway Nodes: A special version of intermediary nodes, “directly connecting the Althea network to the broader internet via low-cost sources like Internet Exchange Points or commercial-grade connections from traditional ISPs.”

Exit Nodes: Deployed in data centers, accessible via the internet, connected to these gateway nodes via “VPN tunnels”—secure, encrypted channels between user devices and the internet. Exit nodes in Althea measure network quality and handle ISP “legal responsibilities” (copyright issues and address translation).

Althea’s routing is managed by the Babel protocol, which “checks service quality for each router on a specific path and compares composite scores with other potential paths,” ensuring Althea delivers the highest-quality service and faster connection speeds.

The micropayment function works by establishing internal accounts between each adjacent node on the Althea router. Bandwidth is metered, tracked, and used for specific tasks, with payments automatically completed and recorded on-chain. Althea uses a “pay-as-you-go” model, avoiding excessive reliance on trust assumptions—under “prepaid” models, malicious nodes are more likely to hinder new users from adopting Althea.

User appeal is one of Althea’s main issues—since Solana, with its ultra-low costs, compressed NFTs, and high throughput, has become the primary choice for DePIN projects, demand from teams wanting to build on an L1 is lacking. What good is a high-performance L1 if it lacks differentiation against established chains with users and liquidity?

It’s unclear what types of DePIN projects Althea wants to launch on its network, though the team communicates well and seems active. The concept of an L1 designed specifically for DePIN is also intriguing—we’ve seen other vertical-specific L1s like Plume (RWA), Immutable (gaming), and Filecoin (storage). If the DePIN space continues attracting high-quality teams with actual products, Althea could find its niche.

The future outlook for fixed wireless is the most uncertain, heavily depending on mobile wireless evolution. On one hand, 5G and 6G might fail to match fixed broadband performance in the medium term, preserving its current market position. On the other, 5G, 6G, and LEO satellite broadband could replace fixed wireless faster than expected. While betting on slowed tech progress is rarely wise, many uncertainties remain around mobile wireless, leaving room for alternative fixed wireless solutions.

WiFi

The last DeWi subcategory is WiFi—though ubiquitous, it holds a small share of wireless service revenue. This is mainly because monetization is difficult: consumers are accustomed to free WiFi everywhere, so telecom giants like AT&T, Comcast, and Spectrum build large public WiFi networks primarily to offload mobile data traffic or enhance customer stickiness.

On the enterprise side, such contracts are typically long-term agreements with WiFi providers, helping boost user retention. Frankly, this might be the least appealing area to build: the market is flooded with low-cost supply. In remote areas, users’ willingness and ability to pay are extremely limited, making it hard to “drain” traditional providers.

Of course, WiFi remains the most widely used connectivity protocol, compatible with the most diverse range of devices. Almost every device in our homes can connect to WiFi, and future smart devices will only increase. In many ways, WiFi is the foundational language underpinning all network interactions. But this doesn’t necessarily make it the most disruptive or valuable capture space for the future.

This situation perhaps explains the limited number of builders in this space. Currently, the best-known WiFi DePIN teams include Dabba and WiCrypt.

Dabba

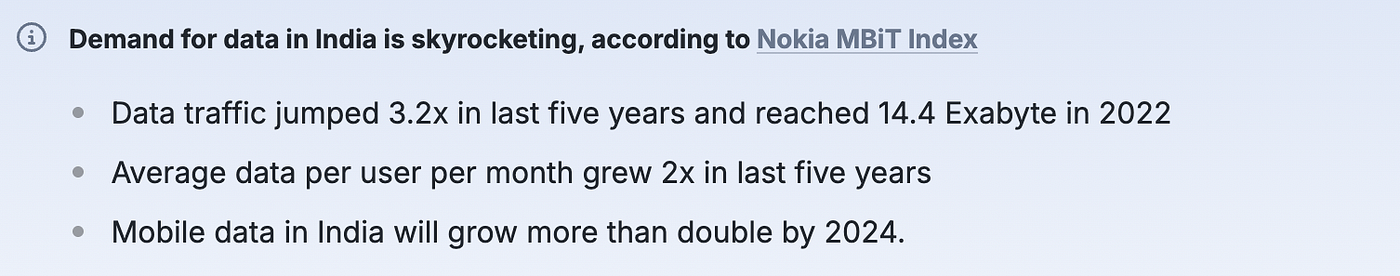

Dabba is building a decentralized connectivity network, focusing on the Indian market. The team’s current strategy prioritizes deploying low-cost hotspot devices—similar to Helium but focused on WiFi—with over 14,000 hotspots deployed and network data consumption surpassing 384TB.

Their core idea is rooted in India’s economic growth and massive population needs. The country needs more efficient infrastructure to compete with centralized providers on uptime and accessibility. Rather than blindly chasing hotspot numbers, the team first deployed devices in high-data-demand areas, building initial traction through word-of-mouth.

In a blog post late last year, the team shared an overview of India’s telecom industry: despite a population exceeding 1.4 billion, only 33 million have broadband service, and just 10 million use 5G.

Today, Dabba’s top priority is expanding its network and reducing entry friction. Dabba believes that while 4G and 5G are necessary, India’s businesses and homes need fiber to bridge mobile and fixed broadband networks. Over time, the goal is to build the largest, most decentralized network to power India at lower costs.

The network architecture is simple: Dabba’s stakeholders include hotspot owners, data consumers, and local cable operators (LCOs) managing relationships between suppliers and consumers. Their strategy has shifted toward targeting some of India’s more remote areas via LCO networks—initially, they deployed in dense urban areas with high WiFi demand.

WiCrypt

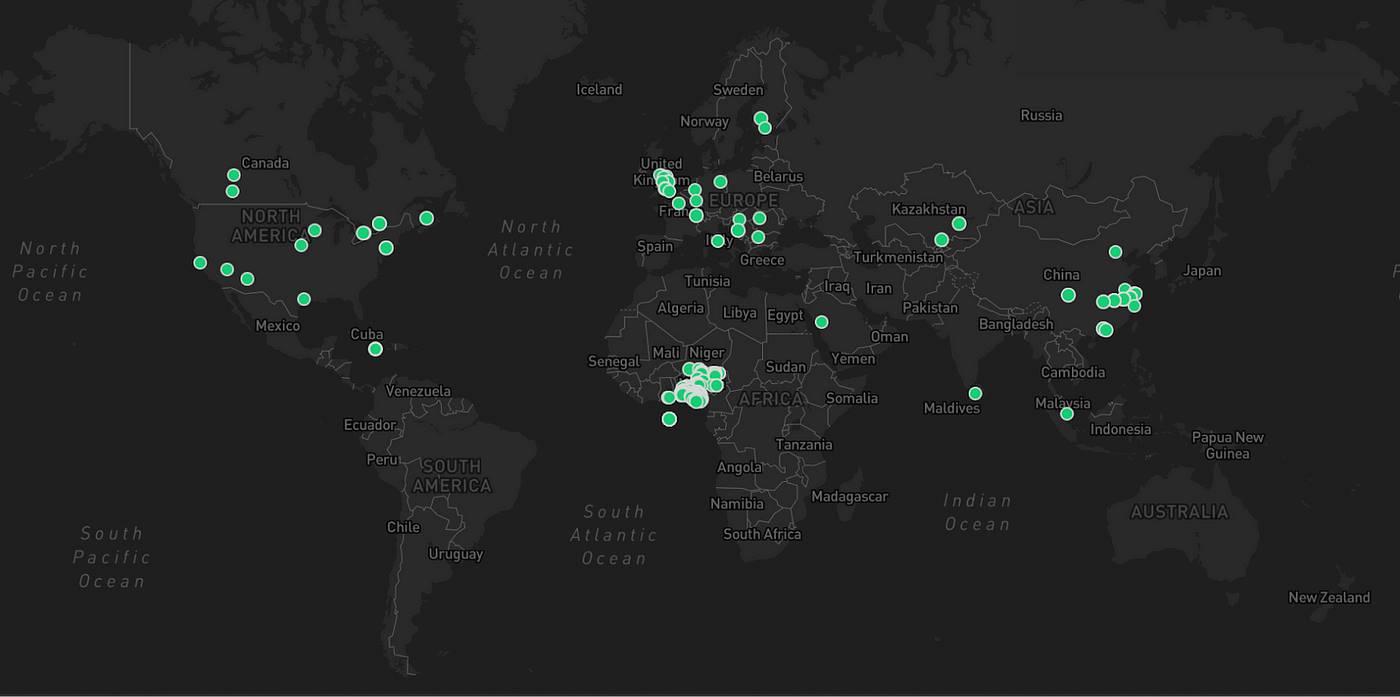

Another project building decentralized WiFi infrastructure is WiCrypt—they aim to let anyone become an ISP through dynamic cost structures and a global hotspot network. This looks similar to Dabba’s direction, primarily focused on enabling individuals or businesses to profitably share WiFi bandwidth. According to WiCrypt’s browser, over $290,000 in rewards have been distributed, establishing notable network coverage across Europe, Asia, Africa, and the U.S.

We must admit, its network size is far smaller than other projects we observe. WiCrypt’s whitepaper specifically highlights several key problem areas:

-

Countries enforcing internet content censorship

-

An ISP oligopoly where nine companies monopolize over 95% of revenue

-

Abusive policies and overreach by existing ISPs

These points hit the mark, highlighting core issues fueling decentralized wireless networks—consumers forced into suboptimal choices, often unable to afford switching costs. WiCrypt aims to let anyone become a secondary ISP retailer, setting more favorable terms outside existing infrastructure and commercial agreements. Given public WiFi’s current ubiquity, this business model seems challenging. From a capital standpoint, it’s hard to imagine demand (users needing network access) being large enough to sustainably incentivize supply.

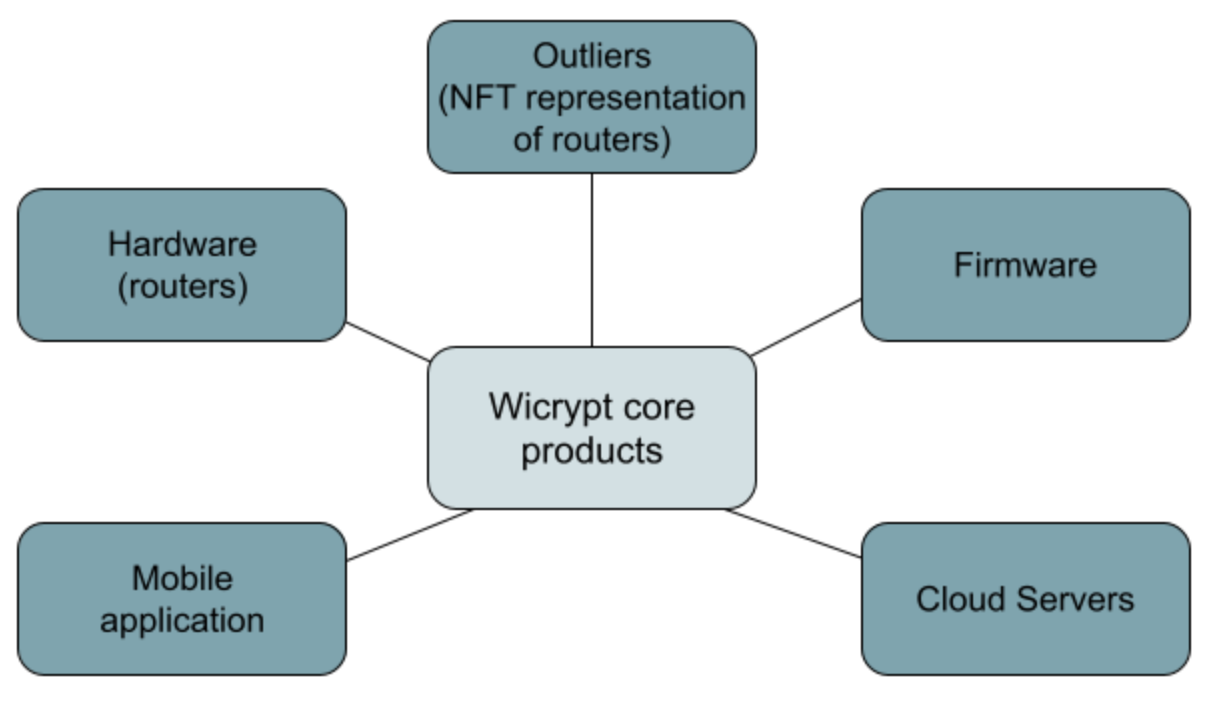

WiCrypt’s architecture includes: hardware (hotspot devices), mobile app (ease of use), router, cloud server, firmware. The router batches all incoming transactions and uploads them to the blockchain, interacting with Linux-based firmware to manage “traffic control” and router activities. Users handle WNT token payments, authentication, data management, and market operations via the WiCrypt mobile app. Cloud servers connect to smart contracts and confirm data proofs as a secondary verification mechanism on-chain.

Decentralized wireless networks deserve high attention—success brings enormous rewards. The telecom industry supports global communication for work, life, and leisure. Decentralizing this tech stack is daunting, but given the uncertainty of traditional telecom’s future, it’s a worthwhile pursuit. Combined with the massive returns possible from successfully executing in this vertical, fierce competition is inevitable.

The market’s recent recognition of Helium’s success proves builders don’t need to obsess over market sentiment—continuously creating value for the network is what matters. This value creation will eventually be recognized. It also shows traditional operators like T-Mobile and Telefonica are willing to embrace this paradigm shift.

If you think the telecom industry suffers from inefficient, outdated, and poorly managed infrastructure, wait until the next chapter: decentralized energy grids.

Energy

We’ve written extensively about distributed energy before. We touched on it in our “Crypto Future” report early 2023 and later analyzed it in our public research database. While few paid attention to this space then, distributed energy is clearly gaining traction now.

The energy sector remains one of the most heavily regulated monopolies in the U.S.—and one of the most suitable industries for DePIN. The energy market is complex across multiple dimensions: hardware, energy capture, transmission networks, financing mechanisms, storage tech, distribution systems, and pricing models.

Renewables indeed enjoy important policy tailwinds, especially at the regulatory level. But solar panels are expensive, not suitable for all regions, and return on investment for upfront funding has been poor. Battery tech is becoming more efficient and cheaper—the ideal vision for renewables is a “solar + storage” combo. Nuclear power, even without crypto factors, struggles to gain support.

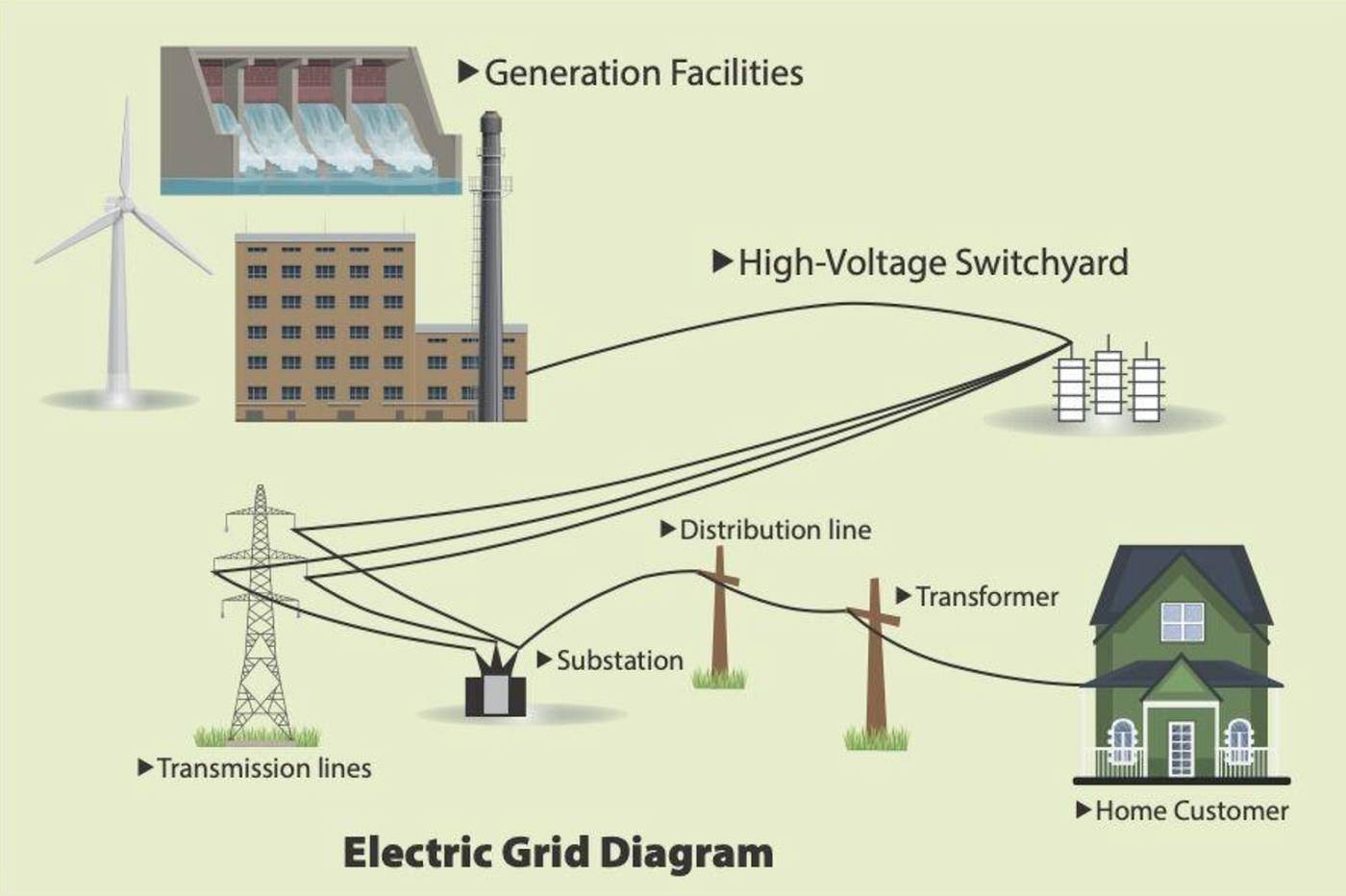

One of the biggest current issues with renewables is intermittency and weather dependency (e.g., inconsistent wind, unreliable sunlight). Integrating these sources into existing grids is challenging—the grid must manage fluctuating power levels, which stresses infrastructure. Traditional grids were designed for one-way energy flow—from centralized power plants to consumers.

Distributed Energy Resources (DERs) require the grid to handle bidirectional flows, potentially causing instability, especially at high DER penetration. DERs can include wind turbines, rooftop solar panels, smart thermostats, custom fuel cells, and more.

Undeniably, centralized energy suppliers hold natural monopolies in many aspects—they typically own transmission and distribution infrastructure, giving them huge control and influence over energy markets. Despite these challenges, we see advances in smart grid tech, large-scale battery storage systems, and regulations opening up to allow DERs fuller participation in energy markets. We’ve always believed distributed energy is fertile ground for crypto and DePIN.

Below is a brief list of more mature energy-related protocols and their building directions:

-

Plural Energy: An SEC-compliant on-chain financing platform for clean energy investments, democratizing financial access to high-yielding energy assets (think Ondo for energy)

-

Daylight: Leveraging DERs to let developers reprogram the grid

-

Power Ledger: Software solutions to track, trade, and trace energy, aiming to solve intermittency issues when integrating renewables into the grid

-

SRCFUL: Creating a distributed energy production network via personal nodes, accelerating renewable development (HIP 128 will allow dual mining via Helium network)

-

StarPower: A decentralized energy network aiming to create virtual power plants via IoT connectivity

-

PowerPod: Offering a reliable, easy-to-use global charging network via a Bitcoin-style shared ownership model

-

DeCharge: Electric vehicle infrastructure using the OCPP global standard (primarily promoted in the Indian market)

One of the most discussed topics in the energy DePIN space is the possibility of grid decentralization. Renewable advocates argue that while we need more alternative energy, integrating it strains an already outdated and aging infrastructure. Tech experts say we need more real-time data on energy consumption and storage, better metering infrastructure, and higher automation. ESG advocates say we need a better grid covering rural and underserved populations. Talk to AI/ML researchers, and they’ll say we need $7 trillion to rebuild the grid from scratch.

Increasing AI computational demands and manufacturing reshoring mean our electricity needs will only rise further. DEP (Decentralized Energy Project) writes: “Reliability assurance in traditional power systems is built on centralized control and top-down engineering.” Not great! Current systems are largely pieced together from 21st-century tech on 20th-century grids—grids originally built to serve resource-intensive societies.

DEP raises reasonable questions about how to transform the grid:

-

What control architecture best supports the evolution from centralized to decentralized grids?

-

How to maintain system reliability and security while implementing fragmented upgrades?

Replacing old parts with new ones can cause downtime, and large-scale integration of renewables is difficult. Meanwhile, the process of energy generation and transmission is inherently complex. Drawing from Ryan McEntush’s recent research, we can depict the grid structure as:

-

The U.S. grid consists of three major interconnected systems: Eastern, Western, and Texas grids; managed by 17 NERC coordinators, independent system operators, and regional transmission operators overseeing economy and infrastructure. Actual power generation and supply are handled by local utilities or cooperatives.

-

Grid operators use interconnection queues to manage new connections, assessing whether the grid can support added power in specific areas and determining upgrade costs.

If you’re a homeowner with solar panels, feeding energy back into the grid involves very complex technology. It includes metering systems, inverters converting DC to AC, FiT systems (replacing metering infrastructure), synchronization systems, and payment infrastructure ensuring homeowners get proper compensation.

“Historically, only 10–20% of queued projects get realized, often taking over five years after application to finally connect—and these timelines keep lengthening.”

Demand for more power and faster grid connections is huge, but our existing infrastructure can’t keep up. The Department of Energy found in a 2023 report that intra-regional transmission must increase by 128%, and inter-regional transmission by 412%. Join TechFlow official community to stay tuned Telegram:https://t.me/TechFlowDaily X (Twitter):https://x.com/TechFlowPost X (Twitter) EN:https://x.com/BlockFlow_News