Alpha opportunities still exist: unpacking DePIN investment logic from scratch|IOSG

TechFlow Selected TechFlow Selected

Alpha opportunities still exist: unpacking DePIN investment logic from scratch|IOSG

The economic benefits derived from DePIN at the foundational level have the potential to replace traditional infrastructure on the user side, enabling application sustainability and large-scale adoption.

Author: Jiawei @IOSG

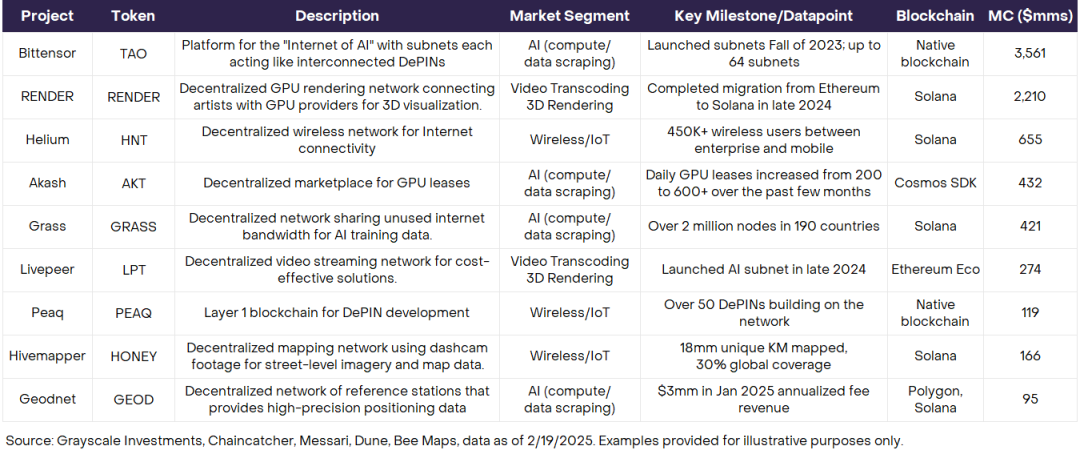

▲ Source: Grayscale

Grayscale published a research report on DePIN at the beginning of this year. The table above shows leading DePIN projects and their market capitalizations. Since 2022, DePIN and AI have been mentioned together as two new directions in crypto investment. However, there hasn't yet emerged a flagship project in the DePIN space. (Helium is considered a top project, but Helium predates the concept of DePIN itself; Bittensor, Render, and Akash in the table are more commonly categorized under the AI sector.)

In this sense, DePIN lacks a strong enough leader to unlock the ceiling of this sector. There may still be some alpha opportunities in the DePIN space over the next 1-3 years.

This article attempts to reconstruct the investment logic of DePIN from scratch—explaining why DePIN is an investment sector worth watching and proposing a simple analytical framework. Since DePIN is a broad concept covering many diverse sub-sectors, this article will zoom out slightly to explain the concept abstractly, while still providing concrete examples.

Why Focus on DePIN Investment

DePIN is not a buzz word

First, it must be clarified that decentralizing physical-world infrastructure is not just a flashy idea or merely a "narrative play," but something executable. In DePIN, decentralization genuinely enables or optimizes certain things.

Here are two simple examples:

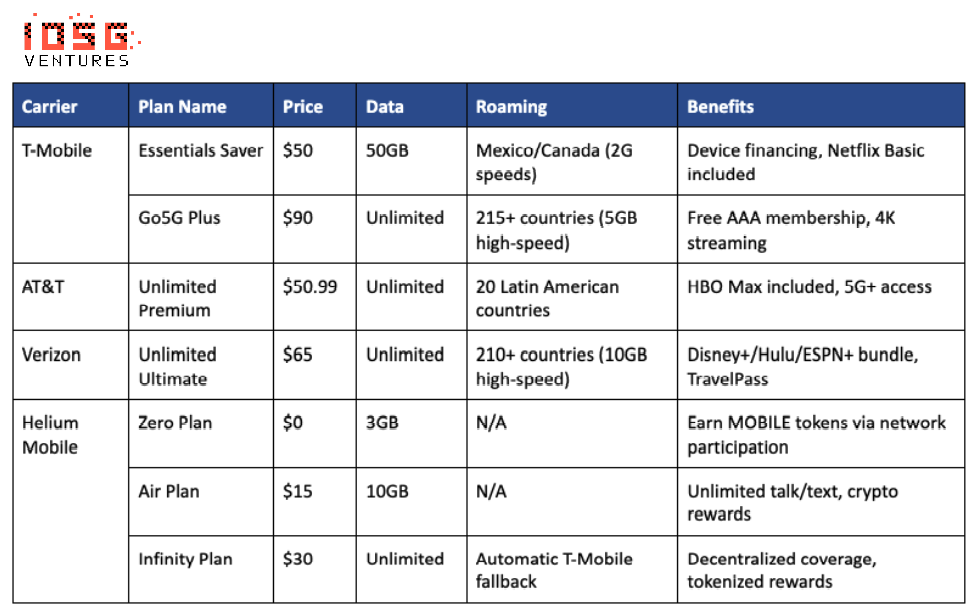

▲ Source: IOSG

In one major DePIN sector—telecommunications—using the U.S. market as an example, traditional telecom operators (e.g., AT&T, T-Mobile) often spend billions of dollars on spectrum license auctions and base station deployment, paying $200,000–$500,000 per macro base station covering a radius of 1–3 kilometers. In a 2022 FCC auction for the 3.45GHz 5G spectrum band, AT&T invested $9 billion, making it the highest bidder. This centralized infrastructure model results in high communication service prices.

Helium Mobile, by contrast, uses community crowdsourcing to distribute these upfront costs among users. Individuals can join the network by purchasing hotspot devices priced at $249 or $499, becoming "micro-carriers." Token incentives drive users to self-organize the network, significantly reducing overall investment. While Verizon spends about $200,000 deploying one macro base station, Helium achieves comparable coverage with around 100 hotspots (total cost ~$50,000), reducing costs by approximately 75%.

Another example lies in AI data. Traditional AI companies pay platforms like Reddit and Twitter up to $300 million annually in API fees to obtain training data, while also relying on web scraping tools such as Bright Data (residential proxies) and Oxylabs (datacenter proxies). Moreover, they increasingly face copyright and technical restrictions, making data source compliance and diversity difficult to ensure.

Grass solves this problem through distributed web scraping, allowing users to share idle bandwidth via a browser extension to help collect public web data and earn token rewards. This model drastically reduces data acquisition costs for AI firms while enhancing data diversity and geographic distribution. According to Grass, 109,755,404 IP addresses from 190 countries currently participate in the network, contributing an average of 1,000 TB of internet data daily.

In summary, a fundamental premise for investing in DePIN is that decentralized physical infrastructure has the potential to outperform traditional infrastructure—and even achieve what traditional methods cannot.

Intersection of Infra and Consumer

Infra and Consumer are two main themes in crypto investment, each facing distinct challenges.

Infrastructure projects generally share two characteristics: first, they are highly technical—technologies like ZK, FHE, and MPC have high barriers to entry, creating a gap in market understanding. Second, aside from well-known projects like Layer1/2, cross-chain bridges, and staking protocols that directly reach end-users, most infra projects are B2B. Developer tools, data availability layers, oracles, coprocessors, etc., remain distant from end users.

These factors make it difficult for infra projects to capture mindshare and limit their virality. Although quality infra projects may achieve product-market fit (PMF) and generate revenue sufficient to survive market cycles, in attention-scarce environments, lack of mindshare makes later-stage listings challenging.

Conversely, consumer projects excel at reaching end users and naturally capturing mindshare. However, new narratives are easily debunked and may collapse once market focus shifts. These projects often cycle through narrative-driven growth, short-term spikes, and eventual decline, typically having short lifespans—examples include friend.tech and Farcaster.

Growth, mindshare, and listing are all heavily discussed issues in this cycle. Overall, DePIN offers a balanced solution that effectively bridges both challenges.

-

DePIN is built on real-world needs—such as energy and wireless networks. High-quality DePIN projects have solid PMF and revenue streams, are hard to debunk, and are easy for the market to understand. For instance, Helium’s $30 monthly unlimited data plan is clearly cheaper than offerings from traditional carriers.

-

DePIN also involves direct user engagement, enabling mindshare capture. Users can download Grass’s browser extension to contribute idle bandwidth. Grass has already reached 2.5 million end users, many of whom are non-crypto-native. Similar cases in eSIM, WiFi, and vehicle data also bring DePIN close to end users.

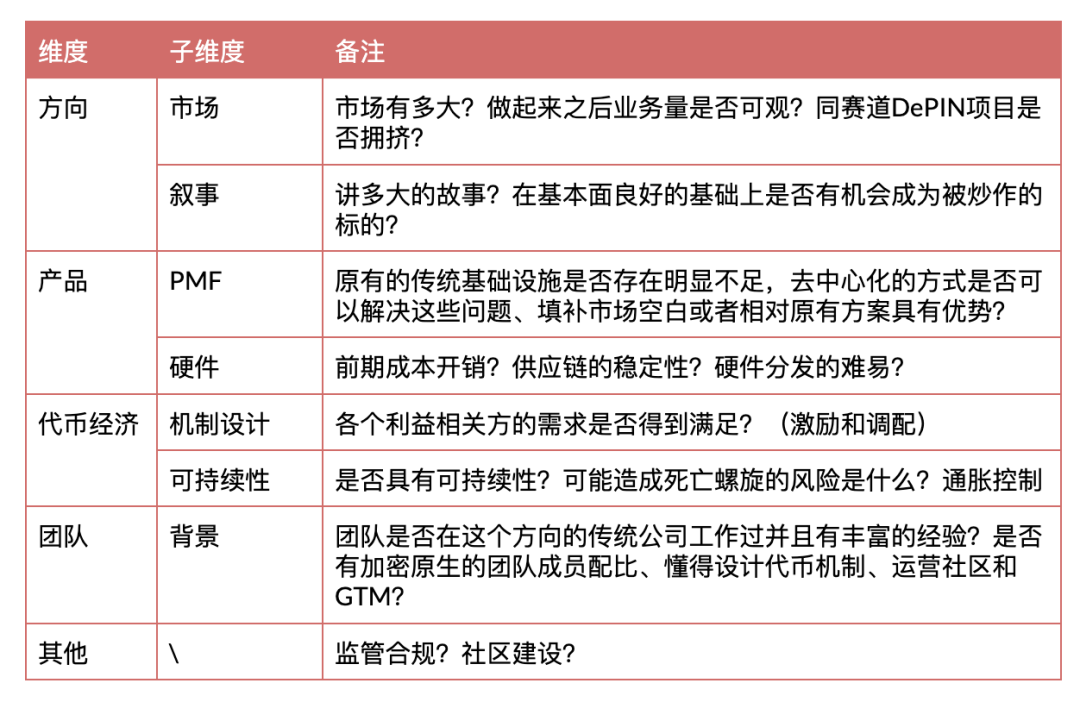

DePIN Investment Framework

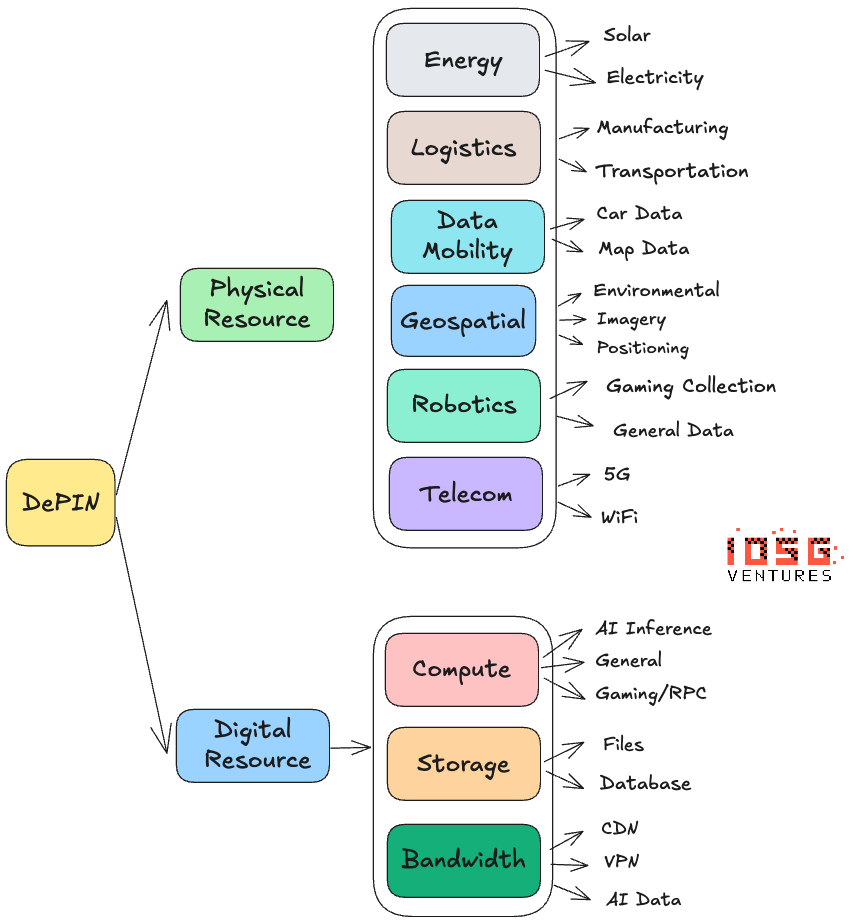

▲ Source: Messari, IOSG

Direction

Intuitively, 5G and wireless networks represent large markets, while vehicle and weather data are smaller. From the demand side, assess whether the need is essential (e.g., 5G) or strongly felt. Given that traditional markets like 5G are massive, even capturing a small fraction via DePIN could yield a significant market size within the crypto ecosystem.

Product

According to Grayscale's report, the DePIN model is particularly suitable for industries with high capital requirements, high entry barriers, clear monopolistic structures, and underutilized resources. Assessing PMF essentially comes down to two aspects.

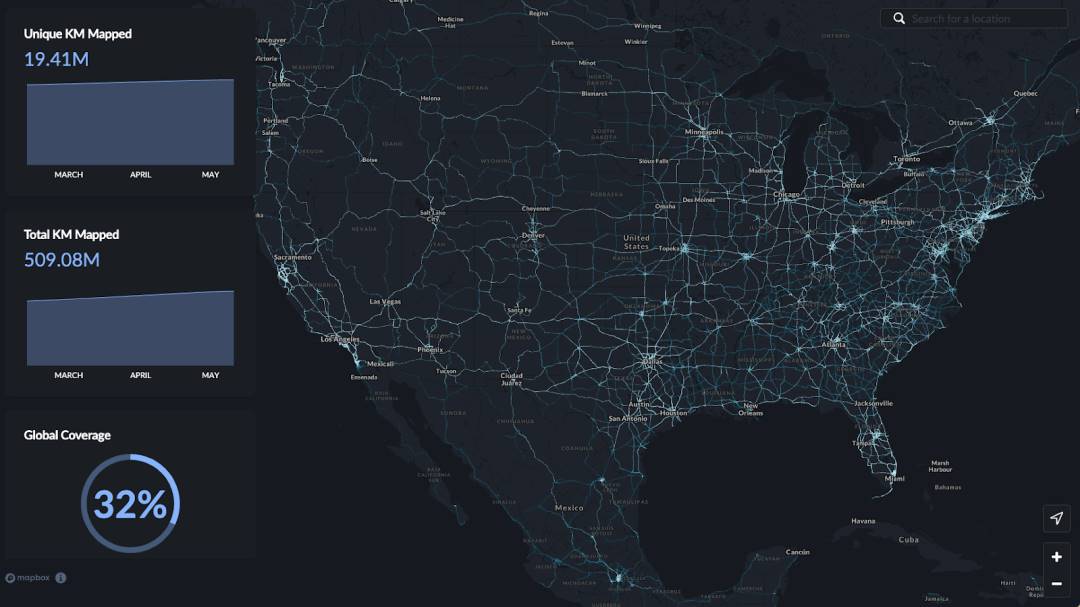

▲ Source: Hivemapper

On the supply side, does DePIN enable something previously impossible, or offer clear advantages (in cost, efficiency, etc.) over existing solutions? Take Hivemapper’s map data collection sector: traditional approaches suffer from three key problems:

-

Reliance on specialized fleets and manual labeling leads to high costs and poor scalability

-

Google Street View has long update cycles and low coverage in remote areas

-

Centralized map providers control data pricing

Hivemapper sells dashcams to users, turning data collection into a routine activity during daily driving via a crowdsourced model. Token incentives guide users to prioritize high-demand areas.

On the demand side, the product offered by DePIN must serve genuine market needs, ideally with strong willingness to pay. In the same example, Hivemapper sells map data to autonomous driving, logistics, insurance companies, and municipal agencies—validating critical demand.

Regarding hardware, Multicoin’s 2023 article “Exploring The Design Space Of DePIN Networks” opens with a discussion on hardware. I’d like to add a few supplementary points here.

The hardware lifecycle can be summarized as “manufacturing—sales—distribution—maintenance.”

#Manufacturing

Does the project design and manufacture its own hardware, or use existing hardware? For example, Helium offers two types of proprietary hotspots while also supporting integration with existing WiFi networks. Compute and storage DePIN projects can directly leverage existing GPUs and hard drives.

#Sales

Pricing is transparent, meaning users calculate payback periods based on potential earnings. Helium’s home mobile hotspot is priced at $249; DIMO’s vehicle data collector costs $1,331.

#Distribution

How is hardware distributed? Distribution involves many uncertainties: shipping timelines, transportation costs, delivery cycles from pre-orders, etc. For projects targeting global reach, poor distribution design can severely delay progress.

#Maintenance

What is required from users to maintain hardware? Some devices may depreciate or wear out. The simplest case is Grass: users only need to install a browser extension, with no further action required. Similarly, Helium hotspots require minimal setup and then run continuously. More complex cases, such as solar power systems, may require greater maintenance.

Considering all this, the simplest model is Grass’s—leveraging existing network bandwidth without manufacturing, distribution, or sales, enabling zero-friction user onboarding and rapid early network expansion.

Certainly, different sectors have varying hardware needs. But hardware affects initial adoption friction. The lower the friction early on, the better. As projects mature, some friction can enhance retention and create stickiness. For startup teams, it’s crucial to manage hardware strategy and resource allocation progressively rather than attempting everything at once.

Imagine if every step—from manufacturing to sales, distribution, and maintenance—is difficult. Unless there’s a very strong and highly certain incentive, why would users participate?

Tokenomics

Token mechanism design is one of the most challenging aspects of DePIN projects. Unlike other sectors, DePIN must incentivize multiple network participants early on, requiring token launches at a very early stage. This topic deserves a dedicated article with case studies, so won’t be expanded here.

Team

The founding team should include at least one member with each of the following backgrounds: first, someone with extensive experience working at traditional companies in the relevant field, responsible for technical and product execution; second, a crypto-native individual who understands token economics and community building, capable of distinguishing between crypto and non-crypto user preferences and mental models.

Others

Regulatory issues—for example, collecting road imagery and data domestically is highly sensitive.

Summary

Crypto has not yet delivered a truly breakout application in this cycle, and widespread adoption by non-crypto users still seems distant. Short-term incentives are often why users engage with crypto apps, but such engagement is unsustainable. DePIN, however, derives economic benefits from the ground up that could allow it to replace traditional infrastructure on the user side, achieving sustainable application usage and mass adoption.

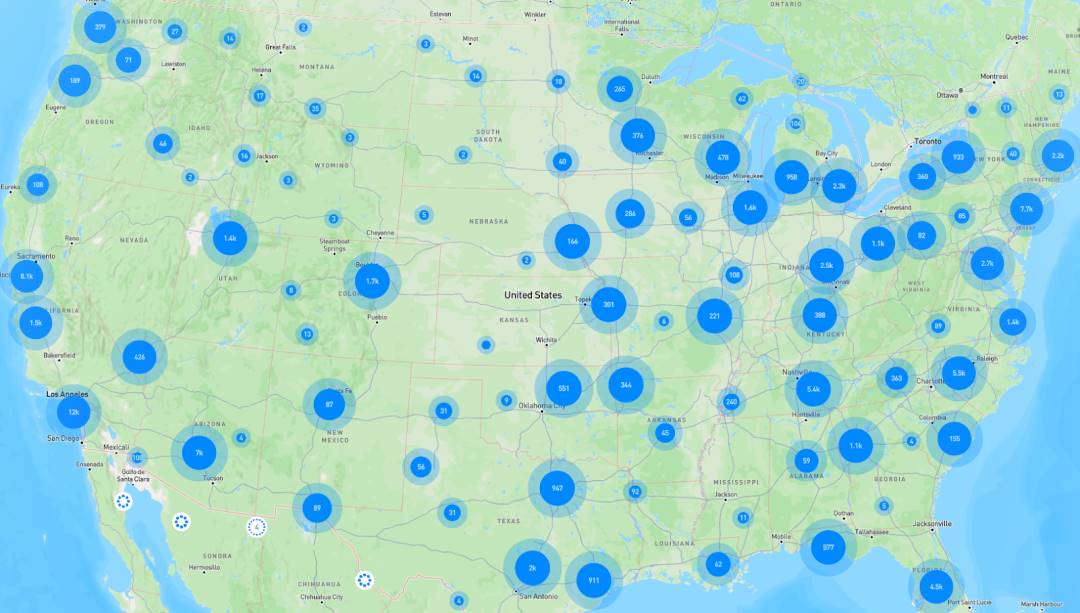

▲ Source: Helium

Although DePIN’s real-world integration implies longer development cycles, we’ve already seen signs of progress from Helium Mobile: Helium Mobile partners with T-Mobile, allowing user devices to seamlessly switch to T-Mobile’s nationwide 5G network. For example, when users leave the range of a Helium community hotspot, their device automatically connects to a T-Mobile base station, avoiding signal loss. Earlier this year, Helium announced a partnership with global telecom giant Telefónica to deploy Helium Mobile 5G hotspots in Mexico City and Oaxaca, marking its expansion into South America. Movistar, Telefónica’s Mexican subsidiary, has around 2.3 million users—this collaboration directly brings them onto Helium’s 5G network.

Beyond the above, we believe DePIN has two unique advantages:

-

Compared to traditional monopolistic large enterprises, DePIN offers more flexible deployment methods and aligns incentives within the ecosystem through token models. Traditional telecom industries, dominated by a few giants, often lack innovation incentives. For rural areas, where populations are sparse and ROI is low and slow, traditional operators have little motivation to expand. With proper token economics, DePIN can incentivize deployment in underserved areas. Similarly, Hivemapper offers higher rewards in regions with scarce map data.

-

DePIN has the potential to generate positive externalities. When AI companies buy internet data from Grass, autonomous driving firms purchase street-level maps from Hivemapper, or Helium Mobile provides low-cost data plans, DePIN transcends the crypto sphere to deliver real-world value to other industries. This value, in turn, feeds back into the ecosystem via token economics. In other words, DePIN tokens are backed by real value—not Ponzi schemes.

Of course, DePIN also faces many uncertainties: operational risks due to hardware, regulatory risks, due diligence risks, etc.

In conclusion, DePIN is a sector we are closely monitoring in 2025, and we will continue to publish more research on DePIN in the future.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News