Western Protocols, Eastern Manufacturing: Mapping Solana DePIN's Asia-Pacific Landscape

TechFlow Selected TechFlow Selected

Western Protocols, Eastern Manufacturing: Mapping Solana DePIN's Asia-Pacific Landscape

Asia is not only the global hub for hardware manufacturing but also a natural testing ground for the demand side of DePIN projects.

By TechFlow

Introduction

As a media outlet deeply rooted in Asia's Web3 market, we have also witnessed the explosive growth of DePIN over the past year.

According to the DePIN 2024 Report released by Messari, more than 13 million devices have been deployed globally as DePIN nodes in the last year alone.

This sector, which deeply binds on-chain governance and incentives with real-world assets, has not only brought Web3 tangible global use cases but also pioneered an entirely new model of asset collaboration.

Within the Solana ecosystem, DePIN projects have leveraged the chain’s low fees and high performance to spawn a wave of highly representative innovations.

However, upon closer observation, we’ve identified a fascinating phenomenon:

While core DePIN protocols and initiatives are predominantly led by Western teams, their development is deeply intertwined with Asia. This interdependence manifests in two key areas: the production and supply of hardware, and large-scale node deployment demand.

Western protocols may rely more on Eastern manufacturing than meets the eye.

In reality, Asia or the Asia-Pacific region plays a unique dual role in the global evolution of DePIN:

On the supply side, it boasts a complete DePIN hardware manufacturing supply chain, efficient production organization, and significant cost advantages;

On the demand side, its vast population, high-density urban environments, openness to new technologies, and acceptance of Web3 and the sharing economy provide ideal application scenarios for DePIN projects.

TechFlow conducted in-depth interviews and research with Asian DePIN projects to uncover the full market landscape of Solana-based DePIN initiatives in Asia.

First, we explored Asia’s hardware manufacturing clusters to understand how they support the global DePIN hardware supply chain; second, through user behavior analysis in key markets such as Southeast Asia, we illustrated region-specific demand patterns; third, we interviewed several flagship projects already established in Asia to summarize their localization strategies and adjustments, with special attention to the investment logic and portfolio of Asian venture capital firms in the DePIN space.

Through these first-hand insights and case studies, we aim to deliver actionable market intelligence for industry participants.

Supply Side: Made in Asia, Growth Overseas

Hardware: The Physical Pillar of the DePIN Ecosystem

The essence of DePIN lies in linking on-chain governance with real-world assets—and hardware devices serve as indispensable physical infrastructure within this ecosystem.

For most DePIN projects, regardless of whether the team is based in Europe, America, or Asia, and no matter if operations span North America or Africa, hardware must be physically deployed in target regions before the network can launch.

Beyond the familiar practice of using personal computers for “idle mining,” broader hardware needs in DePIN include but are not limited to:

-

Mining Devices: LoRaWAN gateways from Helium, wireless hotspot devices from Starpower.

-

Sensors: In-car cameras from Hivemapper, vehicle data collectors from DIMO.

-

Edge Computing Devices: Distributed energy monitoring equipment from React Network.

Have you ever wondered where these project components actually come from?

Asia—the world’s recognized manufacturing hub—plays a critical role as the "maker" behind the scenes.

Asia: Global Center for Smart Device Manufacturing

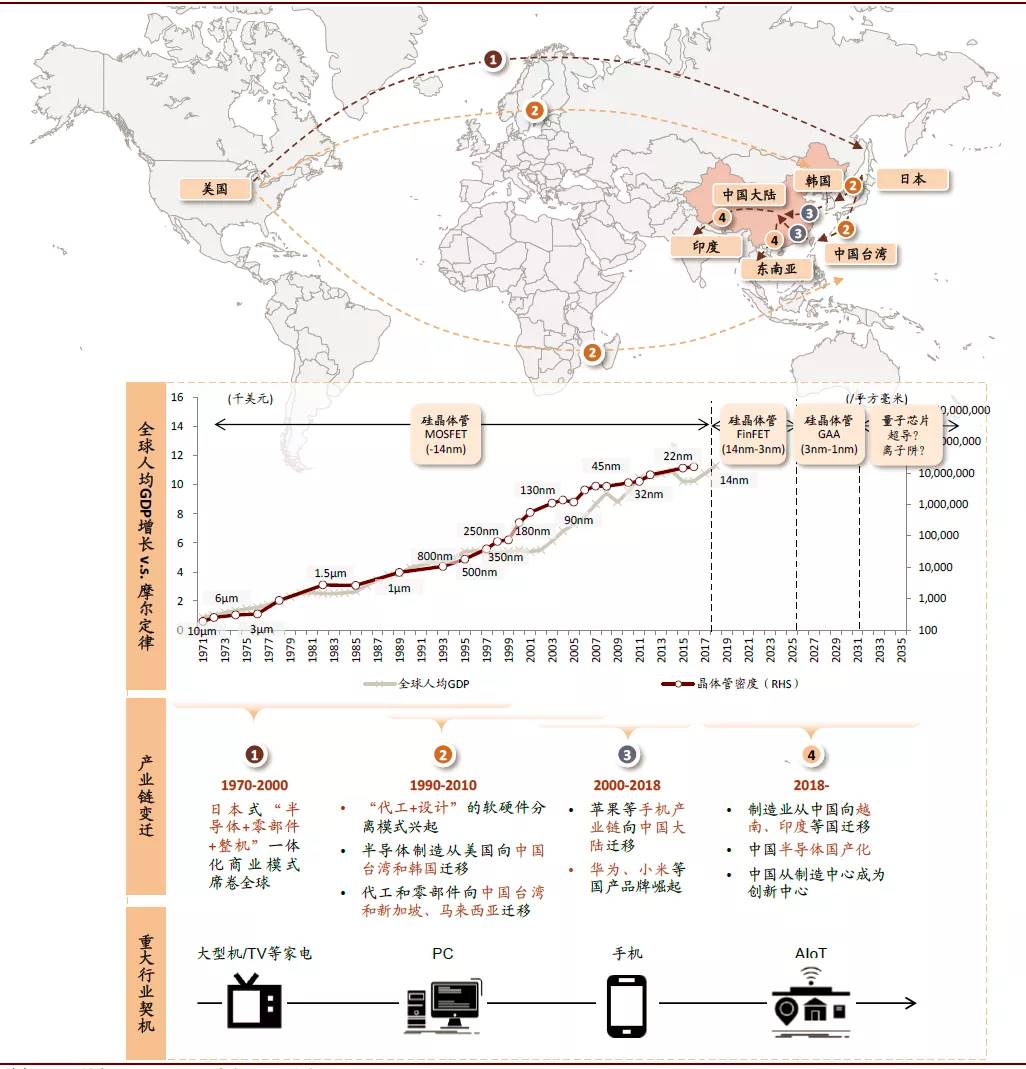

It is well known that due to economic globalization and shifts in global production division, the Greater Bay Area and Yangtze River Delta in China, along with Southeast Asia (Vietnam, Thailand, etc.), have become the world’s largest smart device manufacturing bases.

(Image source: CICC Research: Investment Opportunities in Electronics Supply Chain Relocation Post-Pandemic)

This region’s manufacturing capabilities are highly attractive to any DePIN project relying on hardware at scale worldwide.

-

Complete Supply Chain:

-

From electronic component manufacturing to final device assembly, Asia has developed a highly integrated industrial cluster.

-

Supply chain efficiency: Rapid iteration capabilities in hardware manufacturing meet DePIN projects’ demands for frequent device updates.

-

-

Production Capacity and Cost Advantages:

-

Public data shows that Asia’s organizational efficiency and relatively lower labor costs reduce hardware manufacturing and assembly expenses by 30%-50% compared to Western counterparts.

-

Logistics and distribution: Asian manufacturers can rapidly ship devices globally, enabling DePIN projects to operate internationally.

-

-

Talent and Technical Accumulation:

-

Decades of experience in hardware manufacturing have cultivated a rich pool of engineers, technicians, and supply chain managers across Asia.

-

-

Mining Equipment Expertise:

-

Notably, over a decade ago, China and surrounding regions were among the most vibrant Bitcoin mining hubs globally, leading the world in both miner production and node deployment.

-

Today, technical expertise and market readiness from the Bitcoin mining industry (e.g., Bitmain, Canaan Creative) naturally extend into DePIN hardware, creating a smooth “inheritance gene.”

-

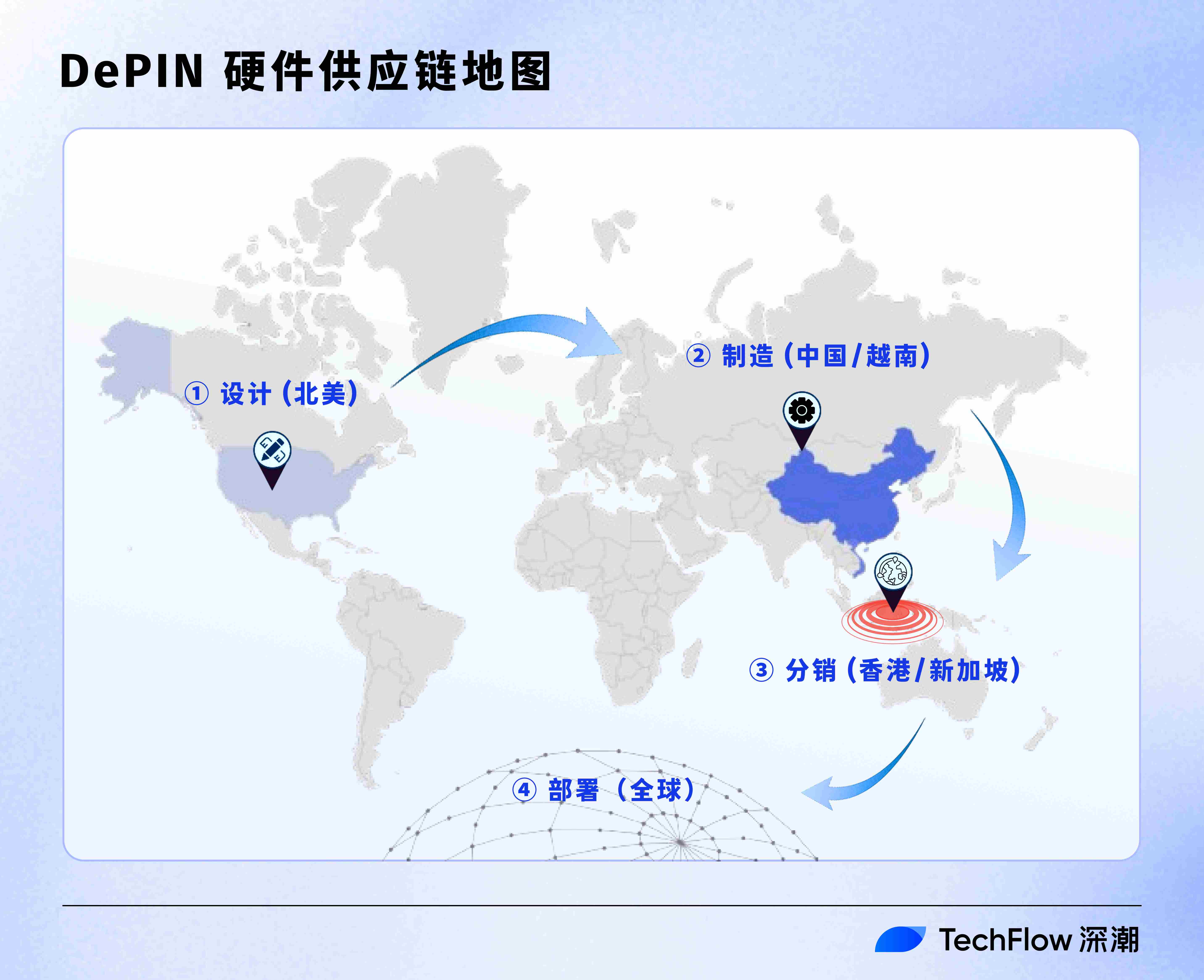

DePIN’s “Front Shop, Back Factory”: Western Protocols, Eastern Manufacturing

"History doesn’t repeat itself, but it often rhymes." – Mark Twain

Today, as global DePIN projects benefit from Asia’s manufacturing prowess, this pattern echoes earlier industrial trends.

We commonly refer to this model as "front shop, back factory."

This term originally described a business model during China’s reform era, where Guangdong Province produced goods domestically while Hong Kong served as an international sales gateway, exporting products to Europe and the U.S.

Interestingly, from traditional Web2 manufacturing to Web3, there exists a clear evolutionary trajectory rooted in fixed geographical advantages:

-

Late 20th Century: Hong Kong (“front shop”) handled international orders, while the Pearl River Delta (“back factory”) executed production. The “Four Asian Tigers” (South Korea, Taiwan, Hong Kong, Singapore) absorbed Western manufacturing shifts.

-

Early Bitcoin Era: Before 2017, China was the world’s largest producer of Bitcoin mining hardware and host to the majority of node deployments. Demand far outpaced supply, with delivery times often racing against Bitcoin’s network difficulty adjustments.

-

Rise of DePIN: In recent years, Western/European DePIN protocols lead in conceptualization, protocol design, marketing, and deployment, while Asia-manufactured DePIN hardware reaches global markets via hubs like Hong Kong and Singapore.

As Xiao Feng, Chairman and CEO of HashKey Group, stated at last year’s Hong Kong Web3 Festival:

"DePIN has natural advantages in the Greater Bay Area and the Yangtze River Delta. These regions are global manufacturing bases for smart devices because all Bitcoin miners were made in the Greater Bay Area. The first generation of DePIN devices were manufactured and distributed from China’s Greater Bay Area, and we can predict future DePIN hardware will continue to be built and shipped from this region."

Moreover, leading DePIN projects within the Solana ecosystem exhibit significant reliance on Asian manufacturing for their hardware.

FutureMoney, an Asia-based crypto asset investment and advisory group, revealed in a public research report:

"DePIN projects require massive hardware capacity to reduce network operating costs. One of our portfolio companies, a leading DePIN hardware manufacturer with supply chains in China and Vietnam, supplies hardware to seven DePIN projects including DIMO, Hivemapper, and React. For these overseas-native Web3 projects, it is a strategically vital partner."

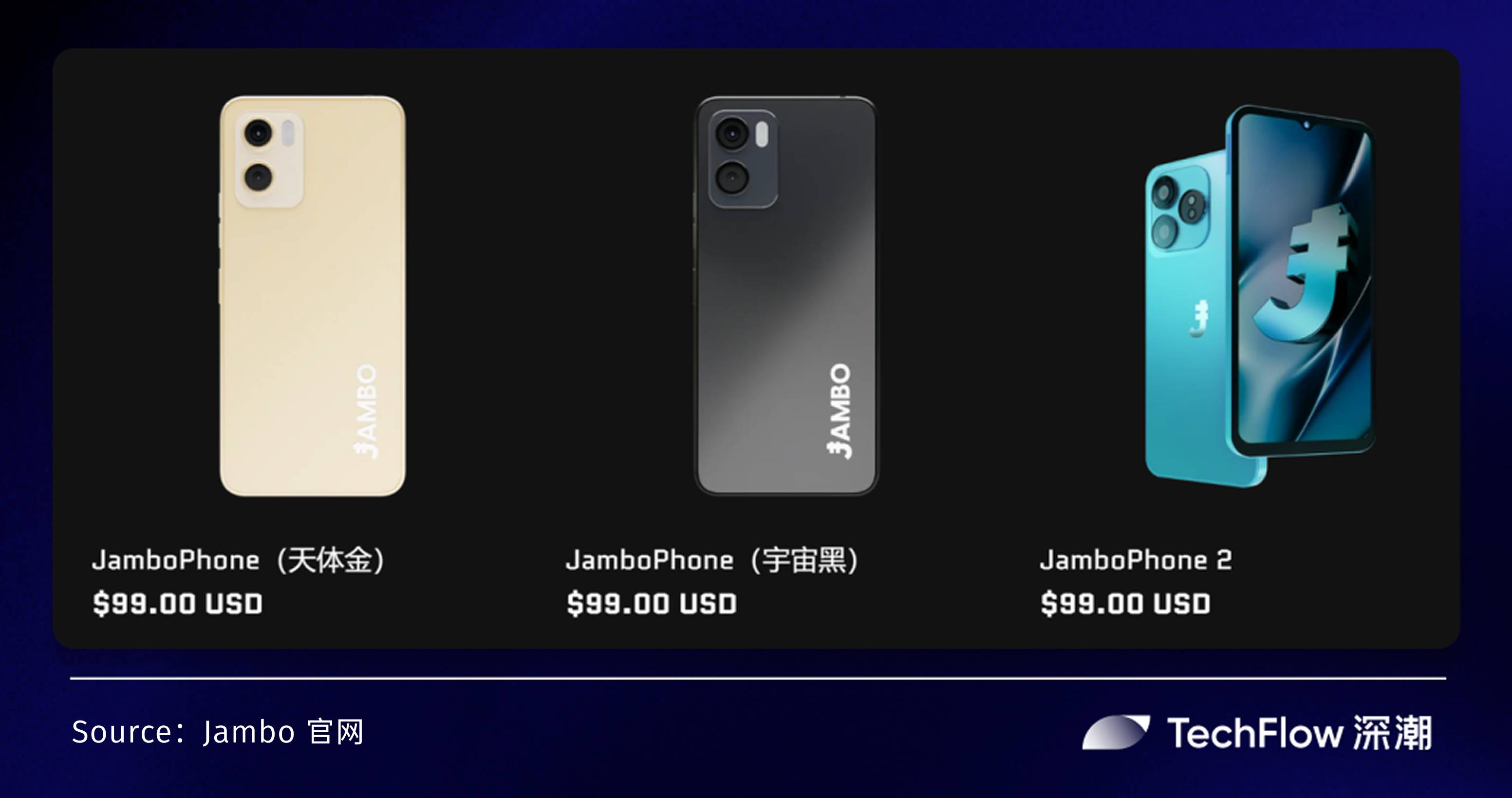

Case Study: Jambo – Web3 Phones Made in Shenzhen, Sold Globally

Jambo is one of the flagship projects in the Solana ecosystem, focused on hardware for the Web3 ecosystem.

Its core mission is to onboard more users into the world of DePIN through affordable smartphones.

Jambo covers smartphone design, production, and sales, while also offering a suite of Web3 application support via its devices—including crypto wallets, decentralized identities (DID), and distributed storage.

Unlike traditional smartphone makers, Jambo does not treat hardware as a profit center. Instead, it uses low-cost devices as entry points, aiming for long-term value through user acquisition and ecosystem growth.

A major talking point is Jambo’s $99 price tag.

After maintaining this pricing strategy with its first-generation product, the second generation doubled performance while still priced at $99—reinforcing its “hardware-as-entry-point” strategy.

Such pricing inevitably depends on tight control over hardware costs.

In a recent podcast episode by TechFlow, we invited James, founder of Jambo, to explore the secrets behind this pricing.

Xiaoyuzhou Link:

https://www.xiaoyuzhoufm.com/episodes/67c31eccb0167b8db9d306b6

Spotify Link:

https://open.spotify.com/episode/3wRdDh1k2GcxHJnYPJq9gG?si=3WcJz90GRJq5LsP3AsJ07g

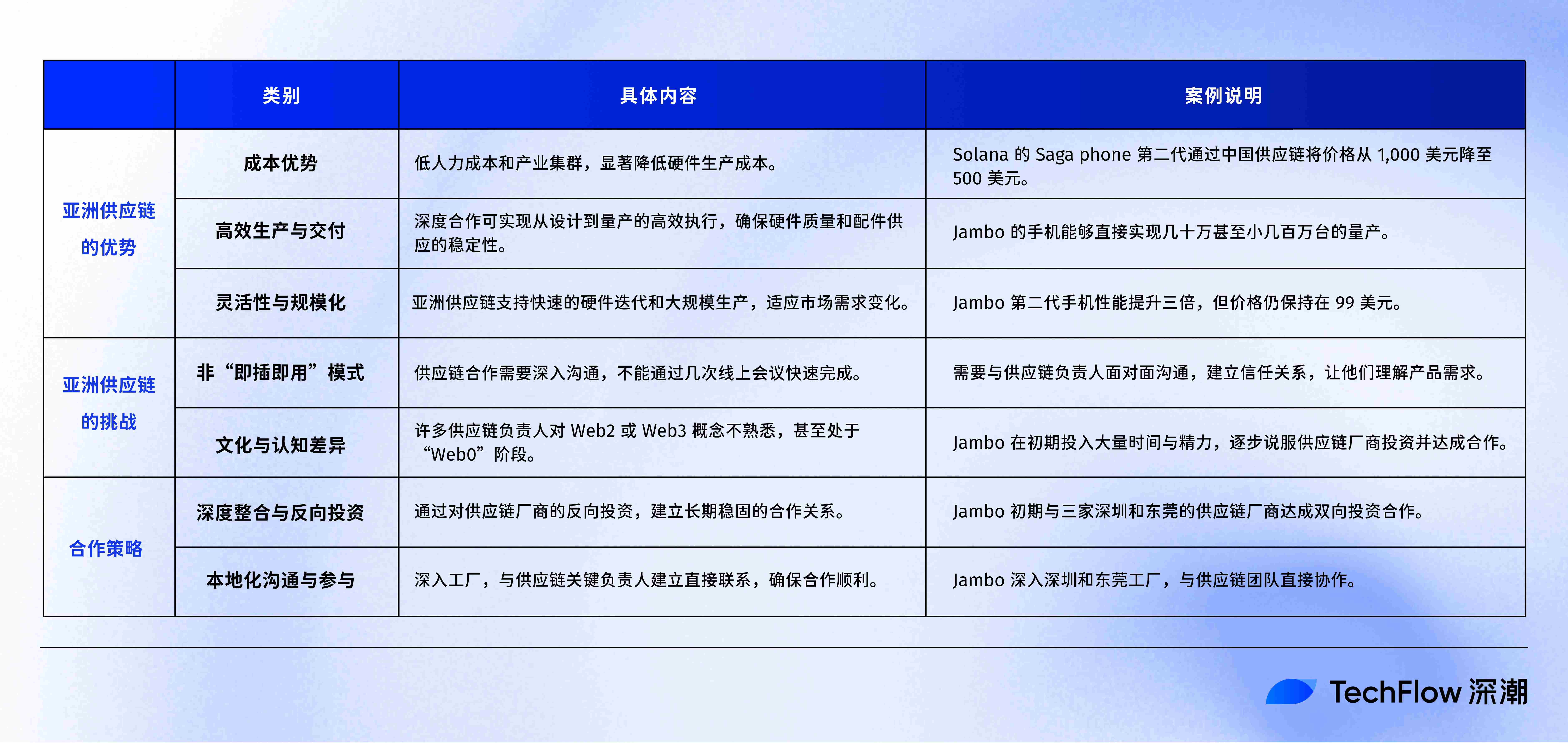

According to James, Jambo relies heavily on China’s manufacturing capabilities to achieve efficient execution from design to mass production, ensuring consistent hardware quality and stable component supply.

Clearly, the low-cost hardware strategy stems from deep integration and optimization of Asian supply chain resources.

"Jambo’s operational model differs significantly from many other DePIN projects. Most hardware-related DePIN projects typically need six months to a year of pre-sales fundraising before sourcing manufacturers and eventually shipping products.

But we’re able to directly produce hundreds of thousands—or even close to a million—phones. This is because we fully leverage the strengths of our Chinese team.

We’ve secured partnerships with three outstanding suppliers in Shenzhen and Dongguan, ensuring efficient production and stable component supply. For teams without access to the Chinese supply chain, I imagine they’d have to work through intermediaries to solve logistics issues."

Beyond Jambo, other DePIN projects are also increasingly drawn to the advantages of Asian supply chains.

Take Solana’s Saga phone: the first generation was priced around $1,000, but after shifting to the Chinese supply chain, the second generation dropped to $500. This illustrates how many Western companies gradually recognize the importance of Asian supply chains in reducing costs.

Ultimately, reliable hardware production and delivery capability is what truly matters.

However, James cautions that Asia’s supply chain is not simply a plug-and-play solution—working with suppliers isn’t as easy as placing remote orders.

Beyond internet jokes about “all innovative electronics coming from Huaqiangbei,” establishing real partnerships requires visiting factories in person and communicating face-to-face with key supply chain decision-makers.

Many Asian supply chain executives aren’t familiar with Web2 or Web3 concepts—their mindset remains firmly rooted in traditional manufacturing, perhaps better described as “Web0.”

Therefore, communication and negotiation demand substantial time and effort.

For example, convincing Jambo’s three supplier partners to invest in the company, conducting reverse investments, and building solid relationships involved complex negotiations—a process built from scratch rather than leveraging existing frameworks.

Overall, such cultural differences may partly explain why Western companies progress slowly when engaging Asian supply chains.

Yet, there’s no denying that Asia’s supply chain offers undeniable advantages in cost and efficiency.

Demand Side: User Traits That Make Asia a Natural DePIN Testing Ground

In the previous section, we examined Asia’s dominant position in DePIN hardware manufacturing.

But Asia’s contribution to the DePIN ecosystem goes much further.

As one of the world’s most densely populated, mobile-payment-advanced, and sharing-economy-active regions, Asia is naturally suited to serve as a testing ground for DePIN applications.

User Behavior and Market Characteristics in the Asia-Pacific Region

-

High Acceptance of the Sharing Economy

The success of sharing economy models in Southeast Asia demonstrates local users’ openness to novel economic paradigms.

In countries like Thailand, ride-hailing platforms Grab and Gojek not only captured market share but expanded into payments, logistics, food delivery, and more, forming diversified ecosystems.

In mainland China, the adoption of the sharing economy is even higher.

Data indicates that China’s shared bike market exceeded RMB 30 billion in 2022 and is projected to grow to RMB 42.74 billion by 2025 (source: 2024 Deep Research Report on China’s Shared Bike Industry). Similarly, in 2023, shared power banks covered 4.04 million locations in China, with penetration rates reaching 44.7% in tier-1 and tier-2 cities (source: 2024 Research Report on China’s Shared Power Bank Industry).

We don’t intend to delve deeper into Web2 industries here, but these figures clearly show that users in China and Southeast Asia are notably receptive to the sharing economy—making it an ideal testbed for DePIN projects.

Looking deeper into Web3 data reveals a natural extension of this behavioral trend.

According to depinscan, in terms of national distribution, China and South Korea lead in DePIN adoption, with over 800K and 790K+ devices respectively.

Interestingly, emerging markets like Indonesia, Vietnam, and Nigeria are surpassing traditional tech hubs, highlighting strong demand beyond the West.

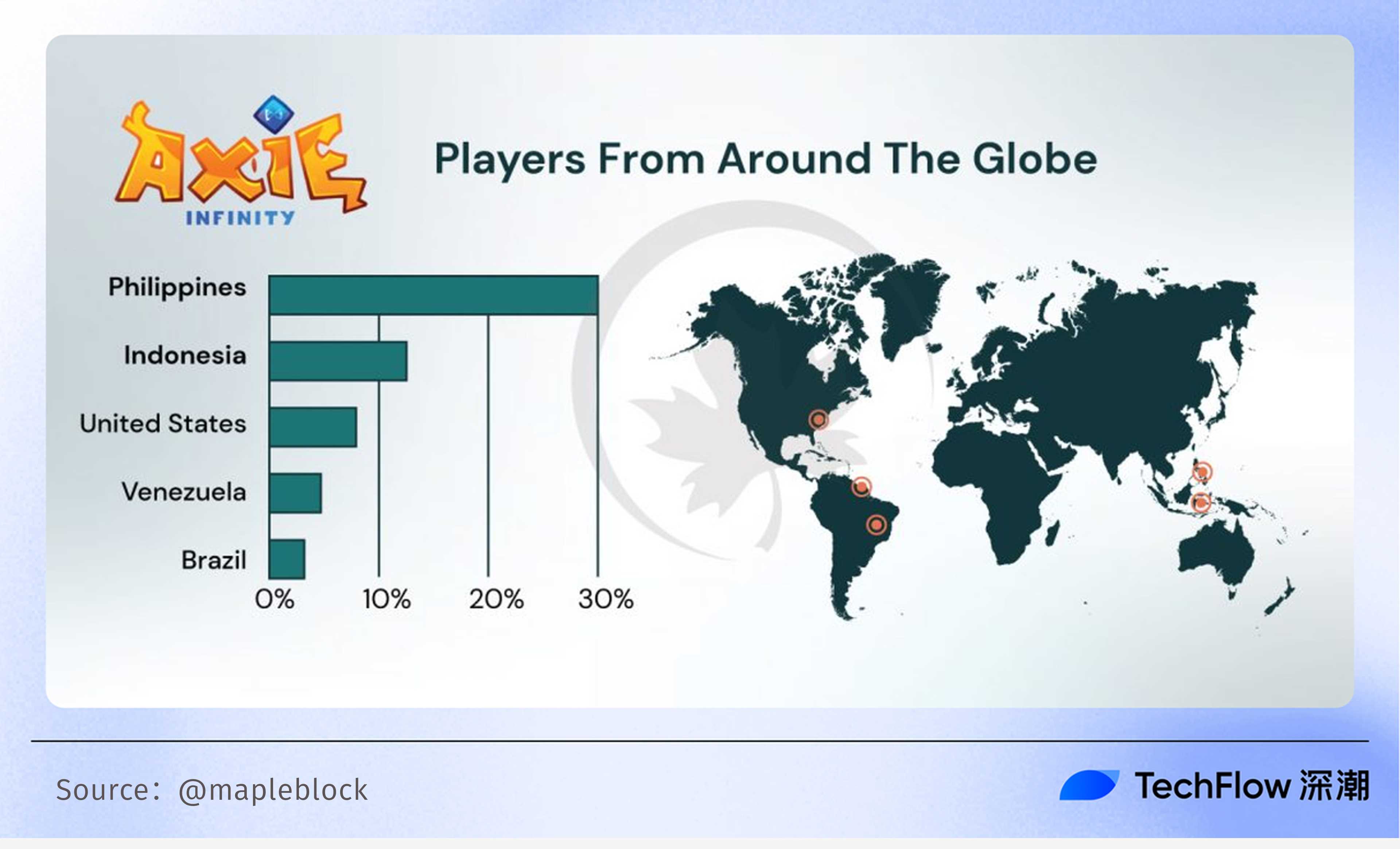

Some DePIN mechanisms are essentially sharing economy models—users earn mining or yield farming rewards by contributing surplus personal or institutional resources. Given generally lower average incomes in Southeast Asia, this model holds greater potential to go viral.

-

Popularity of Idle Mining and Yield Farming Culture

Unique user behaviors in Asian markets create fertile ground for DePIN project promotion.

Models like idle mining and “luma” (yield farming with low barriers to earning small returns) are especially popular in Asia—particularly in China, Vietnam, and the Philippines—where such traits align seamlessly with DePIN incentive mechanisms.

During the last GameFi cycle, Play-to-Earn models like AXIE attracted the highest participation from Southeast Asia—especially the Philippines, accounting for roughly 30% of total players. A similar pattern emerged with StepN.

-

Mobile Internet Penetration: Smartphones as Key Promotion Tools

Asia ranks among the regions with the highest mobile internet penetration and hosts the largest number of smartphone users globally. According to GSMA’s *2023 Global Mobile Economy Report*, by 2025, Asia-Pacific will have 3.4 billion smartphone users—over half of the global total.

This figure carries significant implications for DePIN projects:

-

Smartphone ubiquity allows users to easily access DePIN applications—for instance, managing decentralized storage or bandwidth sharing via mobile apps.

-

Jambo’s success story shows that low-cost smartphones can serve as crucial entry points for DePIN. By pre-installing DePIN apps on hardware, projects can directly reach users and reduce marketing costs.

-

Strong Crypto Community Foundations

Additionally, the Asia-Pacific region has become a vital part of the global cryptocurrency market, particularly among Chinese-speaking communities and Southeast Asian users. On Binance, users from the Asia-Pacific region account for up to 70% of the platform’s user base, including users from China, Hong Kong, Taiwan, and Southeast Asian nations.

Many DePIN projects—such as Helium and Filecoin—have large, active communities within Chinese-speaking circles.

High engagement and community activity provide essential support for DePIN ecosystem development. For example, some projects attract numerous developers and users by hosting hackathons and developer conferences in the Asia-Pacific region.

For any project aiming to enter the DePIN space, the Asian market is an area that cannot be overlooked. By deeply understanding the characteristics of demand in this region, projects can better tailor their products and incentive structures to achieve rapid growth and scalability.

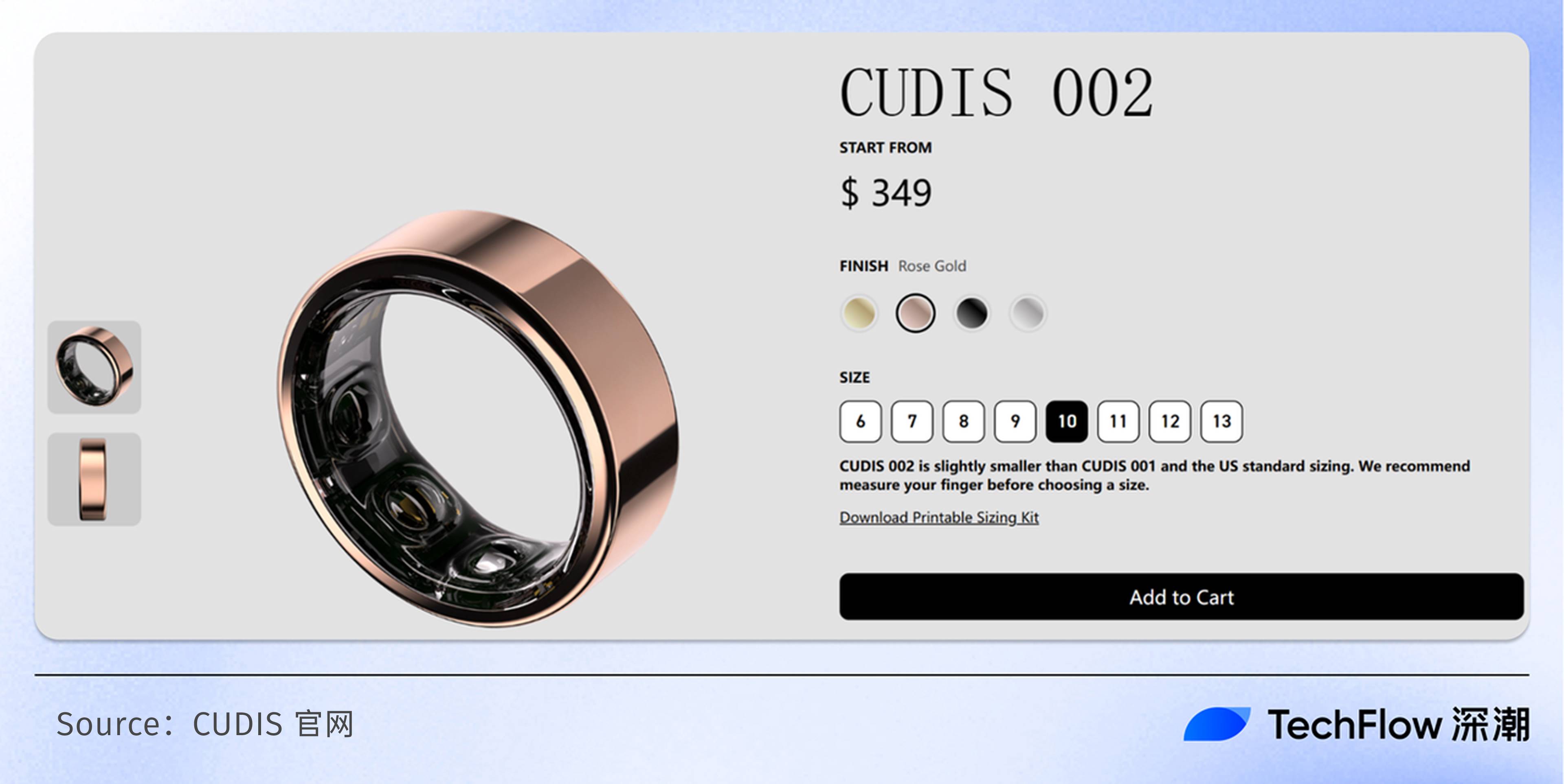

Case Study: CUDIS – When Smart Rings Spontaneously Trend in Japan

When discussing demand in Asia, CUDIS stands out as a compelling case.

As a wearable tech product, CUDIS has gained unexpected popularity in Asian markets—especially Japan. This not only offers insights into how DePIN projects can break into Asian markets but also reflects the region’s consumer potential in health and fitness.

CUDIS’s core product is a smart ring combining health monitoring, reward mechanisms, and decentralized data storage.

By wearing the ring, users can track real-time health metrics such as heart rate and sleep quality, while earning rewards for completing specific activities (e.g., daily step goals). This “earn while staying healthy” model satisfies users’ health interests while integrating Web3 incentives into hardware.

Edison, founder of CUDIS, revealed in our podcast interview:

The project’s primary target markets currently include the U.S., South Korea, Japan, Singapore, and the UK. Among these five, three are located in Asia.

Initially, Edison didn’t fully grasp the importance of the Asian market, given the common stereotype that Western users care more about health and fitness.

However, market performance and internal data show that Asian users are equally passionate about health and exercise. Edison believes this is partly due to prior projects like StepN, which educated a large user base in Asia.

Further discussions revealed an unexpected surprise—the Japanese market demonstrated exceptional enthusiasm for CUDIS.

This momentum wasn’t driven by direct marketing—it emerged organically through influential KOLs who discovered the product and voluntarily promoted it on social media.

CUDIS’s referral mechanism also helped: users who buy a ring can invite others and earn rewards. This attracted non-crypto users into the ecosystem.

These users perceive the product simply: wear the ring, earn rewards, and improve your health.

Edison said:

"After the WebX event in Japan, we hosted a dedicated community meetup with over 100 local users attending. Since most spoke only Japanese, we arranged translators. This event deeply impressed us with the high level of engagement among Asian users. Earlier ‘Social Challenge’ campaigns on Twitter also showcased their passion."

Moreover, our conversation uncovered an important user segmentation: not all CUDIS users are just ‘reward farmers.’

"Overall, Asian users fall into two categories. One consists of low-frequency users who may engage in ‘luma’ behavior. The other includes users with strong willingness and ability to pay.

If the product offers genuine utility, they are willing to pay for it. This is a key insight from our marketing efforts—and a strategic direction for future expansion in Asia."

Consequently, this influences how DePIN projects communicate with Asian audiences.

They focus less on Web3 jargon and emphasize practical product benefits—how data is recorded, why it belongs to users, and its potential future value.

This may be a distinct advantage of hardware-based DePIN products: tangible experiences make them easier to adopt.

Compared to the high communication costs of explaining underlying technologies like Bitcoin, Ethereum, or Solana, physical products drastically lower the barrier to user understanding.

Overview of Solana DePIN Projects in Asia

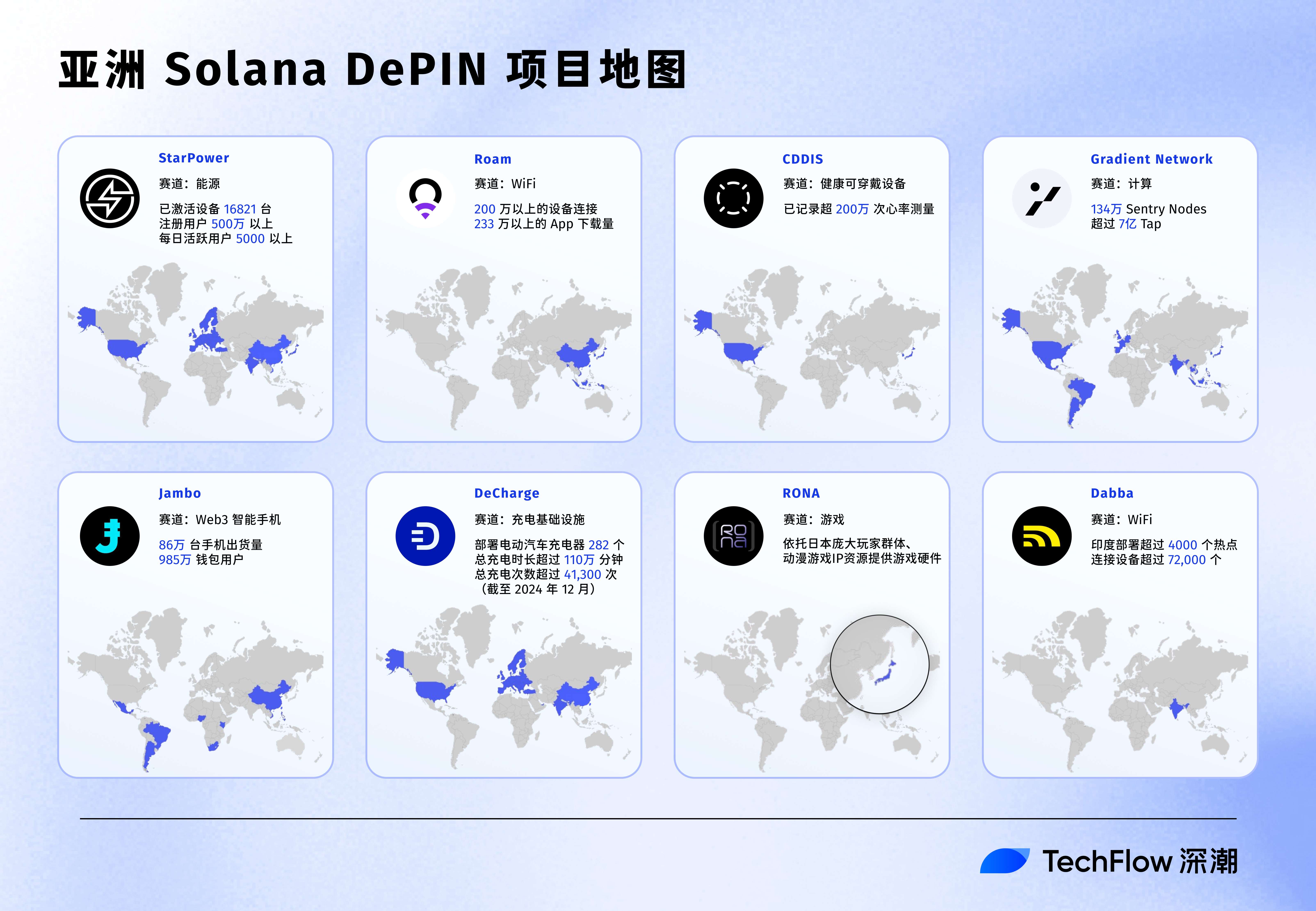

Having explored both supply and demand sides in Asia, we now review DePIN projects with Asian roots or significant presence in the region. Some notable examples are listed below.

StarPower

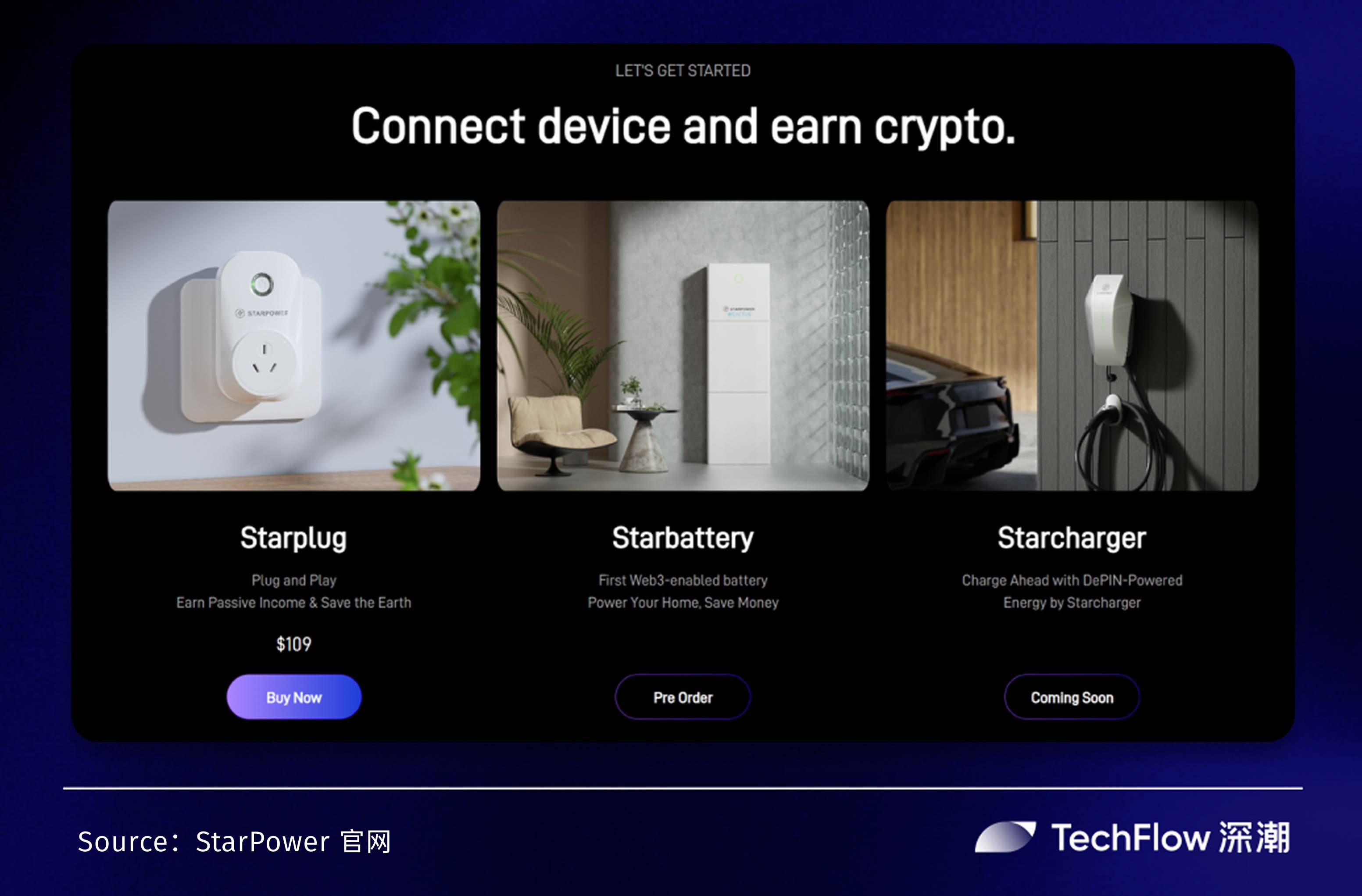

As an energy-focused DePIN project, StarPower aims to build a decentralized energy network based on the concept of a “virtual power plant”—a dispatch system rather than an actual generator.

Renewable energy suffers from instability, and energy storage remains expensive. Virtual power plants help balance supply and demand efficiently, improving energy efficiency, cutting electricity bills, and reducing carbon emissions. However, traditional virtual power plants struggle to integrate residential users due to low per-unit value and high connection costs.

Starpower bridges this gap by combining physical devices with blockchain, IoT, and AI technologies: targeting consumers with smart hardware, incentivizing widespread adoption to aggregate small-scale household and enterprise energy resources into a decentralized network; meanwhile, under privacy-preserving conditions, algorithm-driven analytics optimize electricity usage efficiency.

Planned hardware products include:

-

Starplug: Smart plug, priced at $109, available via official website.

-

Starbattery: Smart battery, priced between $4,000 and $11,500, currently available via pre-order.

-

Starcharger: Smart charger, upcoming.

Software offerings include the Starpower App, designed to unify control and management of various energy devices.

According to Starpower’s official data: the project has over 4 million registered users across 781 cities globally, more than 16,821 activated devices, over 80,000 app users, and daily active users exceeding 5,000+. Device distribution maps show primary markets in Europe, Asia, and North America. With relatively mature solar and peer-to-peer energy markets, StarPower sees dense deployments in South Korea, Japan, China, India, and Southeast Asian countries.

In a recent exclusive interview, Laser, co-founder of StarPower, revealed: Asian users account for approximately 33% of StarPower’s total user base, with South Korean users being particularly active, making up about 25% of Asian users.

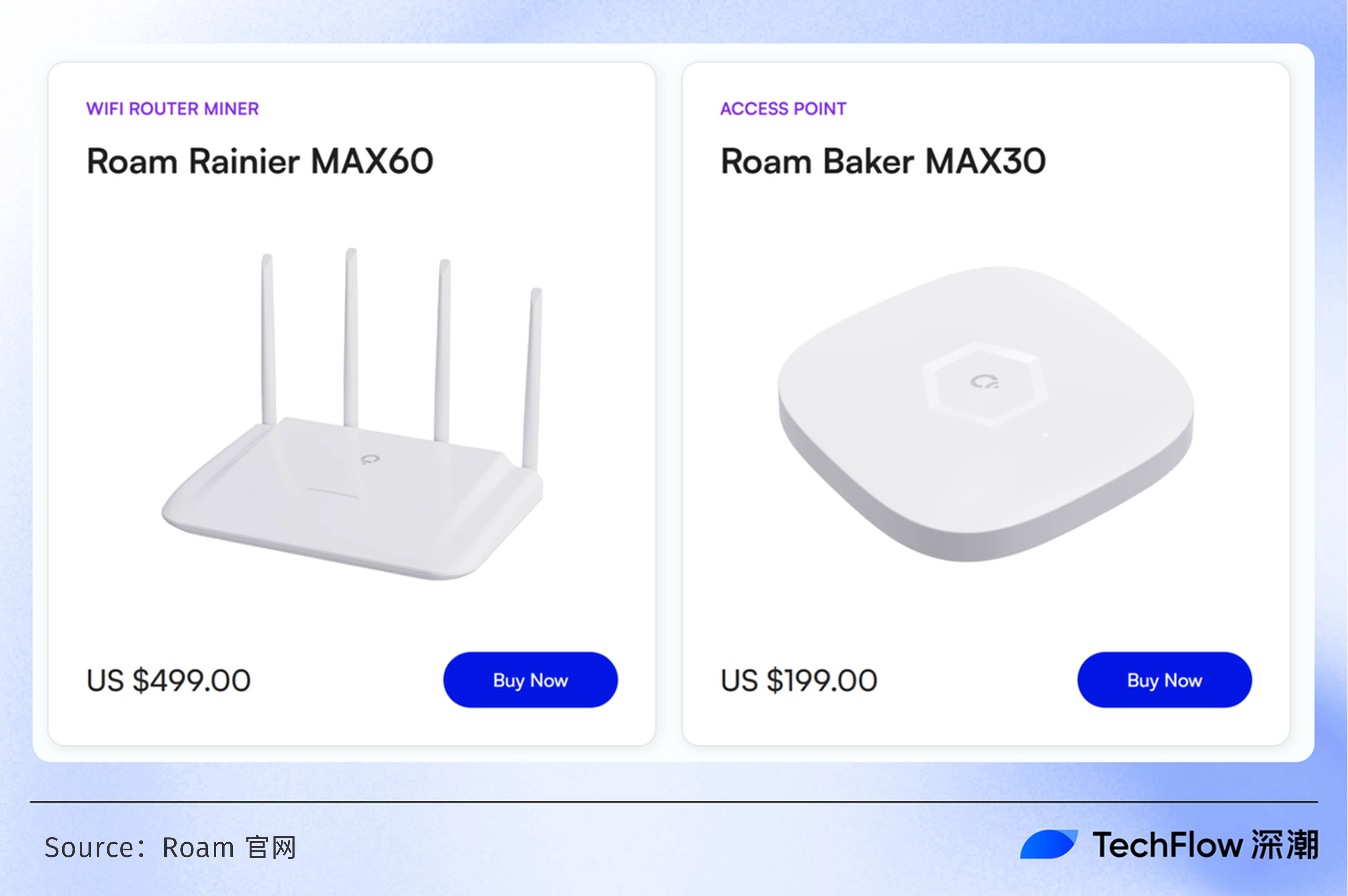

Roam

Roam aims to build a decentralized global WiFi roaming network, providing enterprise-grade WiFi security services and supporting seamless access to OpenRoaming™ and self-hosted WiFi nodes. Notably, Roam is the only Web3 IDP project among the 11 corporate members of WBA’s (Wireless Broadband Alliance) OpenRoaming initiative.

Roam’s operation is simple:

Users contribute their home WiFi to join the Roam network. When others connect, contributors earn积分(rewards), which can be redeemed for ROAM tokens.

In addition, Roam launched official routers, available in two models according to the website:

-

MAX30: $199

-

MAX60: $499

Purchasing an official router grants additional benefits, including NFTs representing greater ecosystem rights and extra reward points.

Official data shows Roam has over 2 million connected devices across more than 140 countries, with over 2.33 million app downloads. Notably, DePIN Scan data reveals a clear trend: higher device coverage in more developed network regions, with Asia showing particularly strong penetration.

DePIN Scan’s device distribution map highlights dense deployments across multiple Asian countries—including South Korea, China (including eastern regions, Taiwan, and Hong Kong), Japan, Bangladesh, Vietnam, and the Philippines—with South Korea standing out as a high-density hotspot, reflecting Roam’s extensive market penetration in Asia.

CUDIS

CUDIS is an AI-powered wearable DePIN product aimed at returning data ownership to users, monetizing personal health data, and building a decentralized health platform where developers can create healthcare services and conduct research. In the future, CUDIS plans to integrate AI Coach, social features, data sovereignty, and DePIN into one comprehensive health solution.

The hardware takes the form of a ring: priced at $349, now updated to version 002. The software component is the CUDIS App, featuring a ChatGPT-powered AI health coach tailored to individual user needs.

Functionally, it offers a 10-day battery life and tracks nine key health metrics—including heart rate, body temperature, and blood oxygen—across 30+ sports modes.

CUDIS also includes daily tasks: users earn积分by completing check-ins, which can later be exchanged for ecosystem tokens.

Additionally, health data collected by the CUDIS ring is stored on-chain with decentralized privacy protection. Users retain full control over their data. Once the CUDIS Health Data Marketplace launches, users can choose to commercialize their data—earning income while advancing medical research.

While exact sales figures aren’t publicly available on social media, Messari’s *2024 State of DePIN* report states CUDIS has recorded over 2 million heart rate measurements.

Edison, co-founder of CUDIS, noted in a recent interview: “Although we did not initially promote in the Asia-Pacific region, shortly after launch, we quickly attracted a large number of buyers from Japan, South Korea, and other areas.”

This trend was confirmed by the “30-Day Health Challenge” campaign: participants primarily came from the U.S. (USA), South Korea (KR), and Japan (JP), underscoring CUDIS’s penetration in Asia, especially East Asia.

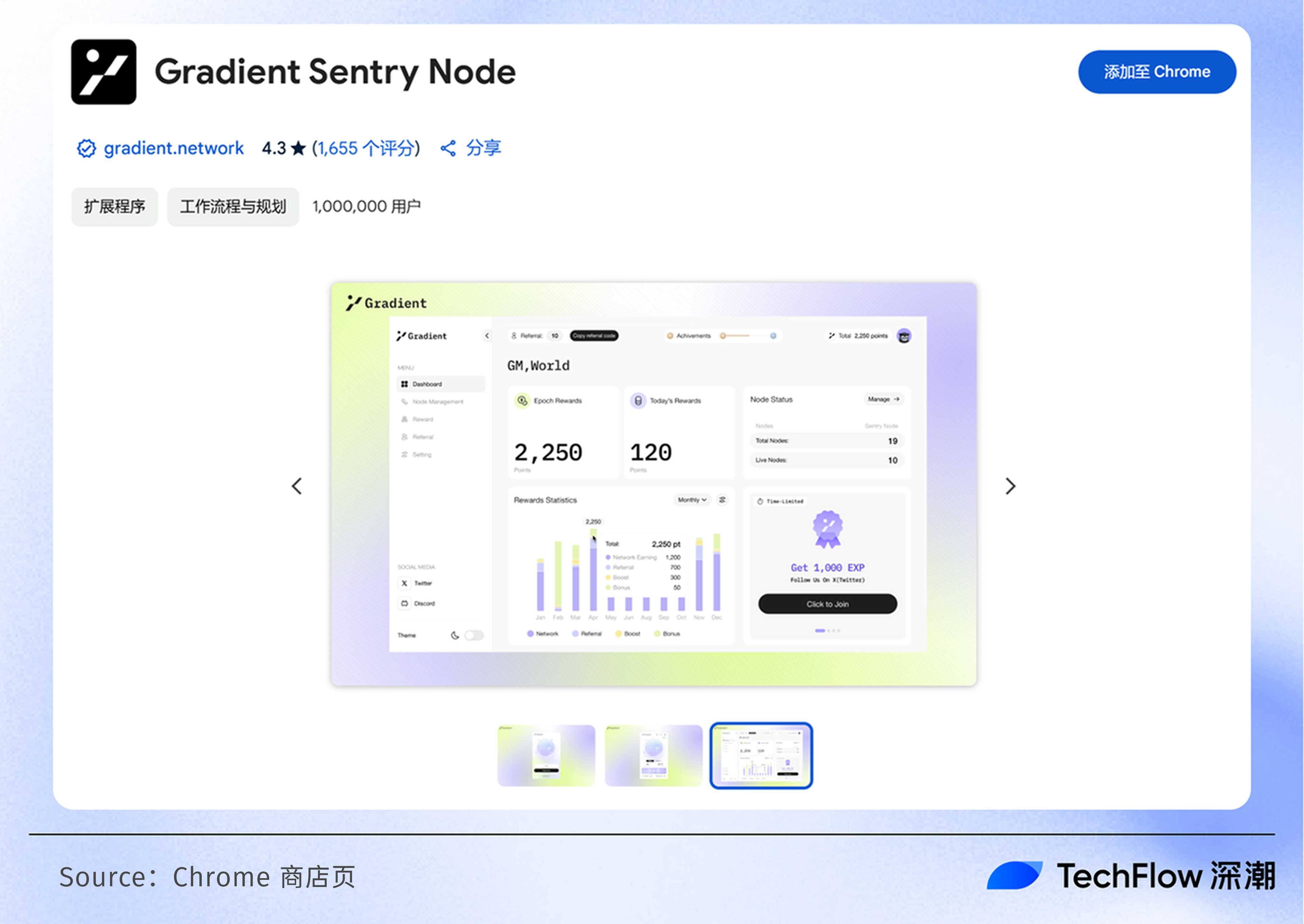

Gradient Network

Gradient Network is an open-layer edge computing infrastructure built on Solana, aiming to connect fragmented, idle computing resources worldwide to enhance interoperability between blockchain networks, making computation inclusive, accessible, and affordable for everyone. In September 2024, the project secured funding from Pantera Capital, Multicoin Capital, Sequoia Capital, and other top-tier firms.

Gradient shares similarities with DAWN as an IP-mining project. Users install Gradient’s mining extension to join the network and earn rewards by supporting AI and Web3 applications.

Previously, Gradient launched Sentry Nodes—a lightweight browser extension whose core function is Taps, brief P2P connections used to verify node activity and measure latency. Personal computing devices can easily install Sentry Nodes, becoming part of a permissionless, global, distributed P2P infrastructure and earning rewards.

According to official data: over 1.34 million Sentry Nodes from 193 global regions have joined, generating over 700 million Taps. Observing the official Sentry Node distribution map:

Mainland China IPs are currently unsupported, leaving that area blank. Outside mainland China, however, Sentry Nodes are densely distributed across South Korea, Japan, Taiwan, Hong Kong, India, Vietnam, Thailand, and the Philippines.

Beyond Asia, Sentry Nodes also have broad coverage in Europe, North America, and South America.

Jambo

Jambo is an on-chain mobile network project centered on its flagship product, the JamboPhone, aiming to revolutionize how people access the crypto industry. Prioritizing scalability, security, and accessibility, it simplifies digital financial tools while fostering creativity and community.

As a crypto-native smartphone, the JamboPhone gained attention in the DePIN community in 2024 for its $99 price point, 860,000 units shipped, and 9.85 million connected wallet users. Functionally, the JamboPhone features a multi-chain wallet supporting storage and management of major blockchain assets, helping users take full control of their digital holdings. It also includes a DApp store with curated decentralized applications spanning gaming, finance, social, and more, meeting diverse user needs.

In January 2025, Jambo officially launched its token $J on Solana via Bitget LaunchX, aiming to fund satellite launches to connect the global JamboPhone network and expand decentralized service coverage.

Many assume Jambo is an African project, yet it maintains close ties with China: James, co-founder and CEO of Jambo, grew up in the Democratic Republic of Congo and is ethnically Chinese from Zhejiang Province.

Furthermore, JamboPhone’s ability to achieve million-unit-scale production in a short timeframe owes much to robust Chinese manufacturing: Jambo has partnered with three top-tier supply chain providers in Shenzhen and Dongguan to ensure efficient hardware production and stable component supply.

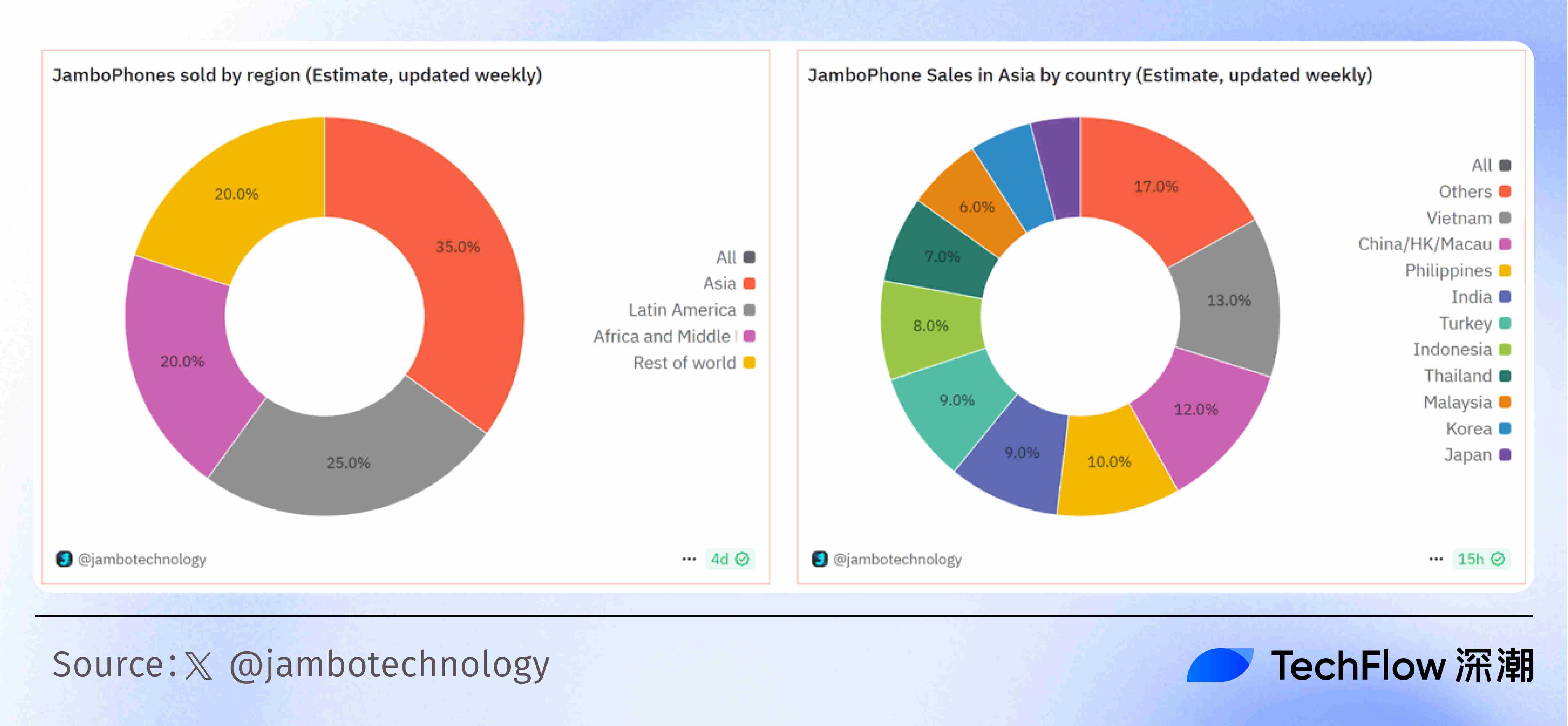

Ironically, while JamboPhone envisions connecting millions in Latin America, Southeast Asia, and Africa to Web3 technology, its $99 China-made hardware rests on a strong Chinese-speaking user base.

According to Dune analytics: Asian markets account for over 35% of JamboPhone sales, with mainland China alone representing 12% of the Asian market.

Decharge

DeCharge aims to build a community-driven, decentralized electric vehicle charging infrastructure—an ambitious vision that naturally aligns with China and broader Asian markets.

According to UK consultancy RhoMotion, global EV sales (excluding hybrids) reached ~17.1 million units in 2024, a 25% year-on-year increase. China alone sold 11 million EVs, capturing 64% of the global market and demonstrating strong leadership.

Meanwhile, EV markets in India, Thailand, and Indonesia are growing rapidly. Independent analyst Canalys predicts Indian EV sales will exceed 300,000 units in 2025, with new car penetration rising to 6%, reflecting a compound annual growth rate of 59%.

The booming EV market in Asia fuels strong demand for charging infrastructure. Against this backdrop, DeCharge’s decentralized, community-driven model positions it to scale rapidly in Asia, potentially becoming a transformative force in the industry.

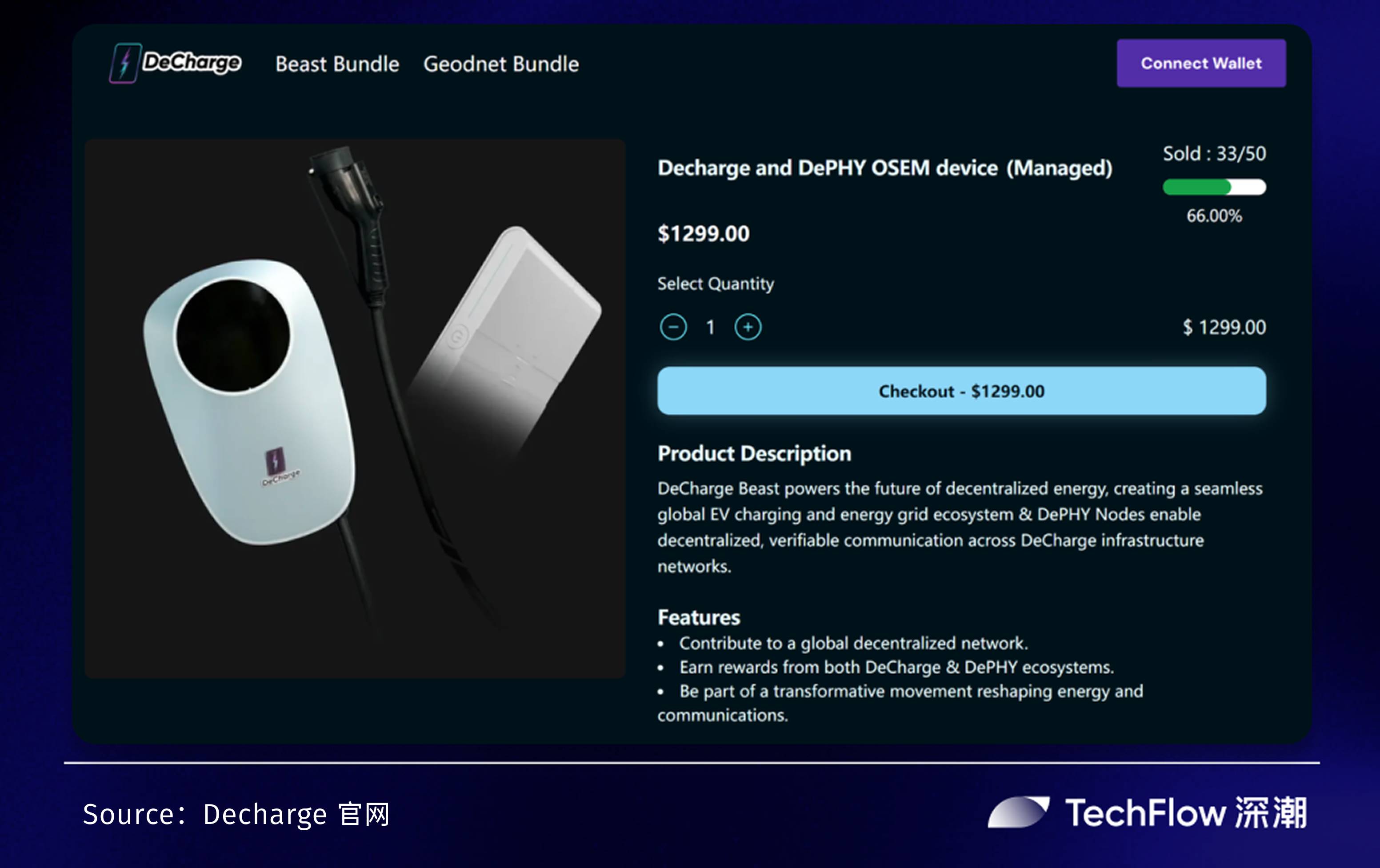

By the end of 2024, DeCharge launched a 7kW charger called The Beast, powered by DePHY technology and priced at $1,299. When others use the charger, owners earn passive income—turning traditional charging stations into income-generating assets.

Currently, The Beast is deployed across Asia, the U.S., and Europe, demonstrating its global scalability. According to DeCharge’s H2 2024 market report: 282 chargers deployed, over 1.1 million minutes of total charging time, and more than 41,300 charging sessions. Additionally, the team is actively promoting the product in India (company headquarters), Southeast Asia, and Dubai.

Rona

RONA is a high-performance Web3 gaming ecosystem combining advanced hardware with blockchain technology to deliver immersive gameplay and play-to-earn opportunities. By integrating fun gameplay, token incentives, and shared AI computing power, RONA creates a new ecosystem where players enjoy games and generate economic value simultaneously.

Core products include gaming hardware RONA NEXUS and RONA SYNC, plus the operating system RONA OS:

The gaming hardware is currently in pre-sale, featuring advanced controllers, powerful CPUs and GPUs, and high-resolution LCD screens to deliver immersive controls and vivid visuals.

RONA also offers earning opportunities: players earn through P2E mechanics; they can also utilize idle device power for mining or share GPU resources with the RONA platform to train AI game models, unlocking additional income. As more games join the RONA platform, players will receive third-party game airdrops.

Notably, although official websites and social media lack detailed user data, Rona is rooted in Japan—a market with deep foundations in gaming, including a massive player base, rich IP resources, and world-leading gaming hardware (e.g., Sony, Nintendo).

Moreover, Rona has secured backing from top-tier traditional and crypto institutions in Japan, including Sony, NTT Docomo, SBI, ACG, and Jasmy. This strong institutional support provides advantages in game development, hardware innovation, and IP integration, strengthening its competitive edge.

WiFi Dabba

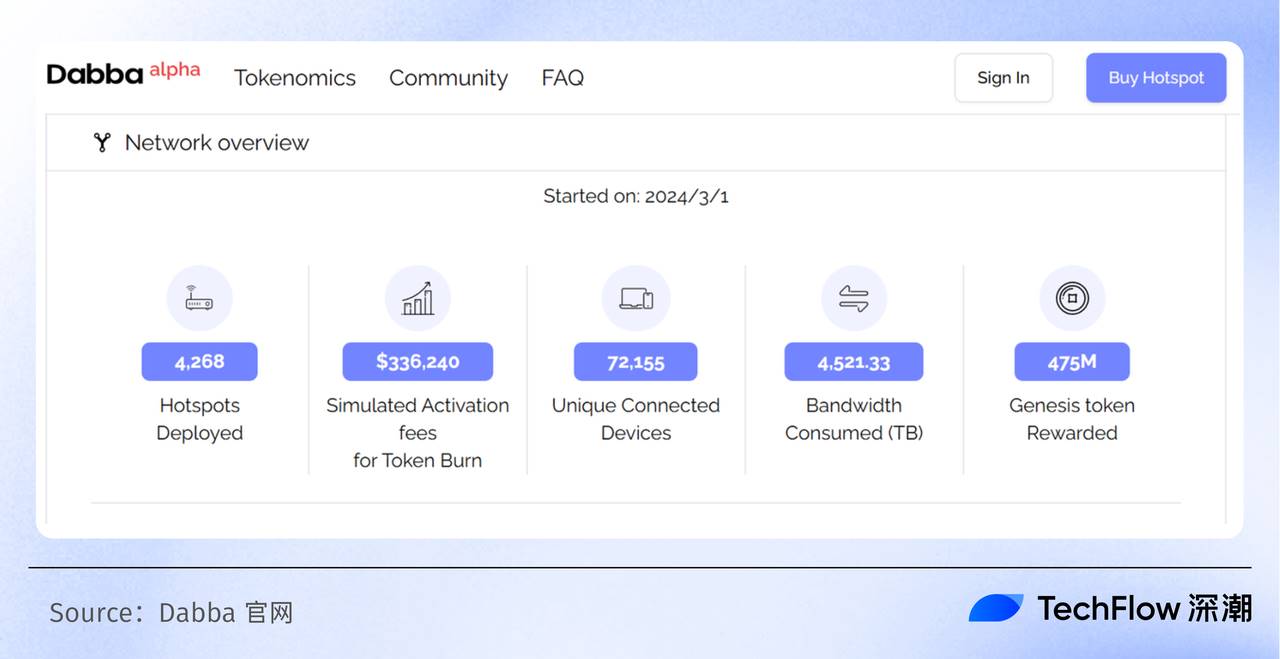

Often seen as India’s version of Helium, Dabba is another Web3 DePIN hotspot project—but with a focus on consumer WiFi.

Specifically, Dabba introduced an innovative “managed deployment” model, partnering with over 100,000 cable operators to deploy hotspots in areas of India with greatest need.

Additionally, for every 1GB of data consumed, an amount of local DBT tokens equal to the price paid by consumers is burned. These local DBT tokens are issued exclusively to hotspot owners—individuals who purchase the physical hardware to provide internet connectivity—while local cable companies install the devices across India.

This approach simplifies hotspot deployment and maintenance while delivering affordable WiFi access to hundreds of millions of Indians.

Currently, Dabba has launched its hardware product, WiFi Dabba Lite, priced at $199. Initially planning to roll out 100,000 Dabba Lite units in India to bring internet access to the unconnected, explorer.dabba data shows over 4,000 hotspots deployed nationwide, connecting more than 72,000 devices.

Historically, India has faced significant shortcomings in network infrastructure coverage and efficiency. According to the Internet and Mobile Association of India (IAMAI), overall internet penetration in India stands at just 35%, dropping to 20% in rural areas—highlighting urgent demand for low-cost internet solutions.

Meanwhile, India’s vast geography and complex terrain make centralized network infrastructure costly to build and maintain, exacerbating urban-rural divides. Centralized networks often suffer congestion during peak hours, degrading user experience.

In this context, Dabba’s decentralized WiFi solution enables more efficient resource utilization, improving network stability and speed while significantly lowering operational costs. Coupled with rapid smartphone adoption and government-led digital transformation initiatives, Dabba enjoys strong tailwinds, amplifying its growth potential in the Indian market.

Overview of Asian VCs Investing in DePIN

In the previous cycle, DePIN investment was primarily led by Western institutions. In the current DePIN cycle, more Asian VCs are emerging, signaling growing regional interest.

We’ve compiled a list of Asian venture capital firms actively investing in DePIN.

Yzi Labs

VC Location: Singapore, UAE

Number of Investments: 5

Portfolio:

-

NYM: Building next-gen privacy infrastructure

-

Ankr: Web3 infrastructure providing node-as-a-service

-

Privasea: Decentralized privacy computing infrastructure

-

Swan Chain: Decentralized AI infrastructure

-

CoralApp: Web3 fitness application

Animoca Brands

VC Location: Hong Kong, China

Number of Investments: 7

Portfolio:

-

io.net: Decentralized computing network

-

GEODNET: Decentralized network for Earth observation

-

peaq: Web3 network supporting IoT

-

Aethir: Decentralized real-time rendering network

-

Hivello: Leverages idle computer resources to support various DePIN protocols

-

Domin Network: DePIN Rollup for enterprises

-

Nodepay: Decentralized bandwidth infrastructure

Waterdrip Capital

VC Location: China

Number of Investments: 15

Portfolio:

-

IoTeX: Modular DePIN infrastructure platform

-

peaq: Web3 network supporting IoT on Polkadot

-

Jambo: On-chain mobile network

-

Oort: Web3 data infrastructure

-

Phala Network: Off-chain computing infrastructure

-

Network3: AI training Layer2 network

-

Swan Chain: Decentralized AI infrastructure

-

SkyX: Decentralized weather network

-

AiGO Network: DePIN data network

-

ATT: Digital advertising ecosystem

-

Nubila Network: Data oracle

-

DePHY: Integrated DePIN framework

-

PowerPod: Shared EV charging network

-

Ordz Games: Retro arcade games

-

Parasail: Re-staking protocol for staking DePIN assets

IOSG Ventures

VC Location: Hong Kong, China / New York, USA

Number of Investments: 6

Portfolio:

-

IoTeX: Modular DePIN infrastructure platform

-

Phala Network: Off-chain computing infrastructure

-

Theta Network: Blockchain centered on media and entertainment

-

Filecoin: Decentralized storage network

-

OpenLayer: Modular real-world data layer

-

MXC: Smart city IoT network

FutureMoney

VC Location: China

Number of Investments: 8

Portfolio:

-

IoTeX: Modular DePIN infrastructure platform

-

Natix Network: Decentralized camera network

-

Pocket Network: Blockchain data ecosystem for Web3 apps

-

Nubila Network: Data oracle

-

DePHY: Integrated DePIN framework

-

PowerPod: Shared EV charging network

-

JDI Global: Web3 hardware manufacturer

-

Hotspotty: All-in-one tool for building and scaling DePIN networks

Foresight Ventures

VC Location: Hong Kong, China / Singapore

Number of Investments: 7

Portfolio:

-

IoTeX: Modular DePIN infrastructure platform

-

io.net: Decentralized computing network

-

Ola: Yield enhancement network for Bitcoin ecosystem

-

CUDIS: AI-powered wearable DePIN product

-

Glacier Network: Data infrastructure accelerating AI and DePIN

-

DePHY: Integrated DePIN framework

-

Parasail: Re-staking protocol for staking DePIN assets

Hashed

VC Location: South Korea

Number of Investments: 2

Portfolio:

-

IoTeX: Modular DePIN infrastructure platform

-

Jambo: DePIN smartphone

JDI Global

Company Location: China (JDI is a hardware manufacturer)

Number of Investments: 9

Portfolio:

-

Roam: Decentralized global WiFi network

-

GEODNET: Decentralized network for Earth observation

-

U2U Network: DAG-based, EVM-compatible blockchain network

-

UXUY: One-stop decentralized exchange

-

MXC: Smart city IoT network

-

PumpX: Decentralized anonymous communication protocol

-

MetaPhone: Smartphone based on TON

-

DeMR: Decentralized private video streaming infrastructure

-

PowerPod: Shared EV charging network

Conclusion: Asia – The Invisible Backbone of Solana DePIN

Through our observations and research into Solana DePIN projects in Asia, it becomes clear that Asia is not only the global epicenter of hardware manufacturing but also a natural testing ground for DePIN demand.

From supply chains to user behavior, from hardware production to market penetration, Asia plays an irreplaceable role in the DePIN ecosystem.

On the supply side, Asia’s complete manufacturing产业链 and significant cost advantages provide essential hardware support for global DePIN projects. The manufacturing strength of the Greater Bay Area, Yangtze River Delta, and Southeast Asia enables efficient, low-cost production, making it the primary source of global DePIN hardware. This advantage extends beyond mere manufacturing to deep integration of supply chain efficiency and technical know-how.

On the demand side, Asian user traits naturally align with DePIN incentive mechanisms. High population density, openness to sharing economies, and high mobile internet penetration make Asia an ideal proving ground for DePIN applications.

From Jambo’s smartphones to CUDIS’s smart rings, and the localized expansions of multiple flagship projects, the enthusiasm and engagement of Asian users offer DePIN projects unparalleled opportunities for rapid scaling.

Moreover, Asian-native investment firms are beginning to emerge as influential players in the DePIN space. Unlike the previous cycle dominated by Western capital, this cycle sees Asian investors actively building portfolios, demonstrating growing regional influence. This not only provides more funding for DePIN projects but also accelerates their落地 in Asian markets.

For any project seeking a foothold in the DePIN space, deeply understanding the uniqueness of the Asian market and actively integrating into its ecosystem will be key to success.

No matter the bull or bear cycles in crypto, the DePIN narrative continues.

And Asia will remain an indispensable chapter in this story.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News