LSD narrative, a brief discussion on Puffer Finance's Based Rollups

TechFlow Selected TechFlow Selected

LSD narrative, a brief discussion on Puffer Finance's Based Rollups

This article introduces Puffer Finance's Based Rollups solution.

Author: Trustless Labs

Recently, Puffer Finance, a liquid restaking protocol active in EigenLayer, launched a solution called Based Rollups, aiming to leverage Ethereum mainnet validators to provide a more secure and efficient decentralized approach for Rollups—particularly in decentralizing sequencers.

As a classic LST protocol capable of combining its unique features (supporting both Ethereum mainnet PoS and EigenLayer restaking) to deliver new technical solutions, this represents a compelling narrative expansion.

Decentralization of the sequencer is a core concern for the community—it’s nearly the weakest point in Rollup systems and directly impacts user experience. Based Rollups attempt to outsource sequencing to Layer 1 to achieve decentralized ordering, which not only reduces the excessive centralization risks of current Rollup sequencers but also significantly lowers transaction costs and enhances system liveness.

Developers can easily deploy and manage their own Rollup chains based on the Based Rollups architecture—just as they would deploy a smart contract—while benefiting from Ethereum's security and decentralization.

Problems with Current Rollups

Current ZK or OP Rollups rely on centralized sequencers to determine transaction order. This centralization introduces risks such as sequencer failure, reduced user trust, and associated MEV issues.

To mitigate these risks, many Rollups offer an "escape hatch"—a mechanism allowing users to exit the Rollup during sequencer failure—but this increases latency and gas fees and may still be subject to malicious ordering and MEV extraction.

There is an urgent need for Rollups with decentralized sequencers.

Introduction to Based Rollups

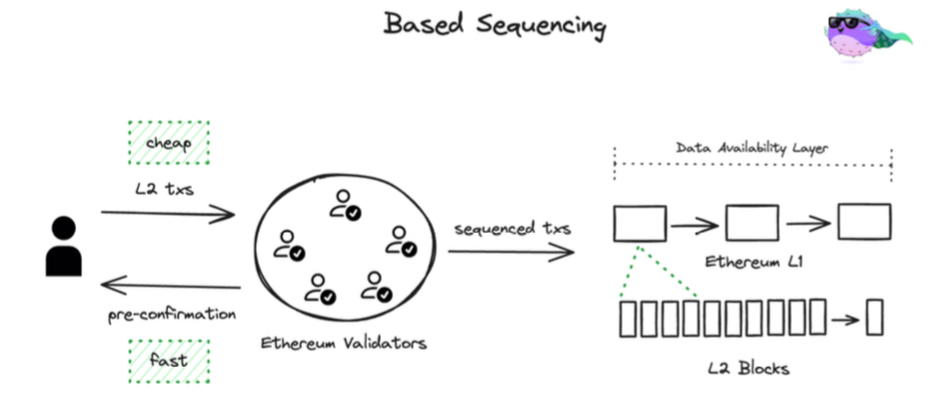

Rollups whose transaction order is determined by L1 are known as Based Rollups, a concept proposed by Ethereum Foundation researcher Justin Drake in March 2023.

Based Rollups achieve decentralized sequencing by leveraging L1 proposers (proPoSers). This method inherits L1’s liveness and decentralization, eliminates the need for escape hatches, and thereby strengthens Rollup security and efficiency.

How Based Rollups Work

In Based Rollups, L1 proPoSers can collaborate with L1 searchers and L1 builders to permissionlessly include Rollup blocks in the next L1 block. In other words, the order of included L2 blocks—and thus final transaction ordering—is determined by the L1 proPoSer. However, L1 proPoSers generally do not build L2 blocks themselves. Instead, each Based Rollup block is constructed by L2 builders, meaning no additional workload is imposed on L1 proPoSers.

Taiko is an example of a Based Rollup: the VM and Rollup execution agent execute transactions off-chain at the execution layer, while transaction ordering is determined from the consensus layer onward by Ethereum’s consensus layer. Transaction data is published on Ethereum and can ultimately be verified on Ethereum.

Advantages of Based Rollups

-

Inherits L1 censorship resistance, enhancing transaction liveness: Since Based Rollups are operated by Ethereum L1 proPoSers and validator nodes, they inherit Ethereum’s censorship resistance and eliminate the need for escape hatches. This ensures transaction liveness and avoids delays and unfairness associated with escape mechanisms.

-

Lower transaction costs: Escape-hatch-based transactions typically incur extra gas overhead, reducing the liveness of traditional Rollups. Based Rollups avoid additional gas fees, do not require verification of centralized sequencer signatures, and eliminate the need for escape hatches or external PoS consensus, further reducing costs.

-

Inherits L1 decentralization—simpler and more secure system: Based Rollups only execute the transaction layer off-chain; the consensus layer for transaction ordering, data availability layer, and validation layer all reside on L1. This reuses the L1 searcher-builder-proPoSer architecture, making the Based Rollup system extremely simple—no sequencer signature verification, escape hatches, or external PoS consensus needed. L1 searchers and block builders are incentivized to include Rollup blocks in their L1 bundles and blocks to capture Rollup MEV, further strengthening L1 security. By default, Based Rollups have almost no negative impact on L1 stakers—the only effect is increased revenue, as most MEV flows to L1.

-

Flexible token governance: Although sequencing is delegated to L1, Based Rollups can still have governance tokens to collect base fees. Alternatively, they can be tokenless, since correctness and fairness are guaranteed by Ethereum.

Challenges Facing Based Rollups

Reduced MEV Revenue

MEV constitutes a major portion of traditional Rollup income, but in most Based Rollups, MEV flows to L1 proPoSers. This sacrifices MEV revenue for Based Rollups, although they retain the ability to earn from L2 congestion fees (e.g., EIP-1559-style L2 base fees).

However, Based Rollups wishing to capture their own MEV might implement bribery mechanisms—for instance, including an auction mechanism like a Dutch auction in an L1 contract, forcing batch submitters to pay ETH into the contract.

Limited sequencing flexibility, no pre-confirmations

While Based Rollups offer many advantages, they face challenges related to soft confirmations—specifically, the ability for users to reliably know their transaction will successfully reach Ethereum L1.

Current Rollups offer pre-confirmations, giving users confidence that their transactions will definitely be submitted to L1.

But delegating sequencing to L1 reduces sequencing flexibility, making it impossible for Based Rollups to support pre-confirmations or Arbitrum-style first-come-first-served (FCFS) ordering.

Justin Drake proposed using restaking in summer 2023 to solve the pre-confirmation problem. In this design, a subset of L1 proPoSers commit (via restaking) to include Based Rollup blocks in their future proposed L1 blocks. Since L1 proPoSers know their proposal schedule at least 32 blocks ahead, it becomes possible to designate who will propose which block.

Puffer Finance’s Improvement to Based Rollups

Puffer Finance aims to integrate pre-confirmations with Base Rollups through its UniFi architecture, delivering fast (100ms) confirmation times while preserving all advantages of Base Rollups.

Pre-confirmation Mechanism Ensures L1 Transaction Submission

Pre-confirmations ensure that the decentralized sequencer effectively submits transactions to L1. Ethereum validators queue up to propose blocks. If a pre-confirmation provider fails to fulfill its commitment, it faces slashing penalties, ensuring higher reliability. This mechanism gives users greater confidence that their transactions will indeed be included in Ethereum L1 state.

100ms Fast Confirmations

For applications like GameFi, soft confirmations are critical to ensuring rapid response times (e.g., around 100ms). However, due to decentralization, Based Rollup sequencers follow the 12-second block production interval, resulting in a minimum confirmation time of 12 seconds—making soft confirmations too slow for responsive use cases.

Puffer’s UniFi integrates pre-confirmations (preconfs) with Based Rollups, enabling them to offer user experiences comparable to centralized sequencers—with 100ms confirmation times—while guaranteeing liveness. This integration allows Based Rollups to retain all their original advantages, ultimately solving Ethereum liquidity fragmentation and fostering a more unified and efficient Rollup ecosystem.

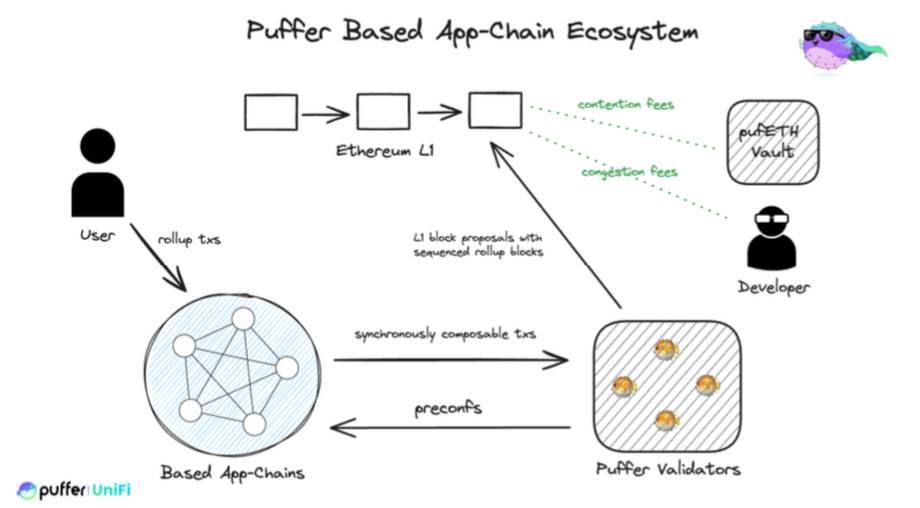

UniFi Architecture

UniFi’s architecture enables it to leverage Puffer’s validator nodes to scale rapidly from a single centralized sequencer to tens of thousands of decentralized sequencers. UniFi aims to seamlessly integrate pre-confirmations into its Based Rollup.

-

Users submit Rollup transactions, which are processed by Puffer validators. These validators provide pre-confirmations, assuring users their transactions will be included in Ethereum L1 state.

-

Puffer validators undergo restaking under additional slashing conditions to ensure reliability. They receive user Rollup transactions and issue pre-confirmations, preparing to include these transactions in L1 blocks.

-

The Preconf Slasher AVS imposes extra slashing conditions on validators to deter violations of pre-confirmation commitments and prevent validators from failing to submit certain Rollup transactions to L1.

-

Puffer validators propose blocks on Ethereum L1 that include the ordered pre-confirmed Rollup transactions.

-

The Puffer sequencer contract accepts the Rollup transactions.

-

The PufETH Vault collects congestion and contention fees generated from Rollup transactions, increasing returns for PufETH holders and distributing native yield back to UniFi users.

uniETH Reduces Market Risk

unifETH is the universal gas token within the UniFi ecosystem. It earns rewards via pufETH and is managed by a decentralized autonomous organization (DAO) to mitigate market risks—such as loan liquidations caused by Ethereum price volatility—while Puffer’s anti-slashing mechanism helps avoid these risks.

Gasless Transaction Scenarios

In Web2, users are accustomed to free internet services subsidized by ads. In Web3, users must pay for services, which can hinder adoption.

Puffer’s Based Rollup users can earn income by locking assets in the Rollup’s native bridge, generating native yield. This enables Puffer to support applications with gasless-like transaction experiences, having significant implications for both Web2 and Web3.

Puffer’s Based dApp Chains

If transaction fees on a dApp’s Rollup chain become too high, developers may choose to leave and create their own dedicated chain to directly capture user transaction fees. Puffer offers Based dApp Chains as a solution.

Launching a Puffer-Based dApp chain becomes as simple as deploying a smart contract. It inherits Ethereum’s security and decentralization, allowing developers to capture transaction fees from their dApp’s Rollup chain without needing to operate a centralized sequencer, while also enabling cross-chain transactions and interactions.

Transactions on Puffer’s Based dApp Chains can be confirmed within 100ms, and Puffer’s pre-confirmations guarantee that transactions are submitted to L1.

Conclusion

Through collaboration with the Ethereum Foundation, Puffer Finance is providing safer and more efficient solutions for Rollups. This decentralized sequencing approach not only reduces risks associated with centralized sequencers but also significantly lowers transaction costs and improves system liveness.

With the integration of pre-confirmation mechanisms and 100ms fast confirmations, Based Rollups will become an ideal choice for various applications—including GameFi—ensuring excellent user experience while guaranteeing transaction finality. Furthermore, with Puffer Finance’s Based dApp Chains, developers can easily deploy and manage their own Rollup chains without worrying about operating centralized sequencers, all while enjoying Ethereum’s security and decentralization.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News