HTX Ventures' Observations from EthCC 2024: Infrastructure Is Strong, Applications Need Innovation

TechFlow Selected TechFlow Selected

HTX Ventures' Observations from EthCC 2024: Infrastructure Is Strong, Applications Need Innovation

Having a powerful consumer application is crucial for getting more people to use blockchain technology.

2024 marks the tenth anniversary of Ethereum's initial coin offering (ICO). To learn from front-end developers and connect with like-minded venture capitalists and ecosystem participants, several investment analysts from HTX Ventures attended EthCC, Europe’s largest annual Ethereum event, last week. This article outlines some of our observations on the current market landscape.

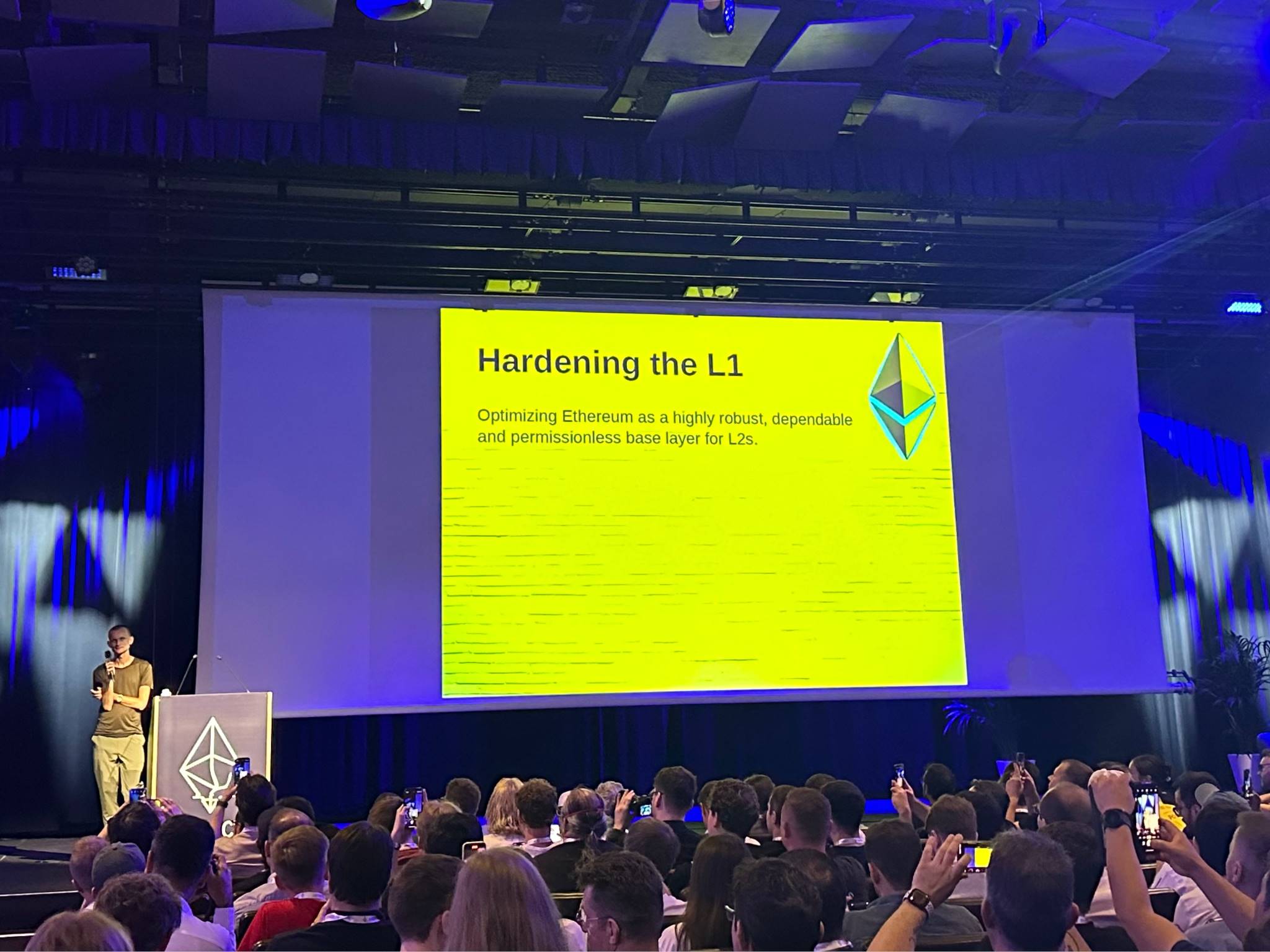

1. Ethereum Optimization Directions

Vitalik Buterin delivered a keynote in Brussels titled "Strengthening L1: Optimizing Ethereum as a Highly Robust, Reliable, and Permissionless Foundation for L2s." In his speech, Vitalik reaffirmed Ethereum’s roadmap—to serve as the most decentralized and secure Layer 1 settlement layer for various Layer 2 solutions—and outlined five key directions for improvement:

1) Decentralized DeFi: To preserve Ethereum’s decentralized nature, solo staking must be encouraged. This can be achieved by simplifying node operations and lowering the capital threshold for staking. Additionally, risks related to liquid staking and MEV (Maximal Extractable Value) must be carefully considered.

2) Layer 2 Solutions: To advance Ethereum’s roadmap, efforts should focus on increasing data availability bandwidth for Layer 2s and reducing on-chain storage costs.

3) Security and Privacy: Vitalik encouraged validators to automatically coordinate on the same minority fork in the event of a 51% attack. He also proposed potential future solutions to defend against quantum computing threats.

4) Light Clients: Promote the adoption of Layer 1 light clients such as Helios, and develop similar solutions for Layer 2s, ensuring users can securely interact with blockchains without relying on centralized servers.

5) Protocol Simplification: To ensure Ethereum remains a robust foundational layer, its technical debt must be reduced.

2. Investment Slowdown

Due to uncertain market liquidity, listing trends/macroeconomic conditions, and high FDV (fully diluted valuation) in venture rounds, the pace of venture capital investment has temporarily slowed. As market valuations correct and political and economic conditions become clearer in the second half of 2024, venture investors are expected to resume more active investment activity.

3. Misalignment in Investment Focus

Strong consumer applications are crucial for bringing blockchain technology to broader audiences. However, current venture funding patterns tell a different story. Most capital continues to flow into infrastructure, particularly AI, security, privacy, and blockchain infrastructure. This trend is especially pronounced within the Ethereum ecosystem. The misalignment stems partly from a lack of innovative narratives in consumer-facing applications.

4. Emerging Focus on Alternative Ecosystems

Beyond core Ethereum ecosystem discussions, three other types of blockchains have drawn significant attention:

1) Community-driven blockchains: Blockchains such as Ton focus on delivering excellent user experiences and consumer applications accessible to millions of non-crypto users.

2) Parallel EVM blockchains and modular solutions: Platforms like Monad and Avail build upon Ethereum’s existing resources while offering functional improvements.

3) BTC ecosystem: The Bitcoin ecosystem is also exploring user-facing applications.

5. Macroeconomic Outlook

With the launch of blockchain ETFs, the crypto market is becoming increasingly synchronized with traditional financial systems. The upcoming U.S. presidential election and anticipated Federal Reserve rate cuts will influence crypto regulations, economic direction, and liquidity in the U.S. dollar and related pegged currencies. Currently, as the probability of Trump winning the election rises, market sentiment toward the crypto outlook beyond late 2024 is turning optimistic.

HTX Ventures’ Participation

In addition to attending main events, HTX Ventures sponsored and spoke at multiple side events, including the LSDFI Summit and the VC<>Startup Connect session. Our researchers and managing partners shared insights on topics such as "Restaking Development" and "How to Successfully Launch a Web3 Ecosystem."

This year’s EthCC highlighted Ethereum’s unshakable position in the ecosystem and offered forward-looking technical discussions and application explorations. HTX Ventures remains committed to supporting the long-term development of the Ethereum ecosystem and continues to seek technologies and projects that enhance the crypto user experience.

-----------------------

About HTX Ventures

HTX Ventures is the global investment arm of HTX, integrating investment, incubation, and research to identify the world’s most outstanding and promising teams. As an industry pioneer with 11 years of history, HTX Ventures excels at identifying cutting-edge technologies and emerging business models. To promote the growth of the blockchain ecosystem, we provide comprehensive support to projects, including fundraising, resources, and strategic guidance.

HTX Ventures currently supports over 300 projects across multiple blockchain sectors, with several high-quality projects already listed on the HTX exchange. Additionally, as one of the most active fund-of-funds (FOF) investors, HTX Ventures collaborates with leading global blockchain funds such as Dragonfly, Bankless, Gitcoin, Figment, and Animoca to co-build the blockchain ecosystem.

For investment and partnership inquiries, please contact VC@htx-inc.com.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News