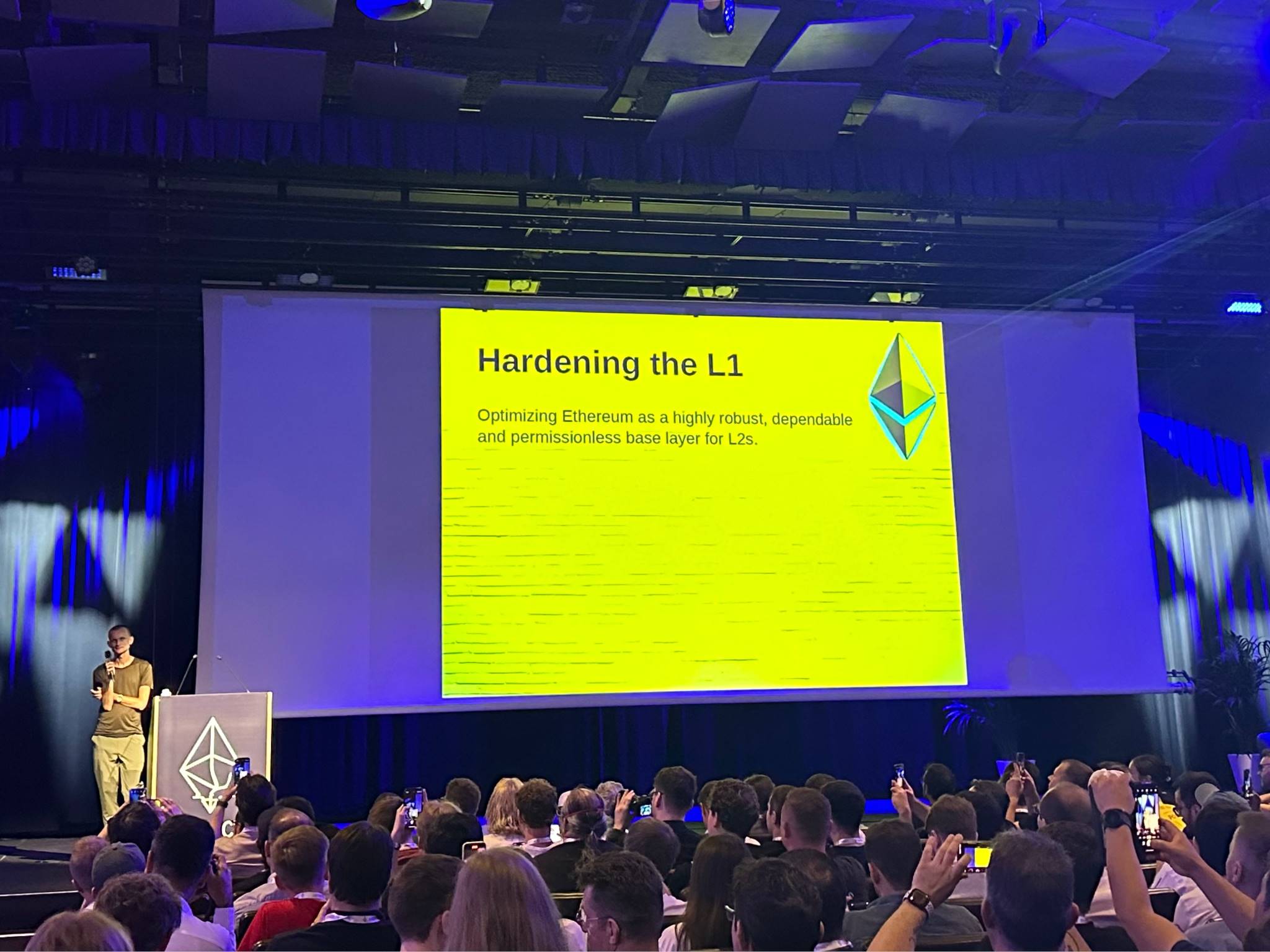

Bankless at EthCC 2023: Protocol Layer Costs Decline, Consumer Applications Set to Explode

TechFlow Selected TechFlow Selected

Bankless at EthCC 2023: Protocol Layer Costs Decline, Consumer Applications Set to Explode

As Ethereum enters the consumer era, cryptocurrencies are facing some of the biggest regulatory battles we've ever seen.

Author: David Hoffman

Translation: TechFlow

So... we’re halfway through 2023—where do we stand?

We’ve taken some time to reflect on the countless conversations held during EthCC 2023 and summarize some of the key thoughts and takeaways.

Protocols Are Becoming Commodities

With the upcoming Dencun upgrade, the Ethereum community is preparing for a hard fork that will eventually introduce massive scalability improvements via EIP-4844 (also known as Proto-Danksharding), providing rollups with a cheaper form of blockspace on L1 called "blobspace." This long-awaited upgrade finally enables these L2s to reach their most scalable versions yet.

This marks a pivotal moment in crypto’s evolution—we are approaching the theoretical minimum cost for cryptographic economic resources. It's not just Ethereum; many different protocols appear to be nearing their final forms, having minimized the cost of accessing their optimized resources.

“Data availability” is the primary category—the type of resource addressed by EIP-4844 and other data availability solutions. For the first time, Ethereum blockspace has become cheap! But Ethereum isn’t the only protocol optimizing data availability. Celestia, Avail, and EigenDA are all external data availability protocols pushing blockchain scalability far beyond what we imagined just a few years ago!

It doesn't stop at data availability. Espresso Systems received enthusiastic reception at the largest EthCC side event—the Modular Summit. Instead of waiting for individual L2s to build their own shared sequencing systems, Espresso, through its shared sequencing testnet and collaboration with Eigenlayer, focuses solely on one thing: optimizing shared sequencing.

In the zkRollup space, “provers” are the critical component enabling end users to verify the zk-proofs of scaled zk-rollups. zkSync released their “Boojum” upgrade, claiming their proofs can now run on mid-to-high-end gaming GPUs. The significance here is that provers can now operate on consumer-grade hardware rather than highly specialized enterprise machines, meaning zk-proofs can meaningfully decentralize these networks.

Protocol Convergence and Verticalization

Aave, originally a money market, now has its own decentralized stablecoin GHO. MakerDAO, originally a decentralized stablecoin platform, now has its own money market “Spark.” Frax has spent over a year developing its own vertically integrated ecosystem combining stablecoins, money markets, and LSDs. These three protocols are converging toward the same basin, now competing directly in the same domains: TVL, stablecoin supply, and most importantly, fees.

Take UniswapX, for example—an order execution protocol built on free-market competition, designed to enable optimal decentralized order execution while also serving as a cross-chain abstraction layer. This allows the free market to choose how best to execute cross-chain DEX swaps—i.e., I have Token A on Chain 1 and want Token B on Chain 2—who can offer me the fastest and best rate?

UniswapX complements Uniswap’s automated market maker (AMM).

Each version of Uniswap adds complexity; with Hooks introduced in v4, homogeneity among Uniswap AMM pools is no longer guaranteed. As the number of chains hosting potential Uniswap deployments grows, the problem of optimizing order routing becomes too complex for rigid on-chain smart contract systems to manage. UniswapX builds a new vertical by allowing order execution and fulfillment to occur off-chain, secured only by minimal viable proofs, thus handling any complexity introduced by Uniswap v1–v4.

Even after all this, the L2 ecosystem continues to thrive through rapid convergence on similar design patterns.

-

We have OP Stack from Optimism;

-

Orbit from Arbitrum;

-

zkSync launched ZK Stack;

-

And finally, with Polygon 2.0, we now have Supernets.

Like L2s themselves, they differ—each has its own strategy. But they all effectively pursue the same vision: the eventual number of chains stemming from Ethereum will rival the number of web pages generated from HTTPS.

Which standard will catalyze this Cambrian explosion of chains?

In this regard, Optimism leads clearly with three major chains and several smaller ones. Polygon has ImmutableX. Arbitrum has Nova (though internally developed). While ZK Stack is still seeking its first large-scale adopter, numerous startups have already reported choosing ZK Stack to build their custom ZK chains.

Add to this news the expected mainnet launch of Base in early August, and Ethereum is well-prepared for the L2 Summer we've been anticipating since 2021.

Consumer-Centric Development

If you’ve read this far, hopefully you realize how far our protocols and infrastructure have come. I declare: the protocol and infrastructure problems in crypto are solved. Of course, there’s still much work to do, but exploration and development in this domain have become a science. For the first time in crypto history, the frontier of protocol development has matured enough for us to see the end goal clearly.

So now that we’ve solved all these big challenges… won’t someone please build applications?

L2s now offer more blockspace than ever before! Data costs are near rock bottom! Latency and responsiveness are better than ever! It’s time to build apps again! Who will consume all this L2 blockspace? Now that we have abundant, cheap, and secure blockspace, let’s start using it. But we shouldn’t stop at blockchain apps! Let’s go further—let’s productize these systems! Has no one thought about the consumer?

Let’s build consumer-facing applications. Let’s hire brilliant UX/UI designers whose job is to serve people without private keys—those who only hold funds on Coinbase or Kraken. Let’s build apps for users who’ve never touched blockchain before.

Our protocols have become so cheap that their usage can be subsidized through user acquisition. As blockspace gets cheaper, new revenue models can begin subsidizing user transactions on our increasingly affordable L2s.

A small group already recognizes this meta-stage we’re in. I hope this article highlights it so others can see it too—our protocols are ready. Let’s start doing the hard work: user research, clever abstraction mechanisms, and consumer-facing applications.

Want an example? Look at Gnosis—they launched Gnosis Pay and Gnosis Card at EthCC.

Within the Gnosis ecosystem, we now have:

-

Gnosis Safe (your high-security crypto vault);

-

Gnosis Chain (a high-speed L2 zkEVM chain based on Polygon Supernet);

-

Gnosis Pay (a payment chain built on Gnosis Chain);

-

Gnosis Card (fintech payments built on top of Gnosis Pay).

With Gnosis, we now have a world where the front end is traditional payments and the back end is crypto protocols. This is literally something people have talked about since Bitcoin’s inception. Gnosis needs to turn this into something uniquely competitive against traditional payments—but notably, our infrastructure is now capable of bridging the Web3/TradFi divide.

As Ethereum enters the consumer era, crypto is simultaneously fighting some of the biggest regulatory battles in its history.

Once we get past all these regulatory trials… once we finally defeat Gary Gensler, reform the SEC, win the right to fairly launch tokens, and pass high-quality legislation through Congress, crypto will enter the most favorable regulatory environment it has ever seen. Right now, crypto is doing the hard work on regulation. We won’t be accepted by larger players until we’ve faced regulators and lawmakers head-on and earned recognition.

Modular Summit vs EthCC

Held on Friday and Saturday after EthCC, the Modular Summit was large and intellectually rich enough that calling it merely an “EthCC side event” feels inadequate.

EthCC has always been a welcoming home for the Cosmos ecosystem and its developers. That same energy has evolved into the modular side of crypto—a space where Ethereum is both part of and distinct from the broader crypto landscape.

I call this corner of the crypto ecosystem “barely aligned with Ethereum”—modular infrastructure that naturally finds utility within Ethereum’s environment, though many of these platforms (Celestia, Cosmos) would happily sit on the monetary throne if Ethereum hadn’t already claimed it.

It’s fascinating to see different prototypes finding homes and resonating more strongly within the modular community than with the 100% pure Ethereum crowd. It’s also interesting to watch these communities naturally converge, as their technical shapes align so well. Ultimately, Ethereum will absorb every useful module produced by the modular community—the nature of the system is to aggregate all valuable open-source code into a single overarching structure.

There’s no doubt the modular ecosystem is advancing faster into new technological frontiers than any other area of crypto. This makes sense—modularity means focusing resources on a single problem instead of spreading them thin across multiple domains. The intellectual rigor expressed in this segment of crypto attracts the brightest minds in the field. I believe you can expect great things from this corner of modularity.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News