A Deep Dive into the Stablecoin Sector: Models, Mechanisms, Trends, and Considerations for Hong Kong Stablecoins

TechFlow Selected TechFlow Selected

A Deep Dive into the Stablecoin Sector: Models, Mechanisms, Trends, and Considerations for Hong Kong Stablecoins

The biggest challenge is not in issuance, but in the design of application scenarios.

Authors: Sun Wei, Aiying Aiying

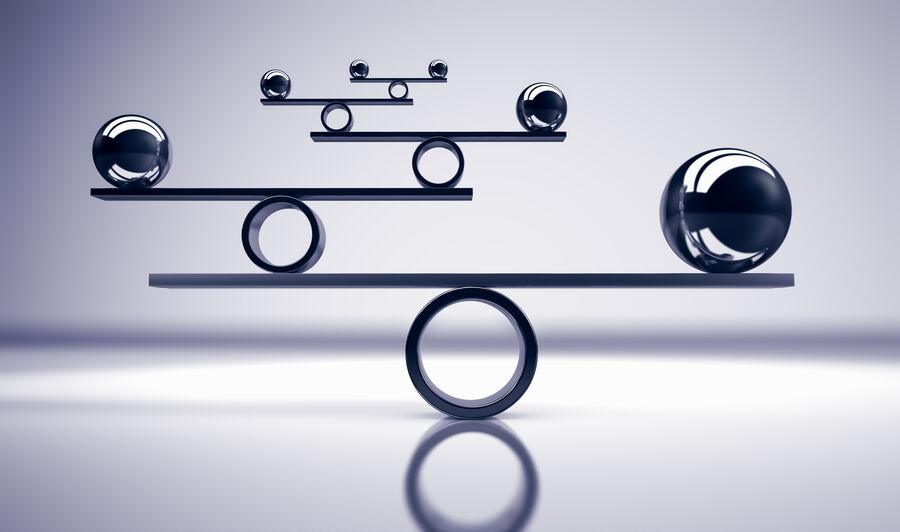

According to data from Token Terminal, monthly stablecoin transfer volumes have increased tenfold over the past four years, rising from $100 billion per month to $1 trillion. On June 20, 2024, the total trading volume across the entire cryptocurrency market reached $743.91 billion, with stablecoins accounting for 60.13%—approximately $447.1 billion. Among these, USDT (Tether) was the most widely used, with a market capitalization of $112.24 billion, representing 69.5% of all stablecoin value. On that day alone, USDT’s trading volume hit $348.4 billion, making up 46.85% of the day's total crypto trading volume.

Stablecoins are a crucial component in the cryptocurrency market, defined as cryptocurrencies pegged to fiat currencies or other assets to maintain price stability. The Bank for International Settlements (BIS) defines stablecoins as “cryptocurrencies whose value is linked to fiat currency or other assets.” This mechanism aims to keep stablecoins’ value stable relative to their reference asset or basket of assets, functioning as reliable stores of value and mediums of exchange. This system resembles the gold standard but benefits from blockchain-based features such as decentralization, peer-to-peer transactions, no central bank clearing, and immutability.

This report by Aiying Aiying will delve into the definition and main models of stablecoins, analyze the current market landscape and competitive dynamics, and focus on explaining the operational principles, advantages, disadvantages, performance, and future prospects of fiat-collateralized, crypto-collateralized, and algorithmic stablecoins.

I. Definition and Main Models of Stablecoins

1. Basic Definition: Pegged to Fiat, Value-Stable

Stablecoins, literally interpreted, are cryptocurrencies designed to maintain stable value. As defined by the Bank for International Settlements (BIS), they are “cryptocurrencies whose value is linked to fiat currency or other assets.” In essence, the primary purpose of stablecoins is to maintain stable value relative to a specific asset or basket of assets, serving as a stable store of value and medium of exchange—similar in principle to the gold standard. Being issued on blockchains, they also inherit characteristics of crypto assets such as decentralization, peer-to-peer transferability, independence from central bank clearance, and immutability.

The key difference between stablecoins' value stability and traditional central banks’ pursuit of fiat currency stability lies in their objectives: stablecoins aim for exchange rate parity against fiat currencies, while central banks focus on maintaining cross-period purchasing power. Put simply, stablecoins fundamentally seek to anchor themselves within the fiat monetary system to ensure token value stability.

2. Main Models: Collateral Type and Degree of Centralization as Key Differentiators

To ensure anchoring to the fiat system, stablecoins can be categorized based on whether they are backed by collateral and their degree of centralization. They fall into two broad categories: collateralized and non-collateralized, and further into centralized and decentralized issuance. For value stability, using real-world valuable assets as collateral to issue stablecoins pegged one-to-one to fiat is the simplest and relatively safer method. A high collateral ratio ensures sufficient solvency. Based on collateral type, this breaks down into fiat-collateralized, crypto-collateralized, and other asset-backed models.

The classification can be detailed as follows:

As shown in the table above, in terms of basic operation, stablecoins rely either on collateral assets or algorithmic mechanisms to maintain price stability within a controlled fiat conversion range. The critical factor isn't price fluctuation itself, but how effectively deviations are corrected to maintain stability.

II. Market Overview and Competitive Landscape of Stablecoins

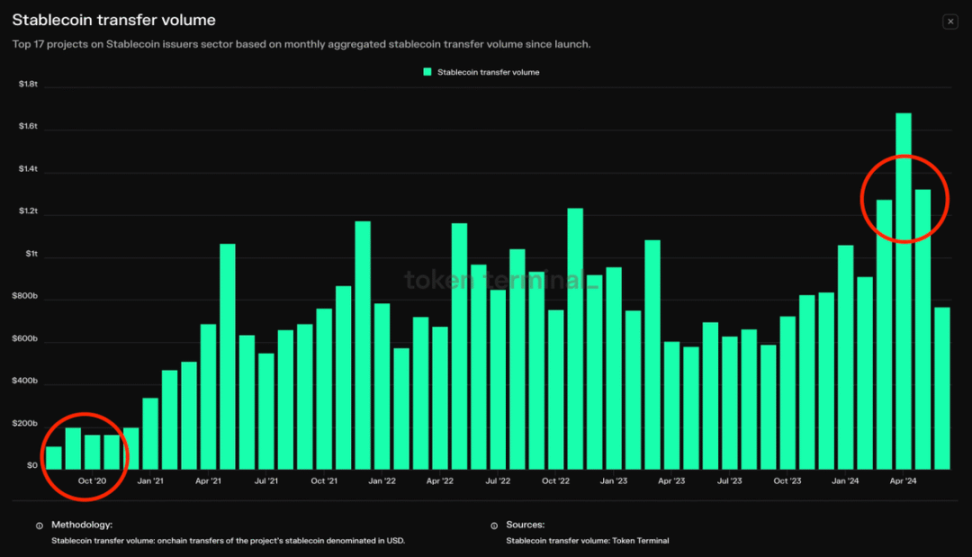

1. From Fiat Pegging Perspective: USD Dominates Nearly Entire Market

In terms of pegged values, aside from PAXG which tracks gold prices, 99% of stablecoins are pegged 1:1 to the US dollar. There are some pegged to other fiat currencies—for example, EURT pegged to the euro has a market cap of $38 million; GYEN pegged to the Japanese yen has a market cap of just $14 million; IDRT pegged to the Indonesian rupiah has a market cap of $11 million. Overall, these markets remain very small.

USD-pegged stablecoins currently account for about 99.3% of the market, with the remainder mainly consisting of euros, Australian dollars, British pounds, Canadian dollars, Hong Kong dollars, renminbi, etc.

Stablecoin Fiat Peg Market Share – Source: The Block

2. By Market Share and Market Cap: USDT Is Absolute Leader, USDC Closes Gap

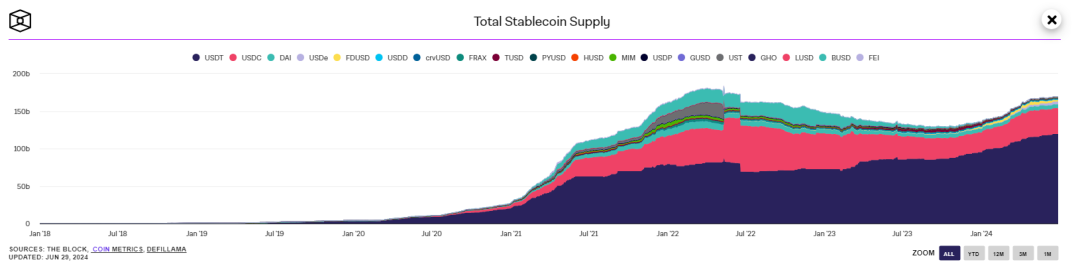

Stablecoin issuance volume closely correlates with market trends. Monitoring data shows overall continuous growth, though it declined during the previous bull-to-bear transition (March 2022). It is now entering a marginal upward phase, signaling the current bull market.

Figure 3: Historical Stablecoin Issuance Trends (Source: The Block)

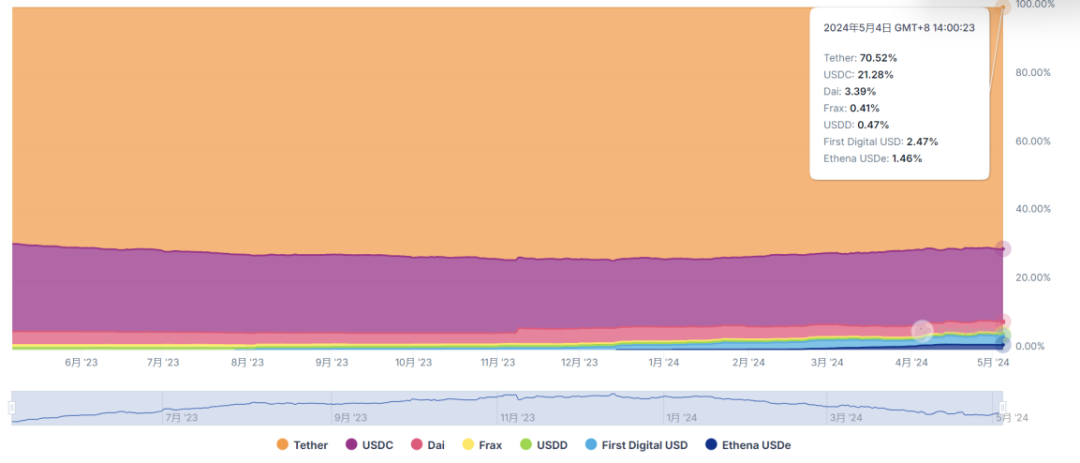

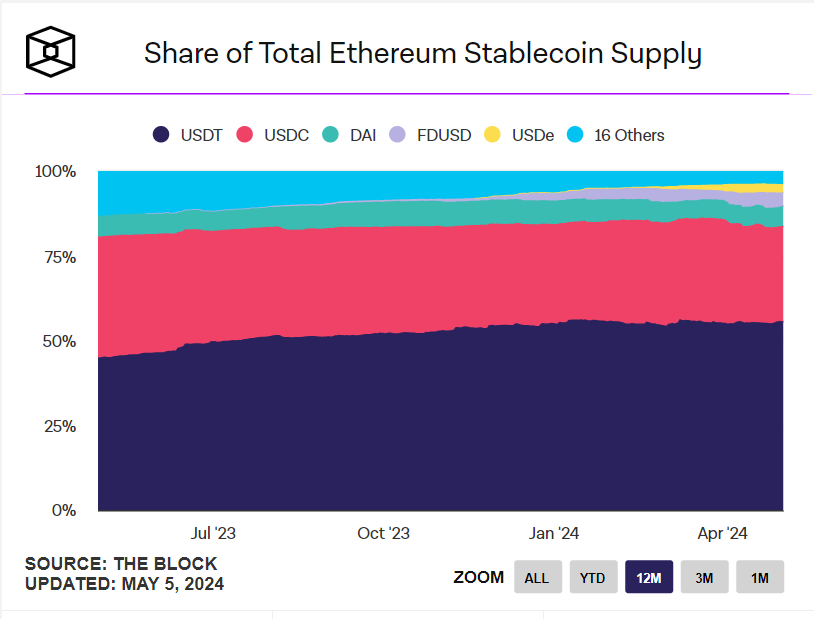

According to the latest data from CoinGecko, as of May 4, USDT holds a market share of 70.5%, followed by USDC at 21.3%, DAI at 3.39%, FDUSD at 2.5%, and FRAX at 0.41%.

Figure 4: Stablecoin Market Share – Source: CoinGecko

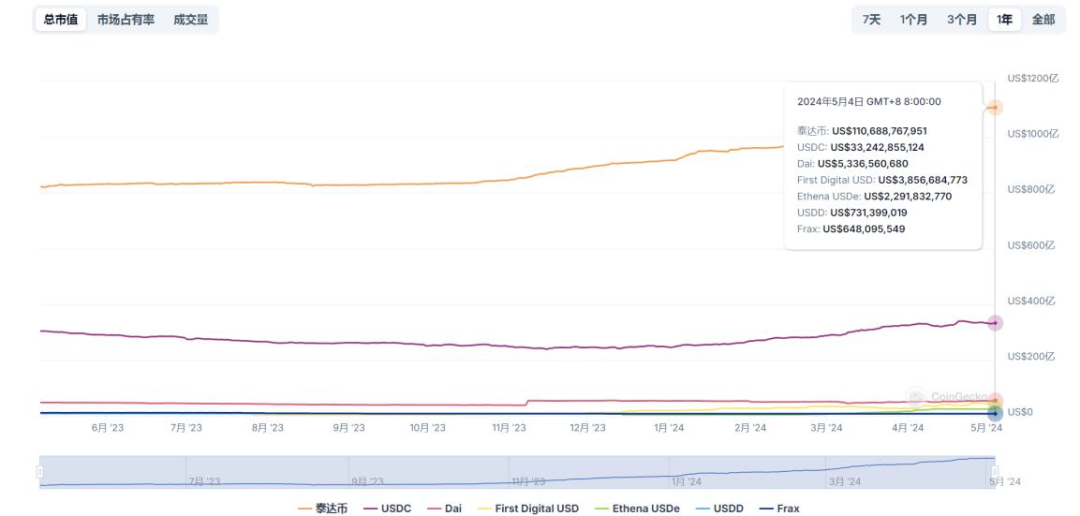

In terms of market capitalization, the total stablecoin market exceeds $160 billion. USDT leads significantly with a stable and growing market cap exceeding $110 billion. USDC’s market cap steadily rises to over $33 billion, still trailing behind USDT, while other stablecoins remain largely flat.

Figure 5: Market Caps of Major Stablecoins – Source: CoinGecko

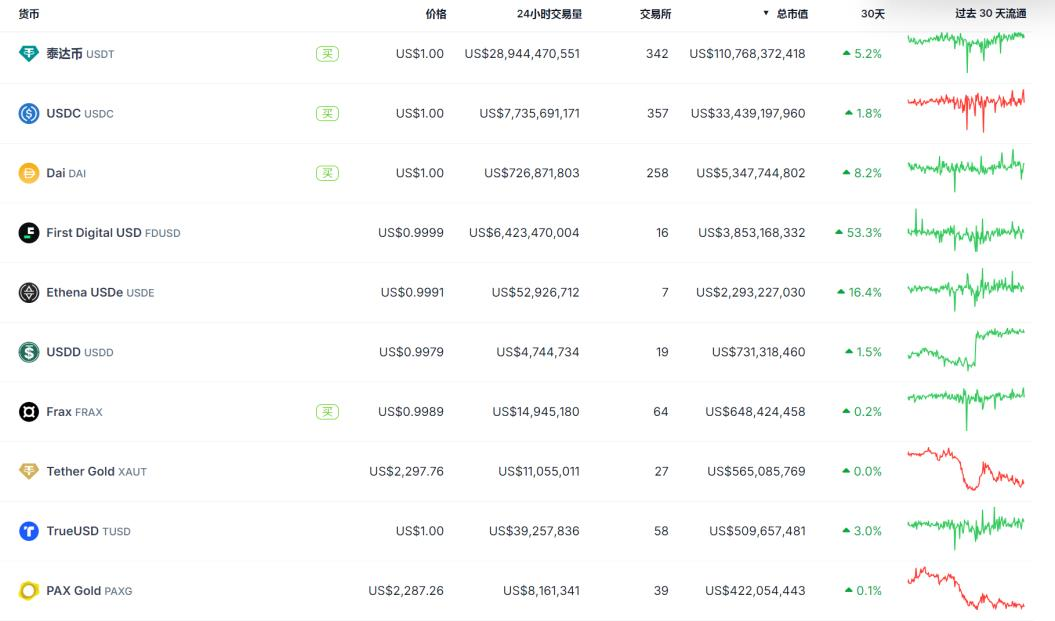

3. Top Ten by Market Cap: Fiat-Collateralized Stablecoins Dominate, Covering All Types

Among the top ten mainstream stablecoins, centralized USD-collateralized stablecoins like USDT, USDC, and FDUSD generally have gross collateral ratios exceeding 100%. DAI is a decentralized crypto-collateralized stablecoin. USDe is a synthetic dollar backed by crypto assets. FRAX is an algorithmic stablecoin, and PAXG is a gold-collateralized stablecoin.

Figure 6: Market Caps of Major Stablecoins – Source: CoinGecko

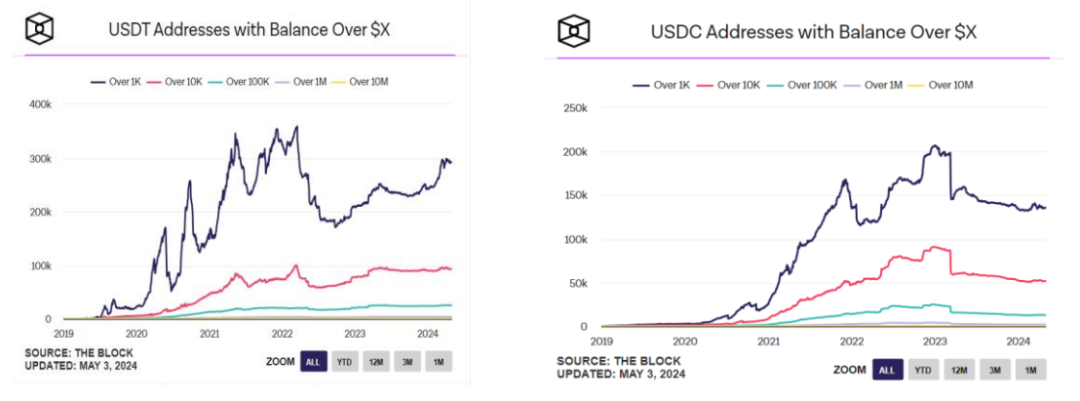

4. Holder Address Analysis: USDT Remains Steady, USDC Shows Recent Weakness

A clear divergence is visible in holder address trends: both experienced sharp drops when they de-pegged from the dollar. On March 11, 2023, USDC briefly lost its peg due to the SVB collapse, dropping to around $0.88, causing a rapid decline in holder addresses. Although it later recovered, USDT pulled ahead again in address count.

Figure 7: USDT vs USDC Holder Address Trends – Source: The Block

As seen in the chart, after the de-peg event, USDC saw reductions across all address tiers—from those holding over $1,000 to those with over $10 million—dropping about 30% from peak levels. In contrast, USDT continued to grow steadily.

III. How Do Leading Stablecoins Work? Their Advantages and Disadvantages

Building on the previous analysis, major stablecoins are typically classified by collateral type and degree of centralization. Generally, fiat-collateralized stablecoins are centrally issued and dominate the market, while crypto-collateralized and algorithmic stablecoins tend to be decentralized. Each category has its leader, and each design framework comes with distinct strengths and weaknesses.

1. Fiat-Collateralized Stablecoins (USDT\USDC)

1) USDT’s Operational Mechanism

-

Overview:

Tether, a company under iFinex, created the stablecoin USDT in 2014. The same group owns the cryptocurrency exchange Bitfinex. Both are registered in the British Virgin Islands, headquartered in Hong Kong, with Tether’s headquarters located in Singapore. The current CEO is Paolo Ardoino (formerly CTO), an Italian who initially developed trading systems for hedge funds. He joined Bitfinex as an executive in 2014 and moved to Tether in 2017, currently holding a 20% stake in Tether.

-

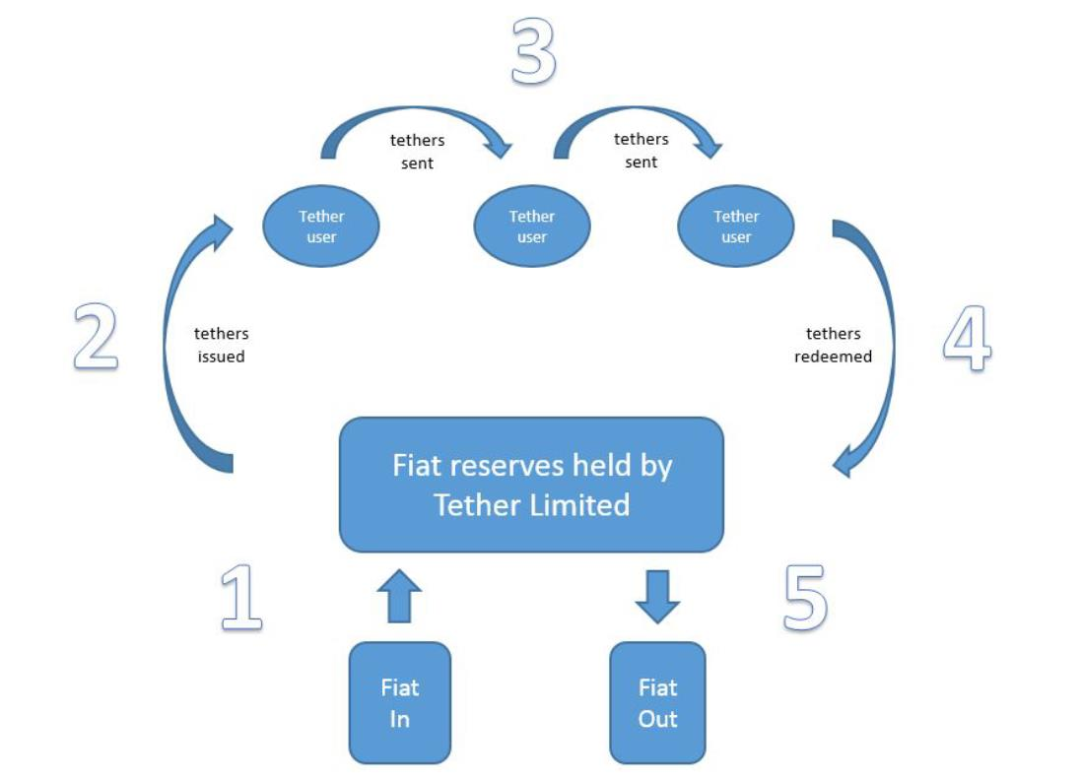

Issuance and Circulation:

The process involves five steps: First, users deposit USD into Tether’s bank account. Second, Tether creates a corresponding account and mints an equivalent amount of USDT. Third, users trade among themselves. Fourth, during redemption, users return USDT to Tether. Fifth, Tether burns the corresponding USDT and returns USD to the user’s bank account.

Figure 8: Full Lifecycle of USDT Issuance, Trading, Circulation, and Redemption – Source: Tether Whitepaper

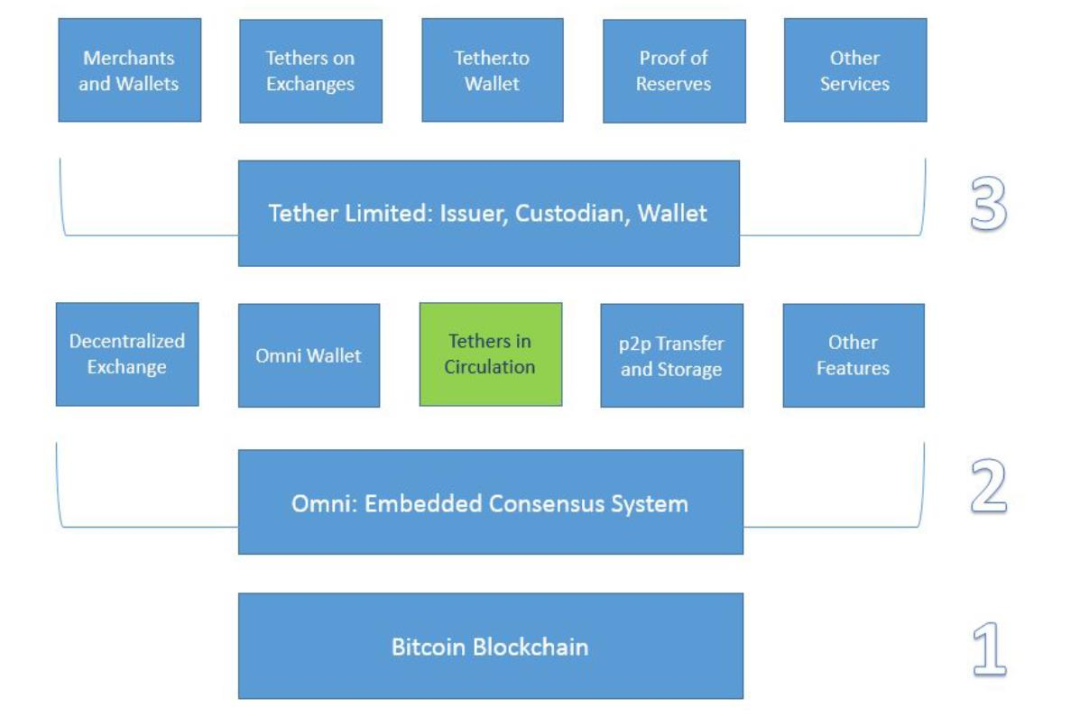

Technical Implementation:

For Tether to implement this process, blockchain technology is essential. The technical architecture is not overly complex and consists of three layers:

-

Layer One: Blockchain Mainnet – Initially built on Bitcoin blockchain, now expanded to over 200 public chains. USDT transaction records are embedded via the Omni Layer Protocol.

-

Layer Two: Omni Layer Protocol – Primarily serves the Bitcoin blockchain, enabling minting, trading, and storage of USDT. Since 2019, USDT issuance has shifted increasingly to Tron and Ethereum networks, utilizing TRC-20 and ERC-20 standards.

-

Layer Three: Tether Company – Responsible for issuing tokens, managing reserve assets, audits, etc.

Figure 9: USDT Technical Architecture (Using Bitcoin Network Example) – Source: Tether Whitepaper

At the core of this issuance and technical framework lies Tether’s Proof of Reserves mechanism. Specifically, every time a USDT is minted, Tether must hold an equivalent $1 in reserves. In other words, each newly issued USDT must be matched by $1 worth of collateral, ensuring full 100% backing.

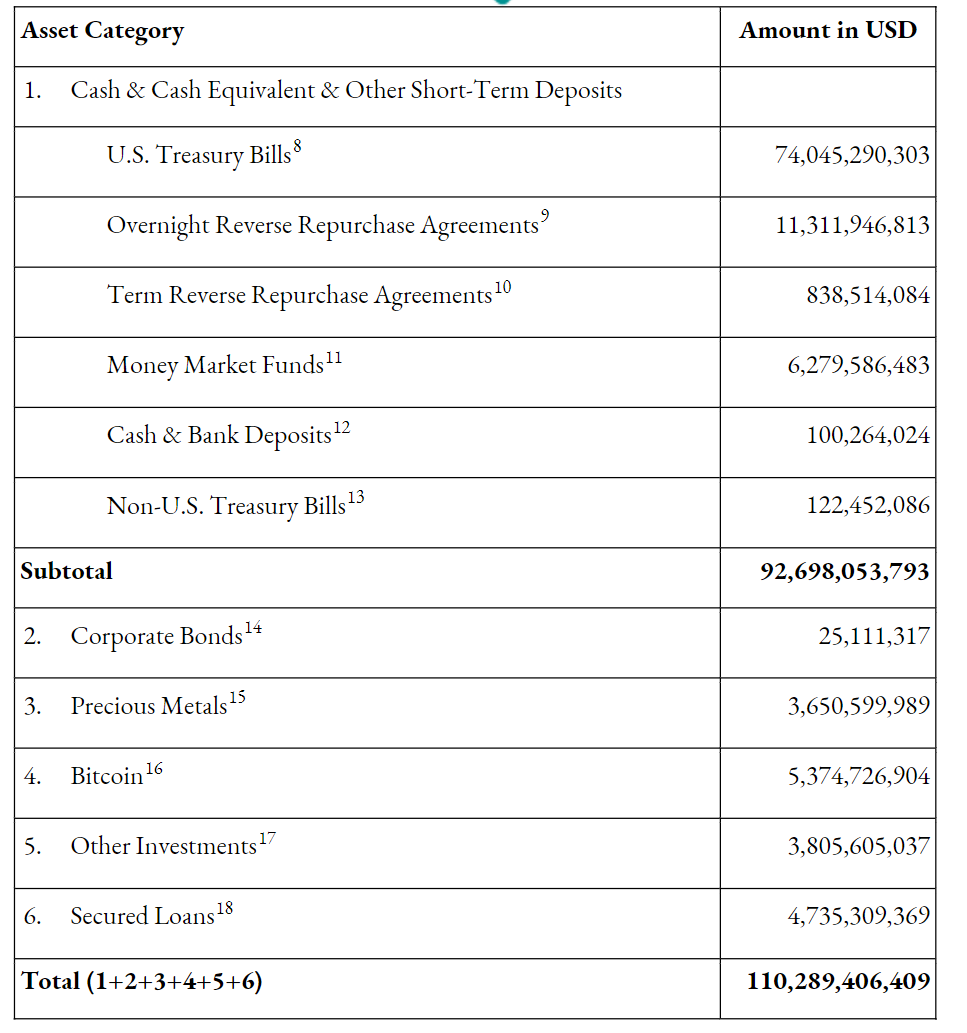

Reserve Asset Composition:

Total reserves exceed $110 billion, aligning with its current market cap. In terms of composition, cash and cash equivalents make up 83%, with other assets accounting for 17%.

Breaking it down further, short-term U.S. Treasuries represent about 80% of cash equivalents, overnight reverse repurchase agreements nearly 12%, and the rest includes money market funds, cash and bank deposits, term repos, and non-U.S. government bonds. Other asset classes include Bitcoin, high-grade corporate bonds, precious metals, and mortgage loans, with Bitcoin and mortgages being significant portions.

Figure 10: Tether Reserve Composition (Data as of Q1 2024) – Source: Tether Official Website

Additionally, audit reports over the past three years show that Tether adjusts its reserves according to macroeconomic conditions—increasing allocations to short-term U.S. Treasuries and money market funds while reducing corporate bonds, cash, and bank deposits. Due to varying maturities of its holdings, there is potential vulnerability to shorting attacks. However, audit disclosures indicate that most held Treasuries and term repos are ultra-short-term (under 90 days), with only corporate bonds and non-U.S. Treasuries having longer durations (within 150–250 days).

This strategic allocation indirectly enhances asset yield while lowering risk exposure, improving overall asset safety. Shorter durations help prevent liquidity mismatches that could trigger shorting attempts.

Revenue Model:

-

Cost Side: Minimal technical and operational staff, extremely low marginal costs

-

Revenue Streams: Service fees after KYC registration ($150/person), deposit/withdrawal fees (~0.1%), interest income (e.g., 4–5% yield from short-term Treasuries at zero cost), loan interest, and custody fees (charged to institutions storing funds with Tether). In Q1 2024, Tether reported a record net profit of $4.5 billion with only around 100 employees—unparalleled efficiency compared to firms like Goldman Sachs or Morgan Stanley, which require over 50,000 employees for similar profits.

2) USDC’s Operational Mechanism

Similar to USDT, USDC operates on a 1:1 USD peg and shares similar issuance and circulation mechanics. Created in 2018 by Coinbase and Circle, USDC came after USDT but differs in several key operational aspects:

-

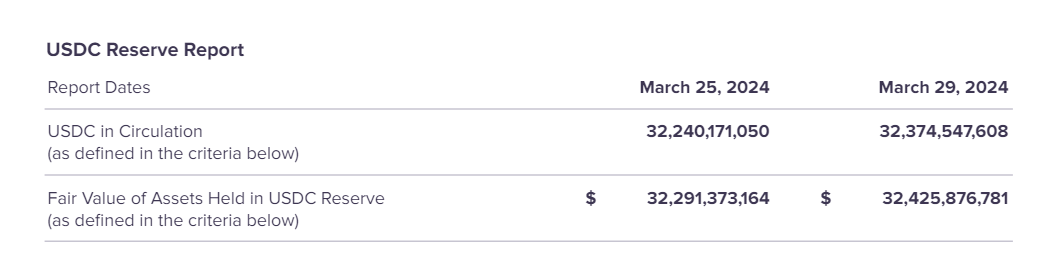

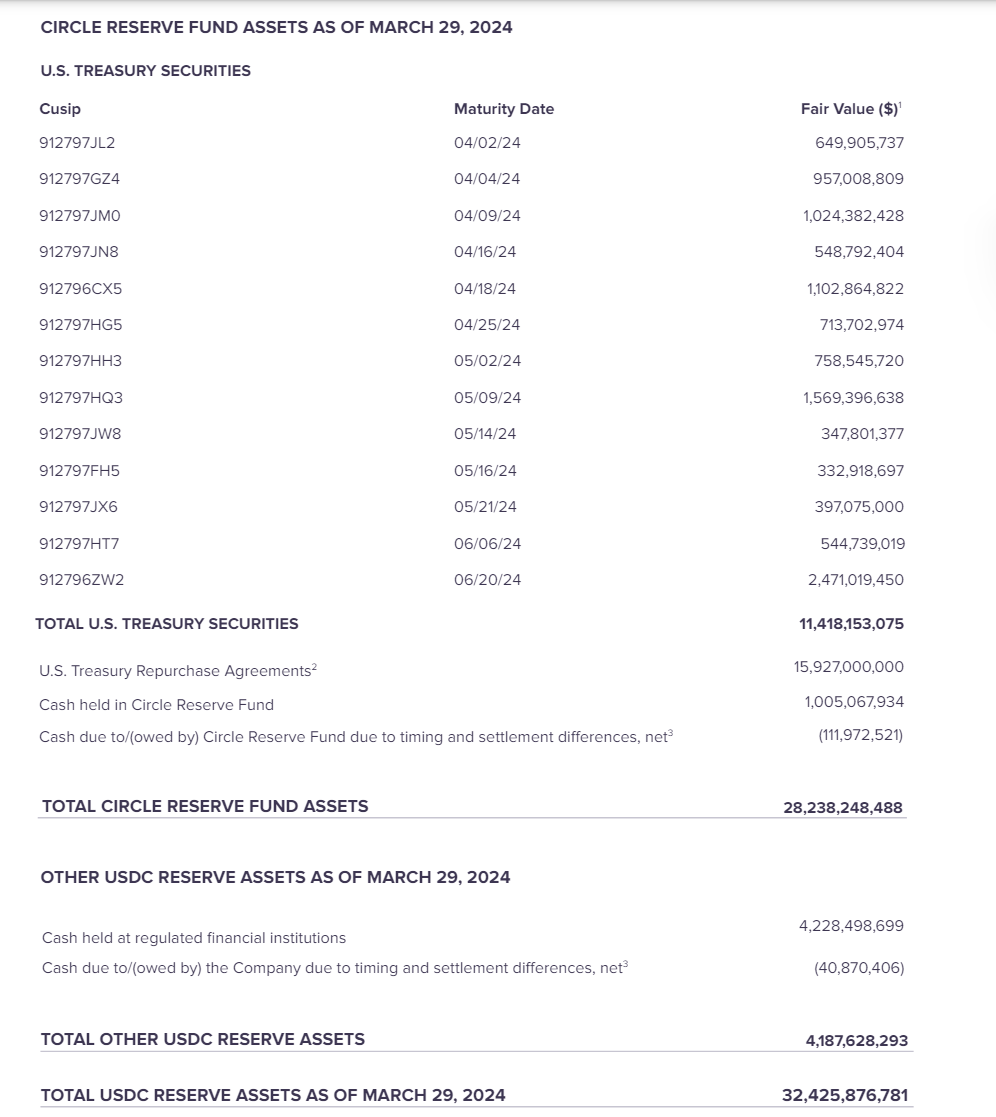

Higher Reserve Transparency: While USDT discloses reserves quarterly, USDC publishes monthly updates. Annual third-party audits were initially conducted by Grant Thornton but switched to Deloitte in 2023. As of March 2024, circulating USDC stood at $32.2 billion, with Circle holding approximately $32.2 billion in equivalent reserves—essentially balanced.

Figure 11: USDC Issuance, Trading, Circulation, and Redemption Process

Shorter-Duration Reserves with Higher Liquidity: Compared to USDT, which only discloses average Treasury maturity, USDC provides exact maturity dates. Data from March 2024 showed all Treasuries maturing within three months, the latest being June-dated short-term debt totaling $11.4 billion. Additional holdings include repo agreements and cash reserves totaling $28.2 billion, plus $4.2 billion in cash—all managed through BlackRock’s SEC-registered CRF (Circle Reserve Fund). Approximately 95% of assets fall under SEC oversight. With higher cash proportions, USDC offers superior liquidity during redemptions compared to USDT.

Figure 12: USDC Reserve Assets (As of March 2024) – Source: Circle Official Website

-

Established Under U.S. Regulatory Framework, Stronger Legal Standing: Circle is registered with FinCEN (Financial Crimes Enforcement Network) under the U.S. Department of Treasury and complies with state-level money transmission laws, treated legally as a prepaid payment instrument. Unlike USDT, USDC’s reserve assets are segregated. If Circle goes bankrupt, these reserves are protected under New York banking law and federal bankruptcy statutes.

-

USDC Does Not Directly Exchange With Individuals: USDT allows direct exchange for amounts over $100,000 upon payment of a registration fee. Circle, however, operates tiered access—only partners or Class A users (exchanges, financial institutions) can directly transact with Circle. Regular individual users (Class B) must go through third parties like Coinbase. Revenue sources mirror USDT, but because USDC holds mostly short-term Treasuries and cash—lower-risk assets—its yields are relatively lower.

3) FDUSD’s Operational Mechanism

After the New York State Department of Financial Services ordered Paxos to stop issuing new BUSD, Binance—the world’s largest crypto exchange—announced on December 15, 2023, that it would cease supporting BUSD products and automatically convert existing BUSD balances into FDUSD. Following this, FDUSD’s market cap surged rapidly, securing third place among fiat-collateralized stablecoins.

-

Overview:

FDUSD is a USD-pegged stablecoin launched in June 2023 by FD121 (First Digital Labs). Its parent company, First Digital Trust, is a qualified custodian and trust firm based in Hong Kong focused on digital asset services. Established in 2017 as part of Legacy Trust—a public trust founded in 1992—it became fully independent in 2019.

-

Operating Model:

FDUSD functions similarly to USDT and USDC: users deposit USD, and the issuer mints an equivalent amount of FDUSD. When withdrawing USD, an equal amount of FDUSD is burned. Audits are performed by Prescient Assurance (a New York-based accounting firm ranked among the top 20 global security testing and audit organizations certified by CREST), with smart contract audits conducted by PeckShield.

-

Asset Disclosure and Reserves:

Like USDC, FDUSD discloses reserves monthly. Its reserve assets are managed by a public trust company in Hong Kong. While the specific financial institutions housing the reserves are not named, they are confirmed to have S&P ratings of A-2 or higher. As of March 2024, FDUSD in circulation totaled $2.5 billion, fully backed by $2.5 billion in reserves. Breakdown: $1.86 billion in short-term Treasuries (latest maturity May 21), $265 million in fixed deposits (max 1-month term), and $170 million in other cash assets—all ultra-short-term holdings, ensuring high liquidity and immediate settlement capacity.

4) Summary of Fiat-Collateralized Stablecoin Category

Reviewing the three leading fiat-collateralized stablecoins—USDT, USDC, and FDUSD—reveals three distinct paths to success:

-

USDT: 1) First-mover advantage, amplified by exchange support and bull markets. During the early days of crypto, USDT pioneered adoption across ecosystems—from Bitcoin to Ethereum. Though founded in 2014, its real rise began in 2017 amid a bull run, marked by massive issuance that critics accused of manipulating Bitcoin prices. However, causality may be reversed: overlooked factors include China banning crypto that year and, more importantly, USDT listing simultaneously on the top three exchanges. 2) Survived multiple crises through timely responses, quickly restoring market confidence. Tether’s affiliate Bitfinex was once perceived as a single entity with Tether. Between 2014–2016, it suffered hacks, U.S. fines, and banking cutoffs (e.g., Wells Fargo, Taiwan Bank), even briefly de-pegging from the dollar. Tether responded swiftly by disclosing reserve details—including excess reserves and retained earnings—to demonstrate financial health, effectively calming concerns regardless of data authenticity. Through first-mover status and effective crisis management, USDT established strong user habits and remains the preferred choice for deposits/withdrawals, supported across the widest range of trading pairs.

-

USDC: 1) Rose during USDT crises, gaining favor due to transparency, regulation, and higher liquidity. Reviewing USDC’s growth, spikes in holder addresses often coincide with declines in USDT—typically following USDT-related incidents. Early on, being the sole stablecoin on regulated exchange Coinbase gave USDC a major regulatory edge, fueling its challenge to USDT’s dominance. 2) Preferred by DeFi protocols due to compliance, liquidity mining accelerated adoption, giving it chain superiority. After Maker introduced regulated USDC in 2020, it became the top choice among DeFi platforms. Today, MakerDAO, Compound, and Aave are major supporters—not only due to regulatory alignment but also because USDC offers lower volatility than USDT as collateral. USDC’s rise marks a victory for compliance. However, note that in August 2023, Circle froze USDC linked to Tornado Cash per U.S. Treasury directives, raising questions about reliance on centralized stablecoins in decentralized DeFi ecosystems.

-

FDUSD: 1) Backed by a top-tier exchange and implicit regulatory compliance fueled its rise. Binance, the #1 crypto exchange, decided in 2023 to abandon BUSD and instead promote FDUSD as the exclusive stablecoin for Launchpad and Launchpool liquidity mining. Thanks to Binance’s lucrative mining and launch incentives, FDUSD’s market cap grew rapidly, becoming the third-largest fiat-collateralized stablecoin. Binance’s endorsement was the most direct driver. More crucially, despite the availability of compliant alternatives like USDC, Binance likely considered Hong Kong’s regulatory environment and U.S. scrutiny toward Binance, making Hong Kong-based FDUSD the optimal choice. 2) Use-case integration and wealth effects determined its growth speed and ceiling. Even with exchange backing, FDUSD might not have succeeded without compelling use cases. After listing on Binance, FDUSD became one of only two eligible mining assets (alongside BNB) for Launchpool and Launchpad. Average annualized mining returns approached 70%, offering attractive short-term gains that boosted FDUSD adoption almost immediately.

In summary, success in the fiat-collateralized stablecoin space hinges on several key factors:

-

Operating within a regulatory framework builds early user trust. Examples include USDC and FDUSD.

-

Audit credibility, security, and transparency provide competitive advantages. For instance, TUSD regained relevance in 2023 by introducing real-time audits and using Chainlink to secure minting processes. Similarly, USDC’s rise benefited greatly from transparent reporting.

-

Exchange support and broad partnerships set the baseline for development. The rise of USDT, USDC, and FDUSD all relied heavily on exchange backing. Only with substantial liquidity from major exchanges can stablecoins achieve stable launches.

-

Use cases and wealth effects determine growth velocity and ceiling. FDUSD exemplifies this—as do USDC and PayPal’s PYUSD (integrated into PayPal wallets). Rapid growth stems from generating strong wealth effects or convenient services within niche applications, increasing user adoption.

2. Crypto-Collateralized Stablecoins (DAI/USDe)

Due to extreme volatility of crypto assets, their credit foundation is weaker than that of risk-free USD assets (like Treasuries or deposits), hence requiring over-collateralization. Synthetic dollar models using derivatives hedging can approach 100% collateralization. Despite this, they retain decentralization traits due to underlying crypto assets.

1) DAI’s Operational Mechanism

-

Overview:

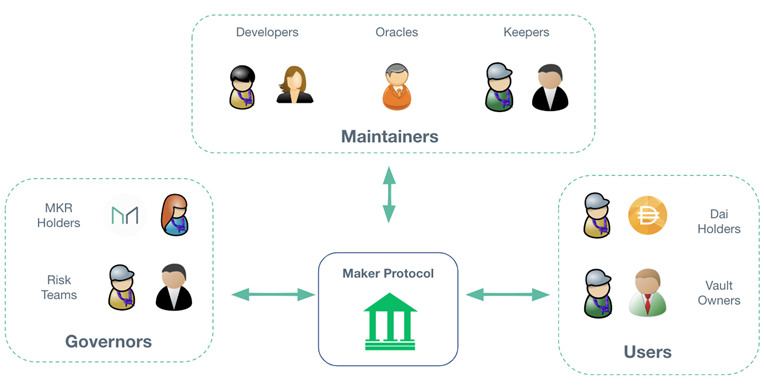

DAI, launched and managed by MakerDAO in 2017, is the leading decentralized stablecoin. MakerDAO is a decentralized finance (DeFi) project headquartered in San Francisco, USA, founded by Rune Christensen. Investors include prominent crypto VCs such as a16z, Paradigm, and Polychain Capital. Originally operated by the Maker Foundation, it is now governed by the community via a decentralized autonomous organization (DAO) where MKR token holders vote on decisions.

-

Core Mechanism:

DAI maintains a 1:1 peg to the USD. The Maker Protocol launched single-collateral DAI in 2017, allowing users to mint DAI by locking ETH. In 2019, multi-collateral DAI was introduced, accepting additional collateral types beyond ETH. Alongside this change came the introduction of DAI Savings Rate (DSR), enabling interest-bearing DAI, and renaming the collateral vaults to "Vaults," with legacy single-collateral DAI renamed SAI.

The creation process works as follows:

-

Step One: Users create a Vault via interfaces like Oasis Borrow, Instadapp, Zerion, or MyEtherWallet (community-built tools), lock in specified types and amounts of collateral to generate DAI (Maker Protocol now supports RWA assets like real estate mortgages and receivables as collateral).

-

Step Two: Initiate and confirm the transaction via a crypto wallet to mint DAI (akin to taking out a loan against collateral).

-

Step Three: To reclaim collateral, users must repay the corresponding amount of DAI (repaying debt) and pay a stability fee (functioning as risk compensation or parameter adjustment to balance supply/demand and maintain the 1:1 USD peg—in bull markets, this fee can exceed 15%). Step Four: The Maker Protocol automatically burns the repaid DAI and returns the collateral.

Figure 13: Participants in the Maker Protocol – Source: Maker Official Website

DAI Price Stability Mechanism: Unlike fiat-collateralized stablecoins, which benefit from low-risk, highly liquid assets and hard pegs that allow quick price stabilization via reserves, crypto-collateralized decentralized stablecoins face price deviations due to market volatility. Therefore, a dedicated stabilization mechanism is required, primarily involving interest rate adjustments and liquidations. Key rates include the Stability Fee (analogous to loan interest) and the DAI Savings Rate (DSR)—equivalent to a base yield or deposit rate. This mirrors traditional banking: if stability fee revenue falls below DSR payouts, the protocol incurs losses, which are covered by minting new MKR tokens, transferring the burden to MKR holders. This mechanism incentivizes fair voting on stability fees.

DAI Liquidation Mechanism: Similar to traditional lending, if collateral value drops sharply, leading to insolvency, forced liquidation occurs. DAI employs Dutch auctions (gradually decreasing price, first bid wins), triggered when the collateral-to-debt ratio falls below a threshold (the liquidation ratio), which varies by Vault. For example, an ETH-backed Vault with 75% LTV and ETH priced at $3,000 allows borrowing up to $2,250 DAI. If the user borrows only $2,000, the collateral coverage is 1.5x, utilization is 66.7%. Liquidation risk arises when utilization exceeds LTV—i.e., if ETH drops to $2,666.

DAI Peg Stabilization Module: In simple terms, this is a currency swap agreement—users deposit 1 USDC and receive 1 DAI at par. Additionally, by swapping stablecoins, the protocol converts USDC in its reserve pool into USD to invest in short-term U.S. Treasuries, boosting returns to enhance DSR yields and attract more users.

DAI Revenue Analysis: Income comes from stability fees (loan interest), liquidation penalties, transaction fees from the peg module swaps, and investment returns from RWA collateral. Protocol revenue reached $96 million in 2023.

2) USDe’s Operational Mechanism

Overview:

USDe is a decentralized on-chain stablecoin created by Ethena Labs. The concept originated from well-known crypto influencer Arthur Hayes, with funding from BitMEX co-founder Arthur Hayes and his family fund, along with major players like Deribit, Bybit, OKX, and Gemini. Launched on February 19, 2024, its supply skyrocketed, entering the top five stablecoins by issuance, just behind FDUSD.

Figure 14: Top Five Stablecoins by Supply Volume (As of May 2024) – Source: The Block

USDe’s Mechanism: Application of Delta-Neutral Hedging Strategy in Crypto

Ethena Labs’ USDe is a synthetic dollar protocol. In crypto, a synthetic dollar protocol uses a combination of derivatives to maintain a stable peg between the issued stablecoin and the U.S. dollar.

Operationally, USDe employs a delta-neutral strategy. Delta refers to the ratio of option price change to underlying asset price change. Delta-neutrality means the portfolio value remains unaffected by small price movements in the underlying asset (delta ≈ 0).

Ethena’s delta-neutral strategy works as follows: When a user mints 1 USDe, Ethena deposits $1 worth of ETH on a derivatives exchange and opens a short position on a 1 ETHUSD perpetual contract. If ETH drops tenfold, the short position gains 9 ETH in profit, resulting in a total position of 10 ETH. Given the tenfold price drop, the total value remains unchanged. The same applies to price increases—ensuring the stablecoin’s value remains stable. When a user redeems USDe, Ethena quickly closes the short position. Thus, USDe’s collateral consists of spot ETH and corresponding shorts. Under bull market conditions, it is nearly 100% fully collateralized, and including ENA tokens, the extended collateral ratio exceeds 120%.

The Secret Behind USDe’s Rapid Growth: Ponzi-Like Dynamics, But More Than That—Ultimately a Carry Trade Product.

First, users who mint USDe can immediately stake it within Ethena to earn staking rewards. Unlike USDT or other stablecoins that offer no yield, this is akin to returning seigniorage—theoretically, any currency issuance collects seigniorage, but USDT keeps it entirely. USDe distributes it upfront. This alone attracts institutional participation. When MakerDAO achieved an 8% yield, the market reacted strongly—imagine sUSDe (staked USDe receipt) offering over 30% APY.

Second, $ENA is the platform’s governance token. While earning base yield from staking USDe, users also receive ENA token incentives. Conversely, holding ENA boosts your staking rewards on USDe.

Fundamentally, USDe constructs a stablecoin architecture fully based on ETH as the underlying asset. Its core anchor is maintaining collateral value stability through derivative futures contracts. To attract users, it redistributes portfolio earnings back to stablecoin minters, allowing them not only stable value but also seigniorage dividends. Simultaneously, issuing a platform token ENA enables dual incentives: staking USDe earns ENA, and holding ENA increases USDe staking yields. It exhibits Ponzi-like traits but transcends

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News