A Casual Talk on Chain Abstraction: Truly More User-Friendly, or Just Another New Buzzword

TechFlow Selected TechFlow Selected

A Casual Talk on Chain Abstraction: Truly More User-Friendly, or Just Another New Buzzword

The ultimate goal of chain abstraction is simple: developers can deploy anywhere.

Author: BRIDGET HARRIS

Translation: TechFlow

Chain abstraction has become a hot topic—and for good reason. Everyone in crypto should be excited about tools that make it easier for consumers to participate on-chain.

But much of the discussion overlooks how we got here, and I believe it starts with one fact: developers are also consumers. Right now, they’re forced to choose between different ecosystems, tech stacks, and communities. This creates lock-in mechanisms that sometimes misalign incentives, pushing developers away from focusing on the right problems. Developers are users too, and they shouldn’t be forced to pick where to build.

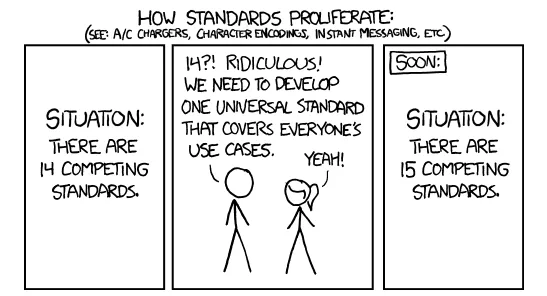

A core challenge for developers is integrating their applications with a variety of different tech stacks and underlying infrastructures—or building infrastructure that works across various apps—while also navigating fragmented community loyalties across ecosystems. On top of that, crypto feels like it has countless competing standards, which doesn’t help developers either.

(Image credit: xkcd: Standards)

Historically, this often forced developers to pick just one ecosystem to build on. Ecosystem creators knew this and actively competed for developer attention, leading to further lock-in and unsustainability. The result? Projects either half-heartedly go multi-chain or dive deep into a single siloed ecosystem. Both approaches have issues—and chain abstraction aims to solve them.

The end goal of chain abstraction is simple: developers can deploy anywhere because reaching users is no longer tied to a specific chain, and users can seamlessly interact across ecosystems using any liquidity and any chain. Convenience is key, and the biggest beneficiaries might be the (increasingly centralized) interfaces through which users submit order flow.

Chain abstraction as a concept is broad and loosely defined—some even argue it’s entirely fictitious. In reality, it’s just a collection of primitives, infrastructure, and tools that make operations easier for both users and developers—many things fall under the “chain abstraction” umbrella. I lean toward the latter view and believe these advancements are overall positive and necessary steps forward.

Below, I’ll provide a non-exhaustive overview of some companies building chain abstraction solutions, along with my outlook for the future.

CEXs as Part of Chain Abstraction

One of the most widely used chain abstraction platforms may actually be Coinbase itself—even though it’s limited in asset coverage and is centralized. Through a single interface, users can buy and sell tokens across different chains, albeit in a custodial manner. This is a major reason behind Coinbase’s strong adoption and revenue—good news for the broader chain abstraction space. It proves convenience has a market: users value—and are willing to pay for—functionality and simplicity within a single interface.

Core Layer Infrastructure

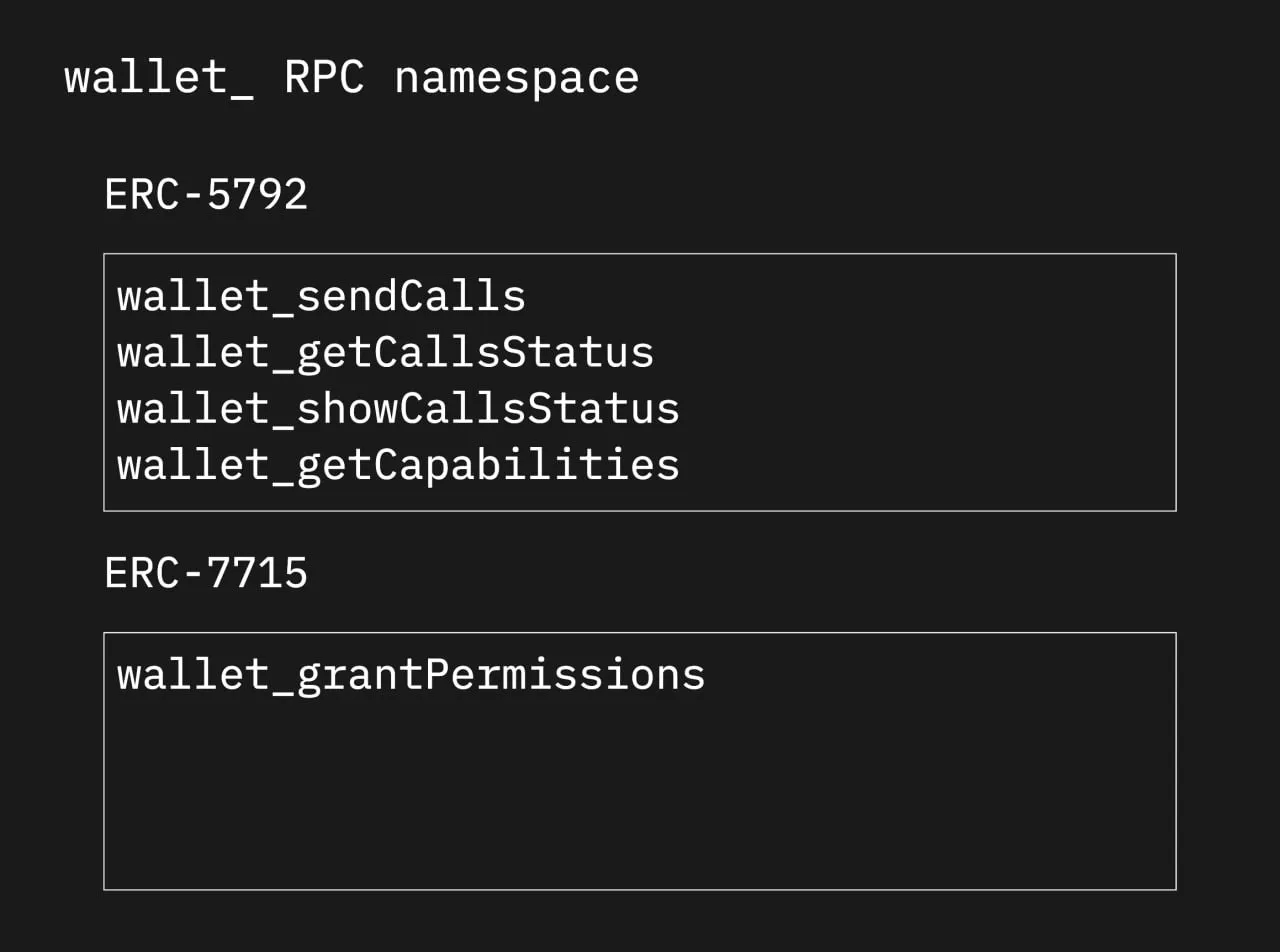

For chain abstraction to truly take off, some argue we need fundamental changes to established standards in crypto. One example is OneBalance, which is enhancing the existing JSON RPC standard natively so new standards allow apps to communicate directly with wallets. Their new API is backward compatible with Ethereum, Bitcoin, Solana, and any assets and smart contracts on those chains. Beyond enabling transactions across three major chains, this architecture—called the CAKE framework—also includes gas abstraction, social recovery, and authentication. Users benefit from faster state transitions, as solvers can request state updates on target chains without waiting for finality on the source chain. The ultimate goal is for wallets—especially Metamask—to integrate their account model, allowing users to directly benefit from this new architecture. Specifically, this means users could theoretically use ETH to buy WIF at Solana speeds instead of Ethereum speeds.

OneBalance's RPC method extension

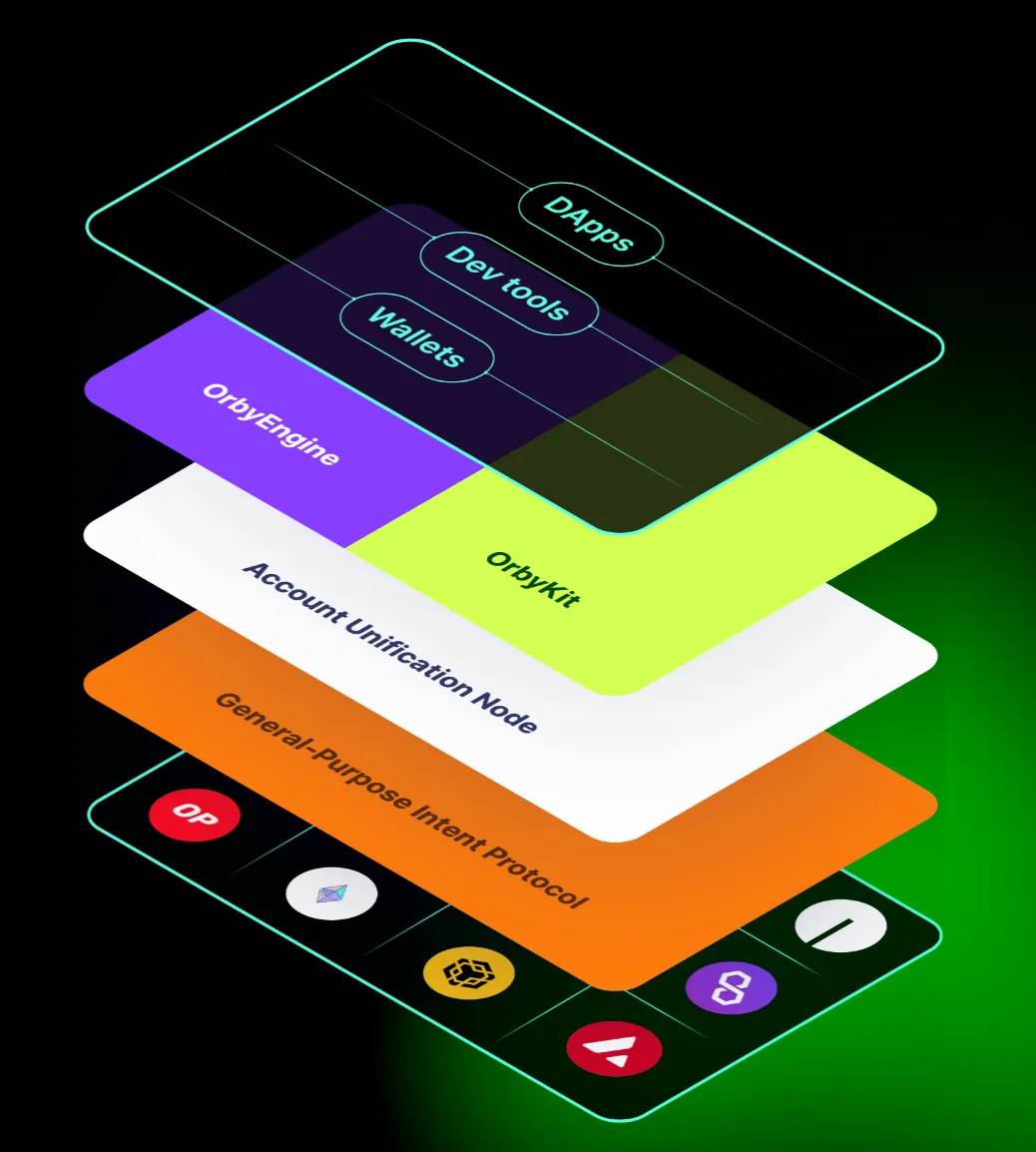

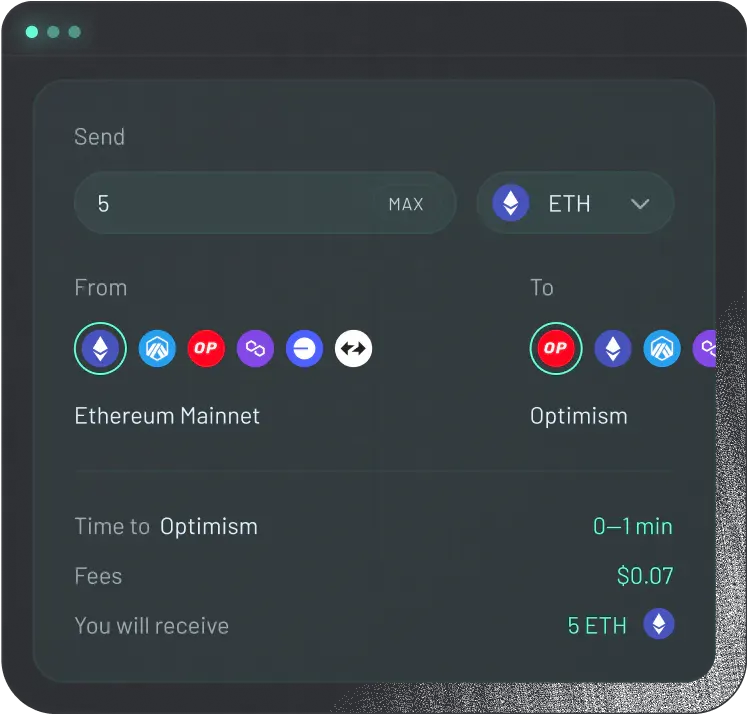

Another company, Orb Labs, aims to solve chain abstraction at the node level rather than the account level. Their system consists of OrbyEngine—a smart RPC endpoint that wallets can use to aggregate and orchestrate account states across all chains—and OrbyKit, a dapp SDK that provides the same functionality for application frontends. OrbyEngine uses a combination of a universal intent protocol and a special node called an Account Unification Node to aggregate and manage account states.

In short, they enable any wallet or dapp to achieve chain abstraction, gas abstraction, and more with just five lines of code. This dynamic fundamentally changes how users interact with wallets, apps, and chains—no longer needing to worry about bridging across ecosystems or manually moving assets. Chains effectively disappear, as users can transact using accounts and assets from other chains regardless of where they are. This transforms the idea of wallets from chain-specific gateways into chain-agnostic connection mechanisms focused entirely on managing relationships between users, assets, and dapps.

NEAR also sits on the core infrastructure side, having natively integrated chain abstraction into their L1. With their chain abstraction stack, developers can:

-

Instantly subsidize gas fees for users, including cross-chain transactions via NEAR’s multi-chain gas relayer.

-

Leverage NEAR’s multi-chain signing service to let users transact on other chains using their NEAR account.

-

Use FastAuth to let users sign up (or recover) NEAR accounts via email, delivering a familiar Web2 experience.

These primitives are crucial for providing developers a smoother experience—one that positively scales to users through such stack designs.

Unification Through Bridges

At a higher layer, many bridge providers are exploring chain abstraction, with Across being the most prominent. The protocol features a fully functional (live) intent engine, where fillers compete via optimal execution paths to fulfill user orders.

Today, Across is the only real-time, intent-driven cross-chain bridging protocol that actually works for both large and small transfers. The market is responding: Across has already processed nearly $10 billion in volume and over 6 million transactions. Developers can also easily integrate Across+—their bridge abstraction framework—into dapps to natively enable chain abstraction. This serves as an early proof-of-concept for what chain abstraction can achieve and how the market values it.

Socket, the creator of Bungee (a bridge aggregator), is also exploring chain abstraction solutions via modular order flow auctions, where users submit intents and solvers compete to fulfill them. Through SocketPlugin, developers can add a widget to natively integrate Bungee—Socket’s bridge aggregator supporting cross-chain asset transfers—into their projects. Most of the time, Bungee actually routes through Across, which reached around 50% share of volume by late June 2024. Across is cited within Socket and other aggregators as the cheapest bridge, accounting for about 78% of the time.

Integrated Interactions

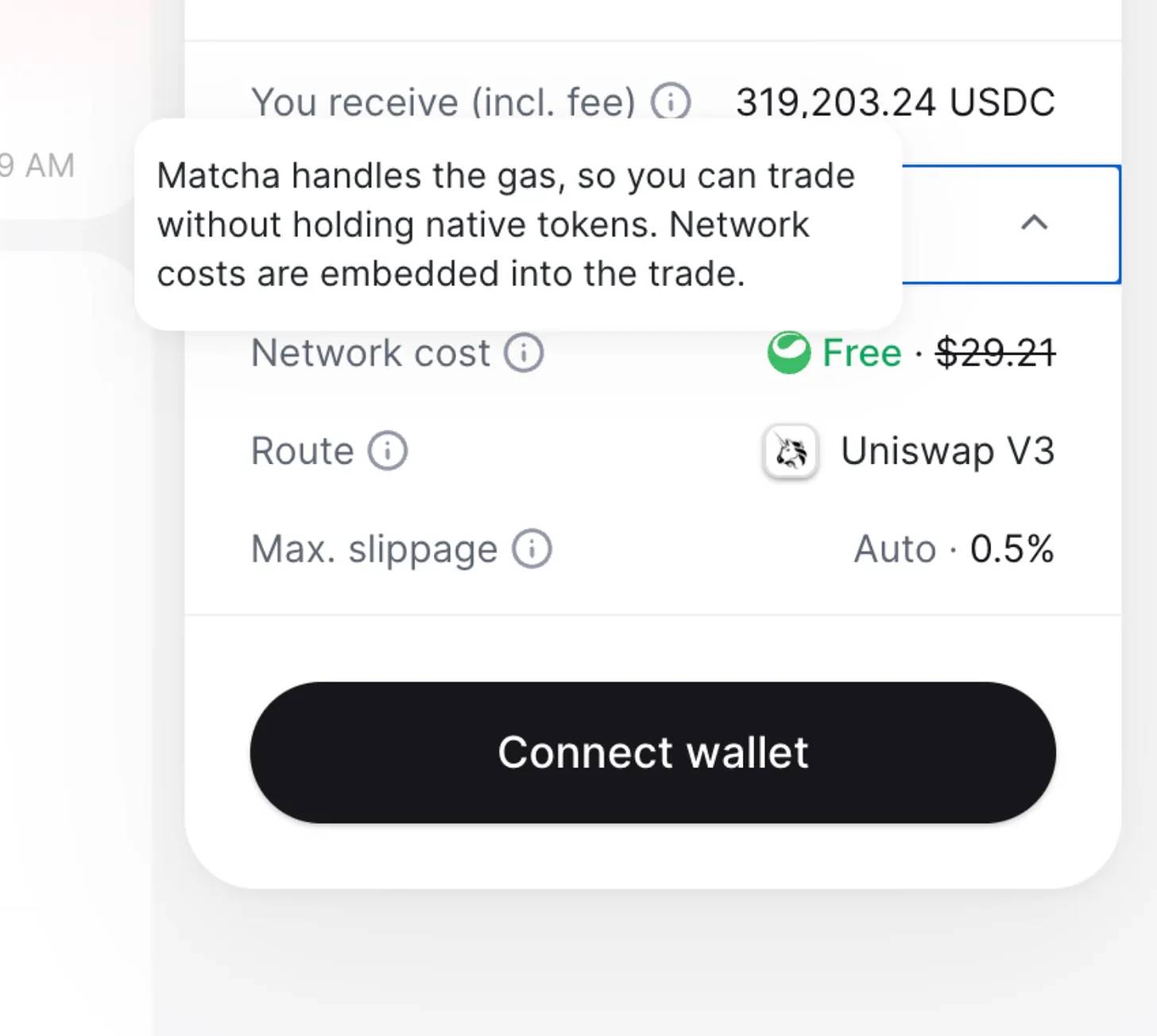

Beyond bridging (and staking, minting, lending...), swapping is one of the most popular on-chain activities for users—and thus represents the largest TAM for projects to tap into. Platforms like UniswapX and Matcha focus on swaps, aiming to abstract away gas, aggregate liquidity sources for cheaper trades, and enable efficient cross-chain swaps. This typically involves solvers competing to fulfill order flow in the most efficient way. Solvers pay gas on behalf of swappers, improve efficiency by batching orders for better pricing, and users benefit from not having to worry about gas tokens.

Middleware Frameworks and Interfaces

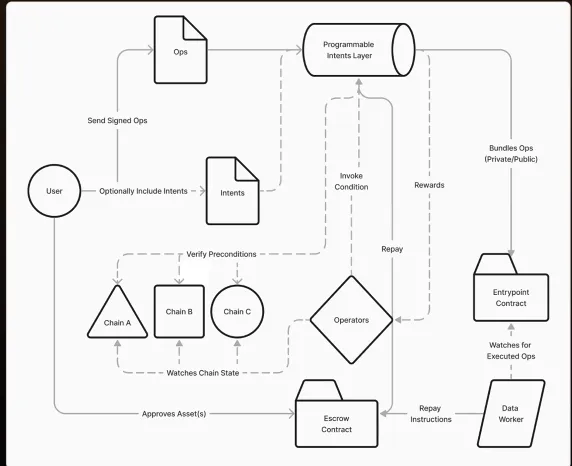

Some teams are building layers that support these protocols. For example, Light operates beneath other cross-chain interoperability protocols—including potentially Across, UniswapX—and acts as middleware for chain-abstracted user interactions. Notably, Light supports any configuration—conditions, DCA, intent graphs, etc.—expressed across multiple chains within EVMs, while most intent-based protocols initially only support limit orders. Additionally, Light uses order flow auctions, allowing users to programmatically define conditions, security, and settlement for cross-chain transactions, helping ensure optimal execution.

Another project in this space, Genius, is partnering with Lit Protocol to build a chain abstraction solution, with Lit serving as the foundational signature scheme for Genius’s liquidity architecture. Initially, they will support EVM, SVM, and Bitcoin, focusing on launching a decentralized filler network and aggregated liquidity rather than pursuing an intent-first approach.

Intent as Part of Chain Abstraction

Intent-based systems often focus on swaps, with the ultimate goal of letting users trade across any chain using any asset—without needing to bridge. Here are a few projects that recently caught my attention:

-

Slingshot is an intent-based on-chain app enabling users to trade across different chains in a non-custodial, bridgeless manner. By creating an extremely simplified user experience—no gas tokens, no “connect wallet” button, no bridging, login from any device, one-click buy/sell—users are more inclined to participate on-chain. The downside is that users are ultimately limited by how much capital each supported chain’s vault holds, but regardless, this architecture encourages more on-chain activity.

-

Blackwing is building a decentralized trading abstraction layer using Initia. Their edge comes from enabling leveraged trading without liquidation risk by using Uniswap LP positions as collateral. This effectively reduces downside risk during major drawdowns while accelerating upside gains.

-

Essential is developing its own intent-based Optimistic L2, where solvers directly propose solutions in the form of new states. Fraud proofs in this case are highly efficient—only requiring proof that a constraint was violated, which is then posted to L1. Developers can directly use Essential’s DSL (domain-specific language) to write applications with built-in intent frameworks, enabling broader and more complex apps to exist and interoperate on their L2.

Mass Adoption Through Abstraction

Just as you can access any website regardless of your browser or operating system, you should be able to access any crypto ecosystem regardless of the underlying chain. And developers shouldn’t be disadvantaged simply because they can’t reach certain users across different ecosystems based on their tech stack. Achieving this is certainly easier said than done—but once realized, I believe it will become a major catalyst for mass crypto adoption.

As Pedro Gomes put it on X: Chain abstraction is a shift in software design—from “chain-centric” to “user-centric.” Make chains work for people, not teach people to work for chains.

Join the official TechFlow community

Telegram subscription group:

Official Twitter account:

English Twitter account:

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News