How did io.net build a decentralized computing power platform?

TechFlow Selected TechFlow Selected

How did io.net build a decentralized computing power platform?

io.net is built on the Ray.io machine learning framework for distributed computing, providing AI applications with distributed computing resources for compute-intensive tasks ranging from reinforcement learning and deep learning to model optimization and model execution.

Author: Trustless Labs

Background

With OpenAI launching the GPT-4 large language model (LLM), the potential of various AI text-to-image models has been demonstrated. As applications based on mature AI models continue to grow, demand for computing resources such as GPUs has surged.

An article published by GPU Utils in 2023 discussing the supply and demand situation of Nvidia's H100 GPU noted that large enterprises involved in AI businesses have strong demand for GPUs. Tech giants like Meta, Tesla, and Google have all purchased substantial quantities of Nvidia GPUs to build AI-focused data centers. Meta owns approximately 21,000 A100 GPUs, Tesla about 7,000, and Google’s data centers also involve significant GPU investments, although specific numbers are not disclosed. Demand for GPUs—especially the H100—continues to rise, driven by the need to train large language models (LLMs) and other AI applications.

Meanwhile, according to Statista, the AI market size grew from $134.8 billion in 2022 to $241.8 billion in 2023, and is projected to reach $738.7 billion by 2030. The cloud services market also expanded by approximately 14%, reaching $633 billion, with part of this growth attributable to the rapidly increasing demand for GPU computing power from the AI sector.

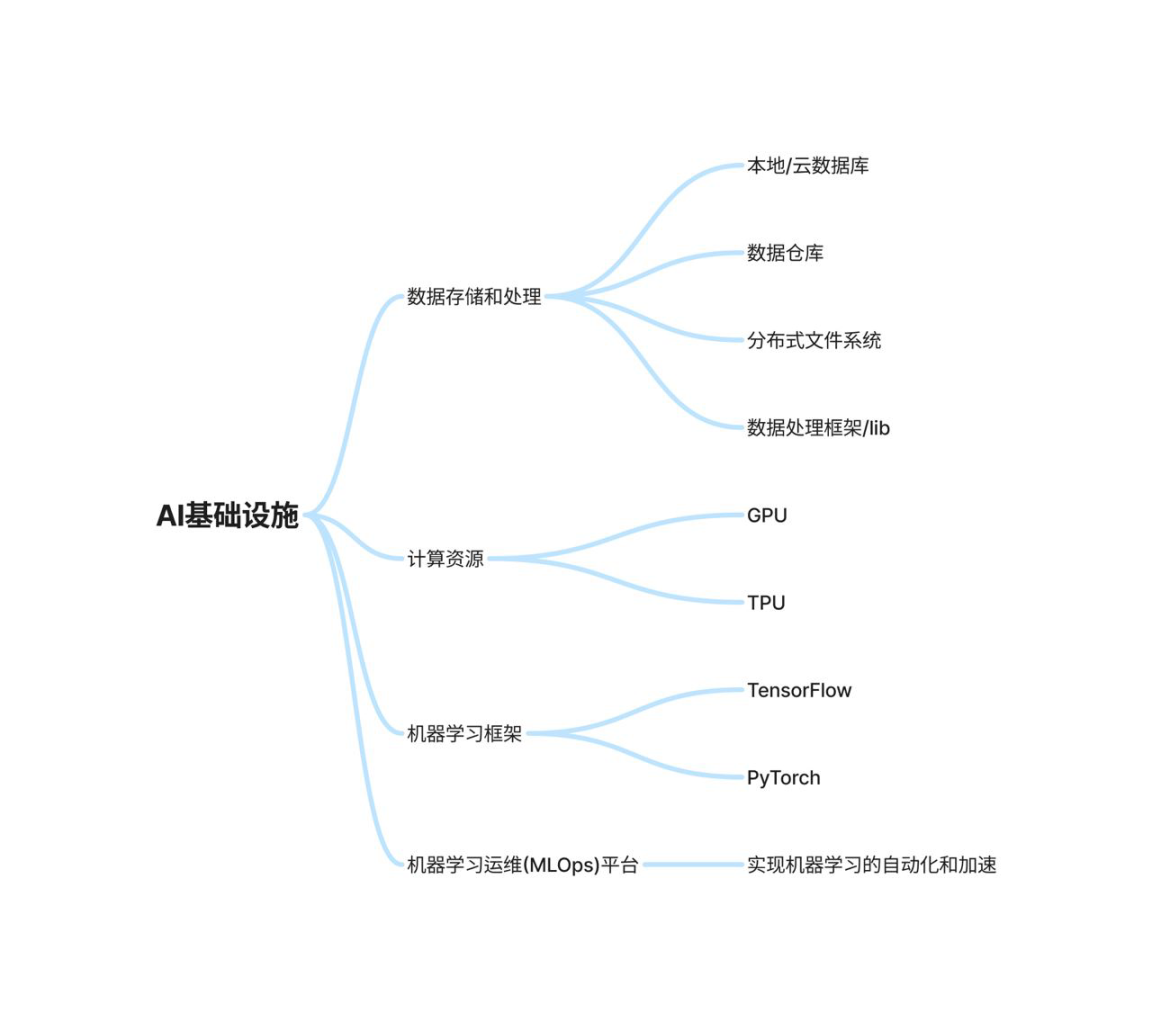

Given the fast-growing and highly promising AI market, what angles can we take to deconstruct it and identify relevant investment opportunities? Based on a report from IBM, we summarize the infrastructure required for creating and deploying artificial intelligence applications and solutions. AI infrastructure primarily exists to process and optimize the massive datasets and computing resources needed for training models, addressing issues of data processing efficiency, model reliability, and application scalability from both hardware and software perspectives.

AI training models and applications require vast amounts of computing power, favoring low-latency cloud environments and GPU performance. On the software stack side, distributed computing platforms such as Apache Spark and Hadoop are included. Spark distributes workflows across large computing clusters and features built-in parallelism and fault tolerance. Blockchain's inherent decentralized design makes distributed nodes commonplace, while Bitcoin's Proof-of-Work (PoW) consensus mechanism establishes that miners must compete through computational power (workload) to win block rewards—a workflow similar to how AI uses computing power to generate models or perform inference. As a result, traditional cloud server providers have begun expanding into new business models, renting out GPUs similarly to servers and selling computing power. By emulating blockchain concepts, AI computing power can adopt a distributed system design, leveraging idle GPU resources to reduce computing costs for startups.

Introduction to IO.NET

Io.net is a distributed computing provider integrating Solana blockchain, aiming to leverage distributed computing resources (GPU & CPU) to address computational challenges in AI and machine learning. IO aggregates over one million GPUs by pooling idle graphics cards from independent data centers and cryptocurrency miners, collaborating with crypto projects such as Filecoin and Render, to alleviate shortages in AI computing resources.

Technically, io.net is built upon ray.io, a framework designed for distributed computing, providing distributed computing resources for AI applications—from reinforcement learning and deep learning to model tuning and execution. Anyone can join io’s computing network as a worker or developer without additional permission. The network adjusts computing prices dynamically based on task complexity, urgency, and resource availability, enabling market-driven pricing. Leveraging its distributed nature, io’s backend pairs GPU providers with developers based on GPU demand type, current availability, requester location, and reputation.

$IO is the native token of the io.net system, serving as a medium of exchange between computing providers and buyers. Using $IO instead of $USDC waives a 2% order fee. Additionally, $IO plays a crucial role in incentivizing network operations: token holders can stake $IO to nodes, and only staked nodes are eligible to earn rewards during periods of machine idleness.

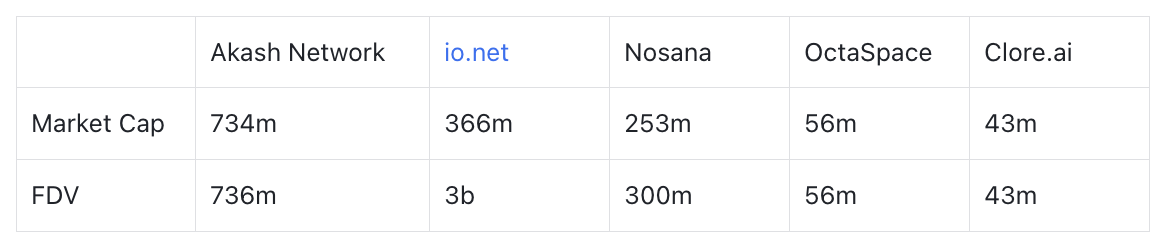

The current market cap of $IO is approximately $360 million, with a fully diluted valuation (FDV) of around $3 billion.

IO Token Economics

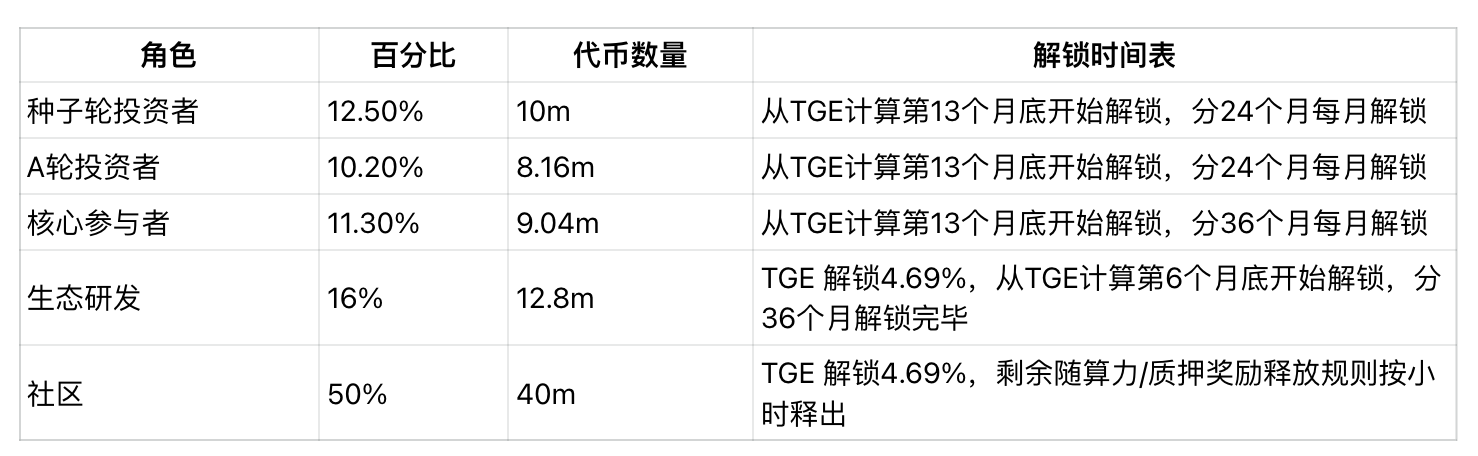

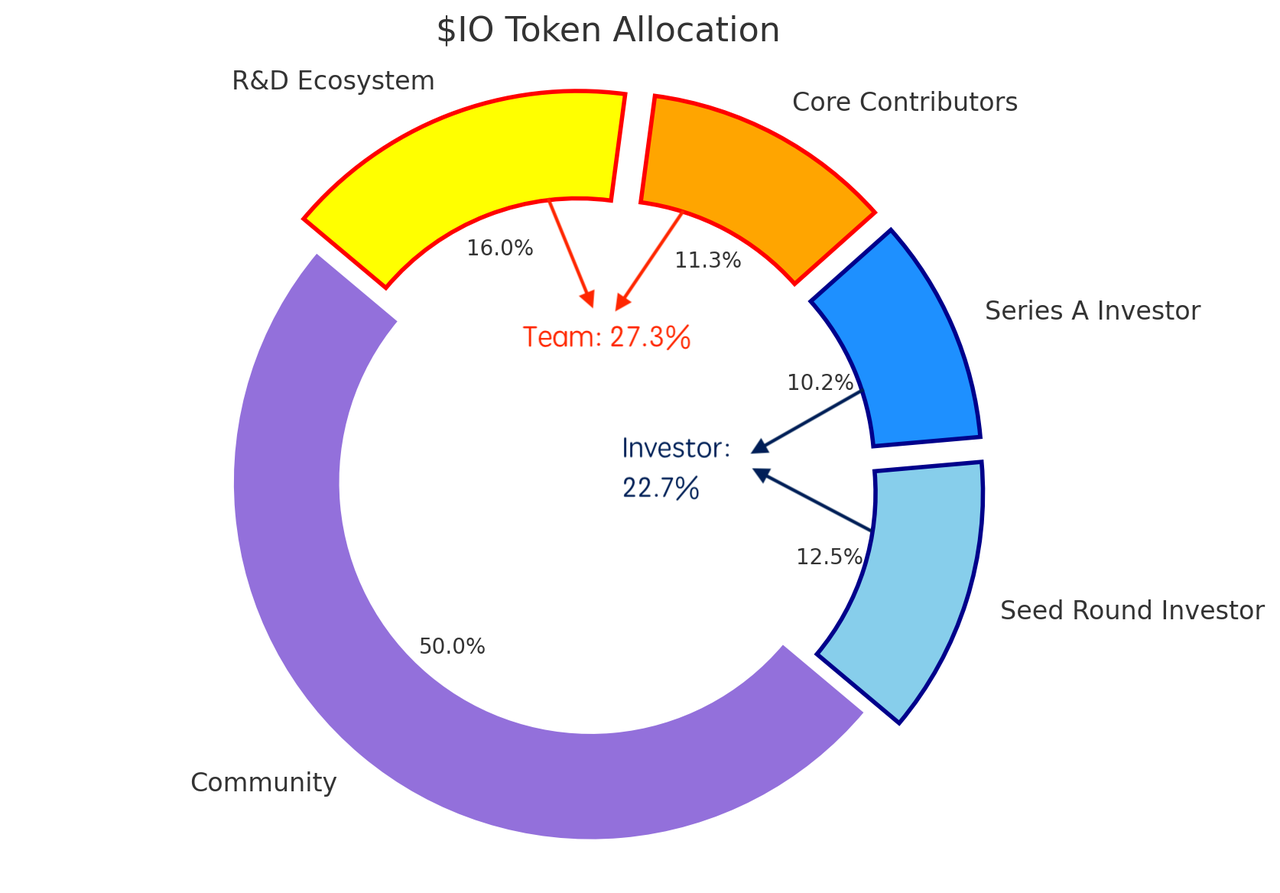

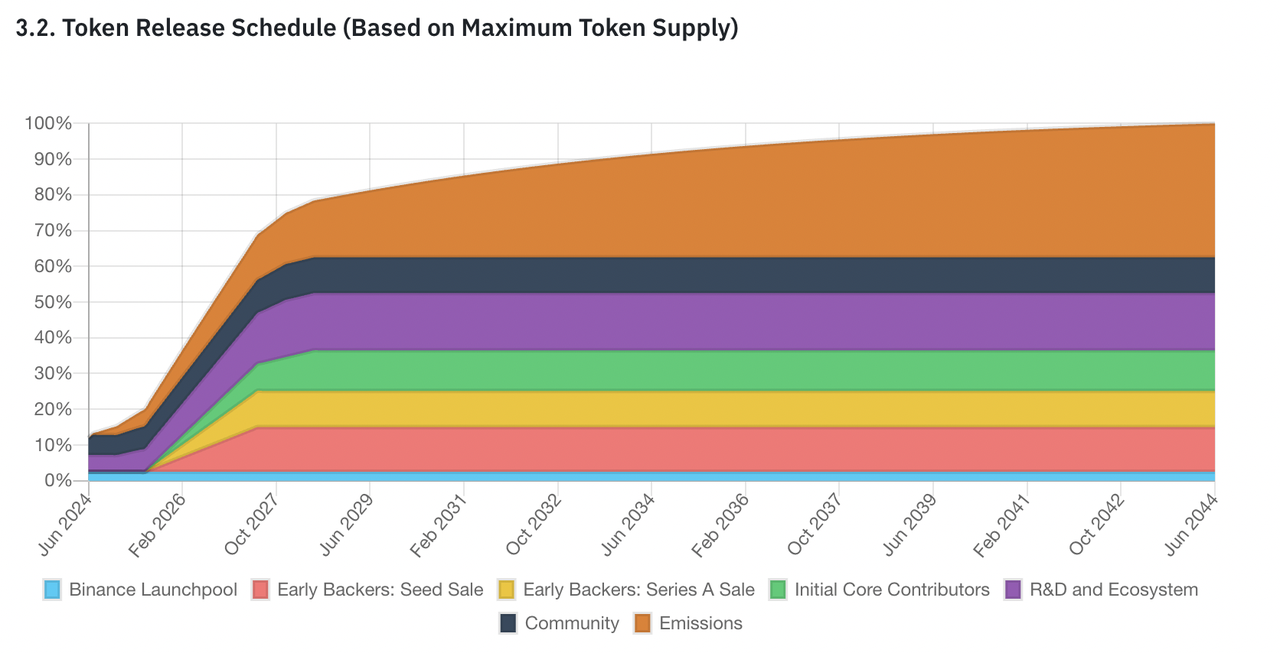

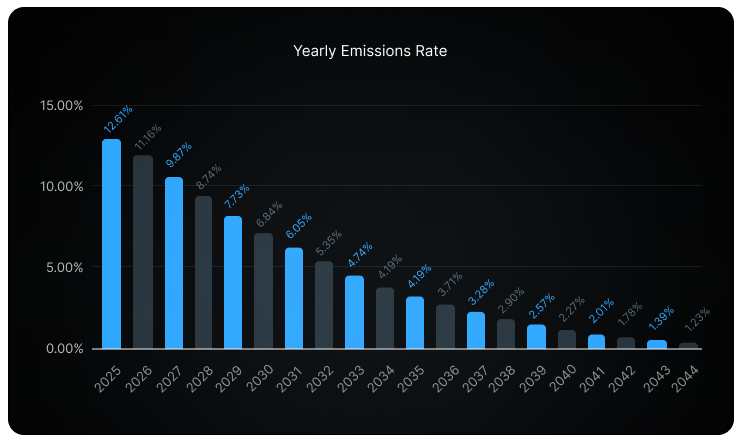

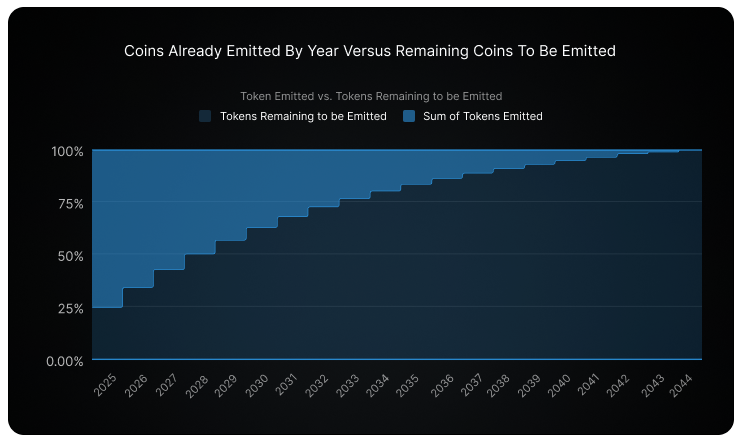

The maximum total supply of $IO is 800 million, with 500 million allocated at token generation event (TGE). The remaining 300 million will be released gradually over 20 years, decreasing monthly by 1.02% (approximately 12% annually). The current circulating supply is 95 million, consisting of 75 million unlocked at TGE for ecosystem development and community building, plus 20 million mining rewards from Binance Launchpool.

Testnet reward distribution for computing providers was as follows:

-

Season 1 (ending April 25) – 17,500,000 IO

-

Season 2 (May 1 – May 31) – 7,500,000 IO

-

Season 3 (June 1 – June 30) – 5,000,000 IO

In addition to testnet compute rewards, IO also distributed airdrops to community contributors:

-

(First round) Community / content creators / Galxe / Discord – 7,500,000 IO

-

Season 3 (June 1 – June 30) Discord and Galxe participants – 2,500,000 IO

The first season’s compute rewards and initial community creation/Galxe rewards were fully distributed at TGE.

According to official documentation, the overall $IO allocation is as follows:

$IO Token Burn Mechanism

Io.net executes a fixed program for $IO token buybacks and burns, where the exact amount depends on the $IO price at execution. Funds used for buybacks come from IOG (The Internet of GPUs) operating revenue—collecting a 0.25% order booking fee each from computing buyers and providers within IOG, as well as a 2% fee when users pay for computing power using $USDC.

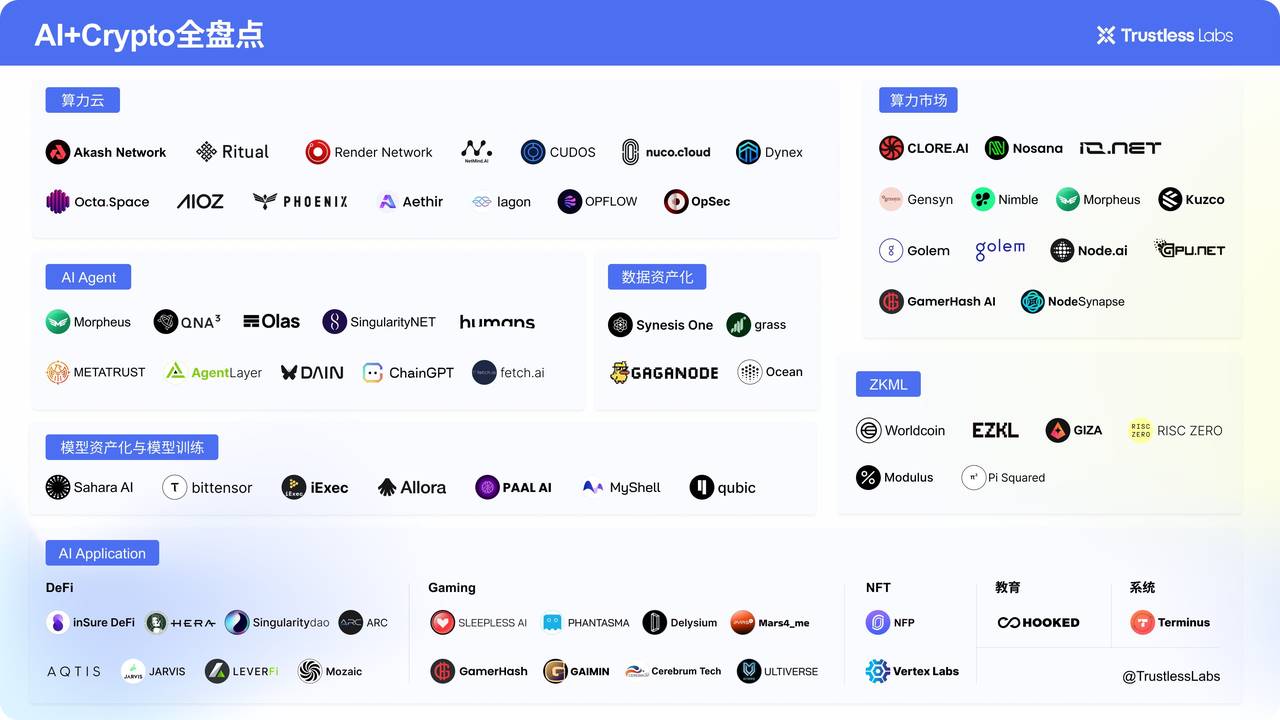

Competitive Analysis

Projects similar to io.net include Akash, Nosana, OctaSpace, Clore.AI—decentralized computing markets focused on meeting AI model computation needs.

-

Akash Network utilizes a decentralized marketplace model to aggregate and rent out excess computing capacity from idle distributed resources. It employs dynamic discounts and incentive mechanisms to balance supply and demand, enabling efficient, trustless resource allocation via smart contracts, thereby delivering secure, cost-effective, and decentralized cloud computing services. It allows Ethereum miners and others with underutilized GPU resources to lease these assets, creating a cloud service marketplace. Pricing occurs through a reverse auction mechanism, where buyers bid for resources, driving competitive price reductions.

-

Nosana is a decentralized computing marketplace project within the Solana ecosystem, aiming to use idle computing power to form GPU grids satisfying computational needs for AI inference. The project defines its marketplace operations via programs on Solana, ensuring participating GPU nodes complete tasks properly. Currently, during its second-phase testnet, it provides computing services for inference processes of models like LLaMA 2 and Stable Diffusion.

-

OctaSpace is an open-source, scalable distributed computing cloud infrastructure offering access to distributed computing, data storage, services, and VPNs. OctaSpace includes CPU and GPU computing power, disk space for ML tasks, AI tools, image processing, and scene rendering using Blender. Launched in 2022, it operates on its own Layer 1 EVM-compatible blockchain featuring a dual-chain system combining Proof-of-Work (PoW) and Proof-of-Authority (PoA) consensus mechanisms.

-

Clore.AI is a distributed GPU supercomputing platform allowing users to access high-end GPU computing resources from global nodes. It supports multiple use cases including AI training, cryptocurrency mining, and film rendering. The platform offers low-cost, high-performance GPU services, and users can earn Clore tokens by leasing GPUs. Clore.ai emphasizes security, complies with European regulations, and provides robust APIs for seamless integration. In terms of project quality, however, Clore.AI’s website appears rough, lacks detailed technical documentation to verify its claims and data authenticity, raising doubts about the actual GPU resources and real participation levels.

Compared to these other decentralized computing market projects, io.net is currently the only one that allows anyone to join without准入 restrictions to provide computing resources. Users can contribute using consumer-grade GPUs as low as the 30 series, or even Apple silicon devices like Macbook M2 and Mac Mini. Abundant GPU and CPU resources combined with rich API support enable IO to meet diverse AI computing needs such as batch inference, parallel training, hyperparameter optimization, and reinforcement learning. Its backend infrastructure consists of modular layers enabling efficient resource management and automated pricing. Other decentralized computing marketplaces typically collaborate with enterprise-level GPU providers, often imposing participation barriers. Therefore, IO may possess a stronger ability to leverage tokenomics and the crypto flywheel effect to attract more GPU resources.

Below is a comparison of current market caps / FDVs between io.net and its competitors:

Review and Conclusion

The listing of $IO on Binance marks a fitting beginning for a high-profile project that attracted significant attention early on, experienced intense testnet engagement, and later faced widespread criticism and skepticism due to delayed mainnet launches and perceived opacity in point rules. The token launched during a market downturn, opened low, rose temporarily, and eventually settled into a relatively rational valuation range. However, for testnet participants drawn by io.net’s impressive investor lineup, results have been mixed. Most users who rented GPUs but did not consistently participate across all testnet seasons failed to achieve expected supernormal returns, instead facing the reality of being “reverse farmed.” During the testnet phase, io.net divided each season’s reward pool into separate GPU and high-performance CPU pools. Season 1 suffered a hacking incident causing delays in score publication, but ultimately the GPU pool conversion rate at TGE was set close to 90:1, meaning users who rented GPUs via major cloud platforms incurred costs far exceeding their airdrop gains. In Season 2, the team successfully implemented a full PoW verification mechanism, with nearly 30,000 GPU devices participating and passing validation, resulting in a final points conversion ratio of 100:1.

After a much-anticipated launch, whether io.net can fulfill its promise of supporting diverse computational needs for AI applications, and how much genuine demand remains post-testnet, may only time reveal.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News