io.net, which has gone viral, who is paying for the AI narrative?

TechFlow Selected TechFlow Selected

io.net, which has gone viral, who is paying for the AI narrative?

"Domestic cloud vendors are all scrambling to poach talent," and embracing the bubble has become like carving a boat to mark a lost sword.

Authors: Joyce, Sky

Three months ago, during io.net's first incentive points campaign that began on March 1, Ahmad Shadid, founder and CEO of io.net, stated in a press interview that the token was expected to launch on April 28. Even as io.net’s GPU supply surged over the following month, Garrison, io.net’s CMO, reaffirmed in early April interviews that “io.net is still on track to release its token,” calling the timing coinciding with NVIDIA’s earnings report “appropriate.”

However, by April 25, the io.net team announced in their Telegram group that exchange partners had requested the TGE (token generation event) be postponed beyond April 28. Now, a full month past the original date, io.net has yet to confirm a new token launch timeline. After the snapshot, however, the community seems to have lost interest in io.net.

Since launching its mining incentive program, io.net has undergone dramatic changes—initially gaining viral popularity and being hailed as a star project of this bull market, only to face repeated accusations of data manipulation and scrutiny over the founder’s controversial past. A large number of users formed维权 groups to protest against io.net. Despite the token not having launched yet, many users feel their high-return expectations have already been dashed, though they still generally agree: “Overall, io.net is a good project.”

Everyone understands that beyond io.net, the market itself has shifted. Just ten days ago, amid growing community dissatisfaction toward “high-FDV” projects, Binance announced it would revise its listing rules to support small- and mid-sized crypto projects, aiming to provide opportunities for those with solid fundamentals, organic communities, sustainable business models, and industry responsibility, thus promoting ecosystem development. And today, after delaying its token launch, io.net announced that its third mining phase will begin on June 1.

An Avalanche of Traffic

Looking back, io.net’s explosive popularity two months ago was almost inevitable. Starting in February, AI became widely recognized in the crypto community as the new path to wealth. NVIDIA’s stock kept hitting new highs, OpenAI launched revolutionary new products, Worldcoin (WLD) multiplied several times within days, and various AI tokens outperformed most other sector tokens.

Retail Investors Fully Equipped and Queueing Up

By traditional narrative logic, this cycle should produce some breakout AI projects, with lucky early adopters reaping hundredfold returns. Guided by the principle of “buy new, not old,” among all AI projects, io.net appeared to be the most “credible” option.

Generally speaking, the crypto community categorizes the convergence of AI and Web3 into three areas: computing power, algorithms, and data. Many new AI projects emerged two months ago, with GPU rental becoming the most popular positioning. The reason is simple: at the public education level, most retail investors struggle to grasp how certain AI-model or application-focused projects fit into the broader landscape. In contrast, NVIDIA’s continuous rise made everyone acutely aware of the importance of “computing power.” This gave io.net a natural advantage in user perception compared to other projects.

In essence, current decentralized compute projects fall under the DePIN category. Last year, DePIN projects on Solana experienced breakout success. With the combination of AI, Solana, and DePIN, io.net became the “chosen one.” Beyond its favorable niche selection, io.net also had a deep collaboration with Render Network early on, just as RNDR entered an upward price cycle—rising from under $4 to $13 within two months.

In February and March, few KOLs promoted io.net on social media. But once io.net launched its two-month Ignitio.netn points reward program on March 1 and directly announced the token launch date—April 28—users poured in. An early participant told BlockBeats: “Discord community membership grew tenfold in just one week.”

On March 5, io.net announced a $30 million Series A funding round led by Hack VC, with participation from Multicoin Capital, 6th Man Ventures, Solana Ventures, OKX Ventures, Aptos Labs, Delphi Digital, and The Sandbox. Notably, Multicoin Capital had prior success in the DePIN space, having backed Helium Mobile (MOBILE) early. Individual investors included Solana co-founder and CEO Anatoly Yakovenko, The Sandbox co-founder and COO Sebastien Borget, and Animoca Brands co-founder and executive chairman Yat Siu.

With strong VC backing, technical challenges around achieving decentralized compute or whether sufficient demand-side users would pay platform participants were simply ignored by most involved. As one user put it: “From a retail perspective, I don’t care if you deliver—it’s all about how well you tell the story.”

The technical barrier to entry for io.net was high. BlockBeats observed that in the early days, Discord channels were flooded with bug reports, prompting the team to open a dedicated “support ticket” channel. One early participant told BlockBeats that the high entry barrier was actually one reason he liked io.net—it meant less competition and potentially larger allocations. Yet no one anticipated how widespread io.net mining tutorials would become online.

Zhu Rui (a pseudonym), an io.net user, shared his experience with BlockBeats. Initially, he tried joining but abandoned the effort when his hardware failed to meet official requirements. Soon after, he noticed more and more people around him mining io.net, often boasting multiple Mac Minis. “A friend of mine… ended up with many Mac Minis… not sure what they’re even used for…”

Perhaps wary of “airdrop farming studios,” io.net did not disclose detailed point calculation rules, only stating that points would depend on factors like machine uptime, bandwidth score, GPU performance, and device leasing duration. Beyond hardware contributions, participation in Galaxy Missions and Discord activity also earned variable points. However, most users opted to purchase additional equipment and fully gear up.

Unwilling to miss out, Zhu Rui reconsidered joining. He studied configurations circulating in the community, first considering buying Mac Minis directly. “This strategy works for users with fewer GPUs—beyond 100 units, maintenance becomes complex and requires dedicated personnel and physical space, similar to a mining farm. It’s capital-intensive. But there are upsides—you can resell them secondhand at half price later or switch to mining other projects.” During his research, he suspected the space was getting crowded: “Initially, a Mac Mini cost 2,100 RMB on Pinduoduo; two weeks later, it jumped to 2,800.”

Besides purchasing Mac Minis, others chose to rent cloud servers. “There are domestic and international options. Domestic providers are usually based in computing centers, cheaper—around 150–200 USD per RTX 3080 Ti card through certain channels.” Overseas prices were higher: “Google Cloud costs ~$1,400/month per card with annual commitment and minimum 50 cards; Tencent Cloud frequently runs out of stock; AWS charges ~$2,400/month per card with minimum 8 cards.”

Zhu Rui ultimately went the “premium account” route, acquiring over 200 single-T4 machines from a small foreign cloud provider at $400/month each, plus 15 eight-A100 machines at $1,200/month each. His monthly equipment cost alone totaled approximately $98,000.

Beyond equipment costs, Zhu Rui also invested heavily in anti-Sybil measures—he bought hundreds of IPs, manually changed passwords for 100 purchased Gmail accounts, and spent a week getting all devices operational.

Zhu Rui represents a larger-scale segment of io.net users. For average retail participants who managed to set up their rigs successfully, they still faced numerous ongoing challenges.

One io.net user recalled to BlockBeats that even after completing the complex setup process, users encountered persistent issues. Devices listed on io.net frequently dropped offline, yet users couldn't easily verify actual connection status. “Sometimes your frontend shows the device as online, but it’s actually disconnected in the backend. We had no choice—we wrote a daily auto-restart script to keep things running.”

Beyond financial costs, users had to constantly monitor their setups. Those unable to write scripts had to manually reconfigure repeatedly. On a YouTube tutorial video with over 10,000 views, even an airdrop-focused content creator admitted defeat: “If you complete all steps but don’t see your device status on the official page, I suggest redoing the entire process.”

High maintenance demands were built into io.net’s design. Officially, the rationale was to filter out Sybil accounts through repeated configuration checks. By the later stages of the campaign, this frequency significantly decreased. At the time, some users interpreted this as a positive sign—after all, “the bigger the wave, the more valuable the fish.” For seasoned Web3 veterans, any amount of upfront labor and mental effort seemed justified if future rewards were large enough.

“Cloud Providers Are All Mining io.net”

Despite user complaints about high maintenance costs, io.net’s popularity showed no signs of slowing. A video title posted two months ago by YouTuber “Alex Crypto Diary” may best capture the mood at the time: “[io.net] The most credible play in AI x Crypto is compute + crypto. Two weeks ago we planned to deploy 600 machines for io.net mining—our data center dream shattered! But without doubt, this is the best project in its category before Gensyn launches.”

In the video, Alex explained why his “data center dream” collapsed. Originally planning to deploy 800 machines, projecting to control 1–2% of total network compute, he secured overseas data center arrangements. But during negotiations, io.net exploded in popularity—every previously contacted overseas cloud provider reached out asking if he was mining io.net, and the data center doubled its quoted price overnight.

As io.net gained mainstream attention, domestic and international cloud providers raising prices likely became the biggest beneficiaries of this surge.

Currently, there’s no way to quantify exactly how much revenue cloud providers earned from the io.net boom. Alex once tweeted that Amazon Web Services (AWS) generated $40 million in revenue specifically from hosting io.net mining operations. Though commenters largely doubted the figure, given io.net’s frontend reportedly showing hundreds of thousands of GPUs, the number might not be far off.

It wasn’t just foreign providers profiting—multiple users interviewed by BlockBeats shared the same view: “All Chinese cloud service providers are mining io.net.”

Xiaoju (a pseudonym), a cloud provider with data center resources who doesn’t serve retail clients, told BlockBeats: “Looking back, renting machines for io.net was the easiest business I’ve ever done.” When asked about scale, she said: “If you have enough hardware, renting out machines worth millions per month is easy—tens of millions isn’t hard, even hundreds of millions is possible with effort. Every domestic and overseas cloud provider sold out completely. All data centers in China were fully rented. Machine suppliers raised prices across the board—you either accepted or someone else quickly took your spot.”

Additionally, since io.net supports Apple Mac Minis, “airdrop farmers drove up prices—Mac Minis on Pinduoduo’s百亿subsidy program rose several hundred yuan, and all used Mac Minis on Xianyu saw similar increases.”

Even in April, halfway through the first incentive phase, users continued rushing to acquire more equipment. Xiaoju recalled: “After April, I stopped renting machines altogether. But people kept contacting me. I’d reply: ‘Renting for one month isn’t worth it anymore—you’ll likely get reverse-rugged. Don’t do it. It’s too competitive now.’”

Misaligned Expectations

Judging by past patterns in the crypto industry, users investing in io.net followed the right formula. Facing potential rug-pull risks, emotional reactions are understandable. However, regarding malfeasance, the io.net team hasn’t clearly acted maliciously—they continuously improved UX and responded promptly to controversies. Yet problems did arise, placing io.net in awkward positions over these past three months.

After the first points distribution, many users received low scores because their machines weren’t online during the snapshot period, sparking community-led维权 actions. Zhu Rui recalled: “On May 3, someone hosted a Twitter Space called the ‘io.net Struggle Session’—over 1,000 users joined spontaneously, and WeChat groups overflowed with维权 messages.”

Unclear Points Calculation

Unlike other projects with transparent point dashboards, io.net never intended to show real-time point tracking from the start. In early March, BlockBeats asked a source close to the team about the lack of visible stats on the frontend. The source speculated: “They might be understaffed. If I get the chance, I’ll suggest adding it.”

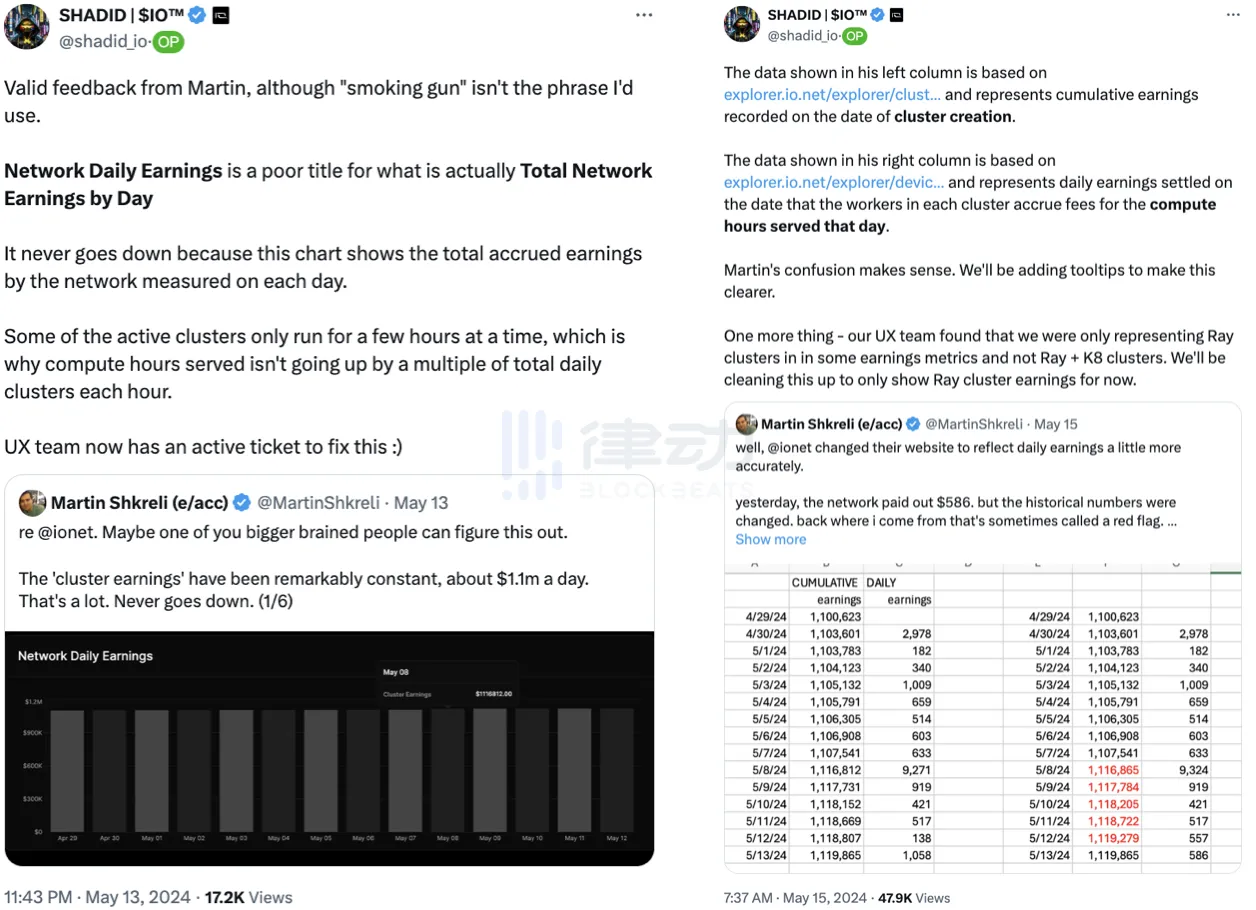

Throughout the two-month points campaign, persistent doubts arose about the accuracy of GPU counts displayed on io.net. The most notable came on May 13, when community member Martin Shkreli questioned the data on Twitter, prompting a direct response from io.net founder Shadid.

Shkreli pointed out inconsistencies such as daily revenue always showing $1.1 million, very few active clusters despite high reported numbers, and total compute time stuck at 88 hours. After receiving Shadid’s explanation, Shkreli published his own calculations of daily earnings metrics. Shadid clarified misunderstandings around statistical indicators—such as confusing daily vs. cumulative revenue, and failing to account for clusters of different specifications.

Pima, founder of ContinueCapital, noted two months ago that several decentralized AI projects were mutually calling APIs and “sharing compute.” An anonymous early io.net user explained to BlockBeats that devices contributed via io.net could be rented out on Render Network, and vice versa. In early April, io.net’s frontend showed 200,000 available GPUs, while Render Network reported only around 3,700.

Under these conditions, accurately calculating points required advanced technical skills. Investment firm Mint Ventures highlighted engineering challenges in decentralized compute, including verification, parallelization, and privacy protection. Parallelization involves significant technical hurdles—decomposing AI tasks, managing data dependencies, and minimizing inter-device communication overhead.

Objectively, some users affected by Sybil detection had unknowingly acquired “fake cards” from virtualized machines. Xiaoju told BlockBeats: “The rental market was chaotic. Theoretically, hardware was scarce, yet countless suppliers claimed they could provide unlimited machines. They were selling virtual machines as real ones—for example, one RTX 4090 could be split into infinite virtual GPUs. Suppliers profited at zero cost. These machines were eventually flagged, leading to zero points.”

Facing widespread backlash, the io.net team posted a long response in Discord, announcing a second points calculation to remove Sybil accounts while preserving legitimate users. Beyond point disputes, the team claimed the community was under attack from “false news and rumors,” attributing this to organized fake-card operations.

Regarding data pollution from fake cards, multiple io.net users told BlockBeats the issue had existed long before. “Two months before io.net released points, I knew people were mass-producing fake cards. I reported it in Discord—no official response. Others raised concerns too, but nothing changed until points calculation started. By then, it was too late,” Xiaoju said.

ImbaTrader also recalled: “When Discord only had a few thousand members, a self-proclaimed student from a U.S. university questioned the authenticity of the frontend GPU count—but no one responded.”

On the flip side, ambiguous point allocation gave the io.net team flexibility to adjust token distribution based on circumstances. As “too competitive” became a common refrain, many community members reported seeing “large holders receiving minimal points.” One user noted: “My small account (one or two machines) got more points than my big rig with dozens of high-end GPUs. Small accounts generally scored higher, while large operators received lower allocations—seems like they’re punishing whales and supporting retail.” After the second update, some users saw their points triple.

Regardless of point distribution, the total token allocation for miners remains fixed at 32 million. Within these miner devices, the io.net team itself appears to have operated a significant portion.

A user told BlockBeats in early March: “I suspect many A100s shown are actually owned by the team.” Given device records aren’t on-chain, the community suspects io.net may have manipulated frontend data.

YouTuber Alex Crypto Diary mentioned in an April video that io.net’s frontend GPU count hovered between 60,000–80,000, then suddenly spiked to 140,000–150,000 overnight. He noticed the count increased linearly every half hour by several thousand units, and previously absent RTX 4070s suddenly appeared in quantities exceeding 20,000. Considering real-user devices have unstable uptime, such perfectly linear growth strongly suggests artificial inflation by the team.

Days ago, during a Space session, Asa, io.net’s Asia representative, addressed community concerns about inconsistent frontend/backend data and centralized device logging. She replied: “Decentralizing the tech stack is a planned improvement. Our engineering team has worked at a pace equivalent to the last three months’ workload in just the past month.”

Strict anti-Sybil measures, delayed fake-card detection, and opaque point systems collectively raised the participation cost for genuine users. Beyond electricity and traffic expenses, “they psychologically pressure you to stay online constantly while withholding actual point data. So everyone invests immense effort—and the stronger the backlash afterward.” User Liu analyzed the pre-launch维权 actions to BlockBeats.

Hard-to-Earn Allocations

User Xiaoju expressed deep frustration: “Losing money on io.net is trivial, but it’s the most torturous project I’ve ever touched. Machines dropped offline multiple times daily. Each full restart took hours. Once fixed, they’d drop again. Honestly, io.net is the most painful project I’ve done—blockchain trauma.”

From the team’s perspective, the high maintenance burden was intentional—to manage low-quality nodes. In a podcast interview, COO Garrison Yang specifically discussed node quality during airdrops: “We introduced ‘time score’ and ‘reputation score.’ Each node on io.net has a reputation score reflecting uptime, availability, and performance metrics, helping clients make decisions. We continuously ping each node—if unresponsive, it’s marked unavailable and earns no rewards.”

In the team’s vision: “Crypto-economic incentives are straightforward: if a node stays available, provides better service, and gets hired more often, it earns more rewards. As long as nodes maintain availability and performance when hired, demand-side users get needed compute—win-win.” Still, this design later fueled one of io.net’s major controversies.

Based on valuations, token shares, total points, and OTC pricing estimates, most users (except early entrants) believe they won’t profit much from io.net. “About a month before points were announced, I realized I’d get reverse-rugged—because airdrops are capped, but machines are unlimited.” “Based on OTC prices and estimated ratios, I’ll either lose about half or barely break even at best.”

Still, Xiaoju believes the team’s issues stemmed from technical flaws—not intentional wrongdoing: “All machines were rented; io.net never took a single penny from retail users.” Beyond Xiaoju, early users and large participants interviewed by BlockBeats expressed continued optimism in io.net to varying degrees. As Alex said in his video: “Though I wouldn’t recommend joining now, I still believe io.net is a noteworthy and promising project.”

“Although we got reverse-rugged, our money didn’t go to io.net. People need to understand this first,” Alex explained in a BlockBeats interview. “Normally, when you interact with a project, your investment goes straight to the team, who then decides how to distribute tokens. But in io.net’s case, it’s not just retail and the team—it’s cloud providers, retail, and the team. Retail pays cloud providers, who don’t pass funds to io.net. So io.net only paid salary, operational costs, and rising user expectations—all along.”

A VC investor involved in io.net’s funding told BlockBeats they were evaluating AI projects when a partner fund introduced io.net. From initial contact to investment decision took about six weeks. “Their early execution stood out—strong technical documentation and partnership with Render made them one of the better candidates among peers. But their valuation was high—$300M—so we hesitated. Only when secondary market valuations rose did $300M seem reasonable.”

The investor told BlockBeats that actual returns fell far short of expectations. “Originally, we expected favorable macro conditions pushing FDV to $5B—offering 10x+ upside. Also, insiders revealed some VCs redirected existing compute rigs to io.net, mining at near-zero cost.”

Regarding subsequent developments: “There’s not much we can do—just observe how things evolve.” Technical shortcomings and founder controversies aren’t reasons to exit.

Where Is the PMF?

io.net’s token launch date remains undetermined. Though high returns are no longer expected, Zhu Rui and most users still believe “io.net itself is a good project.” “In crypto, product logic isn’t everything. If you applied the same scrutiny to io.net on other crypto projects, how many would truly hold up?” Zhu Rui told BlockBeats. “The recent FUD forced io.net to clarify its product structure—that’s healthy. Now markets are recovering—launching later is better than doing so during last month’s bearish sentiment.”

Over a decade of decentralized ownership ideals meeting the evolving AI revolution—under the belief that “AI represents productivity, Web3 represents production relations”—no one can deny the vast imaginative potential when these forces collide. From VCs to retail, high hopes remain for AI’s evolution.

Objectively, as a key narrative of this bull market, the appeal of Web3 x AI stems from explosive innovation in AI productivity outside the crypto sphere. Compared to previous cycles dominated by DeFi, GameFi—projects with distinct crypto DNA and traceable valuation models—AI is entirely different. Most research reports remain at the stage of “describing imagination” and “categorizing existing projects.”

Early io.net user ImbaTrader told BlockBeats: “I think the reason for io.net’s high narrative expectations isn’t necessarily due to the project’s excellence—it’s because the Web3 market desperately craves this narrative.”

Questions about technical capability and product logic are common to all Web3 projects. io.net’s real challenge lies in shifting perception—from being seen as “this year’s top narrative” to being labeled a “VC-backed high-FDV” project.

Yet, the AI narrative remains undeniably powerful. Amid tightening compute supply, io.net continues refining its product, maintaining clear advantages in scale and funding within decentralized compute. For AI projects—which inherently require massive capital—dismissing development solely due to “high FDV” is overly simplistic.

In the Web3 world, mastering hype cycles is a critical challenge every project must confront. Whether they’re “embracing the bubble” or “carving the boat seeking the sword,” only time will tell.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News