MIIX Capital: io.net Project Research Report

TechFlow Selected TechFlow Selected

MIIX Capital: io.net Project Research Report

io.net is a decentralized GPU network designed to provide computing power for machine learning (ML).

Written by: MIIX Capital

1. Project Overview

1.1 Business Summary

io.net is a decentralized GPU network designed to provide computing power for machine learning (ML). It aggregates over one million GPUs from independent data centers, cryptocurrency miners, and projects such as Filecoin or Render to obtain computational capacity.

Its goal is to integrate one million GPUs into a DePIN (Decentralized Physical Infrastructure Network), creating an enterprise-grade, decentralized distributed computing network that consolidates idle global computing resources—primarily GPUs—to deliver more affordable, accessible, and flexible computing services for AI engineers.

For users, it functions as a decentralized marketplace for idle global GPU resources, allowing AI engineers or teams to customize and purchase required GPU computing services based on their specific needs.

1.2 Team Background

-

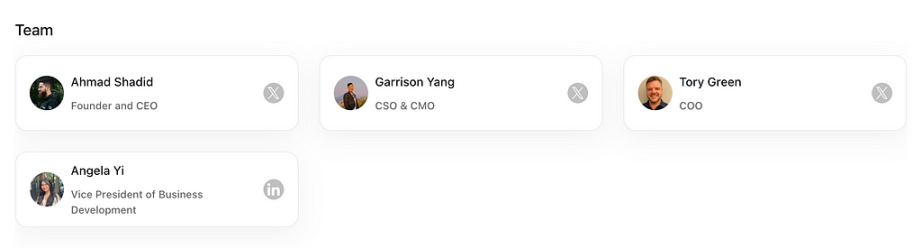

Ahmad Shadid is the founder and CEO, formerly a quantitative systems engineer at WhalesTrader.

-

Garrison Yang is Chief Strategy Officer and CMO, previously Vice President of Growth and Strategy at Ava Labs.

-

Tory Green is COO, previously COO at Hum Capital and Director of Corporate Development and Strategy at Fox Mobile Group.

-

Angela Yi is VP of Business Development, a Harvard University graduate responsible for planning and executing key strategies including sales, partnerships, and vendor management.

In 2020, Ahmad Shadid built a GPU computing network for Dark Tick, a machine learning quantitative trading firm. Because their trading strategy approached high-frequency trading, they required massive computing power, and the high cost of GPU services from cloud providers became a major challenge.

The enormous demand for computing power and the high associated costs prompted them to pursue decentralized distributed computing resources. They later gained attention at the Austin Solana Hacker House. Thus, io.net originated from the team’s firsthand experience with this pain point, leading them to develop a solution and bring it to market.

1.3 Product / Technology

Problems faced by users in the market:

Limited availability: Accessing hardware through cloud services like AWS, GCP, or Azure often takes weeks, and popular GPU models are frequently unavailable.

Limited choice: Users have little flexibility regarding GPU hardware, location, security level, or latency.

High cost: High-quality GPUs are extremely expensive, with monthly training and inference costs reaching hundreds of thousands of dollars.

Solution:

By aggregating underutilized GPUs (e.g., from independent data centers, crypto miners, and crypto projects like Filecoin and Render) and integrating these resources into a DePIN, engineers can access vast computational power within the system. It enables ML teams to build inference and model service workflows across a distributed GPU network and leverage distributed computing libraries to orchestrate and batch training jobs, enabling parallelization across many distributed devices using data and model parallelism.

Additionally, io.net uses distributed computing libraries with advanced hyperparameter tuning to identify optimal results, optimize scheduling, and easily specify search patterns. It also employs open-source reinforcement learning libraries that support production-grade, highly distributed RL (Reinforcement Learning) workloads and offer simple APIs.

Product Components:

IO Cloud: Designed to deploy and manage on-demand decentralized GPU clusters, seamlessly integrated with IO-SDK to provide a comprehensive solution for scaling AI and Python applications. It offers unlimited computing capacity while simplifying deployment and management of GPU/CPU resources.

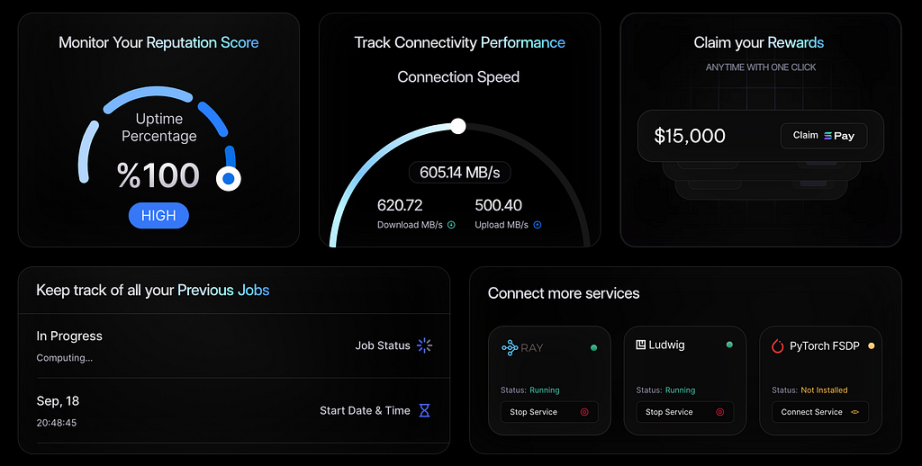

IO Worker: Provides users with a comprehensive and user-friendly interface via an intuitive web application to efficiently manage their GPU node operations. Features include user account management, monitoring of computing activities, real-time data display, temperature and power consumption tracking, installation assistance, wallet management, security measures, and profitability calculations.

IO Explorer: Offers users comprehensive statistics and visualizations of various aspects of the GPU cloud, enabling easy, real-time monitoring, analysis, and understanding of the complex details of the io.net network, providing full visibility into network activity, key metrics, data points, and reward transactions.

Product Features:

Decentralized computing network: io.net adopts a decentralized computing model, distributing computing resources globally to improve efficiency and stability.

Low-cost access: Compared to traditional centralized services, io.net Cloud offers significantly lower access costs, enabling more machine learning engineers and researchers to access computing resources.

Distributed cloud cluster: The platform provides a distributed cloud cluster, allowing users to select suitable computing resources based on their needs and distribute tasks across different nodes for processing.

Supports machine learning tasks: io.net Cloud focuses on providing computing resources for machine learning engineers, enabling easier model training, data processing, and related tasks.

1.4 Development Roadmap

https://developers.io.net/docs/product-timeline

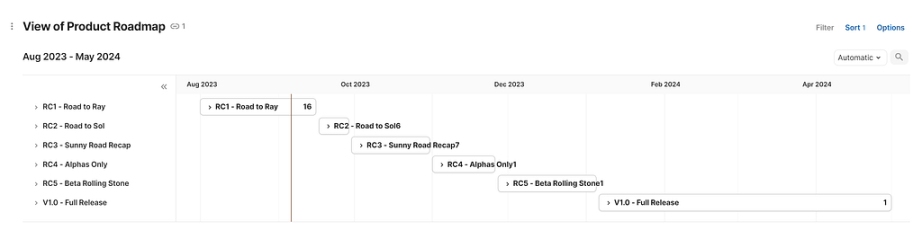

According to information published in the io.net whitepaper, the project's product roadmap is: January–April 2024: Full release of V1.0, focused on decentralizing the io.net ecosystem to enable self-hosting and self-replication.

1.5 Funding Information

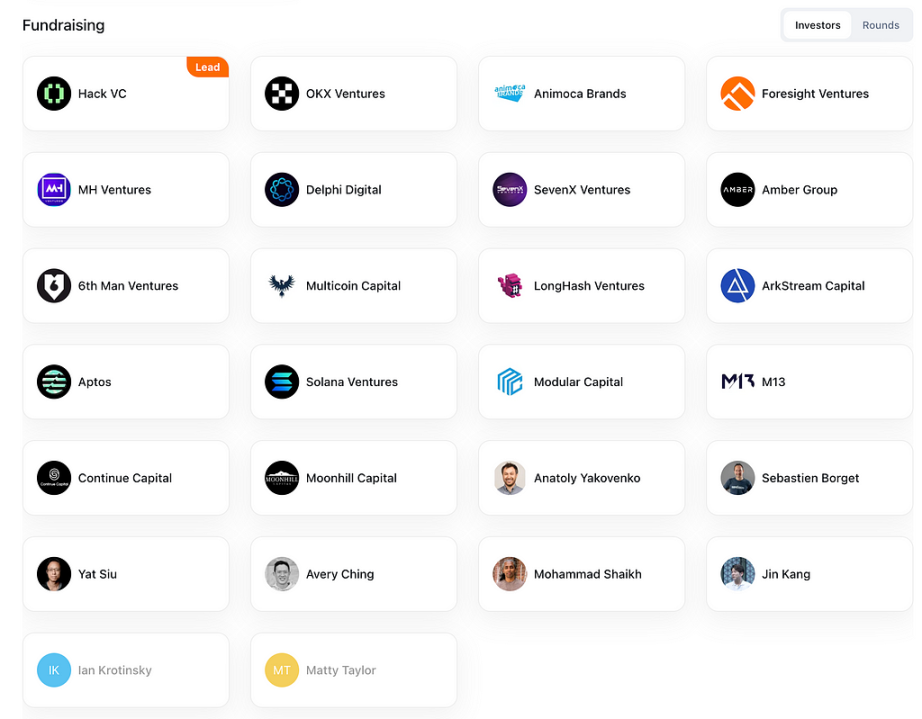

According to public news, on March 5, 2024, io.net announced the completion of a $30 million Series A funding round led by Hack VC, with participation from Multicoin Capital, 6th Man Ventures, M13, Delphi Digital, Solana Labs, Aptos Labs, Foresight Ventures, Longhash, SevenX, ArkStream, Animoca Brands, Continue Capital, MH Ventures, Sandbox Games, and others. [1] Notably, following this funding round, io.net’s overall valuation reached $1 billion.

2. Market Data

2.1 Official Website

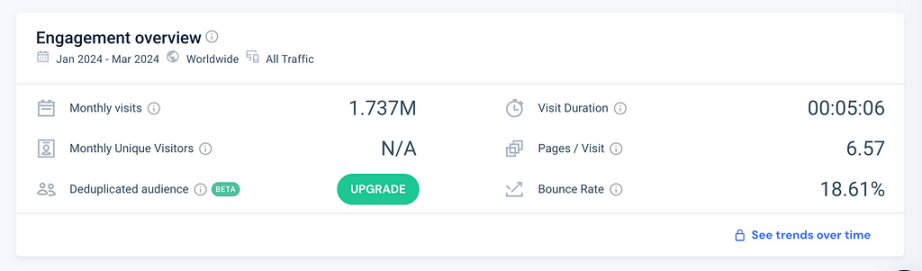

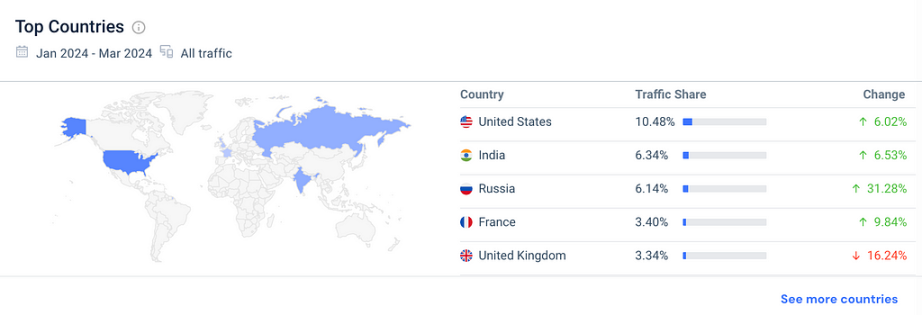

From January 2024 to March 2024, the official website recorded a total of 5.212 million visits, averaging 1.737 million per month, with a low bounce rate of 18.61%. User traffic was evenly distributed across regions, and direct and search traffic accounted for over 80%, suggesting a relatively clean user base with genuine interest in io.net who are willing to engage further with the site.

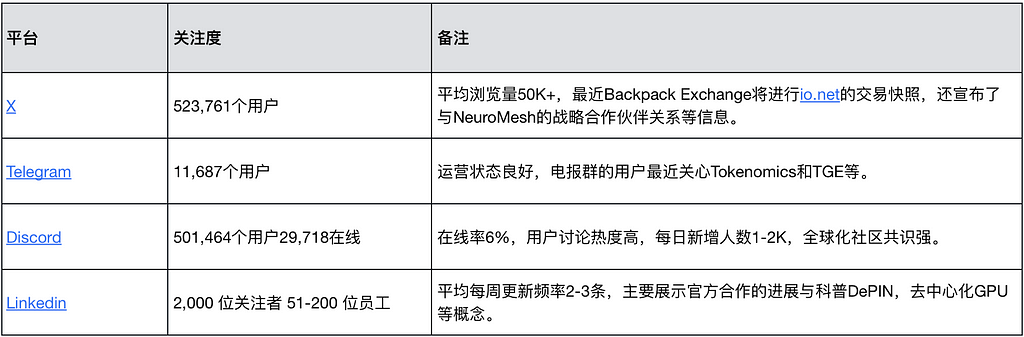

2.2 Social Media & Communities

3. Competitive Analysis

3.1 Competitive Landscape

io.net’s core business revolves around decentralized AI computing power. Its primary competitors are traditional cloud service providers such as AWS, Google Cloud, and Microsoft Azure. According to the "2022–2023 Global Computing Power Index Assessment Report" jointly compiled by IDC, Inspur Information, and Tsinghua University’s Global Industry Institute, the global AI computing market is expected to grow from $1.95 billion in 2022 to $3.466 billion in 2026. [2]

Comparing revenues of major global cloud providers: In 2023, AWS generated $9.08 billion in cloud revenue, Google Cloud earned $3.37 billion, and Microsoft’s Intelligent Cloud business brought in $9.68 billion. [3] Together, these three giants hold about 66% of the global market share, each with valuations exceeding $1 trillion.

https://www.alluxio.io/blog/maximize-gpu-utilization-for-model-training/

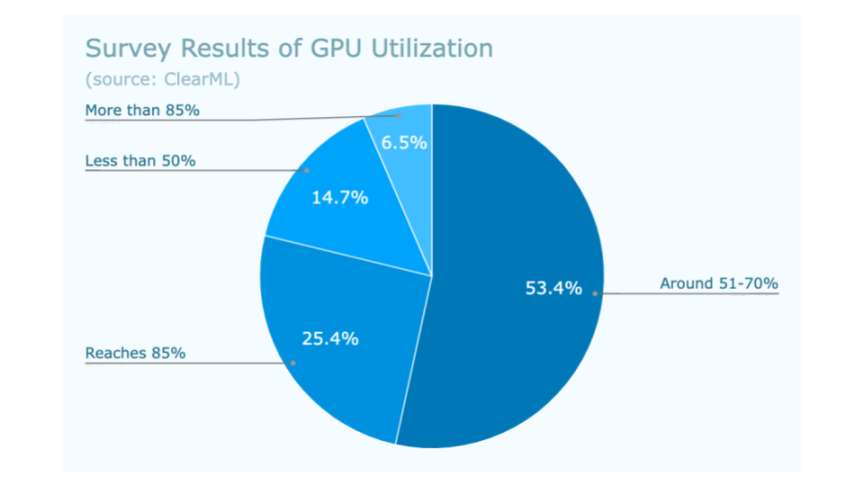

In stark contrast to the high revenues of cloud providers, improving GPU utilization has become a critical issue. According to a survey by AI infrastructure, most GPU resources are underutilized—about 53% believe 51–70% of GPU resources are underused, 25% report utilization up to 85%, and only 7% claim utilization exceeds 85%. For io.net, the massive demand for cloud computing combined with inefficient GPU utilization presents a significant market opportunity.

3.2 Advantage Analysis

https://twitter.com/eli5_defi/status/1768261383576289429

io.net’s greatest competitive advantage lies in its niche positioning and first-mover advantage. According to official data: io.net currently has over 40K GPUs, over 5,600 CPUs, over 69K worker nodes, deploys 10,000 GPUs in less than 90 seconds, offers prices 90% cheaper than competitors, and has a $1 billion valuation. io.net not only offers customers prices 10–20% of those from centralized cloud providers with instant, permissionless onboarding but also provides additional launch incentives to resource providers through its upcoming IO token, collectively working toward connecting one million GPUs.

Moreover, compared to other DePIN computing projects, io.net specializes in GPU computing power and already leads similar projects by over 100x in GPU network scale. io.net is also the first blockchain project to integrate cutting-edge ML technology stacks—such as Ray clusters, Kubernetes clusters, and large-scale clusters—into a GPU DePIN and implement them at scale, placing it ahead both in GPU quantity and technical capabilities for model training.

As io.net continues to grow, if it can scale GPU capacity to 500,000 concurrent GPUs—rivaling centralized cloud providers—it could deliver Web2-equivalent services at lower costs. With strong partnerships established with key DePIN and AI players—including Render Network, Filecoin, Solana, Ritual, and others—it has the potential to solidify its leadership position as the dominant decentralized GPU network and settlement layer, energizing the entire Web3 x AI ecosystem.

3.3 Risks and Challenges

io.net is an emerging computing resource integration and distribution platform deeply integrated with Web3, operating in a space highly overlapping with traditional cloud providers, exposing it to significant technological and market risks.

Security risks: As a new platform, io.net has not undergone large-scale application testing nor demonstrated its ability to prevent or respond to malicious attacks. Managing massive computing resources involves no proven experience or validation, making compatibility, robustness, and security issues common. Any failure could be fatal, as customers prioritize security and stability and are unwilling to bear such risks.

Slow market expansion: Due to significant overlap with traditional cloud providers, io.net must directly compete with giants like AWS, Google Cloud, and Alibaba Cloud—even second- and third-tier providers. Despite offering lower costs, its B2B service and marketing systems are still nascent, differing greatly from typical Web3 marketing approaches. Consequently, market adoption remains slow, potentially affecting project valuation and future token performance.

Recent Security Incident: On April 25, io.net’s founder and CEO Ahmad Shadid tweeted that the io.net metadata API suffered a security incident. Attackers exploited a publicly accessible mapping from user ID to device ID, enabling unauthorized metadata updates. This vulnerability did not affect GPU access but impacted metadata displayed to users on the frontend. io.net does not collect any PII and did not leak sensitive user or device data. Shadid noted that the system design allows self-healing by continuously updating each device to restore incorrectly changed metadata. In response, io.net accelerated deployment of OKTA-based user-level authentication, completed within six hours. Additionally, io.net introduced Auth0 tokens for user verification to block unauthorized metadata changes. During database recovery, users were temporarily unable to log in. All uptime records remain unaffected, and provider computation rewards were not impacted.

4. Token Valuation

4.1 Token Model

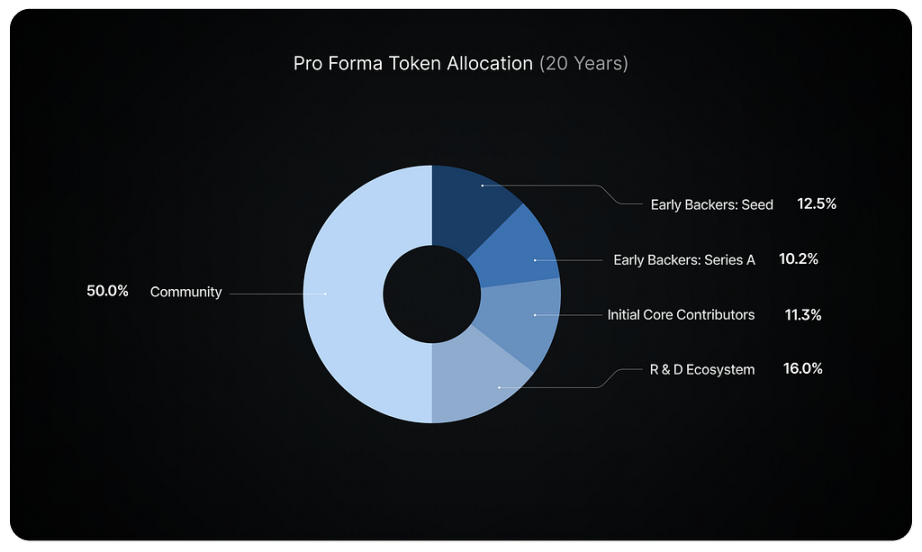

The io.net token economy starts with an initial supply of 500 million IO tokens, divided into five categories: Seed Investors (12.5%), Series A Investors (10.2%), Core Contributors (11.3%), R&D and Ecosystem (16%), and Community (50%). Over 20 years, the total supply will gradually increase to a fixed maximum of 800 million IO tokens to incentivize network growth and adoption.

Rewards follow a deflationary model, starting at 8% in the first year and decreasing by 1.02% monthly (~12% annually), until the cap of 800 million IO is reached. As rewards are distributed, the share held by early supporters and core contributors will gradually decrease. After all rewards are distributed, the community’s share will reach 50%. [4]

Token utilities include allocating incentives to IO Workers, rewarding AI and ML deployment teams for continued network usage, balancing supply and demand, pricing computing units for IO Workers, and enabling community governance.

To avoid payment issues caused by IO price volatility, io.net developed a USD-pegged stablecoin called IOSD. 1 IOSD always equals $1. IOSD can only be obtained by burning IO tokens. Additionally, io.net is considering mechanisms to enhance network functionality—for example, allowing IO Workers to increase their rental probability by staking native assets. The more assets they stake, the higher their chance of being selected. AI engineers who stake native assets may gain priority access to high-demand GPUs.

4.2 Token Mechanism

IO tokens primarily serve two groups: demand-side users and supply-side providers. For demand-side users, each compute job is priced in USD, and payments are held by the network until job completion. Once node operators configure their reward split between USD and tokens, all USD amounts go directly to node operators, while the token portion is used to burn IO. Then, all IO tokens minted during that period as compute rewards are distributed to users based on the dollar value of their coupon tokens (computing credits).

For supply-side providers, rewards include availability rewards and compute rewards. Compute rewards are given for jobs submitted to the network. Users can choose time preferences ("duration to deploy clusters by the hour") and receive cost estimates from io.net’s pricing oracle. Availability rewards are determined by the network submitting small test jobs randomly to assess which nodes operate regularly and reliably accept jobs from demand-side users.

Notably, both supply-side and demand-side participants benefit from a reputation system that accumulates scores based on computational performance and network engagement, unlocking rewards or discounts.

Additionally, io.net implements ecosystem growth mechanisms including staking, referral rewards, and network fees. IO token holders can stake their tokens to node operators or users. Once staked, stakers earn 1–3% of the participant’s total rewards. Users can invite new participants and share a portion of their future earnings. A 5% network fee is applied.

4.3 Valuation Analysis

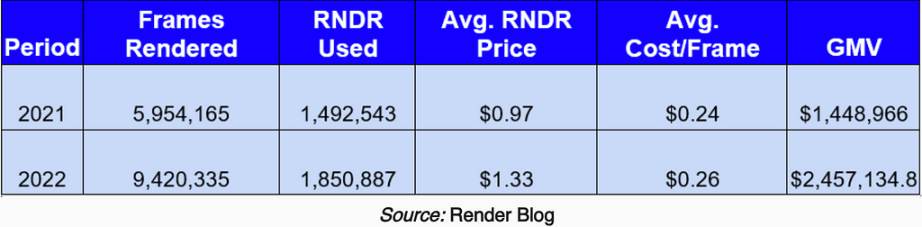

We currently lack accurate revenue data for comparable projects, making precise valuation difficult. Here, we compare io.net with Render, another AI + DePIN project, for reference.

https://x.com/ionet/status/1777397552591294797

https://globalcoinresearch.com/2023/04/26/render-network-scaling-rendering-for-the-future/

As shown, Render Network is currently the leading decentralized GPU rendering solution in the AI + Web3 sector, with 11,946 GPUs and a current market cap of $3 billion (FDV $5 billion). In comparison, io.net has 461,772 GPUs—38 times more than Render—and a current valuation of $1 billion. Since both projects rely fundamentally on decentralized GPU computing power, using GPU supply as the core metric suggests io.net’s eventual market cap will likely surpass or at least match Render’s.

https://stats.renderfoundation.com/

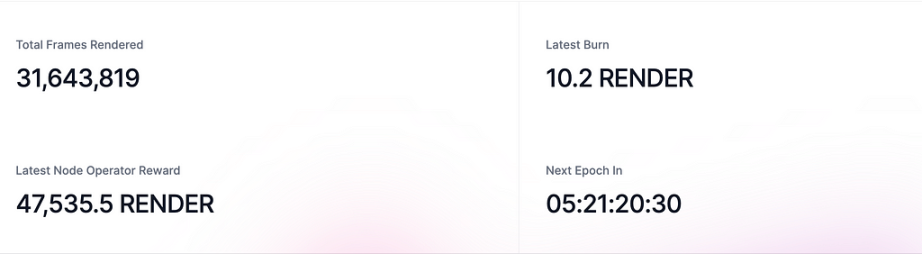

Render Network rendered 9,420,335 frames in 2022, generating $2,457,134 in GMV. Currently, it has rendered 31,643,819 frames, implying a GMV of approximately $8,253,751.

In contrast, io.net’s GMV over four months is $400,000. Assuming steady growth, its annual GMV would be $1.2 million. To reach Render’s current GMV, io.net still has 6.8x growth potential. Given its current $1 billion valuation, io.net’s market cap could exceed $5 billion during a bull cycle based on this analysis.

5. Conclusion

io.net fills a gap in the decentralized computing space, offering users a novel and promising computing paradigm. As artificial intelligence and machine learning continue to advance, demand for computing resources keeps rising, giving io.net substantial market potential and value.

On the other hand, despite receiving a high $1 billion valuation from the market, io.net’s product has yet to be fully tested. Technical uncertainties remain, and whether it can effectively balance supply and demand will be crucial to achieving higher valuations. Currently, io.net shows early success on the supply side but has not fully activated demand, resulting in underutilized GPU resources. Effectively stimulating demand for GPU resources remains a key challenge for the team.

If io.net can rapidly onboard demand-side users and avoid major risks or technical setbacks during operations, its AI + DePIN business model could trigger a powerful growth flywheel, making it one of the most prominent projects in the Web3 space. This would position io.net as a highly attractive investment opportunity. We will continue to monitor and validate its progress closely.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News