Decrypting the DePIN Ecosystem: The Transformative Power of AI Computing

TechFlow Selected TechFlow Selected

Decrypting the DePIN Ecosystem: The Transformative Power of AI Computing

DePIN is a new form of "shared economy" and serves as a bridge connecting the physical world with the digital world.

Written by: @0xFourStones, @cryptoyzr

Advisors: @CryptoScott_ETH, @artoriatech

Introduction

The concept of DePIN was formally introduced by Messari in November 2022. However, this is not a novel idea and shares similarities with earlier concepts such as IoT (Internet of Things). The author believes that DePIN represents a new form of "shared economy."

Unlike previous DePIN booms, the current wave of DePIN projects primarily revolves around the three pillars of AI—data, algorithms, and computing power—with particular emphasis on "computing power." Projects like io.net, Aethir, and Heurist stand out in this category. This article focuses specifically on analyzing these computing-power-focused initiatives.

This article summarizes the fundamental framework of DePIN projects using a WHAT-WHY-HOW structure to provide an overview and summary of the DePIN sector. Based on personal experience, the author outlines a clear analytical approach for evaluating DePIN projects and applies it to detailed case studies of specific computing-power projects.

1. What Is DePIN?

1.1 Definition of DePIN

DePIN stands for Decentralized Physical Infrastructure Networks—a term that translates to "decentralized physical infrastructure network" in Chinese. DePIN leverages blockchain technology to connect physical hardware infrastructure in a decentralized manner, enabling permissionless access to network resources at affordable costs. DePIN projects typically use token-based reward systems to incentivize user participation in building the network, following the principle of "the more you contribute, the more you earn."

DePIN applications span across various domains including data collection, computation, and storage. Any area involving CePIN (Centralized Physical Infrastructure Network) often has corresponding DePIN counterparts.

From both operational mechanics and economic modeling perspectives, DePIN essentially embodies a new form of "shared economy." When conducting preliminary analysis of DePIN projects, one can adopt a simplified method: first identify the core business of the project.

If a project mainly involves computing or storage services, it can be simply categorized as providing 'shared compute' and 'shared storage' services. Such classification helps clarify the project's value proposition and market positioning.

source: @IoTeX

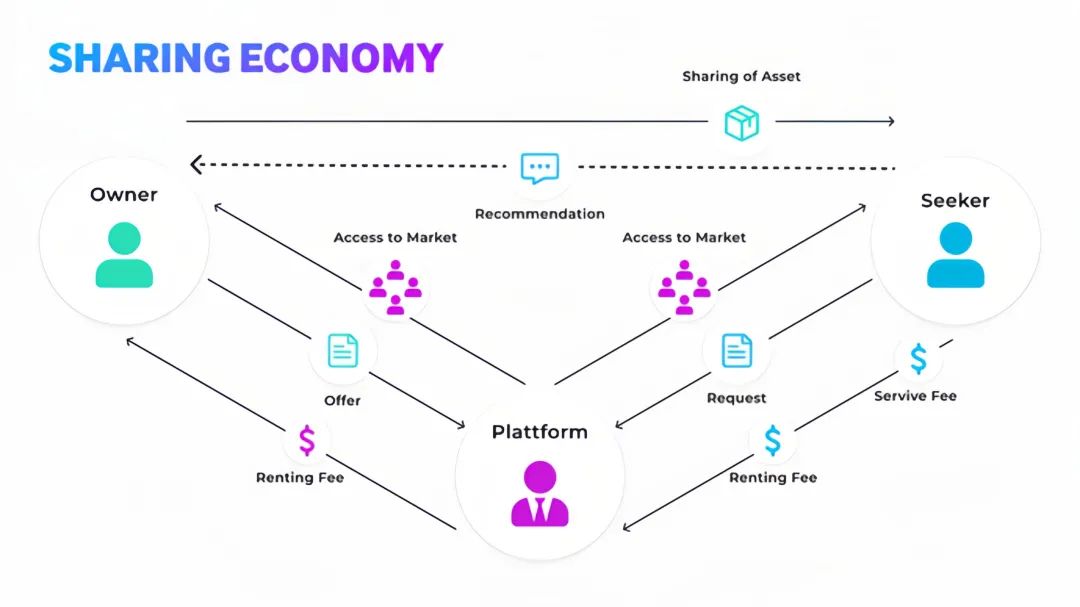

In the above shared economy model diagram, there are three main participants: demand side, supply side, and platform. In this model, the demand side sends requests (e.g., rides, housing) to the platform; the platform then relays these needs to suppliers who deliver corresponding services, completing the entire business cycle.

In this model, funds flow from the demand side to the platform first. After order confirmation, they move from the platform to the supplier. The platform earns transaction fees by offering stable trading infrastructure and smooth settlement experiences. Think about your experience hailing a Didi ride—it reflects exactly this model.

In traditional "shared economy" models, platforms are usually centralized corporations maintaining full control over networks, drivers, and operations (e.g., Didi). Sometimes even suppliers are owned by the platform itself, such as shared power banks or electric scooters. This leads to several issues: corporate monopolization, low cost of misconduct, excessive fee extraction harming supplier interests. In short, pricing power lies with central enterprises while those owning production assets lack pricing authority—hardly communist.

However, in Web3’s version of the shared economy, the matchmaking platform becomes a decentralized protocol eliminating intermediaries (like Didi), placing pricing power directly into the hands of suppliers. This offers passengers cheaper rides, higher earnings for drivers, and gives them influence over the network they help build daily—an all-win scenario.

1.2 History of DePIN Development

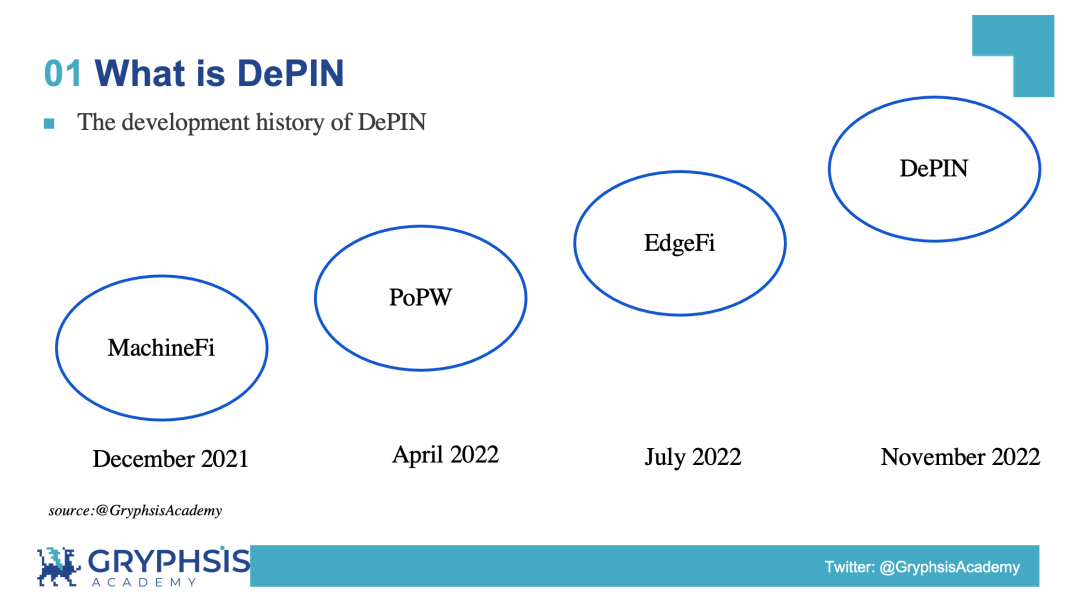

Since Bitcoin emerged, people have explored combining peer-to-peer networks with physical infrastructure—building open, economically incentivized decentralized networks among devices. Influenced by terms like DeFi and GameFi in Web3, MachineFi was among the earliest concepts proposed.

-

December 2021: IoTeX became the first company to name this emerging field “MachineFi,” merging “Machine” and “DeFi” to represent the financialization of machines and their generated data.

-

April 2022: Multicoin introduced the concept of “Proof of Physical Work” (PoPW), an incentive mechanism allowing anyone permissionlessly to contribute toward shared goals. This significantly accelerated DePIN development.

-

September 2022: Borderless Capital proposed the term “EdgeFi.”

-

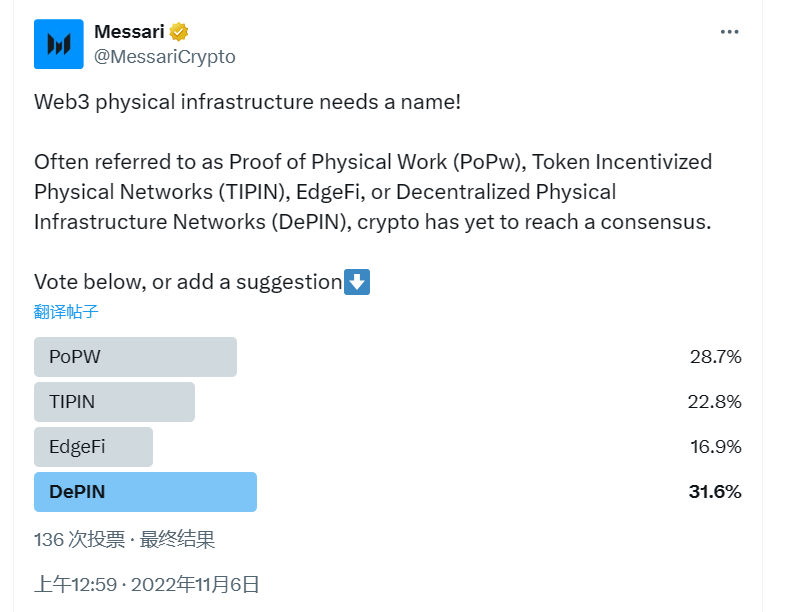

November 2022: Messari conducted a Twitter poll to unify naming conventions, with options including PoPW, TIPIN, EdgeFi, and DePIN. DePIN won with 31.6% of votes, becoming the standardized term.

source: @MessariCrypto

2. Why Do We Need DePIN?

Traditional physical infrastructure networks (e.g., telecom, cloud services, energy grids) are dominated by large corporations due to massive capital investment and high operating costs. This centralized industrial characteristic brings several challenges:

-

Tight entanglement between government and enterprise interests, high entry barriers: For example, in the U.S. telecommunications industry, the FCC auctions wireless spectrum to the highest bidders. Well-capitalized firms dominate, creating significant market advantages and reinforcing the Matthew effect—“the rich get richer.”

-

Stable market competition landscape, insufficient innovation and vitality: A few licensed companies hold pricing power. With stable, lucrative cash flows, they often lack motivation for further development, leading to slow network optimization, delayed reinvestment/upgrades, and reduced incentives for technological innovation and personnel renewal.

-

Outsourcing of technical services, inconsistent service standards: While industries trend toward specialized outsourcing, varying philosophies and skill levels among vendors result in poor quality control and lack effective collaboration mechanisms.

2.1 Drawbacks of CePIN

-

Centralized Control: CePIN is managed by centralized entities, posing single points of failure, vulnerability to attacks, low transparency, and no user control over data or operations.

-

High Entry Barriers: New entrants face steep capital requirements and complex regulatory hurdles, limiting market competition and innovation.

-

Resource Waste: Centralized management results in idle or underutilized resources and low efficiency.

-

Inefficient Equipment Reinvestment: Decision-making concentrated within a few institutions leads to inefficient equipment upgrades and investments.

-

Inconsistent Service Quality: Outsourced service quality is hard to guarantee due to non-uniform standards.

-

Information Asymmetry: Central authorities possess all data and records, leaving users unaware of internal system operations and increasing information asymmetry risks.

-

Lack of Incentives: CePIN lacks effective incentive mechanisms, resulting in low user engagement and contribution to network resources.

2.2 Advantages of DePIN

-

Decentralization: No single point of failure enhances reliability, resilience, reduces attack risks, and improves overall security.

-

Transparency: All transactions and operations are publicly auditable. Users have full data control and can participate in decision-making, enhancing transparency and democratization.

-

Incentive Mechanisms: Tokenomics enables users to earn tokens by contributing network resources, encouraging active participation and maintenance.

-

Censorship Resistance: Without a central control point, the network resists censorship and ensures free information flow.

-

Efficient Resource Utilization: Distributed networks activate latent idle resources, improving utilization rates.

-

Openness and Global Deployment: Permissionless, open-source protocols enable global deployment, breaking geographical and regulatory constraints inherent in traditional CePIN.

By leveraging decentralization, transparency, user autonomy, incentive structures, and censorship resistance, DePIN addresses key shortcomings of CePIN—including centralization, data privacy concerns, resource waste, and inconsistent service quality—driving transformation in real-world production relationships and enabling more efficient, sustainable physical infrastructure networks. Therefore, for physical infrastructures requiring high security, transparency, and user engagement, DePIN offers a superior alternative.

3. How to Build a DePIN Network

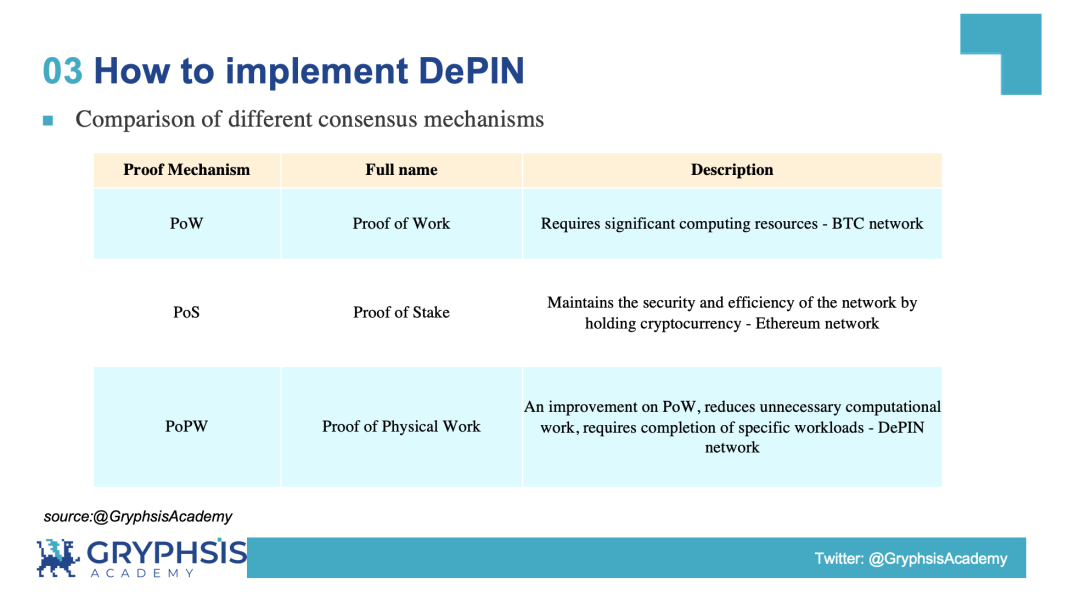

3.1 Comparison of Different Consensus Mechanisms

Before discussing how to implement a DePIN network, let's examine the commonly used PoPW mechanism.

A DePIN network requires rapid scalability, low node participation cost, abundant supply nodes, and high decentralization.

PoW demands expensive mining rigs upfront, raising participation barriers too high for DePIN. PoS requires staking native tokens, which may discourage users from running nodes. PoPW perfectly aligns with DePIN characteristics, enabling seamless integration of physical devices into the network and accelerating DePIN adoption.

Combined with token economics, PoPW fundamentally solves the chicken-and-egg problem. Using token rewards, protocols can incentivize supply-side construction until it becomes attractive enough for users.

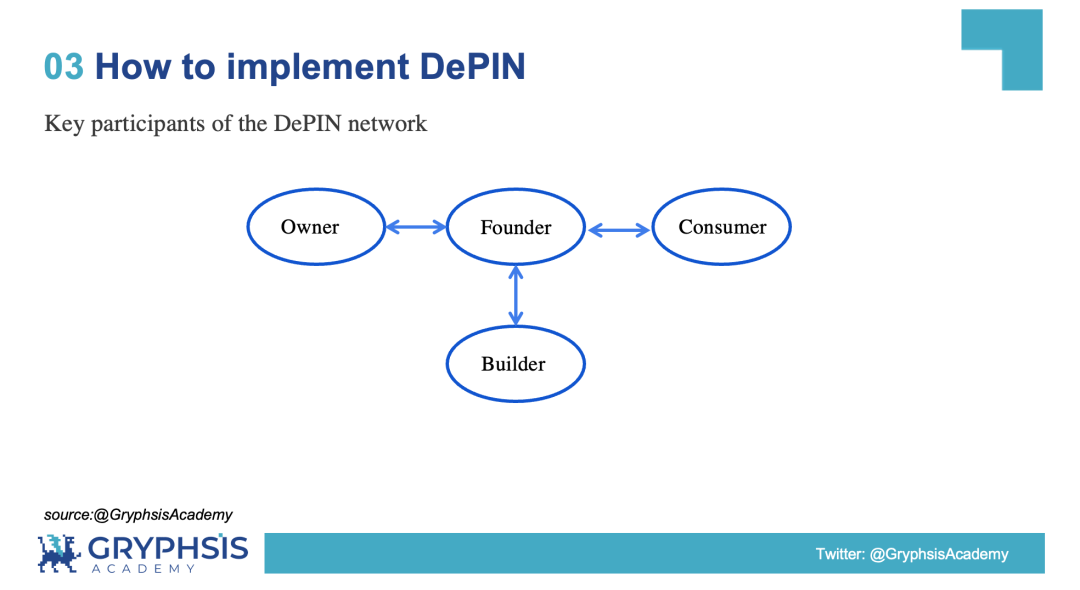

3.2 Key Participants in a DePIN Network

Typically, a complete DePIN network includes the following roles:

-

Founder: The initiator of the DePIN network—the usual “project team.” Founders play a crucial role in early-stage network construction and cold-start processes.

-

Owner: Suppliers of network resources such as compute miners or storage providers. They earn protocol tokens by contributing hardware/software resources. Owners are vital during the network’s initial phase.

-

Consumer: Demand-side users, mostly B2B clients from Web2. Web3 demand alone cannot sustain most DePIN networks. Filecoin and Bittensor are typical examples.

-

Builder: Individuals maintaining the DePIN network and expanding its ecosystem. More builders join as the network grows, though initially they’re primarily composed of founders.

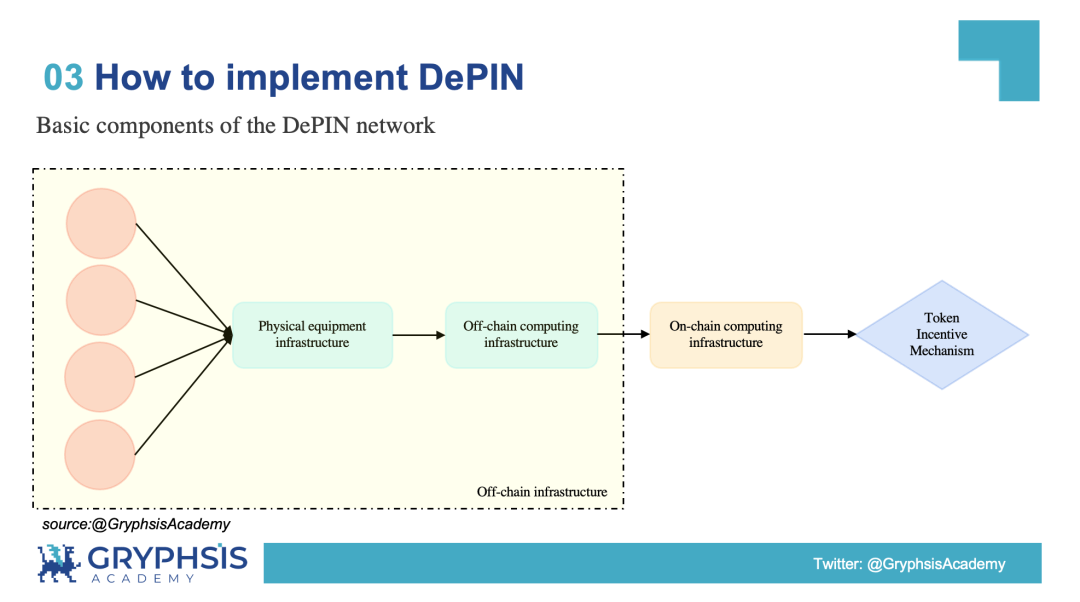

3.3 Core Components of a DePIN Network

For successful operation, a DePIN network must interact reliably with both on-chain and off-chain data, necessitating robust infrastructure and communication protocols. Key components include:

-

Physical Device Infrastructure: Typically provided by owners—hardware like GPUs and CPUs.

-

Off-Chain Computing Facilities: Data generated by physical devices must be uploaded via off-chain facilities for on-chain verification—this is the PoPW mechanism, usually implemented through oracles.

-

On-Chain Computing Facilities: Once verified, the system checks the owner’s on-chain address and distributes token rewards accordingly.

-

Token Incentive Mechanism: Also known as tokenomics, playing a critical role throughout different stages of network development—discussed in detail later.

3.4 Basic Operating Model of a DePIN Network

The operation follows a sequence similar to the architecture diagram: off-chain data generation → on-chain confirmation. Off-chain data flows bottom-up; on-chain data flows top-down.

-

Devices provide services to earn rewards: Hardware earns rewards (e.g., $HNT in Helium) by delivering services (e.g., signal coverage).

-

Provide Proof: Before receiving rewards, devices must prove they’ve performed required work—called Proof of Physical Work (PoPW).

-

Identity Verification via Public/Private Keys: Similar to public chains, DePIN devices use private keys to sign PoPW proofs, while public keys serve as identity tags (Device ID) for external validation.

-

Reward Distribution: Smart contracts record device owners’ wallet addresses, enabling direct transfer of earned tokens upon proof verification.

To simplify this process, consider an analogy with taking an exam.

-

Teacher: Token issuer, responsible for verifying authenticity of “student answers.”

-

Student: Token recipient, must complete the “exam paper” to receive token rewards.

First, the teacher distributes the exam papers. Students follow instructions to finish the test. Then students submit completed exams to the teacher for grading. Top scorers receive red flower awards based on descending rankings.

Here, the “distributed exam” corresponds to DePIN demand-side orders. Answers must follow certain rules (PoPW). To verify that student A completed the paper, the teacher checks handwriting (private key) and name (public key). Grading follows ranking principles—mirroring DePIN’s token distribution logic: “more contribution, more rewards.”

The basic operation of DePIN mirrors real-life examination systems. Many crypto projects map real-world models onto blockchains. When facing difficult concepts, using analogies with familiar life scenarios helps understand underlying logic and principles.

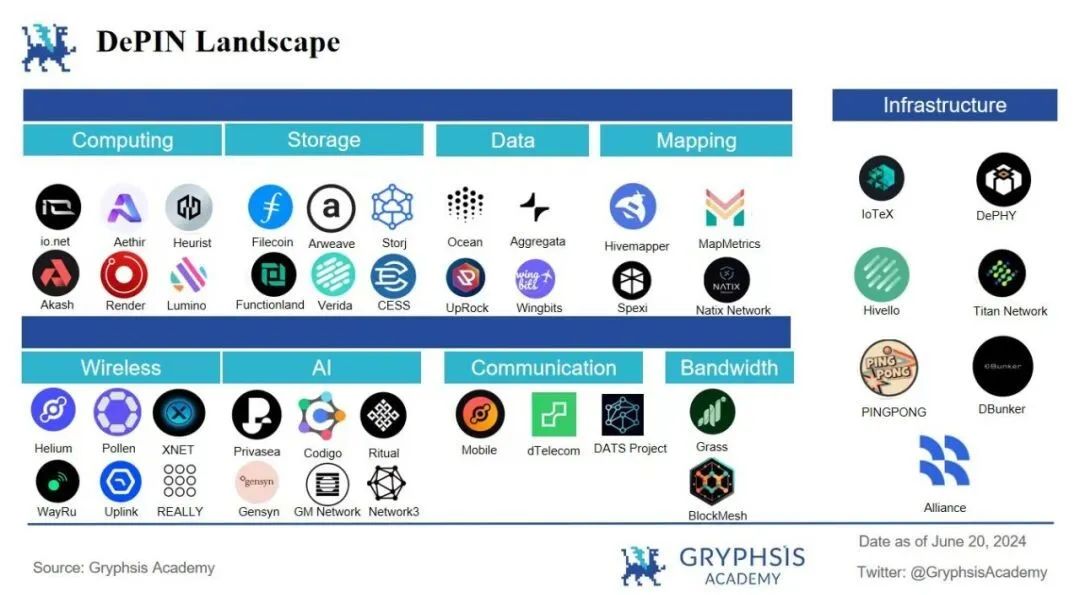

4. DePIN Sector Classification

Using the WHAT-WHY-HOW logical flow, we’ve reviewed the DePIN landscape broadly. Next, we break down specific subsectors. The categorization splits into two parts: Physical Resource Networks – Digital Resource Networks.

-

Physical Resource Networks: Incentivize participants to deploy location-based hardware, offering real-world, non-standardized goods/services. Subcategories: wireless networks, geospatial data networks, mobile data networks, energy networks.

-

Digital Resource Networks: Incentivize participants to deploy hardware and offer standardized digital resources. Subcategories: storage networks, compute networks, bandwidth networks.

Representative projects in each category include:

4.1 Decentralized Storage Network - Filecoin (FIL)

Filecoin is the world’s largest distributed storage network, with over 3,800 storage providers contributing more than 17M TB of capacity. Arguably the most famous DePIN project, its $FIL price peaked on April 1, 2021. Filecoin aims to bring openness and public verifiability to the three pillars supporting the data economy: storage, compute, and content delivery.

Filecoin stores files via IPFS (InterPlanetary File System), ensuring secure and efficient file storage.

A unique feature of Filecoin is its economic model: becoming a storage node requires staking a certain amount of $FIL. During bull markets, this creates a flywheel effect: “stake tokens → increase total storage space → attract more nodes → drive up token demand → surge in price.” But in bear markets, it risks spiraling price declines—making this model better suited for bullish cycles.

4.2 Decentralized GPU Rendering Platform - Render Network (RNDR)

Render Network is OTOY’s decentralized GPU rendering platform, connecting artists and GPU contributors to offer globally accessible powerful rendering capabilities. Its $RNDR price peaked on March 17, 2024—coinciding with the AI sector boom, as RNDR belongs to the AI narrative.

Render Network works as follows: creators submit GPU-intensive tasks (e.g., 3D scenes, HD images/videos), which are distributed to GPU nodes across the network. Node operators contribute idle GPU power and receive $RNDR rewards.

Its dynamic pricing model is another highlight, setting prices based on task complexity, urgency, and available resources—offering competitive rates for creators while fairly compensating GPU providers.

A recent positive development: iPad versions of Octane (a professional rendering app) are powered by the Render Network.

4.3 Decentralized Data Marketplace - Ocean (OCEAN)

Ocean Protocol is a decentralized data exchange protocol focused on secure data sharing and commercialization. Like other DePIN projects, it has multiple stakeholders:

-

Data Providers: Share data on the protocol

-

Data Consumers: Purchase access rights using OCEAN tokens

-

Node Operators: Maintain infrastructure and earn OCEAN rewards

For data providers, data security and privacy are paramount. Ocean Protocol ensures safe data circulation and protection through:

-

Security & Control: Blockchain ensures transparent and secure data transactions, giving full ownership and control to data creators.

-

Data Tokenization: Enables data to be traded like cryptocurrencies, boosting market liquidity.

-

Privacy Protection: Compute-to-Data allows computation without exposing raw data. Data owners approve AI algorithms to run locally, ensuring data never leaves their control.

-

Fine-Grained Access Control: Offers detailed permissions—specifying which users/groups can access what data and under what conditions—enabling secure sharing while preserving privacy.

4.4 An EVM-Compatible L1 - IoTeX (IOTX)

Founded in 2017, IoTeX is an open-source, privacy-centric platform integrating blockchain, secure hardware, and innovative data services to support a trustworthy Internet of Things.

Unlike other DePIN projects, IoTeX positions itself as a developer platform for DePIN builders—akin to Google Colab. Its key technology is W3bStream, an off-chain computing protocol connecting IoT devices to blockchains. Notable IoTeX-based DePIN projects include Envirobloq, Drop Wireless, and HealthBlocks.

4.5 Decentralized Hotspot Network - Helium (HNT)

Launched in 2013, Helium is a veteran DePIN project and the first to create a large-scale user-contributed hardware network. Users purchase third-party-manufactured Helium hotspots to provide wireless connectivity for nearby IoT devices. In return, Helium rewards hotspot owners with $HNT tokens for maintaining network stability—a mining-like model where the mining hardware is specified by the project.

There are two main hardware models in the DePIN space: (1) project-specified custom hardware (e.g., Helium); (2) incorporating widely available consumer hardware into the network (e.g., Render Network, io.net integrate users’ idle GPUs).

Helium’s core technology is LoRaWAN—a low-power, long-range wireless communication protocol ideal for IoT devices. These hotspots use LoRaWAN to provide wide-area wireless coverage.

Despite building the world’s largest LoRaWAN network, demand didn’t materialize as expected. Now Helium focuses on launching a 5G cellular network.

On April 20, 2023, Helium migrated to Solana and launched Helium Mobile (Americas Mobile)—offering unlimited 5G plans for $20/month. Thanks to its affordability, it quickly gained popularity in North America.

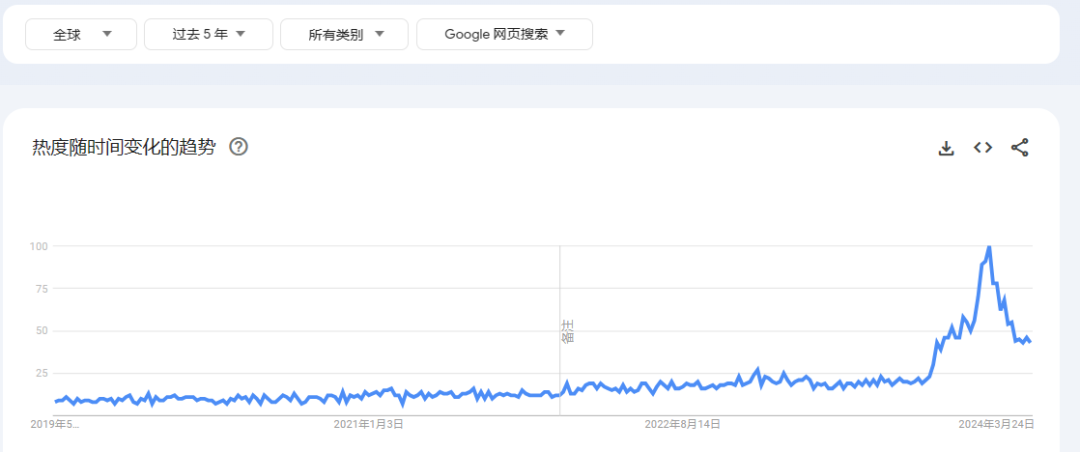

Global “DePIN” search trends show a spike from December 2023 to January 2024—exactly when $MOBILE prices peaked. Since then, DePIN interest has continued rising. Indeed, Helium Mobile ignited a new era of DePIN exploration.

source: @Google Trends

5. DePIN Economic Models

Economic models are crucial to DePIN project success, serving distinct purposes at different stages. During early phases, token incentives primarily attract users to contribute hardware/software resources and build supply-side infrastructure.

5.1 BME Model

Before diving deeper, let’s briefly review the BME model, as many DePIN economic designs relate to it.

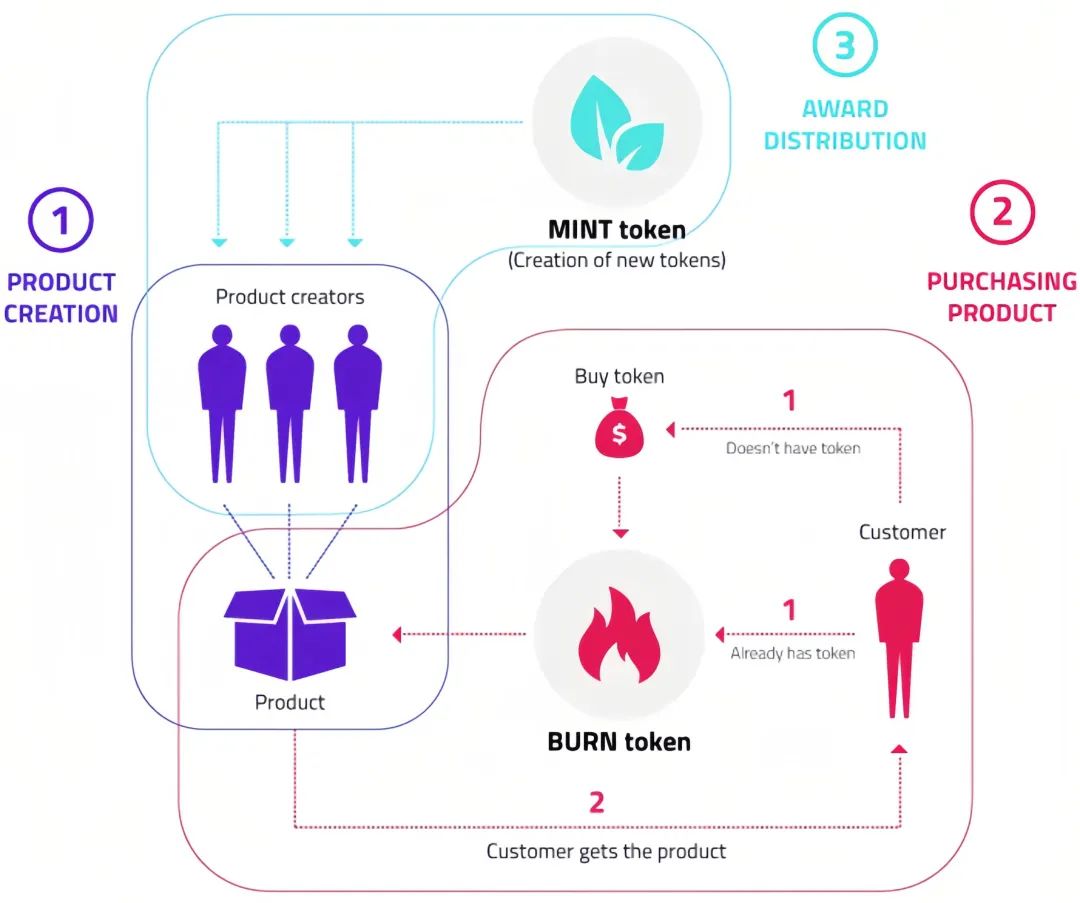

BME (Burn-and-Mint Equivalent) manages token supply and demand by having users burn tokens to buy goods/services while the protocol mints new tokens to reward contributors along the supply chain.

If newly minted tokens exceed burned amounts, supply increases and prices fall. Conversely, if burns surpass minting, deflation occurs and prices rise. Rising token prices attract more suppliers, creating a virtuous cycle.

Supply > Demand => Price drops

Supply < Demand => Price rises

We can further explain the BME model using the Fisher Equation—an economic model describing the relationship between money supply (M), velocity (V), price level (P), and transaction volume (T):

MV = PT

-

M = Money Supply

-

V = Velocity of Money

-

P = Price Level

-

T = Number of Transactions

When token velocity (V) increases, only burning tokens (reducing M) maintains equilibrium assuming other factors remain constant. Thus, as network usage grows, burn rate accelerates. When inflation and burn rates achieve dynamic balance, the BME model reaches stable equilibrium.

source: @Medium

Take purchasing goods in real life as an example. First, manufacturers produce goods, then consumers buy them.

During purchase, you don’t pay the manufacturer directly—you burn a set amount as public proof of receiving the good. Meanwhile, the protocol periodically mints new currency, transparently and fairly distributing funds to all contributors involved in production, distribution, sales, etc.

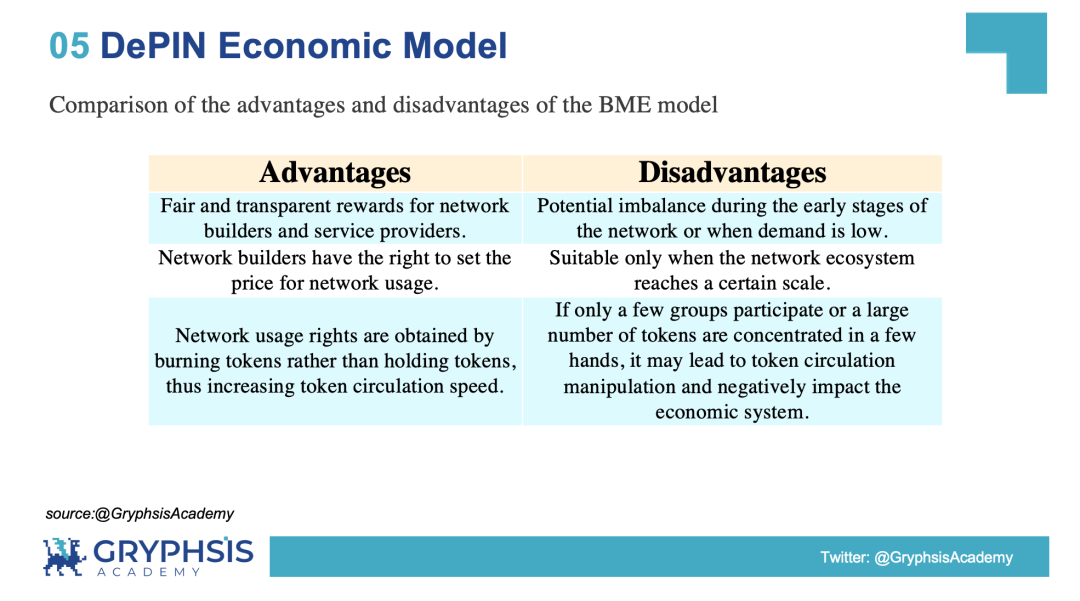

5.2 Pros and Cons of the BME Model

source:@GryphsisAcademy

5.3 Stages of Economic Model Development

With a basic understanding of BME, we can now clearly grasp common DePIN economic models.

Overall, DePIN economic models progress through roughly three stages:

Stage One: Cold Start & Network Construction Phase

-

Initial stage focused on establishing physical infrastructure

-

Use token incentives to attract individuals and organizations to contribute hardware/software (compute, storage, bandwidth), driving deployment and expansion

-

Projects often rely on core teams deploying nodes and promoting centrally until reaching critical mass

-

Tokens mainly reward hardware contributors, not used for paying network usage fees

Stage Two: Network Growth & Value Capture Phase

-

Once achieving critical scale, transition gradually to decentralized community governance

-

Attract end-users; tokens now also used to pay for network usage beyond just rewarding contributors

-

Capture economic value generated within the network and distribute it among contributors and participants

-

Tokenomics often employs BME to balance supply and real demand, avoiding inflation or deflation

Stage Three: Maturity & Value Maximization Phase

-

Large base of active users and contributors forming a self-reinforcing loop

-

Tokenomics emphasizes long-term value creation, using well-designed deflationary mechanisms to boost token value

-

May introduce new token models to optimize supply and enhance positive externalities in two-sided markets

-

Community self-governance becomes dominant mode of network management

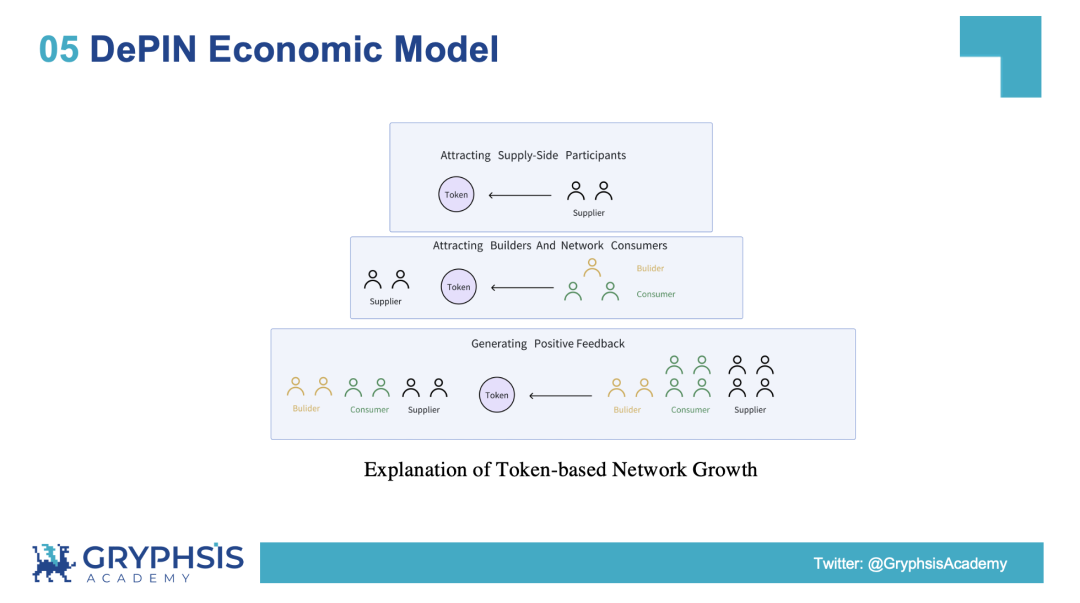

A strong economic model creates a flywheel effect for DePIN projects. Thanks to token incentives attracting early supply-side attention, DePIN can rapidly scale.

Token incentives are key to fast growth. Projects must define appropriate reward schemes based on infrastructure type and scalability goals. For instance, Helium offers higher rewards in areas with lower network coverage density to expand reach.

As shown below, early investors inject real capital, giving tokens initial economic value. Suppliers join actively to earn token rewards. As the network gains traction and offers cheaper alternatives to CePIN, more demand-side users adopt its services, generating revenue and forming a healthy supply-demand loop.

As demand increases, token prices rise via buyback/burn (BME model), further incentivizing suppliers to expand—increasing perceived token value.

With continuous network expansion, investor interest grows, bringing additional funding.

If the project is open-source or shares contributor/user data publicly, developers can build dApps atop it, creating extra value and attracting more users and

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News