A New Token Launch Model: How Does Lumoz Stand Out in the Current Node Sales Battle?

TechFlow Selected TechFlow Selected

A New Token Launch Model: How Does Lumoz Stand Out in the Current Node Sales Battle?

Why have so many project teams with strong technical backgrounds recently been particularly keen on selling nodes?

Author: Joe@Go2Mars

Last month, Lumoz announced the completion of a new strategic funding round, with well-known traditional mega funds such as IDG participating—just about a month after its Pre-A round. Earlier, Lumoz had revealed plans for an upcoming node sale, which has already surpassed half of its sales target, reflecting strong market response. Over the past few months, numerous high-quality projects have also conducted node sales. So why are so many technically robust projects recently favoring node sales?

Node Sales on the Rise: A Battle Ready to Begin

Node sales represent a novel token distribution model that benefits multiple parties. Due to their flexibility, they have become increasingly popular among both project teams and investors, emerging as a mainstream fundraising method. Any decentralized network requires a large number of nodes to function. Therefore, projects can allocate a certain portion of their tokenomics for node rewards (Node Rewards) through node sales, allowing investors to purchase mining nodes and earn these node token rewards.

So how should we understand node sales? Let's start from the familiar concepts of primary and secondary markets. The primary market is the main channel for project fundraising, but ordinary investors rarely get access to high-potential projects at this stage. The secondary market has no entry barriers, but projects listed there often come with higher valuations, placing significant demands on investors’ research and judgment. Node sales can thus be seen simply as a "1.5-level" market between the primary and secondary markets. For project teams, node sales offer greater flexibility compared to traditional primary fundraising. For retail investors, it allows early participation at lower valuations before the official token generation event (TGE), potentially yielding higher returns.

The factors influencing node sales are similar to those affecting regular token offerings. Therefore, when evaluating whether to participate in a project’s node sale, beyond fundamental analysis of the project itself, one should consider: 1) the proportion of node token rewards; 2) the release/ redemption rules for node tokens; and 3) the release schedules of other token allocations—such as those for ecosystem incentives, marketing, and most importantly—the team and investor token unlocks.

Data Speaks: Key Metrics from Lumoz

Next, let’s compare several leading node sale projects currently in the market—Lumoz, Aethir, CARV, and Sophon—using data, focusing on expected returns to understand why Lumoz stands out in the current wave of node sales.

Project Overview

-

Lumoz: Focused on modular compute layer and ZK-RaaS platform development and innovation. Lumoz aims to simplify the use of ZK-Rollups and enhance their general applicability, enabling mass deployment of zkEVM-based application chains. Developers can easily deploy their ZK-Rollup (zkEVM) across multiple blockchains. For miners, Lumoz operates as a multi-chain PoW protocol supporting mining across various public chains while generating zero-knowledge proofs for ZK-Rollups. Its modular compute layer efficiently utilizes idle computational power in the market, providing modularized support for ZK-Rollups.

-

Aethir: A scalable decentralized cloud infrastructure building distributed computing infrastructure based on GPUs, breaking down hardware-related barriers to empower AI and gaming applications.

-

Sophon: A modular blockchain focused on the entertainment sector, built on zkSync. As a zkSync hyperchain leveraging the ZK Stack, Sophon is customized for high-throughput applications.

-

CARV: A modular data layer protocol facilitating data exchange and value distribution between gaming and AI sectors. With CARV, individuals can now own, control, verify, and monetize their data, ensuring privacy, ownership, and control remain in personal hands.

Comparison of Basic Data

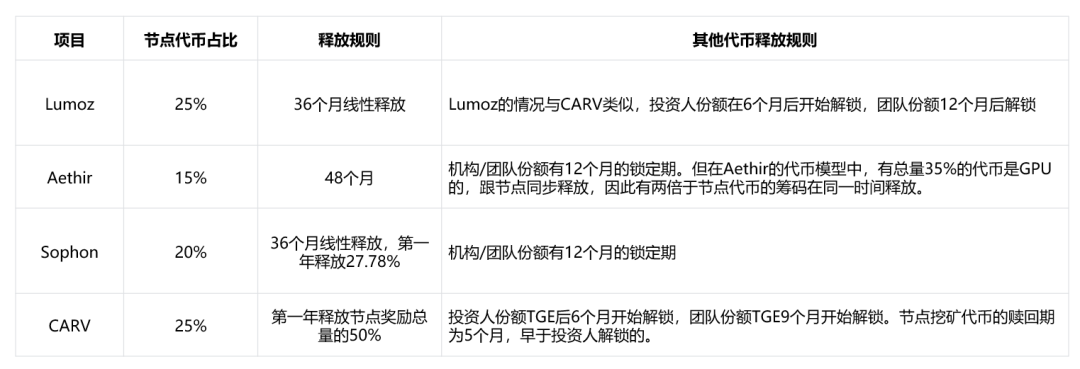

From the above node sale data panel, comparing the four major projects, Lumoz and CARV stand out for being generous in node token allocation, both assigning 25% of total supply to node sales, while Aethir and Sophon allocate only 15% and 20%, respectively. The most impactful factor on price stability during token release is the unlock schedule of the team and institutional investor allocations from earlier funding rounds.

In terms of token release mechanics, Lumoz distributes node tokens linearly over 36 months. Investors from two funding rounds face a 6-month lock-up followed by 36-month vesting, while the team’s allocation has a 12-month lock-up and 48-month vesting period. CARV’s investors unlock after 6 months, the team after 9 months. However, since CARV’s node tokens have a 5-month redemption period, they enter circulation earlier than investor tokens.

Aethir imposes a 12-month lock-up for both team and investors, but releases 35% of GPU tokens simultaneously with node tokens, creating twice the circulating supply of node tokens—likely resulting in unavoidable inflationary pressure. In contrast, Lumoz and CARV—with more generous node allocations and friendlier release structures—are likely to experience lower inflation rates during token unlocking.

Expected ROI and Payback Period Analysis

Lumoz’s Sale Plan

-

Node Token Reward Allocation: Purchasing and operating a Lumoz zkVerifier node grants access to 25% of total MOZ token rewards

-

Payment Methods:

-

ETH payments supported via Arbitrum network

-

BTC payments supported via Merlin Chain

-

BNB/BTCB payments supported via BSC network

-

USDT/USDC/ZKF (with 10% discount) payments supported via Arbitrum, BSC, and ZKFair Network

-

Referral Mechanism: Buyers can input a referral code during purchase to receive a discount (applied retroactively). Referrers can earn up to 10% commission.

-

Refund Policy: Six months after TGE, a refund window opens, allowing users to return all earned tokens and NFTs and receive an unconditional 80% refund of their payment.

Expected Returns and Payback Period for MOZ Node Token Holders

The above outlines Lumoz’s specific node sale plan: a maximum of 100,000 nodes across 10 tiers. The zkVerifier node price increases with each tier—from $200 in Tier 1 to $704 in the final tier, representing a ~2.5x increase. If all 100,000 nodes sell out, Lumoz will raise $40 million via node sales. Node buyers can expect total returns including: a share of 40 million Lumoz Points (pre-TGE), 25% of Lumoz tokens (post-TGE), and potential airdrops from new chains within the Lumoz ecosystem and partner projects.

Focusing on the most critical component of returns, we analyze only the MOZ node token rewards to estimate potential earnings from Lumoz’s node sale. Lumoz has completed three funding rounds, with a $300 million valuation in the latest round. Typically, a project’s market cap at TGE reaches around 10x its last private valuation—$3 billion in Lumoz’s case—making 25% of MOZ tokens worth $750 million. However, considering market sentiment, volatility, and other uncontrollable factors, we conservatively estimate the market cap at $1 billion, giving 25% of MOZ tokens a value of $250 million.

Further cost analysis shows a 15% price increase per tier from Tier 1 to Tier 10. Participating in Tier 1 costs $200 per node; Tier 3 costs $265; Tier 6 costs $402; and Tier 10 reaches $704. The chart displays only the first 12 months of token unlocks, though full vesting spans 36 months.

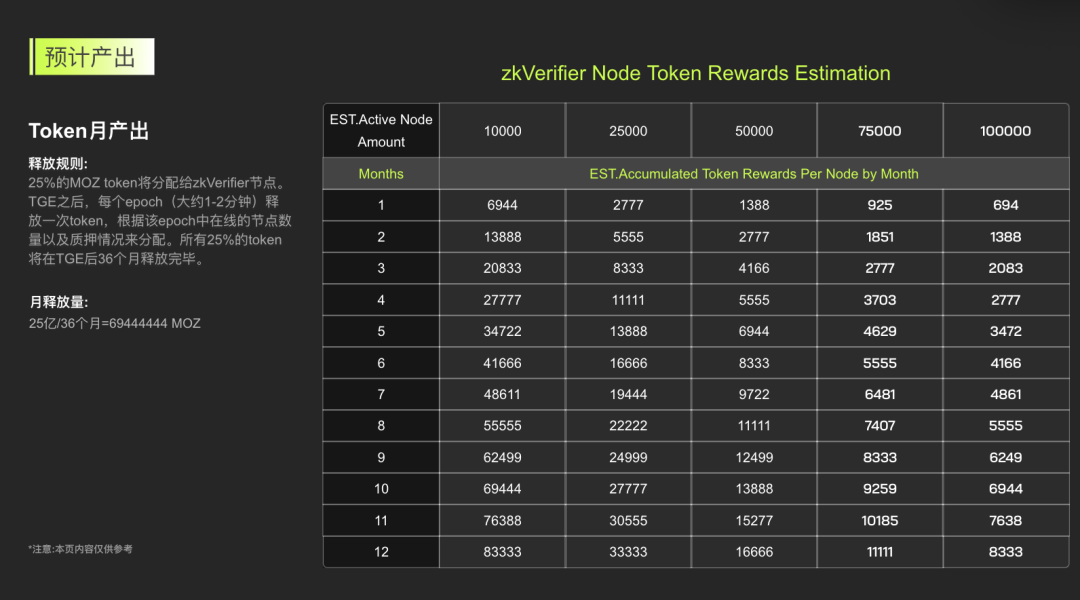

Total MOZ token supply: 10 billion. Monthly estimated token rewards: cumulative rewards per node by month.

After the node sale concludes, actual mining rewards depend on the number of concurrently online nodes and uptime. As shown in the chart, with 10,000 nodes online, each node earns 6,944 tokens in the first month. With 50,000 nodes online, monthly rewards drop to 1,388 tokens per node. In other words, the more nodes online simultaneously, the fewer tokens each individual node receives.

Total duration for full node reward release: 36 months

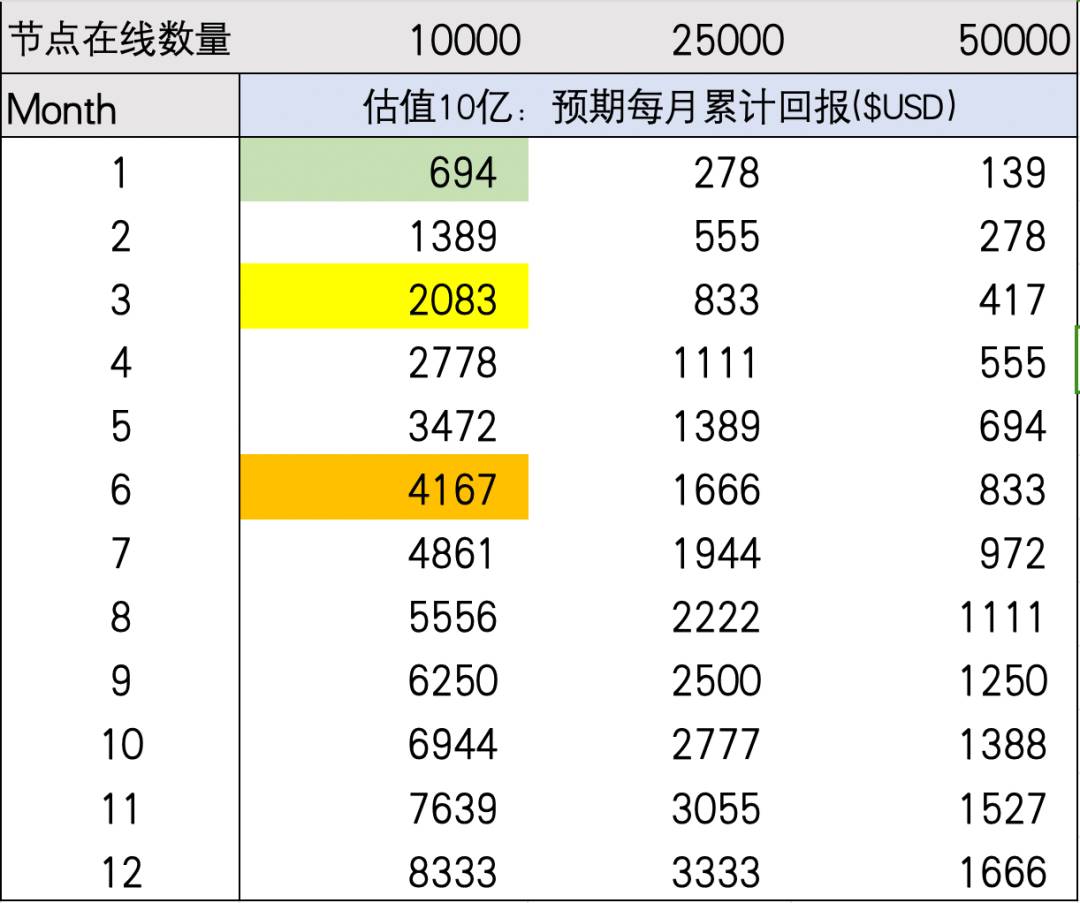

We can now further estimate mining returns. The table shows projected monthly returns in the first year based on a $1 billion valuation. Suppose lucky investor Xiao A successfully purchased in Tier 1 at $200 cost—the green blocks in the chart indicate his break-even point. With 10,000 nodes online, Xiao A achieves over 300% ROI in just one month and hits 10x returns ($2,083) by month three. Investor Xiao B, who bought into Tier 6 at $402, breaks even in the first month with over 150% ROI and exceeds 10x returns ($4,167) within six months.

Comparing with other projects, XAI—which sparked this wave of node sales—has a payback period of about four months. CARV, most similar to Lumoz, allows Tier 1 buyers to break even in the first month as well. However, because veCARV tokens must be redeemed into tradable CARV, a 1:1 redemption requires a 150-day waiting period—resulting in a minimum payback time of 4–5 months.

Regarding airdrop rewards, zkVerifier node buyers may also qualify for future airdrops from newly launched chains supported by Lumoz, ecosystem partners (e.g., Merlin Chain, ZKFair), and portfolio companies. Notably, MERL and ZKF token prices are currently near lows due to selling pressure from unlocks. As this pressure eases and market sentiment shifts, the anticipated airdrop value adds further appeal to Lumoz’s node sale, especially given the strong technology, backing, and narratives behind Merlin and ZKFair.

To Succeed, You Need Strength and Backing

As a global distributed modular computing network, Lumoz is dedicated to delivering advanced zero-knowledge proof (ZKP) services, supporting Rollup network growth and providing powerful compute resources for cutting-edge technologies like artificial intelligence (AI). To address the high computational costs in today’s ZKP landscape, Lumoz leverages years of deep expertise to innovate circuit designs and algorithms, significantly improving computation efficiency. This effectively solves the high-cost, low-efficiency challenges faced by Rollup projects and lowers the barrier for everyday users to enter the zero-knowledge computing space. Meanwhile, Lumoz’s modular compute layer absorbs excess market compute capacity to provide backend support for its ZK-Rollups.

Additionally, Lumoz’s zkVerifier node offers unprecedented convenience. By running a lightweight node, users can easily perform ZK computations and earn network rewards. This innovative approach promotes broader adoption of zero-knowledge computing, opening vast application possibilities for the industry. Since 2022, Lumoz has supported over 16 Rollup projects on testnet, processed 20,002,146 transactions, grown its community to 440,000 members, and since 2024 provided ZKP technical support for Merlin Chain (BTC L2), ZKFair (EVM L2), Orange Chain (BTC L2), and over 20 upcoming new chains.

With compelling narratives, unique core technology, and solid R&D capabilities, Lumoz has attracted strong interest from capital markets. In April, Lumoz closed its Series A round at a $120 million valuation, led by Polychain. Other investors include top crypto-native firms like OKX Ventures and traditional U.S. dollar funds active in crypto, such as GGV and IDG Capital. Then at the end of May, Lumoz announced a strategic round at a $300 million valuation, with undisclosed amount, co-led by IDG Blockchain, Gate Ventures, Blockchain Coinvestors, and Xiayan Capital. This robust funding background undoubtedly strengthens Lumoz’s competitive edge in the ongoing node sale race.

Conclusion

Summer is approaching, and we’ve just endured what felt like a long two-month bear market. Now, with ETH ETF approvals and strong pro-crypto statements from Trump, market expectations for a bull run are poised to reach another peak. Historically, the consensus suggests the real climax of this bull cycle hasn’t arrived yet—or at least hasn’t matched March’s highs. Under this optimistic momentum, a project like Lumoz—rich in narrative, strength, and backing—is hard not to root for.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News