Lumoz TGE Imminent: Can It Become the Leader in the Modular Track?

TechFlow Selected TechFlow Selected

Lumoz TGE Imminent: Can It Become the Leader in the Modular Track?

Where does the high value assessment of Lumoz tokens come from?

Author: Shaofaye123, Foresight News

As the Ethereum ecosystem continues to evolve, issues such as network congestion, high transaction fees, and lack of customization have become increasingly prominent. Scalability and customization are now primary concerns for application developers, and Rollup, as a mainstream scaling solution, has significantly improved the throughput and efficiency of blockchains like Ethereum. Lumoz, a leading player in the RaaS (Rollup-as-a-Service) space, is about to launch its mainnet. This article will provide an in-depth analysis of Lumoz and the value accrual behind its token.

What Is the Value of the Airdropped Token?

Crypto market sentiment is steadily recovering, and 2024’s final major airdrop has finally arrived. Modular compute layer and RaaS platform Lumoz is approaching mainnet launch and TGE. The airdrop campaign launched on November 5 allocates 10% of the total token supply (with a total supply of 10 billion tokens). Based on the last funding round valuation, the total airdrop value is approximately $30 million. The campaign covers users from the ETH ecosystem, Move ecosystem, and more. Its broad eligibility and substantial value have drawn significant market attention, attracting over 5 million users to check and confirm their esMOZ balances.

Currently, Lumoz employs a dual-token economic model consisting primarily of the utility token MOZ and the staking token esMOZ. The utility token MOZ is used for transaction fees, resource usage fees, and other applications; esMOZ can be used for incentives, delegating to zkVerifier nodes, and exchanging for the utility token MOZ. The current airdrop distributes the staking token esMOZ, which can be exchanged 1:1 for the utility token MOZ—though subject to a vesting period. However, to accommodate community demand for immediate access, the Lumoz team introduced an innovative mechanism via OG NFTs, allowing esMOZ holders to directly exchange for MOZ without locking. Moreover, all official channels for obtaining Lumoz OG NFTs are free. This initiative has earned widespread praise from the community. As of this writing, Lumoz OG NFTs remain the top search and trading item on NFT marketplaces such as Element and AlienSwap. With increasing rarity and proximity to TGE, the value of Lumoz OG NFTs continues to rise. It is understood that Lumoz OG NFTs will remain usable after the mainnet launch, maintaining the 1:1 exchange ratio. Given the immense community anticipation, the price trajectory of Lumoz OG NFTs is expected to surge even further.

But what exactly is the intrinsic value of MOZ, Lumoz’s utility token? How much upside potential could it have upon listing?

MOZ Token Valuation Analysis

According to Lumoz’s published tokenomics, the total supply of MOZ is 10 billion tokens, with 66% allocated to the community, ecosystem, nodes, and miners. Specifically, 25% goes to the zkProver network, 25% to zkVerifier nodes, 16% to early contributors, 18% to early investors, 10% to the ecosystem, and 6% to the community. This distribution genuinely prioritizes community and user ownership. Currently, the initial circulating supply of MOZ is only 11%, with the remainder gradually unlocking over the next 10 years. This design effectively reduces sell pressure at launch, enhances market stability, and aligns with long-term project goals. Additionally, the MOZ token will never be inflated, further ensuring its value is not diluted.

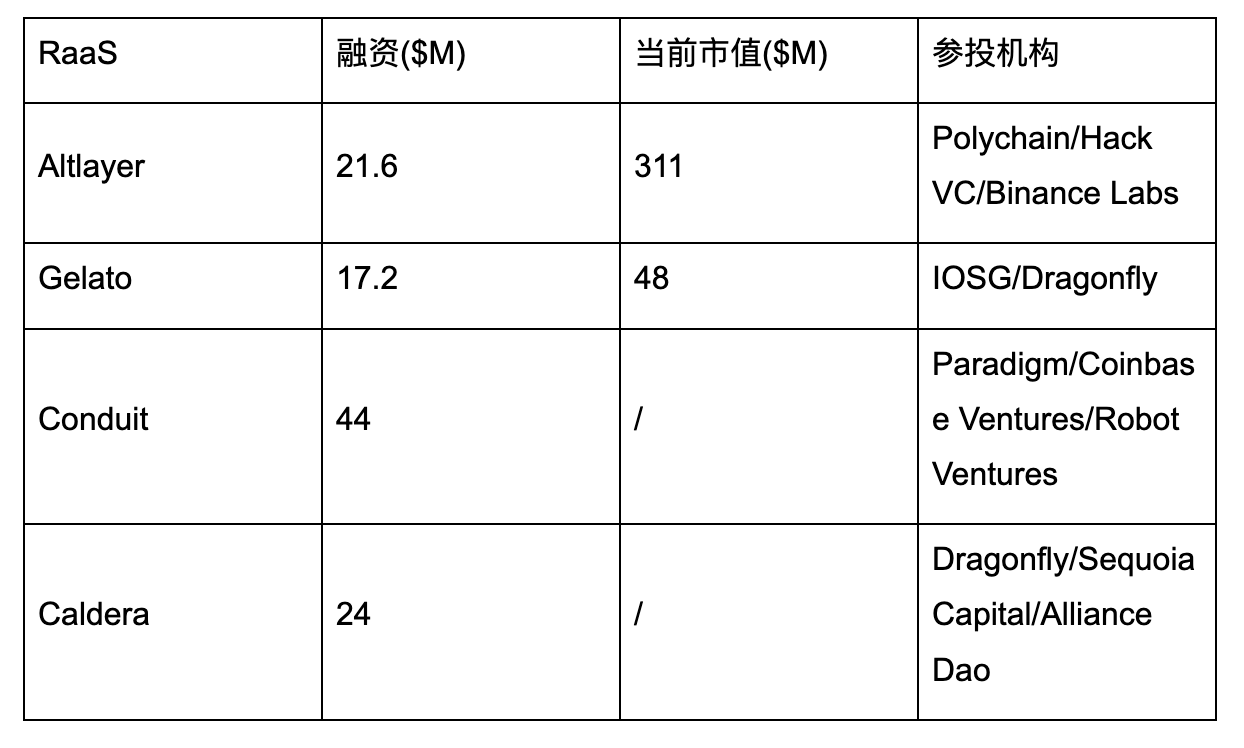

Compared to other projects in the RaaS (Rollup-as-a-Service) sector, while Altlayer and Gelato have introduced no-code chain deployment services, Lumoz stands out through its RaaS Launch Base platform, showcasing unique technological advantages and competitiveness.

Relative to Altlayer and Gelato, Lumoz holds clear advantages in Rollup compatibility and ecosystem extensibility. Altlayer has strengths in no-code deployment but relies on a single technical stack, limiting developer flexibility. Gelato focuses mainly on automation and improving developer toolchains—reducing operational complexity to some extent—but lacks the broad Rollup compatibility offered by Lumoz. In contrast, Lumoz integrates multiple cutting-edge ZK Rollup technologies, comprehensively meeting diverse developer needs and making its ecosystem more attractive and innovation-friendly.

This diversified integration provides strong support for the long-term value of the Lumoz token. By supporting multiple ZK Rollup technologies, Lumoz significantly lowers development and deployment complexity, enabling more developers to enter the Rollup ecosystem, thereby directly driving demand for the token. Furthermore, the diversified tech stack ensures high adaptability and risk resilience in the market, meaning that amid technological evolution and market shifts, the Lumoz token is better positioned to maintain sustained demand and appreciate in value.

With mainnet launch imminent, the high value of Lumoz’s token is beginning to emerge. From a financing perspective, disclosed information reveals a strategic round raising $14 million, achieving a $300 million valuation—comparable to Altlayer’s current market cap of $311 million.

RaaS, as a potentially hot narrative, is a prime destination for capital inflow. Unlike other projects in the space focusing on the technically simpler Optimistic Rollup, Lumoz is currently the only pure-play ZK Rollup project. It plays a pivotal role in advancing large-scale adoption and popularization of ZK-Rollup technology, positioning its token as a potential leader capable of breaking through sector ceilings.

Beyond technical leadership, Lumoz supports over 20 L2s and continues innovating. Operationally, it actively builds its brand through marketing initiatives in crypto-active regions such as Japan, South Korea, Turkey, and Russia, establishing strong brand recognition and a vast user base.

As the market thrives, CZ recently tweeted hints about ALT, causing Altlayer’s token price to spike toward $0.19, with FDV nearing $2 billion. Meanwhile, Celestia, another key modular narrative, now boasts a valuation of $9 billion. Considering TIA’s pre-listing valuation of $1 billion, its ROI has already reached 900%.

In this context, Lumoz’s fully diluted market cap at launch could reasonably reach around $1 billion.

Web3’s AWS: Driving High Valuation Potential

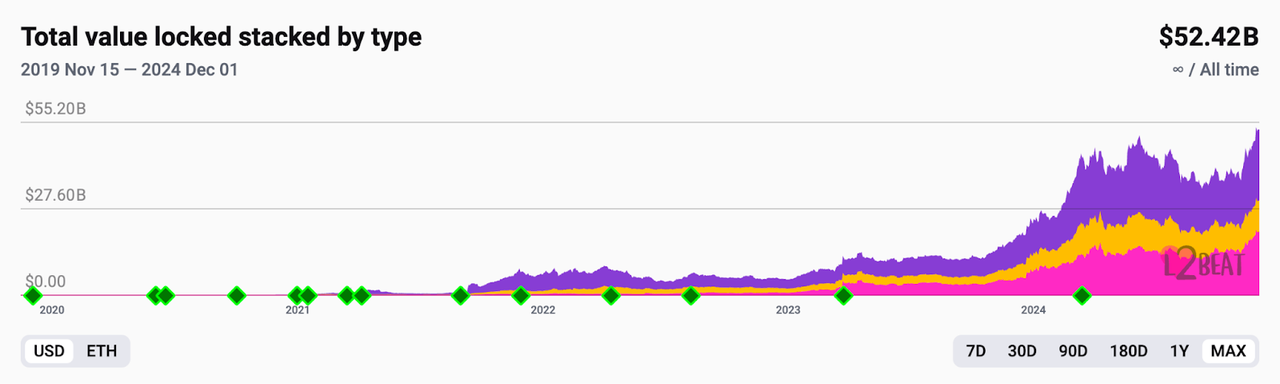

Under the blockchain trilemma, scalability remains a core bottleneck plaguing the industry. The continuously growing TVL reflects strong market demand for L2 solutions. Effectively solving scalability remains key to achieving Web3 mass adoption.

ZK Rollup, as a scaling solution, effectively addresses these challenges, leading the way in Layer 2 expansion due to its advantages in scalability and privacy protection. Yet, despite growing attention and deployment, deep challenges remain.

Leader in the RaaS Sector

High computational complexity, difficult development, and hardware dependency have become hallmarks of ZK Rollup. These factors deter many projects or force them to divert excessive resources to foundational infrastructure, detracting from their core business focus.

This dilemma closely mirrors the early days of the internet—until Amazon Web Services (AWS) emerged and broke the deadlock. Post-AWS, it became evident that projects leveraging cloud hosting to focus on their core operations tended to succeed further. AWS drastically reduced computing and storage costs, enabling applications to concentrate on product development, lower expenses, and innovate faster—enhancing competitive advantage.

Similarly, Lumoz, as a leader in the RaaS space, provides developers and applications with essential modules—including decentralized storage, smart contract execution, identity verification, and data computation—creating fertile ground for innovation. Compared to AWS’s centralized risks such as single points of failure and data privacy concerns, Lumoz, as a decentralized platform, leverages blockchain’s immutability and decentralization to eliminate reliance on any single entity, offering Web3 applications a more secure and transparent infrastructure. Furthermore, just as AWS serves as foundational infrastructure across industries—from internet and finance to healthcare—virtually every sector can build its tech stack on AWS. Likewise, Lumoz is expanding into multiple industries and use cases, especially during Web3’s early growth phase, where DeFi, GameFi, RWA, and the metaverse are rapidly evolving. Through collaboration with other blockchain projects and protocols, Lumoz empowers dApps with greater diversity and accelerates the Web3 transformation across verticals. Lumoz is not merely a modular tool—it is foundational to the prosperity of other ecosystems.

Thus, viewing Lumoz as “AWS of Web3” is far more than a superficial analogy. The role it plays in decentralized networks bears profound similarity to AWS’s function in traditional internet infrastructure. Since its inception, Lumoz’s ZK-PoW mechanism has attracted 145 global miners, over 20,000 testnet validator nodes, more than 1.5 million users, 200+ projects, and 28,137 validators. As the AWS of Web3, Lumoz ranks among the few blockchain applications with genuine real-world value. It is not merely middleware—it is a foundational pillar enabling the flourishing of the Web3 ecosystem. Therefore, comparing Lumoz’s potential to AWS’s current trillion-dollar market cap, Lumoz remains vastly undervalued despite its immense upside.

Strong Overall Capabilities

After analyzing Lumoz’s high valuation ceiling, we must also rationally assess its valuation floor. Evaluating the team's strength, technical capabilities, and ecosystem advantages reveals whether the token is suitable for long-term value investment.

Team strength and community building are key drivers of sustainable growth—and Lumoz excels in both areas. Lumoz’s core team has been deeply involved in ZK technology since 2018, consistently committed to making zero-knowledge computation more efficient and accessible: “Making ZK-Rollup Within Reach.” On the funding front, Lumoz has completed a strategic round raising $14 million, backed by top-tier investors including OKX Ventures, HashKey Capital, KuCoin Ventures, Polygon, and IDG Blockchain.

On community development, Lumoz consistently prioritizes sustainability. Whether through testnet campaigns or airdrops, it places strong emphasis on community rights, drawing massive participation. The Pre-Alpha testnet attracted 87,567 participants, Alpha testnet gained 286,179 followers, and Quidditch testnet surpassed one million participants.

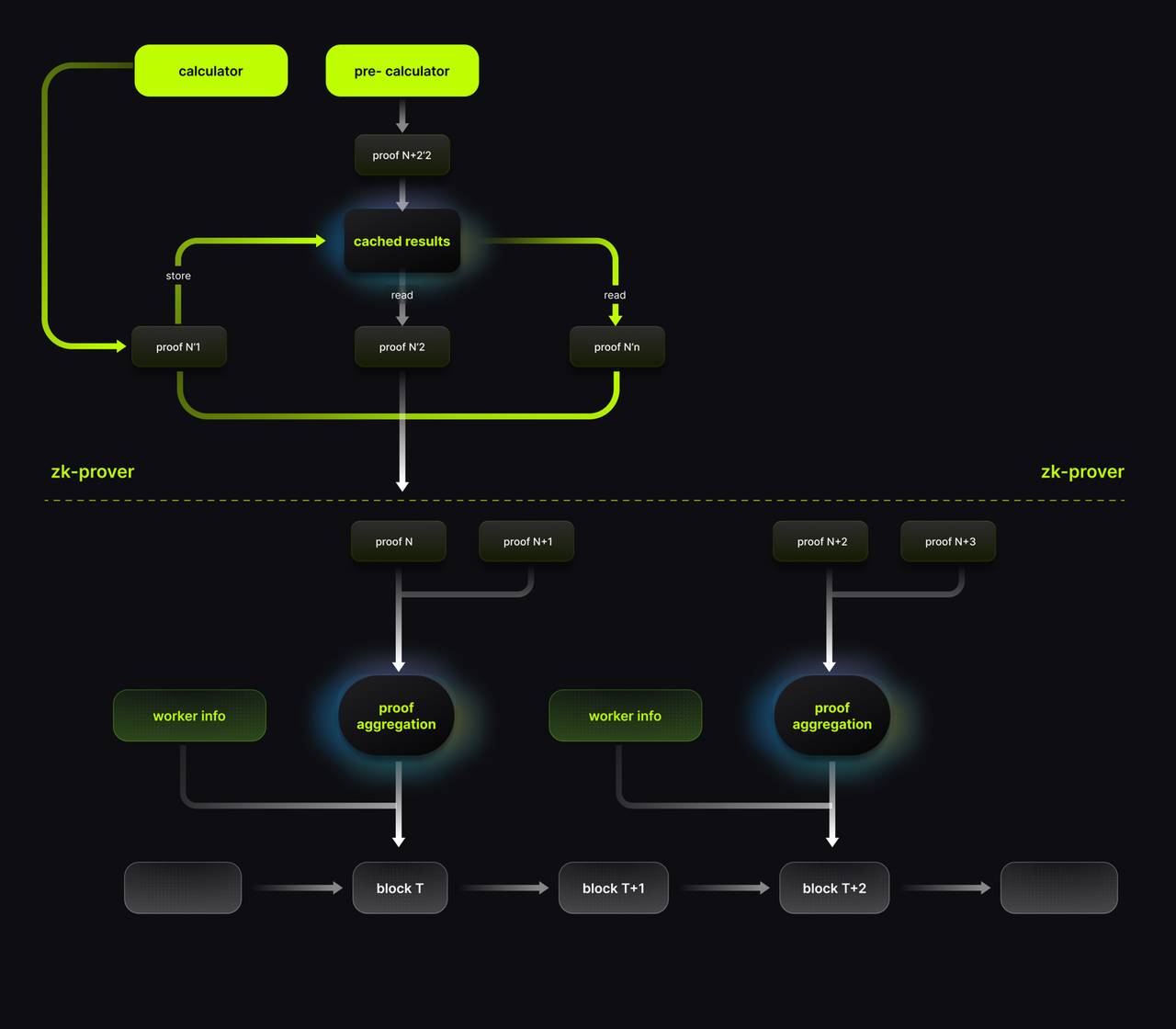

Building technological moats and delivering leading solutions are critical forces shaping future market dynamics. Lumoz occupies a key position thanks to its unique technical advantages and innovative approaches. Lumoz’s ZK-PoW algorithm creates a unified marketplace for ZKP computing power, eliminating unnecessary proofs and address aggregation calculations. Its two-step submission algorithm enables parallel ZKP computation with sequential submission, allowing miners to concurrently execute multiple ZKP generation tasks—significantly accelerating proof generation. The “OP Stack + ZK Optimization Architecture” introduces a new zk-proposer component, reducing integration and maintenance costs while enhancing network security and stability. The “ZK Fraud Proof Module Optimization” greatly improves ecosystem flexibility. The NCRC Protocol delivers a trustless native cross-chain bridge for ZK-Rollup, enabling seamless asset transfers across chains.

Lumoz stands at the forefront of the modular赛道, having provided technical services or support to over 20 high-quality projects or L2s, including CARV, UXLINK, ZKFair, Merlin Chain, MATR1X, and Ultiverse. Its technological innovations further empower ecosystem growth. On one hand, Lumoz continuously expands its ecosystem and strengthens partnerships, boosting the token’s latent value. On the other, its strategy reflects a blend of global vision and localized execution. For instance, Lumoz partnered with UFLY, the fund under Web3 social platform UXLINK, to co-develop a Social Growth Layer (SGL), leveraging social apps to drive growth and user adoption in Japan and South Korea’s crypto markets. Just one week before announcing the UXLINK collaboration, Lumoz revealed cooperation and an airdrop with the CARV community, jointly empowering AI compute and market initiatives to strengthen the ecosystem. Additionally, Lumoz has conducted a series of marketing activities in crypto-thriving regions like Turkey and Russia, actively building brand awareness and deepening ties with local communities. Through these strategies, Lumoz not only expands its geographic reach but also advances social协同发展, transcending regional value boundaries.

Therefore, from these perspectives, Lumoz—as a project committed to long-term development—exhibits strong value accrual, providing a solid foundation for its token valuation.

Conclusion

Today’s blockchain ecosystem faces challenges similar to those of the early internet—an inflection point requiring RaaS to突破scalability limits. As the “AWS of Web3,” Lumoz possesses extraordinary upside potential. As a continuously evolving project, the MOZ token is projected to deliver at least a 5x return in the long run. The RaaS narrative is poised for breakout, and Lumoz, as a distinctive player in the space, stands at the intersection of opportunity and challenge.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News