Huobi Research | BTCFi and CoreX: Leading the Future of Bitcoin Decentralized Finance

TechFlow Selected TechFlow Selected

Huobi Research | BTCFi and CoreX: Leading the Future of Bitcoin Decentralized Finance

This report provides a detailed introduction to CoreX's product design philosophy, functional features, and competitiveness.

Preface

2024 has been a year of explosive momentum for Bitcoin. At the beginning of the year, the SEC approved Bitcoin ETF listings, followed by Hong Kong granting similar approvals—good news continued to pour in. With last month’s halving now complete, Bitcoin is undoubtedly advancing toward even greater ambitions. On the application front, we’ve seen ecosystem innovation driven by Ordinals. As growing interest led to network congestion, Bitcoin scalability has once again become a focal topic. After several months of development, the market now sees a flourishing landscape of Bitcoin Layer 2 solutions and sidechains, with BTCFi emerging as a major sector expected to have vast future potential.

We noticed Core early in the development of BTCFi because it introduced an innovative approach as a public blockchain addressing core challenges of Layer 1 security, speed, and decentralization. The Satoshi Plus mechanism fully leverages Bitcoin’s network security, with consensus backed by the Bitcoin network while delivering high transaction throughput and sufficient decentralization (for more details on Core, refer to: https://docs.coredao.org/core-white-paper-v1.0.7).

We believe Core is the ideal foundation for developing BTCFi. As one of the earliest ecosystem partners supporting Core, Huobi HTX strategically invested in CoreX—the decentralized exchange built on its ecosystem—and views CoreX as the gateway and liquidity hub for the future CoreDAO ecosystem, offering a new trading experience. This report details CoreX’s product design philosophy, features, and competitive advantages. Huobi HTX believes CoreX will become one of the most competitive DEXs within CoreDAO and serve as an ecosystem catalyst, becoming the central destination for user liquidity.

Why We Are Bullish on BTCFi

Bitcoin Decentralized Finance (BTCFi) refers to bringing DeFi functionalities into the Bitcoin ecosystem. For years, despite being the blockchain network with the strongest consensus and security, Bitcoin lacked smart contract capabilities, preventing it from hosting decentralized applications like Ethereum or other programmable blockchains. As a result, Bitcoin has largely been treated as a "hold" (HODL) asset. For Bitcoin holders, experiences such as on-chain lending, decentralized exchanges, and derivatives trading have remained largely absent.

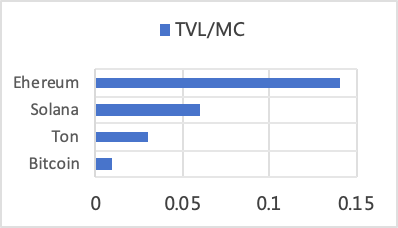

This year’s emergence of Ordinals and Runes explored new use cases for the Bitcoin ecosystem, demonstrating strong market demand for general-purpose functionality on Bitcoin. However, we believe Bitcoin’s potential in DeFi remains largely untapped. Currently, BTCFi’s total value locked (TVL) stands at nearly $1.2 billion, only 0.09% of Bitcoin’s total market cap. In comparison, leading smart contract platforms show much higher ratios: Ethereum’s DeFi TVL represents 14% of its market cap, Solana 6%, and Ton around 3%. Even at just 1%, BTCFi would have tenfold room for growth.

Figure 1: Comparison of Ecosystem TVL-to-Market Cap Ratios and Market Caps

We believe BTCFi not only unlocks immense value within Bitcoin’s market capitalization but also offers new yield-generating opportunities for BTC holders. Through BTCFi, users can move beyond passive holding (HODLing) and actively utilize their BTC via staking, lending, and market-making. As BTCFi protocols evolve, they are poised to compete with—and potentially surpass—existing ecosystems on other blockchains, fostering a more diverse and robust DeFi ecosystem.

The Rise of CoreDAO

There are various approaches to expanding Bitcoin’s functionality today. Among them, Core—a Layer 1 public blockchain secured by the Bitcoin network and compatible with the Ethereum Virtual Machine (EVM)—offers an innovative solution.

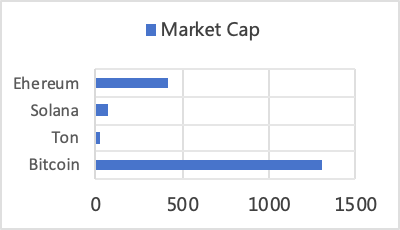

Core’s security is guaranteed by a consensus mechanism called Satoshi Plus, which ensures network safety through three channels: DPOW (Delayed Proof of Work), DPoS (Delegated Proof of Stake), and non-custodial Bitcoin staking. First, DPOW leverages Bitcoin’s PoW security—miners securing the Bitcoin network can simultaneously delegate their hashing power to Core nodes, contributing to Core’s consensus security. Currently, 46% of Bitcoin mining nodes have delegated hashing power to Core, providing 259 EH/s of computational support. Additionally, Core’s security is reinforced by staked Core tokens and Bitcoin across the network, with approximately 125 million Core tokens and 3,000 BTC already staked. This hybrid PoW+DPoS model ensures both robust security and fast transaction execution.

Non-custodial staking is another milestone innovation from Core. Without requiring trust in centralized custodians, Bitcoin holders can securely participate in Core’s consensus and earn staking rewards while retaining full control over their BTC. This significantly lowers the barrier to entry for Bitcoin holders and enhances Core’s overall security. Users don’t need to bridge their Bitcoin across chains or wrap it into assets like WBTC. This fully non-custodial mechanism has the potential to attract a massive number of Bitcoin holders to participate in Core’s consensus.

Looking ahead, we see DeFi as a key focus area for CoreDAO’s development. Bitcoin users will be able to engage in lending, derivatives trading, and other protocols without giving up ownership of their BTC. Innovations may include using BTC as collateral for positions, earning liquidity rewards directly in Bitcoin, or Bitcoin-denominated liquidations. Building upon staking yields, liquid staking models are also expected to emerge.

What Is CoreX

CoreX will serve as the flagship DEX within the CoreDAO ecosystem, offering users an exceptional trading environment through its simple yet intelligent design and comprehensive toolkit. Built on Uniswap V3’s architecture, CoreX addresses critical issues like insufficient liquidity and high slippage, while integrating advanced artificial intelligence to create a dynamic social trading center.

How CoreX Creates a New Trading Experience

CoreX delivers a completely new trading experience through its optimized user experience, social features, and AI technology. It aims to lower the entry barrier for new users, enabling them to easily access the world of DeFi.

By providing a user-friendly trading interface, CoreX significantly enhances the traditional DEX experience. The platform includes advanced real-time charting tools that allow traders to track price movements of selected tokens, along with integrated technical indicators and drawing tools for deeper analysis. These features are especially useful and intuitive for traders who wish to share insights on social media. Beyond these powerful charting capabilities, detailed transaction information—including realized profit or loss—is displayed directly on the trading interface, making key data easy to understand and access. Looking forward, CoreX plans to introduce customization options, allowing traders to tailor their trading environment using an intuitive drag-and-drop interface to meet their specific needs.

CoreX also elevates social trading to a new level. It offers global chat rooms and coin-specific chat rooms where traders can exchange ideas and share trading opportunities with fellow crypto enthusiasts. For dedicated users, CoreX provides one-on-one encrypted messaging and the ability to create private chat rooms. Moreover, CoreX integrates social elements into its operations, including high-yield staking programs and exclusive online and offline events to recognize and reward NFT holders. Recently, CoreX launched a major social airdrop campaign distributing up to 10 million tokens, attracting significant attention.

Additionally, CoreX offers users an intelligent trading assistant powered by machine learning algorithms. This assistant recommends personalized trading opportunities based on individual preferences, technical analysis, and social sentiment. CoreX also features one-click copy trading, allowing users to effortlessly follow successful traders’ strategies. Furthermore, it partners with algorithmic trading firms to provide precise price predictions, helping users gain an edge in competitive markets.

HTX Ventures’ Strategic Investment in CoreX

Crypto traders are constantly seeking platforms that deliver consistent returns and superior trading experiences. CoreX places user experience at its core and leverages social and AI technologies to offer intelligent, high-quality interactions—giving us strong reasons to pay close attention. We believe CoreX will elevate CoreDAO’s DeFi ecosystem to new heights. Going forward, HTX Ventures will continue monitoring the CoreDAO ecosystem and leverage our resources and expertise to support its growth.

—---------------------------

About HTX Ventures:

HTX Ventures is the global investment arm of Huobi HTX, integrating investment, incubation, and research to identify the world’s most outstanding and promising teams. As a blockchain industry pioneer with over a decade of experience, HTX Ventures drives cutting-edge technological advancements and emerging business models, providing partner projects with comprehensive support—including fundraising, resources, and strategic consulting—to build a sustainable blockchain ecosystem.

To date, HTX Ventures has supported over 300 projects across multiple blockchain sectors, with select high-potential projects listed on Huobi HTX. Additionally, HTX Ventures is one of the most active fund-of-funds (FoF) investors, collaborating with top-tier global blockchain funds such as Dragonfly, Bankless Ventures, Gitcoin, Figment, and Animoca to co-develop the blockchain ecosystem.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News