A Comprehensive Analysis of AO Tokenomics: 100% Fair Distribution, Earn AO by Holding AR in the Future

TechFlow Selected TechFlow Selected

A Comprehensive Analysis of AO Tokenomics: 100% Fair Distribution, Earn AO by Holding AR in the Future

A total of 21 million coins, a 100% fair issuance token modeled after Bitcoin.

Author: AO Foundation

Translation: PANews Editorial Team

On June 14, the AO Foundation officially launched the tokenomics of its decentralized supercomputer, AO.

8 Key Facts and Dates About AO Tokens

-

AO is a 100% fairly launched token following the Bitcoin economic model.

-

AO tokens will be used to secure messaging within its network.

-

The minting mechanism began retroactively running from February 27, 2024, at 13:00 Eastern Time (block 1372724). During this period, 100% of the AO tokens minted have been distributed to Arweave token holders based on their respective balances held every five minutes. If AR was held on an exchange or custodian, users should inquire about how to receive the tokens.

-

In the future, one-third (33.3%) of newly minted AO tokens will be distributed proportionally to AR token holders every five minutes. The remaining two-thirds (66.6%) will be minted for depositing assets into AO, strongly incentivizing economic growth.

-

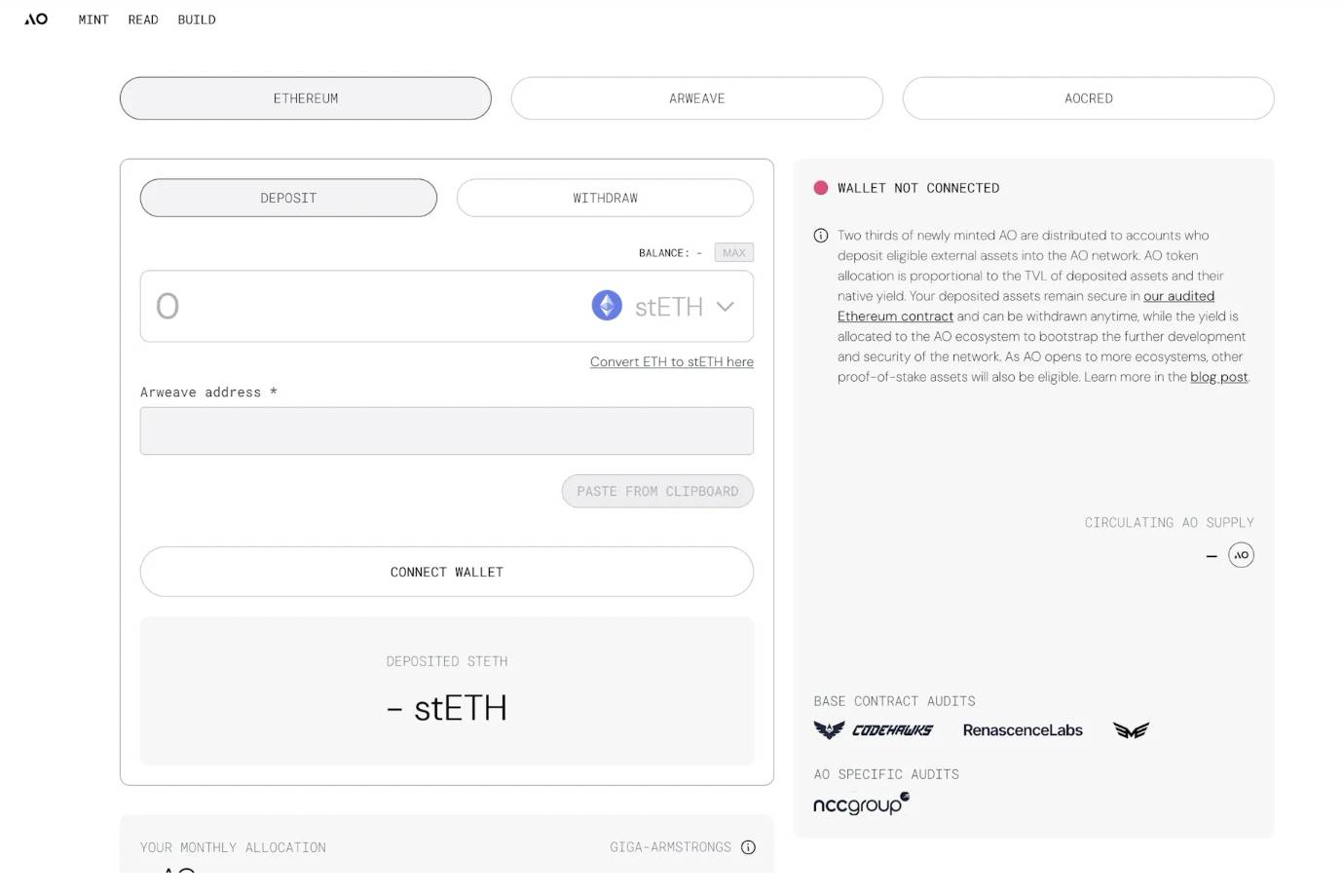

Phase one of the bridging contract has gone live today. In this pre-bridge phase, users’ tokens remain securely on their native network while they begin earning AO tokens. Once phase two of the bridge launches, users will be able to deposit assets into the new bridging contract and use them on AO—while continuing to earn rewards. Users can deposit staked Ethereum (stETH) tokens into the audited pre-bridge contract here.

-

Transition rewards will begin on June 18, 2024, at 11:00 AM Eastern Time.

-

Users may withdraw tokens from the pre-bridge at any time, but will only start earning AO once rewards begin on June 18. Rewards are distributed once every 24 hours.

-

AO tokens will remain locked until approximately 15% of the total supply has been minted, expected around February 8, 2025.

Overview: 21 Million Total Supply, 100% Fair Launch

AO is a 100% fairly launched token modeled after Bitcoin.

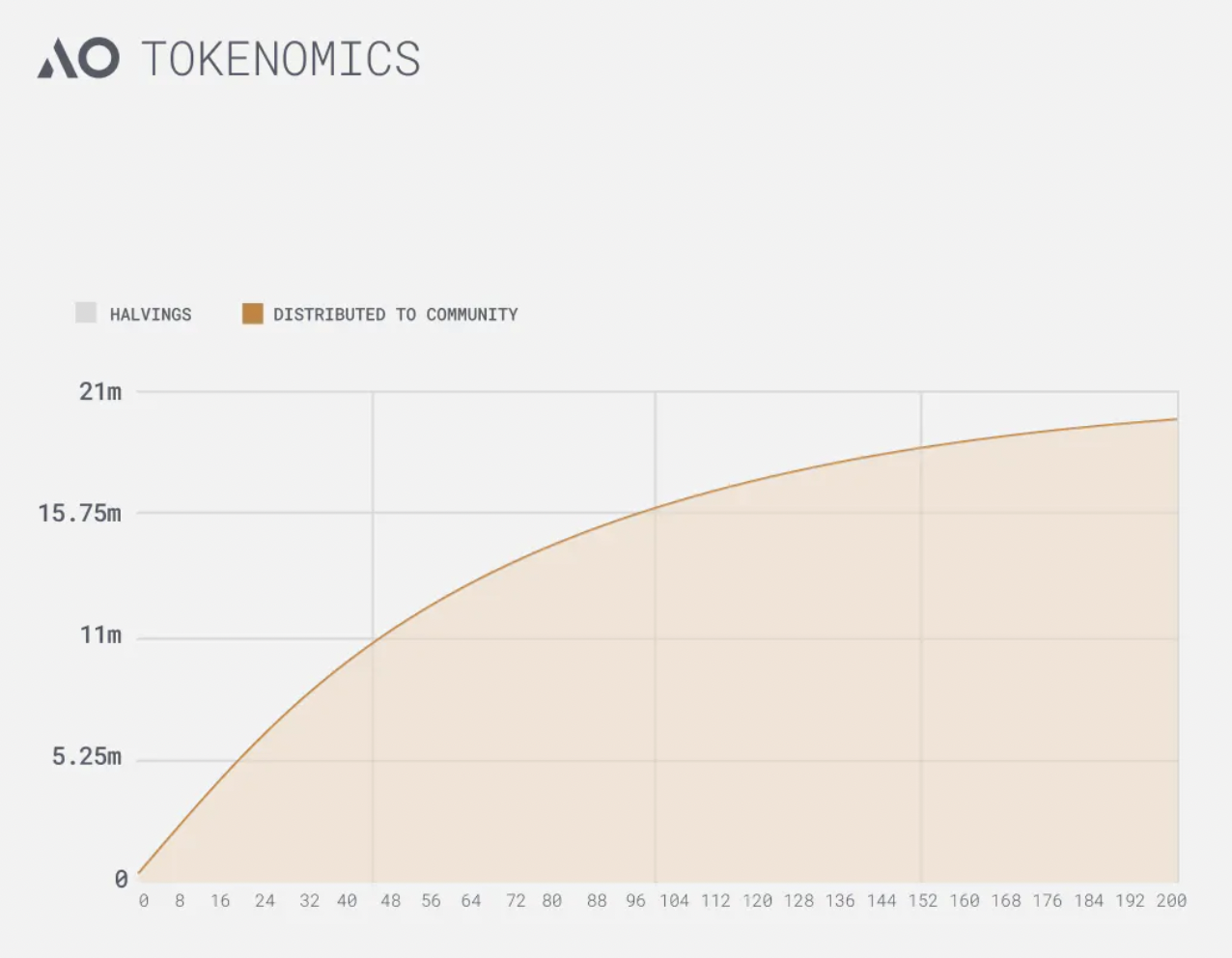

Like Bitcoin, AO has a total supply capped at 21 million tokens, with a four-year halving cycle. AO distributes tokens every five minutes, at a monthly issuance rate of 1.425% of the remaining supply. As of June 13, the circulating supply of AO stood at 1.0387 million. This makes AO extremely scarce—especially when compared to 120 million Ether, 461 million Solana tokens, and 55 billion Ripple coins.

AO’s minting mechanism means that although the number of new tokens issued halves every four years, there is no sudden “halving event.” Instead, the issuance gradually decreases month by month, resulting in a smooth emission schedule.

While most token distribution models favor insiders over the community, AO adheres to principles of fairness and equal access—the core ideals of the crypto revolution. There is no pre-sale or pre-allocation. Instead, the AO token reward mechanism incentivizes two key aspects of a successful ecosystem: economic growth and base-layer security.

Here’s how it works:

~36% of AO tokens (100% during the first four months, then 33.3% thereafter) are minted over time by Arweave token holders, whose holdings incentivize the security of AO’s foundational layer—Arweave.

Approximately 64% of AO tokens are minted over time by providing external yield and bringing assets into AO, thus stimulating economic growth. This creates a powerful incentive to increase liquidity within the ecosystem, forming a self-reinforcing economic flywheel.

Meanwhile, without conducting any token sale, the network funds its own ecosystem development in two ways:

Permissionless Ecosystem Funding

After the bridge goes live, developers who attract users to deposit eligible assets into their applications will receive corresponding AO token rewards. This provides developers with a permissionless, long-term revenue stream—without requiring grants, external investment, or even tokenizing their projects. Developers may optionally choose to share a portion of these AO rewards with users, allowing users to continue earning AO tokens while using applications within the ecosystem.

Permaweb Ecosystem Development Association

Additionally, certain dedicated ecosystem development organizations and builders will share the native yield from assets stored in the bridge. These entities focus on developing AO’s core protocols, marketing operations, and critical infrastructure. These funds will gradually decrease over time, aligning with the decay rate of network minting—allowing the network to bootstrap itself while preserving neutrality as a shared protocol.

How AO Balances Are Calculated for Existing AR Holders

AO token minting for Arweave token holders began retroactively from February 27, 2024, at 12:00 UTC—the moment the AO testnet launched. Minting AO since testnet launch ensures sufficient circulation before full release, targeting approximately 15% of total supply (3.15 million) by around February 8, 2025.

If you’ve held $AR consistently since the testnet launch, you had accumulated approximately 0.016 AO per AR as of June 13, 2024. Keep in mind that AO’s current supply is 1/65th of AR’s.

Major exchanges are currently evaluating whether and how to distribute $AO to users. Please contact your exchange or custodian to learn about their process.

If you’ve self-custodied your $AR tokens, you can check your balance by visiting ao.arweave.dev. Click on the Arweave tab and connect your self-custody wallet (e.g., ArConnect).

Earning AO by Holding AR in the Future

New AO tokens are minted every five minutes. Before the pre-bridge launch on June 18, 100% of AO tokens were minted by AR holders. After the pre-bridge launch, 33% of AO tokens will be distributed proportionally to AR holders, amounting to roughly 36% of the total AO supply minted by AR holders over time. This process occurs automatically.

The list below shows the approximate amount of AO you can expect to accumulate over the next 12 months based on your AR balance:

1 AR: 0.016 AO

10 AR: 0.16 AO

50 AR: 0.8 AO

100 AR: 1.6 AO

500 AR: 8.0 AO

1000 AR: 16.0 AO

The quantity of newly minted $AO will gradually decrease over time until all AO tokens are fully minted. AO tokens will become transferable around February 8, 2025.

Pre-bridge stETH to Convert Yield into AO

Note: AO transition rewards are not available to U.S. citizens

During this initial phase, users can deposit stETH (Lido-staked ETH) to accumulate AO token rewards. As AO expands to more ecosystems, additional proof-of-stake assets will become eligible.

In this initial phase, pre-bridged assets cannot yet be used in applications on the AO network. After phase two of the bridge launches, you will be able to use stETH within AO applications while still earning AO token rewards.

When users pre-bridge their stETH to AO, their original stETH deposits remain secured in an audited contract on the Ethereum network, while the native yield is distributed among designated ecosystem development organizations and builders of the AO ecosystem to promote growth. At launch, these include the Open Access Supercomputing Foundation, Forward Research, Autonomous Finance, Warp Contracts, Longview Labs, and ao/acc. More organizations will be added as the ecosystem evolves.

Users may withdraw their initial stETH deposit at any time.

New AO tokens will be minted every five minutes starting at 11:00 AM Eastern Time on June 18, 2024—exactly 16 weeks after the AO testnet launch. From that point onward, 66% of newly minted $AO will be distributed proportionally to wallets that have pre-bridged to AO. This process happens automatically.

The exact number of AO tokens earned by yield providers depends on the proportion of total assets they deposit into the contract. As AO opens to more ecosystems and supports multiple proof-of-stake assets, the number of AO tokens received will depend not only on the deposited asset share but also on the yield generated by each asset.

The list below shows how many AO tokens you can expect to accumulate over the next 12 months based on your share of the total yield asset pool (assuming only stETH is provided):

0.01%: 210 AO

0.1%: 2,105 AO

0.5%: 10,524 AO

1%: 21,049 AO

5%: 105,243 AO

AO tokens will become transferable around February 8, 2025.

How to Deposit stETH to Earn AO

Note: AO transition rewards are not available to U.S. citizens

Users can begin depositing stETH into the pre-bridge today. Rewards will start accumulating at 11:00 AM Eastern Time on June 18, 2024. Rewards are distributed daily, so users may need to wait up to 24 hours to receive their first payout.

Follow these simple steps to convert your stETH yield into AO tokens:

-

Go to the minting page on the AO website.

-

Click on the Ethereum tab and connect your Ethereum wallet (Metamask or Rabby).

-

Enter the Arweave wallet address where you’d like to receive AO tokens.

-

Deposit stETH into the audited contract by entering the amount you wish to provide. These tokens remain in a trustless contract on Ethereum and can be withdrawn at any time. If you don’t have stETH in your wallet, you’ll need to swap other tokens to obtain some before depositing.

-

Sign the transaction in your ETH wallet to deposit stETH into the contract.

-

You will receive AO tokens directly deposited into your specified Arweave wallet.

Smart Contract Security

The pre-bridge contract has undergone extensive audits and is trustless—no one except you can access your tokens. The only privileged role is that the Open Access Supercomputing Foundation (the organization coordinating with Arweave ecosystem groups to launch AO tokens) can withdraw tokens from the contract in the event of a security incident and return them to their rightful owners. This feature adds an extra security layer without placing pre-bridge assets under control of any centralized entity.

These contracts themselves are minor modifications of the MorpheusAI deposit contracts, leveraging battle-tested foundations to minimize security risks.

Conclusion

The AO token minting process introduces a radically different model grounded in fairness and equal access, rewarding both users and developers. The teams behind this initiative draw inspiration from Bitcoin’s groundbreaking innovations and the foundational principles established by Satoshi Nakamoto.

Over the past fifteen years, the crypto industry has experienced tremendous growth. However, this expansion hasn't always aligned with broader societal interests. To truly advance the mission of building a permissionless, decentralized, user-empowered network, rethinking how value and incentives are structured becomes essential.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News