After several cycles of bull and bear markets, what has cryptocurrency left behind for the world?

TechFlow Selected TechFlow Selected

After several cycles of bull and bear markets, what has cryptocurrency left behind for the world?

We're feeling a bit optimistic now—but billions of dollars in venture capital were wasted after the crash.

Author: Jack Niewold

Compiled by: TechFlow

We're feeling somewhat optimistic now — yet billions of dollars in venture capital were wasted after the crash. Despite all our efforts, it's a bit embarrassing that this is all we've managed to leave behind after so many years of bull markets.

Still, at its core, almost everyone agrees that there’s something novel about crypto—some fundamentally different element, whether it stems from cryptography, tokenomics, permissionless capital, or something entirely new.

As for criticisms of cryptocurrency? There are plenty—and many are fair (and thus should be taken seriously by the industry):

-

Cryptocurrency has drawn attention away from solving larger, more pressing problems;

-

Cryptocurrency is largely a zero-sum speculative game;

-

Cryptocurrency has made many promises that have yet to be fulfilled;

-

To date, cryptocurrency use cases are less efficient than traditional rails;

-

Cryptocurrency exploits inexperienced retail investors;

However, it would be completely wrong to claim that cryptocurrency hasn’t produced anything valuable—there are numerous secure, tokenless networks that have created new use cases with strong product-market fit.

While Layer 1s like Ethereum and Solana may dominate social media influence, their value is ultimately limited to what applications built on top of them can deliver.

On the other hand, the following five protocols offer clear value to the world and require cryptographic technology to function. So, for skeptics and pessimists: here’s your answer.

1. Stablecoins

A whole category of widely adopted cryptocurrencies has emerged in the form of stablecoins—assets pegged to stable value (typically USD) and existing on blockchains. Even fervent Bitcoin maximalists acknowledge that stablecoins allow people living under hyperinflation or oppressive monetary regimes (think Argentina, Turkey, and Lebanon) to preserve wealth through a stable store of value.

In Lebanon, if bank accounts are frozen—even if fiat retains value—users cannot withdraw their funds. With stablecoins stored in self-custodied crypto wallets (remember: not your keys, not your coin), no one can restrict access to your wealth.

One reason this sector isn't often discussed: it's hard to speculate on. By design, stablecoins have no price volatility. Market share is already dominated by Tether (USDT), Circle (USDC), and Binance (BUSD)—all difficult to invest in directly. Moreover, they aren't decentralized: these three are essentially "blockchain-wrapped dollars." $DAI is the leading decentralized stablecoin contender, and its governance token $MKR is easily accessible. Behind it, numerous new decentralized competitors are emerging.

2. Fundraising

Remember ConstitutionDAO and its PEOPLE token? This project raised a massive sum—$47 million—to form a DAO (decentralized autonomous organization) with the explicit goal of purchasing an early copy of the U.S. Constitution. For some reason, the idea went viral and became a crypto legend—from 13 young crypto natives to a failed phone bid at Christie’s auction house.

Online fundraising isn't new, but the idea of permissionless, tokenized ownership is genuinely novel. Existing models are rent-seeking—they take a cut of funds raised (like GoFundMe)—and don't grant ownership in the underlying DAO or asset.

For ConstitutionDAO, the appeal and virality stemmed from actual ownership of the Constitution copy. ConstitutionDAO claimed “owning the Constitution”—by purchasing the DAO token, you became a member; by buying the token, you became a custodian of the physical document.

Decentralized fundraising offers a clear path to decentralized ownership that goes beyond simple product ownership. It allows anyone to buy equity, without any barriers to entry.

3. Arweave

Most file storage services are centralized, often requiring some level of KYC, while others are unstable or could vanish instantly. When you want something to exist permanently on the public internet, that’s where Arweave’s token-based network comes in. Think of it as a permanent digital billboard, where maintainers are rewarded with Arweave tokens.

4. The Graph

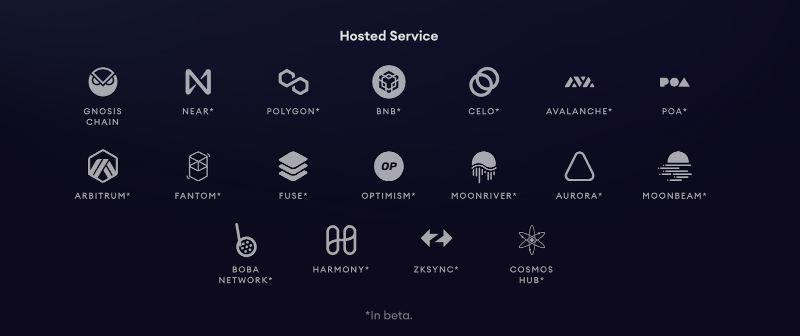

The Graph is an incredible crypto project because it has evolved beyond just "crypto success," achieving industry penetration comparable to monopolies. It's used by at least 19 Layer 1/Layer 2 projects, all relying on its publicly accessible APIs.

Does The Graph need crypto? Yes—because "the graph" is more valuable than competing services, thanks to its cryptographically verifiable data. Queries via this method are inherently more trustworthy than those using centralized, trusted providers.

The Graph has spawned a successful product that extends beyond crypto-native use, yet relies on crypto-based infrastructure to operate. It doesn’t get much attention, but I believe The Graph will be seen as one of the key proofs of concept for native crypto products and viable business models.

In terms of market penetration, The Graph resembles AWS. Its only unresolved challenge is monetization—a major hurdle in crypto, even Bitcoin hasn’t cracked long-term security economics. We’ll see if they can solve it.

5. Filecoin

Filecoin was conceived early in crypto history, and its whitepaper and vision remain influential. By market cap, Filecoin is still the 33rd largest cryptocurrency: why has it endured so long?

Filecoin is an open-source network and digital payment system designed for cooperative file storage and data retrieval. Similar to the non-tokenized decentralized network IPFS, Filecoin allows users to rent out unused hard drive space via a decentralized blockchain mechanism. The blockchain records these storage "commitments" and facilitates $FIL transfers.

Like Arweave and IPFS, Filecoin is a decentralized file storage service. Unlike IPFS, Filecoin effectively solves incentive issues around data storage and supports diverse applications across its network. While Arweave functions like a decentralized IPFS, Filecoin enables:

- Fleek, a service provider helping users interact with IPFS

- Slate, a personal search engine

- Chainsafe, a decentralized Dropbox

Cryptocurrency adds tangible benefits to each use case described above: slightly marginal in file storage, but clearly non-marginal in stablecoins. Of course, there’s still massive room for innovation and improvement in crypto. Much has been built—and much remains to be built.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News