AR shines, what new moves is Arweave making from storage to AI?

TechFlow Selected TechFlow Selected

AR shines, what new moves is Arweave making from storage to AI?

Arweave has moved beyond simple storage solutions and entered the AI narrative, potentially showing signs of a re-rating similar to $NEAR.

Author: ReveloIntel

Translation: TechFlow

Introduction

Arweave, a protocol that has long remained relatively obscure, has recently drawn market attention due to its newly introduced AO (Actor-Oriented) system. The $AR token has consequently outperformed the broader market. Arweave is not only expanding its application in decentralized storage but is also making strides into the artificial intelligence domain. This article will detail Arweave’s transformation and analyze what this means for investors.

Main Content

Last week, we briefly discussed why Arweave—a well-established yet typically low-profile protocol—is now becoming more interesting. The primary reason is AO (Actor-Oriented), a hyperparallel computer built on top of Arweave. This recently added functionality has enabled the native AR token to outperform related markets recently—an unusual feat for this asset. While this is already a significant development, another catalyst has been hinted at...

Arweave primarily functions as a decentralized storage solution, but it is now expanding its offerings into the AI space through its AO computer. AO may soon launch its own token, but currently, holding AR is the only way to gain early exposure to this possibility. AR is also a mature project and one of the few tokens in the industry with 100% FDV unlocked.

Exposure to Relative Strength

In the current market environment—characterized by high volatility and sharp downturns—reallocating assets toward those demonstrating relative strength is key to staying positioned within the market.

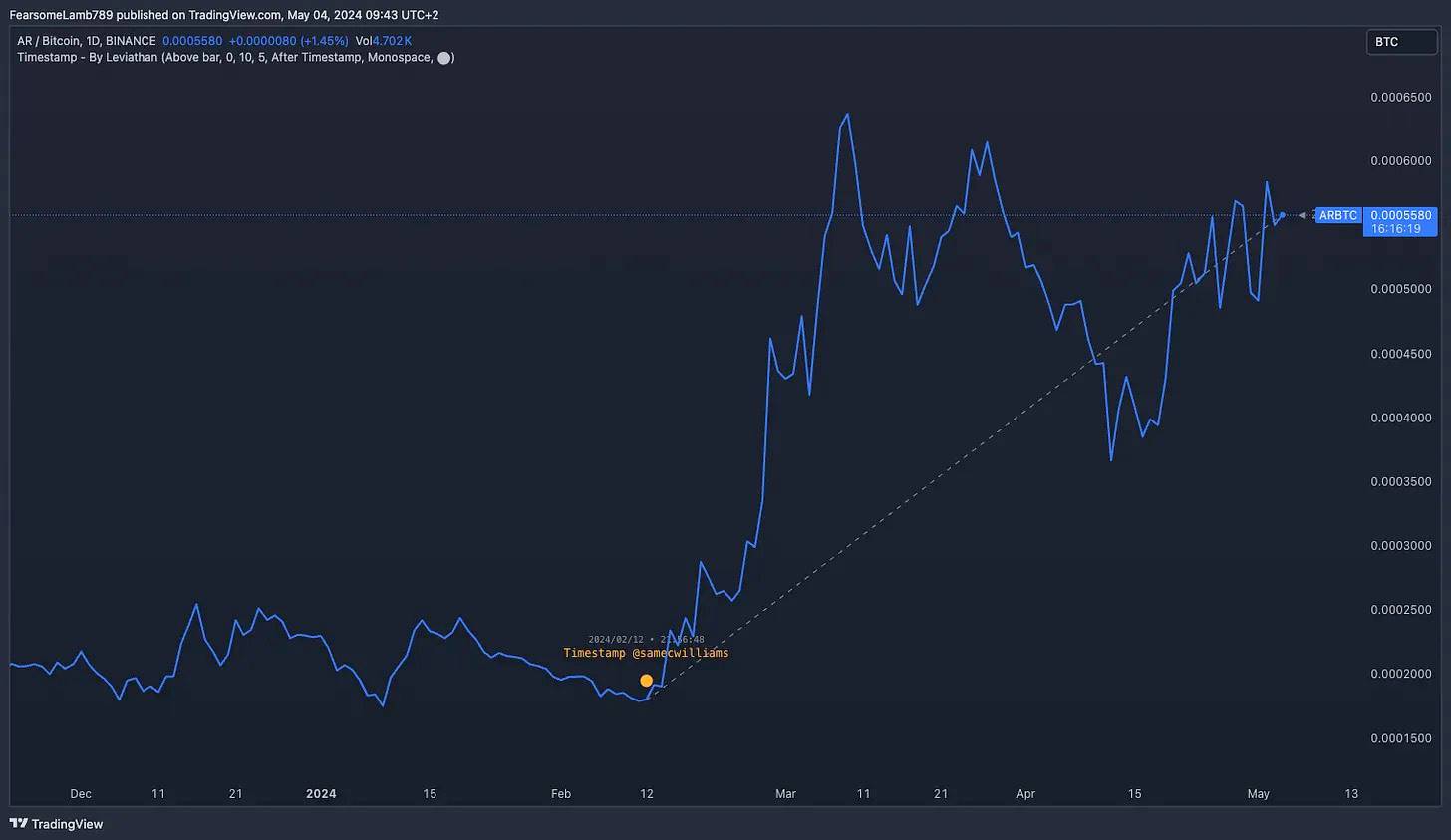

$AR has stood out during recent market corrections, showing unusual resilience amid rising BTC dominance and declining prices across other tokens. These rapid capital flows present an excellent opportunity to shift funds from underperforming assets into higher-quality projects or “fast horses.”

This tactical rotation leverages the relative strength of assets like $AR during market downturns, positioning portfolios to capture potential incremental gains when the market rebounds.

Conversely, holding weaker, less liquid assets increases the risk of amplified losses should market conditions deteriorate further.

Overall, this creates a favorable environment for hedged positions—providing exposure to $AR without blind commitment, while hedging against broader market risks.

Broadly speaking, Arweave is commonly viewed as a decentralized data storage solution, often grouped alongside platforms like Filecoin, Storj, Siacoin, and ShadowDrive. However, Arweave has moved beyond simple storage, entering the AI narrative and showing signs of a potential re-rating similar to $NEAR. Its latest initiative—the AO hyperparallel computer—aims to solve the challenge of infinite scalability and foster an ecosystem of projects capable of serving multiple high-growth sectors such as AI, DePIN, and autonomous agents.

Although AO, launched in February, has already been absorbed by the market, we can expect another major catalyst to emerge in the near term.

Given that Arweave can now be categorized as an AI project, releasing news around May 22—coinciding with NVIDIA's earnings report—would be exceptionally well-timed.

Key Points

-

Arweave aims to keep data "unchanged for as long as possible."

-

Inspired by Bitcoin’s proof-of-work mechanism, Arweave adapts this concept for large-scale data storage.

-

Users pay a one-time upfront fee to store data on the network, part of which covers initial storage costs for 200 years, while the remainder goes into an endowment fund to cover future storage expenses.

-

As storage costs decline over time, tokens in the endowment fund may remain out of circulation for extended periods, creating deflationary pressure.

-

$AR has one of the highest mcap/FDV ratios in the industry, contrasting sharply with prevailing negative sentiment around low-circulating-supply, high-FDV tokens.

-

Currently, holding $AR is the only way to gain early access to AO.

-

Sam Williams, Arweave’s founder, has been hinting at the upcoming launch of another ambitious project similar in scope to AO.

-

As AO continues to expand and attract more users and applications, demand for Arweave’s storage capacity is expected to grow accordingly.

-

Arweave has performed strongly throughout previous bull markets, making it an attractive long-term investment for hedged trading strategies.

-

Over the past few weeks, $AR’s price has surged relative to $BTC, demonstrating resilience amid broad market declines.

-

Arweave is no longer just a storage network—it now sits at the intersection of crypto, DePIN, and AI, recently entering the top 50 by market capitalization.

Background on Arweave

Arweave’s team is led by Sam Williams, who currently serves as CEO. Williams graduated with first-class honors (BSc Hons.) in Computer Science in 2014 and pursued doctoral studies at the University of Kent. During this time, his research focused on distributed systems and their scalability, laying the foundational knowledge for Arweave’s unique data storage approach.

Since May 2017, Williams’ team has collectively advanced Arweave, evolving the project from a conceptual framework into a functional decentralized storage network. Notable ecosystem members and contributors include William Jones (co-founder and former CTO) and Tate Berenbaum (current CEO of Community Labs, a venture studio focused on building and accelerating adoption and growth within the AO ecosystem).

A token sale in June 2018 raised approximately $8.7 million for Arweave. A year later, in November 2019, Arweave secured $5 million from a16z, USV, and Multicoin to build the "permaweb." These same investors doubled down in March 2020, joining Coinbase Ventures to provide Arweave with $8.3 million in funding.

Overview: Bitcoin, but for Data

Arweave operates as a decentralized storage solution, utilizing a blockchain-based protocol to offer permanent data storage. This is achieved through an economic model involving a one-time data storage fee, designed to cover indefinite data preservation. The model leverages an endowment mechanism, where upfront payments help fund long-term storage.

At the heart of this vision is the $AR token, providing a global hard drive for permanent storage. This not only enables the network to serve as a data repository but also helps power a vast ecosystem of applications built atop AO.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News