Understanding the RWA Narrative Logic and 10 Projects to Watch

TechFlow Selected TechFlow Selected

Understanding the RWA Narrative Logic and 10 Projects to Watch

If software is eating the world, then tokenization of real-world assets is eating capital markets.

Translation: TechFlow

We are at a pivotal moment in the history of cryptocurrency.

In recent weeks, we’ve witnessed a 180-degree shift in the U.S. stance on crypto. Surprisingly, all eight Ethereum ETFs have been approved by the SEC. Additionally, the U.S. House of Representatives has not only passed the crypto FIT21 bill, but also legislation preventing the creation of a central bank digital currency. Even more striking is seeing cryptocurrency becoming a key issue in the upcoming U.S. presidential election.

Therefore, if you’re a large financial institution, the message is clear: crypto isn’t going away. You’d better familiarize yourself with it and start exploring its various use cases—before you get left behind.

From this perspective, it seems obvious that the real-world assets (RWA) tokenization space holds immense growth potential.

But what exactly is this trend, why is it generating so much excitement, and how can one best capitalize on it? That’s precisely what we’ll explore in this article.

The Case for Real-World Asset Tokenization

If software is eating the world, then real-world asset tokenization is devouring capital markets.

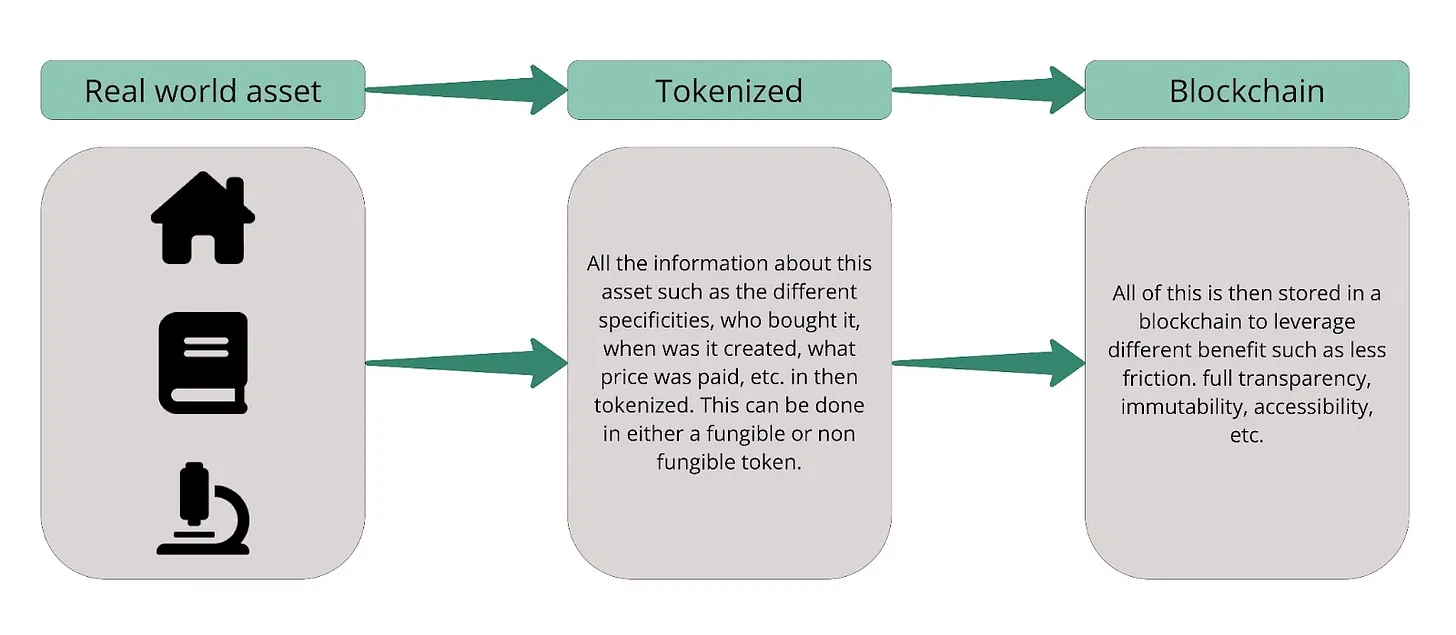

In recent years, real-world assets (RWA) have emerged as one of blockchain technology’s most promising applications—by bringing tangible off-chain assets on-chain. The case for RWA is straightforward: bridging the stability and value proposition of real-world assets with the innovation and potential efficiency of blockchain technology and decentralized finance (DeFi).

Indeed, many view this sector as the new frontier in finance. Recently, we've even seen giants like BlackRock and Franklin Templeton show strong interest and launch their own tokenized funds.

(Source: Bloomberg)

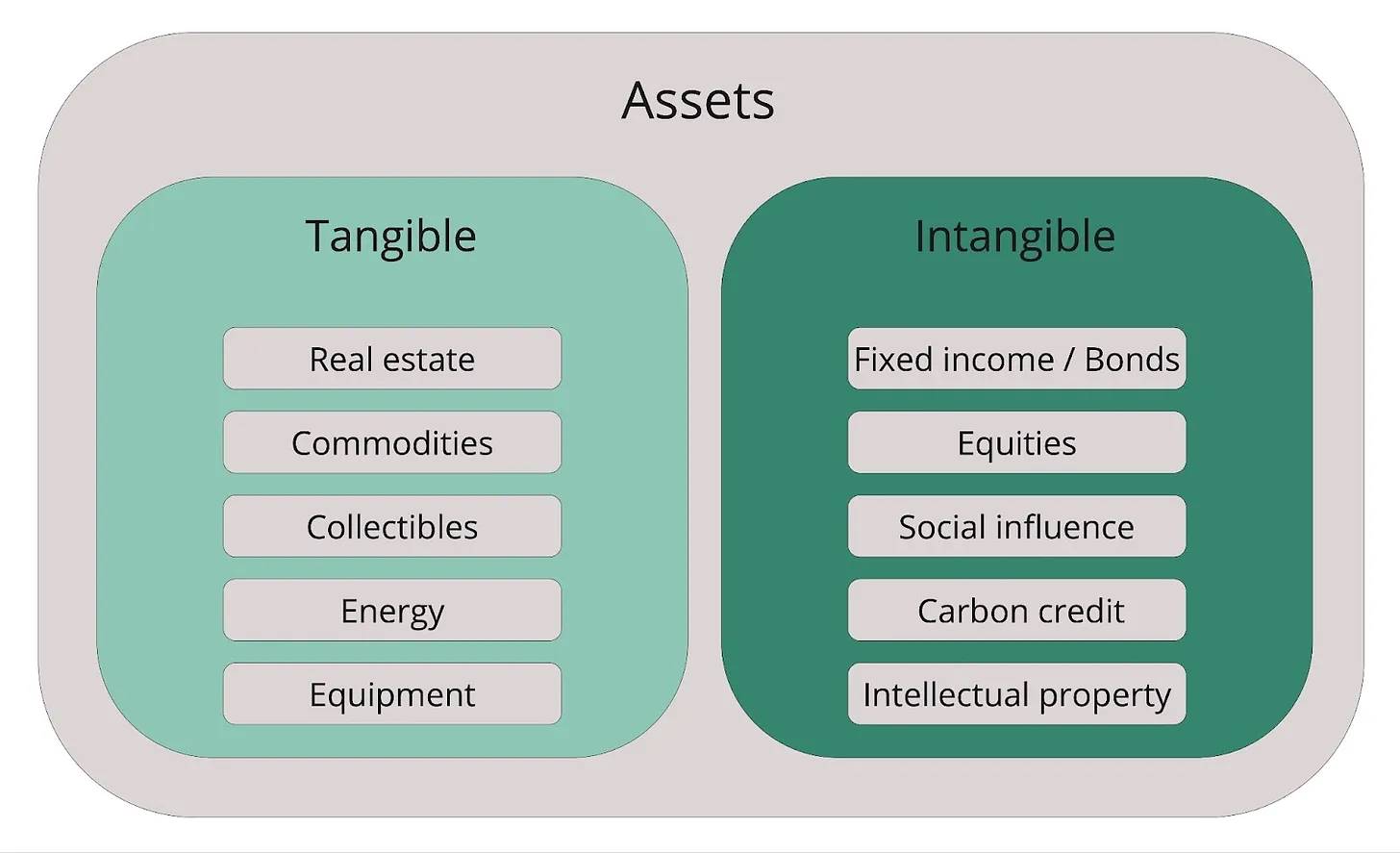

In theory, any tradable real-world asset can be tokenized and brought on-chain. This includes both tangible and intangible assets, as well as fungible or non-fungible ones. Below is a non-exhaustive list of such assets.

Why Tokenization Matters

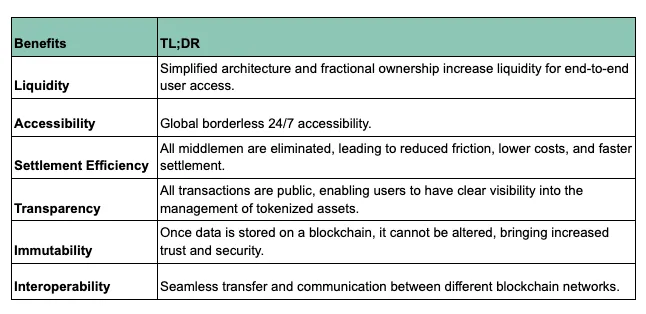

RWA wouldn’t have gained such attention without clear advantages to moving assets on-chain. The table below outlines the primary benefits of tokenization.

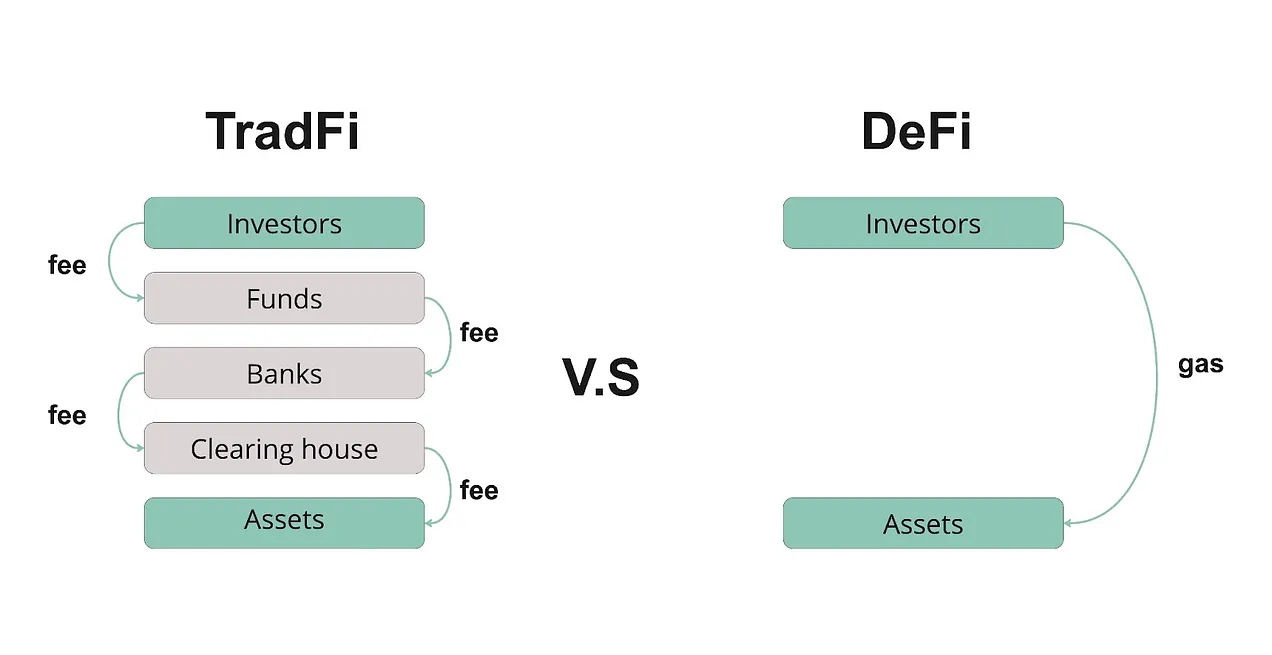

At its core, DeFi's thesis is that blockchains can create a better standard for seamlessly exchanging different assets. In this sense, RWA is simply about recognizing DeFi’s value proposition and extending it to every tradable asset—to build the next generation of markets: ones that are more transparent, secure, fair, and open.

Understanding the RWA Trend

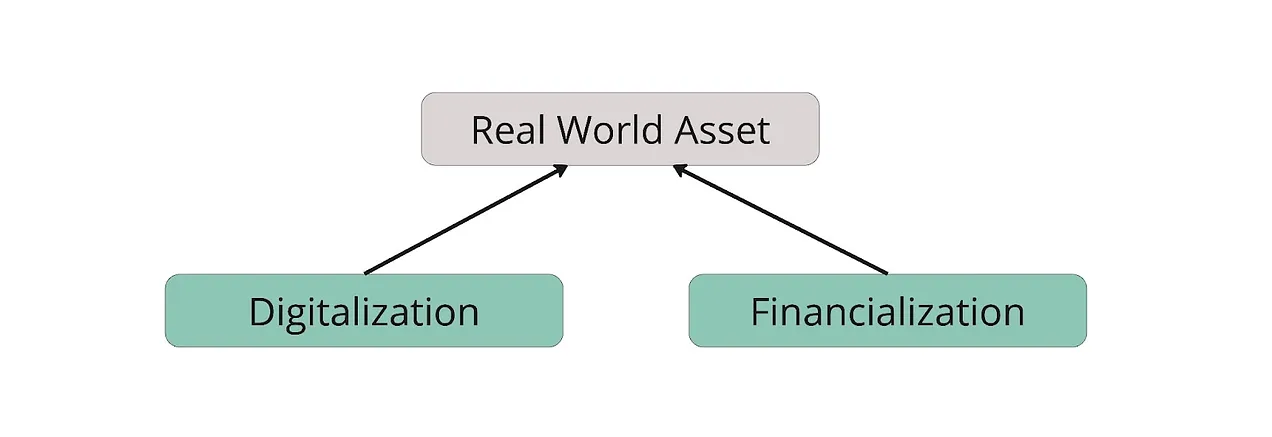

We are entering the era of tokenized markets. Gradually, all assets will move on-chain, challenging the status quo of global capital markets over the past 30 years. This is especially true when considering that the RWA trend sits at the intersection of two powerful forces shaping the world today: financialization and digitization.

-

Financialization: Today, finance knows no borders. Economies are increasingly borderless, with individuals transferring ownership of assets globally. Everything has a market, everything has a price, and everything becomes tradable. Thus, building more efficient, transparent, fair, and open market mechanisms makes increasing sense.

-

Digitization: The world is becoming increasingly digital. We have connected phones, watches, and soon, perhaps, connected brains. In this context, migrating proof of asset ownership onto blockchain networks appears to be a logical progression.

In this way, RWA is uniquely positioned to capture both of these trends.

Key Challenges

Undoubtedly, bringing real-world assets on-chain offers very compelling features. But it also presents numerous challenges. The main issues revolve around:

-

Regulation: Currently, there’s no clear answer on where to establish a market for tokenized assets without navigating complex regulatory environments. However, this could change as understanding of crypto evolves.

-

Liquidity: Creating suitable market structures to provide liquidity and market-making for real-world assets can be challenging, especially for highly illiquid markets operating 24/7.

-

Education: It will take time for everyone to grasp the true value proposition of bringing real-world assets on-chain, as blockchain technology and its trade-offs may be difficult to understand initially.

Evolution of RWA

Dollar-Pegged Stablecoins

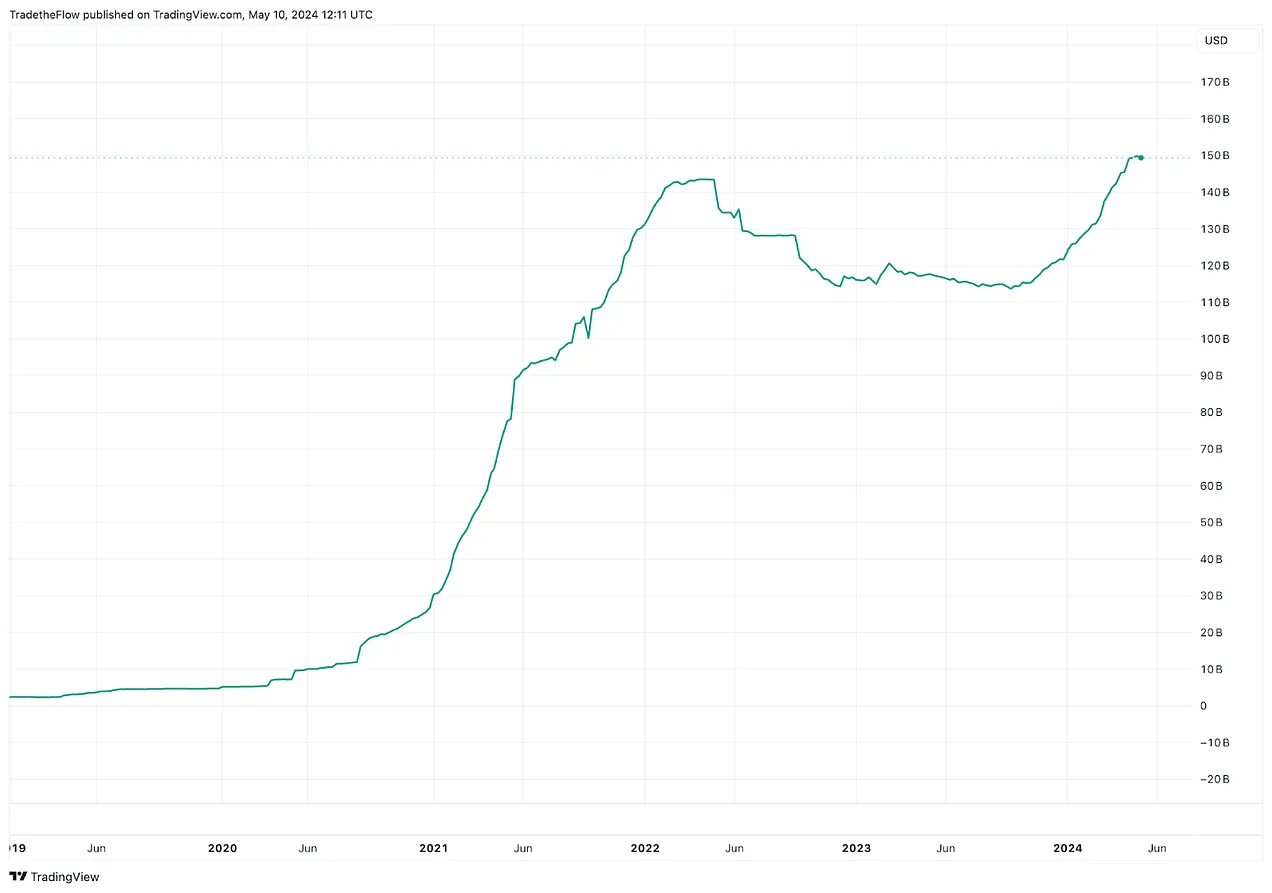

Fiat-backed stablecoins represent the first killer use case of real-world asset tokenization. This market has grown significantly in recent years. Today, the two largest fiat-backed stablecoins—Circle’s USDC and Tether’s USDT—have a combined market cap exceeding $130 billion, up from around $5 billion at the beginning of 2020.

Commodity-Backed Tokens

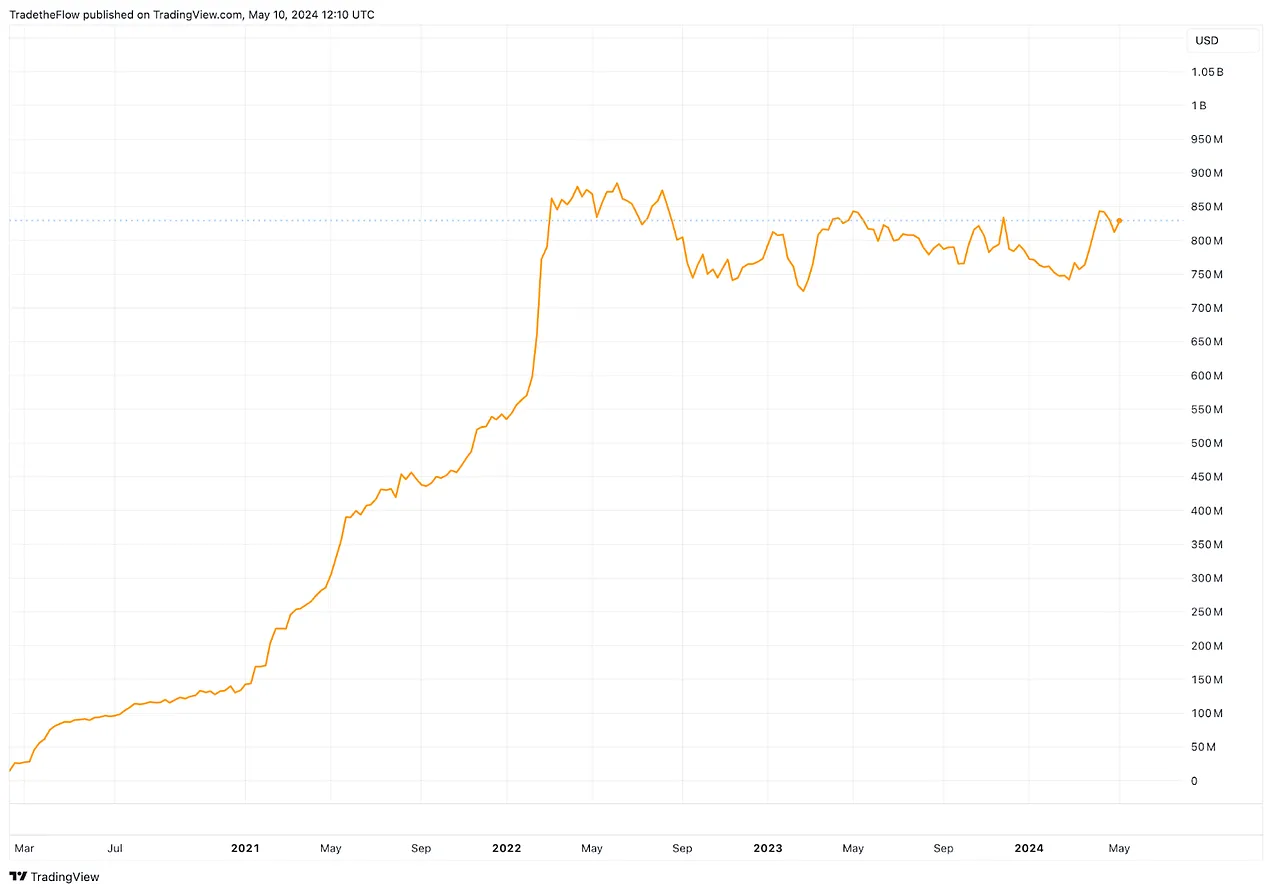

Tokenization of precious metals has become another popular RWA application. Examples include Tether Gold (XAUT) or PAX Gold (PAXG)—tokens backed by physical gold. While relatively new, this market is growing rapidly, with XAUT and PAXG having a combined market cap of approximately $840 million.

Tokenized Treasuries

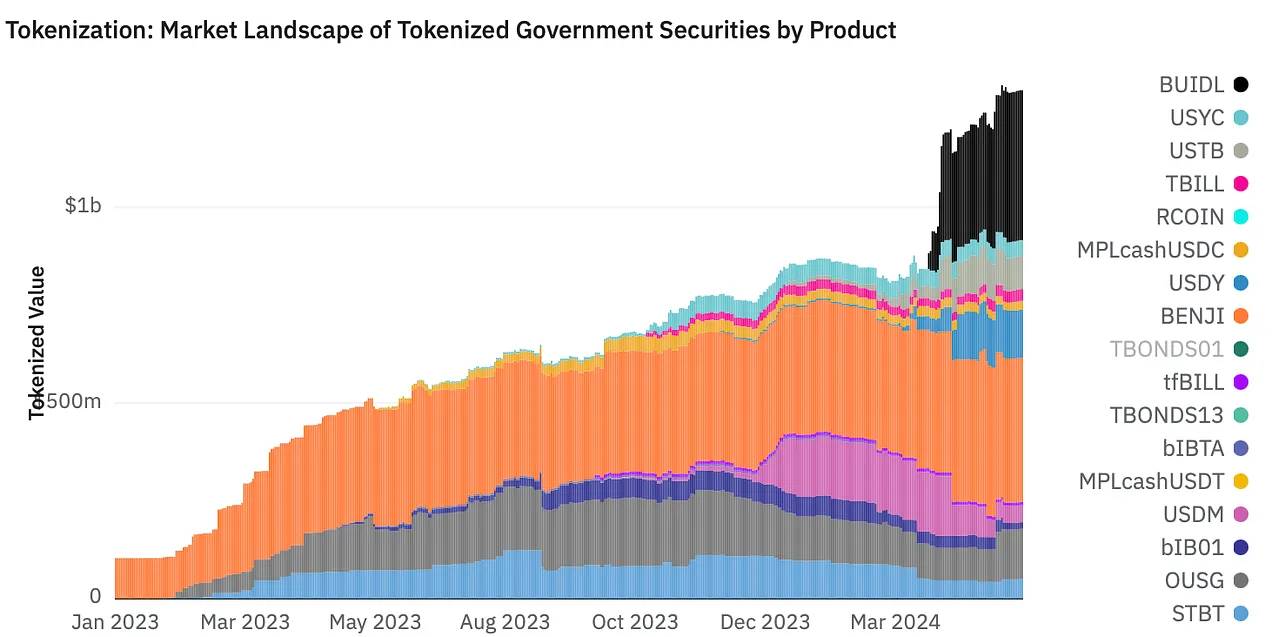

The latest major RWA trend is the tokenization of U.S. Treasuries. According to data from 21co, we observe rapid growth in market cap within this sector—surpassing $1.3 billion. More interestingly, traditional financial institutions are entering this space. For example, Franklin Templeton’s BENJI token has already accumulated around $370 million in deposits, while BlackRock’s BUIDL token has attracted over $380 million.

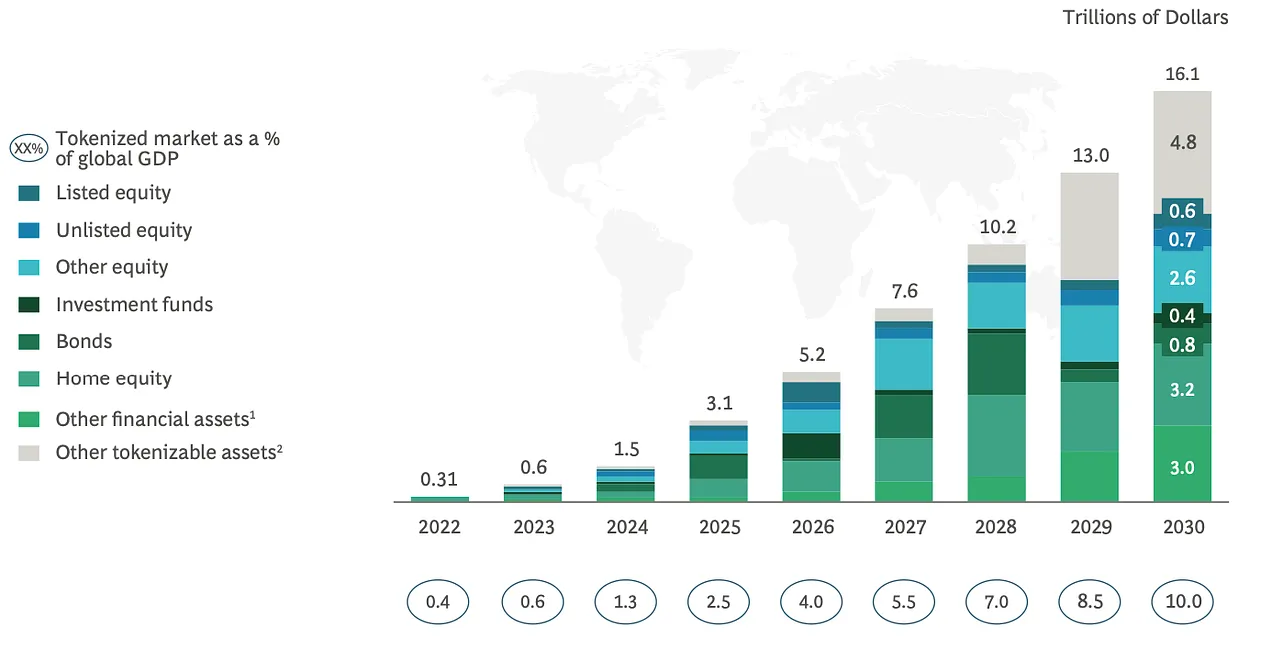

The Beginning of the Next Chapter

This tokenization trend has just begun and is expected to continue growing rapidly. According to Boston Consulting Group, the on-chain tokenized financial assets market could reach $16 trillion by 2030—a potential bridge connecting traditional finance and DeFi, paving the way for next-generation markets.

Looking ahead, we can envision a future where not just pure financial assets, but nearly all monetizable assets—from luxury watches to art to real estate—are tokenized on blockchains. This is the future of finance.

Capitalizing on the Opportunity

After reading this, I’m sure you’re now asking: “Okay, I get it—but how can I position my portfolio to benefit from this new trend?” Don’t worry—I’ve prepared an RWA watchlist for you (plus a bonus).

But before diving in, a quick reminder: the crypto market currently exhibits significant speculation, so caution is essential. Therefore, what follows is not prediction—just some ideas. And as data availability improves and time passes, these views may evolve considerably.

This is not an exhaustive list—just a few projects I’ve researched deeply that I believe are worth watching. There are many other projects in this category that I’ve clearly missed.

RWA Projects

Ready? Now let’s explore some projects you might want to add to your watchlist:

-

Chainlink ($LINK)

In short: Chainlink recently updated its network description, calling it “a universal platform pioneering the future of global markets on-chain.” By bridging real-world data and blockchains, Chainlink plays a critical role in enabling real-world asset tokenization.

A tweet I wrote earlier still applies strongly today. Chainlink is actively collaborating with Swift, The DTCC, and some of the world’s largest banks. These aren’t hype-driven partnerships. There have already been real pilot programs and case studies demonstrating technical feasibility. Full settlement of RWAs on-chain is just a matter of time.

(See the full tweet here)

Long-term, I remain very bullish on Chainlink.

-

Ondo Finance ($ONDO)

In short: Ondo is building next-generation financial infrastructure to enhance market efficiency, transparency, and accessibility. It enables retail and qualified investors to access bond markets on-chain through products like USDY (tokenized bills backed by U.S. Treasuries) and OUSG (short-term U.S. Treasuries).

Here’s what you need to know about ONDO:

(See the thread here)

ONDO is one of the best-performing new tokens of 2024. I find this project very interesting and it has seen significant momentum recently. However, it may now be slightly overhyped and overvalued. Nonetheless, it absolutely deserves a spot on your RWA watchlist.

-

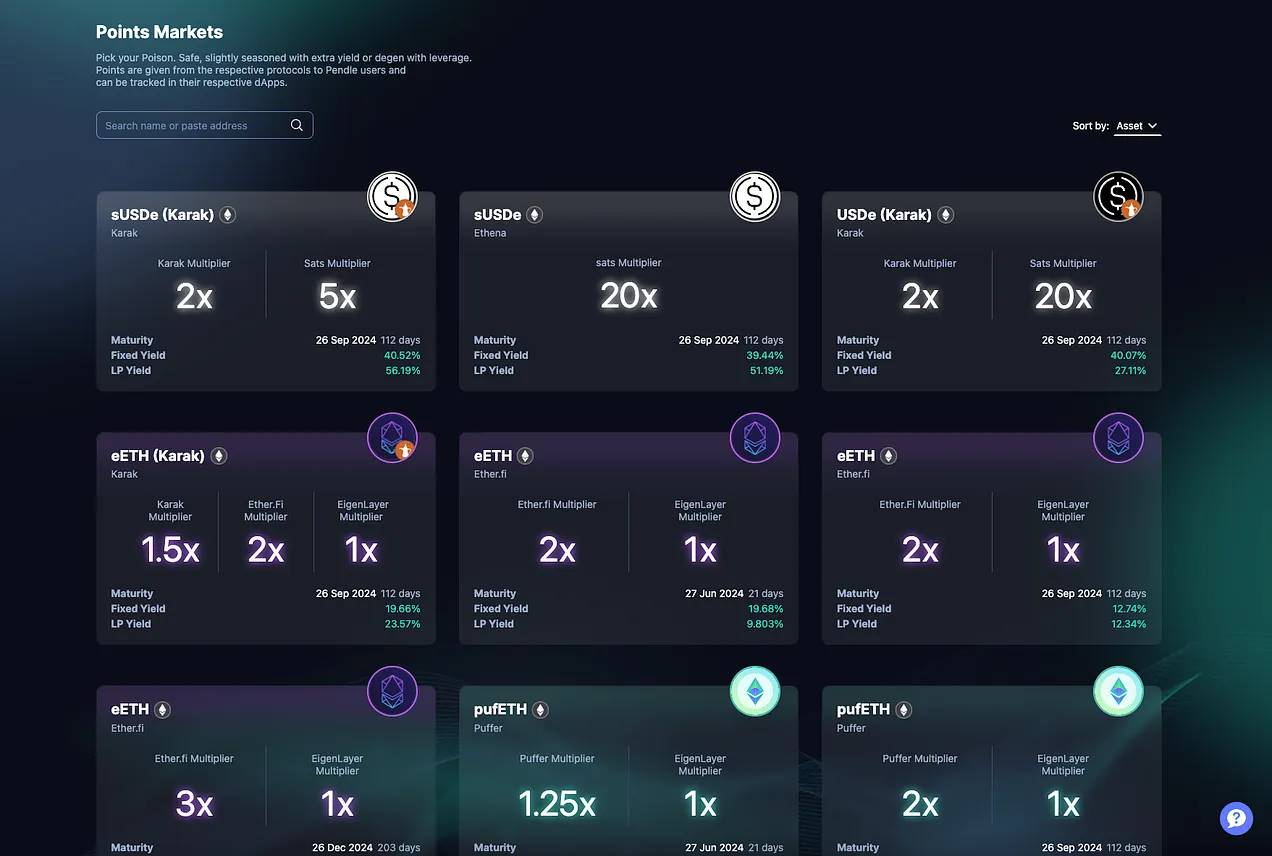

Pendle Finance ($PENDLE)

In short: Pendle is a decentralized finance protocol that allows users to tokenize and sell future yield. It offers an innovative tokenization model, providing users with flexible and dynamic yield management options.

It’s also a great protocol for earning points.

-

TrueFi ($TRU)

In short: TrueFi is a modular on-chain credit infrastructure that connects lenders, borrowers, and portfolio managers via smart contracts, governed by $TRU.

-

Mantra Network ($OM)

In short: Mantra is a security-first, RWA-native Layer 1 blockchain designed to comply with real-world regulatory requirements.

Dive deeper into this project via this tweet:

-

Polymesh Network ($POLYX)

In short: Similar to Mantra, Polymesh is an institutional-grade permissioned blockchain built specifically for regulated assets.

For more on why this project matters, check out this thread:

-

Centrifuge ($CFG)

In short: Centrifuge provides the infrastructure and ecosystem to tokenize, manage, and invest in a full, diversified portfolio of real-world assets. Pools are fully collateralized, investors have legal recourse, and the protocol imposes no restrictions on asset classes—covering structured credit, real estate, U.S. Treasuries, carbon credits, consumer finance, and more.

-

Dusk Network ($DUSK)

In short: Dusk is a permissionless, ZK-friendly Layer 1 blockchain protocol focused on real-world asset tokenization.

Learn more about Dusk here:

-

Clearpool ($CPOOL)

In short: Clearpool is a decentralized finance ecosystem dedicated to creating the first permissionless institutional liquidity market.

-

Polytrade ($TRADE)

In short: This is a marketplace for real-world assets. It brings together tokenized treasury bills, credit, equities, real estate, commodities, as well as collectibles, art, intellectual property, creator royalties, luxury goods, and more—all aggregated across chains into a single platform.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News