Is now a good time to start dollar-cost averaging into ENA?

TechFlow Selected TechFlow Selected

Is now a good time to start dollar-cost averaging into ENA?

ENA (Ethena) makes it possible for the Web3 world to have independent control over stablecoin issuance and pricing.

Author: Da Peng Tong Feng Qi

ENA (Ethena) makes it possible for the Web3 world to have independent control over monetary issuance and pricing—stablecoin issuance rights and valuation sovereignty—with tremendous future growth potential and vast imagination. According to Professor Lin's on-chain data analysis of chip distribution and MVRV, this is currently an ideal time to gradually establish positions through dollar-cost averaging, with relatively low risk.

For those interested in detailed research and investment insights into the ENA project, please read this article thoroughly. Feedback and discussions are welcome.

Chapter 1: Project Overview

1.1 Project Introduction

When people mention ENA (Ethena), many still perceive it merely as a decentralized stablecoin project—USDe—a synthetic U.S. dollar protocol built on Ethereum that offers a crypto-native monetary solution independent of traditional banking infrastructure, and a globally accessible dollar-denominated tool known as the "internet bond." Compared to centralized stablecoins, Ethena has several advantages, though some drawbacks exist. However, in my view, the significance of the ENA project runs much deeper—it aims to solve the fundamental issue of autonomous currency issuance and base valuation within the Web3 ecosystem, returning monetary sovereignty to the Web3 world.

To understand this deeper meaning, we must first examine the evolution of money. The first major division of labor in human history led to barter trade, but the inconvenience of carrying goods and finding counterparties naturally gave rise to real currency.

Early human currencies were primarily seashells, later evolving into bronze (and eventually copper), silver, gold, iron, etc. Due to oxidation and difficulty in dividing them, copper and iron gradually fell out of favor, leaving silver and gold as the most widely accepted forms of money. However, with rapid development in handicrafts and economy, wealth accumulated quickly, making traditional silver and gold insufficient. This led to the invention of paper money—the earliest form being silver notes in China. The invention of paper money greatly boosted economic development, but printing could not be arbitrary. Each banknote had to be backed by corresponding reserves of silver or gold—what we call the silver standard or gold standard. The rise of the U.S. dollar was largely due to the classic gold standard under the Bretton Woods system, which ensured its status as hard currency and facilitated internationalization. In other words, the amount of new currency issued annually depended directly on newly mined or reserved gold (as was the case with early dollars).

However, when economic development reached a new stage where gold reserves could no longer keep up, the fixed exchange rate system of Bretton Woods faced mounting pressure and ultimately collapsed under the "Smithsonian Agreement." Since then, major global economies like the United States transitioned from a gold standard to a debt-based monetary system. Recently, another major nation adopted a similar national debt-backed currency issuance mechanism. Specifically, when governments issue ultra-long-term bonds (e.g., 10, 20, 30, or 50 years), central banks print equivalent amounts of cash to purchase these bonds, thus injecting new money into circulation. This increases government funding for investment and enhances market liquidity—a process commonly known as "quantitative easing" or "money printing." While such measures aim to stimulate the economy, they easily lead to traps of excessive money supply.

Returning to the Web3 world, doesn't Ethena’s concept of “internet bonds” now seem strikingly familiar? But what exactly is the investment logic behind it?

1.2 Investment Logic

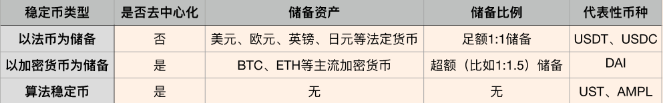

BTC, ETH, and others are primarily high-quality assets akin to gold in the real world. Though usable for payments, they are fundamentally assets rather than units of account or mediums of exchange. As Web3 expands rapidly, markets demand greater liquidity, which today mainly comes from centralized stablecoins like USDT and USDC—both reliant on traditional financial infrastructure. These centralized stablecoins face three critical challenges:

(1) They require custodial collateral (e.g., U.S. Treasuries) held in regulated bank accounts, creating unavoidable custody risks and exposure to regulatory scrutiny;

(2) They heavily depend on existing banking systems and evolving regulations in specific countries, particularly the United States;

(3) Users bear the risk of "no returns," as issuers internalize yield generated from backing assets while transferring depegging risks onto users.

Therefore, a decentralized, reasonably stable asset independent of traditional finance is essential for Web3’s long-term development—serving both as transactional currency and foundational financing asset. Without an independent and soundly backed stable asset, both centralized and decentralized order books remain inherently fragile.

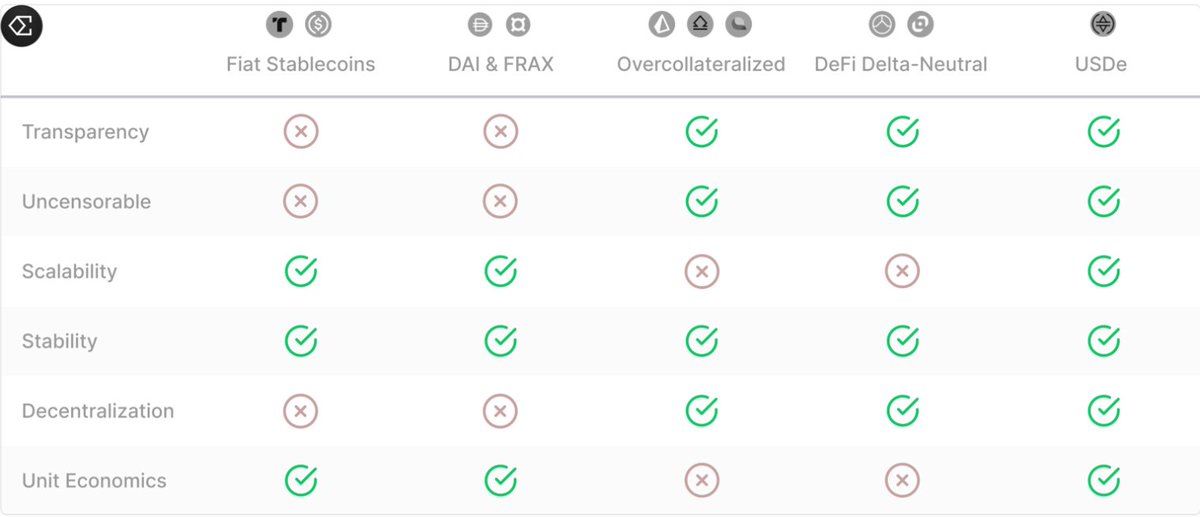

Before ENA, pioneers attempted decentralized stablecoins, notably MakerDAO (DAI) and UST. However, these projects encountered issues related to scalability, mechanism design, and lack of user incentives.

(1) "Over-collateralized stablecoins" (exemplified by DAI from MakerDAO, requiring a 1.5x collateral ratio) historically faced scaling limitations because their growth closely tied to leveraged demand on Ethereum and volatile ETH price swings. For example, DAI’s 1.5x collateral requirement and 1.4x liquidation threshold proved inefficient and discouraged staking. Recently, some stablecoins began incorporating Treasuries to improve scalability, but at the cost of censorship resistance.

(2) "Algorithmic stablecoins" (represented by UST) suffered from flawed designs that made them intrinsically fragile and unstable. Such models are unlikely to achieve sustainable scalability.

(3) Previous attempts at "delta-neutral synthetic dollars" struggled to scale due to reliance on decentralized exchanges lacking sufficient liquidity and vulnerable to smart contract attacks.

Learning from past failures, ENA presents a relatively perfect solution, addressing scalability, stability, and censorship resistance—details of which will be covered in the technical section. ENA makes it possible for the Web3 world to independently issue its own currency (stablecoin), while its economic model incentivizes broader participation to provide more USDe liquidity.

In 2023 alone, stablecoin settlements on-chain exceeded $12 trillion. Once a stablecoin gains market acceptance, its value potential becomes immeasurable. AllianceBernstein, a leading global asset manager with $725 billion in AUM, forecasts the stablecoin market could reach $2.8 trillion by 2028. This suggests massive growth potential from the current $140 billion market cap (previously peaking at $187 billion).

1.3 Investment Risks

Despite its unique advantages, Ethena faces certain potential risks worth noting:

(1) Funding Risk

This refers to the possibility of persistently negative funding rates. While Ethena can earn positive funding yields, it may also need to pay funding fees. However, negative rates typically don’t last long and revert to positive quickly. Moreover, the reserve fund ensures any negative yield does not get passed on to users.

(2) Liquidation Risk

This arises during delta-neutral hedging when forced liquidations occur on centralized exchanges due to insufficient margin. For Ethena, derivative trading serves only to maintain delta neutrality with low leverage, minimizing liquidation probability. Additionally, Ethena employs extra collateral, temporary cross-exchange delegation, and a reserve fund to prevent or mitigate liquidation impacts.

(3) Custody Risk

Ethena relies on "off-exchange settlement" (OES) providers to hold protocol-backed assets, introducing custody risk. To address this, Ethena uses bankruptcy-remote trusts and partners with multiple OES providers such as Copper, Ceffu, and Fireblocks.

(4) Exchange Bankruptcy Risk

Firstly, Ethena mitigates risk by collaborating with multiple exchanges; secondly, Ethena retains full control and ownership of assets via OES providers without depositing collateral on any exchange. Thus, the impact of any single exchange incident remains limited to unsettled PnL between OES settlement cycles.

(5) Collateral Risk

"Collateral risk" refers to the mismatch between USDe’s backing asset (stETH) and the underlying asset of perpetual futures (ETH). However, due to low leverage and minimal collateral discount, even if stETH depegs slightly, the effect on hedging positions is negligible.

Chapter 2: Technology, Risk Mitigation, Business Development & Competitive Analysis

2.1 Technology

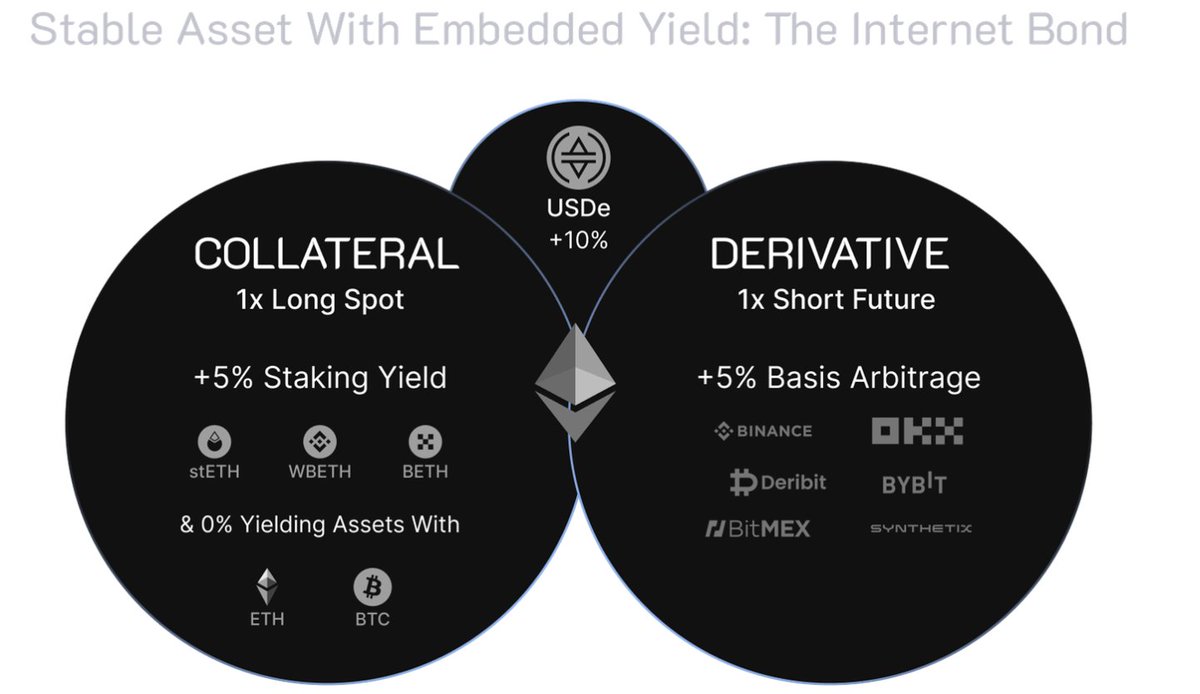

Technically, Ethena is an Ethereum-based synthetic dollar protocol providing a crypto-native monetary solution independent of traditional banking infrastructure—a globally accessible dollar-denominated tool dubbed the "internet bond." Ethena’s synthetic dollar, USDe, offers a scalable, crypto-native currency solution, maintaining peg stability through delta-hedging using ETH and BTC collateral.

The "internet bond" combines yield from staked assets (e.g., staked Ethereum), along with funding rates and basis spreads from perpetual and futures markets, to create the first on-chain, crypto-native monetary solution.

How does USDe achieve stability, censorship resistance, and economic yield, while overcoming shortcomings and risks seen in previous projects?

(1) Stability

Users can obtain USDe via permissionless external liquidity pools (e.g., USDT, USDC, DAI) or directly mint/redeem USDe using stETH, stBTC, etc., through Ethena contracts.

At the moment of minting, Ethena executes delta-neutral hedging across multiple centralized exchanges via derivatives, ensuring the portfolio’s USD value remains stable regardless of market movements. Even if ETH surges 300% in one second and drops 90% shortly after, the dollar value of the portfolio stays unaffected (except for brief mispricing between spot and derivatives markets). The profit from rising ETH prices is fully offset by losses from an equally sized short perpetual position.

(2) Scalability

Thanks to the 1:1 delta-neutral strategy, abundant liquidity from major centralized exchanges, and highly valuable, scalable staking assets like ETH and BTC, USDe has strong scalability. Currently, ETH staking stands at 27% (as of April 2024), totaling ~$160 billion. Ethereum researchers and community members expect staking ratios to exceed 40% soon, opening vast room for USDe expansion.

(3) Censorship Resistance

Ethena uses "off-exchange settlement" (OES) providers to hold backing assets, enabling delegation to centralized exchanges without exposure to exchange-specific risks.

While relying on OES introduces technical dependency, it does not transfer counterparty risk to OES providers. OES providers typically hold funds in bankruptcy-remote trusts without MPC solutions, ensuring creditors cannot claim these assets. If an OES fails, assets are expected to remain outside its estate, insulated from credit risk.

All OES providers are located outside the U.S., avoiding U.S. regulatory oversight. Traditional custody via exchanges or holding fiat/Treasuries/stablecoins in U.S. banks or custodians carries significant censorship risk due to the current U.S. regulatory environment and global compliance focus.

(4) Economic Yield

Revenue for the ENA protocol comes from two sources:

1. Consensus and execution layer rewards from staked assets (primarily ETH staking yield)

2. Funding rates and basis spreads from delta-hedged derivative positions

Historically, due to supply-demand imbalances in digital assets, participants taking short delta-zero positions have earned positive funding rates and basis spreads.

Additionally, USDe holders who refrain from trading can stake their USDe to receive sUSDe. When unstaking and burning sUSDe, users retrieve their original USDe plus accrued staking rewards. This design attracts more ETH holders beyond just leveraged traders, enhancing overall USDe liquidity across Web3.

2.2 Risk Mitigation

Although decentralized stablecoins offer great promise, they come with non-negligible risks. Ethena’s strength lies in proactively integrating risk mitigation into its core design, minimizing potential threats. Let’s analyze each:

1. Funding Risk

Funding risk relates to the possibility of sustained negative funding rates. While Ethena earns yield from funding, it may occasionally pay fees. Although this poses direct protocol risk, historical data shows negative yields rarely persist and quickly revert to positive averages.

Negative funding rates are a feature, not a flaw, accounted for in USDe’s design. Therefore, Ethena established a reserve fund that intervenes when the combined yield from LST assets (e.g., stETH) and short-term perpetual positions turns negative. This protects the spot backing of USDe. Ethena never passes negative yields to users staking USDe into sUSDe.

Using LST collateral (e.g., stETH), which earns 3–5% annual yield, adds an extra safety margin. Protocol yield only turns negative if the sum of LST yield and funding rate becomes negative.

2. Liquidation Risk

Liquidation risk here refers to forced liquidations on centralized exchanges during delta-neutral hedging due to insufficient margin. For Ethena, derivatives are used solely for delta-neutrality with low leverage, making liquidation unlikely. While Ethena’s exchange margin consists of both ETH spot and stETH (with stETH capped at 50%), since Ethereum’s Shapella upgrade enabled stETH unstaking, the stETH/ETH discount has never exceeded 0.3%, meaning stETH value closely tracks ETH spot value.

Moreover, Ethena has implemented additional safeguards for extreme scenarios:

(1) Systematically allocate additional collateral upon any risk event to improve hedging margin health.

(2) Temporarily cycle collateral across exchanges to support specific situations.

(3) Deploy the reserve fund swiftly to bolster exchange hedging positions.

(4) In extreme cases (e.g., severe smart contract flaws in staked ETH), Ethena immediately reduces exposure to protect backing asset value—closing hedges to avoid liquidation issues and reallocating affected assets.

3. Custody Risk

Since Ethena depends on OES providers to hold supporting assets, it faces operational dependency—this is the so-called "custody risk." Custodians’ business models are based on asset protection, not leaving collateral on centralized exchanges.

Using OES for custody involves three main risks:

(1) Accessibility and availability: Ethena must be able to deposit, withdraw, and delegate to exchanges. Any disruption affects workflow and minting/redemption functionality—but does not impact USDe’s underlying value.

(2) Fulfillment of operational duties: If an exchange fails, OES must quickly transfer unrealized PnL risk. Ethena reduces this risk by frequently settling PnL with exchanges. For example, Copper’s Clearloop settles daily between exchange partners and Ethena.

(3) Custodian operational failure: Though no major crypto custodian has yet suffered catastrophic failure or bankruptcy, the risk exists. Assets are held in segregated accounts; even if a custodian goes bankrupt, assets should remain outside its estate and immune to creditor claims—thanks to either bankruptcy-remote trusts or MPC wallet solutions used by OES providers.

Ethena avoids over-concentration with any single OES provider and manages concentration risk accordingly. Even for the same exchange, multiple OES providers are engaged to mitigate risks.

4. Exchange Bankruptcy Risk

First, Ethena diversifies risk by partnering with multiple exchanges to reduce the impact of any single exchange’s collapse. Second, Ethena maintains full control and ownership of assets through OES providers, without depositing collateral on any exchange. This limits the impact of any exchange incident to unsettled PnL between OES settlement cycles.

If an exchange fails, Ethena delegates collateral to another exchange and hedges the previously uncovered delta. Derivative positions are treated as closed upon exchange bankruptcy. Capital preservation remains Ethena’s top priority. In extreme cases, Ethena will always strive to protect collateral value and maintain USDe’s peg stability—using reserve funds if necessary.

5. Collateral Risk

Here, "collateral risk" refers to the mismatch between USDe’s backing asset (stETH) and the underlying asset of perpetual futures (ETH). Since stETH differs from spot ETH, Ethena must ensure minimal price divergence. As discussed earlier, due to low leverage and small collateral discounts, stETH depegging has negligible impact on hedging positions, making liquidation extremely unlikely.

2.3 Business Development and Competitive Analysis

Since inception, ENA has experienced explosive growth with sharp short-term value appreciation. This surge stems not only from robust technology and institutional backing but also from its attractive yields, appealing to both retail and institutional investors. On March 29, 2024, Binance announced that Ethena (ENA) would be the 50th project on Binance Launchpool. Users could stake BNB and FDUSD into the ENA mining pool starting at 08:00 UTC+8 on March 30 for three days. Additionally, Binance listed ENA on April 2 at 16:00 UTC+8, launching trading pairs ENA/BTC, ENA/USDT, ENA/BNB, ENA/FDUSD, and ENA/TRY. These activities highlight ENA’s rapid development.

ENA’s structural advantages enable it to stand out as a true representative of decentralized stablecoins, capable of competing with dominant centralized alternatives like USDT and USDC. Despite initial hurdles, its momentum is accelerating, generating significant industry expectations.

Chapter 3: Team and Funding

3.1 Team Background

Ethena was founded by Guy Yang, inspired by a blog post from Arthur Hayes. The core team consists of five members.

Guy Young is Founder and CEO of Ethena.

Conor Ryder is Research Lead at Ethena Labs, formerly a research analyst at Kaiko. He graduated from University College Dublin and Gonzaga College.

Elliot Parker is Head of Product Management at Ethena Labs, previously a product manager at Paradigm. He studied at the Australian National University.

Seraphim Czecker is Head of Business Development at Ethena. Previously, he served as Risk Lead at Euler Labs and FX trader in emerging markets at Goldman Sachs.

Zach Rosenberg is General Counsel at Ethena Labs, formerly at PwC. He holds degrees from Georgetown University, American University Washington College of Law, American University Kogod School of Business, and the University of Rochester.

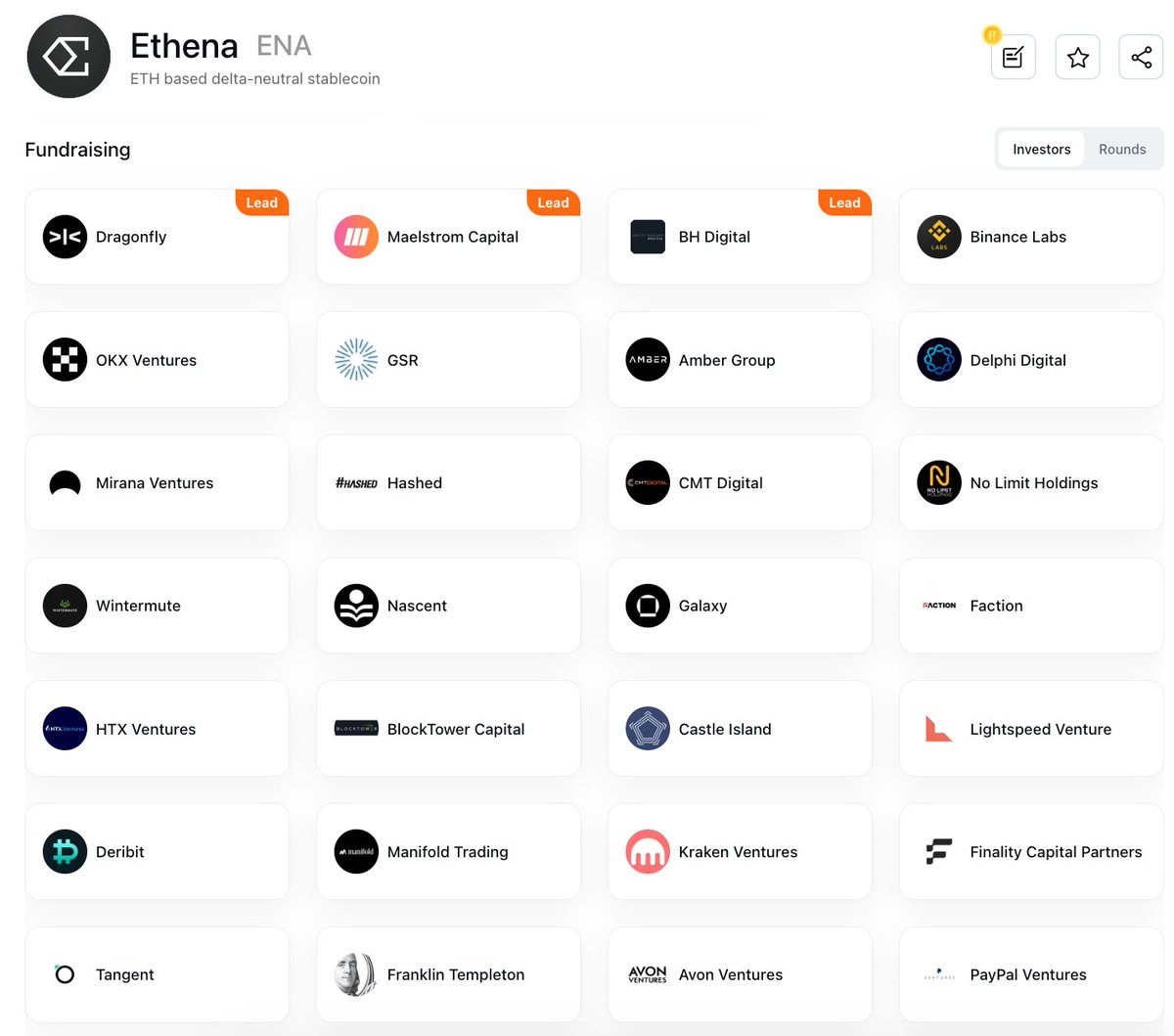

3.2 Funding History

In July 2023, Ethena raised $6.5 million in seed funding led by Dragonfly, with participation from Deribit, Bybit, OKX Ventures, BitMEX, among others.

In February 2024, Ethena secured $14 million in strategic funding led by Dragonfly, with PayPal Ventures, Binance Labs, Deribit, Gemini Frontier Fund, Kraken Ventures, and others participating. The round valued the company at $300 million.

Chapter 4: Tokenomics

4.1 Token Distribution

Total Supply: 15 billion

Initial Circulating Supply: 1.425 billion

Foundation: 15% – allocated to promote USDe adoption, reduce dependence on traditional banking and centralized stablecoins, and support future development, risk assessment, audits, etc.

Investors: 25% (25% unlocked in Year 1, monthly linear unlocking thereafter)

Ecosystem Development: 30% – dedicated to building the Ethena ecosystem, including 5% airdropped to early users. The remainder supports ongoing initiatives and incentive programs. Binance’s Launchpool activity accounts for 2% of total supply.

Core Contributors: 30% (Ethena Labs team and advisors, 25% unlocked in Year 1)

Following the launch of Ethena’s governance token, the “Q2 Campaign” will begin immediately, expanding its tokenomic model. This campaign focuses on developing new products using Bitcoin (BTC) as backing assets—an initiative that broadens USDe’s growth potential and enhances market adoption and use cases.

Sats Rewards, central to the Q2 campaign, aims to reward users contributing to Ethena’s ecosystem. By increasing early-user rewards, Ethena strengthens community engagement and encourages new participants. This incentive structure reflects Ethena’s recognition of building a lasting, active community.

Through carefully designed tokenomics and incentives, Ethena strives to build an inclusive and sustainable DeFi platform, exploring new frontiers for decentralized finance.

4.2 Token Unlock Schedule

June 2, 2024: 0.36% unlock

July 2, 2024: 0.36% unlock

August 2, 2024: 0.36% unlock

September 2, 2024: 0.36% unlock

October 2, 2024: 0.36% unlock

April 2, 2025: 13.75% unlock—a significant portion requiring close attention.

Chapter 5: Target Valuation

Currently, ENA’s circulating market cap is $1.4B, with a FDV of $14B. Stablecoins are generally not undervalued. In 2023 alone, on-chain stablecoin transaction settlements exceeded $12 trillion. Once a stablecoin gains market traction, its value potential is boundless. AllianceBernstein, a global leader in asset management with $725 billion AUM, estimates the stablecoin market could reach $2.8 trillion by 2028—indicating enormous growth potential from today’s $140 billion market cap (previously peaked at $187 billion).

So how should ENA be valued?

There is no perfect comparable, and the stablecoin market remains large with substantial upside. Under such conditions, assigning a precise valuation is difficult. Instead, we should assess whether Ethena’s design meets Web3’s needs for decentralized stablecoins and effectively manages potential risks.

Nonetheless, Arthur Hayes, founder of BitMEX, proposed a valuation model for ENA similar to Ondo’s. His model assumes: long-term, 80% of protocol-generated revenue flows to staked USDe (sUSDe), and 20% to the Ethena protocol. Specifically:

Ethena Annual Revenue = Total Yield × (1 – 80% × (1 – sUSDe Supply / USDe Supply))

If 100% of USDe is staked (i.e., sUSDe Supply = USDe Supply): Ethena Annual Revenue = Total Yield × 20%

Total Yield = USDe Supply × (ETH Staking Yield + ETH Perp Swap Funding Rate)

Both ETH staking yield and ETH perp swap funding are variable rates.

ETH Staking Yield – assumed PA rate of 4%

ETH Perp Swap Funding – assumed PA rate of 20%

The key part of this model is applying a revenue multiple to derive a fully diluted valuation (FDV). Using these multiples as benchmarks, potential Ethena FDV is estimated.

In early March, Ethena’s $820 million in assets generated a 67% yield. Assuming a 50% sUSDe-to-USDe supply ratio, projected annual revenue reaches ~$300 million. Applying a valuation method similar to Ondo yields an FDV estimate of $189 billion.

Thus, ENA’s upside potential = 189 / 14 = 13.5x, translating to a price target of $12.6.

Whether analyzed by market size or revenue structure, ENA offers immense upside, warranting serious attention and investment. So how should one approach investing? See the next chapter.

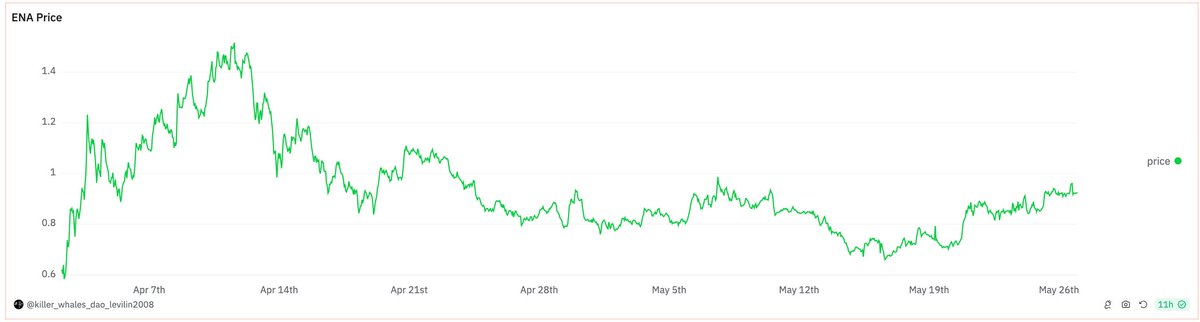

Chapter 6: ENA Investment Analysis and Recommendations

Given that ENA is a promising long-term investment, one approach is buying now and holding indefinitely. Another is timing entries and exits strategically to ride waves over time. This chapter focuses on the latter, analyzing optimal strategies using chip distribution and MVRV metrics to offer actionable recommendations.

6.1 Chip Distribution Analysis

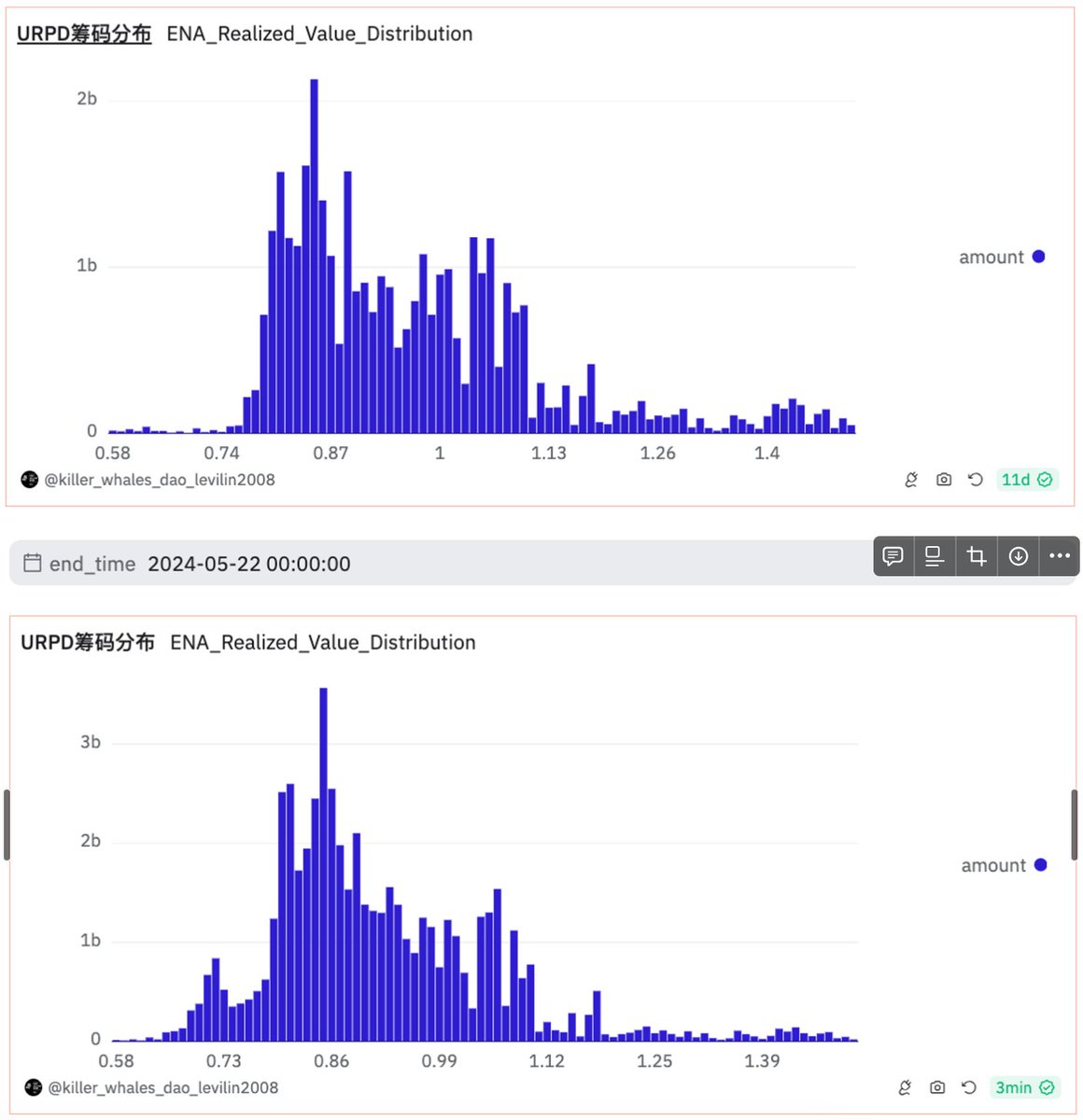

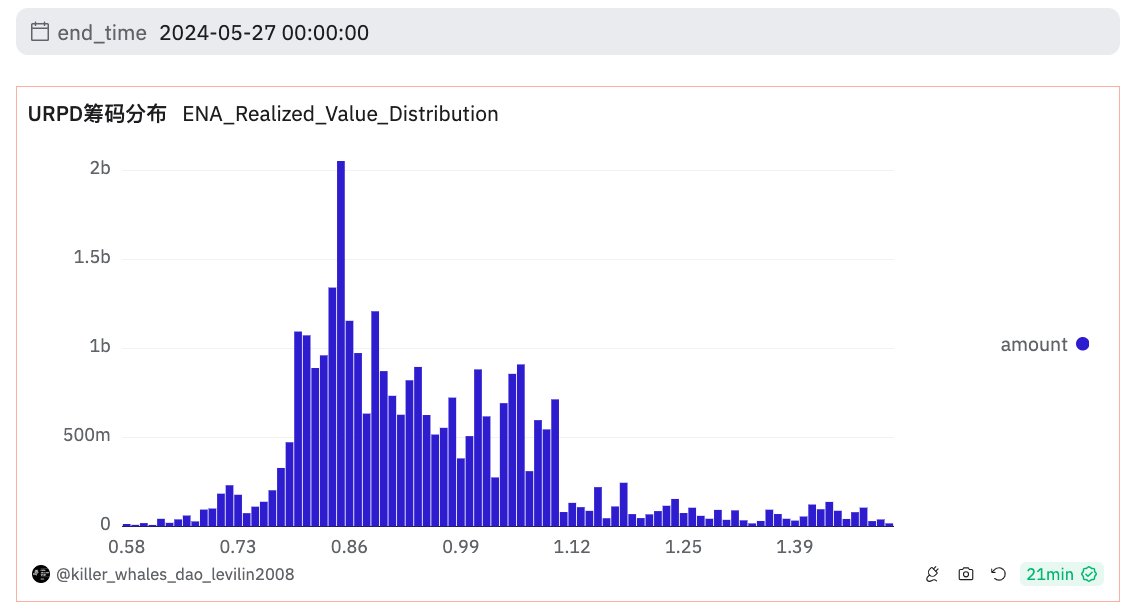

Based on the URPD chip distribution chart shared in Professor Lin’s VIP group dashboard for ENA, we observe:

Starting May 15, chips priced above $1 have been gradually decreasing, while a major consensus zone has formed around $0.85, peaking on May 22.

From May 22 onward, nearly one-third of chips in the $0.7–1.2 range—especially near $0.85—have disappeared, yet the consensus area remains concentrated around $0.85, forming a strong support level. Establishing positions here would be highly advantageous.

Above $1, there is no significant accumulation zone—essentially clear path ahead. Should a bull market emerge, upward resistance will be minimal, allowing for rapid and substantial price increases.

6.2 MVRV Indicator Analysis

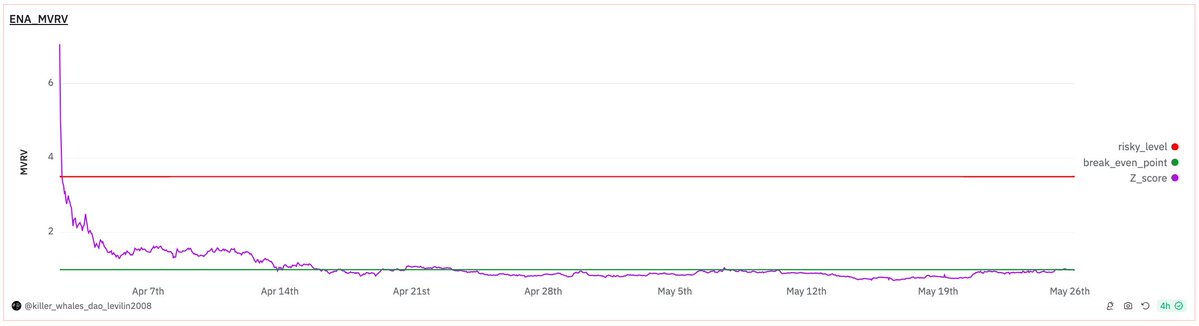

Now consider the MVRV (Market Value to Realized Value) Z-score indicator.

MVRV-Z Score = Market Cap / Realized Cap, where "Realized Cap" aggregates the "last moved value" of all tokens on-chain based on transfer history. A high reading suggests overvaluation relative to actual cost basis, discouraging further upside. Conversely, undervaluation signals opportunity. Historically, when this metric hits highs, downside risk increases—caution against chasing peaks. When below 1, the network-wide average holding cost is underwater, giving new entrants psychological and cost advantages.

When above 3, net profits exceed 3x, entering high-risk territory—ideal for phased profit-taking.

As shown in the chart, since April 14, ENA’s MVRV has hovered around 1, dipping as low as 0.71. The current Z-score is 1—making it an ideal time for dollar-cost averaging into positions.

Therefore, now is a favorable entry window. Building positions near $0.85—or lower—would be even better.

Chapter 7: Market Sentiment

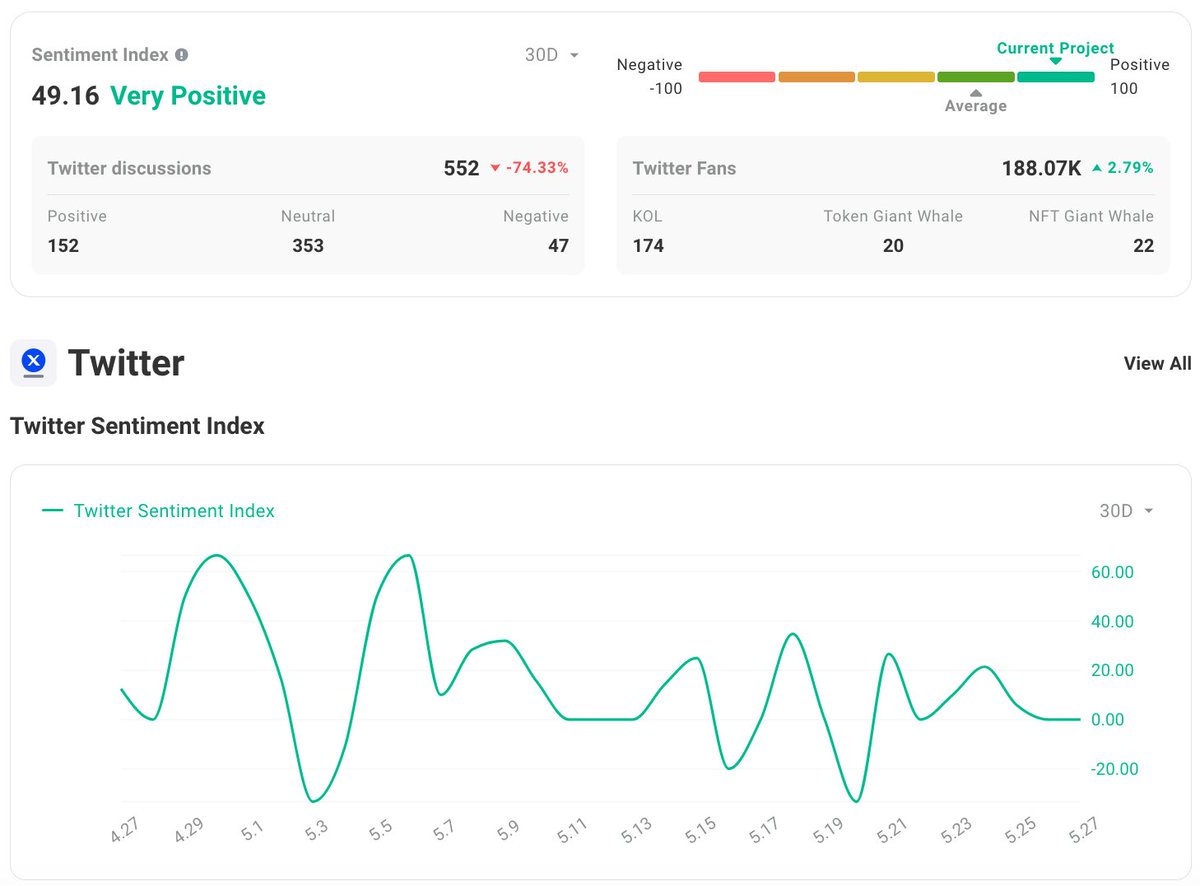

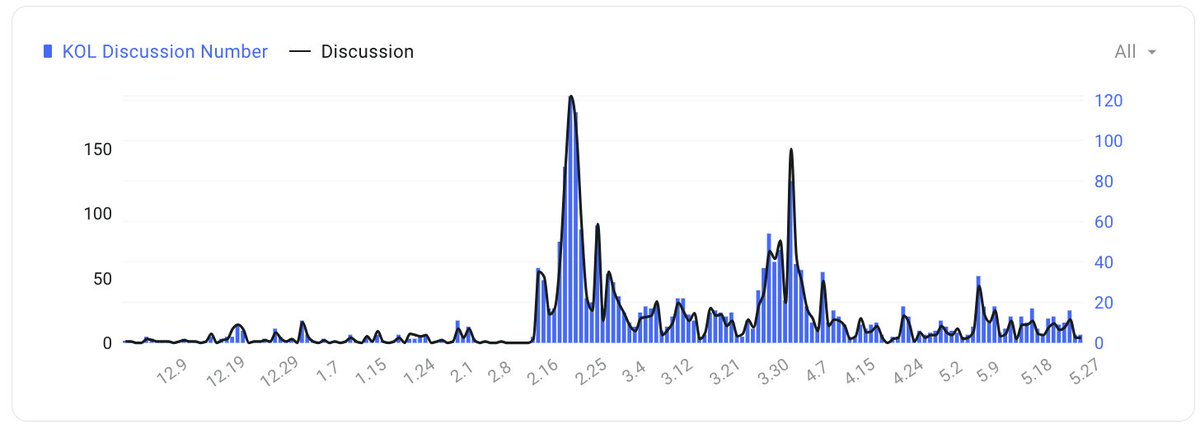

Market sentiment toward ENA remains highly positive. From the following three images, we can see:

Although ENA’s price pulled back due to broader market corrections, market and KOL interest has remained consistently positive. Notably, KOL attention increased significantly in May compared to April, indirectly validating ENA’s technological strengths and future prospects.

Chapter 8: Conclusion

ENA (Ethena) makes it possible for the Web3 world to gain independent control over currency (stablecoin) issuance and pricing rights. Its future growth potential and vision are enormous. Based on Professor Lin’s chip distribution and MVRV on-chain data, now is an excellent time to gradually build positions through dollar-cost averaging, with relatively low risk.

ENA (Ethena) is currently the most compelling decentralized stablecoin project available. We hope the team continues iterating and refining its approach, resolving potential risks with ever-better technical and operational solutions.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News