MT Capital Research Report: DePIN – Decentralizing the Future of Physical Infrastructure

TechFlow Selected TechFlow Selected

MT Capital Research Report: DePIN – Decentralizing the Future of Physical Infrastructure

The core definition of DePIN lies in bringing real-world users into Web3, achieving cost efficiency and socialization through decentralized networks.

Authors: Ian, Xinwei, Severin, MT Capital

TL;DR

1. DePIN Overview: Decentralized Physical Infrastructure Networks (DePIN) integrate the physical world with Web3 by leveraging decentralized technologies to reduce costs and improve efficiency. DePIN has broad applications across computing, storage, wireless networks—from traditional fixed equipment to next-generation portable and wearable devices—offering vast market potential.

2. Investment Trends & Projects: DePIN projects have shown significant growth throughout both bull and bear cycles, spanning sectors such as wireless networks, mapping, connected vehicles, agriculture, drones, weather, and energy. Investment interest has expanded from Europe and North America to Asia, with increasing numbers of institutions and funding rounds reflecting strong market enthusiasm.

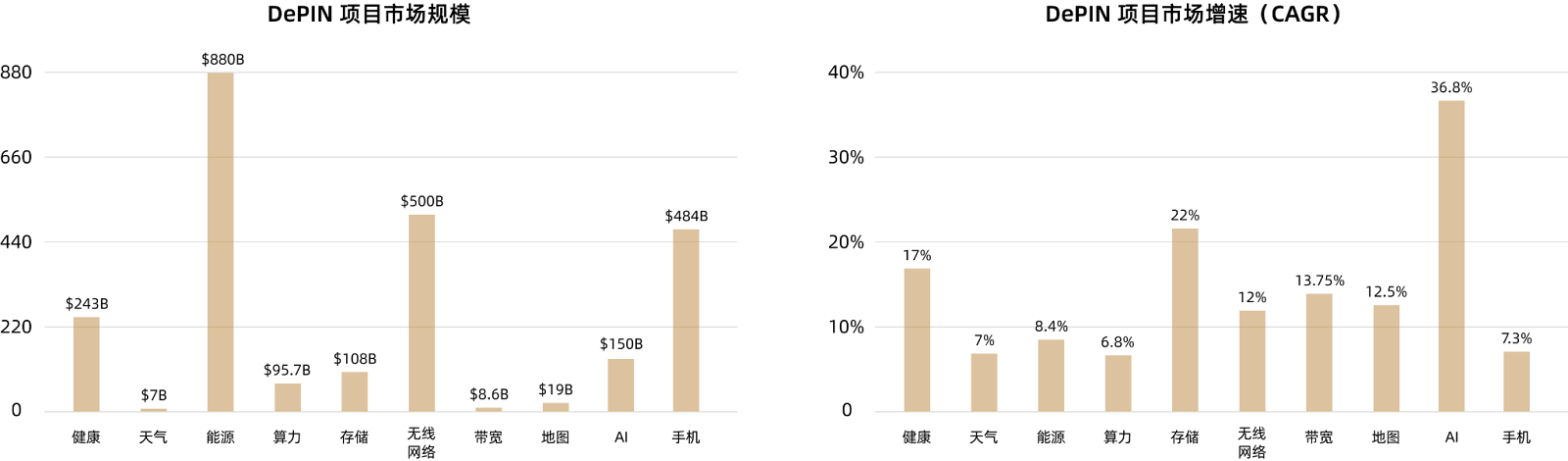

3. Market Demand & Potential: Emerging DePIN markets—including health data, weather, energy, bandwidth, AI, and mobile—are highly diverse, offering large addressable markets and high growth rates. Energy and mobile markets show particularly strong potential, while health data and AI markets boast impressive year-over-year growth.

4. Ecosystem & Blockchain Selection: Ethereum dominates existing DePIN projects, while Solana is emerging as the preferred chain for new initiatives due to its high performance, low cost, and robust community support. Leading projects like Render, Helium, and Hivemapper demonstrate DePIN's diverse use cases. Core platforms such as Solana and IoTeX provide critical technical infrastructure and ecosystem support, accelerating DePIN adoption.

5. Modular Blockchain Trend: Modular architecture significantly enhances DePIN’s scalability and adaptability. Through standardized interfaces and interchangeable components, DePIN networks can flexibly serve various applications and technical requirements, enabling faster deployment and easier maintenance.

6. Evolution of Token Economics: DePIN token models have evolved from fixed incentive schemes to dynamic mechanisms. Projects like Helium now implement differentiated incentives based on device age, geographic region, time-of-use, and network density to ensure sustainable network growth and long-term health.

Definition of DePIN

DePIN stands for Decentralized Physical Infrastructure Network. Literally, it means “decentralized physical infrastructure network,” where “De” refers to decentralization, “P” to physical, “I” to infrastructure, and “N” to network.

At its core, DePIN brings real-world users into Web3 by achieving cost reduction and socialization through decentralized networks. In today’s landscape—especially in the physical economy—DePIN leverages decentralized technology to drive efficiency and lower operational costs.

While past research often emphasized the infrastructure aspect of DePIN, this report focuses more on the decentralization component, aiming to highlight the wide variety of future DePIN markets and investment opportunities. (For the full PDF version, please visit the official website.)

Types of DePIN Projects

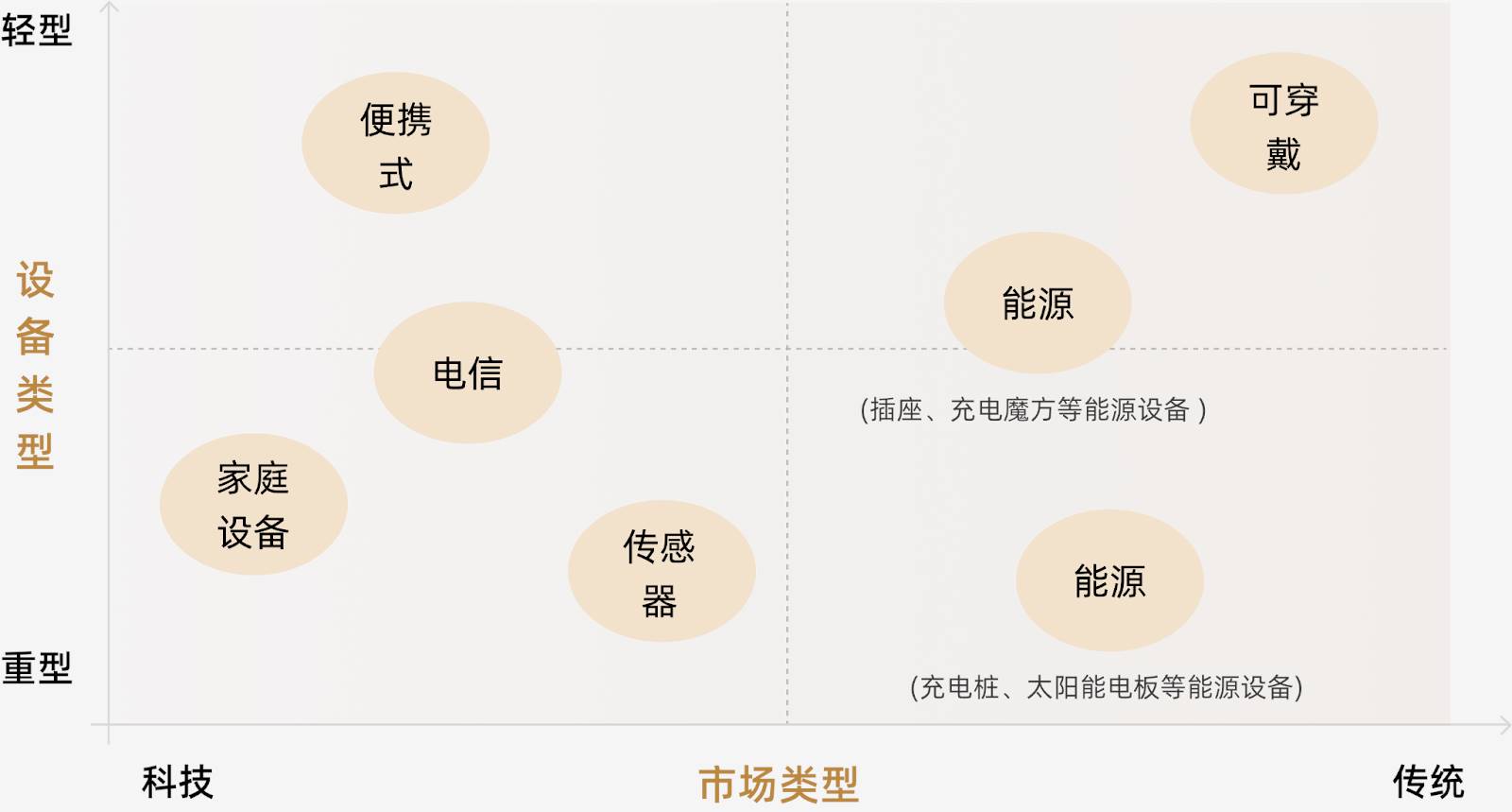

Classic DePIN Devices:

Characteristics: These devices are typically non-portable and fixed in place.

Main Applications: Computation, bandwidth, and storage.

Market Characteristics: Classic DePIN projects lean toward tech-focused markets, especially areas like AI compute, which attract significant capital and user traffic. This market is large but highly competitive—a red ocean.

Representative Projects: Filecoin, RNDR, etc.

Next-Gen DePIN Devices:

Characteristics: Compact, flexible, portable, and even wearable.

Main Applications: Lifestyle-oriented services such as health monitoring, weather forecasting, and mobile functionality.

Market Characteristics: Next-gen DePIN projects focus more on daily life, are low-cost, and suitable for everyday use. The market is highly diverse with broad application scope, still largely untapped—an emerging blue ocean.

Comparing these two generations reveals that DePIN technology continues to evolve, expanding into broader application scenarios. From fixed traditional devices to modern portable ones, DePIN's market potential spans both high-tech domains and everyday needs. While classic DePIN operates in a crowded red ocean, next-gen innovations represent a promising blue ocean with immense growth potential.

New Investment Landscape of DePIN

During this bull cycle, the number and diversity of DePIN projects have significantly increased, with many lightweight, next-gen DePIN initiatives emerging—such as wearables (e.g., AI-powered rings, smartwatches) collecting health data, and numerous portable, lightweight physical DePIN devices.

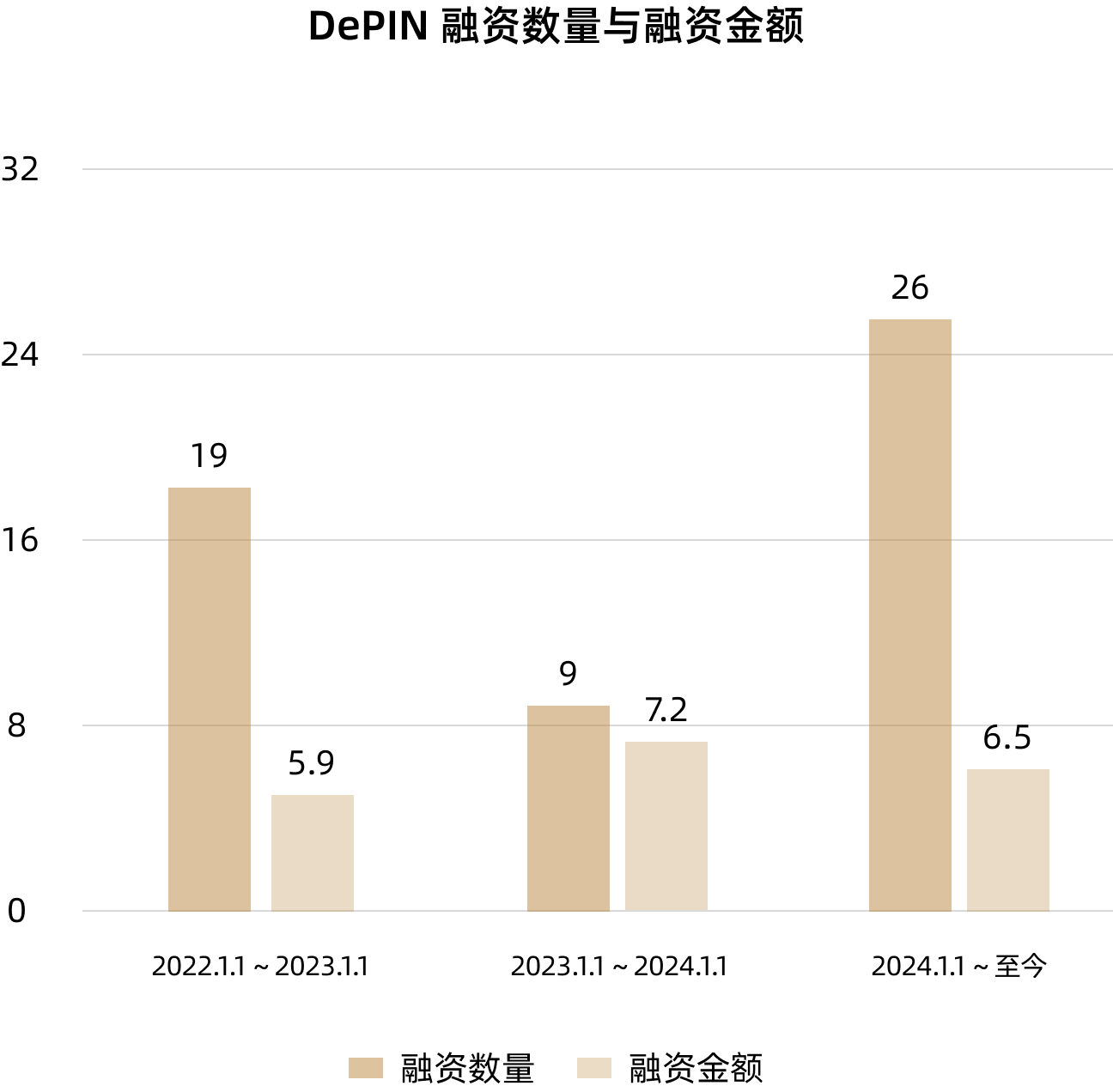

2022.1.1 – 2023.1.1

A total of 19 DePIN project financings occurred, with an average disclosed amount of $18M. Excluding Helium’s $200M Series D round, the average drops to $5.9M.

Project types included wireless networks, mapping, connected vehicle data, agriculture, drone imagery, weather, electricity markets, and DePIN infrastructure—with wireless network projects being the most common (7 total).

2023.1.1 – 2024.1.1

Nine DePIN project financings were recorded, with an average disclosed amount of $7.2M—significantly fewer than in 2022 (a bear market period), though the average deal size rose 22% compared to 2022.

Project categories narrowed to wireless networks, decentralized computing, geospatial data, weather, and DePIN infrastructure—both quantity and diversity declined significantly. (Bear markets demand more viable business models and use cases.)

2024.1.1 – 2024.5.20

Twenty-six DePIN project financings occurred, averaging $6.5M per round—showing a sharp increase in volume despite a slight decrease in average size.

Project types expanded to include decentralized compute, connected vehicles, IoT, wireless networks, FHE, mapping, weather & environment, bandwidth, DePIN infrastructure, mobile phones, energy, storage, and mixed reality.

New early-stage, undisclosed projects emerged in AI, VPNs, wearables (e.g., bands/watches), and other portable devices focused on health data collection.

source: MT Capital

Number of DePIN Projects & Investors

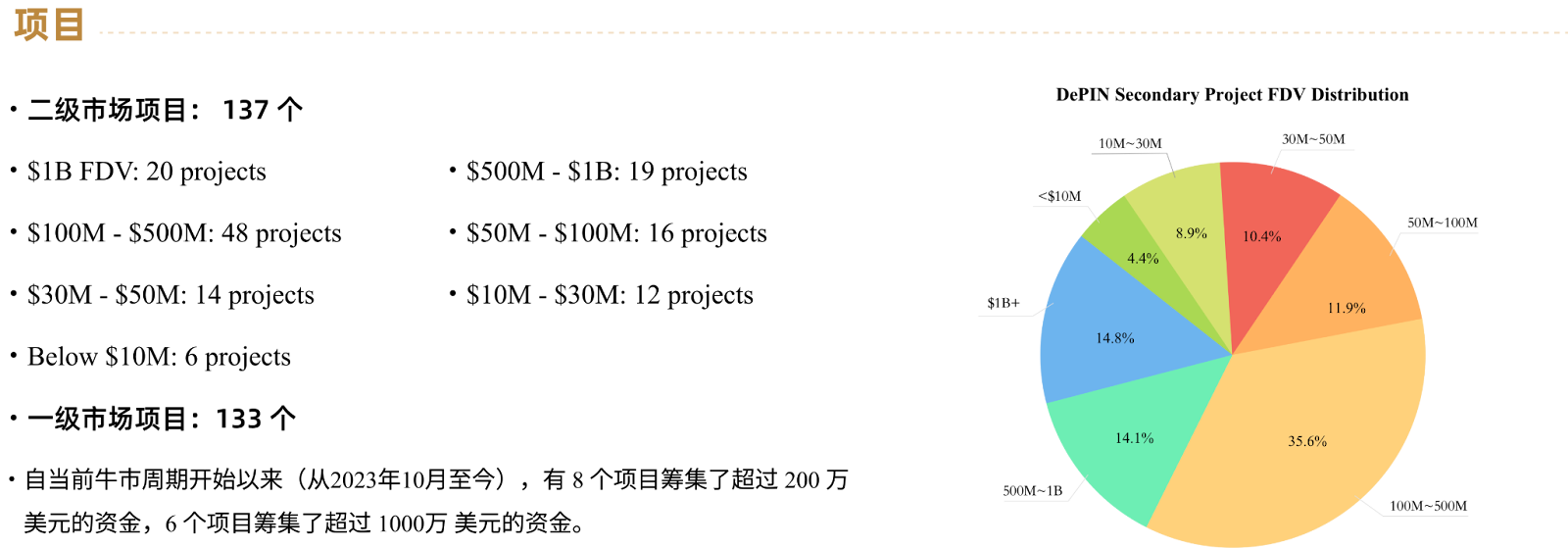

In the previous cycle, participating investors were primarily from Europe and North America. This cycle has seen a growing presence of Asian institutions, demonstrating strong regional interest in DePIN. The total number of DePIN projects has also surged, with over 135 secondary-market projects and over 130 primary-market projects cumulatively launched.

Projects:

• Secondary Market Projects: 137

• >$1B FDV: 20

• $500M - $1B: 19

• $100M - $500M: 48

• $50M - $100M: 16

• $30M - $50M: 14

• $10M - $30M: 12

• <$10M: 6

• Primary Market Projects: 133

• Since the start of this bull cycle (October 2023 to present), 8 projects have raised over $2 million, and 6 have raised over $10 million.

source: MT Capital

Investors:

Previous Cycle:

• Andreessen Horowitz (A16z)

• Multicoin Capital

• HashKey Capital

• IOSG Ventures

• Spartan Group

• Borderless Capital

• Lattice Ventures

• Variant Fund

• Delphi Digital

• Big Brain Holdings

• Cogitent Ventures

Current Cycle:

• OKX

• Animoca Brands

• JDI

• IoTeX

• FMG

• Waterdrip Capital

• MH

DePIN Market Demand

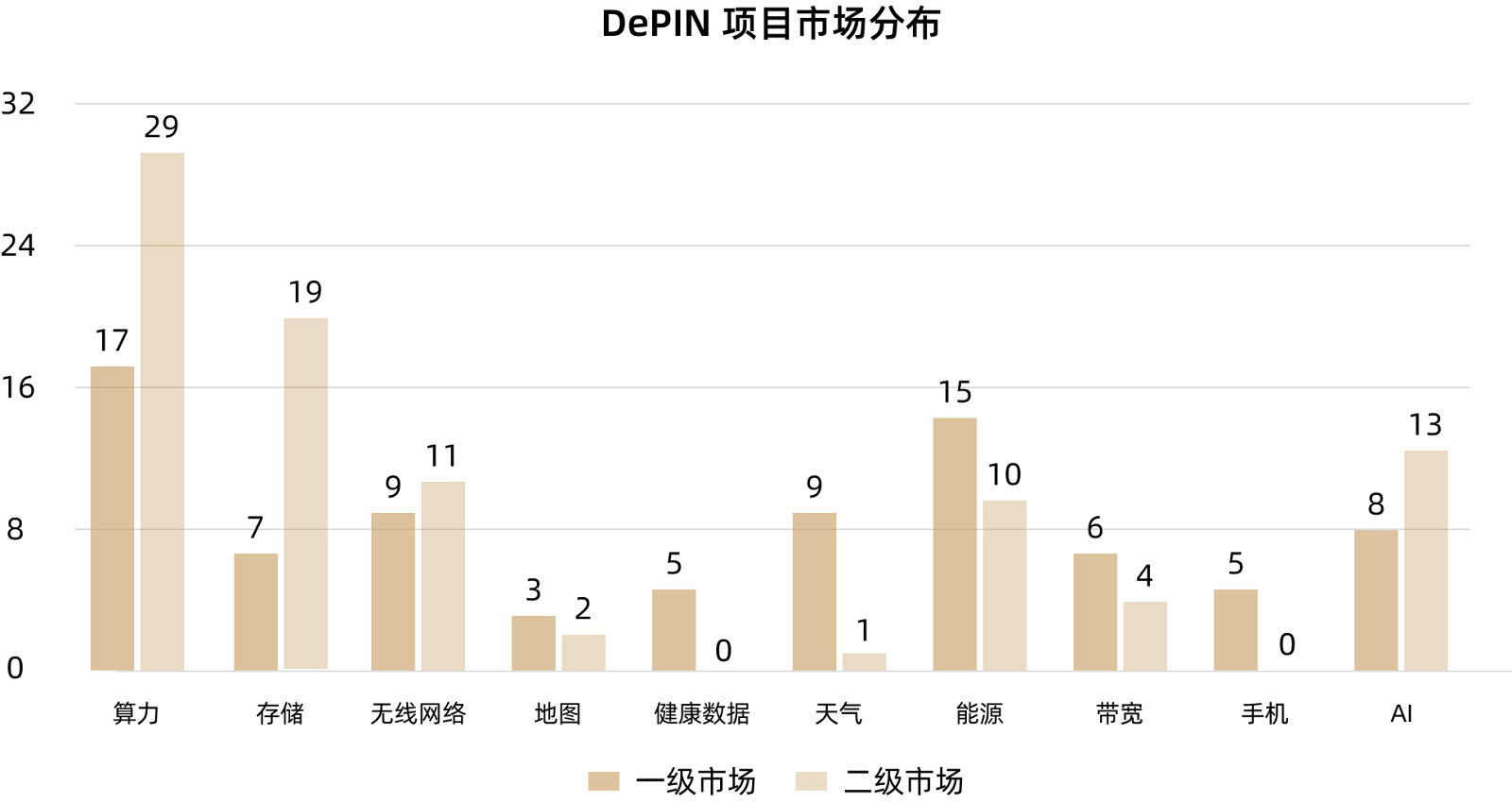

Established DePIN sub-sectors such as computing, storage, wireless networks, and mapping continue to see new entrants. This cycle introduces emerging verticals including wearable-based health data, weather, energy, bandwidth, AI, and mobile devices.

From a demand perspective, the energy and mobile markets offer massive scale. Health data and AI markets not only have large total value but also exhibit very high year-over-year growth, making them highly attractive.

Market (Primary + Secondary Projects):

Health (5+), Weather (9+1), Energy (15+10), Compute (17+29), Storage (7+19), Wireless (9+11), Bandwidth (6+4), Mapping (3+2), AI (8+13), Mobile (5+)

Previous Cycle Project Counts

• Compute: 17+29

• Storage: 7+19

• Wireless: 9+11

• Mapping: 3+2

Emerging Market Project Counts

• Health Data (Wearables): 5+

• Weather: 9+1

• Energy: 15+10

• Bandwidth: 6+4

• Mobile: 5+

• AI: 8+13

source: MT Capital

Market Size & Growth Rate

• Health Market: $243B, CAGR 17%

• Weather Market: $7B, CAGR 7%

• Energy Market: $880B, CAGR 8.4%

• Compute Market: $95.7B, CAGR 6.8%

• Storage Market: $108B, CAGR 22%

• Wireless Network Market: $500B, CAGR 12%

• Bandwidth Market: $8.6B, CAGR 13.75%

• Mapping Market: $19B, CAGR 12.5%

• AI Market: $150B, CAGR 36.8%

• Mobile Market: $484B, CAGR 7.3%

source: MT Capital

Blockchain Choice & Device Types

source: MT Capital

Currently, Ethereum hosts the largest number of secondary-market DePIN projects, with 70 out of 86 projects (81%) built on Ethereum.

Among primary-market projects, Solana leads with 28 out of 45 projects (62%). Solana is increasingly becoming the launchpad blockchain for new DePIN initiatives in this cycle.

source: MT Capital

From a device type perspective, there has been a surge in new projects involving energy systems and sensor devices. Additionally, more projects using Wearable, Portable, and Home Devices as physical hardware are emerging in the primary market.

Full DePIN Industry Chain

Upstream Supply Chain

1. Hardware Manufacturing & Supply

Hardware Suppliers: Produce various devices and sensors used in DePIN networks, such as GPUs, servers, IoT devices, and wireless equipment. For example, LoRaWAN hotspots for Helium and dashcams for Hivemapper.

Specialized Hardware Makers: Custom-build hardware for specific DePIN projects, such as Filecoin storage miners or Render network GPUs.

2. Chips & Semiconductors

Chip Manufacturers: Companies like NVIDIA and AMD supply high-performance GPUs essential for compute networks such as Render and Akash, serving as the backbone for AI workloads and complex computations.

3. IoT Devices

Sensor Makers: Provide sensors for environmental monitoring, traffic data collection, etc. Examples include Bluetooth sensors in Nodle and noise pollution detectors in Silencio.

Smart Devices: Smartphones and other mobile devices can act as sensor nodes for data collection and transmission.

4. Power & Energy Equipment

Energy Equipment Suppliers: Provide solar panels, wind turbines, and battery storage systems for decentralized energy networks. For instance, solar panels and battery systems in Daylight Energy.

Midstream Industry Chain

1. Network Operation & Maintenance

Network Operators: Entities like Helium and Hivemapper manage and maintain decentralized networks, including node management, data transmission, and storage.

Service Providers: Offer infrastructure services such as cloud computing and storage.

2. Software & Platform Development

Blockchain Platforms: Such as Solana and IoTeX, providing foundational blockchain support including smart contract execution, data storage, and validation.

Software Developers: Build software platforms and tools for managing and operating DePIN networks, e.g., Filebase’s distributed storage platform or Livepeer Studio’s video streaming tools.

3. Data Processing & Analytics

Data Analytics Firms: Process and analyze data collected from sensor networks to deliver actionable insights and services.

AI & Machine Learning Services: Like Beam, offering cloud-based AI computing by distributing model training and inference across decentralized GPU networks.

Downstream Industry Chain

1. Applications & Services

Enterprise Clients: Leverage DePIN services to enhance business efficiency—e.g., logistics companies using Hivemapper’s maps, agribusinesses using Geodnet’s precise location data.

Consumer Applications: Apps like Teleport for shared mobility or DIMO for vehicle data empower users with convenient services and reward contributions.

Smart Cities & Public Infrastructure: Use decentralized data and services to optimize urban management and public services such as energy and transportation.

Modular/Data Layer/Middleware

Modular blockchains enhance scalability, security, and flexibility by separating core functions—execution, consensus, data availability, and settlement—into distinct layers. For example, Ethereum improves data availability and throughput via sharding and rollups, while Cosmos enables cross-chain interoperability and customization through IBC and Tendermint. Benefits include higher transaction throughput, enhanced security, and greater developer flexibility, paving the way for broader blockchain innovation.

The modular trend significantly boosts DePIN’s scalability. Modular design allows DePIN networks to flexibly adapt to diverse applications and technical demands through standardized interfaces and interchangeable components, simplifying deployment and maintenance. For instance, Render expanded from image rendering to AI model training via modularity, broadening its service scope and market reach. Similarly, Filecoin’s modular architecture enables extensions into hot storage and data computation, enhancing utility and appeal. This approach not only improves technical compatibility and upgradeability but also allows independent module development, accelerating ecosystem-wide innovation. This flexible, efficient architecture greatly enhances DePIN’s scalability, enabling rapid adaptation to market and technological changes, thus driving widespread adoption of decentralized infrastructure.

Notable Projects

DePHY

DePHY is a development framework designed specifically for DePIN, significantly reducing development cost and time through key features like message layer, DID (Device ID), open-source hardware designs, off-chain compute network, and re-staking layer. It supports any standard-interface hardware, enabling fast, efficient, and secure deployment of decentralized infrastructure projects.

PINGPONG

PINGPONG is a DePIN liquidity and service aggregator that optimizes and maximizes mining returns across multiple networks using innovative tools and solutions.

DePIN Platforms & Key Players

Solana

Solana is emerging as a new super-infrastructure for DePIN. Its high performance, low fees, strong developer and user communities, and high purchasing power make it the go-to launchpad for many DePIN projects. Established stars like Render and Helium have thrived after migrating to Solana, showcasing the chain’s powerful infrastructure and broad user base. Solana is attracting cutting-edge DePIN projects across categories—including Grass, Natix, and Exabits—and steadily building a comprehensive DePIN ecosystem.

Featured Projects

Render

Render Network is a decentralized GPU rendering platform that connects artists with GPU providers via blockchain, delivering scalable and cost-effective rendering solutions.

Hivemapper

Hivemapper is a decentralized mapping network that uses blockchain and crowdsourced dashcam footage to create detailed, real-time maps.

Helium

Helium is a pioneering DePIN project that created a decentralized wireless network allowing IoT devices to connect globally via a distributed hotspot network.

Natix:

Natix Network is a blockchain-based crowdsourced camera network for creating real-time world maps.

Exabits:

Exabits is a decentralized infrastructure for AI and compute-intensive applications, enabling users to offer distributed GPU services, data storage, or expertise without central authority or intermediaries.

Grass:

Grass is a DePIN project developed by Wynd Network that allows users to monetize unused internet bandwidth by contributing their connected devices to a decentralized network aimed at providing data for AI training.

EV3

EV3 is an investment firm driven by a mission to back exceptional entrepreneurs building DePIN. By investing up to $1 million in early-stage projects, EV3 aims to unlock the next $100 trillion of global GDP through next-generation open infrastructure networks in telecom, logistics, energy, cloud computing, and AI. Founded by institutional-trained investors Mahesh Ramakrishnan and Salvador Gala, EV3 combines deep industry expertise and long-term partnerships backed by leading investors.

Featured Projects

3DOS

3DOS is the world’s largest decentralized on-demand manufacturing network, aiming to revolutionize manufacturing via blockchain and 3D printing. The platform enables anyone to upload designs, earn royalties, and enable global on-demand production.

Zonal

Zonal is developing a decentralized network based on micro-location protocols, using UWB and BLE wireless technologies to deliver highly reliable global and indoor positioning services that verify real-world interactions. Its goal is to create a unified protocol providing location verification tools for various services and enterprises.

XNET

XNET is a next-generation mobile operator building a decentralized network using blockchain. Leveraging CBRS spectrum, XNET aims to establish a reliable, industry-grade neutral-host network. The project seeks to solve inefficiencies and capital intensity in telecom through its distributed RAN.

IoTeX

IoTeX is an open platform modularly constructing AI+DePIN infrastructure, bridging smart devices and real-world data with Web3, enabling seamless Web2-to-blockchain integration, and fostering a multidimensional, decentralized open ecosystem for the real world. With modular architecture, developers can build cross-domain innovations connecting wearables, connected vehicles, green energy, environmental data, and more—from smart living to industrial intelligence.

As of Q1 2024, the IoTeX network had 108 active nodes, with total staked value reaching $29 million—up 73% quarter-on-quarter. Average staking participation hit a record high of 40.6%. Node rewards rose 71% to $3.3 million.

IoTeX offers complete “plug-and-play” products and tools, enabling efficient development and deployment of blockchain-powered IoT applications. The platform consists of four layers: hardware, middleware, tools, and blockchain. Since inception, IoTeX has raised over $90 million to support R&D and market expansion. Its solutions support various IoT ecosystems, including sharing economy, smart homes, autonomous driving, and supply chain management.

Featured Projects

Network3

Network3 is a Layer2 blockchain platform integrating AIoT technology, designed to provide AI developers with efficient model training and validation tools while empowering users to earn cryptocurrency by running nodes.

Inferix

Inferix is a decentralized GPU visual computing platform dedicated to 3D/AR/VR rendering and AI inference.

Wayru

Wayru Network is a decentralized wireless network that delivers various smart functionalities via WayruOS and the Wayru Connectivity Superapp.

DePIN Sub-Sectors by Physical Hardware

Join TechFlow official community to stay tuned Telegram:https://t.me/TechFlowDaily X (Twitter):https://x.com/TechFlowPost X (Twitter) EN:https://x.com/BlockFlow_News