From ETHLend to Aave V4: The Lending Leader's Ecosystem Development Plan

TechFlow Selected TechFlow Selected

From ETHLend to Aave V4: The Lending Leader's Ecosystem Development Plan

As Aave's business continues to expand and mature, against the backdrop of a recovering market in 2024, both AAVE's TVL and price have increased.

Author: @Elias201179

Advisor: @CryptoScott_ETH

TL;DR

-

Aave is a multi-chain lending protocol whose core business revolves around P2C (peer-to-contract) lending of crypto assets through dynamic interest rate models and liquidity pools. Currently ranked third in total value locked (TVL) among DeFi projects, it holds a leading position particularly within the lending category. Aave’s parent company, Avara, is gradually expanding into new areas including cross-chain lending, stablecoins, open social protocols, and institutional lending platforms.

-

The total supply of AAVE tokens is 16 million, with 13 million allocated to token holders and the remaining 3 million reserved for the Aave ecosystem. The current circulating supply of AAVE tokens is approximately 14.8 million.

-

With Aave's continued expansion and maturation, both AAVE’s TVL and price have increased amid the 2024 market recovery. Avara announced plans in May for the Aave V4 upgrade, focusing on further improving liquidity and asset utilization across the platform.

-

Aave V3 has largely replaced V2, and with its business model and user base stabilizing, Aave now significantly outperforms other lending protocols in terms of TVL, trading volume, and number of supported chains.

-

Avara faces challenges in its expansion efforts. Its primary revenue still relies heavily on traditional lending activities. The stablecoin GHO recently regained its peg after a period of de-pegging. Meanwhile, the institutional lending platform Aave Arc has seen its TVL remain low following a sharp decline.

-

For future growth, recommendations include further optimizing its cross-chain lending solution, strengthening its stablecoin operations and deeply integrating GHO with the Aave platform, incorporating DeFi capabilities into emerging ventures like social platforms, and consolidating currently independent business units into a comprehensive ecosystem.

Introduction

In Q1 2024, the DeFi market demonstrated significant growth and vitality, reaching annual highs in fees and revenue. During the quarter, the DeFi sector generated over $1.6 billion in fees and more than $467 million in total revenue, with March alone generating $230 million—setting a new yearly high.

Lending, as one of the core functions of the cryptocurrency ecosystem, leverages smart contracts to match borrowers and lenders, lock collateral, calculate interest, and execute repayments. According to Defillama data, as of mid-May 2024, the lending sector had a total TVL of $29.586 billion, accounting for 36% of the entire DeFi market’s TVL.

Against this backdrop, Aave, as a key player in the DeFi lending space, stands out. In Q1 2024, Aave recorded $6.1 billion in total borrowing volume—a 79% increase quarter-on-quarter—far exceeding the broader market’s average growth rate.

Additionally, Aave’s lending income grew by 40% during the quarter to $34.9 million, maintaining its leadership in the DeFi lending market. Despite intense competition from rivals, Aave continues to dominate in both total value locked (TVL) and revenue.

Studying Aave’s performance offers valuable insights into broader DeFi market trends and future potential. Its success and operational model serve as reference points for other DeFi projects.

1. Project Overview

In May 2017, Stani Kulechov founded ETHLend. Initially, ETHLend faced severe liquidity challenges. By the end of 2018, it underwent a strategic shift—from a P2P (peer-to-peer) model to a P2C (peer-to-contract) model—introducing a liquidity pool mechanism and rebranding as Aave. This transformation marked Aave’s official launch in 2020.

In November 2023, Aave Companies announced a rebrand to Avara. Avara has since launched new initiatives including the GHO stablecoin, the Lens social network protocol, and the institutional lending platform Aave Arc, while also beginning strategic moves into crypto wallets, gaming, and other sectors.

Aave V3 is now stable and operational across 12 different blockchains. Meanwhile, Aave Labs is advancing upgrades to the lending platform, announcing a V4 upgrade proposal in May 2024.

According to Defillama, as of May 15, 2024, AAVE ranks third in total value locked (TVL) within DeFi at $1.0694 billion.

2. Team Background and Funding

2.1 Team Background

Avara, Aave’s parent company, is headquartered in London, UK. Originally an 18-member innovation team, it now employs 96 people according to LinkedIn.

-

Founder & CEO: Stani Kulechov holds a Master of Laws from the University of Helsinki. His thesis focused on using technology to improve commercial agreements, and he is a serial entrepreneur in Web3.

-

COO: Jordan Lazaro Gustave began coding as a teenager and earned a Master’s degree in Risk Management from University Paris X Nanterre.

-

CFO: Peter Kerr graduated from Massey University and the University of Oxford, previously working at HSBC, Deutsche Bank, and Sonali Bank before joining Avara as CFO in 2021.

-

Head of Institutional Business: Ajit Tripathi holds degrees from IMD Business School and the Indian Institute of Technology, with prior roles at Binance, ConsenSys, and PwC.

2.2 Funding History

-

In 2017, ETHLend raised $16.2 million via an ICO, selling 1 billion LEND tokens.

-

In 2018, the project rebranded to Aave.

-

In July 2020, Aave secured a $3 million Series A round led by Three Arrows Capital.

-

In October 2020, Aave raised $25 million in a Series B round and launched its governance token $AAVE.

-

In May 2021, the AAVE protocol was deployed on Polygon, qualifying for $200 million in MATIC liquidity mining rewards over the following year.

3. Historical Events Timeline

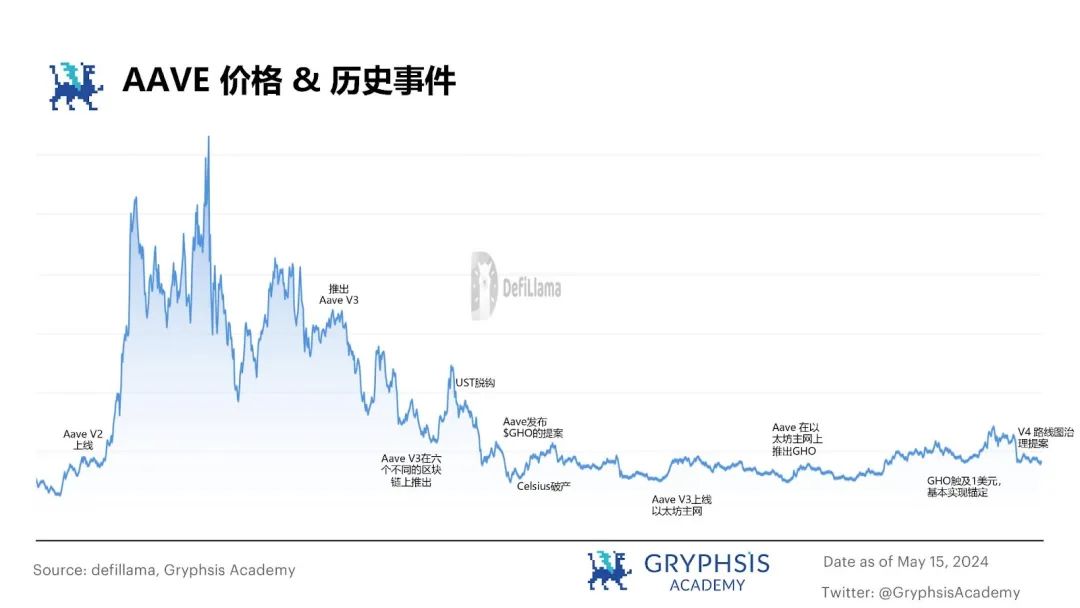

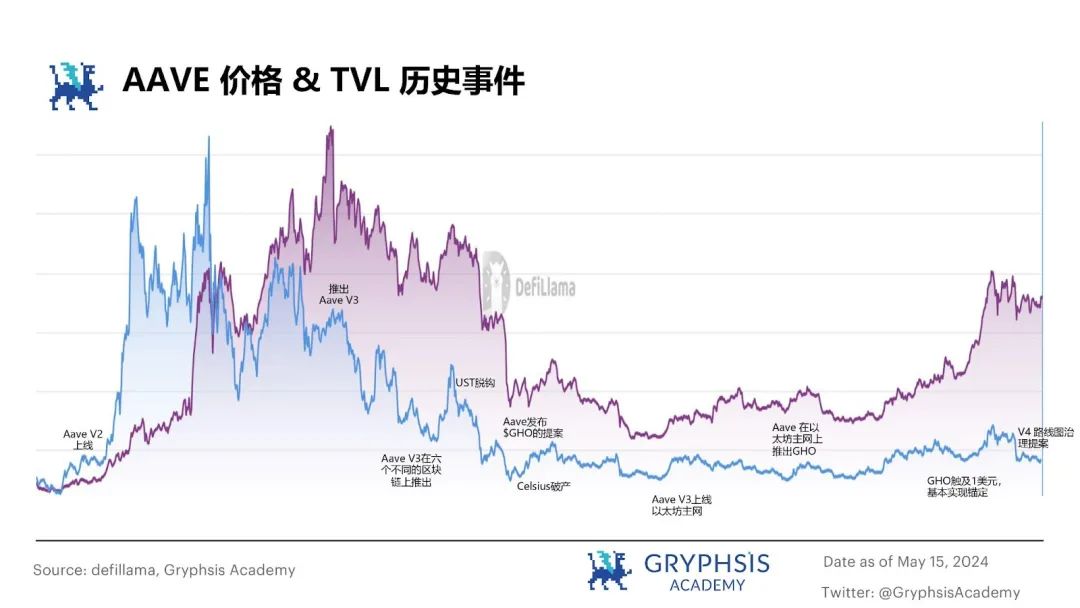

Figure 1: Aave Historical Events

Major events and announcements often significantly impact the price and total value locked (TVL) of decentralized lending protocols. For example, after Aave V2 launched at the end of 2020, both AAVE’s price and TVL saw notable increases. This trend continued throughout the 2021 “DeFi Summer,” when growing collateralization and borrowing volumes sustained Aave’s high price levels. In March 2022, the release of Aave V3 again drove clear growth in AAVE’s price and TVL. However, the subsequent UST depeg event and ensuing bear market caused AAVE’s TVL to shrink and its price to fall.

Despite a temporary drop in AAVE’s price and TVL following a report of a protocol issue and the temporary suspension of Aave V2 markets on November 5, 2023, recent improvements in overall market conditions and GHO regaining its peg have led to a clear upward trend in both metrics.

Figure 2: Aave Price & Historical Events

Figure 3: Aave TVL & Historical Events

4. Business Segments and Implementation Mechanisms

4.1 Core Lending Business

4.1.1 Evolution of Aave’s Framework – V3 Enhances Capital Efficiency Through E-mode, Isolation Mode, and Portals

Since Aave’s debut in January 2020, it has established itself as a major player in decentralized finance (DeFi), thanks to core features such as lending pools, aToken mechanics, innovative interest rate models, and flash loans. As Aave evolved from V1 to V3, its lending business model demonstrated consistent and steady development.

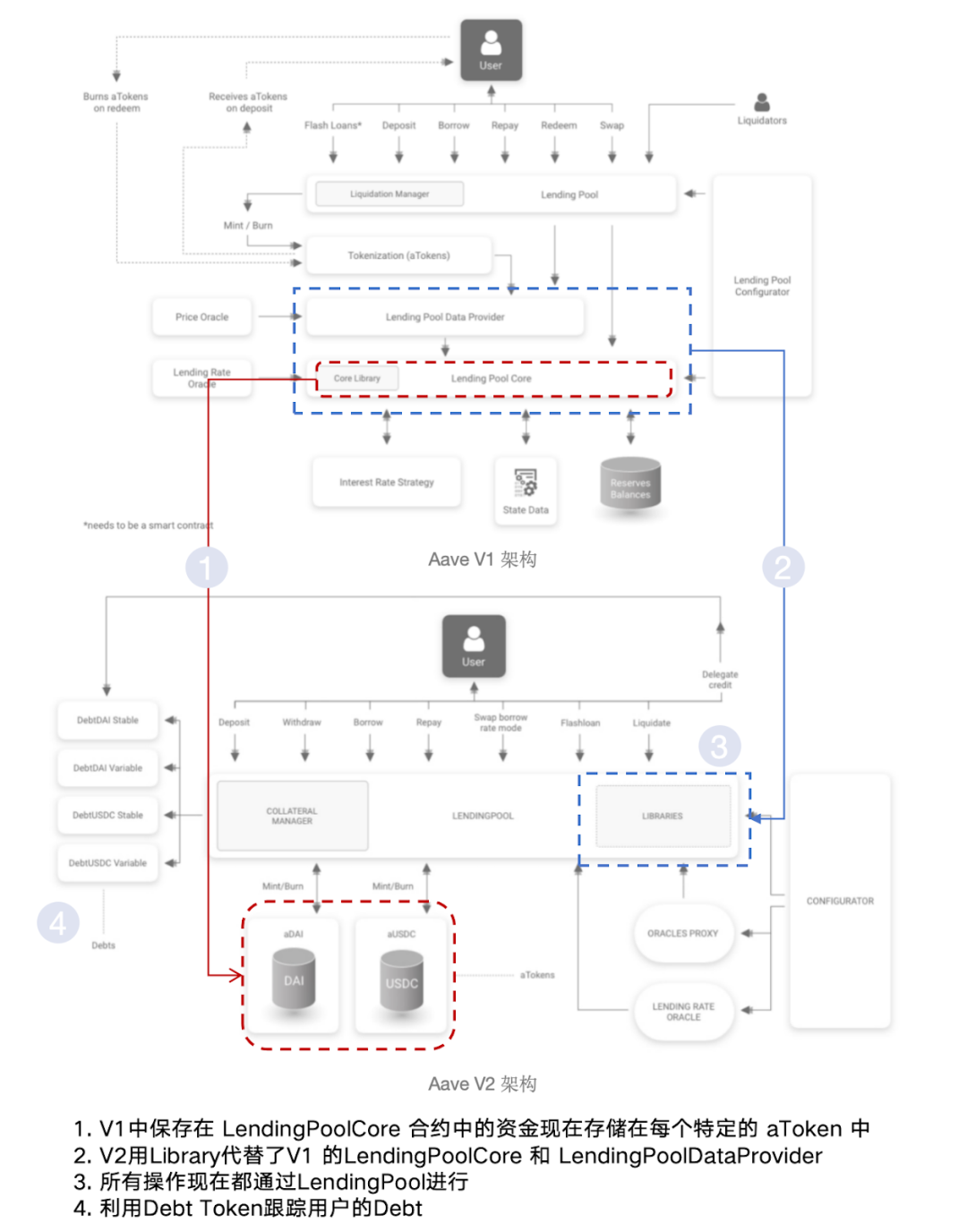

In December 2020, Aave released V2, which improved user experience by simplifying and optimizing its architecture and introducing features like debt tokenization and Flash Loans V2. According to the official whitepaper, these architectural improvements were expected to reduce gas costs by approximately 15% to 20%. Aave launched V3 in January 2023, building on V2 to further enhance capital efficiency with minimal changes to overall architecture. V3 introduced three innovations: Efficient Mode (E-mode), Isolation Mode, and Portals.

In May 2024, Aave proposed a V4 upgrade featuring a completely new architecture, including a unified liquidity layer, fuzzy-controlled interest rates, native GHO integration, and the Aave Network. Specific mechanisms of V4 will be detailed in section 4.1.6 below.

Figure 4: Aave Protocol Architecture Comparison Between V2 and V3

4.1.2 Aave’s Interest Rate Model – Using Dynamic Models to Adjust Liquidity Pool Supply

Borrowing Rates

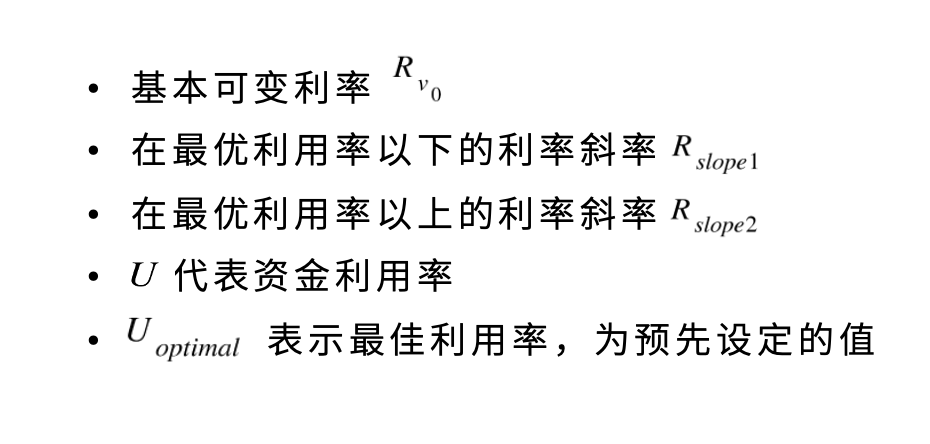

Each reserve in Aave has a dedicated Interest Rate Strategy contract. Specifically, the basic strategy contract defines the following:

The variable rate formula is:

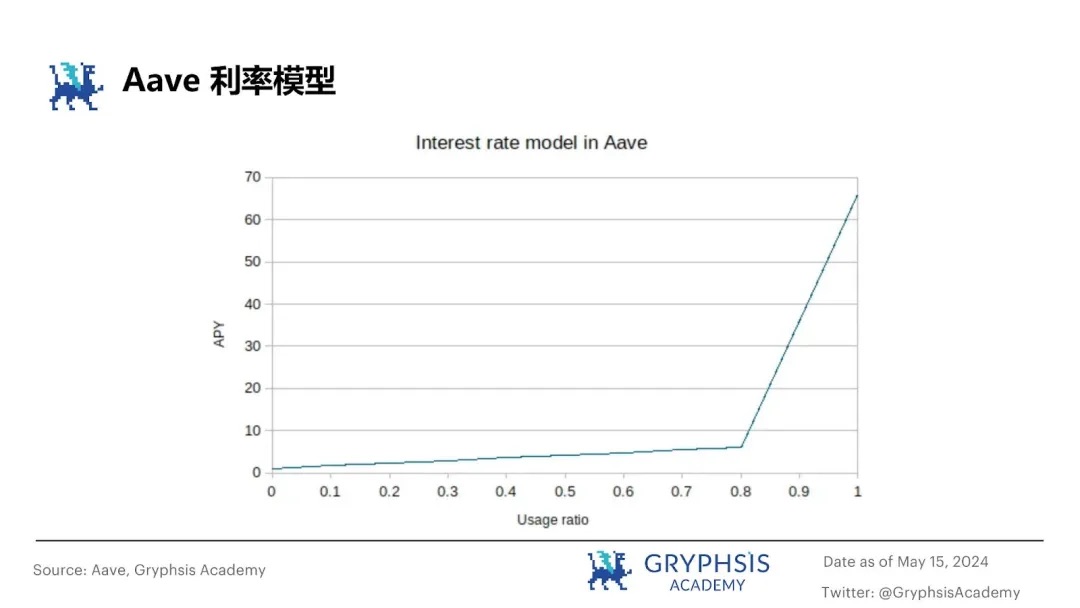

Analyzing the rate model shows that borrowing rates rise slowly when utilization is below the optimal level. However, once utilization exceeds the optimal threshold, borrowing rates spike sharply—i.e., low rates encourage borrowing when liquidity is high; high rates preserve liquidity when it is low.

Figure 5: Aave Deposit Rate Fluctuations

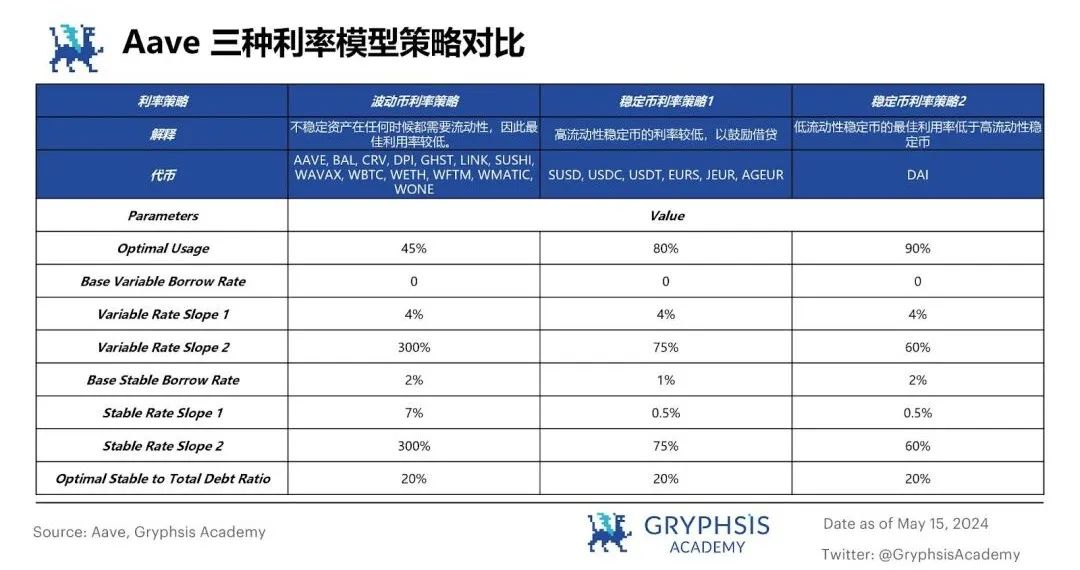

Each asset has a predefined optimal utilization rate. Based on this model, Aave V3 categorizes risk profiles into three interest rate strategies:

Figure 6: Comparison of Aave V3’s Three Interest Rate Strategies

4.1.3 Aave’s Lending Process and Liquidation Mechanism

The interaction flow in Aave works as follows:

-

Deposit providers receive corresponding aTokens upon depositing assets into Aave’s liquidity pool. These aTokens serve as deposit receipts and can be freely traded or transferred on secondary markets.

-

Borrowers can access crypto assets through over-collateralized loans or flash loans. When repaying, they must return principal plus interest calculated based on asset utilization and market supply-demand dynamics. Once debt is settled, borrowers reclaim their collateral, and associated aTokens are burned.

Aave’s liquidation mechanism works as follows:

When the market value of collateral drops or the borrowed asset appreciates, causing the borrower’s collateral value to fall below the predefined liquidation threshold, Aave’s liquidation mechanism is triggered. Different tokens have varying Loan-to-Value (LTV) ratios and liquidation thresholds based on their risk profiles. During liquidation, borrowers must repay principal and interest, plus a liquidation bonus paid to third-party liquidators.

Key Parameters:

-

Loan-to-Value (LTV): Determines the maximum borrowable amount. For example, a 70% LTV means a $100 USDT collateral allows borrowing up to $70 USDT.

-

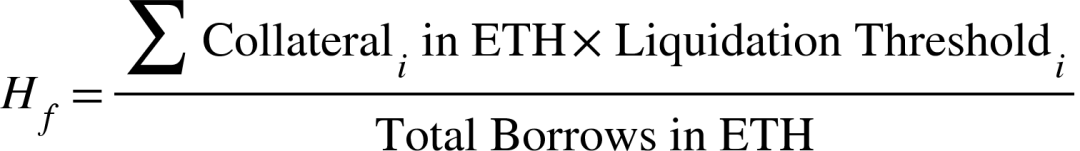

Health Factor: Reflects the safety margin of a borrowing position. A higher health factor indicates stronger repayment capacity. If it drops below 1, the position risks liquidation.

-

Liquidation Threshold: Sets the minimum ratio between collateral value and borrowed amount. When this threshold is breached, the collateral becomes subject to liquidation.

4.1.4 Flash Loan Mechanism

Flash loans in the Aave protocol represent a groundbreaking financial innovation leveraging the atomicity of Ethereum transactions—all actions either fully execute or revert entirely. This enables users to borrow large sums without collateral. Borrowers take out funds from Aave within a single block (~13 seconds) and must repay within the same block, creating a rapid closed-loop process.

Flash loans greatly simplify arbitrage, automated trading strategies, and other DeFi operations while effectively mitigating liquidity risk. In Aave V3, each flash loan transaction incurs a 0.05% fee—significantly lower than Uniswap V2’s 0.3%—providing users with a more cost-effective option.

4.1.5 Credit Delegation Mechanism

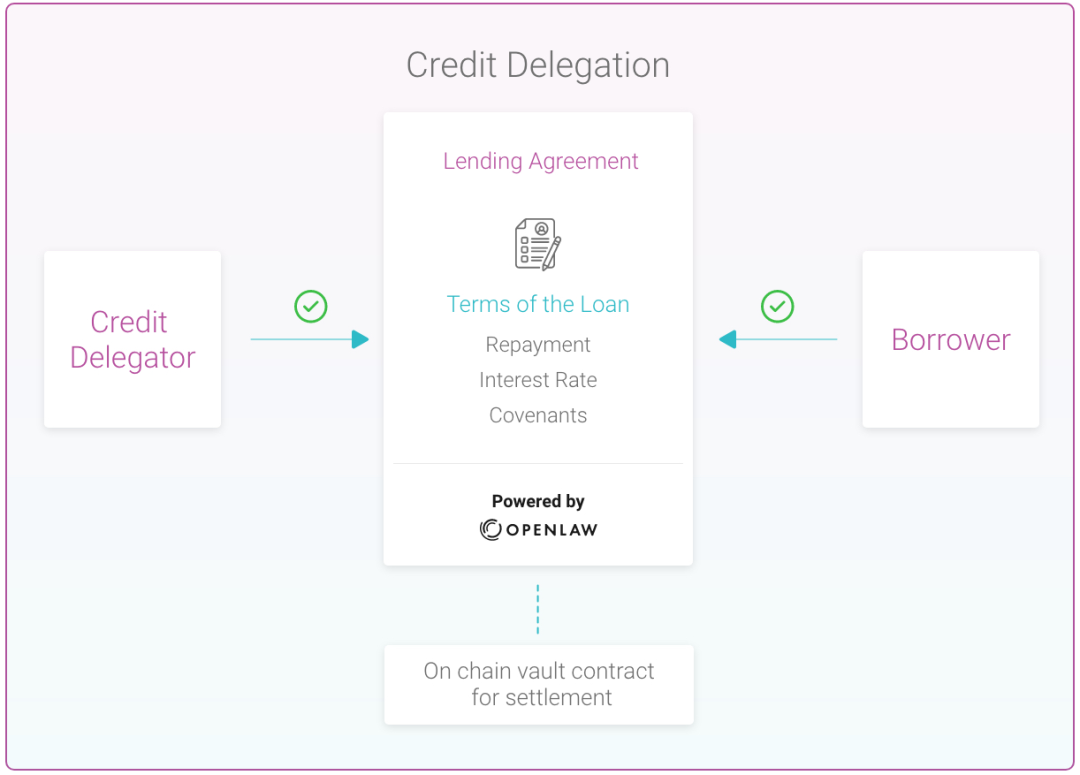

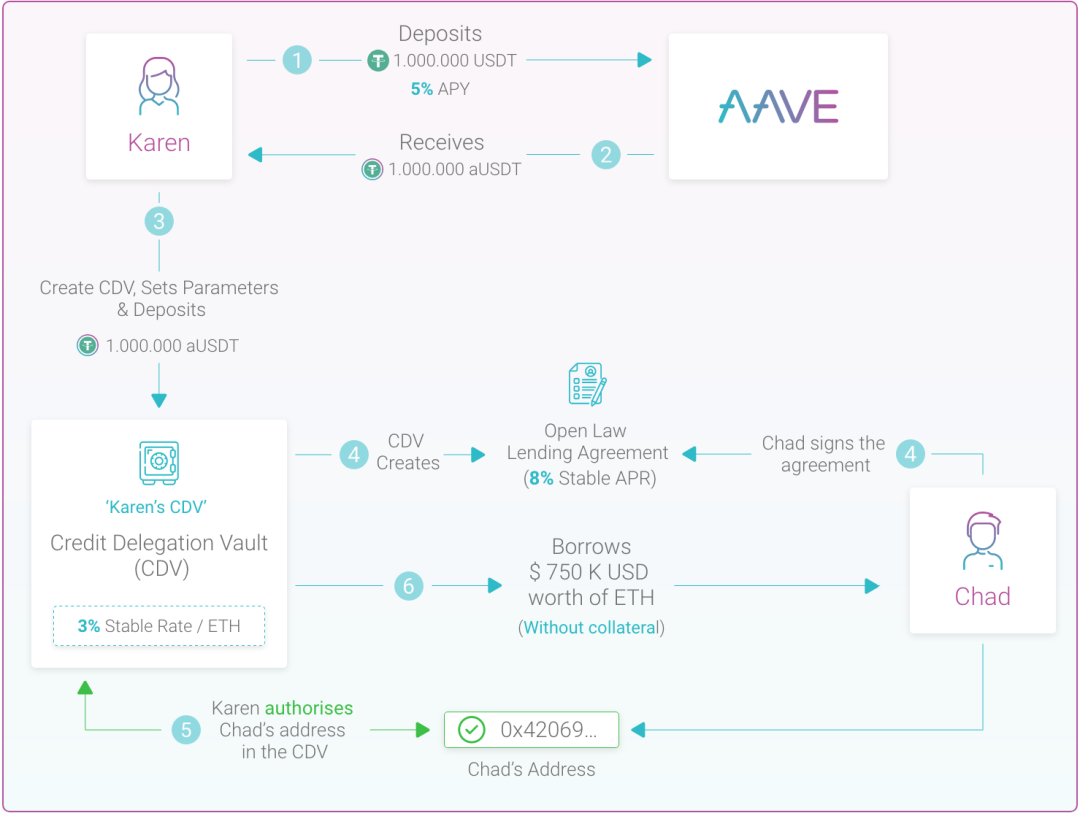

Figure 7: Credit Delegation Diagram

Aave launched its credit delegation mechanism in August 2020, allowing depositors to delegate unused credit lines to others, enabling borrowers to gain additional borrowing power.

Moreover, Opium introduced a Credit Default Swap (CDS) product in September 2020 specifically for Aave’s credit delegation system. CDS acts as a risk management tool, allowing investors to hedge against default risks, adding an extra layer of protection. Below is Aave’s illustrative case explaining how credit delegation works:

Figure 8: Aave Credit Delegation Example

-

Karen, a depositor, deposits $1 million USDT into Aave, earning a 5% APY. As proof, she receives $1 million worth of aUSDT.

-

To participate in credit delegation, Karen creates a CDV (Credit Delegation Vault) smart contract. She deposits $1 million worth of aUSDT and sets parameters including credit limits, paying a 3% ETH stability fee.

-

Karen and Chad agree via OpenLaw on loan terms at an 8% APR. Both parties sign the agreement.

-

Karen adds Chad’s receiving address to the CDV whitelist, allowing him to borrow $750,000 worth of ETH without collateral.

-

In this case, Karen’s effective APY is 5% minus 3% fee plus 8% lending rate: 5% - 3% + 8% = 10%, higher than standard Aave deposit yields. Chad successfully borrows $750,000 ETH at 8% APR without posting collateral.

4.1.6 New Features in Aave V4

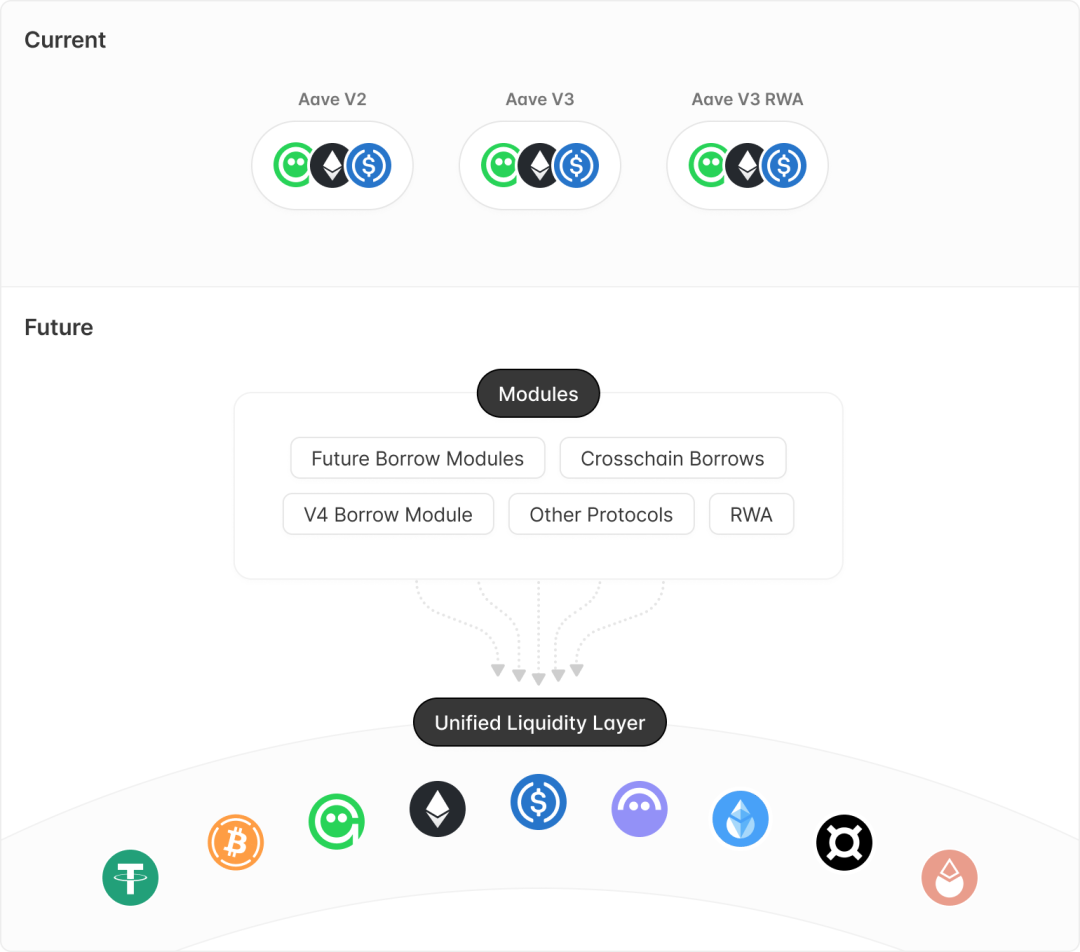

According to the Aave V4 development proposal, V4 will feature a completely new architecture designed to be efficient, modular, and minimally disruptive to third parties, facilitating easier extensibility.

Liquidity Layer

-

Unified Liquidity Layer

The liquidity layer builds upon Aave V3’s Portal concept. Currently, Aave V2 and V3 suffer from fragmented liquidity due to version transitions, with migration taking considerable time. The proposed liquidity layer aims to centrally manage supply and borrowing caps, interest rates, assets, and incentives, allowing other modules to draw liquidity directly. In short, when Aave DAO plans to add or remove new functional modules (e.g., isolation pools, RWA modules, CDPs), liquidity migration won’t be required—modules simply pull liquidity from the unified layer.

Figure 9: Unified Liquidity Layer Illustration

-

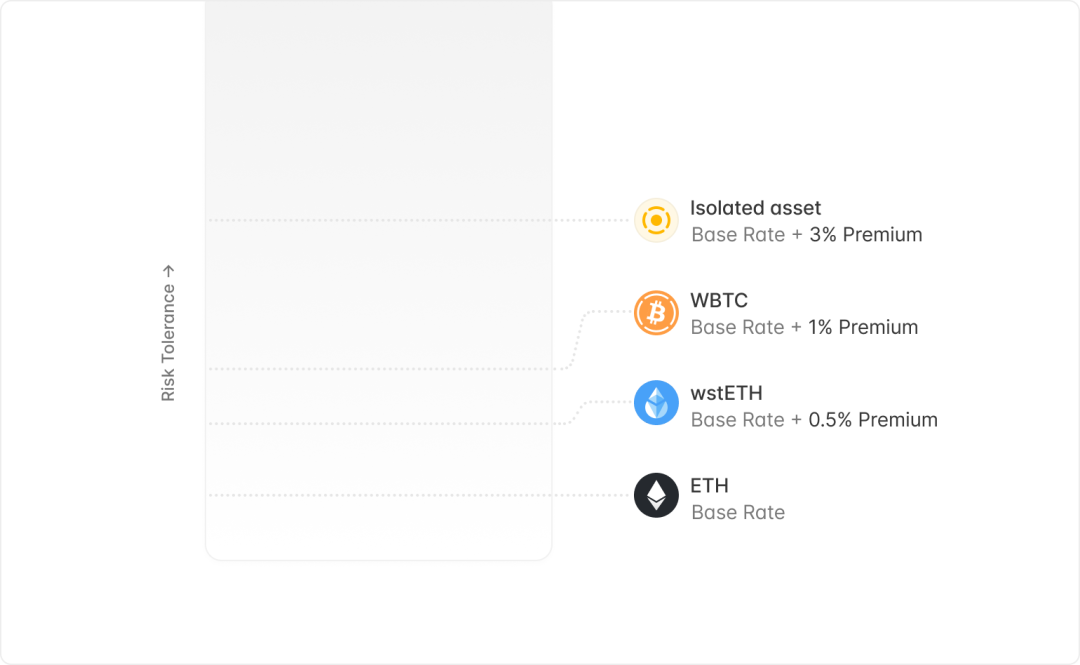

Liquidity Premium

Aave V4 introduces a liquidity premium feature that adjusts borrowing rates based on collateral risk. Each asset is assigned a risk factor, dynamically adjusted according to market and external risks. Lower-risk assets (e.g., Ethereum) enjoy lower borrowing costs, while higher-risk assets (e.g., altcoins) face higher rates.

Figure 10: Liquidity Premium Illustration

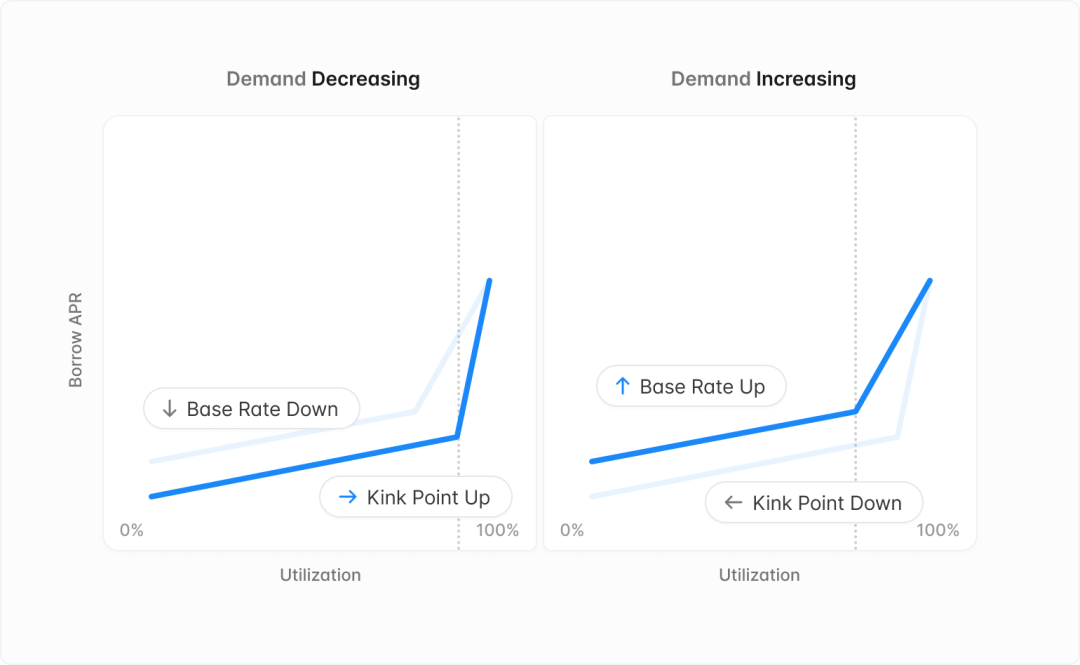

Fuzzy-Controlled Interest Rates

Currently, Aave’s interest rate settings increase governance complexity and reduce capital efficiency. Aave V4 proposes a fully automated rate mechanism using fuzzy logic to dynamically adjust the slope and inflection points of the rate curve. This innovative approach allows Aave to flexibly raise or lower base rates based on real-time demand, offering optimized rates for both depositors and borrowers.

Figure 11: Fuzzy-Controlled Interest Rate Illustration

Aave V4 Lending Module

Aave V4 enhances security, user experience, and governance simplicity through several innovations:

-

Smart accounts and vaults greatly improve UX, allowing users to manage multiple positions via a single wallet. Vault functionality enabled by smart accounts allows borrowing without directly pledging collateral to the liquidity layer; collateral locks only during active borrowing or liquidation, enhancing convenience and security.

-

V4 also introduces dynamic risk configuration to adjust risk parameters as market conditions change. Borrowers are linked to current asset configurations, while new ones apply to new users, avoiding disruption to existing borrowers. Additionally, V4 includes an automatic delisting mechanism to simplify asset removal.

Excess Debt Protection Mechanism

Due to shared liquidity’s risk of bad debt contagion, Aave V4 introduces a mechanism to track undercollateralized positions and automatically handle accumulated excess debt. By setting debt thresholds, assets exceeding them lose borrowing privileges, preventing spread of toxic debt and protecting the shared liquidity model.

GHO Native Integration Plan

Aave V4 proposes deeper GHO integration to improve UX and boost returns for stablecoin suppliers.

-

Native GHO Minting: V4 proposes efficient native GHO minting within the liquidity layer;

-

GHO "Soft" Liquidation: Inspired by crvUSD’s model, V4 introduces a Lending-Liquidation Automated Market Maker (LLAMM) to streamline liquidations. Users can convert to GHO during downturns or buy back collateral during rallies;

-

Interest Payments in GHO: V4 will support interest payouts in GHO for depositors. Choosing this converts interest payments into V4’s PCV (Protocol Controlled Value), enhancing GHO stability and capital efficiency;

-

Emergency Redemption Mechanism: V4 proposes an emergency redemption to counter extreme de-peg scenarios. When triggered, the lowest-health positions’ collateral is redeemed into GHO to repay debts.

Aave Network

Aave also introduced the concept of Aave Network—a dedicated blockchain envisioned as the central hub for Aave and GHO. Centered on Aave V4, it would use GHO for payments and be governed by community votes via Aave Governance V3, inheriting security from Ethereum. Currently in design phase, the team says it will monitor L1/L2 tech developments to finalize implementation.

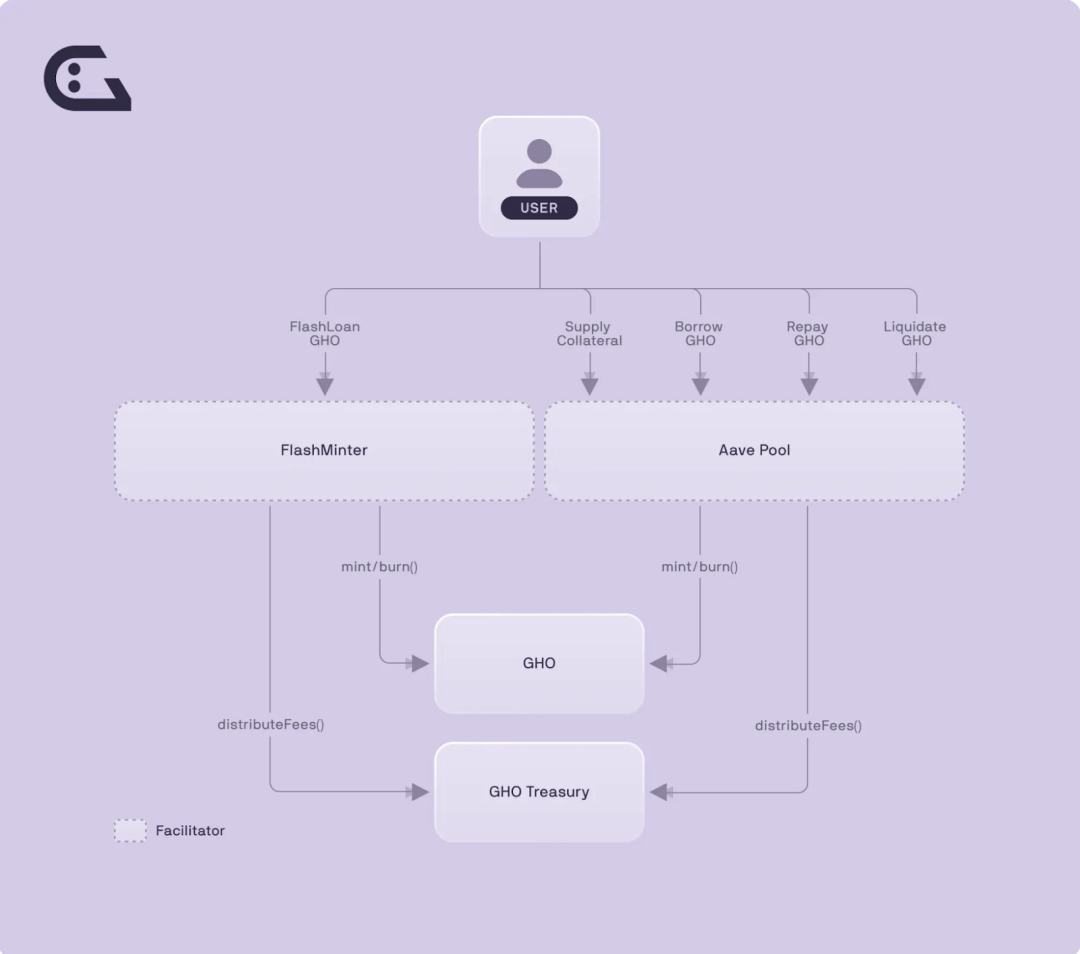

4.2 Stablecoin GHO – Strengthening Platform Stability and Promoting GHO Growth Through Interlocking Design

GHO’s borrowing rate is set by AaveDAO and can be dynamically adjusted based on market conditions to adapt to economic cycles and shifts in supply-demand balance.

GHO’s innovative features focus on three key aspects:

-

Facilitator: The protocol, entity, or project controlling GHO minting and burning. Aave is GHO’s first facilitator.

-

Asset Bucket: A cap on GHO holdings determined by community governance votes, aimed at maintaining price stability and liquidity.

-

Discount Model: Borrowing fees discounted based on stkAAVE holdings.

Updates in Aave V3 positively impacted GHO’s operation:

-

Isolation Mode: Allows users to generate GHO using various assets supported by Aave, reducing market volatility’s impact on system stability.

-

Efficient Mode: Enables users to borrow more GHO using non-volatile collateral to balance positions, increasing GHO supply and easing demand pressure.

-

Cross-chain Portal: Provides an ideal path for GHO’s expansion across multi-chain ecosystems, reducing cross-chain interaction risks.

Figure 12: GHO Mechanism

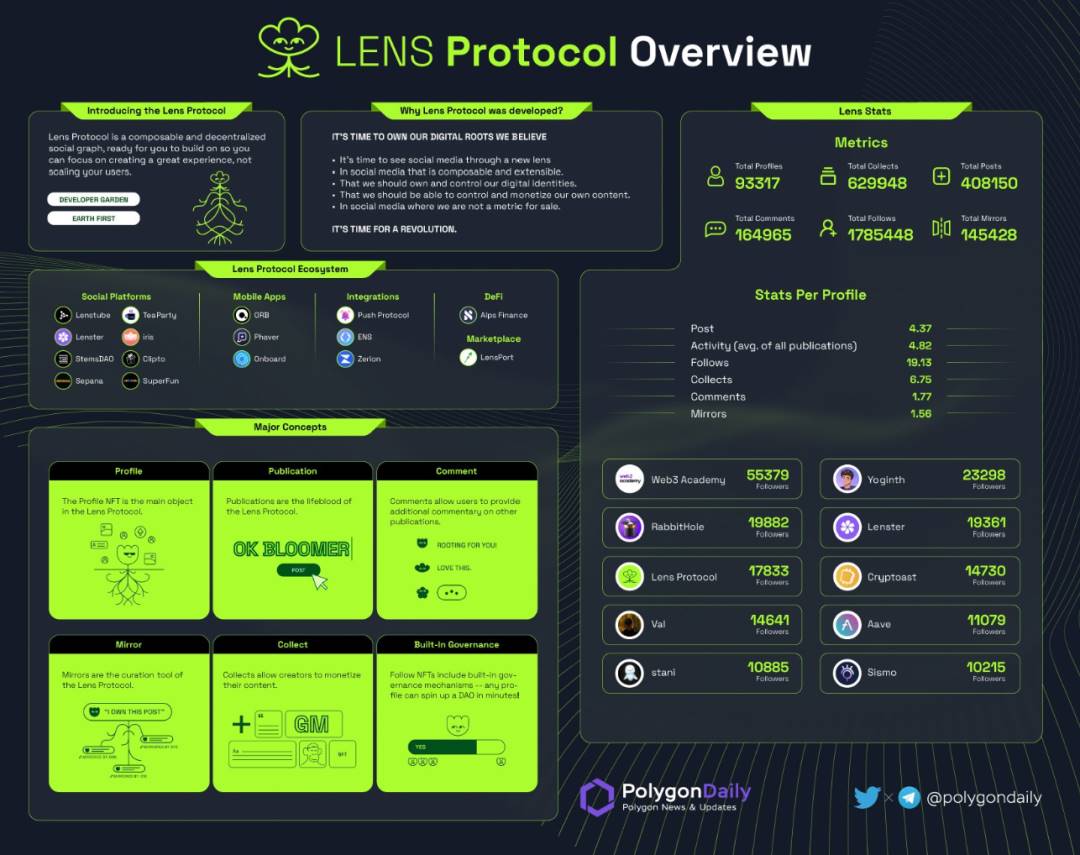

4.3 Open Social Protocol Lens Protocol – Ensuring Users Own All Content via Modular Infrastructure

Lens Protocol is an innovative social networking protocol launched by Aave on the Polygon blockchain. Designed as a modular base layer, it aims to foster community expansion and continuous development. It encourages developers to build social apps atop it while ensuring users retain full control over their content and relationships.

4.3.1 NFT-Enabled Social Actions

The core innovation of Lens Protocol lies in transforming social media behaviors into NFTs (non-fungible tokens), reflected in the following ways:

-

Profile NFT: Acts as a user’s identity within the Lens ecosystem. Users can mint or purchase one. It contains full history of posts, mirrors, comments, and grants complete ownership over content.

-

Collect NFT: Represents creators’ monetization model—followers can purchase content they create.

-

Follow NFT: Represents the follow mechanism. When a user follows a profile on Lens Protocol, they receive a Follow NFT.

4.3.2 Lens Functional Modules

Lens Protocol’s functional modules include:

-

Publication: Comes in three types: post, comment, and mirror. Publications are posted directly to the user’s Profile NFT, ensuring all created content belongs to the user.

-

Comment: Allows users to comment on others’ publications. Comments reside in the user’s NFT and thus belong fully to them.

-

Mirror: Equivalent to retweeting on traditional social media. Because Mirrors reference other publications, they’re bound by the original publication’s reference module and cannot be collected.

4.3.3 Lens Products and Analytics

Several social applications have already been built on Lens Protocol, such as Lenster.xyz (a decentralized Twitter alternative), Lenstube.xyz (video platform), and Orb.ac (decentralized resume). These showcase Lens Protocol’s potential in reshaping social interactions.

Figure 13: Lens Protocol Ecosystem Overview

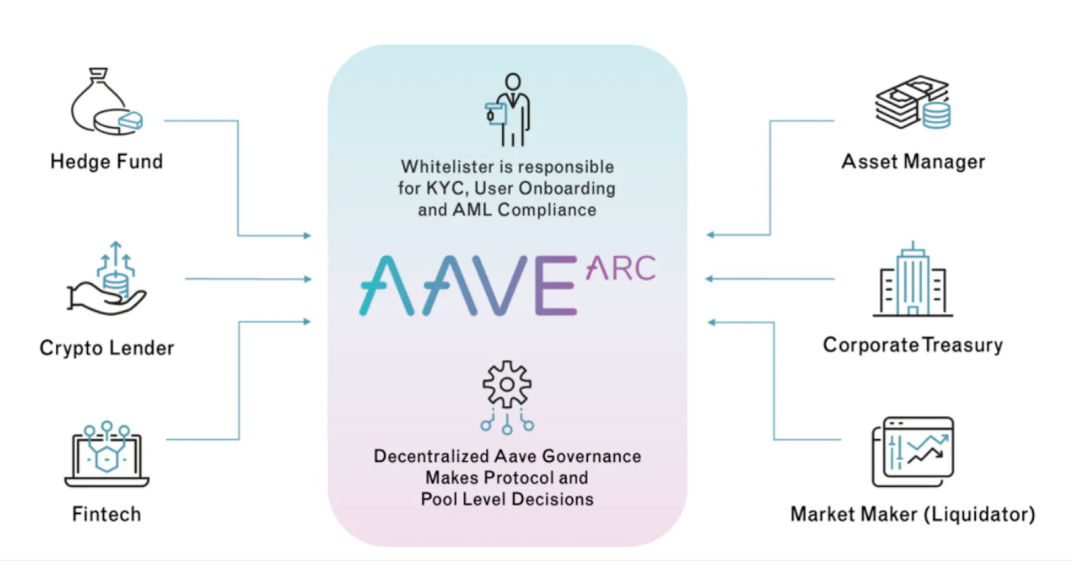

4.4 Institutional Lending Platform Aave Arc – Offering Open Social Protocols for Traditional Financial Markets

As decentralized finance (DeFi) gains influence in global financial markets, demand for DeFi solutions from traditional fintech firms, hedge funds, family offices, and asset managers continues to grow. In response, Aave launched Aave Arc—an exclusive private liquidity pool solution tailored for regulated institutional investors.

Private pools in Aave Arc operate independently from public pools on Aave, ensuring participants can engage securely within a compliant environment.

In the Aave Arc ecosystem, USDC is the sole stablecoin offered, chosen due to its strict regulatory compliance and broad acceptance among institutional investors. Besides USDC, Aave Arc supports three other major assets: Bitcoin (BTC), Ethereum (ETH), and AAVE.

To address institutional concerns about regulatory risk, Aave Arc enforces strict Know Your Customer (KYC) procedures and a “whitelist” system, further enhancing platform security and compliance, and providing greater trust and reliability for institutional users.

Figure 14: Aave Arc

According to Defillama, Aave Arc’s TVL has remained low since a sharp drop in November 2022, with no recent progress reported.

Figure 15: Aave Arc TVL

5. Revenue Streams – One of the Few Lending Protocols Capable of Covering Token Incentive Costs

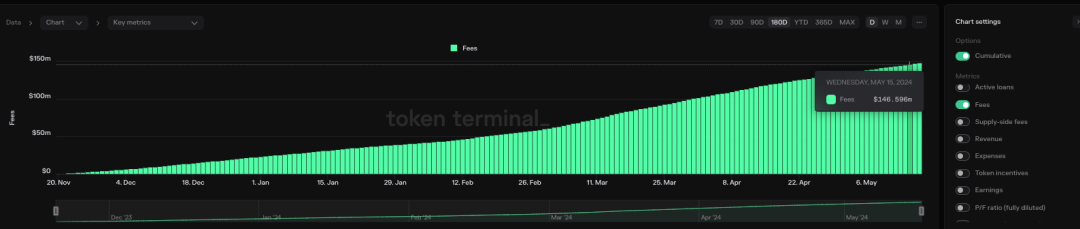

According to Token Terminal, as of May 15, 2024, Aave V3 has generated cumulative borrowing fees of $146.6 million. Of this, Ethereum-based borrowing fees account for the majority at $45.6 million.

Figure 16: Aave Fees

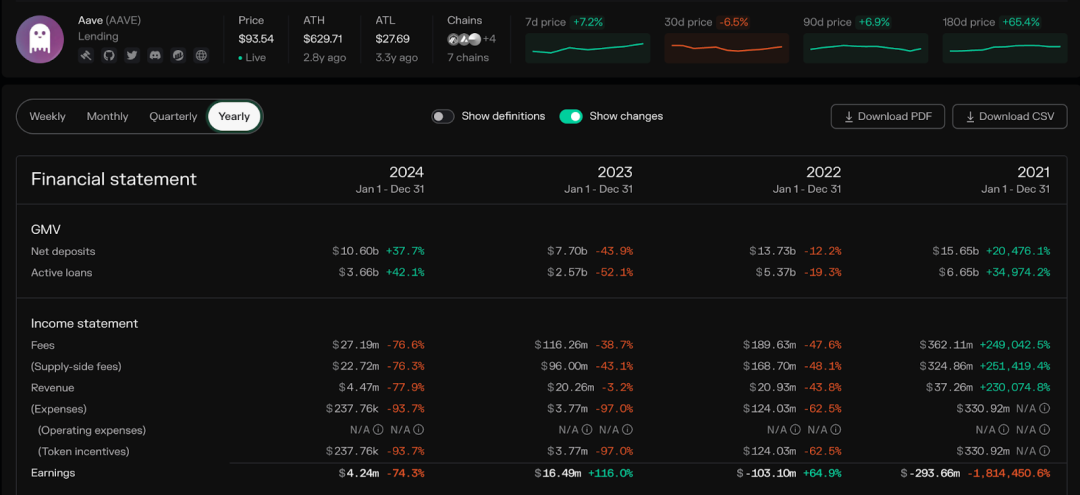

Between 2023 and 2024, Aave V2 and V3 generated $20.26 million in annual protocol revenue, down 3.2% from $20.93 million in the prior year. Despite the slight decrease, since December 2022, Aave’s revenue has consistently exceeded its token incentive expenses, achieving surplus—a sign of strong financial discipline.

Aave’s main revenue streams fall into four categories:

Figure 17: Aave Annual Revenue Analysis

-

Borrowing Income (Protocol Revenue): Fees collected from borrowers

-

Flash Loan Fees: Charges on flash loan usage; Aave V3 charges 0.05% per transaction

-

Other Feature Fees: Additional fees from liquidations, portal bridges, Aave Arc, etc.

-

GHO Minting Fees

6. Market Size and Competitive Landscape

6.1 DeFi Lending

The lending sector plays a pivotal role in decentralized finance (DeFi), ranking second in total value locked (TVL) behind only liquid staking. According to Defillama, there are currently 379 lending protocols in the market. Top players include AAVE, JustLend, Spark, Compound, Venus, and Morpho.

Aave stands out with a clear lead, boasting a current TVL of $1.025 billion. Among the top five lending protocols, Aave operates on 12 distinct blockchains—the most by far, compared to Compound’s 4.

In detail, Aave (V2/V3) leads in scale on Ethereum, Arbitrum, Avalanche, Polygon, and Optimism, and ranks fifth on BSC.

Figure 18: DeFi Lending Sector Comparison

6.2 Flash Loans

Flash loans are a key innovation in the DeFi ecosystem, playing a vital role in its development. According to Dune, flash loans achieved ~$248,596 in transaction volume last month. Among flash loan tools, Balancer, Aave, and Uniswap rank top three, dominating the market.

From a market share perspective, Balancer and Aave have stood out over the past three months, each holding around 40% market share—higher than Uniswap.

On specific blockchains, Aave trails slightly behind Balancer on Ethereum, Avalanche, Optimism, and Arbitrum. However, on Polygon, Aave significantly outpaces competitors

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News