StakeStone Explained: A Cross-Chain Liquidity Infrastructure Beyond Restaking

TechFlow Selected TechFlow Selected

StakeStone Explained: A Cross-Chain Liquidity Infrastructure Beyond Restaking

StakeStone provides users and developers with a new platform for releasing and utilizing liquidity through its cross-chain liquidity distribution network.

By: SANYUAN Labs

With Ethereum's transition into the PoS era, demand for ETH staking has grown significantly. The emergence of restaking has further raised user expectations for ETH yields.

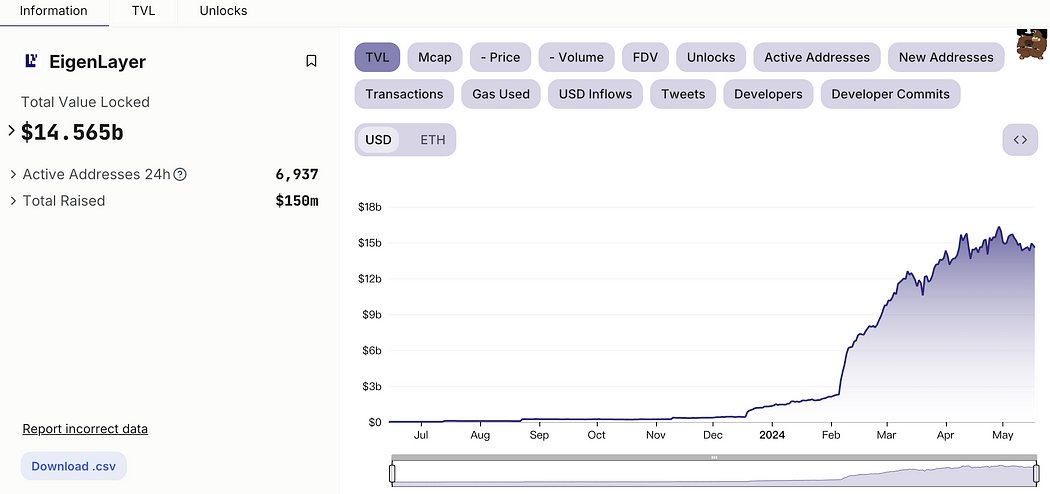

As the foundational layer of the restaking sector, let’s first examine EigenLayer’s growth metrics. According to DefiLlama, EigenLayer has attracted a TVL of $14.56 billion and remains at a high level.

However, traditional staking methods suffer from liquidity constraints. Once users stake ETH, their assets become largely illiquid and cannot be used across other DeFi applications. Especially during mid-bull market phases, the opportunity cost of capital is high, and locking up funds significantly reduces potential gains. For example, the lock-up issues on Ethereum L2 Blast have frequently been criticized by the community.

If staking occurs during bear markets or early bull phases—when asset prices are lower—it may still be profitable if the assets can be unlocked during later bull phases, allowing users to benefit from passive appreciation during the locked period.

But if staking happens in the middle of a bull run or near peak prices, users without hedging mechanisms risk missing out on high-price exits. Upon unlocking, they might face asset depreciation, resulting in net losses. Even in sideways markets, locked capital loses opportunities for alternative yield-generating strategies.

Therefore, free deposit and withdrawal capabilities are critical pain points for staking participants. Currently, liquid staking and restaking tokens (LRTs) have emerged as popular solutions.

Liquid staking and restaking tokens enable various "multiple yield stacking" strategies, attracting ETH flows to staking protocols across the chain.

Many restaking protocols offer Liquid Restaking Tokens (LRTs) while competing on yield. For instance, Renzo issues ezETH; Swell offers swETH; KelpDAO provides rsETH; Puffer distributes pufETH, among others. Some LRT holders pursue additional returns by deploying their LRT tokens into DeFi products, or even engaging in recursive lending to maximize yields.

However, as these LRT nesting layers increase, risks become more apparent. For example, Renzo’s ezETH previously suffered de-pegging due to pool liquidity issues, leading to liquidations for highly leveraged users. This is a common challenge faced by all LRT tokens that rely solely on DEXs for liquidity exit when underlying assets are locked.

The rapid growth of the restaking sector has led to numerous new protocols, but one consequence is fragmented LRT liquidity, which further exposes LRTs to de-pegging risks. Additionally, there's a growing trend of extending LRTs to Layer 2 networks. While this expansion brings benefits—such as introducing high-quality assets to L2s, enriching LRT utility, and lowering participation barriers with cheaper gas fees—it also exacerbates the fragmentation of LRT liquidity. Thus, enhancing LRT liquidity has become a major pain point in the current restaking landscape.

For DeFi products, liquidity is key to driving market development and innovation. Enabling liquidity to flow freely is crucial. StakeStone, as a cross-chain liquidity distribution protocol offering unrestricted deposit and withdrawal, directly addresses these liquidity pain points. With its unique mechanism and vision, StakeStone is reshaping the landscape of liquid staking and distribution, unlocking unprecedented opportunities for liquidity release and utilization for both users and developers.

Unique Liquidity Release Mechanism

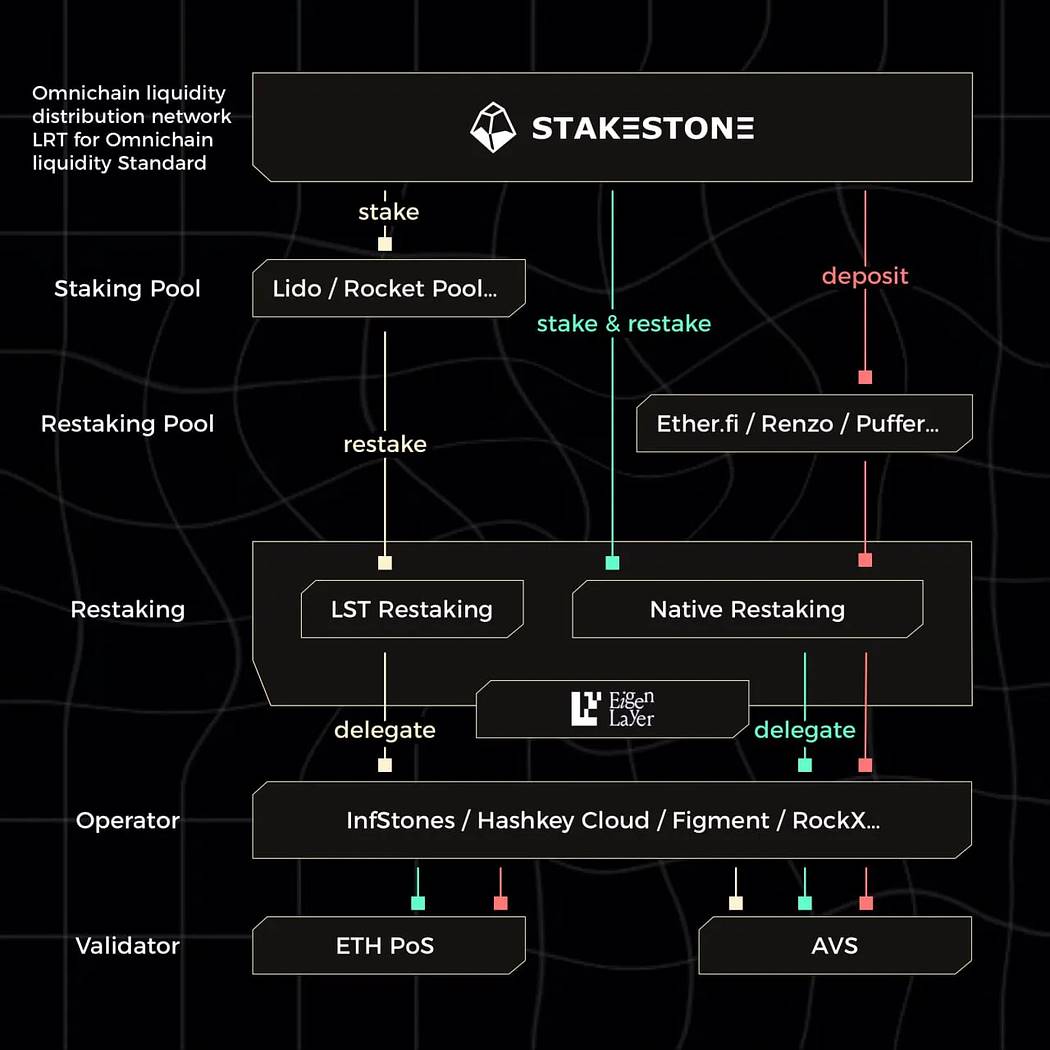

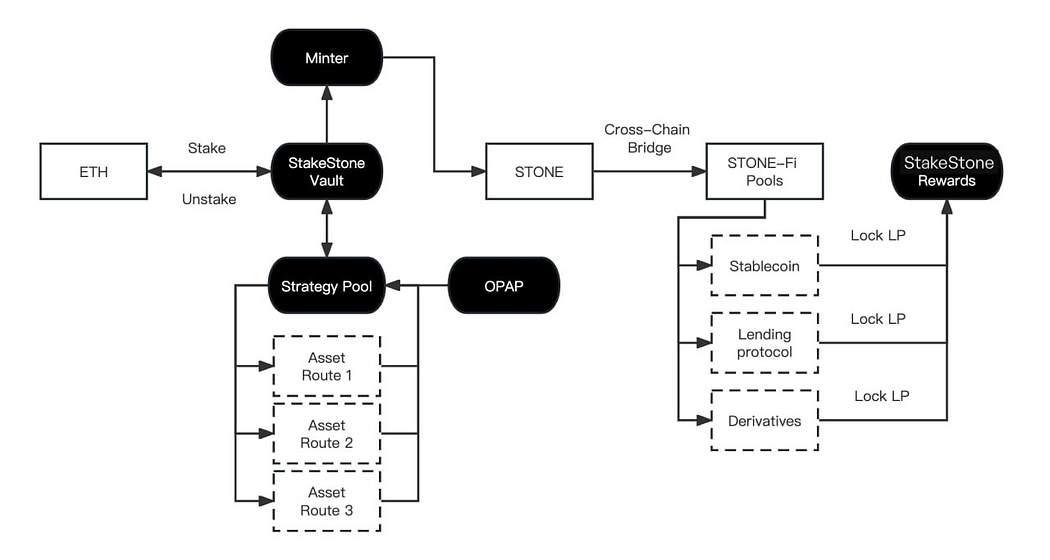

StakeStone packages ETH staking and potential blue-chip restaking rewards—represented by EigenLayer—into STONE, distributing them across application layers in various ecosystems. STONE acts as a standardized unit, improving efficiency for users, blockchains, and the broader ecosystem. Users deposit ETH into StakeStone and receive corresponding STONE tokens, representing both staked ETH and accrued yield. Importantly, users can freely unstake and withdraw their assets at any time. Unlike protocols relying solely on DEX-based liquidity exits, StakeStone’s protocol-level exit mechanism supports higher liquidity demands. From day one, StakeStone has supported full unstaking flexibility, having already processed hundreds of millions of dollars in transfers.

While similar to Ether.fi, Renzo, Swell, KelpDAO, and Puffer in offering liquid staking tokens (LSTs) to unlock ETH and other asset liquidity, StakeStone does not compete directly with these protocols. Instead, it aims to complement and synergize with them.

StakeStone has introduced three types of restaking-related solutions:

-

Liquid Stake Token (LST) Restaking Solution: using LSTs for restaking;

-

Beacon Chain Restaking Solution: applying beacon chain restaking;

-

Restaking Pool Aggregation Solution: consolidating LRTs.

Currently, the restaking landscape remains fluid, and AVS ecosystems continue evolving. In the future, diverse restaking assets and derivative strategies may emerge. Under the premise of ensuring overall safety and stability of STONE assets, StakeStone maintains compatibility with various restaking strategies, aiming to achieve a potential balance between yield and stability through diversified asset combinations.

So how does StakeStone select underlying assets among numerous restaking options?

StakeStone introduces the OPAP (Optimized Portfolio and Allocation Proposal) mechanism—an decentralized asset allocation strategy. Through OPAP, any STONE holder can participate in governance by voting on the portfolio composition behind STONE, including ETH staking pools, restaking protocols, or other yield-generating protocols.

This mechanism not only enhances fund security and yield potential but also enables StakeStone to flexibly adapt to market changes, delivering optimal asset allocation for users. For example, the recently concluded OPAP-3 proposal added EigenLayer native restaking as one of the base assets and allocated an initial batch of ETH to it. The proposed allocation ratio was: Lido Staked Ether (stETH): 99.9%; EigenLayer Native Restaking: 0.1%.

StakeStone proposal link: https://app.stakestone.io/u/portfolio-allocation/vote/vote-list

Cross-Chain Liquidity Distribution

Another core advantage of StakeStone lies in its cross-chain liquidity distribution capability, focusing on establishing STONE as a standardized cross-chain liquidity asset. Its mechanism allows users to seamlessly transfer and utilize their liquidity across different blockchains and Layer 2 networks, thereby increasing capital efficiency and yield potential.

By integrating with cross-chain technologies like LayerZero, StakeStone enables seamless asset and price transfers across multiple blockchains. This means users can deploy STONE tokens across various chains to participate in DeFi, GameFi, or NFTfi projects without being confined to a single network. It helps L2s attract liquidity and creates multi-layered earning opportunities for users.

For example, StakeStone’s collaboration with Manta Network attracted over 700 million STONE in liquidity within a month, achieving broad ecosystem integration and pioneering a new liquidity paradigm. The first wave of its recent Omnichain Carnival launched a partnership with Scroll. Recently, StakeStone has also partnered with emerging Bitcoin L2s such as B² Network, Merlin Chain, and BounceBit, positioning STONE as the standard ETH asset within the emerging Bitcoin ecosystem.

Asset Security

Another critical issue in the staking sector is fund security. Recent incidents like Zkasino’s staking collapse serve as stark warnings to stakers.

For StakeStone, asset security is a top priority. StakeStone focuses primarily on STONE rather than launching multiple derivatives based on different AVS combinations. It may not integrate all types of restaked assets, instead concentrating on more stable, secure assets and partnering with best-in-class providers.

For instance, its Beacon Chain restaking strategy is implemented through a collaboration with InfStones, integrating InfStones’ EigenLayer restaking technology into StakeStone. InfStones is an expert in the staking domain, providing premium node operation services. Currently, InfStones supports over 20,000 nodes across more than 80 blockchains, serving 100 clients including Binance, CoinList, BitGo, OKX, Chainlink, Polygon, Harmony, and KuCoin.

On the technical security front, restaking strategies incorporate Cobo’s security solution to further enhance system stability. Cobo is an industry-leading security expert. Additionally, the protocol’s code undergoes multiple audit rounds by firms such as Secure3 and SlowMist to maximize security assurance.

Regarding leverage, StakeStone adopts a conservative approach—holding selected base assets directly without resorting to recursive lending or inflating base assets to increase leverage.

In terms of centralization risk, all operations within StakeStone are executed via smart contracts, completely eliminating manipulation risks. Its decentralized governance framework ensures a robust and reliable structure for portfolio optimization.

Regarding price stability of STONE, it functions as a deposit-and-yield-sharing token rather than a rebase token. By design, the StakeStone Vault acts as a funding buffer, retaining deposited ETH within the contract until a new settlement occurs, at which point funds are deployed into underlying strategy pools. The Minter functionality decouples STONE token minting from its underlying assets.

This separation allows independent adjustments of underlying assets and circulating STONE supply. By decoupling STONE minting/burning from asset management contracts, STONE’s stability is ensured. Adding or removing base assets—or even upgrading asset management contracts—does not require re-minting currently circulating STONE tokens.

On the strategy side, the strategy pool employs a whitelist mechanism governed by OPAP, demonstrating high compatibility with various assets such as staking pools and restaking protocols. Meanwhile, asset risks are isolated within individual strategy routes to prevent cross-contamination.

Partnerships and Ecosystem Development

StakeStone is jointly invested by Binance and OKX. Notably, BounceBit and Renzo—also co-invested by both exchanges—have already been listed on Binance.

As a liquidity infrastructure provider, StakeStone is committed to serving a wide range of liquid assets. Beyond ETH, StakeStone sees potential in integrating Bitcoin into its liquidity distribution network and has established partnerships with several prominent projects. It is expected that StakeStone’s liquidity distribution architecture will play a unique role within the BTC liquidity ecosystem.

These collaborations not only strengthen StakeStone’s credibility and market influence but also provide users with more earning opportunities and use cases.

Recent Activities

Following the first wave of the StakeStone x Scroll Omnichain Carnival, the second wave has now launched in partnership with BNB Chain, featuring a total reward of 1,000,000 tokens. Details can be found in the StakeStone documentation.

Conclusion

Through its cross-chain liquidity distribution network, StakeStone provides users and developers with a novel platform for liquidity release and utilization. As more Layer 2s and app chains emerge, StakeStone’s cross-chain liquidity infrastructure will grow increasingly vital, potentially serving as a bridge connecting disparate chains and ecosystems. It promises richer, more efficient asset utilization methods, driving innovation in the liquid staking and distribution market. Led by StakeStone, we may be entering a new era of fully unleashed and optimized liquidity.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News