From Vault to LiquidityPad: Unveiling StakeStone, the Invisible New Elephant Behind the Optimal Solution for Cross-Chain Liquidity

TechFlow Selected TechFlow Selected

From Vault to LiquidityPad: Unveiling StakeStone, the Invisible New Elephant Behind the Optimal Solution for Cross-Chain Liquidity

In the era of multi-chain "entropy increase," a full-chain liquidity infrastructure targeting the broadest base of ordinary users may have reached a tipping point.

By: Web3 Farmer Frank

How did you fare in the latest Plume airdrop?

The answer might be mixed. In fact, under today’s hyper-competitive environment, airdrops have long ceased to be an effective open-source incentive mechanism. Instead, they’ve morphed into financial games dominated by crypto studios and on-chain whales. With recent token airdrops like PLUME finally materializing, one question becomes increasingly evident: How can ordinary users participate more fairly and efficiently in the upside of emerging ecosystems—without merely serving as cannon fodder for whales?

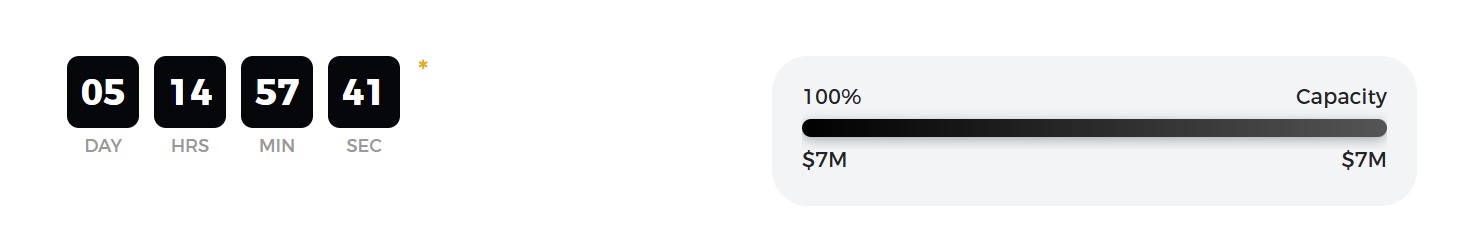

Interestingly, StakeStone, which previously launched a pre-deposit vault ahead of the Plume airdrop, has now officially upgraded its original StakeStone Vault brand into StakeStone LiquidityPad. The platform’s first project, Aria, hit its $7 million purchase cap within just nine minutes.

An apt analogy is this: in today’s multi-chain era, each emerging public chain resembles a country with its own unique industries, all urgently needing capital and resources to complete industrialization. In this context, much like how the VIE legal structure enabled companies from developing countries to access U.S. dollar capital—and later brought their growth back to trade on American financial markets—StakeStone LiquidityPad is essentially playing a similar role:

Connecting one end to Ethereum’s mature on-chain financial ecosystem, and the other to various emerging public chain ecosystems, StakeStone LiquidityPad helps emerging chains raise resources on Ethereum’s mainnet, then brings the excess returns (Alpha) generated from these growing ecosystems back to Ethereum’s sophisticated financial infrastructure for trading—effectively becoming the largest pipeline infrastructure bridging Ethereum (dollar capital) and emerging chains (developing economies).

In the prosperous multi-chain era, liquidity faces an 'entropy increase' dilemma

Everything tends toward increasing entropy—and crypto is no exception.

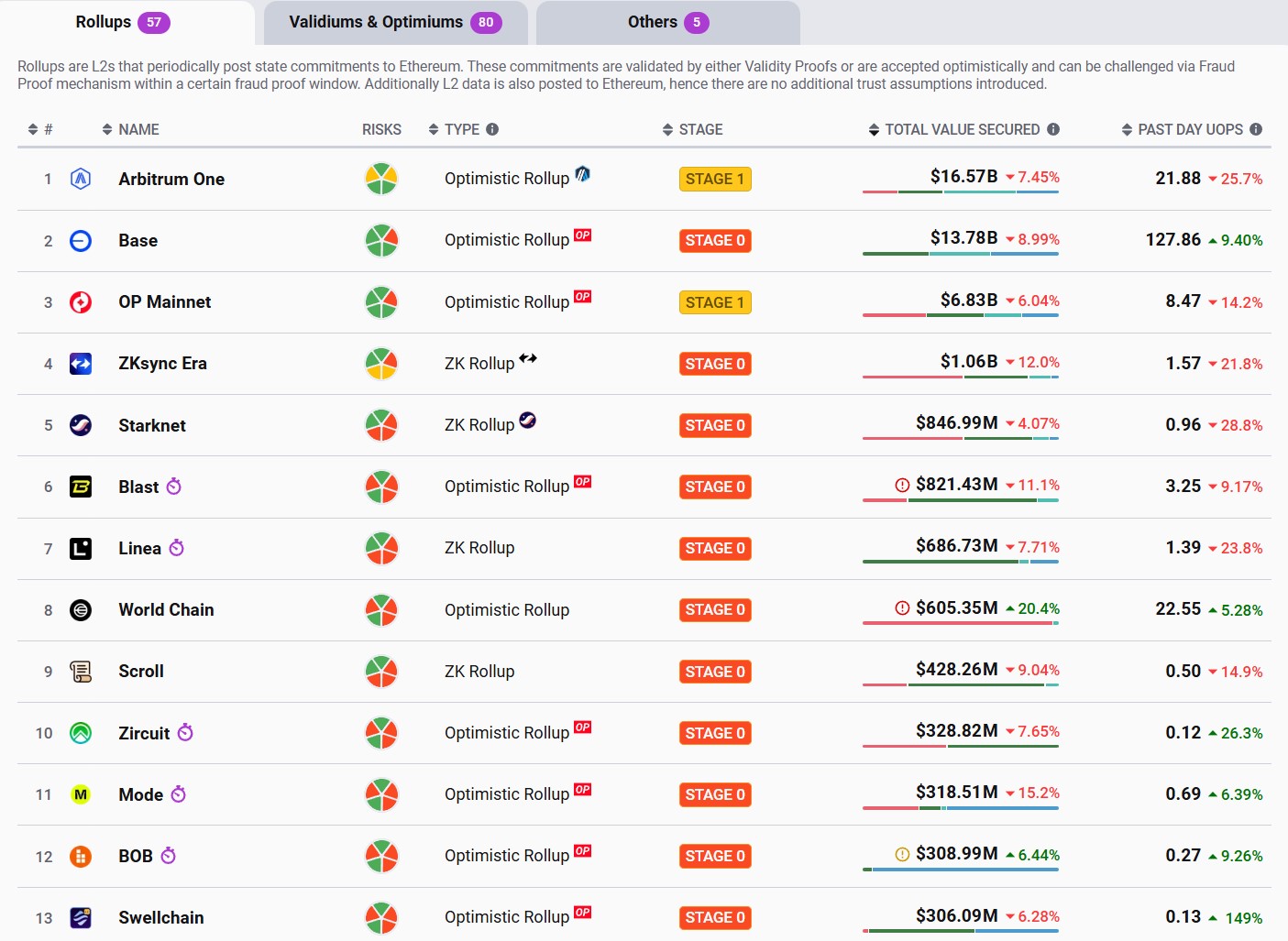

Driven by the modularization wave, from early multi-chain concepts championed by Cosmos and Polkadot, to the Rollup boom of Ethereum’s Layer 2 era, and now to application-specific chains built on OP Stack, Arbitrum Nova, Starknet, and others—more and more protocols are building dedicated chains tailored to specific needs, seeking optimal balance between performance, cost, and functionality.

According to incomplete data from L2BEAT, there are already over a hundred chains broadly categorized as Ethereum L2s. While this diversity expands possibilities for the ecosystem, it also gives rise to a long-standing issue—extreme fragmentation of liquidity.

Especially since 2024, liquidity hasn't just been scattered across Ethereum and its L2s—it's become severely isolated within individual emerging public chains and application-specific ecosystems. This fragmentation not only complicates user operations and experience but also significantly hampers further development of DeFi and on-chain applications:

For Ethereum and L2s, restricted liquidity flow reduces capital efficiency and limits the full potential of the “money Lego” paradigm. Meanwhile, for emerging chains like Plume and Berachain, high migration costs and entry barriers make it difficult to break through the "zero-to-one" liquidity island effect, stalling ecosystem expansion.

In short, the “entropy increase” trend of the multi-chain era paradoxically becomes its biggest curse.

Against the backdrop of accelerating liquidity fragmentation across chains, both users and developers urgently desire seamless capital flow across DEXs, lending protocols, and other on-chain systems on any network—especially breaking down silos between user experience and isolated networks, particularly in emerging ecosystems outside Ethereum such as Plume and Berachain:

These nascent ecosystems often offer highly attractive yield opportunities. Users need a frictionless way to move assets from Ethereum or other chains into these new ecosystems to participate in DeFi protocols, liquidity mining, or other earning mechanisms.

Ultimately, regardless of composability, liquidity remains key. Objectively speaking, if Ethereum and the broader multi-chain ecosystem are to scale and thrive, there is an urgent need to efficiently integrate liquidity resources scattered across multiple chains and platforms.

This requires establishing a unified technical framework and standard to counteract “entropy increase,” thereby enabling broader applicability, fluidity, and scalability across multi-chain ecosystems. Such infrastructure would not only advance the “unification” of on-chain liquidity but also accelerate the maturation of the entire multi-chain landscape.

This very demand and vision for “unification” creates space for full-chain liquidity infrastructures like StakeStone LiquidityPad to shine. As an innovative platform for launching full-chain liquidity vault products, StakeStone LiquidityPad aims to provide customized liquidity fundraising solutions that help emerging public chains and appchains efficiently consolidate cross-chain liquidity, break down liquidity silos, and enable efficient capital circulation.

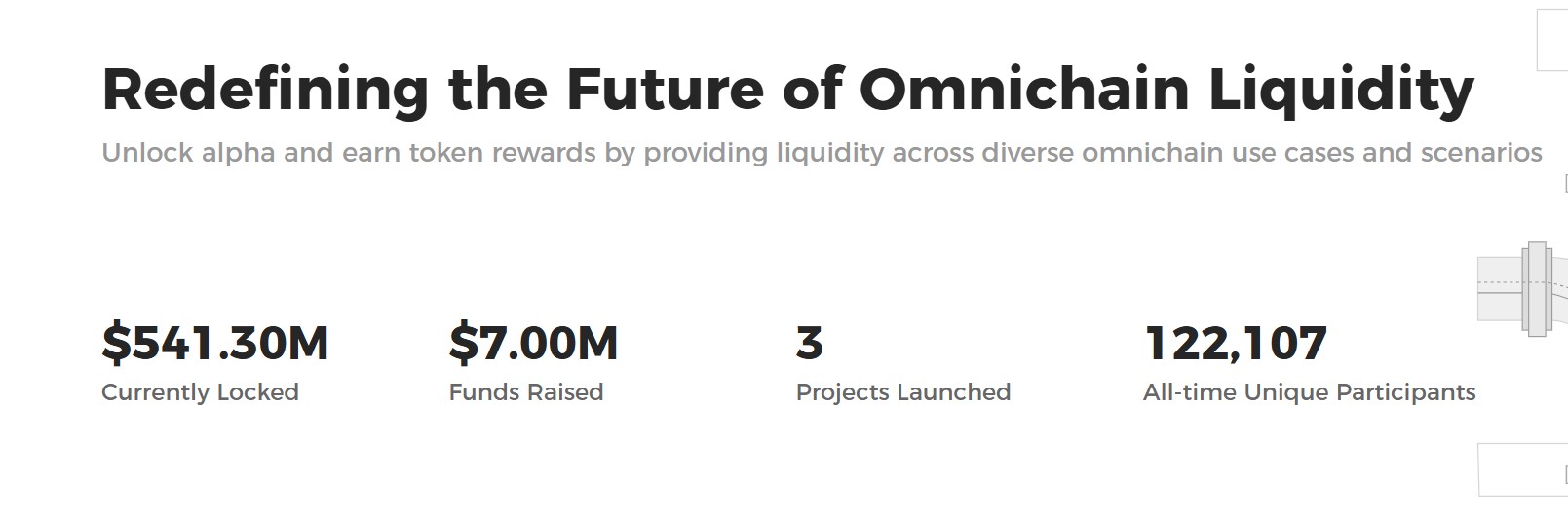

At the time of writing, StakeStone LiquidityPad has locked in over $540 million in funds, with participation from more than 120,000 unique on-chain addresses. These figures not only reflect market recognition of StakeStone LiquidityPad but also highlight strong user demand for full-chain liquidity solutions.

StakeStone LiquidityPad: From point-to-point to point-to-multipoint—evolving into a liquidity network

Many users may still associate StakeStone primarily with Ethereum staking/restaking yield protocols. But from the outset, StakeStone’s product architecture was designed around full-chain liquidity infrastructure. Early vault products targeting specific emerging ecosystems laid the groundwork for what would become its liquidity network:

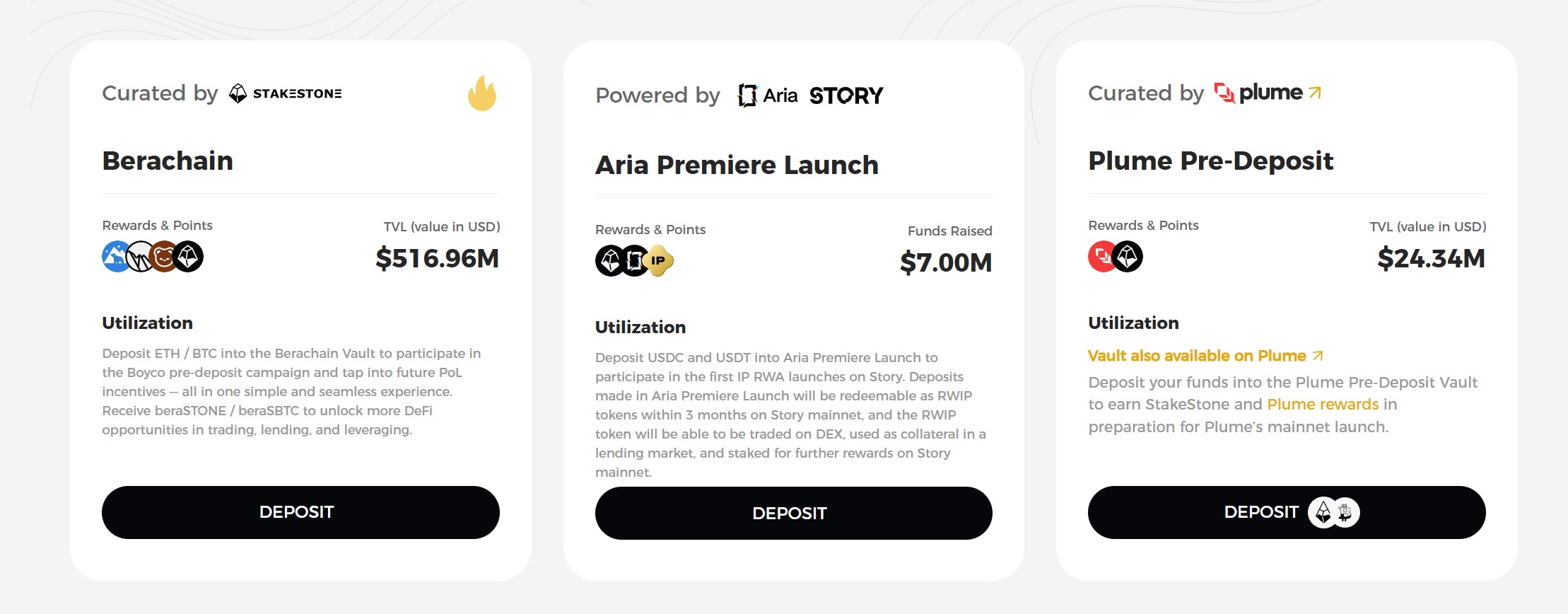

Whether it was the Plume Pre-Deposit Vault or the Berachain StakeStone Vault, these were pioneering experiments across different ecosystem contexts. They delivered much-needed liquidity support to emerging chains while setting a solid precedent for StakeStone’s future development as a full-chain liquidity infrastructure provider.

This explains why StakeStone decided to further upgrade its product line—rebranding the original Vault offering as StakeStone LiquidityPad: a more comprehensive, flexible, and customizable platform for full-chain liquidity raising and management. This isn’t just a product evolution; it marks StakeStone’s critical leap from a “point-to-point” liquidity solution to a “point-to-multipoint” liquidity network.

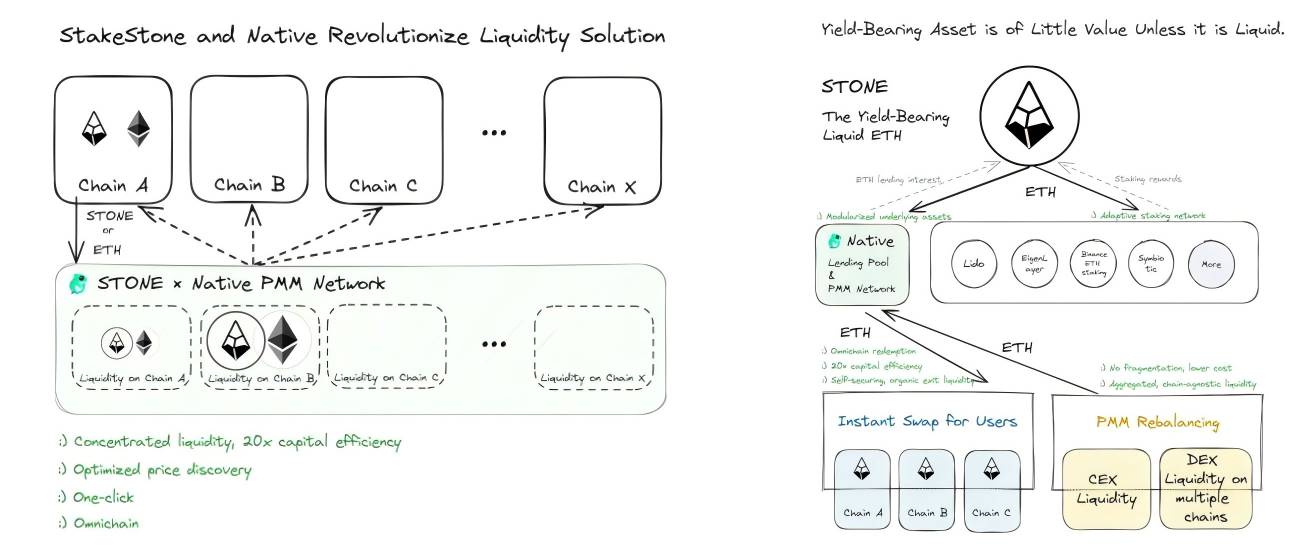

In essence, as a full-chain liquidity infrastructure, StakeStone has always focused on connecting liquid assets on Ethereum’s mainnet with the liquidity demands of emerging public chains and L2 ecosystems.

From this perspective, the rebranded StakeStone LiquidityPad is a fully customizable full-chain liquidity solution catering to diverse needs, offering lifecycle support ranging from cold starts to ecosystem scaling.

1. Projects without live mainnets: Pre-deposit vaults for cold-start acceleration

For public chains or protocols still in the pre-mainnet, cold-start phase, StakeStone LiquidityPad enables teams to launch pre-deposit vaults on Ethereum’s mainnet to raise initial liquidity needed for bootstrapping. Funds raised can be used for:

-

Liquidity provisioning for DeFi protocols: such as the Berachain Vault, helping rapidly build core DeFi components in the Berachain ecosystem;

-

Liquidity support for RWA protocols: such as the Plume Vault, providing resources for tokenizing real-world assets (RWA);

-

Investment in RWA assets: such as the Story Protocol Vault, supporting emerging protocols in bringing on-chain liquidity into real-world asset use cases;

2. Live mainnet projects: Customized vaults for targeted yield scenarios to accelerate growth

For projects already live and operating at maturity, StakeStone LiquidityPad supports custom vaults tailored to specific liquidity yield scenarios, helping ecosystems grow rapidly—for example:

-

Liquidity provisioning for DeFi protocols: such as Solana/SUI Vault, providing liquidity support for DeFi protocols on these chains and improving capital efficiency;

-

Liquidity for special yield scenarios: such as BNB Chain Vault, delivering customized liquidity solutions to support unique yield opportunities on BNB Chain—including liquidity mining and staking rewards—to meet high-yield demands in specific ecosystems;

Looking ahead, to accommodate even broader use cases, StakeStone plans to expand support beyond its native STONE/SBTC/STONEBTC tokens to include major mainstream assets such as ETH, WETH, WBTC, cbBTC, BTCB, LBTC, FBTC, USDT, USDC, and more.

It’s clear that through the LiquidityPad upgrade—from point to surface—StakeStone is not only offering emerging chains and L2s more flexible tools but also building a more efficient full-chain liquidity network. Whether supporting cold starts or facilitating mature ecosystem expansion, LiquidityPad aims to become the crucial nexus in the on-chain liquidity cycle.

This allows it to meet diverse liquidity needs while efficiently consolidating fragmented liquidity across chains into an interconnected liquidity network. Whether for cold-start requirements of emerging chains or scaling needs of mature ecosystems, StakeStone LiquidityPad stands ready as their most reliable liquidity partner.

The "full-chain liquidity flywheel" behind StakeStone

Growth is Web3’s core primitive.

For StakeStone LiquidityPad, its core value lies not only in solving the problem of liquidity isolation in emerging chains and appchains, but also in creating a “full-chain liquidity flywheel” through its unique mechanism design—one that combines multi-asset yields with renewed liquidity release.

At the heart of this flywheel effect is the dual-use mechanism centered around LP Tokens.

When users deposit assets via StakeStone LiquidityPad, they receive LP Tokens (e.g., beraSTONE). These LP Tokens are not only proof of their stake in the emerging chain ecosystem—they’re also the key to unlocking multiple layers of yield.

On one hand, deposited assets directly engage in activities within emerging ecosystems—such as liquidity mining rewards and governance token airdrops on Berachain. StakeStone’s automated strategies capture these native yields efficiently, sparing users complex technical interactions via in-vault automation.

This low-barrier entry allows more users to easily join emerging ecosystems and seize early-stage benefits.

On the other hand, the corresponding LP Tokens represent not only ownership stakes but also encapsulate earnings from nascent ecosystems into interest-bearing assets that interface seamlessly with mature mainnet infrastructure—offering high financial composability. Users can leverage LP Tokens to plug into Ethereum’s DeFi ecosystem and unlock further liquidity potential:

-

Provide liquidity or trade on DEXs like Uniswap/Curve: Users can deploy LP Tokens in liquidity pools or trade them for additional returns;

-

Mint loans using AAVE/Morpho: LP Tokens can serve as collateral in lending markets, further boosting capital utilization;

-

Sell future yield via Pendle: Users can split or sell the yield rights of LP Tokens through protocols like Pendle, enabling early monetization of future income;

This mechanism allows a single asset to be reused across multiple ecosystems, maximizing returns, while significantly lowering the barrier to entry—enabling more users to efficiently capture native yields from emerging chains like Berachain.

With compounded yields stacking up, user ROI is maximized, and emerging ecosystems gain rapid traction, creating a virtuous flywheel effect: more participation → increased liquidity injection → accelerated ecosystem growth → rising value of yield-wrapped assets → attracting even more participants.

Even more interestingly, the evolution of StakeStone LiquidityPad means it can now better connect emerging ecosystems in cold-start phases—like Berachain—with mature ecosystems offering diversified yield opportunities:

-

Raise cold-start capital for emerging chains: Through StakeStone LiquidityPad, emerging chains can raise seed funding on Ethereum’s mainnet, securing essential “from zero to one” liquidity;

-

Bring excess returns back to mature markets: After growing through injected resources, the alpha (excess returns) generated on emerging chains will be funneled back to Ethereum’s mature financial markets for trading, completing the entire capital cycle;

Overall, this dynamically adaptive mechanism enhances compound yield generation and strengthens StakeStone LiquidityPad’s market adaptability and competitiveness.

Human demand for new assets is eternal. Viewed this way, amid the horse race dynamics of the multi-chain era, StakeStone LiquidityPad could very well emerge as a pivotal force in shaping niche liquidity assets and fostering thriving on-chain ecosystems:

By introducing a new yield architecture with inherent full-chain liquidity properties, it can revitalize stagnant on-chain environments and enable higher-capital-efficiency products and composable DeFi scenarios. This satisfies users’ appetite for diversified yields while delivering efficient liquidity solutions to both emerging and mature ecosystems.

Conclusion

Going forward, as multi-chain ecosystems continue to expand, StakeStone LiquidityPad is poised to become the central hub linking emerging chains with mature markets—delivering more efficient and equitable liquidity solutions for users and protocol builders alike.

From overcoming the “entropy increase” of fragmented liquidity to driving ecosystem prosperity via a “flywheel effect,” redefining Web3’s liquidity infrastructure is not only the natural next step for StakeStone in advancing the full-chain liquidity narrative—it’s the optimal path toward maturing the multi-chain ecosystem.

Whether it will reach a transformative tipping point in 2025 remains to be seen.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News