Interview with StakeStone Founder Charles: Why was it selected by WLFI, and how did it take the first bite of the USD1 crab?

TechFlow Selected TechFlow Selected

Interview with StakeStone Founder Charles: Why was it selected by WLFI, and how did it take the first bite of the USD1 crab?

As StakeStone USD1 launches its liquidity distribution product, a conversation with Charles explores the new variables and opportunity windows in the 2025 alpha stablecoin market.

By: Web3 Farmer Frank

What is the core competitiveness in the stablecoin business?

"Credit."

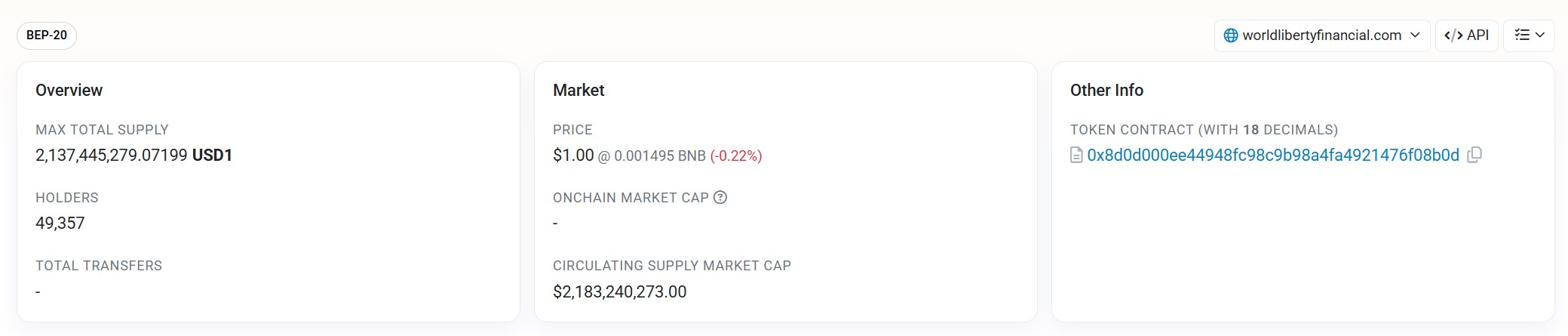

Charles, founder of StakeStone, responded bluntly. In the stablecoin landscape, a prime example of this "credit" is USD1, backed by the Trump family's credibility. Within less than 100 days of its launch, USD1 achieved a phenomenal "from zero to one" growth and full coverage across top-tier exchanges:

Since March, its issuance has surged to $2.1 billion, surpassing FDUSD and PYUSD to become the fifth-largest stablecoin globally (CoinMarketCap data), and it has fully launched on major CEXs including HTX, Bitget, and Binance. In contrast, PYUSD, backed by PayPal for two years, is still struggling with market penetration.

In Charles' view, "the essence of currency issuance is credit," and stronger credit leads to faster adoption. Therefore, he firmly believes that USD1 will be the most promising high-growth stablecoin in 2025.

So why did StakeStone secure this first-mover advantage?

"The development logic of USD1 differs fundamentally from USDT/USDC." The unique credit backing of USD1 gives it superior cross-domain adoption and resource integration capabilities in real-world applications compared to traditional stablecoins.

Thus, the greatest growth potential for USD1 does not lie within the Web3 community—just as today’s larger use cases for USDT and USDC are also found in traditional finance sectors, including but not limited to large financial institutions, cross-border trading companies, SMEs, individual entrepreneurs (such as freelancers, content creators), and underbanked regions. These areas will greatly benefit from the widespread adoption of digital stablecoins (Digital Money).

However, broad on-chain adoption of USD1 must be enabled through a cross-chain liquidity hub. According to Charles, as early as the second half of 2024, StakeStone began discussions with World Liberty Finance (WLFI), the issuer behind USD1, regarding cooperation on cross-chain liquidity.

The key factor that ultimately led WLFI to choose StakeStone was StakeStone’s demonstrated multi-chain operational capability in previous projects like Berachain, particularly its consistent performance in building “cross-chain liquidity distribution.” Thus, within the USD1 ecosystem map, StakeStone actually plays a dual role: official minting channel and cross-chain liquidity hub—providing a one-stop gateway for USD1 from minting to full-chain, all-scenario coverage.

From this perspective, StakeStone taking the lead with USD1 represents a natural alignment between WLFI and USD1. This exclusive interview aims to understand, through Charles’ insights, the collaboration logic between WLFI/USD1 and StakeStone, the fundamental shifts occurring in the stablecoin landscape, and thereby uncover a crucial piece of this new stablecoin narrative puzzle.

Negotiations since late last year—why did WLFI choose StakeStone?

When asked why StakeStone became the first DeFi minter for USD1, Charles first explained USD1's issuance mechanism:

After institutional users complete KYC and other compliance procedures, they deposit U.S. dollars into a designated custodial bank account. Once WLFI verifies the funds have arrived, institutions can mint USD1 in minimum units of $100—but during this process, the USD1 balance remains within the account system and has not yet gone on-chain; it must be "withdrawn" into the public blockchain world. Currently, USD1 officially supports only Ethereum and BNB Chain (with the latter accounting for over 98% of total issuance).

In other words, in the current on-chain environment, USD1 has not achieved native multi-chain deployment. To enable circulation and usage of USD1 on other chains, there are currently only two options. One is relying on the official cross-chain bridge, which is far from sufficient—it only solves asset "cross-chain existence" but fails to build complete application scenarios. The second is through partners constructing an independent cross-chain distribution system.

StakeStone enters precisely at this critical juncture, leveraging its own multi-chain distribution and scenario operation capabilities to deploy USD1 across more than 20 chains, enabling native落地 and application in diverse DeFi environments.

According to Charles, StakeStone held multiple rounds of discussions with the WLFI team starting at the end of 2024. Their final decision to collaborate was driven by StakeStone’s established asset distribution system within the multi-chain ecosystem, as well as appreciation for its rich experience in integrating yield from blue-chip assets—enabling rapid integration of USD1 into real DeFi application scenarios. This means that from the very beginning of USD1’s inception, StakeStone has been more than just a "minter"—it functions more like a strategic partner guiding USD1 into the multi-chain ecosystem, responsible not only for serving as the core hub for cross-chain distribution of USD1, but also for building yield-bearing products across DeFi chains, providing yield certificates, and cultivating an on-chain usage environment for USD1—ultimately achieving seamless integration from "fiat on-ramp → minting → cross-chain distribution → on-chain/off-chain scenario connectivity," establishing a true one-stop liquidity closed-loop service for USD1.

Below are the related interview questions:

Frank: We see that StakeStone is the "official cross-chain liquidity support partner of the USD1 stablecoin." Could you elaborate on the specifics of your collaboration with WLFI and what core support and services StakeStone provides for USD1?

Charles: Currently, we serve both as a USD1 minting service provider and deeply participate in its governance ecosystem, undertaking the construction of cross-chain liquidity. Future cooperation plans include:

-

Payment Products: Launching USD1-based payment collection tools supporting global enterprises to directly receive USD1 via Visa/Mastercard, and eventually connecting to traditional banking systems once stablecoins gain legal recognition;

-

Cross-Chain DeFi Yield Products: Launching a one-stop cross-chain yield product suite on-chain—the USD1 LiquidityPad Vault;

-

CeDeFi Products: Simultaneously developing USD1CeDeFi products that integrate with traditional financial institutions’ dollar wealth management products and quantitative trading yields;

-

Compliance Channel Development: Applying for payment licenses in multiple countries to establish a streamlined fiat-to-USD1 exchange pathway, gradually replacing OTC channels;

Frank: Currently, USD1 sets very high qualification requirements for minting service providers. Why did WLFI select StakeStone as the first DeFi protocol minter? What prompted this partnership?

Charles: Our collaboration with the USD1 team began during their private sale phase at the end of last year (Q4 2024). We were involved early in technical roadmap planning. Based on our successful track record in liquidity distribution across multiple projects, the USD1 team recognized our capabilities in multi-chain ecosystem development, leading us to form a strategic partnership.

Frank: Previously, StakeStone had never launched any business or product directly related to stablecoins. Does this deep collaboration with USD1 mark StakeStone's official entry into the regulated stablecoin domain?

Charles: We indeed didn't have stablecoin products before. This collaboration marks our first step into stablecoin infrastructure. In the future, we will definitely build a comprehensive suite of products around USD1, including the LiquidityPad cross-chain liquidity distribution vault for USD1, USD1 minting, and stable-yield products.

These are essentially things StakeStone already excels at—we previously focused mainly on blue-chip or public chain assets, and now we’ll deliver a full "stablecoin-as-a-service" solution for USD1.

Frank: As the 'first DeFi protocol minter for USD1,' will ordinary users be able to directly mint or cross-chain swap USD1 via StakeStone in the future?

Charles: We certainly aim to package this mechanism neatly—for instance, users link their bank card through StakeStone’s frontend, make a fiat deposit, then our backend automatically mints USD1 via our institutional account and bridges it to the user’s chosen target chain, thus delivering a seamless, one-stop experience from deposit to minting and distribution.

We’re already working on securing relevant compliance licenses, especially in jurisdictions like Singapore and Hong Kong where regulatory frameworks are clearer, aiming to open up payment channels. In the future, users might be able to deposit and convert to USD1 using credit cards, SWIFT, or wire transfers.

"USD1’s bigger use cases aren’t in crypto circles"—a new growth paradigm combining cross-chain liquidity × global liquidity

"USD1’s biggest use cases lie outside the crypto space."

StakeStone is also preparing USD1-based payment products, offering compliant and efficient global aggregated payment solutions for SMEs, digital nomads, self-employed individuals, and others.

He sees this direction pointing toward an undeniable second-half market for stablecoins. StakeStone aims not only to provide full-stack "stablecoin-as-a-service" support for USD1 but also to help evolve it into an "on-chain dollar API" serving real-world settlements and global circulation.

Below are the related interview questions:

Frank: Cross-chain stablecoin distribution products may seem abstract. Can you give an example of how regular users can use USD1 across chains via StakeStone, engage in different ecosystems, and earn yield?

Charles: Think of it as a "three-step process": First, users deposit USD1 into StakeStone’s liquidity vault. StakeStone issues interest-bearing stablecoin receipts. Then, users leverage these yield-bearing receipts to participate in blue-chip DeFi protocols (like Morpho, Pendle) on target chains to earn returns.

Meanwhile, StakeStone distributes the underlying USD1 across the multi-chain ecosystem, deploying it into cross-chain multi-yield strategies.

Finally, users can effortlessly claim cross-chain yields through their yield-bearing receipts.

Frank: From an ecosystem partnership perspective, how do you assess the synergistic value of StakeStone × USD1? Does this imply a long-term alliance between a stablecoin and a liquidity protocol to jointly penetrate multi-chain and cross-regional markets?

Charles: In the future, we will be the one-stop gateway for USD1—from minting to distribution.

Within the crypto space, we’ve launched a dedicated LiquidityPad vault for USD1 to support its expansion into multi-chain DeFi scenarios. We’ll also release RWA+CeDeFi products based on USD1, providing stable yield services. On the traditional finance front, we’re advancing license applications and partnerships to achieve a compliant, low-friction path for users to directly mint USD1 from fiat, effectively opening the off-chain capital on-ramp.

For this closed loop to truly materialize, three key variables remain pivotal: First, regulatory progress—whether policies such as the U.S. Stablecoin Act pass will directly determine the legality of USD1’s fiat channels. Second, scenario penetration—whether SMEs, cross-border freelancers, and global trade entities widely adopt USD1 as a payment tool. Third, yield product scalability—whether USD1’s on-chain yields can be extended to off-chain assets like RWAs, government bonds, and CeDeFi platforms.

The biggest alpha in 2025 is "regulated stablecoins," and the actualization of this closed loop depends on the joint momentum of regulation, use-case adoption, and product innovation.

What’s next?

"The stablecoin industry has entered its second half, with competition shifting from scale and traffic to compliance capability and real-world adoption."

Beyond product collaboration, Charles shared his views on how stablecoins will reshape the future of the industry. He believes regulated stablecoins represent a watershed moment for the crypto sector. Specifically:

-

The emergence of regulated stablecoins will gradually erode traditional fiat’s market share in cross-border payments, as crypto stablecoins clearly offer lower ledger security costs and lower global access barriers.

-

The rise of regulated stablecoins will end the current P2P deposit/withdrawal model, eventually being replaced by licensed foreign exchange firms in each country.

-

The arrival of regulated stablecoins will blur the operational boundaries between traditional banks and Web3 stablecoin asset management, with future differences lying only in bookkeeping methods (centralized databases vs. on-chain ledgers) and regulatory requirements—their business scopes becoming increasingly similar.

Therefore, in 2025, StakeStone will firmly embrace the stablecoin market, especially emerging stablecoins like USD1 that have the highest potential to become legally recognized stablecoins.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News