TGE Approaches: A Guide to Mining BERA with StakeStone Berachain Vault

TechFlow Selected TechFlow Selected

TGE Approaches: A Guide to Mining BERA with StakeStone Berachain Vault

Deposit once, access two networks, enjoy multiple benefits.

Author: Frank

With the mainnet launch approaching, how can users easily and efficiently capture the maximum amount of BGT/BERA on Berachain?

As projects like Movement and Fuel prepare for token launches, Berachain has emerged as one of the few new-generation blockchains still drawing significant attention—thanks to its innovative on-chain liquidity "flywheel" built on Proof-of-Liquidity (PoL). However, for average users, this innovation also erects a high barrier to entry:

From participating in Boyco pre-deposits and selecting DApps, to calculating yield strategies and dynamically engaging in governance voting, each step demands substantial on-chain experience and operational skill. This complexity prevents most users from maximizing their BERA rewards, and currently there are almost no tools available to simplify the process.

Notably, StakeStone has just launched the market’s first all-in-one Berachain liquidity provision product—“Berachain Vault”—specifically designed to streamline everything from Berachain pre-deposit activities to yield farming under the PoL mechanism. By offering a full-service “hands-on” solution, it aims to help ordinary users effortlessly participate in the Berachain ecosystem and seize early-stage opportunities.

Could this Vault product become the “express lane” for retail investors entering Berachain? This article explores that question by examining the needs of emerging ecosystems like Berachain and analyzing the core design of StakeStone’s Berachain Vault, assessing its potential and value in lowering barriers and optimizing yield management.

Berachain: The “Flywheel” and the “High Wall” of the PoL Mechanism

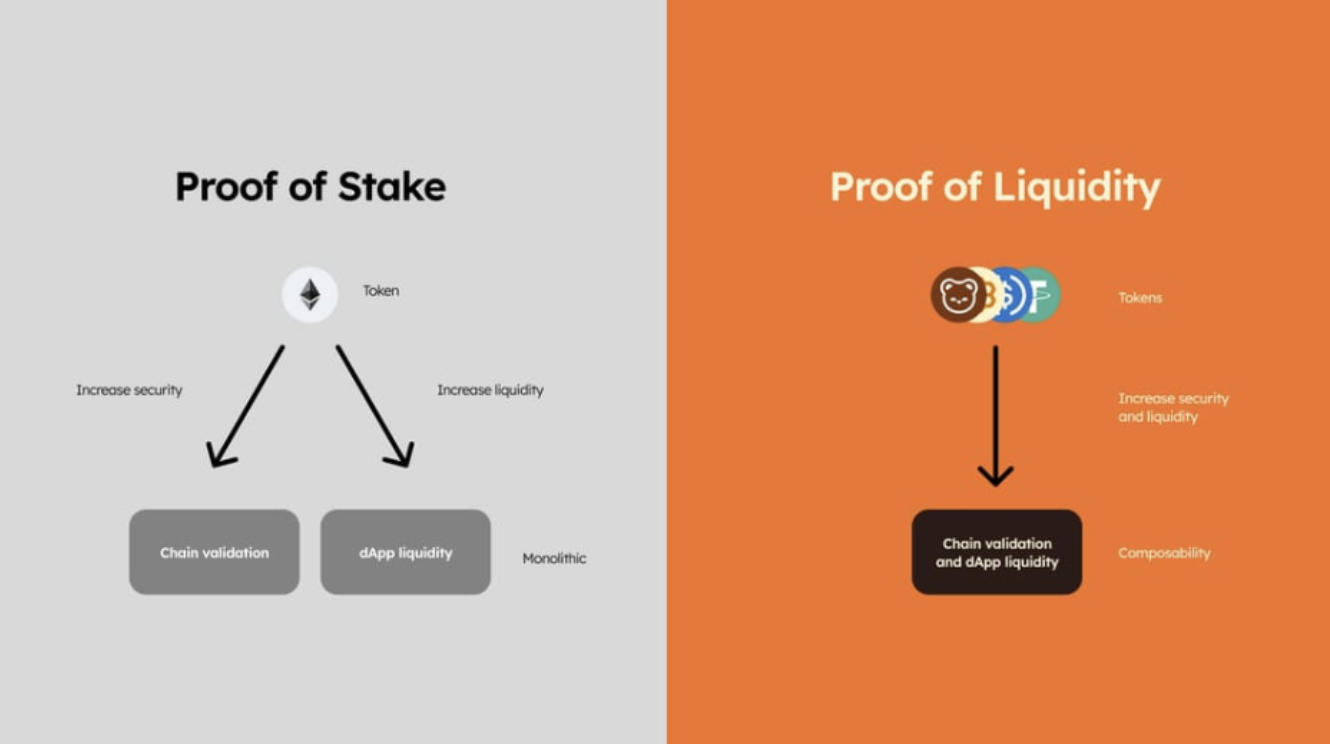

Talk about Berachain inevitably centers on its key innovation: the Proof-of-Liquidity (PoL) mechanism. Under this model, users must provide liquidity to designated pools to earn BGT—a governance token that can later be converted into BERA. Which liquidity pools receive more BGT emissions is determined by votes from validators who are delegated by BGT holders.

Does this sound familiar? If we substitute Berachain with Curve, PoL with the ve model, and BGT with CRV, the operational logic looks strikingly similar: On Curve, CRV holders lock their tokens for varying durations to obtain veCRV with voting power, which they then use to vote on which trading pairs should receive future CRV emissions. In essence, Berachain can be understood as a “blockchain version of Curve,” or a public chain operating on a ve-like economic model:

Under the PoL mechanism, validator voting directly influences BGT distribution, strongly incentivizing ecosystem projects to create liquidity incentive programs to compete for more BGT emissions—mirroring the so-called “bribe economy” seen on Curve.

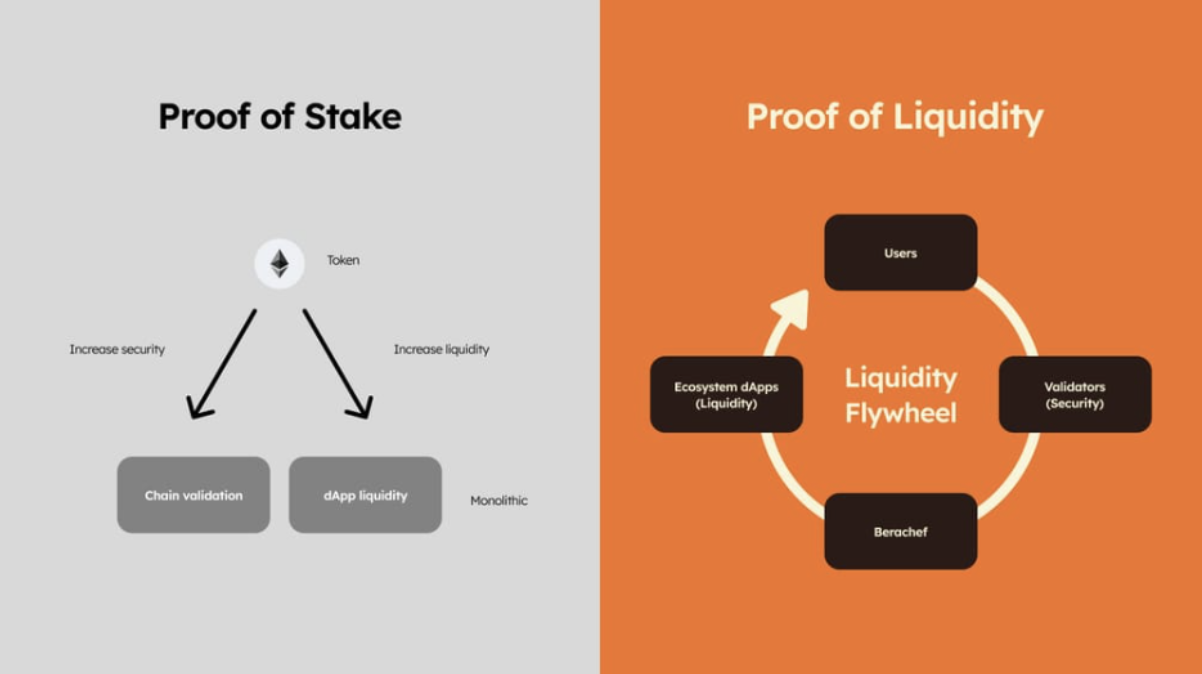

However, Berachain embeds this logic at the foundational layer of the blockchain, creating a highly collaborative “community of shared interests” among users, validators, and DApps:

In an ideal scenario, validators and DApps share aligned incentives: validators have motivation to allocate more BGT emissions to high-volume, active DApps, while those DApps boost rewards for LPs to attract more liquidity, generating higher returns for these popular pools.

As more users join due to attractive yields, DApp governance support and liquidity scale grow further, enabling them to secure even greater BGT emissions. This expanding cycle of liquidity and governance weight not only strengthens protocol growth but also attracts additional users and capital into the ecosystem—gradually forming a powerful positive feedback loop.

But a new challenge arises: once the Berachain mainnet launches, how can ordinary users determine where to provide liquidity to maximize their returns?

Every decision—from choosing validators, selecting DApps, to picking liquidity pools—requires deep research across multiple options. This creates a formidable “high wall” for participants.

Just as Curve relies on user-facing services such as Convex (for vote delegation) and Yearn.finance (for yield optimization), Berachain will similarly require supporting infrastructure to address the pain points of everyday users.

Typical user challenges include:

-

Information asymmetry: Yields and governance weight allocations across different DApps and liquidity pools are constantly changing. Retail users must invest considerable time tracking and analyzing project developments to make optimal decisions;

-

Disadvantage in economies of scale: Individual retail contributions are small, making it difficult to compete with large funds or professional players when vying for emission rights, thus missing out on scale advantages;

-

Operational complexity: Managing liquidity, participating in governance voting, and optimizing yields simultaneously presents a steep learning curve. A minor misstep—such as failing to timely adjust voting directions or rebalance liquidity—can significantly impact overall returns;

Against this backdrop, StakeStone, a cross-chain liquid asset protocol, has launched an innovative product tailored for the Berachain ecosystem: Berachain Vault. It has become the first officially recommended, end-to-end mining service platform for Berachain currently available in the market.

StakeStone Berachain Vault: One Deposit, Two Networks, Multiple Yields

In the DeFi context, a “Vault” is an automated investment strategy designed to simplify user experience. Users deposit assets, and the protocol automatically executes financial operations using various strategies to maximize returns. While traditional Vault products offer convenient asset management, they often face clear limitations in yield enhancement and liquidity utilization.

On one hand, deposited assets are typically non-yielding native assets like ETH—widely recognized but not inherently productive. On the other hand, liquidity is usually locked upon deposit, limiting further utility and reducing investment flexibility.

With stETH, pufETH, rzETH, and other yield-bearing assets becoming mainstream, Vault products have evolved to support these income-generating assets, allowing them to capture base-level PoS staking rewards and stack additional yields through strategies like liquidity mining and lending, thereby maximizing investor returns.

Extending this idea: what if the liquidity locked within a Vault could itself be represented as a Vault LP Token and reused across various DeFi yield scenarios? Wouldn’t that enable the ultimate stacking of multi-layered yields?

The newly launched StakeStone Berachain Vault exemplifies exactly this innovation. Beyond standard Vault asset management functions, it introduces a novel dual-layer structure—Vault + Vault LP Token—that unlocks every dimension of compound yield:

-

Wrapping Vault LP assets into yield-bearing instruments: Users seeking exposure to Berachain's ecosystem can deposit LP assets (yielding or non-yielding) such as ETH or STONE. The Vault deploys these assets via liquidity mining and governance strategies under the PoL mechanism to maximize returns, then wraps the position into a yield-bearing Vault LP Token (e.g., beraSTONE).

-

Leveraging the wrapped yield-bearing assets across DeFi: These Vault LP Tokens can then be used across mature Ethereum-based DeFi infrastructures, creating a unique parallel universe structure—where yield generation occurs on chains like Berachain, while capital deployment happens on Ethereum. This setup combines the high-yield potential of new chains with the deep capital pools and robust DeFi infrastructure of Ethereum, potentially establishing a new paradigm in DeFi.

In StakeStone’s design, the wrapped Vault LP Tokens enjoy top-tier composability—just like ETH—enabling participation in Uniswap liquidity mining, Aave/Morpho collateralized borrowing, or even being split into PT and YT tokens on Pendle, further amplifying returns.

Therefore, the true innovation of the StakeStone Berachain Vault lies in its ability to reuse and deeply unlock a single asset, bridging Berachain’s emerging ecosystem with mature networks like Ethereum (or other EVM chains), creating a “multi-layer yield” flywheel effect:

-

First-layer yield: PoS yield from base-level yield-bearing assets. For example, depositing ETH earns underlying PoS yield via STONE, a cross-chain liquid asset;

-

Second-layer yield: POL yield from the Berachain ecosystem. STONE deposited into the StakeStone Berachain Vault generates liquidity mining rewards under Berachain’s PoL mechanism, which are then encapsulated into a Vault LP Token (e.g., beraSTONE);

-

Third-layer yield: Diversified DeFi strategy yield on Ethereum. The beraSTONE LP Token can generate additional returns on Ethereum through leveraged strategies, liquidity mining, etc.;

By combining Berachain’s unique ecosystem dynamics with Ethereum’s diverse yield opportunities, StakeStone Berachain Vault enables repeated reuse of a single asset across emerging and mature ecosystems—maximizing returns, fully unlocking liquidity potential, dramatically increasing capital efficiency, and bringing enhanced liquidity and market recognition to the Berachain ecosystem.

Through these two assets, users not only gain access to high BERA yields under Berachain’s Proof-of-Liquidity (PoL) mechanism but also achieve yield stacking on mature networks like Ethereum. More importantly, participants in the StakeStone Vault can also pre-lock future governance token STO allocations:

During the campaign, holding or using beraSTONE and beraSBTC grants eligibility for a total reward pool of 15 million STO tokens—including 8.25 million Bera-Wave points (distributed as points, settled at TGE) and an extra 4 million STO bonus during the Boyco event. Additionally, the first 10,000 early adopters (depositing ≥0.042 ETH or ≥0.0015 BTC) will receive an additional 150 STO per person.

How to earn Bera-Wave points? There are two main components: Base Point Rules + DeFi Acceleration Bonuses (referral incentives detailed below):

1. Base Point Rules:

-

Holding 1 beraSTONE earns 1 point per hour;

-

Holding 1 beraSBTC earns 25 points per hour (points accumulate hourly without requiring additional actions);

2. DeFi Acceleration Rewards—Depositing beraSTONE or beraSBTC into supported DeFi protocols significantly boosts point accumulation:

-

Providing liquidity on Uniswap: 5x base points;

-

Precise liquidity range (±0.1%): When maintaining liquidity within ±0.1% of the current price, earn 6x base points (must remain actively positioned);

-

More protocol support: Future integration with Pendle, Morpho, and others will offer additional reward opportunities and further increase point earnings;

Overall, these rewards cover Berachain PoL incentives, Boyco protocol benefits, future ecosystem yields, and StakeStone token airdrops—an example of “killing multiple birds with one stone”—providing comprehensive participation opportunities in both Berachain and StakeStone. The process is simple:

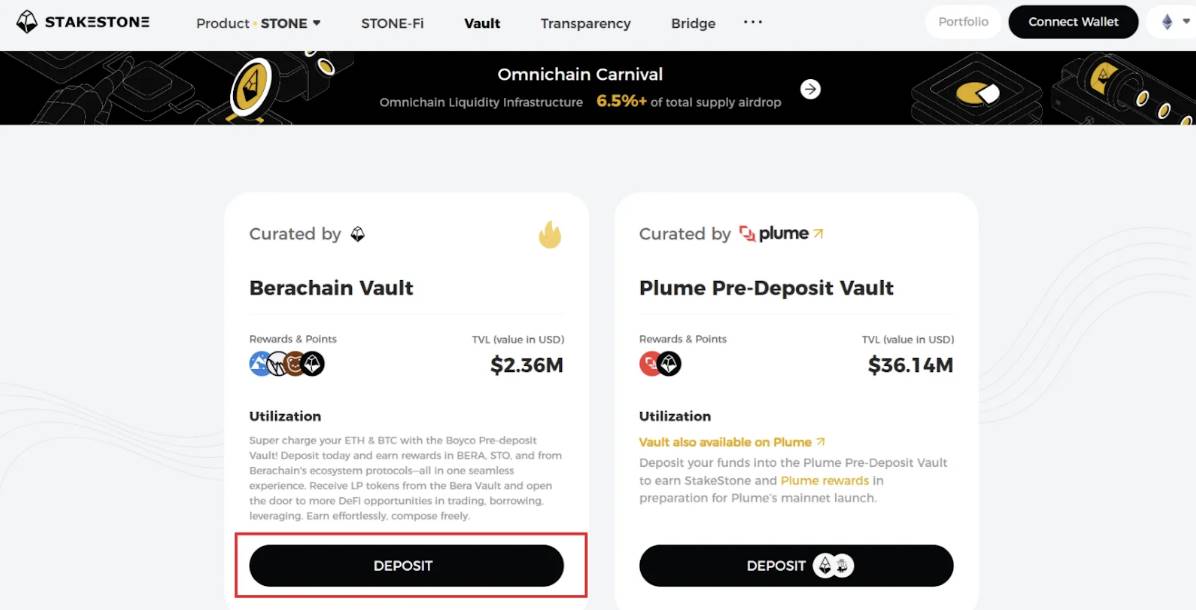

1. Go to the StakeStone Vault interface, click “Deposit” to enter the StakeStone Berachain Vault page.

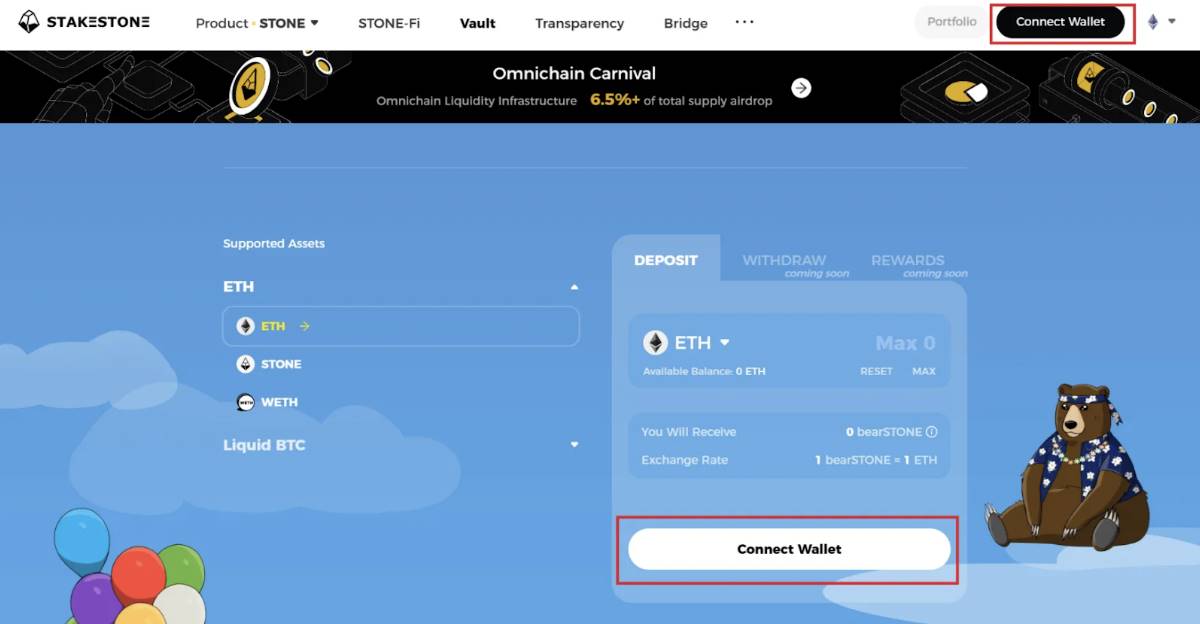

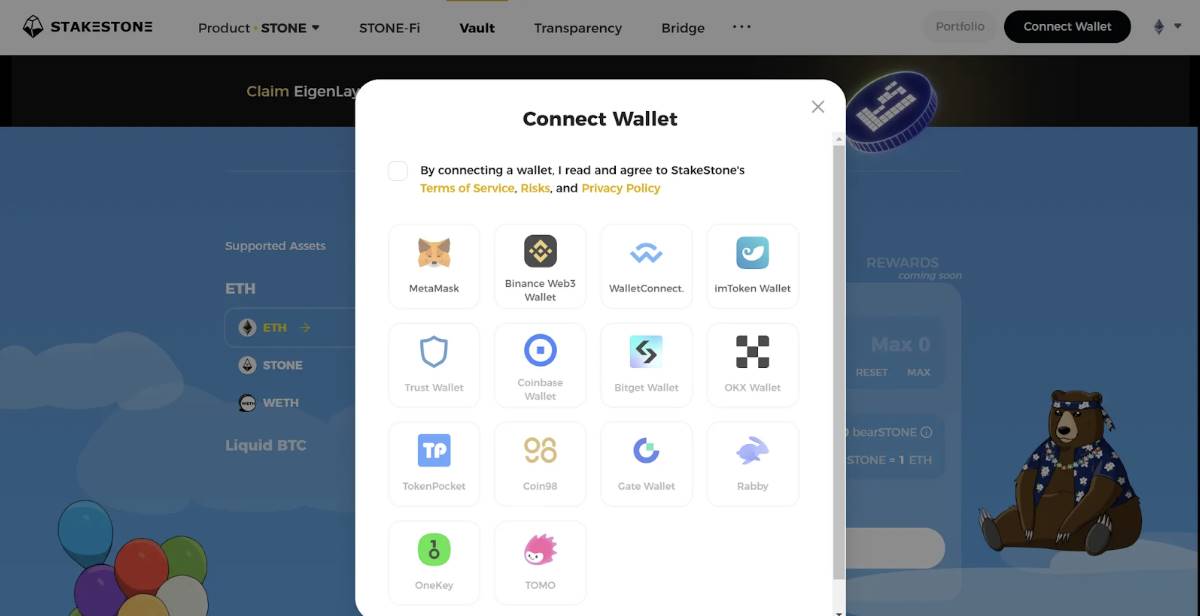

2. Connect your wallet in the top-right corner.

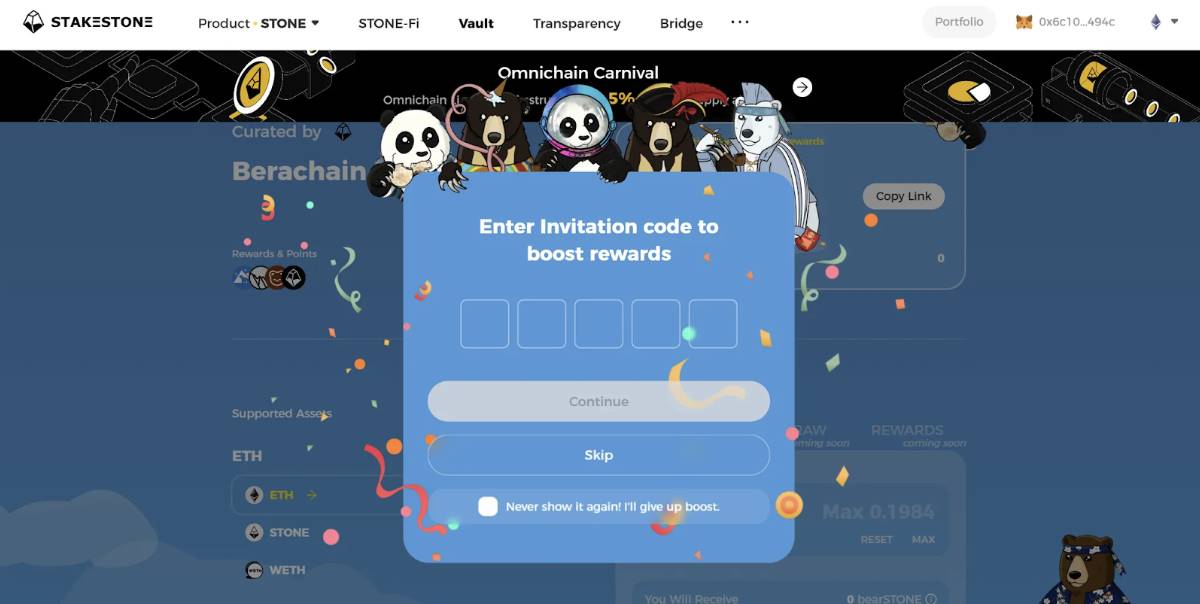

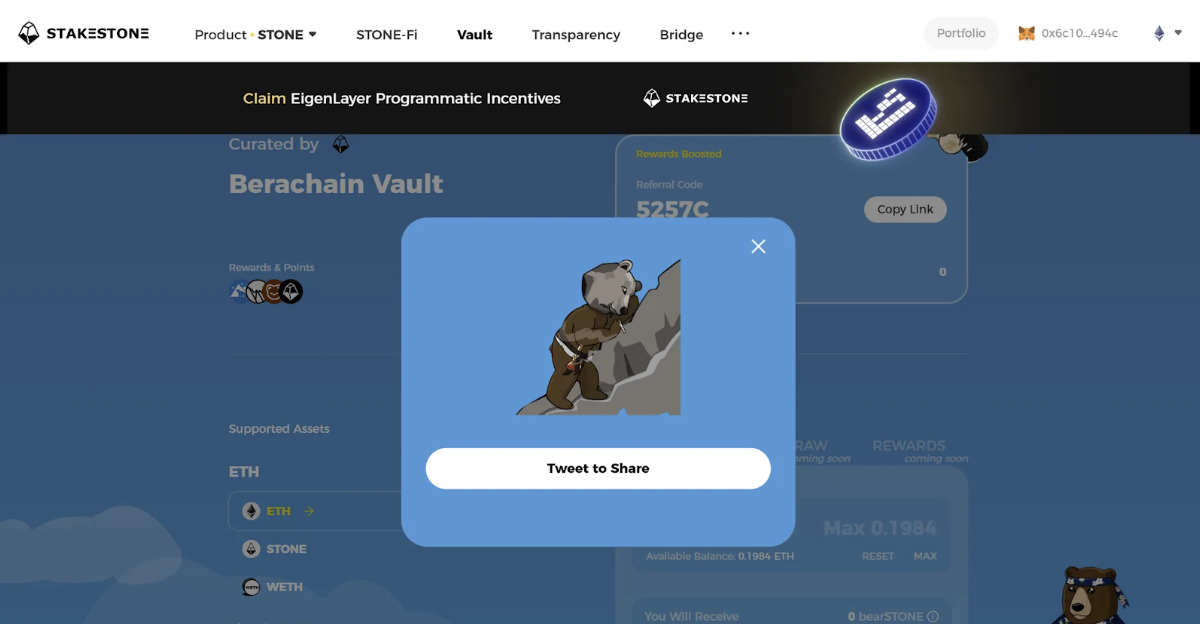

3. Enter referral code for a 10% points boost (use code 91852), and share your own referral link on Twitter to earn additional commission rewards (20%).

4. Deposit ETH/STONE/WETH to receive beraSTONE; deposit SBTC/WBTC/cbBTC/BTCB to receive beraSBTC (not yet live). Holding either beraSTONE or beraSBTC earns points.

-

Only assets on the Ethereum mainnet are accepted—if not, click “Switch Network” to switch to Ethereum;

-

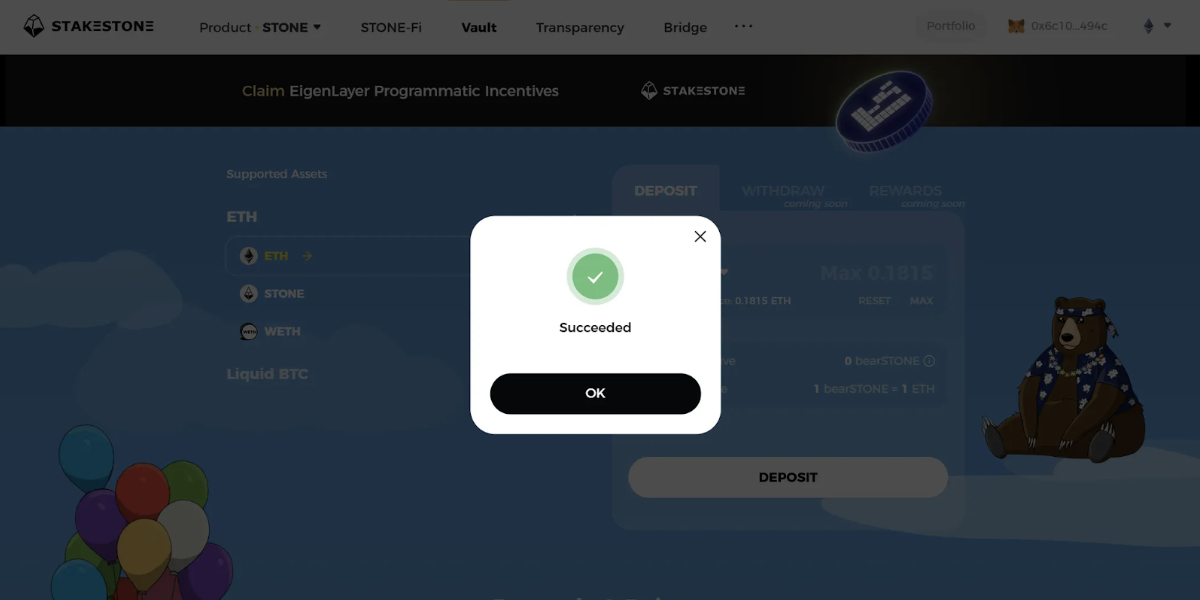

Select the asset to deposit on the left, enter the amount, and click “Deposit,” then confirm in your wallet;

5. Participate in DeFi protocols to earn more rewards.

It’s worth noting that Berachain hasn’t launched its mainnet yet. Therefore, the initial operation of StakeStone Berachain Vault focuses primarily on the Boyco pre-deposit protocol. Funds deployed to Boyco not only earn direct BERA token rewards during the pre-deposit period but will also be 1:1 mapped to the mainnet, laying the foundation for full integration once the Berachain mainnet goes live.

Once Berachain launches its mainnet, the Vault’s core functionality will transition to the POL system on the Berachain mainnet, providing users with a one-stop liquidity mining service.

This phased deployment approach reduces technical and operational risks while giving early participants the chance to engage in Berachain’s liquidity-building phase—allowing users to gain a head start on liquidity positioning and capture early-stage mining rewards through the Boyco protocol even before the mainnet launch.

Is StakeStone Vault the New Solution for Emerging On-Chain Ecosystems?

From a purely Berachain-centric view, the StakeStone Berachain Vault offers the earliest pre-deposit channel in the market—the go-to tool for seizing early advantages and maximizing returns.

Especially during this critical window just before the Berachain mainnet launch and the activation of its mining mechanism, it allows regular users to bypass complex technical steps and get ahead of the curve, capturing early ecosystem rewards fairly—even for retail investors.

Yet, looking beyond Berachain, the significance of this product extends much further. It doesn’t merely offer an innovative liquidity management solution for Berachain—it presents a completely new development blueprint for emerging ecosystems: packaging yield from nascent chains into yield-bearing assets and connecting them with mature mainnet infrastructures, serving as a vital conduit for cross-ecosystem liquidity and yield management.

This model is particularly suitable for emerging markets like Berachain and Movement, which often face challenges such as insufficient liquidity and underdeveloped infrastructure during cold starts or early growth phases. StakeStone’s prior Vault collaborations with projects like Plume have already demonstrated the feasibility of this approach. The Berachain Vault represents a deeper evolution of this same framework.

Its core value lies in enabling a single asset to be reused across multiple ecosystems, maximizing returns while unlocking liquidity potential:

-

Lowering entry barriers: Users don’t need complex operations—through the Vault, they can easily access ecosystem rewards, broadening participation in native yield capture on chains like Berachain;

-

Enhancing asset appeal: By wrapping traditionally locked assets into liquid, yield-bearing Ethereum-native instruments (via Vault LP Tokens), the model increases capital efficiency and makes emerging ecosystem assets more attractive;

-

Connecting with mature networks for value flow: The yield-bearing assets generated by the Vault (e.g., beraSTONE) seamlessly integrate with mature financial systems on Ethereum, amplifying yield potential while fostering deeper synergy between Berachain and the global DeFi market;

This means StakeStone Vault products can not only capture local yields from emerging ecosystems but also transform LP positions into yield-bearing assets with advanced financial properties—structured products that plug into deeper, more mature liquidity markets like Ethereum, greatly enhancing capital efficiency.

Berachain’s complex POL mechanism and initial asset management demands make it the ideal testbed for the StakeStone Vault model. The Vault mechanism effectively addresses Berachain’s liquidity bottleneck during its bootstrapping phase, while injecting new use cases and revenue streams into its ecosystem assets:

On one hand, automated strategies inside the Vault help users efficiently capture local yields from liquidity mining and governance rewards. On the other hand, the wrapped yield-bearing assets can participate in multi-layered yield scenarios within mature ecosystems—such as liquidity mining on Uniswap, collateralized loans on Aave, or yield splitting on Pendle.

This architecture not only enhances compounded yield generation but also boosts adoption and credibility for emerging ecosystems like Berachain. As more new ecosystems emerge, user demand for efficient yield capture and capital utilization will only grow more sophisticated—meaning StakeStone’s innovative Vault mechanism provides a dynamically adaptable asset management framework capable of supporting diversified yield stacking and secondary utilization across any new ecosystem, further boosting investment returns.

Within this framework, StakeStone Vault is not just an efficient asset management tool—it’s a crucial bridge linking emerging ecosystems with mainstream blockchain networks.

Conclusion

Whether in traditional finance or DeFi, improving capital efficiency remains the ultimate goal for all market participants.

For on-chain yield products, the eternal “muse” is how to simply and securely maximize returns—how to make every dollar work as hard as possible. From this perspective, StakeStone Berachain Vault—and the broader StakeStone Vault architecture behind it—offers a compelling new paradigm for next-gen blockchains:

Using multi-strategy Vaults as bridges, it simplifies user participation and increases attractiveness to external capital on one side, while packaging in-ecosystem yields into liquid, yield-bearing assets that seamlessly connect local earning opportunities with mainstream DeFi markets. This approach opens up a more ideal path for launching and sustaining long-term growth in emerging ecosystems.

Whether this model will evolve into a universal solution for new ecosystems—or even grow into a billion-dollar on-chain financial narrative—remains to be seen. But the vision and execution behind StakeStone Berachain Vault may well represent one of our best paths toward that future.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News