StakeStone's DeFi 3.0 Strategy: The "UnionPay + Alipay" of the Crypto World, Ending Industry "Self-Competition" Once and for All

TechFlow Selected TechFlow Selected

StakeStone's DeFi 3.0 Strategy: The "UnionPay + Alipay" of the Crypto World, Ending Industry "Self-Competition" Once and for All

In the DeFi 3.0 era, omnichain liquidity is the core narrative, and StakeStone's positioning is highly forward-looking.

Author: Icefrog

In the crypto world, liquidity determines everything. Without sufficient liquidity, even the most sophisticated DeFi protocols are just "stagnant pools" incapable of realizing true value. As blockchain ecosystems continue to expand, fragmented liquidity across chains has become the biggest obstacle to industry growth.

StakeStone precisely targets this critical pain point, aiming to become the “UnionPay + Alipay” of crypto by building a full-chain liquidity infrastructure that enables capital to flow freely across different blockchains—ending the era of fragmented, inefficient, and self-consuming liquidity traps.

In essence, StakeStone is attempting to build the financial infrastructure for DeFi 3.0, helping the entire blockchain industry move beyond meaningless liquidity wars and enter a new era of free capital movement.

Below, I’ll break down this project in the simplest terms possible:

1. StakeStone’s Positioning: The Breakthrough Player in Full-Chain Liquidity Infrastructure

1.1 Pain Points and Solutions

Industry Pain Points:

Liquidity fragmentation,单一收益 models, yield disparities between established and emerging chains.

Currently, cross-chain transfers require complex operations and high fees. Full-chain technology bridges these isolated islands, enabling seamless capital flow across any chain.

From a cross-chain liquidity perspective, key issues include: fragmented liquidity (e.g., BTC cannot easily participate in DeFi),单一收益 strategies (token incentives without utility, unsustainable), and difficulty for new chains to bootstrap. More simply, there are three core problems:

1⃣ Funds are "trapped" on one chain. For example, Bitcoin can only sit idle on the Bitcoin chain, while ETH must be on Ethereum to access DeFi.

2⃣ New chains lack users; old chains are overcrowded. Newly launched public chains often struggle with low deposits, while mature chains like Ethereum suffer from capital overflow but diminishing yields.

3⃣ Yields are hard to sustain. Many projects attract users with high token rewards, but once emissions stop, capital flees immediately.

StakeStone’s Solution: Three Core Products to Solve Full-Chain Liquidity Allocation

1⃣ STONE (Yield-Bearing ETH): Aggregates multi-chain ETH liquidity and dynamically optimizes收益 strategies.

2⃣ SBTC/STONEBTC (Full-Chain BTC & Yield-Bearing BTC): Unifies BTC liquidity pools, unlocking DeFi potential for Bitcoin.

3⃣ LiquidityPad: Bridges capital flows between Ethereum and emerging chains, enabling bidirectional value capture.

1.2 What Makes StakeStone Unique?

To illustrate StakeStone’s unique approach, think of it as an integrated “Alipay + UnionPay” system for crypto.

1⃣ Alipay-Level User Experience

STONE: Like Yu’ebao in Alipay—deposit ETH and earn interest automatically, with instant cross-chain spending capability.

SBTC: A “digital gold credit card,” allowing BTC to generate returns and be spent widely.

2⃣ UnionPay-Level Network

LiquidityPad connects all chain liquidity pools, enabling new chains to quickly attract investment (“招商引资”) and redirect surplus capital from mature chains (“下乡扶贫”).

With these products and experiences combined, users can manage funds across all chains through a single account while earning passive income. It also transforms Bitcoin into a yield-generating asset.

For the industry, it accelerates cold starts for new chains using real yields to attract capital, ends internal liquidity battles, and allows money to flow freely to wherever it's most effective.

In today’s crypto market, liquidity is the lifeblood of every product. Idle money is dead money. At its core, StakeStone’s full-chain liquidity protocol does three fundamental things:

Builds liquidity pipelines so asset pools across all chains connect seamlessly; installs liquidity pumps that automatically route capital to higher-yield chains (e.g., new chains); and establishes unified standards so assets move under a common framework. This creates frictionless capital flow across blockchains. Ordinary users can earn returns effortlessly, while the industry finally escapes fragmentation and inefficiency—the real value behind the full-chain narrative.

2. Dual-Token Model Explained: One Works, One Earns Dividends

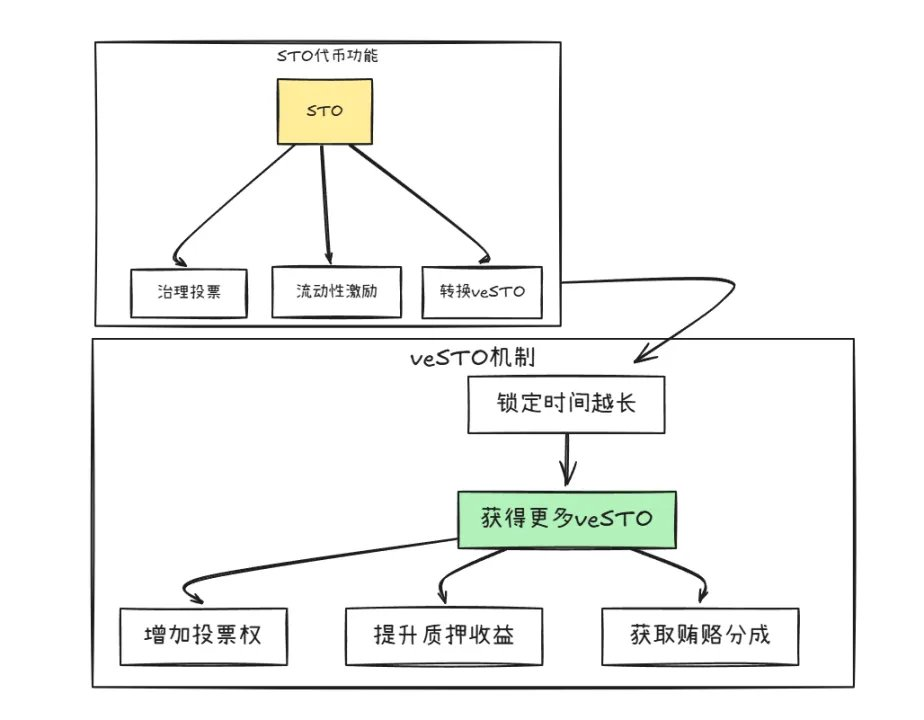

StakeStone recently released its whitepaper and introduced a dual-token model (STO and veSTO)—a design worth deep analysis.

This model reflects the team’s ambition to shift current DeFi’s casino-like dynamics toward a partnership model, signaling long-term strategic vision.

As shown above, STO and veSTO have a conversion mechanism but serve distinct functions:

1⃣ STO: The Working Token

Main functions: Governance voting—holders vote on protocol direction (e.g., which chain to prioritize). Reward distribution—used to incentivize liquidity providers (e.g., those staking ETH). Fee collection—transaction fees are distributed to STO holders.

Notably, STO includes a deflationary mechanism: external projects needing StakeStone’s liquidity must buy and burn STO tokens.

2⃣ veSTO: The Revenue-Sharing Token

Obtained by locking STO (like a fixed deposit), veSTO grants three key privileges: enhanced voting power (influencing where STO rewards go), doubled yield on deposits, and eligibility for “bribe” payments (e.g., direct ETH distributions) from projects seeking liquidity.

To prevent immediate dumping, veSTO requires a 30-day lock-up period, discouraging short-term speculation.

This dual-token model may seem simple, but every aspect directly addresses industry pain points:

1⃣ Previously, users would farm tokens and dump them immediately, causing price declines. Now, veSTO locking encourages long-term participation—higher earnings require longer commitment, reducing speculation.

2⃣ In the past, teams bootstrapped by indiscriminate token drops, often resulting in empty pools. Now, veSTO holders decide where capital flows—giving governance back to the community.

3⃣ Historically, many projects featured infinite token emissions or malicious inflation. Now, if other projects want access to StakeStone’s liquidity? They must buy and burn STO. The more adoption, the scarcer STO becomes.

The token design clearly aims to align user and protocol incentives—making participants co-owners: the longer you stay, the more you earn, and the more influence you gain.

3. Valuation and Return Potential: Points, Airdrops, and Ecosystem Benefits

3.1 Project Valuation Analysis

Looking at comparable valuations in the sector, leading liquid staking protocols like EtherFi (FDV $820M) and Puffer (FDV $250M) typically fall within the $200–800M range. StakeStone’s projected FDV of $500M–$1B represents a premium, justified by three core pillars:

1⃣ Scarcity Premium from Full-Chain Positioning

Unlike traditional single-chain staking protocols, StakeStone is the first to position itself as a full-chain liquidity infrastructure. Compared to niche players like Renzo or Puffer, it spans three major use cases: ETH staking, BTC yield assets, and cross-chain liquidity aggregation—effectively competing across LRT, BTC-Fi, and cross-chain bridge sectors simultaneously.

Compared to LayerZero (a full-chain interoperability protocol valued at $3B), StakeStone’s focus on capital efficiency offers differentiated upside potential.

2⃣ Fundamental Strength Driven by TVL

StakeStone’s on-chain Total Value Locked (TVL) has surpassed $700 million. High TVL signals strong market validation and justifies higher valuation multiples.

Crucially, its dual-token model creates a multiplier effect: protocol revenue from fees and bribes scales directly with TVL, fueling a flywheel of “revenue growth → ecosystem expansion → rising TVL.”

3⃣ Strategic Depth via Ecosystem Synergies

Through LiquidityPad, StakeStone has formed deep partnerships with top-tier projects like Plume (raised $10M) and Story Protocol, providing initial on-chain liquidity.

This “liquidity infrastructure provider” role delivers triple benefits: direct fee and bribe income from partner projects; capturing incremental users and assets each time a new chain integrates.

In summary, StakeStone’s valuation should not be benchmarked against single-sector peers alone. Its positioning as a full-chain liquidity hub, monetization capacity from high TVL, and compounding ecosystem growth collectively support a $500M–$1B FDV.

3.2 Participation Return Analysis

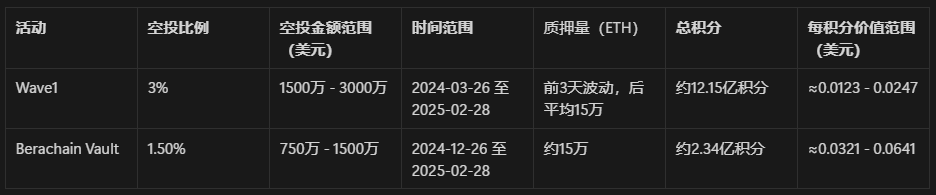

The project has confirmed airdrop allocations: 3% of total supply for the first phase of the Full-Chain Carnival (Wave1), and 1.5% for the Berachain Vault campaign. Given BTC’s smaller share, we estimate returns based on average ETH staking amounts.

1) Wave1

Duration: March 26, 2024 – February 28, 2025 (~340 days)

Staking levels: First 3 days: 342K, 275K, 259K ETH; thereafter: ~150K ETH

Points calculation: First 3 days: ~2,102,400 points; remaining 337 days: daily avg ≈ 150K × 24 = 3,600,000; total = 3,600,000 × 337 = 1,213,200,000

Total Wave1 points: 1,215,302,400

Per-point value:

Low: $15M ÷ 1,215,302,400 ≈ $0.0123 per point

High: $30M ÷ 1,215,302,400 ≈ $0.0247 per point

2) Berachain Vault

Duration: December 26, 2024 – February 28, 2025 (~65 days)

Avg staking level: ~150K ETH

Daily points: 150K × 24 = 3,600,000; total points: 3,600,000 × 65 = 234,000,000

Per-point value:

Low: $7.5M ÷ 234,000,000 ≈ $0.032 per point

High: $15M ÷ 234,000,000 ≈ $0.064 per point

Overall, estimated point values range between $0.0123–$0.064 per point across phases, excluding bonus multipliers such as referral points or boost mechanisms (which are minor and not included here).

Due to averaging and data uncertainty, these figures are approximate. Official feedback suggests possible adjustments to Wave1 allocation—final results subject to official announcement.

4. Conclusion

StakeStone recently unveiled two major updates: snapshot and dual-token model rollout—solidifying its role as a full-chain capital hub and enhancing tokenomic sustainability.

In the DeFi 3.0 era, full-chain liquidity is the dominant narrative, and StakeStone’s strategy is highly forward-looking:

Free Capital Flow: Enables BTC, ETH, and assets across public chains to break ecological silos and achieve efficient cross-chain movement.

Upgraded收益Model: The veSTO mechanism aligns long-term protocol success with user incentives, reducing short-term speculation.

Industry-Wide Efficiency: Ends the “farm-and-dump” cycle, guiding liquidity from competition to collaboration and improving capital utilization.

For the broader industry, StakeStone offers a viable path from liquidity waste to value creation. In a DeFi world where liquidity reigns supreme, StakeStone is building the foundational financial infrastructure of crypto.

If successfully executed, this won’t just be a win for the protocol—it will mark a significant step toward maturity for the entire blockchain ecosystem.

Disclaimer: All estimates in this article are derived from public information and reasonable assumptions. Not investment advice. Please make your own decisions and participate at your discretion.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News