Ethena's 2024 Roadmap: How We Will Claim Crypto's Holy Grail

TechFlow Selected TechFlow Selected

Ethena's 2024 Roadmap: How We Will Claim Crypto's Holy Grail

This article aims to outline Ethena's roadmap and unified vision for the coming months.

Author: Ethena

Translation: GaryMa, Wu Shuo Blockchain

Summary

This article aims to outline Ethena's roadmap and unifying vision for the coming months.

i) Why we believe Ethena matters

ii) What excites us: The convergence of USDe with DeFi, CeFi, and TradFi

iii) Ethena’s ultimate goal: Money, network, exchange

Why Does Ethena Matter?

For a long time, the holy grail of cryptocurrency has been achieving monetary status.

Bitcoin was originally conceived as peer-to-peer electronic cash, but over time evolved into a narrower, simplified value proposition: digital store of wealth.

Next, Ethereum realized the vision of a programmable smart contract platform and decentralized applications. Over time, various iterations of Ethereum’s monetary policy caused ETH’s asset value proposition to converge again on its use as money.

As we continue building more infrastructure layers—most of which are entirely virtual products impossible to justify by any fee-generating metrics—valuation repeatedly ties back to whether tokens can serve as money within their hollow blockspace economies.

Despite their differing value propositions and the narratives we’ve collectively built around each asset, the reality is that while Bitcoin, Ethereum, and your favorite infrastructure layers exhibit some narrow monetary traits, the lifeblood of trading within crypto capital markets is conducted in digital dollars.

All data on transaction volumes related to crypto—whether on-chain or at centralized exchanges—confirms this reality: stablecoins and dollar-pegged assets are the digital currencies; everything else competes for the weaker status of digital store of wealth.

Rather than viewing the world through the lens of how we wish it existed, perhaps it’s better to see it as it actually exists.

Perhaps the greatest irony is that the most impactful real-world application of cryptocurrency—the system meant to dismantle existing monetary power structures—is the storage, transfer, and value movement of digital dollars.

Whether you like it or not, whether it aligns with your idealized vision of crypto, digital dollars are effectively being used as money.

Yet, we have not yet found a native currency form suited for ourselves—one detached from and independent of traditional systems.

So why does Ethena matter?

If you believe:

● The use case for money is the holy grail

● The addressable market for money in crypto is the largest

● Crypto’s killer application is our own native form of money

Then creating our own form of money—even if not the most important—is surely one of the most important tasks.

Maybe you disagree. That’s fine.

We may very well fail. That’s also fine.

But we do believe it matters. That’s why we’re here.

What excites us? The convergence of DeFi, CeFi, and TradFi

In 2014, Tether permanently changed the course of CeFi.

In 2017, MakerDAO permanently reshaped DeFi.

In 2024, we believe Ethena will reshape and drive the convergence of DeFi, CeFi, and TradFi:

1. DeFi

2. CeFi

3. TradFi

With USDe serving as the thread connecting them all.

1. DeFi: Internet Bond Collateral

I first met Synthetix’s Kain after Ethena closed its seed round. Unfortunately, he missed the pitch deck in his inbox. He sat down to outline all the ways he wanted to help Ethena—on product direction, how it might fit into the broader DeFi ecosystem, who else I should talk to iterate on the idea, and what introducing a new dollar primitive on-chain could mean at scale.

At the end of breakfast, I asked him why he was helping Ethena despite having zero economic exposure. He replied: “I think this might be one of the most important new developments in DeFi, and I just want to see DeFi win.”

How does DeFi win?

The U.S. dollar is the lifeblood of every major primitive in DeFi. Producing dollars is the best business model in crypto. This is why you can almost see every major DeFi application expand into the dollar issuance vertical.

If we examine each core primitive in DeFi and where Ethena fits in:

sUSDe as collateral in money markets

Before Ethena launched, the only meaningful use cases in money markets were directional leverage on WBTC or ETH, or leverage on staking yields from stETH. Introducing a new scalable dollar-denominated asset with structurally higher market yields—entirely exogenous to DeFi—provides money markets with a new use case: cheap dollar-denominated leveraged borrowing for cash-and-carry trades in CeFi. Funding from DeFi lending into perpetual markets in CeFi represents a multi-billion dollar opportunity that will force interest rate convergence between these two markets. We’ve already seen every major DeFi money market rapidly act on this insight—including Aave, Curve, Maker (via Spark), Ajna, and Morpho—where USDe has become the fastest-growing dollar-denominated collateral asset.

sUSDe as margin collateral in perpetual DEXs

Hedging volume related solely to Ethena already exceeds twice the open interest across all perpetual DEXs combined. Liquidity tied to USDe hedging would easily double the size of any DEX market where the Ethena protocol deploys. More interestingly, every DEX uses dollars as margin. By combining USDe as margin collateral with the yield embedded via sUSDe, capital efficiency and returns improve significantly. The basis on CEX platforms can offset trading fees on DEXs. Ethena can provide valuable one-way non-toxic liquidity to these platforms while embedding USDe as a margin asset. Deeper liquidity, higher open interest, and lower funding costs will fuel a virtuous cycle of healthy growth and increase the addressable market for perpetual DEXs by an order of magnitude.

sUSDe as backend infrastructure for stablecoin issuers

Since Ethena’s USDe launch, it has become the fastest-growing dollar-denominated asset in crypto history. Generating structurally higher economic returns from dollar-denominated assets is one of the strongest moats in any crypto product. Stablecoin issuers now have three viable, billion-dollar-scale sources of yield for their backing:

i) RWA yields

ii) Overcollateralized loans against BTC and ETH

iii) Perpetual funding fees from perpetual futures and futures basis

Instead of competing directly with issuers like MakerDAO and Frax, Ethena serves as neutral infrastructure behind these protocols, allowing them to choose to combine their own backing with USDe. This gives those protocols access to a massive source of returns previously unavailable—both protocols have announced allocations of up to $1.25 billion into USDe. As other stablecoin issuers grow and multiply across DeFi, Ethena will scale alongside them.

sUSDe as underlying asset for interest rate swaps

Pendle’s growth this year unlocked a new primitive for interest rate swap products within DeFi. So far, much of this volume has centered on speculation around points for pre-token projects. But once Ethena is adopted, it will unlock the first scalable yield-bearing dollar instrument, enabling the construction of a yield curve. Interest rate swap products are still in early development, but sUSDe provides the foundational asset to unlock the largest real yield in crypto: staked ETH and basis from centralized futures markets. The basis in futures markets is the largest real yield in crypto. Thus, USDe will be the core primitive upon which these rate markets are built.

USDe as money in AMM DEXs

On any given day, 3 out of the top 4 highest-volume on-chain assets are dollar-denominated. Similarly, digital dollars are objectively the most important assets in both on-chain and off-chain spot markets. As USDe becomes one of the most liquid assets on-chain, it will continue circulating as the monetary pair in DEX spot trading pairs.

In short, every major DeFi primitive is backed by dollars. We believe USDe is an ideal crypto-native dollar construct capable of serving as a foundational layer asset for other financial applications. In its brief existence, USDe has already become one of the most widely integrated assets in DeFi.

2. Tether’s Privilege: Money in CeFi

Tether isn’t just one of the greatest companies in crypto. It’s one of the greatest companies ever built under any circumstances.

What is their strongest moat?

USDT is effectively the currency of centralized exchanges. The most liquid BTC and ETH trading pairs on the largest exchanges are priced in USDT. Crucially, the most traded instrument in crypto—perpetual swaps—is primarily leveraged and settled in USDT.

Centralized exchanges are also the only viable distribution channels at scale. I don’t believe we have more than 1,000,000 truly active users on-chain, while the largest exchanges hold keys for over 100,000,000 users.

Every stablecoin’s main success story is tightly linked to distribution through exchanges. However, these relationships are often strained by political and competitive economic dynamics between issuers and distributors.

Although Ethena and USDe began initially on-chain in DeFi, the larger opportunity lies in providing neutral dollar infrastructure across every major centralized exchange to function as money.

As Arthur outlined in his piece, it’s crucial that Ethena is not owned or built by a single centralized exchange. Ethena needs to be broadly owned as neutral infrastructure across the space—enabling it to power all such venues with USDe, rather than serving just one.

Embedding USDe as the monetary pair in spot trading and integrating with Ethena unlocks yield-bearing collateral for $20 billion in dollar-margined perpetual contracts, representing one of the largest growth opportunities in dollar-based “yield” products.

3. Final Boss: Dollar Yield in TradFi

Fixed income is the world’s largest and most liquid investment category, exceeding $130 trillion in size. Sovereign wealth funds, pension funds, and insurance pools allocate most of their capital to fixed income products. The most important financial tools for preserving and protecting wealth globally are simply dollars with yield. It sounds simple, but demand for this product dwarfs the entire crypto market by several orders of magnitude.

What makes Ethena’s generated yield uniquely compelling?

i) It combines two billion-dollar-scale, crypto-native real yield sources

ii) Its yield exhibits weak negative correlation with FX rates in traditional finance

iii) The underlying backing resides with custodians acceptable to traditional finance

Packaging scalable crypto-native yield sources into a dollar-like product offers allocators a straightforward path to access and leverage excess crypto yields within a single asset. When viewed against their existing fixed income portfolios, dollar-denominated yields last year generated >20% unlevered returns—an unprecedented level.

Most interestingly, when real FX rates eventually decline, speculative activity in crypto increases, along with long-side demand for leverage—boosting the yields Ethena generates. As benchmark RWA rates fall, Ethena becomes increasingly attractive from a risk-adjusted perspective, helping offset declining real yields on traditional fixed income products.

These characteristics are among the primary reasons why hundred-billion-dollar TradFi entities are investing into the Ethena ecosystem.

RWA will never be a category capable of bringing meaningful new capital into crypto.

Why would TradFi allocate dollars into on-chain tokenized Treasuries—facing shell entities in the Cayman Islands, plus additional fees, operational risk, smart contract risk, and regulatory uncertainty—instead of accessing them directly?

Yet, higher risk-adjusted dollar yields generated from crypto-native sources represent a product that pulls billions of dollars from the old system into the internet-native system.

Although the core product is a synthetic dollar, Ethena can also be viewed as an interest rate arbitrage tool—one that drives convergence of different interest rates across DeFi, CeFi, and TradFi, with USDe acting as the balancing factor unifying them.

Beyond USDe: Ethena’s Ultimate Goal

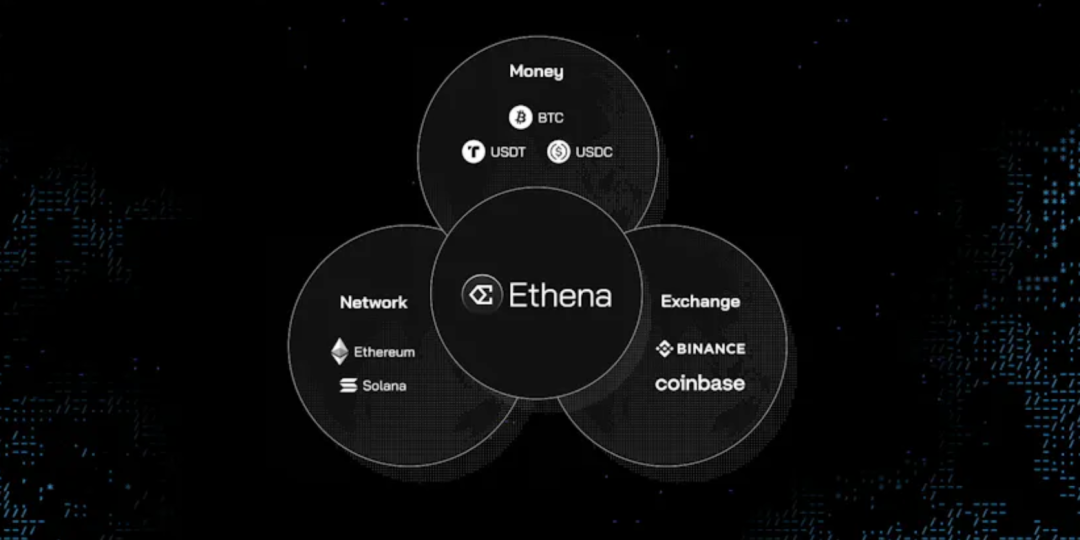

What does it take to build a $100 billion business or protocol in crypto?

First, you need to dominate one of three categories:

i) Money: BTC and ETH

ii) Network: ETH and SOL (2021 valuation)

iii) Exchange: Binance and Coinbase (2021 valuation)

Ethena’s ultimate goal spans all three categories.

i) Money: USDe

The summary above outlines why we believe USDe represents our best chance at creating our own money. This has always been Ethena’s guiding end vision.

Two additional initiatives are currently under development that will further support and accelerate USDe’s growth.

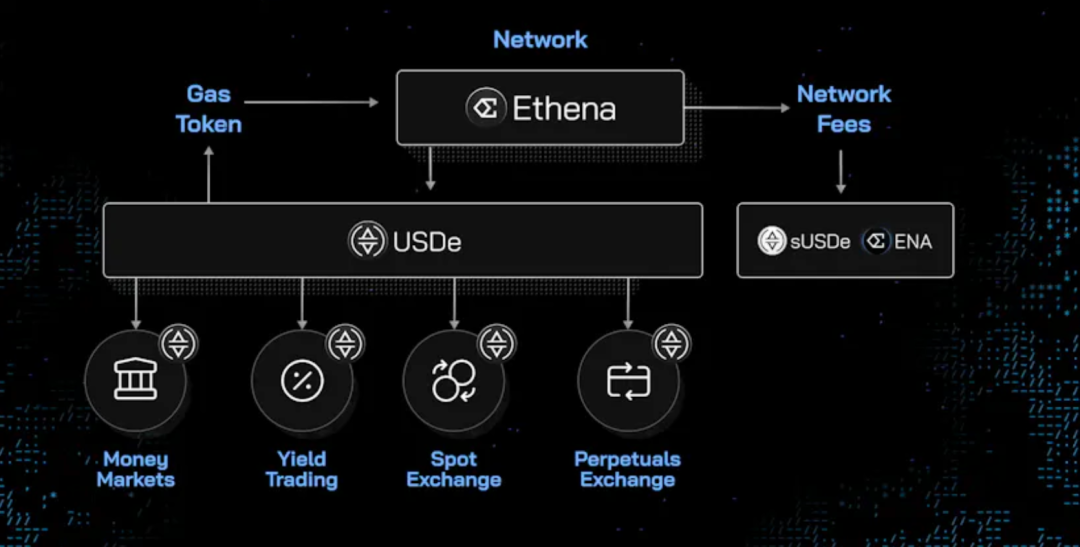

ii) Network: Unified Monetary Layer

Once you’ve created money, you now possess the most powerful product in crypto—and the killer app.

The natural extension of this core product is building an economy and network on top of it.

Most base-layer infrastructures start with a platform and then attempt to attract apps and users.

We believe this sequence is suboptimal.

Why?

Ethena starts with the killer product: money. This core product provides the lifeblood asset upon which other financial applications can build—many of which are already integrated with USDe and benefit from its existence.

Using USDe as a pivot asset, these applications can integrate and compose within a base layer optimized for monetary and financial use cases. As we’ve outlined, we believe native-yield dollar assets are the single most important foundation upon which other financial apps can build.

For users, digital dollars are the only product every participant in the crypto world uses daily—and the only product crypto offers to the rest of the world with indisputable product-market fit.

In less than three months, Ethena alone has attracted enough dollar-denominated TVL to rank sixth on any existing chain—many of which have existed for years.

How do we get a billion users on-chain?

Well, the target address market for programmable dollars is the entire world.

When you make this dollar more useful, more composable, and offer optimal risk-adjusted returns, the world will eventually realize it.

Ethena starts with the killer product—money—then builds a new internet-native economy and financial system on top of it.

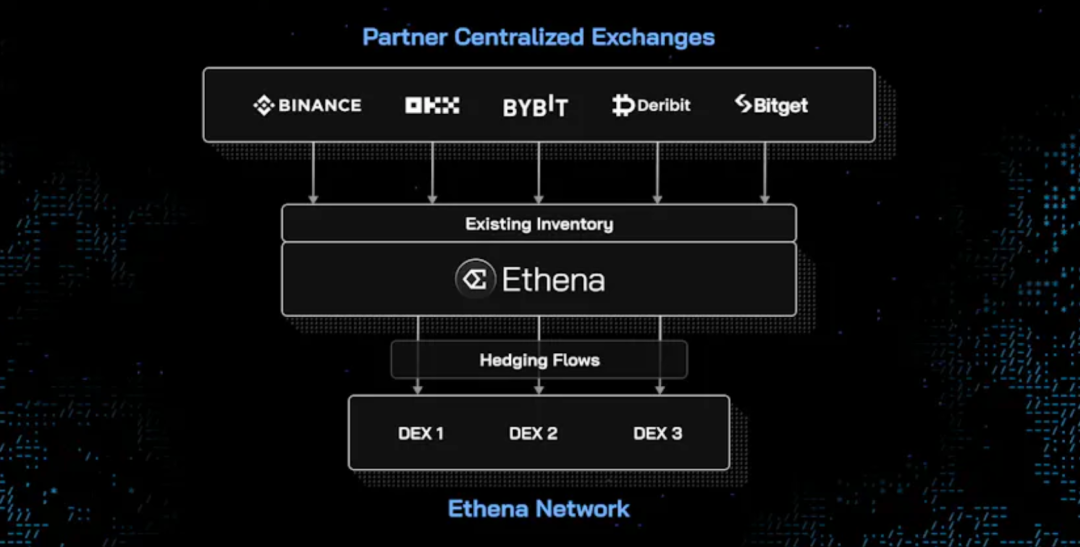

iii) Exchange: Aggregated Liquidity Layer

Ethena holds a unique position in the crypto capital markets.

While USDe has already made significant impact across major DeFi applications, we have yet to see the second-order effects of the liquidity Ethena possesses and the liquidity it could unlock for both existing and new exchanges.

It is not yet widely understood how Ethena will ultimately transform into one of the liquidity pools—alongside other CEXs and DEXs.

Specifically, the existing backing behind USDe and its associated hedging flows enables:

i) A liquidity aggregation layer, operating alongside our existing centralized and decentralized exchange partners to support deeper liquidity on their venues

ii) Bootstrapping newly incubated decentralized exchanges on the Ethena network

Just as USDe is positioned as neutral infrastructure across DeFi and CeFi platforms, the backing behind USDe can also be conceptualized as a large inventory pool of spot collateral and perpetual bonds, supporting other exchange venues through an aggregated liquidity layer.

At any moment, Ethena knows where it wants to buy or sell spot, and where to buy or sell perps. These can be aggregated across all major exchanges, where Ethena’s balance sheet will provide one of the deepest order books and OTC pools across the entire spot and derivatives landscape—with Ethena itself becoming the largest counterparty for external buyers.

Having the ability to support the launch of new DEXs on the Ethena network will also allow Ethena to immediately solve the cold-start problem faced by new decentralized exchanges building on base-layer networks.

Liquidity cold-start is the most challenging barrier preventing DEXs from beginning meaningful competition.

Liquidity is one of the few qualities that truly differentiate any exchange—and currently the only real moat held by incumbent exchanges. In under three months, Ethena has become the largest counterparty on centralized exchanges—twice the size of the entire DEX space combined.

Traffic associated with Ethena is already the most significant of any entity in the space, and at this scale, it will be the decisive factor determining which venues grow and which wither.

Ethena is uniquely positioned to provide solutions that support the growth of new venues on its network.

Just as USDe benefits from being neutral infrastructure in DeFi and CeFi—rather than direct competition—the Ethena exchange layer will occupy a similar position:

i) Supporting existing partner venues and building an aggregation layer between them

ii) Supporting the growth of new venues on the Ethena network. The greater the growth of USDe, the lower the dollar capital cost in crypto. The larger Ethena scales, the deeper and more liquid all venues become.

This is how we win together—a syllogism:

● Money

● Network

● Exchange

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News