Deep Dive into Swell Network: The Most Interesting L2

TechFlow Selected TechFlow Selected

Deep Dive into Swell Network: The Most Interesting L2

This article will delve into the Swell network, examine its growth, analyze its architecture, and explore how it stands out from numerous competitors.

Author: Kairos Research

Translation: TechFlow

Introduction

We are rapidly entering an era rich with Layer 2 (L2) technologies. With service providers offering Rollup-as-a-Service (RaaS), the barrier to launching an L2 continues to fall, unlocking a massive supply and blurring the differentiation among these new chains. For protocols that were originally standalone blockchains or existed only as smart contracts on the mainnet, transitioning into an L2 makes particularly strong sense. Implementing an L2 allows existing protocols or blockchains to avoid the high costs of bootstrapping their own validator set and offers a more efficient vertical path for value accumulation through transaction sequencing. However, in the long run, if we truly live in a world of thousands of rollups, this means we will see hundreds of losers and only dozens of big winners. We believe most activity will concentrate on a few general-purpose and domain-specific L2s (e.g., core vertical focus like DeFi). Ultimately, what will differentiate winners from losers is network effects. Based on what we know today, Swell has significant potential to emerge as a leader in the latter category for many reasons. But what exactly is Swell? In this article, we will dive deep into the Swell network, examine its growth trajectory, analyze its architecture, understand how it stands out among competitors, and explore how it aims to achieve dominant L2 status.

What is Swell?

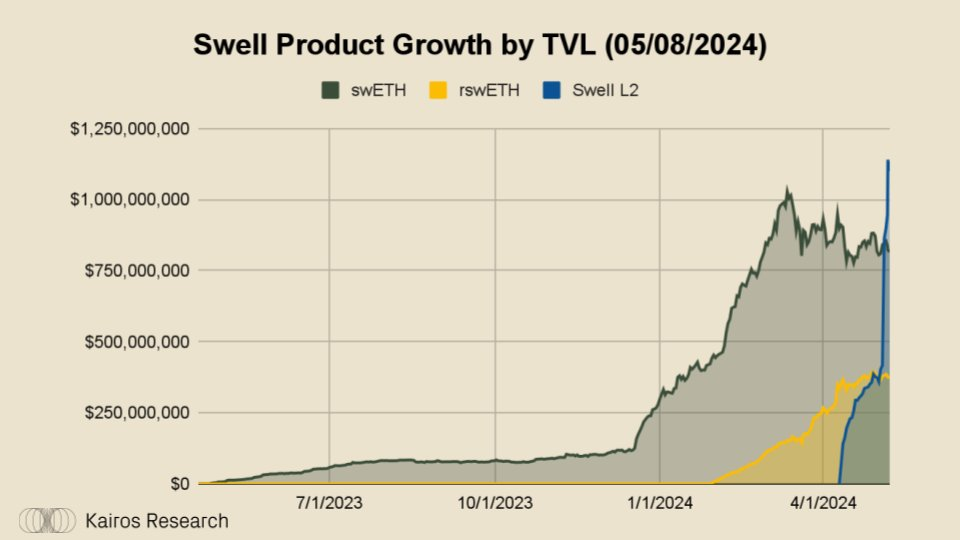

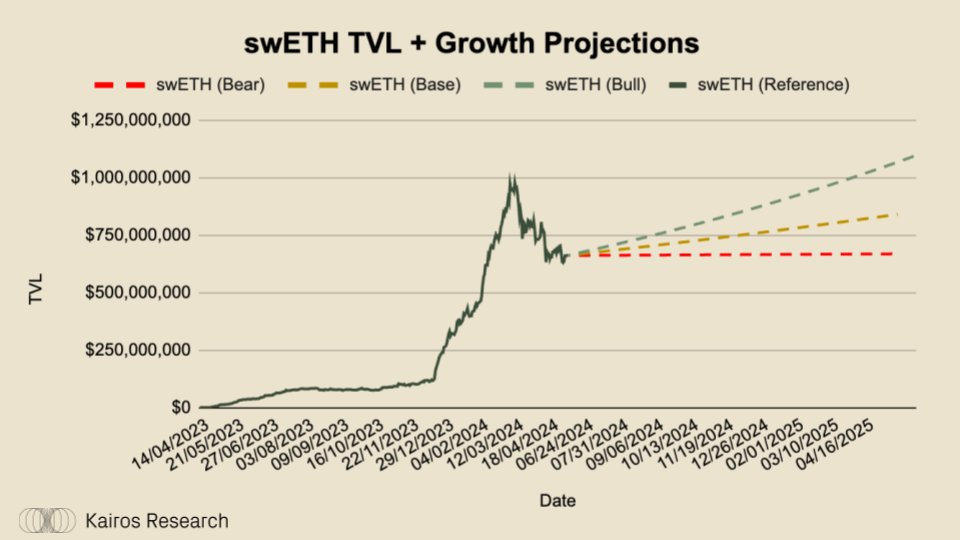

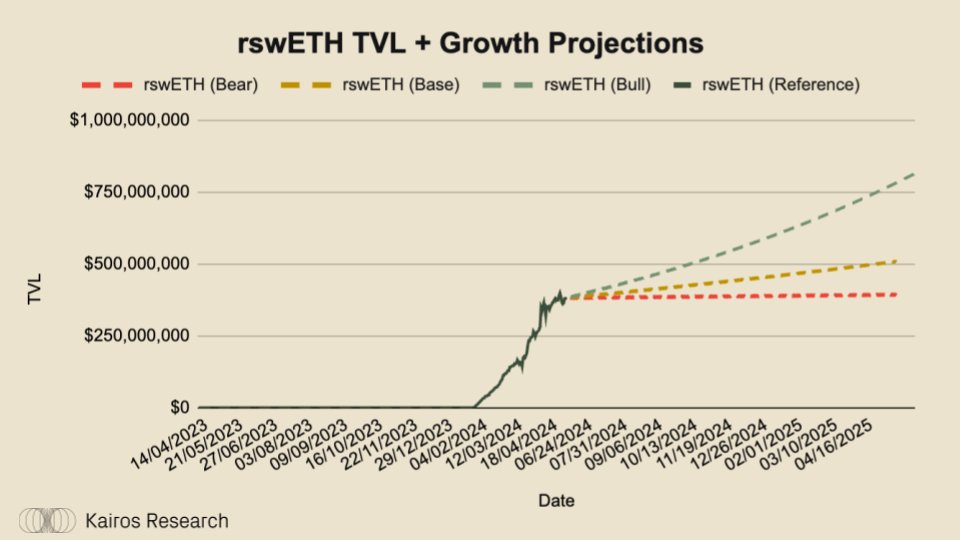

Swell describes itself as a “non-custodial staking protocol” whose mission is “to provide the best liquid staking and restaking experience in the world, simplify access to DeFi, and secure the future of Ethereum and restaking services.” So how does this hold up in practice? At the time of writing, Swell has accumulated $2.1 billion in Total Value Locked (TVL) (713,000 ETH). Of this, 29.57% is in its liquid staking token swETH, 17.78% in its liquid restaking token rswETH, and the remaining 52.65% resides in its L2 deposit contract.

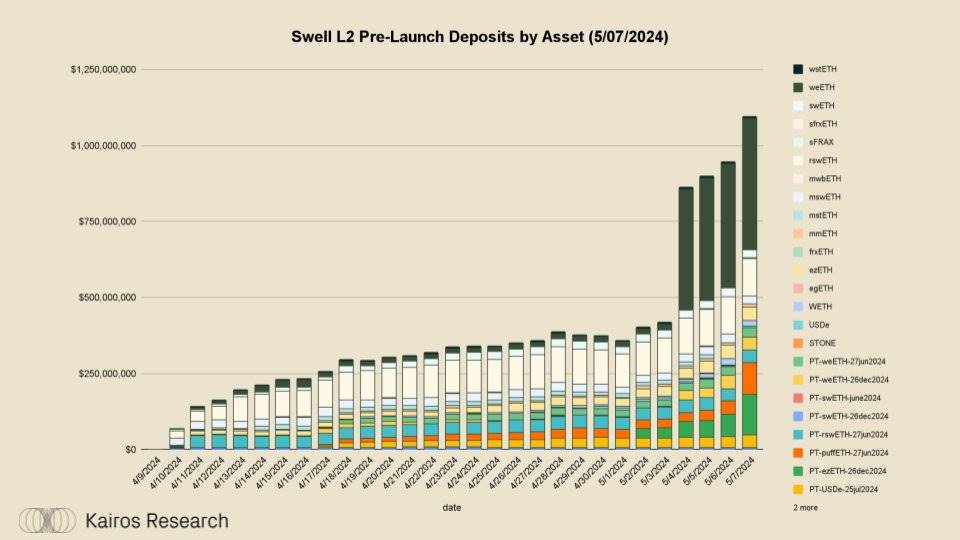

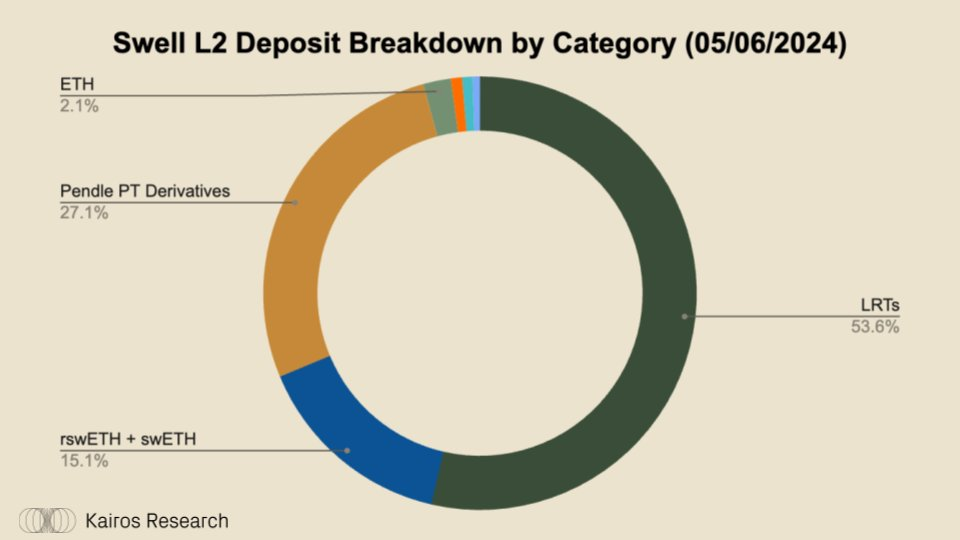

As you can see, the growth trajectory of Swell L2 pre-launch deposits is the fastest-growing among all Swell products. Let’s examine what’s driving this growth:

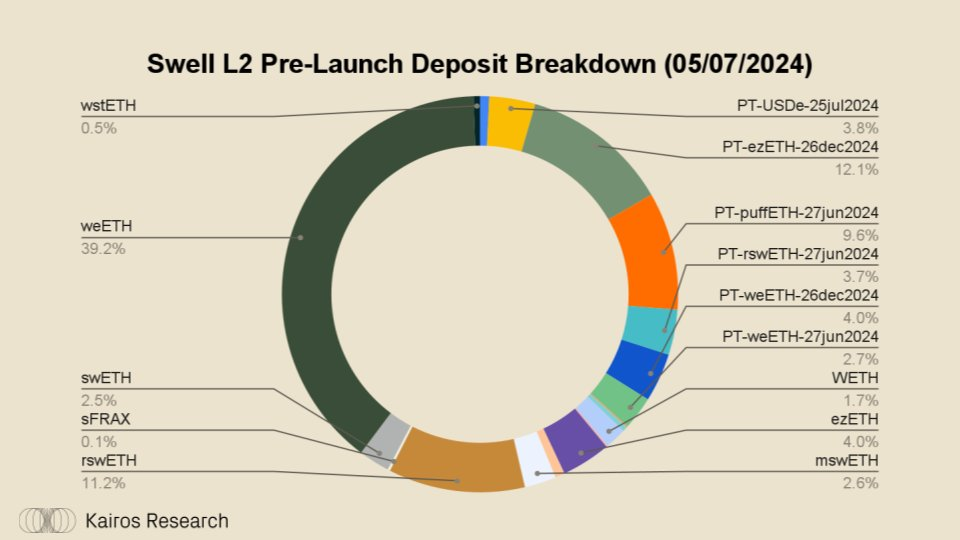

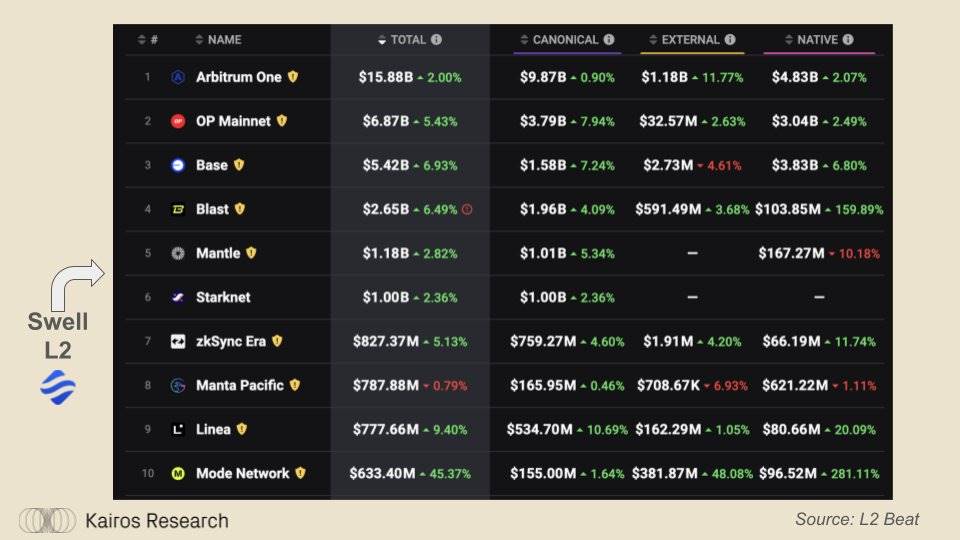

As shown, the majority of Swell L2 deposits consist of tokens native to the Swell ecosystem—such as rswETH, swETH, and associated Pendle principal tokens. These represent the most aligned participants within the Swell ecosystem. Beyond this, Swell L2 also holds millions of dollars’ worth of other LRTs and their corresponding PT tokens via Pendle. Including their $1.1 billion in total deposits, this would place them as the sixth-largest in TVL, ahead of prominent L2s such as StarkNet, ZkSync Era, Manta, Linea, and the recently launched Mode Network.

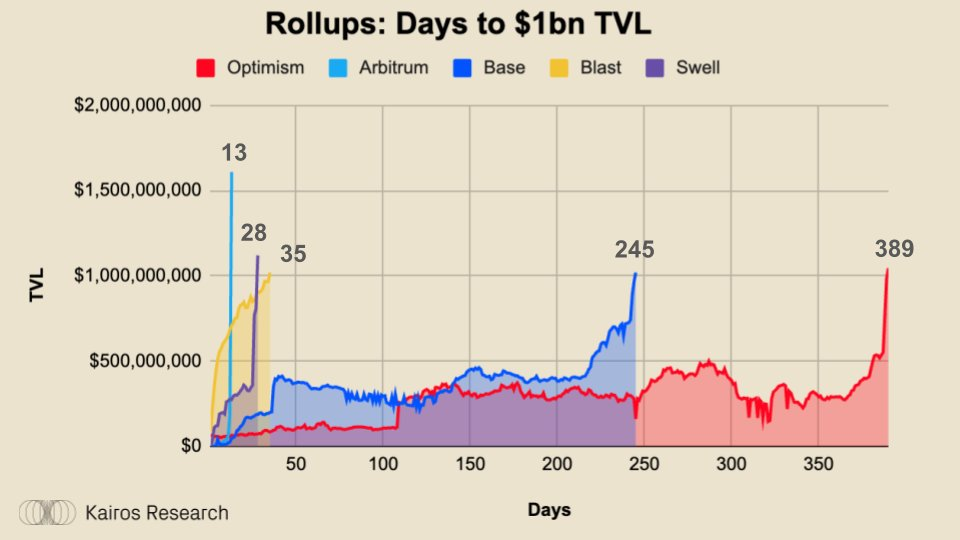

The most striking aspect of all this is: the first deposit occurred just about four weeks ago, on April 9. In merely 28 days, Swell’s L2 pre-launch deposits surged from zero to over $1 billion, making it one of the fastest-growing rollups to reach the $1 billion TVL milestone, second only to Arbitrum. It should be noted that Swell L2 is not yet fully launched; even compared to giants like Blast that allow pre-launch deposits, Swell’s growth rate is faster, reaching the $1 billion mark seven days earlier than Blast.

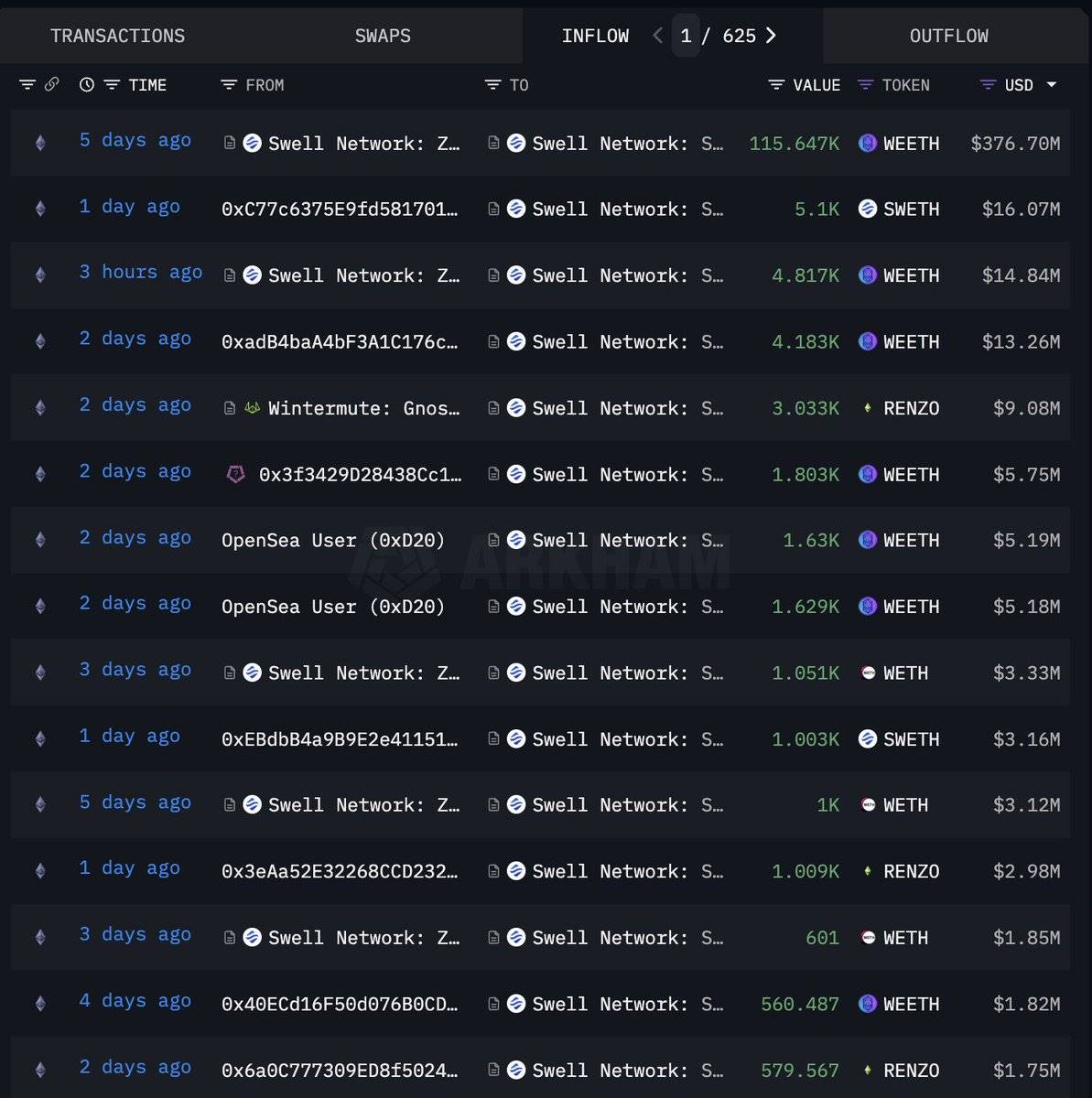

An important caveat is that a large portion of Swell L2’s deposits reportedly came from a single individual, Justin Sun, allegedly using his wallet to deposit 120,000 EtherFi eETH, valued at $376 million at the time. Today, his deposits account for approximately 30% of the entire Swell L2 TVL. However, following his deposit, we’ve seen other whales begin making seven- and eight-figure deposits—particularly Wintermute, which deposited around $9 million in Renzo’s ezETH. Overall, since Sun’s deposit, Swell L2’s TVL has grown by another $360 million.

They’ve achieved remarkable growth in pre-launch deposits—but what exactly is Swell L2?

Diving Into Swell L2

Swell L2 is truly unique.

From an architectural standpoint, they are launching using AltLayer’s technology stack as a “restaking rollup,” built with Polygon’s Composable Development Kit (CDK). Additionally, they will use EigenDA as their data availability layer, and crucially, they will have “native yield” built directly into the chain, driven by staking and restaking rewards. Finally, as an interesting twist, they will have their own Liquid Restaking Token (LRT), rswETH, serve as the canonical gas token for the network.

There’s a lot here to unpack—let’s break it down step by step.

What is a Restaking Rollup?

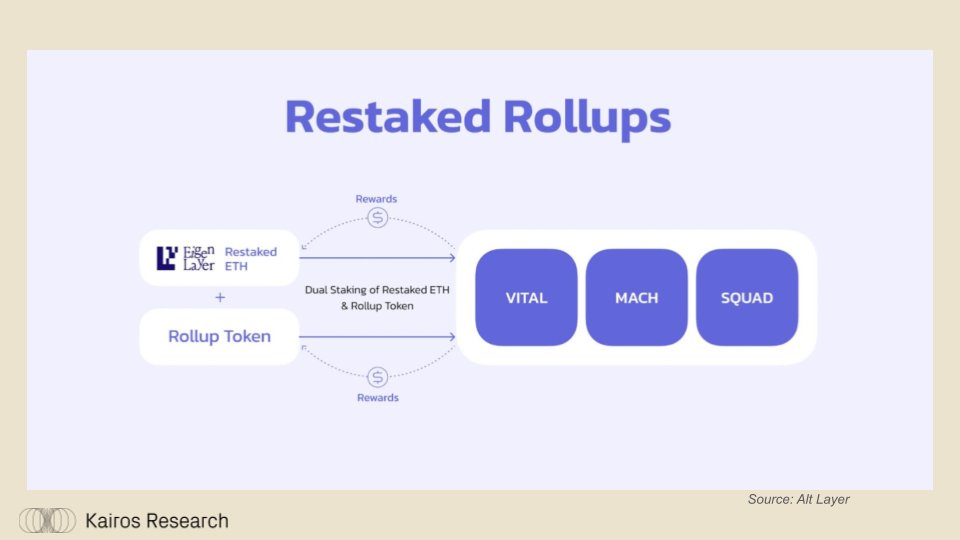

Simply put, a restaking rollup is a rollup leveraging AltLayer’s vertically integrated three-part AVS stack, consisting of:

-

VITAL (AVS for decentralized verification of rollup states)

-

MACH (AVS for fast finality)

-

SQUAD (AVS for decentralized sequencing)

Most importantly, restaking rollups allow restaking of both LSTs like swETH and the SWELL token itself. When the SWELL token is staked, it can accrue sequencer fees. This addresses a major issue faced by current L2s: a misalignment of incentives between sequencers and actual token holders, creating asymmetry between users and the legal or lab entities behind these L2s. While most (if not all) L2s are working toward solving this problem to improve alignment between protocol and user incentives, they are ultimately playing catch-up. From day one, Swell has properly aligned incentives for both token holders and real users on-chain.

Using the suite of tools provided by AltLayer mentioned above, Swell has chosen to build their zero-knowledge (ZK) Validium rollups using the Polygon Chain Development Kit (CDK). Validium rollups, popularized primarily by Immutable X, process transactions privately off-chain and later submit validity proofs to the main chain (in this case, Polygon), improving transaction speed and privacy compared to optimistic rollups.

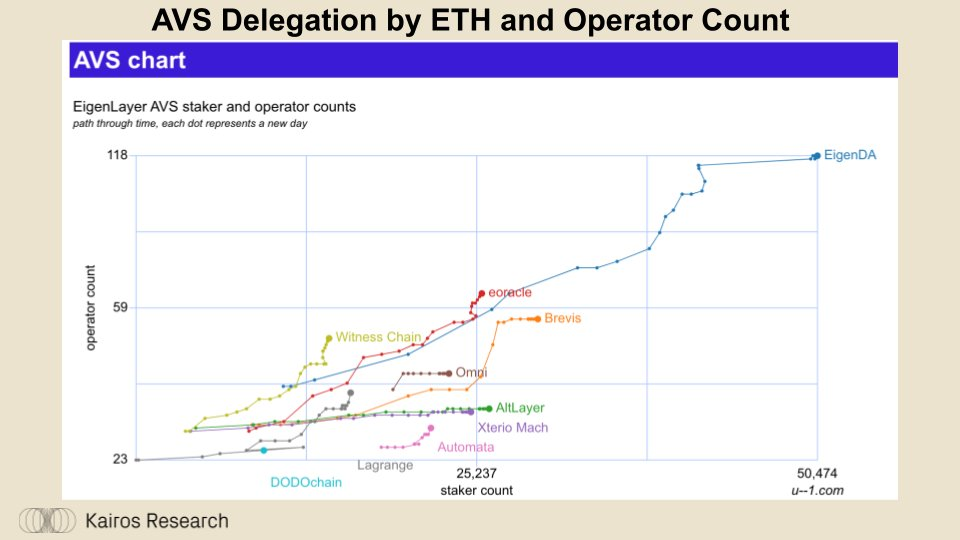

Beyond choosing their rollup tech stack, Swell has also opted to use EigenDA as their Data Availability (DA) service provider. EigenDA feeds into the positive feedback flywheel we’ll discuss in detail in the next section. At the time of writing, EigenDA is the most popular AVS, securing over $9 billion in restaked capital across 118 operators.

So, setting aside all technical architecture, how exactly does the Swell chain stand out?

The key lies in its clever architecture creating a unique feedback loop, harnessing all key value accumulation vectors within both the Swell and Ethereum ecosystems.

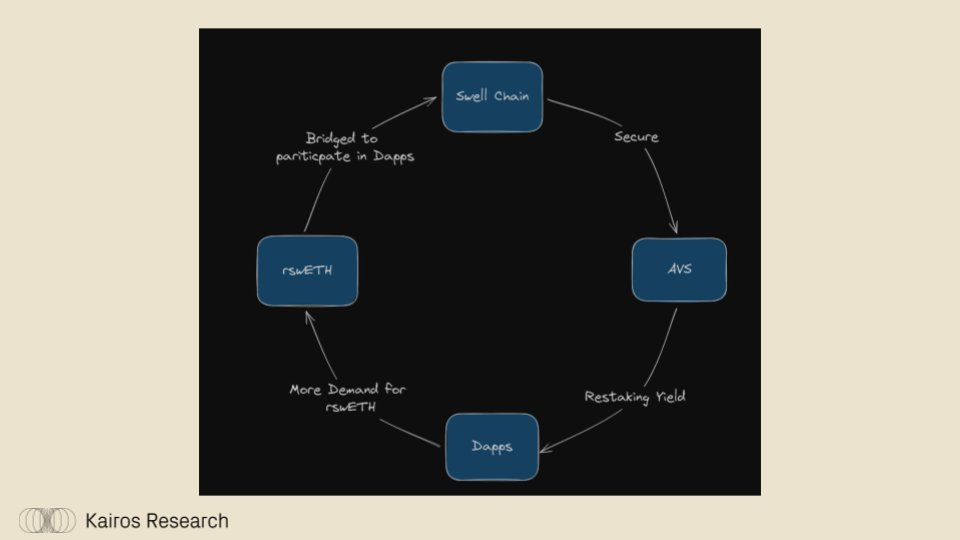

Given that the native gas token is rswETH, users who want to use DApps on Swell L2 must either bridge their LRTs or restake their ETH to obtain rswETH. The more rswETH bridged or staked, the higher the cryptoeconomic security of EigenLayer, thereby deepening the collective security of the entire platform, strengthening EigenLayer’s moat, and attracting more developers to build AVSs. More AVSs expand the overall market and could increase restaking yields. For DApps on Swell L2, higher restaking yields make better use of rswETH—the better DApps perform, the more users they attract, and the more sequencer fees flow back to SWELL stakers, creating a continuous cycle.

Objectively speaking, no other protocol or L2 possesses the same vertically integrated reflexive value capture mechanism as Swell. The rise and fall of most crypto networks depend on liquidity network effects, and Swell L2 is well-positioned to leverage key long-term value appreciation areas offered by Ethereum.

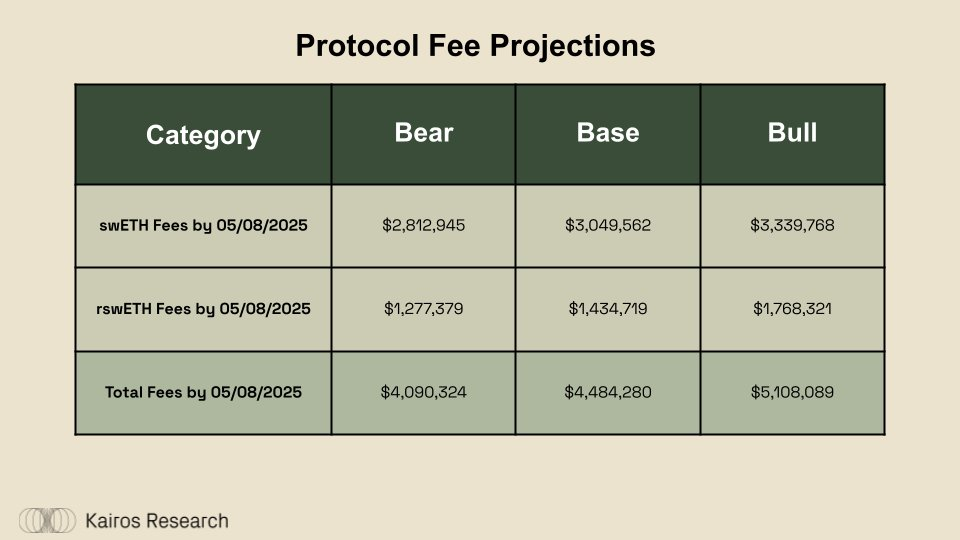

Swell Fee Capture

For both swETH and rswETH tokens, Swell maintains a standard 10% fee rate, split evenly between node operators and the treasury. Despite launching both products in under a year, the protocol has already accumulated over $1 million in fees at the time of writing. Looking ahead, assuming growth during a bull market, these fees could increase significantly, potentially exceeding $5 million annually.

Who is Building on Swell?

As we’ve discussed, Swell L2 is gearing up for launch—but which projects plan to deploy on its chain? In a blog post by the Swell team, they publicly announced plans to airdrop the SWELL token to Swell L2 pre-launch depositors. Additionally, several notable DeFi projects plan to allocate portions of their own airdrops to Swell L2 pre-launch depositors. These include:

-

Ion Protocol: A lending platform focused on staked and restaked assets. Ion raised a $2 million pre-seed round in July 2023 and currently has a TVL of $6.27 million according to DeFi Llama.

-

Ambient Finance: A “zero-to-one” decentralized exchange (DEX) where the entire DEX runs within a single smart contract. Ambient is currently deployed on Ethereum mainnet, Canto, Scroll, and Blast. They raised $6.5 million in seed funding in July 2023 and currently have a TVL of approximately $87 million on DeFi Llama.

-

Brahma Finance: An on-chain execution and custody environment that raised $6.7 million in seed and seed extension rounds in February 2022 and December 2023. Brahma is currently deployed on Blast.

-

Sturdy Finance: An isolated lending platform with shared liquidity, allowing permissionless creation of liquidity markets for any asset. Sturdy raised $3.9 million in seed and strategic rounds in March 2022.

AVS Partnerships

Additionally, in recent days, Swell announced partnerships with three AVSs on EigenLayer: Drosera, Brevis, and LaGrange. While it's still early, given Swell’s strongest economic incentive alignment with AVSs, it may become the de facto liquidity hub for all AVS tokens outside the Ethereum mainnet. Swell is unlikely to capture all liquidity, as established market participants will likely arbitrage these AVS tokens across CEXs and DEXs, but Swell could capture a significant share of on-chain liquidity and trading volume for AVS tokens.

The Growth Story of Swell

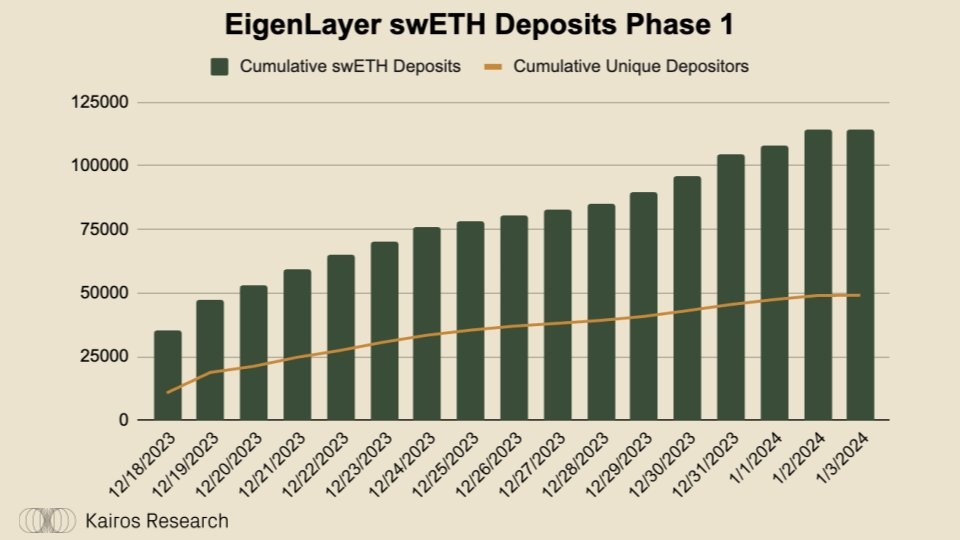

To better understand Swell’s prospects, we first need to trace how it arrived at its current position. When reviewing Swell’s growth history, one pivotal date stands out: December 18, 2023—the day EigenLayer opened deposits for the “long tail” of LSTs. On that day alone, 35,000 swETH from Swell were deposited into EigenLayer, and by January 3, 2024, before deposits paused, this amount had grown by 225%.

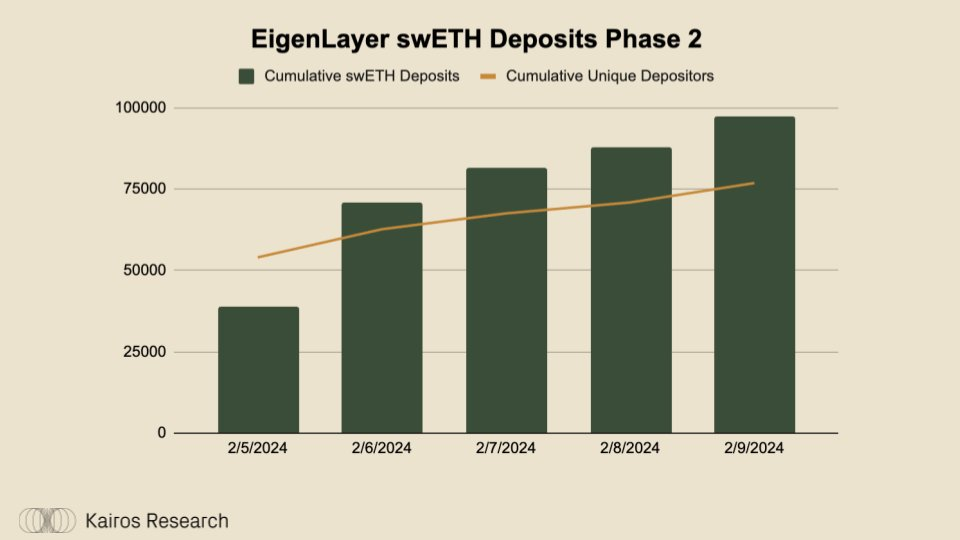

During EigenLayer’s second deposit phase beginning February 5, 2024, deposits surged again to 39,000 on day one—an increase of 148%—and were paused again on February 9 (just four days later).

Today, swETH remains the second most popular restaking LST, with Lido’s stETH currently ranking first. Since only 27% of the total ETH supply is staked, there remains a massive addressable market (TAM) for liquid staking tokens like swETH. Moreover, as more ETH gets staked, staking reward rates will naturally compress. Any compression in yields across economic environments will drive individuals to seek alternative high-yield opportunities. In DeFi, this may manifest as swETH holders depositing funds into fixed-yield trading protocols like Pendle, where users can earn a 4.46% staking yield versus the standard ~3.2%. Users also employ leveraged looping strategies via lending protocols to enhance returns on LSTs. We expect swETH to continue growing, driven by inherent demand for ETH and better staking yield opportunities within DeFi protocols.

Another avenue for enhanced staking yields comes from EigenLayer, where restakers can earn additional rewards by delegating to operators supporting Active Validation Services (AVS) on the network. However, restaking LSTs carry the same opportunity cost as staking ETH, which is one of the major value propositions of rswETH—it allows users to capture restaking rewards. Furthermore, assuming sufficient liquidity in the pool, users can also hold liquid assets, enabling them to bypass EigenLayer’s 7-day withdrawal period. Given the demand drivers around rswETH, we expect its adoption to continue increasing.

Looking ahead, we believe Swell is best positioned among all L2s to capture the majority of DeFi activity related to restaking—including but not limited to LRT tokens, AVS tokens, and protocol tokens tied to or adjacent to EigenLayer projects.

rswETH Risks

While using rswETH as the canonical gas token offers advantages in creating a positive feedback loop, it also carries risks. However, long-term success is more likely if the community understands these potential risks. For rswETH, we can categorize the main risks into three groups:

-

Operational Risk:

-

While liquid staking tokens simply stake users’ ETH onto the underlying Ethereum blockchain, liquid restaking tokens (LRTs) like rswETH are first staked to Ethereum and then opt into EigenLayer’s restaking infrastructure. Through rswETH, users choose to delegate their restaked ETH to a whitelist of “operators” who distribute the underlying ETH across multiple Active Validation Services (AVSs)—projects built on EigenLayer.

-

AVSs will initially launch without slashing, though it is expected to be implemented soon. Each AVS will have its own slashing conditions, and operators must ensure compliance to avoid penalties. Additionally, Swell has partnered with Gauntlet, an industry leader in protocol risk management, to help develop an AVS selection framework.

-

Liquidity Risk:

-

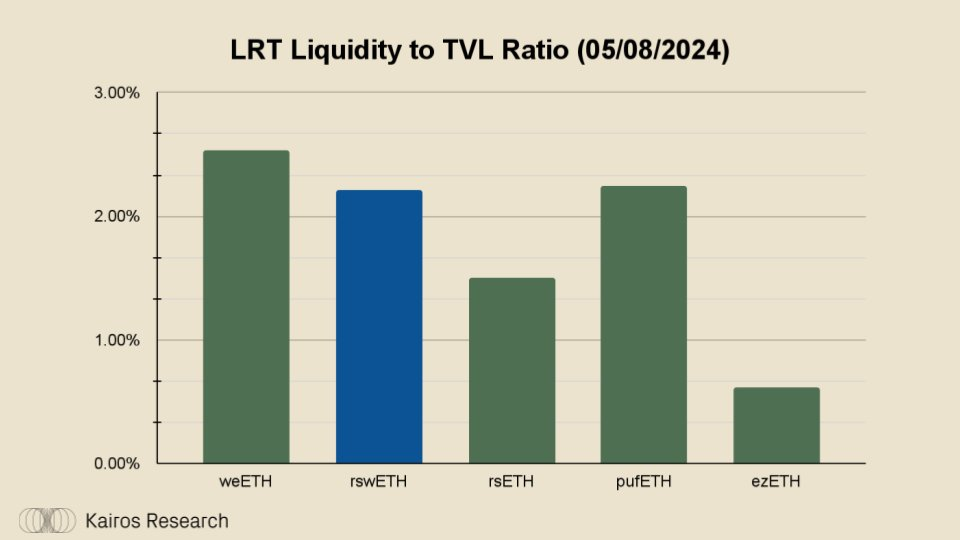

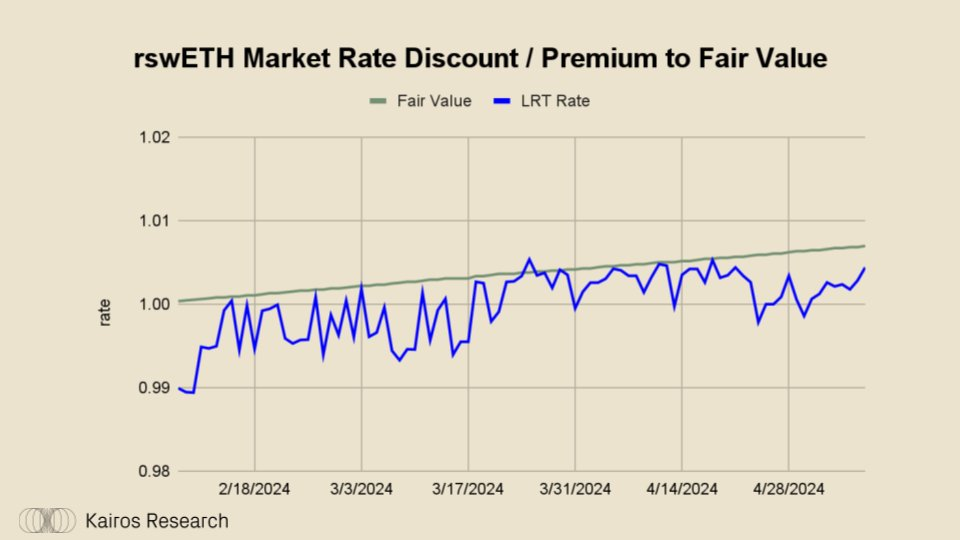

This applies to all LRTs, not just rswETH, but liquidity is absolutely critical. Liquidity risk refers to ensuring there are sufficiently deep pools with adequate pairing against rswETH to maintain its price at 1:1 with fair value. In this case, fair value is the price of the underlying assets composing rswETH—staked ETH and its associated staking rewards. Since rswETH is a non-rebasing token, it follows a redemption curve aligned with staking yield accrual. Essentially, rswETH should always trade at a “premium” above ETH. At the time of writing, rswETH trades at a 0.55% discount to fair value. For a deeper dive into LRT liquidity landscapes, read our report on LRT liquidity.

When ezETH announced the launch of its REZ token, rswETH’s liquidity situation was briefly impacted by ezETH “depegging.” Opportunistic farmers used every method available to swap out of ezETH, causing confusion for both rswETH and rsETH. rswETH currently trades at a slight discount, but this gap may close within weeks once native rswETH withdrawals are implemented.

-

Smart Contract Risk:

-

This is not a risk specific to Swell, but it’s important to mention and understand how they mitigate this widespread concern. Swell has undergone audits from multiple firms for all past upgrades and the Swell L2 pre-launch deposit contract—Sigma Prime + Cyfrin audited swETH and rswETH, while Mixbytes + Hexens audited the pre-launch contract. Additionally, Swell has launched a bug bounty program via ImmuneFi, offering rewards ranging from $1,000 to $250,000.

Conclusion & Thoughts

In summary, no one operates quite like Swell—they have successfully identified key value accumulation areas within the Ethereum ecosystem and executed effectively so far. We believe their key to success in the L2 space lies in incentivizing DeFi DApps, especially those building around EigenLayer, LRTs, LSTs, etc., to build atop Swell L2. Their unique feedback structure, highlighted earlier in this report, underscores their understanding of network effects and sustainable growth potential. Moreover, as LRTs may become the most popular form of staking in DeFi, vertically owning the stack via an L2 like Swell becomes a highly attractive proposition. If you don’t fully own the stack—through sequencing or otherwise—you unfortunately miss out on—or even lose—part of the profit. Finally, in other areas of the L2 landscape, we haven’t yet seen such deep, long-term market segmentation understanding. We expect others to follow and attempt replication in the same manner as Swell, but Swell undeniably holds a first-mover advantage in leveraging this “game” on Ethereum. Winner takes all—that’s all there is to it.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News