Ethena Protocol Insights: Challenges of Funding Rates and Strategy Optimization

TechFlow Selected TechFlow Selected

Ethena Protocol Insights: Challenges of Funding Rates and Strategy Optimization

Ethena's revenue sources are spot staking yield and short position funding rate yield.

Author: @0x0_chichi

Advisor: @CryptoScott_ETH

TL;DR

-

Ethena protocol's revenue comes from spot staking yield plus funding rate income from short positions. The introduction of BTC collateral dilutes staking yields, while market calmness and Ethena’s large short positions reduce funding rate gains.

-

Expanding collateral types is essential for Ethena’s long-term growth, but may lead to prolonged low yields.

-

Currently, the protocol’s insurance fund is insufficient, posing significant risks.

-

Ethena has a natural advantage when facing bank runs triggered by negative funding rates.

-

The total open interest (OI) in the market is a key limiting factor for USDe issuance volume.

1. Project Overview

Ethena is a stablecoin protocol built on the Ethereum blockchain that uses a delta-neutral strategy to issue a "synthetic dollar" called USDe.

The mechanism works as follows: users deposit stETH into the protocol and mint an equivalent amount of USDe. Ethena employs an Off-Exchange Settlement (OES) solution, mapping the stETH balance to centralized exchanges (CEXs) as margin to short an equal amount of ETH perpetual contracts. This portfolio achieves delta neutrality—its value remains unaffected by fluctuations in ETH price—thus theoretically ensuring USDe’s price stability.

Users can further stake their USDe within the protocol to mint sUSDe, which entitles them to earn funding rate-generated returns. These yields have previously exceeded 30%, serving as one of Ethena’s primary tools for attracting deposits.

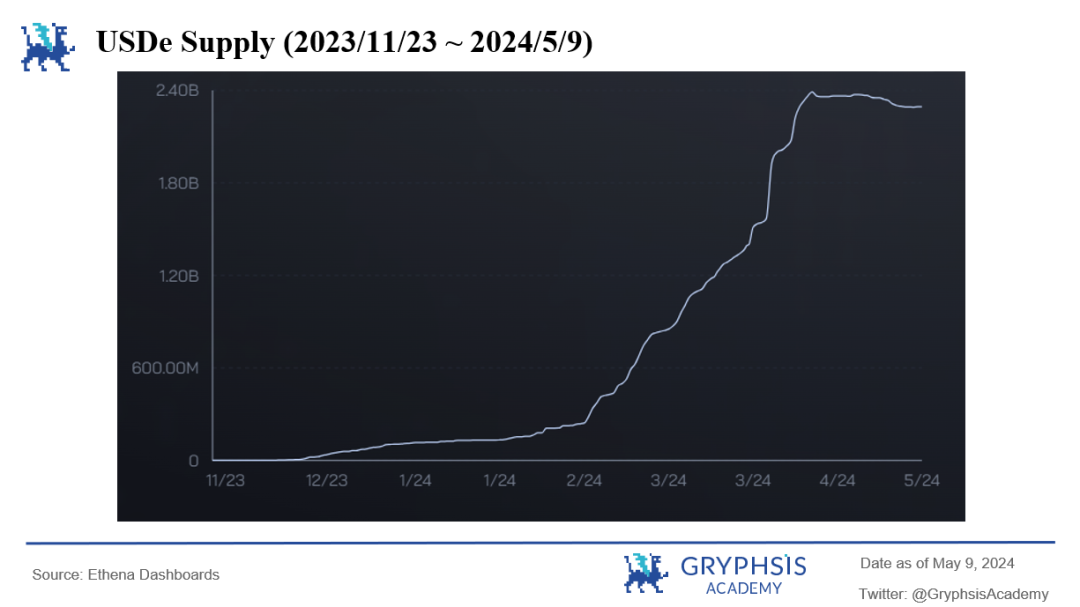

As of May 9, 2024, the yield for holding sUSDe stands at 15.3%. The total supply of USDe has reached $2.29 billion, accounting for approximately 1.43% of the total stablecoin market cap, ranking fifth in the sector.

2. Sources of Yield

In the Ethena protocol, both stETH collateral and short positions in ETH perpetual contracts generate income (from funding rates). If the combined yield of these two positions is negative, the protocol’s insurance fund covers the shortfall.

What is Funding Rate?

In traditional commodity futures contracts, both parties agree on a delivery date—an expiration point for physical settlement. As such, near expiry, the futures price theoretically converges with the spot price. However, in cryptocurrency trading, perpetual contracts are widely used to avoid delivery costs. Unlike traditional futures, they lack an expiry date, severing the automatic link between futures and spot prices.

To address this, funding rates were introduced: when the perpetual contract price exceeds the spot price (positive basis), longs pay shorts a funding fee (proportional to the absolute basis); when the perpetual price is below the spot price (negative basis), shorts pay longs the funding fee.

Thus, the greater the deviation between perpetual and spot prices (larger absolute basis), the higher the funding rate, strengthening the anchoring force. The funding rate effectively re-links perpetual and spot prices.

Ethena holds short ETH positions and stETH collateral, earning both funding fees and staking rewards. When net yield is positive, part of the earnings are allocated to the insurance fund, which compensates users if net yield turns negative.

During the current bull market, bullish sentiment significantly outweighs bearish sentiment, resulting in consistently high demand for long positions and elevated funding rates. In Ethena’s setup, the delta risk of stETH holdings is hedged by offsetting short positions, while those short positions collect substantial funding income—this is why Ethena generates seemingly risk-free high yields.

3. Sustainability and Growth Drivers

3.1 Leveraging Centralized Exchanges for Better Liquidity

Before USDe emerged, Solana-based stablecoin project UXD adopted a similar approach. However, UXD used DEXs for hedging, which ultimately contributed to its failure.

From a liquidity standpoint, centralized exchanges account for over 95% of total open interest. To scale USDe to multi-billion-dollar levels, CEXs are the optimal choice: during periods of rapid issuance growth or potential bank runs, Ethena’s short positions would not cause significant market disruption.

3.2 Off-Exchange Settlement (OES)

Since Ethena relies on centralized exchanges for hedging, new centralization risks arise. To mitigate this, Ethena introduced the OES mechanism: collateral is held by third-party custodians (e.g., Copper, Fireblocks), ensuring CEXs never hold user funds. This resembles storing user collateral in a multisig wallet, minimizing centralization risk.

3.3 Net Yield and the Insurance Fund

The insurance fund is a critical component of the Ethena protocol. It accumulates surplus income when the combined yield from stETH and short positions is positive, then releases funds when net yield turns negative, helping maintain USDe’s peg.

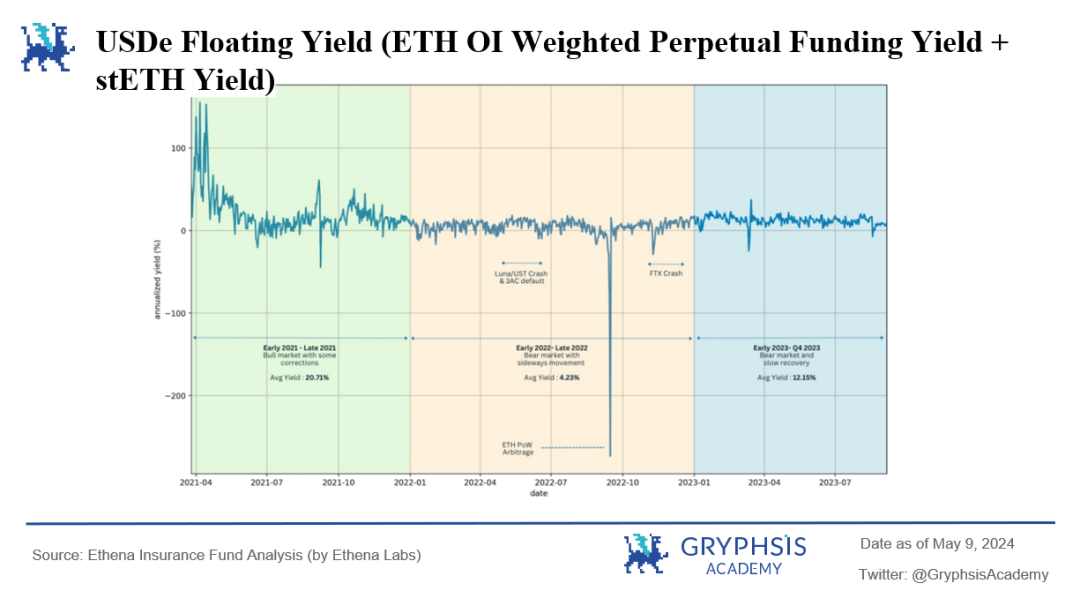

Figure 1: Simulated Floating Yield of USDe

High USDe yields during the 2021 bull run reflected strong bullish demand, with longs paying shorts annualized funding rates up to 40%. As the 2022 bear market began, funding rates frequently dipped below zero but did not remain negative for long, maintaining a mean above zero.

In Q2 2022, the collapses of Luna and 3AC had surprisingly little impact on funding rates. A brief dip caused rates to hover near zero temporarily, but they quickly rebounded to positive territory.

September 2022 marked Ethereum’s transition from PoW to PoS—the largest black swan event in funding rate history. Rates briefly plunged to -300%. The reason: users could earn staking rewards simply by holding ETH spot, prompting many to simultaneously take long ETH spot positions and hedge with short perpetuals to lock in risk-free yield.

This surge in short positions caused ETH perpetual funding rates to crash temporarily. However, once staking rewards stabilized, funding rates quickly returned to positive levels.

Similarly, FTX’s collapse in November 2022 drove funding rates down to -30%, but again, the drop was short-lived and rates soon recovered.

Historical data shows that USDe’s net yield has consistently averaged above zero, supporting the long-term viability of the project. Short-term market shocks or black swan events causing temporary negative net yield are not sustainable. A well-capitalized insurance fund allows the protocol to weather such periods smoothly.

3.4 Expanding Collateral Types

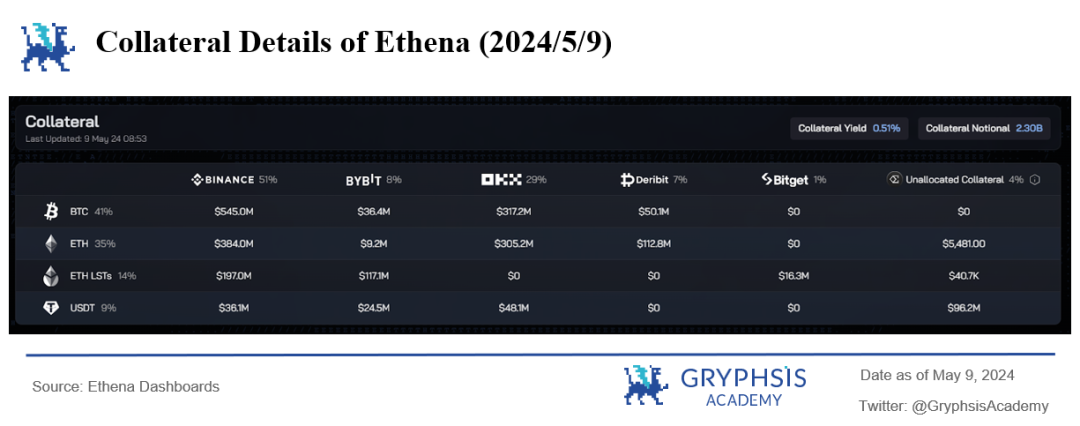

Starting April 2024, users can now pledge BTC to mint USDe. As of May 9, 2024, BTC collateral accounts for 41% of total collateral.

Figure 2: Ethena Collateral Breakdown as of May 9, 2024

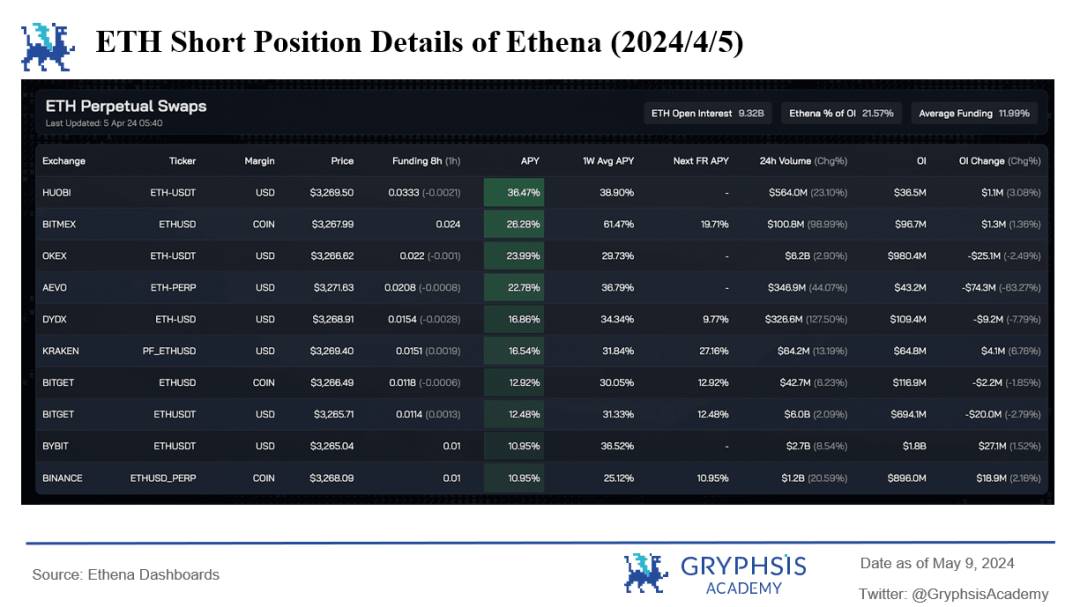

Figure 3: Ethena Protocol’s ETH Short Position Details as of April 5, 2024

Prior to accepting BTC, Ethena’s ETH short position already represented 21.57% of total open interest. Despite strong CEX liquidity and Ethena’s presence across multiple exchanges, the explosive growth of USDe issuance risks exhausting available ETH perpetual liquidity. Thus, Ethena urgently needed new growth vectors.

Unlike liquid staking tokens, BTC lacks native staking yield. Introducing BTC as collateral dilutes the overall staking yield contributed by stETH. However, BTC perpetual open interest on CEXs exceeds $20 billion. Adding BTC collateral significantly boosts USDe’s short-term scalability. Long-term growth, however, will be constrained by the expansion rate of total BTC and ETH open interest.

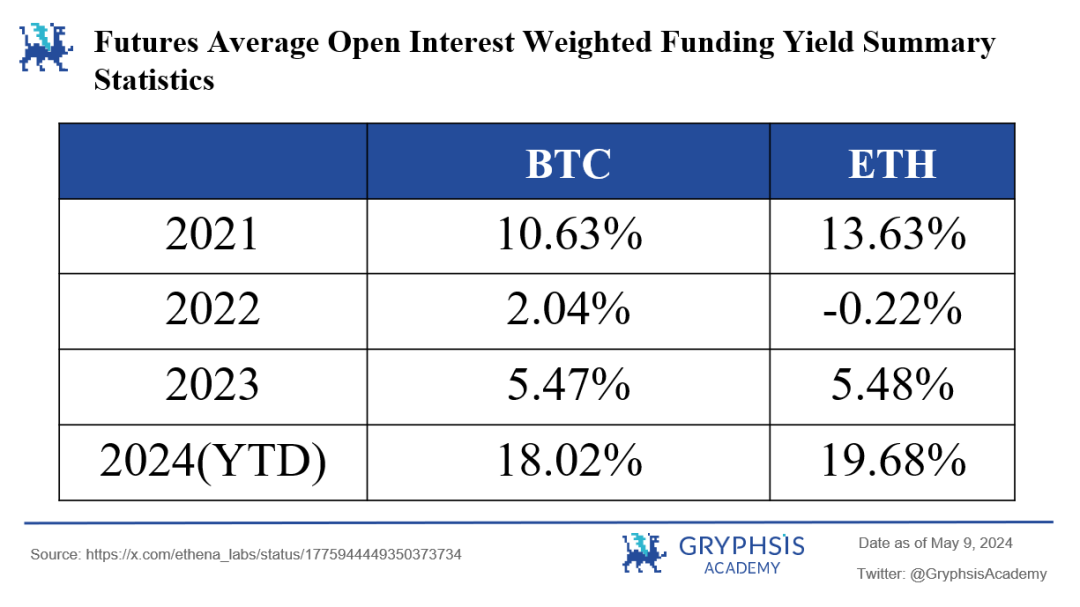

Figure 4: Annual Average Funding Rate Yields

Although BTC collateral dilutes stETH yield, historical data shows that BTC perpetual funding rates tend to be lower than ETH’s during bull markets but higher during bear markets. This provides a hedge against bear market funding rate slumps, enhances portfolio diversification, and reduces the risk of USDe depegging in downturns.

4. Risks

4.1 Prolonged Basis Weakness

The sUSDe yield has rapidly declined from over 30% to around 10%, due both to broader market sentiment and the market impact of Ethena’s growing short positions.

It’s well known that USDe’s explosive growth stems from exceptionally high funding rates during bull markets. However, USDe currently lacks real-world use cases—its trading pairs mostly involve other stablecoins. Therefore, most holders are only interested in high APYs and potential token airdrops.

Although the insurance fund activates when net yield turns negative, stETH providers will redeem once net yield falls below standalone stETH staking returns. BTC depositors will be even more cautious. As the basis narrows and funding yields remain depressed, a wave of redemptions could occur after the second airdrop campaign ends—similar to the challenges faced by Bitcoin L2s, where many users (especially large holders) treat BTC primarily as a store of value and demand extremely high security.

Therefore, I believe that if USDe fails to achieve breakthroughs in utility before the end of its second airdrop season—and if funding rates continue to shrink—USDe could face irreversible decline.

4.2 Insufficient Insurance Fund

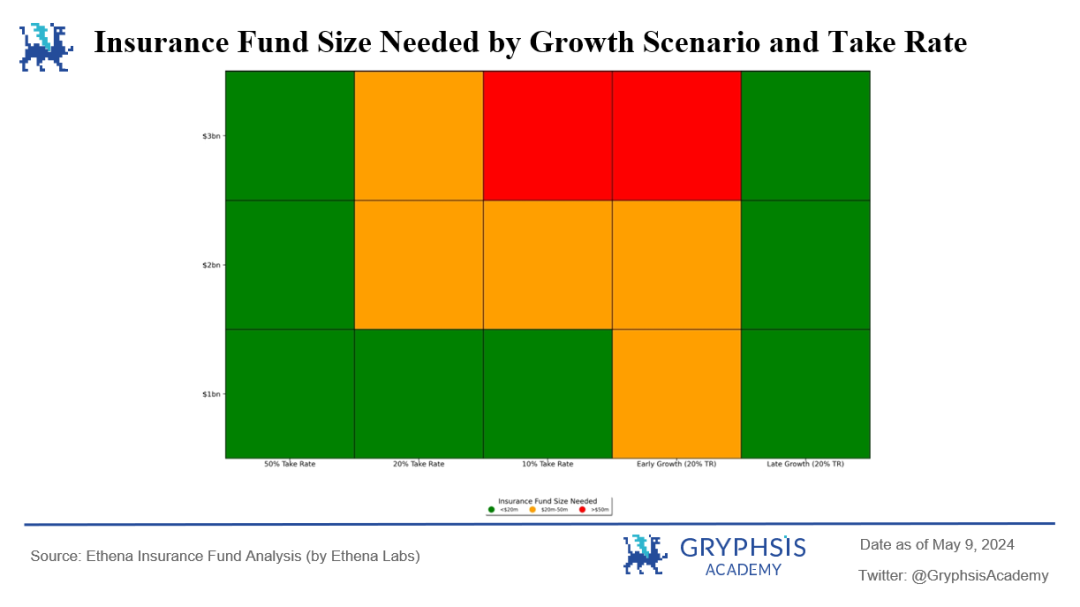

Ethena’s official simulations produced the following conclusions regarding the insurance fund:

Figure 5: Required Initial Insurance Fund Size by Growth Scenario and Drawdown Rate

In Figure 5, green, yellow, and red indicate initial insurance fund sizes below $20M, between $20M–$50M, and above $50M, respectively—each representing adequate safety thresholds.

The vertical axis shows projected final USDe issuance amounts ($1B, $2B, $3B) expected within 2.5 years (Apr 2021–Oct 2023). The first three horizontal categories represent linear issuance growth with insurance drawdown rates of 50%, 20%, and 10%. The fourth assumes exponential growth in year one followed by stagnation, with a 20% drawdown rate. The fifth assumes sustained exponential growth with a 20% drawdown rate.

The analysis shows that a $20M initial fund with a 50% drawdown rate is highly secure, maintaining sufficient capital under nearly all scenarios. However, early exponential growth—especially before the fund can accumulate reserves via positive yields—could jeopardize solvency during a black swan event. Late exponential growth is safer, allowing more time for the fund to grow.

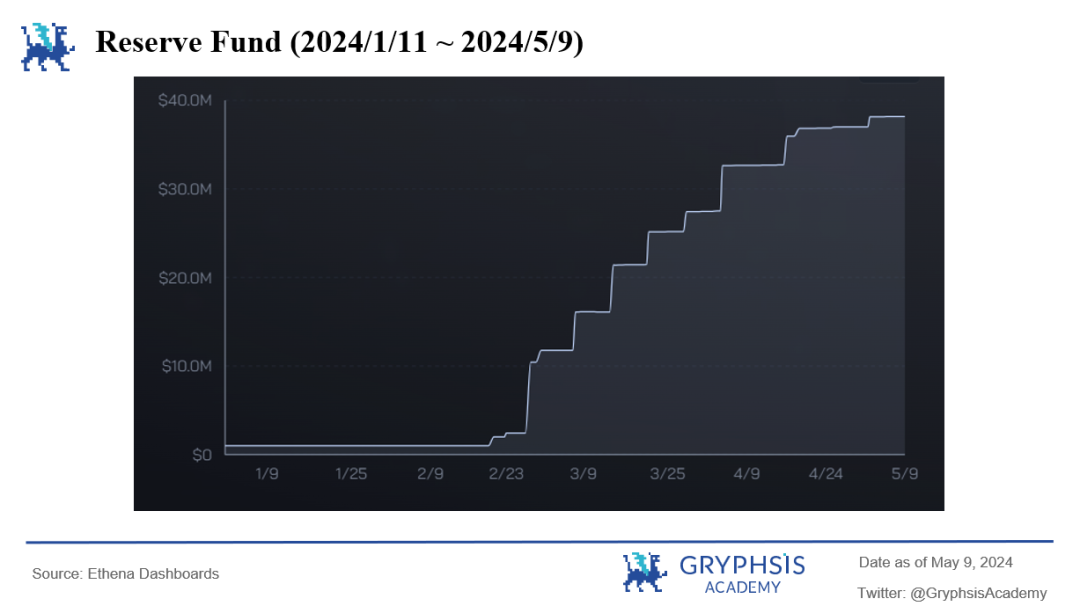

In reality, however, the initial insurance fund was only $1 million, and USDe issuance grew far faster than even the “Early Growth” model scenario. Currently, the $38.2 million insurance fund (just 1.66% of total USDe supply) saw nearly half added in the past month alone. Clearly, Ethena’s early-stage insurance fund was severely undercapitalized compared to its own simulation models.

An underfunded insurance fund leads to two consequences:

-

Reduced user confidence—if high yields begin to fall, TVL will gradually decline.

-

High TVL with a low insurance fund forces the team to increase the drawdown rate (likely to 30% or higher) to rapidly replenish reserves. But as funding rate income declines, this further reduces user yields, potentially accelerating outflows.

Figure 6: Total USDe Issuance from Nov 23, 2023 to May 9, 2024

Figure 7: Insurance Fund Balance from Jan 11, 2024 to May 9, 2024

4.3 Bank Runs Triggered by Black Swan Events

Referring to the Q3 2022 ETH PoW arbitrage event shown in Figure 1, funding rates plummeted sharply, briefly exceeding -300% annualized. During such black swan events, a USDe bank run is almost inevitable. However, USDe’s unique design appears to offer inherent resilience against such runs.

At the onset of a funding rate collapse, redemptions may begin. As users withdraw, Ethena must return spot collateral and close corresponding short positions. With fewer short positions, insurance fund outflows decrease, extending the fund’s lifespan.

From a liquidity perspective, during a bank run Ethena needs to close short positions. In a negative funding rate environment, long-side liquidity is typically abundant, so closing shorts faces minimal slippage or liquidity issues.

Additionally, the 7-day cooling-off period for sUSDe (preventing immediate liquidation within one week of deposit) acts as a buffer during sudden market shifts.

However, all of this depends on having a sufficiently capitalized insurance fund.

4.4 Total Market Open Interest

Total market open interest (OI) remains a key constraint on USDe issuance and a potential future risk. As of May 9, 2024, Ethena’s ETH OI accounts for 13.77% of total ETH OI, and BTC OI for 4.71%. The massive short positions generated by Ethena have already begun to impact the derivatives market, and further scaling could face liquidity bottlenecks.

The best solution is to add more high-quality collateral assets (with long-term positive funding rates), which would raise the ceiling for USDe supply while improving portfolio diversification and reducing risk.

5. Conclusion

In summary, the Ethena protocol demonstrates a unique stablecoin mechanism and acute sensitivity to market dynamics. Despite challenges such as prolonged basis weakness, insufficient insurance reserves, and potential bank runs, Ethena maintains competitiveness through innovative off-exchange settlement and diversified collateral options.

As market conditions evolve and technological innovation progresses, Ethena must continuously refine its strategies and strengthen risk management—ensuring sufficient insurance funding and stable liquidity. For investors and users, understanding the protocol’s mechanics, yield sources, and inherent risks is crucial.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News