Everything You Need to Know About Pump.Fun (With a Tutorial on How to Identify Projects)

TechFlow Selected TechFlow Selected

Everything You Need to Know About Pump.Fun (With a Tutorial on How to Identify Projects)

On Pump.Fun, unlike elsewhere, the earlier I enter a token, the larger position I stake.

Author: Hermes

Translation: TechFlow

This market offers the fairest on-chain PvP environment. If you want to stay ahead in the game, you must dive into the trenches of Pump.Fun; otherwise, you won't be profitable.

This thread will cover:

-

Why Pump.Fun?

-

What makes a quality coin?

-

Trading strategies

-

Pre-Raydium

-

Post-Raydium

-

-

Risk reduction

-

Other useful information

1. Why Pump.Fun?

To answer this question, you first need to understand how the product works.

Anyone can create a token within seconds for a small fee of 0.02 $SOL. It's simple, fast, and low-cost. If creators want a portion of the supply, they must buy it at the moment of creation. This makes tracking developer and team wallets much easier—an inherently fair market because there are no hidden wallets, no airdrops, no farms. This is also why many Pump.Fun coins successfully have a Chief Troll Officer (CTO).

When trading on Pump.Fun, you'll never get fully rug-pulled because liquidity cannot be removed, and—as previously mentioned—there are no token airdrops.

Finally, and very importantly, even if you miss the initial Pump.Fun phase, you can still catch an early opportunity, as a coin typically takes about 5–20 minutes to migrate from Pump.Fun to Raydium at a market cap of around $60K.

No other platform provides such favorable and fair on-chain market conditions. All these reasons should convince you that Pump.Fun is worth trying.

2. What makes a quality coin?

Different people look for different things when hunting for wealth. I try to keep it simple:

-

Name—Does it make sense? Is the meme narrative compelling? Does it have meme potential? (e.g., wif/michi has infinite meme potential)

-

Token symbol—Should be relevant, short, and memorable

-

Website—Does it have a website? → Is the website unique? → Was effort and thought put into its design?

-

Twitter—Must have a relevant profile picture and banner (you’d be surprised how important banners are)

-

Bonus points: Telegram stickers, bot setup, pre-paid DEX, and non-anonymous dev/team

Of course, just because a project meets all the above criteria doesn’t guarantee success, but it increases your chances of stumbling upon a good one and significantly reduces time spent sifting through junk.

3. Trading Strategies

A) Pre-Raydium

While a coin is still on Pump.Fun, pay attention to these key market cap levels:

$15K market cap—This is the first level that must be broken. Breaking it isn’t usually hard, but you should recognize it as a solid re-entry point.

KOTH (~$30K)—An important level, often a primary exit zone, because reaching KOTH means you (or new buyers) will see it on the landing page, attracting more attention. Most coins face selling pressure after hitting KOTH. If you're observing, wait for this sell-off.

*Ruggers often buy large amounts of their own tokens and push price directly to KOTH before dumping everything at once. Watch out for projects that reach this level in a single candle—don’t rush in.

$45K–55K—The final hurdle before Raydium, and the hardest to overcome. People sell here because: 1. Liquidity is thicker on Raydium; 2. Traders front-run the expected "Raydium dump" (explained later). I never buy in this range because the risk-reward ratio isn’t worth it—many coins lack the strength to break through.

On Pump.Fun, unlike elsewhere, the earlier I enter a coin, the larger my position size. Why? Because downside risk is limited. For example, if you buy a coin at $10K, the lowest it can go is ~$5K—the upside potential far outweighs the downside risk.

B) Post-Raydium

Typically, tokens drop and bottom out during the first 5–10 minutes of Raydium trading. Depending on the coin’s strength, you’ll usually see it bottom between $50K (very strong) and $20K (very weak). My approach is to decide how much I want to invest (e.g., 1 SOL), then deploy 50% when the price is between $50K–40K, and the remaining 50% between $20K–30K.

Why is the initial dump so brutal?

One reason is that liquidity is roughly three times thinner than on Pump.Fun. Another is panic if the DEX hasn’t been updated (pre-paid DEX coins usually perform better). Finally, traders expect the dump, so they hesitate to buy initially.

Usually, if I missed a coin on Pump.Fun, I wait for this initial drop. If it doesn’t happen, I abandon the trade 90% of the time.

Critically, coins launched via Pump.Fun never truly die.

What does this mean? People love becoming CTOs of Pump.Fun coins because they’re safe. We’ve seen many successful examples—$SC, $boy, $speed are just recent ones.

If a coin stands out among others, shows strong performance, builds a community, but later “dies,” keep an eye on it. Often, another team will step in to take over and push it again (these are the most profitable plays—and where I’ve made most of my profits).

4. Risk Reduction

In this section, I’ll discuss what I do and don’t do when trading Pump.Fun coins.

On Pump.Fun

I won’t enter a coin with a market cap above $30K unless I have information about the team and their professional background. The risk-reward isn’t worth it, as most coins fail to breakout from Pump.Fun (less than 2x).

I partially sell at KOTH and the $45K–55K level. If the narrative is strong enough, I hold a base position; otherwise, I fully exit before Raydium and re-enter after the initial dump.

Outside Pump.Fun

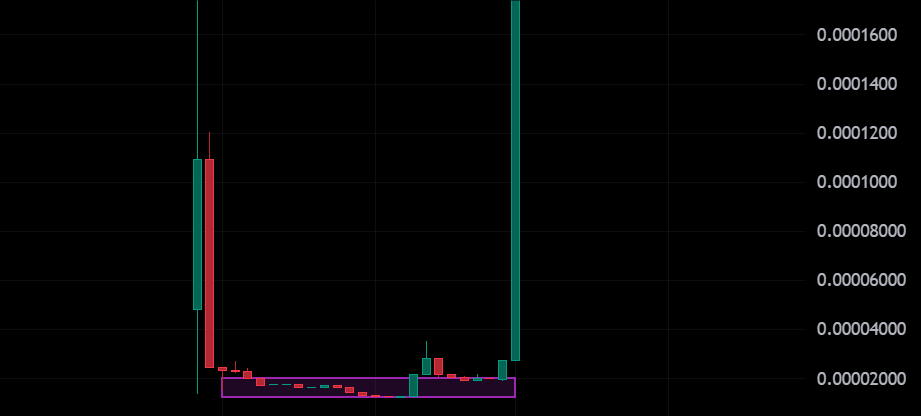

I buy coins that have already bottomed or are in accumulation zones. I consider a coin’s “bottom” to be in the $10K–20K market cap range.

Example of a bottom (chart looks bad, but this is actually common for most coins):

Accumulation zone:

These coins are worth a shot if:

a) The meme is strong, and you believe others will notice and turn it into a CTO

b) A CTO is forming or already exists and is being managed well

When you buy a coin at its lowest possible price, you drastically reduce trading risk. Worst case: you lose 50%. Best case: you gain 100x—the risk-reward ratio is excellent.

5. Other Useful Information

When trading tokens on Pump.Fun, I use Photon (which already integrates support for Pump.Fun)—it’s much smoother than manual buying and selling.

To find coins, I simply watch for volatility on Pump.Fun and check anything that catches my eye. But if you prefer a more structured approach, you can filter coin types using pumpmaster.fun.

One last tip: Don’t sell something worthless too early, as these often become popular CTOs. You don’t want to be the person who sold right before a massive pump.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News