Opinion: When everyone hates $PUMP, the contrarian investment opportunity has arrived

TechFlow Selected TechFlow Selected

Opinion: When everyone hates $PUMP, the contrarian investment opportunity has arrived

Buying when there's "blood in the streets" has always been a classic and profitable investment strategy.

Author: Karl

Compiled by: TechFlow

Go long $PUMP: betting on the most criticized token in crypto, essentially entering at maximum pain.

Extreme sentiment signals market bottom, presenting an ideal time for contrarian investment

Currently, $PUMP's market sentiment has reached a state of widespread extreme disgust and panic selling—exactly the textbook signal of a market bottom. The token price has retraced all gains previously driven by millions of dollars in buybacks and is now trading at or below its record-breaking initial coin offering (ICO) price, giving investors a "second chance" to enter. On-chain data shows that over 59% of ICO participants have already sold their tokens, while the derivatives market has seen massive liquidations of $PUMP long positions on Hyperliquid. Trader discussions are filled with terms like "looted," "orchestrated dump," and "extractive garbage," while competitors such as Bonkfun are viewed as winners.

As trader unvested put it, "The more intense the hatred, the stronger the rebound." The current $PUMP environment exemplifies this perfectly. Buying when there's "blood in the streets" has always been a classic and profitable investment strategy.

$2 billion war chest: an underappreciated and underutilized potential catalyst

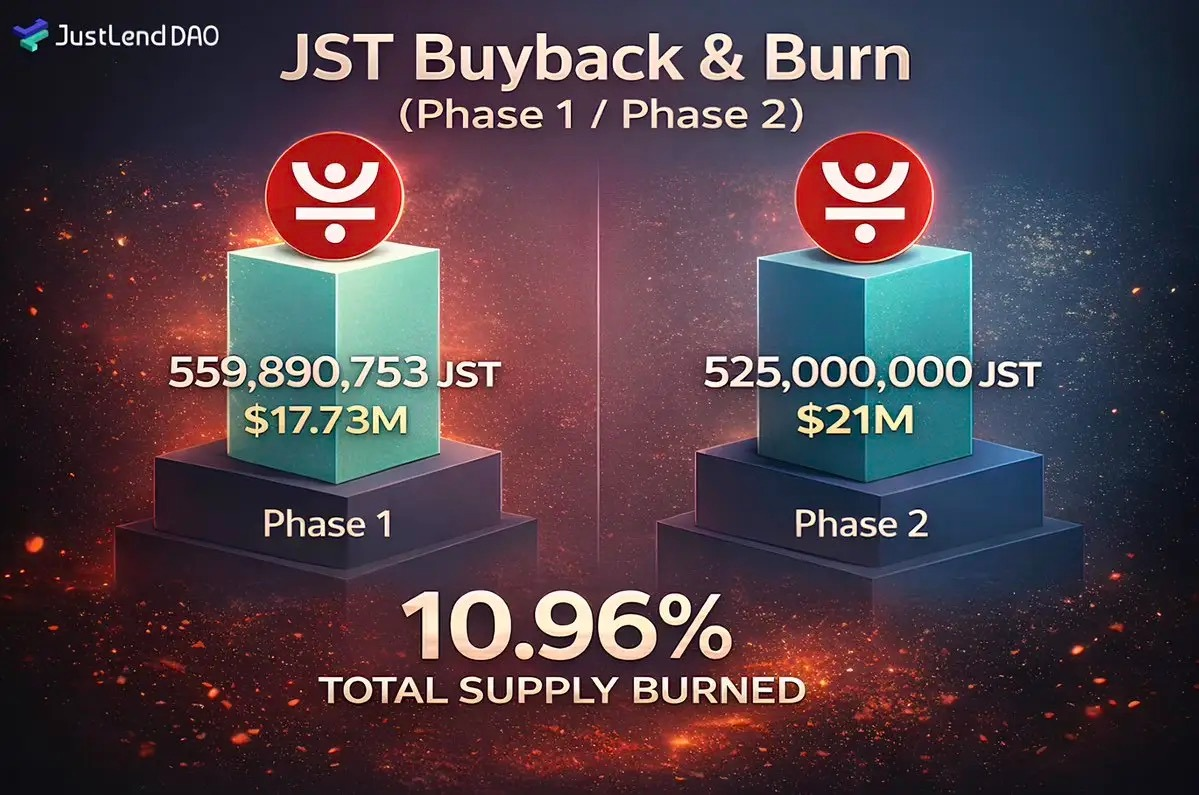

The primary complaint about $PUMP is that the team hasn't deployed its massive financial reserves—but this very fact is the core of the bullish thesis. Approximately $500 million to $1.3 billion raised during the ICO remains a powerful, unused catalyst. Although the initial ~$30 million in buyback efforts appeared clumsy, it demonstrated the team’s willingness and ability to support the token price. The buyback wallet still holds over $12 million in SOL, ready to be deployed at any moment.

While mainstream opinion views the team's inaction as a "mistake," trader 0xjaypeg proposes an alternative theory: this is a deliberate strategy designed to allow short-term ICO speculators and leveraged longs to exit gradually, thereby building a stronger holder base at lower valuations in preparation for the next upward leg. The market is currently digesting the team’s "inaction," setting up a massive asymmetric upside opportunity when the team finally deploys its reserves to defend market share or reignite momentum.

Holder structure and derivatives reset: a new market landscape emerges

Intense selling has fundamentally cleaned up the market structure. Two major funds have offloaded $86.4 million worth of $PUMP, eliminating significant supply pressure from early, insensitive investors. This redistribution shifts tokens from weak hands taking profits to potentially strong-handed believers accumulating at lows. At the same time, long liquidations have reshaped the derivatives landscape. Funding rates briefly turned negative, indicating shorts are piling in at the bottom—providing fuel for a potential violent short squeeze. The consensus trade has shifted from overcrowded longs to overcrowded shorts, all occurring near historical support levels.

Competitive pressure forces action: $PUMP's comeback is imminent

Pump.fun is engaged in a "launchpad war" with BonkFun and is perceived as lagging in key metrics such as revenue and number of projects launched. However, this competitive pressure isn't a death sentence—it's a powerful motivator. The Pump team cannot afford to let its platform dominance erode indefinitely, meaning they now face existential pressure to deploy their vast resources in retaliation.

The expected response may include sustained programmatic buybacks, aggressive marketing campaigns, deep incentives for projects to launch on its platform, or finally delivering the long-awaited airdrop. Regardless, the platform remains a "highly financialized TikTok" and a "battle-tested launchpad" with enormous revenue potential. Inaction is no longer an option, meaning the deployment of a major catalyst is now just a question of "when," not "if."

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News