Which node provider offers the best value? Data comparison of Aethir, Sopon, and CARV

TechFlow Selected TechFlow Selected

Which node provider offers the best value? Data comparison of Aethir, Sopon, and CARV

In terms of node token rewards, CARV is the most generous.

By: Riyue Xiaochu

First, let's understand node sales. Node sale is actually a new method of token distribution, benefiting multiple parties. For projects, a decentralized network inherently requires a large number of nodes. For project teams, node sales have become a new fundraising approach. For retail investors like us, most current projects are listed at high valuations dominated by institutions, leaving limited profit opportunities in the secondary market. Participating in node sales allows early investment in a project before its official launch.

Overall, in terms of node token rewards, CARV is the most generous, allocating 25% of its total supply to nodes—the highest among the three—and releasing 12.5% of the total supply in the first year during the bull market, more than double that of the other two projects.

In terms of sales performance, Sophon raised 30,000 ETH and Aethir raised 40,000 ETH. CARV’s sale is about to begin and is also expected to perform well. Investors can use these figures as reference points.

1 Project Overview

Aethir is a decentralized computing power platform aiming to build scalable, decentralized cloud infrastructure (DCI). The network helps gaming and artificial intelligence companies, regardless of size, deliver products directly to end users no matter their location or hardware. Aethir addresses market fragmentation through decentralized cloud solutions.

Sophon is an entertainment-focused ecosystem built as a modular rollup leveraging zkSync's Hyperchain technology. As a zkSync Hyperchain using ZK Stack, Sophon aims to customize solutions for any high-throughput applications such as AI and gaming.

CARV aims to build the largest modular data layer, providing data services for GameFi and AI. It revolutionizes how data is used and shared by ensuring privacy, ownership, and control remain firmly in individual hands, ushering in a future where data creates value for everyone. CARV already has 2.5 million registered users, 1.2 million monthly active users, and over 750 gaming and AI companies integrated into its ecosystem.

2 Total Token Supply Allocated to Nodes

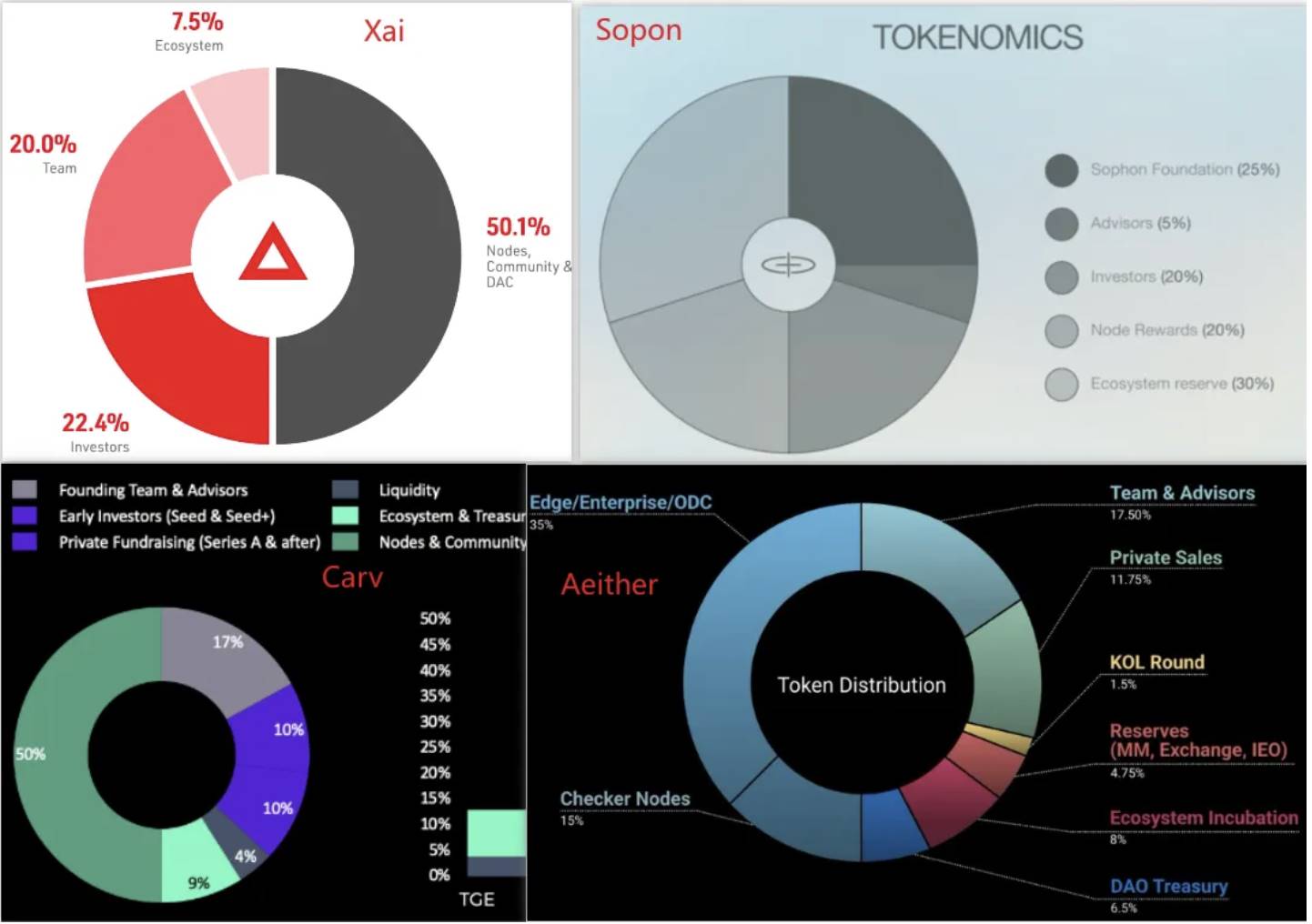

CARV has a total token supply of 1 billion, with 25% allocated to node rewards.

Aethir has a total supply of 42 billion tokens, with 15% allocated to node rewards.

Sophon’s total token supply has not yet been disclosed, but 20% will be allocated to node rewards.

Xai has a total supply of 2.5 billion tokens, with 42.09% allocated to DACs and nodes.

Thus, Xai allocates 42.09% to both nodes and DACs, meaning the overall allocation to nodes is relatively substantial. Among recent node sale projects, CARV offers the largest total token allocation to nodes.

3 First-Year Node Token Release

The first-year token release for nodes is the most critical. Given that the next year is likely to be a bull market, prices are expected to perform well. Afterwards, the market may turn bearish, while token releases continue accumulating, compounded by unlocks from institutions and core teams—making a 10x price drop entirely possible. Therefore, when evaluating node releases, focus should be on how many tokens can be mined within the first year.

Xai’s 42.09% allocation consists of two parts. Based on the official node release schedule, Xai starts with an initial daily release of 1.712 million tokens, reducing to 856,000 tokens per day once circulating supply reaches 1.25 billion (expected 5–6 months after TGE). Calculations show approximately 440 million tokens released in the first year, with 85% allocated to node rewards—about 374 million tokens, or roughly 14.98% of the total supply.

CARV allocates 25% to node rewards, with a relatively fast release schedule. According to the whitepaper, 50% of the node reward pool is released in the first year—equivalent to 12.5% of the total supply—roughly matching Xai’s rate.

Aethir does not specify clear release rules, only indicating a four-year vesting period. With only 15% of the total supply allocated to node rewards, the first-year release is estimated at 5%–7%. This is primarily because Aethir reserves a significant portion for mining rewards to computing power providers.

Sophon’s node rewards are linearly released over three years, with 27.78% released in the first year—equivalent to 5.56% of the total supply.

In terms of node token rewards, CARV releases 12.5% in the first year—the highest among the three. In contrast, Aethir and Sophon allocate only around 5% of total supply to nodes, significantly less by comparison.

4 Redemption Period for Node Tokens

After mining node tokens, participants do not receive tradable tokens immediately but instead receive esXai, vATH, or veCARV. These must be converted into exchange-listed tokens through a redemption process with a waiting period.

For Xai, converting esXai to Xai requires a 180-day wait. Alternatively, users can choose a 15-day conversion receiving only 25% of Xai, or a 90-day conversion receiving 62.5%.

Aethir’s policy allows redemption within 30 days at only 25% of tokens, with the default redemption period set at 180 days.

For CARV, converting veCARV to CARV requires a 150-day wait. Users may opt for a 15-day conversion receiving 25% of tokens, or a 90-day conversion receiving 60% of CARV.

Sophon has not yet disclosed its node redemption schedule.

Overall, all three projects have relatively long redemption periods, broadly similar in length. If differentiated, CARV holds a slight advantage with its 150-day redemption being one month shorter than Xai and Aethir’s 180-day requirement.

5 First-Year Unlock of Other Tokens

Beyond node rewards, we must also consider unlocks from other token allocations, as they contribute to inflation.

Token allocations typically include three main components beyond mining rewards: (1) project needs such as market making and operational activities, which are often heavily released at TGE and thus require less attention; (2) ecosystem rewards, community funds, and foundation reserves, which are usually governed by DAO voting due to long-term development needs; and (3) institutional and team allocations, which require special consideration.

In this regard, Xai appears less favorable. Its team and institutional tokens start unlocking six months after TGE, releasing approximately 1.5% of the total supply monthly. Meanwhile, node reward tokens become eligible for redemption about two months after TGE, followed by a 180-day redemption period. This means institutional and team holdings enter circulation significantly earlier than node-mined tokens.

CARV’s investors begin unlocking six months post-TGE, with the team starting nine months later. These terms are superior to Xai’s. Notably, CARV’s node-mined tokens have a 150-day redemption period (approximately five months), meaning node tokens will circulate before investor unlocks.

Aethir and Sophon both enforce a 12-month lock-up period for institutional and team tokens. However, Aethir’s token model includes 35% of tokens allocated to GPU miners, released concurrently with nodes—effectively doubling the amount of tokens unlocked alongside nodes.

6 Node Sale Performance

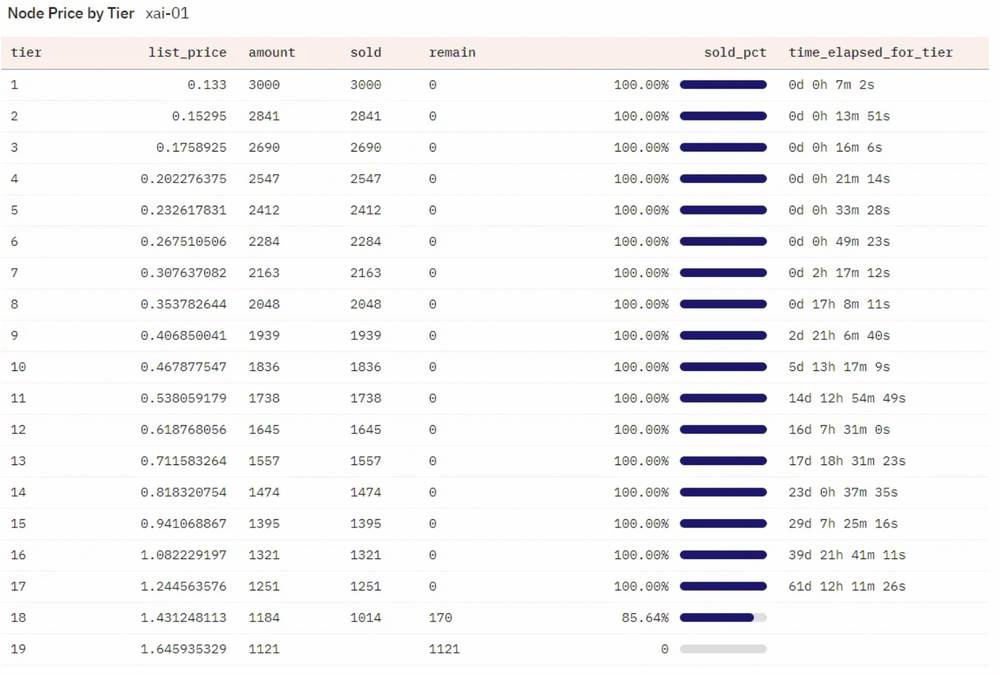

Regarding node sales, Xai has sold 35,155 nodes, raising 13,080 ETH (~$40 million USD), with an average node cost of 0.372 ETH. Node prices rose from a low of 0.133 ETH to 1.43 ETH—an increase of slightly over 10x.

Aethir has sold 74,040 nodes, raising 41,627 ETH (~$130 million USD), with an average node cost of 0.56 ETH. Node prices surged from 0.1259 ETH to 1.8232 ETH—a 14x increase.

Sophon has sold 121,261 nodes, raising 31,087 ETH (~$96 million USD), with an average node cost of 0.256 ETH.

In terms of node sales, Xai marked the beginning of this trend, with most subsequent projects modeling themselves after Xai. However, Xai’s own sales data was modest, partly because market conditions were not extremely bullish at the time. Additionally, as the first major experiment, many were skeptical about this new model. Many who participated in GALA’s node sale back in 2021 had not yet recovered their costs. Nevertheless, after Xai’s listing on Binance, early node participants enjoyed substantial returns, paving the way for future node sale projects to attract user interest.

Aethir’s node sale benefited not only from Xai’s success but also from occurring at the peak of AI sector hype. Other solid projects might expect results somewhere between Xai and Aethir.

7 Summary

1 From a project perspective, Aethir, Sophon, and CARV operate in different sectors and cannot be directly compared. Each has unique strengths: Aethir belongs to the AI sector and offers scarce GPU computing power—the hottest niche currently. Sophon appears more like a timely venture launched during favorable market conditions, though backed by zkSync’s founding team, giving it strong name recognition and industry resources. CARV has accumulated experience over years, growing rapidly with a massive user base and rich ecosystem.

2 In terms of node sales, CARV is the most generous, allocating 25% of its total supply to nodes—the highest among the three—and releasing 12.5% of total supply in the first year, more than double that of the others.

3 Based on sales performance, Sophon raised 30,000 ETH and Aethir raised 40,000 ETH. CARV’s sale is upcoming and is expected to perform solidly. Investors can use these benchmarks as reference.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News