Interpreting Botanix Spiderchain: An EVM-equivalent Bitcoin L2 with Separated Assets and Chain for Smart Contracts

TechFlow Selected TechFlow Selected

Interpreting Botanix Spiderchain: An EVM-equivalent Bitcoin L2 with Separated Assets and Chain for Smart Contracts

Spiderchain aims to combine the usability of EVM with the security of Bitcoin.

By TechFlow

The Bitcoin ecosystem remains a battleground for strategic competition.

According to Galaxy's research report, one of the most concentrated bets by crypto venture investors in Q1 2024 was on Bitcoin Layer 2 projects.

Yesterday, Botanix Labs, the developer behind the new BTC L2 solution Spiderchain, announced it had raised $11.5 million in funding, with participation from Polychain Capital, Placeholder Capital, Valor Equity Partners, and ABCDE.

Official information indicates that the Spiderchain network offers EVM-equivalent functionality, aiming to combine the usability of EVM with Bitcoin’s security.

With the Bitcoin L2 space becoming increasingly crowded and growing skepticism around whether so many projects truly qualify as L2s, does Spiderchain—backed by top-tier VCs—actually offer any unique design advantages?

We read through Spiderchain’s whitepaper and provide a quick analysis below.

Purpose of Building Spiderchain

There are countless BTC L2 solutions, but their core narratives all point to two fundamental goals:

Improving scalability and supporting smart contracts.

The first implies that Bitcoin has limited transaction processing capacity, hence the need to improve performance; the second stems from Bitcoin’s architecture lacking native support for complex smart contracts, leading developers to believe it should be capable of more—enabling richer Dapp ecosystems on Bitcoin.

Botanix argues that existing BTC L2 approaches each come with certain limitations:

-

State Channels (e.g., Lightning Network): Enable near-instant payments via off-chain channels, but are primarily suited for simple transactions and do not support complex smart contracts.

-

Federated Sidechains (e.g., Liquid Network): Improve speed and composability through multisig mechanisms, but rely on trust among federation members, introducing some degree of centralization.

-

Bulk Verification (e.g., Optimistic Rollups and ZK-Rollups): Offer scalable transaction processing, but require changes to the Bitcoin mainchain via BIPs (Bitcoin Improvement Proposals), which are typically difficult to implement.

Therefore, Botanix proposes a completely new Layer 2 framework built atop Bitcoin, aiming to introduce an EVM-compatible smart contract environment while preserving decentralization to overcome these challenges.

The intended outcome is to enable Ethereum-like composability and application ecosystems on Bitcoin without sacrificing its core strengths as a decentralized digital currency.

Spider’s Web: A Sidechain Built on Multisig Wallets

Balancing Bitcoin’s inherent security with the desire to support smart contracts and applications means Botanix must adopt a sidechain approach to independently process smart contracts and dapps.

This is where Spiderchain comes into play.

Setting aside technical details, here’s a simplified analogy to understand Botanix’s Spiderchain:

-

You store BTC in a highly secure vault—the Bitcoin network—which is extremely safe but functionally limited.

-

To unlock more utility, you transfer your BTC to a place called Spiderchain—a chain formed by interconnected smaller vaults (multisig wallets). Each small vault requires multiple keys (signatures) to open, ensuring no single entity controls the entire chain.

-

Once these smaller vaults are unlocked, your BTC can be used for various advanced functions such as interacting with Dapps and executing smart contracts.

In essence, Spiderchain operates as a sidechain separate from the Bitcoin network, absorbing BTC-pegged assets and providing an EVM environment behind the scenes to execute smart contracts, enabling BTC to be used across various DeFi activities and other use cases.

Now let’s go slightly more technical. This intuitive flow described above is formally referred to in the whitepaper as the Botanix Protocol, composed of the following key components:

-

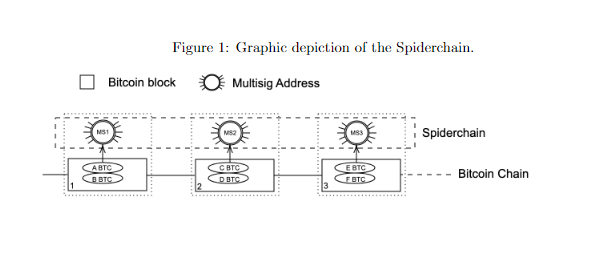

Spiderchain: The core technology of Botanix Protocol—a continuous chain of multisignature wallets managed by operators known as “Orchestrator nodes.” These nodes run Bitcoin Core, Spiderchain, and the EVM to ensure decentralization and security.

-

Orchestrator Nodes: Critical participants in the network who operate the full protocol stack, provide liquidity, create new blocks, and validate transactions. They stake Bitcoin to participate in consensus and face financial penalties (“slashing”) for malicious behavior—similar to PoS mechanisms.

-

Synthetic BTC: Tokens used on the Botanix chain, pegged 1:1 to Bitcoin. Each synthetic BTC represents a BTC locked within the Spiderchain system.

-

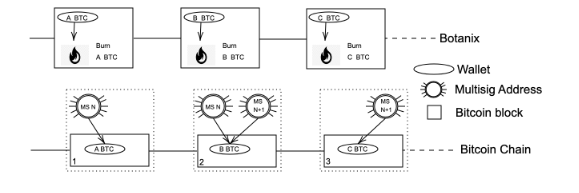

Two-Way Peg: Enables BTC transfer between the Bitcoin blockchain and Botanix chain. Users deposit BTC via a “peg-in” process and withdraw via “peg-out.”

From this explanation, we can now appreciate why it's named Spiderchain:

In this system, multisig wallets act like nodes on a spider web, requiring signatures from multiple Orchestrator nodes to execute transactions—mirroring the multi-point structural support of a spider’s web, where each node contributes to the overall stability and security of the network.

Edge nodes represent multisig wallets; inward extensions represent multiple Orchestrator nodes. Only when multiple orchestrators sign can a wallet be unlocked. Only when multiple wallets are unlocked can the BTC mapped on this chain be utilized.

Separation of Bitcoin Assets and the Base Chain

The existence of Spiderchain allows BTC to be detached from the base chain and used for more complex operations on the Spiderchain.

Let’s illustrate how BTC enters, exits, and is used within the system using a simple example.

-

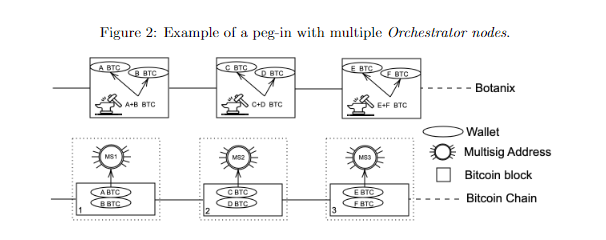

Peg-In Process: Alice wants to transfer her Bitcoin to the Botanix chain.

-

Alice sends her BTC to a new multisig address generated by the current set of Orchestrator nodes.

-

Once confirmed, the Orchestrator nodes mint an equivalent amount of synthetic BTC on the Botanix chain for Alice.

-

Alice can now use this synthetic BTC on Botanix to transact and interact with smart contracts.

-

Usage (Executing Smart Contracts): Alice uses her synthetic BTC to interact with smart contracts—for instance, participating in a decentralized finance (DeFi) platform.

-

Alice initiates a transaction calling a function in a smart contract.

-

The transaction is validated by Orchestrator nodes and included in a new block on the Botanix chain.

-

Peg-Out Process: Alice decides to convert her synthetic BTC back into Bitcoin.

-

Alice sends her synthetic BTC to an Orchestrator node.

-

The Orchestrator node burns the corresponding amount of synthetic BTC and triggers a transfer of an equal amount of BTC from the multisig wallet to Alice’s Bitcoin address.

Through this design, Botanix achieves decentralization via multisig wallets and randomized selection of Orchestrator nodes, supports EVM compatibility—allowing any DApp running on Ethereum to also run on Botanix—while maintaining Bitcoin’s security and decentralization properties.

Regarding Spiderchain’s own security, the whitepaper outlines safeguards based on system architecture, consensus mechanism, and multiple strategies to ensure network security and resistance against attacks:

For example, Orchestrator nodes must stake Bitcoin to participate in consensus, creating both economic incentives and raising the cost of malicious actions;

At the systemic level, Spiderchain implements a forward-security mechanism: even if a node becomes compromised in the future, historical records remain secure. This is achieved by regularly rotating the set of nodes involved in consensus, preventing any single node or subgroup from gaining long-term control.

To resist Sybil attacks, requiring nodes to stake BTC before joining consensus and penalizing bad actors significantly increases the cost of launching an attack.

Finally, Botanix has planned a phased rollout to prevent overextension and uncontrolled risk escalation—from an initial small network controlled by the founding team and trusted partners, gradually transitioning toward a fully decentralized, community-driven network.

Lastly, it’s important to note that Spiderchain uses Bitcoin as its native token. The project aims to build the future of programmable Bitcoin using BTC as the foundational settlement layer. All fees collected and paid on the Spiderchain EVM are settled in Bitcoin (BTC).

Additionally, Spiderchain EVM leverages Bitcoin’s main root upgrade for its Layer 2 design, requiring no additional BIPs (Bitcoin Improvement Proposals), lowering adoption barriers.

Currently, Spiderchain’s testnet is live. Interested users can click here to claim test tokens, perform cross-chain transfers, swaps, and other actions. Backed by top-tier U.S. and European VCs, the project may offer attractive incentives, making early participation a potentially rewarding move.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News