Optimistic Trust: EigenLayer AVS Will Lead the Web3 Privacy Computing Race with "Cheap Security"

TechFlow Selected TechFlow Selected

Optimistic Trust: EigenLayer AVS Will Lead the Web3 Privacy Computing Race with "Cheap Security"

With its low-cost consensus, EigenLayer will attract an increasing number of privacy computing products to shift toward low-execution-cost optimistic trustless solutions. Compared to the highly competitive Rollup-related space, the Web3 privacy sector remains a blue ocean, making it more conducive to the adoption of new paradigms.

Author: @Web3Mario

EigenLayer AVS has been live for some time now. Beyond the officially supported use cases such as EigenDA and Layer2, I've observed a fascinating trend—projects in the privacy computing space appear particularly drawn to EigenLayer AVS. Among the nine launched AVS projects, three belong to this sector: two ZK coprocessor projects, Brevis and Lagrange, and one Trusted Execution Environment (TEE) project, Automata. This article aims to explore the significance of EigenLayer AVS for these types of applications and analyze future development trends.

The appeal of "cheap security" is key to the success of the EigenLayer AVS ecosystem

With total value locked (TVL) now exceeding $1.5 billion, EigenLayer has had an impressive start. While much of this capital may be seeking potential airdrop rewards, it nonetheless provides a solid foundation for EigenLayer’s next phase—the success of which hinges on the growth of its AVS ecosystem. The scale of transaction fee revenue generated by AVSs will determine when EigenLayer transitions from a subsidy-driven model to a sustainable, mature stage.

Numerous articles have already covered EigenLayer's technical details, so I won't repeat them here. In short, EigenLayer leverages Ethereum's PoS consensus through restaking to create a low-cost consensus layer protocol. Here, I want to highlight what I see as EigenLayer’s three core values:

* Decoupling consensus from execution enables better handling of large-scale or high-cost data processing and consensus operations: Most mainstream blockchain protocols are seen as expensive and inefficient execution environments. Their high execution cost stems from “competition for block space”—a popular term describing how blockchain systems allocate node computing resources via market mechanisms. Higher bidders get priority execution, creating competition among users. When demand spikes, fair prices rise, increasing execution costs. Low efficiency originates from blockchain’s original design as a digital currency settlement system, where transaction processing is time-sensitive. Hence, execution layers are typically designed in series, making them inefficient for time-insensitive scenarios like social networks or AI training.

By decoupling consensus and execution, application developers can build specialized execution environments—often called appchains or Layer3s—freeing users from competing with other dApps and reducing usage costs. It also allows developers to tailor execution layers to specific application needs, improving efficiency.

* Consensus-as-a-Service: Productizing consensus unlocks latent market demand: Anyone who lived through the Layer1 boom-and-bust cycle knows that establishing consensus is costly and difficult. Most chains must subsidize their security—whether via mining rewards or staked capital—until they generate enough fees to sustain themselves. Only a few, like Ethereum after its economic shift, successfully transition to self-sufficiency through transaction fee revenue. These high startup costs deter innovation, as building a custom execution environment—or launching an appchain—is prohibitively risky. This creates a strong Matthew effect in Web3, where technological evolution is largely dominated by Ethereum’s roadmap.

By offering consensus as a service, innovative applications gain an alternative: they can purchase only the amount of consensus security they need. For example, if an early-stage app manages $1 million in assets, purchasing more than $1 million worth of PoS consensus ensures security—because attacking would be economically irrational. As the app grows, it can scale its consensus purchases accordingly. This reduces startup costs and risks, unlocking broader market potential.

* Cheap source of consensus: Finally, EigenLayer sources its consensus by reusing Ethereum’s existing PoS stake. This means validators earn additional yield beyond their base staking returns, transforming EigenLayer’s relationship with Ethereum from competitive to symbiotic. This significantly lowers EigenLayer’s cost of attracting consensus capital, allowing it to offer more competitive pricing for AVSs—making it especially attractive to new applications. A truly ingenious approach.

These three advantages give EigenLayer a unique edge over other Web3 execution environments by providing “cheaper security,” enabling lower execution costs, greater scalability, and more flexible business models. Therefore, I believe the vitality of the EigenLayer AVS ecosystem depends on whether Web3 applications find this cheap security compelling enough to migrate en masse.

High usage cost is the fundamental bottleneck in Web3 privacy computing

After discussing EigenLayer’s core value proposition, let’s examine the challenges facing the Web3 privacy computing sector. While not an expert in this field, I’ve studied the current state of privacy-focused AVS projects, particularly ZK coprocessors. I believe most cryptographic products using zero-knowledge proofs face the same core issue: prohibitively high usage costs limit real-world adoption.

The origin of the term “ZK coprocessor” matters less than its intent: leveraging zero-knowledge proofs to offload complex and expensive computations from main blockchain networks to off-chain systems, while maintaining verifiable correctness. This modular concept mirrors the relationship between CPUs and GPUs—where parallel tasks like graphics rendering or AI training are handled by a dedicated module to improve efficiency.

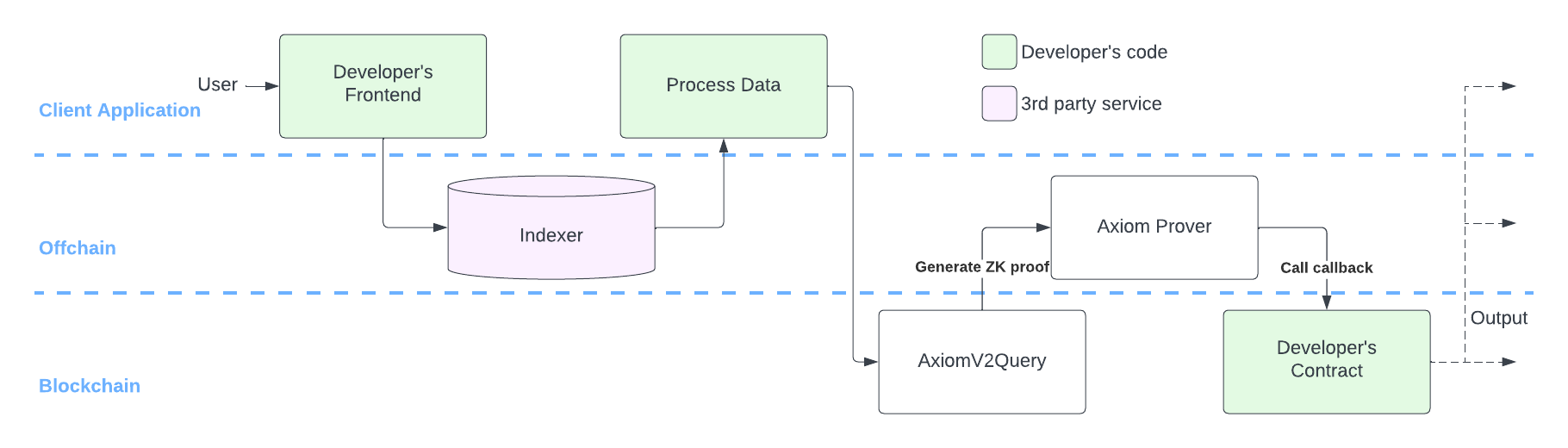

A typical ZK coprocessor architecture looks something like this—the simplified version shown is from Axiom, one of the leading projects in this space. When a user needs to perform a complex computation, they use Axiom’s off-chain service to compute the result and generate a corresponding ZK proof. Axiom then submits both the result and proof to its on-chain verification contract. Using the result, the proof, and trusted blockchain data (e.g., transaction Merkle roots) published on-chain by Axiom in a trustless manner, the contract verifies correctness via an on-chain algorithm. Upon successful validation, a callback function notifies the target contract to trigger subsequent actions.

Proof generation is computationally intensive, while verification is relatively lightweight. According to Axiom’s documentation, a single on-chain ZK proof verification requires approximately 420,000 gas. At a gas price of 10 Gwei, this translates to ~0.0042 ETH per verification. With ETH priced at $3,000, that’s about $12. This cost remains too high for average end-users, severely limiting the practical deployment of such products.

Consider a commonly cited use case: Uniswap VIP programs. Uniswap could use a ZK coprocessor to implement a loyalty program similar to those in centralized exchanges—rewarding traders who exceed certain volume thresholds with fee rebates or waivers. Cumulative volume calculation is complex, so offloading it via a ZK coprocessor avoids major on-chain protocol changes while reducing computational load.

Let’s do a quick cost analysis: suppose Uniswap offers a VIP program waiving all fees for users who trade over $1,000,000 in a month. If a trader uses a 0.01% fee pool and makes $100,000 trades, each transaction incurs a $10 fee—but the verification cost alone is $12. This disincentivizes participation and raises entry barriers, ultimately benefiting only whales.

Similar examples abound among pure-ZK architecture products. The use cases and technical designs are promising, but high usage costs remain the primary barrier to broader adoption.

From Brevis’ pivot to EigenLayer: The magnetic effect of “cheap security”

Now let’s look at Brevis—one of the first AVS projects—and how it was influenced by EigenLayer. This illustrates how EigenLayer’s “cheap security” exerts a strong pull on cryptographic applications.

Brevis’s core team comes from the well-known project Celer Network, composed primarily of accomplished Chinese technologists. After struggling for a while, they launched Brevis in early 2023, initially positioning it as a ZK-powered cross-chain data computation and verification platform. While functionally similar to ZK coprocessors, the latter branding is trendier. For a long time, Brevis operated under the so-called “Pure-ZK” model described earlier, which limited its ability to scale use cases. Then, on April 11, they announced a partnership with EigenLayer and introduced a new hybrid solution: Brevis coChain—an “economics + ZK proof” framework. In this model, the verification layer moves from Ethereum mainnet to a coChain maintained by an AVS.

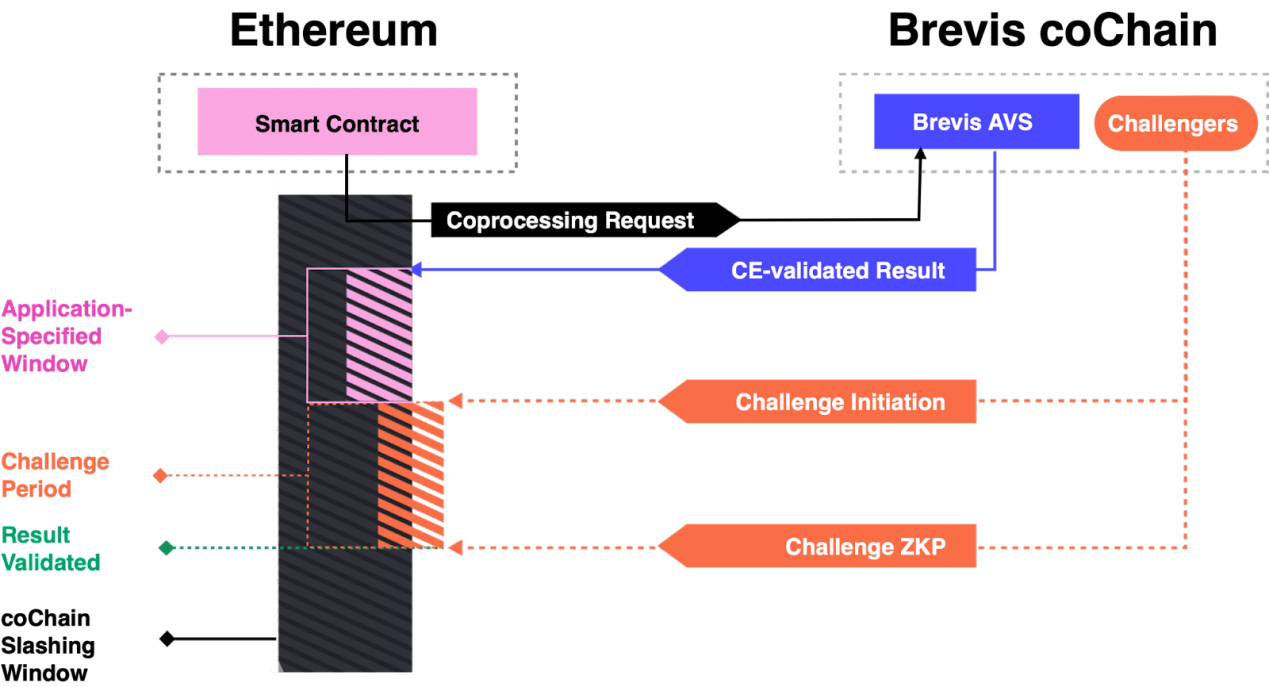

When a user requests a computation, a client-side circuit computes the result and generates a ZK proof. An on-chain smart contract sends the request to the Brevis coChain. Once the AVS observes the request, it validates correctness, compresses the data, and relays it to Ethereum, asserting the result’s validity. Like other “optimistic verification” systems, a challenge period follows—during which challengers can submit ZK fraud proofs to dispute results and potentially slash malicious actors. After the challenge window closes, the AVS triggers the final callback via an on-chain contract to notify the target application. Given that most privacy computing efforts aim to eliminate trust through mathematics, I refer to this approach as “optimistic trustlessness.”

Lagrange and Automata likely underwent similar shifts before adopting AVS-based optimistic trustless solutions. The main advantage? Drastically reduced verification costs. Since full on-chain ZK verification is no longer required, security relies instead on optimistic assumptions backed by EigenLayer’s consensus and ZK fraud proofs. Of course, shifting from mathematical trust to economic incentives may raise skepticism in Web3 circles. But compared to the gains in usability, I believe this is a reasonable trade-off. This approach effectively breaks the cost barrier that previously limited adoption. I expect many novel applications to emerge soon. Moreover, this sets a precedent for other privacy computing projects. Given that this sector remains largely untapped—unlike the crowded rollup space—it offers fertile ground for new paradigms. I believe the AVS ecosystem will see an early surge in privacy computing innovations. As I’m not a cryptography specialist, errors may exist—feedback from experts is welcome.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News