Ethena Season 2 Mining Yield Analysis: Is a 400%+ APY No Longer a Dream?

TechFlow Selected TechFlow Selected

Ethena Season 2 Mining Yield Analysis: Is a 400%+ APY No Longer a Dream?

This article will analyze three different Ethena mining strategies and their potential returns.

Original author: Donovan Choy, Former Analyst at Bankless

Translation: Azuma, Odaily Planet News

Editor's note: Earlier this month, Ethena Labs, the developer behind USDe, announced the launch of its second campaign, Sats. This new phase coincides with Ethena’s integration of BTC as a reserve asset and is expected to run until September 2 (lasting five months) or until USDe’s supply reaches $5 billion—whichever comes first.

As one of the most watched stablecoin projects in the market today, Ethena Labs has reached peak popularity following ENA’s token generation event (TGE). Currently, ENA’s fully diluted valuation (FDV) exceeds $13 billion. For users interested in participating in the project, aside from buying ENA directly on the secondary market, the most efficient method is earning future ENA rewards through the Sats campaign.

This article presents a detailed analysis by former Bankless analyst Donovan Choy on low-, medium-, and high-risk mining strategies within the Sats campaign, including operational guidance and potential returns, translated by Odaily Planet News.

Ethena’s first campaign, Shards, lasted six weeks, during which top yield farmers such as Defi Maestro reportedly earned eight-figure profits.

If you missed the first season, there’s still time to join the second season, Sats—although Pendle pool capacities are gradually approaching full, participation remains possible.

Below, we analyze three distinct Ethena mining strategies and their potential returns.

Before diving into data analysis, let’s briefly review several key concepts involved in these strategies.

-

First, Ethena is the issuance protocol for USDe, a self-yielding synthetic dollar-pegged stablecoin. When you purchase USDe during the Sats campaign, your address automatically accumulates points (sats), which will determine your ENA reward allocation in the second season—ENA being Ethena’s governance token, currently boasting an FDV of $14.3 billion at the time of writing.

-

Second, Pendle is a yield-splitting protocol that separates yield-bearing tokens (such as USDe) into “Principal Tokens” (PT) and “Yield Tokens” (YT). PT allows users to maintain exposure to principal, while YT captures pure yield exposure. Since YT does not include principal, its value decays toward zero as it approaches maturity. For the strategies discussed here, our focus will be primarily on YT.

In this context, since USDe currently offers a 17% annualized yield, when you buy USDe YT on Pendle, the YT token carries only the value of that 17% yield plus积分 rewards distributed by the underlying protocol (Ethena).

-

Third, Mantle and Arbitrum are Layer 2 networks where Pendle has deployed, in addition to Ethereum mainnet.

With these foundational concepts covered, let’s examine the three mainstream mining strategies in the Sats campaign:

-

Low risk: Holding USDe on Ethereum (earning 5x sats daily), or locking for at least 7 days (earning 20x sats daily);

-

Medium risk: Purchasing USDe YT on Pendle;

-

High risk: Locking ENA for boosted rewards and simultaneously allocating equal capital to buy USDe YT on Pendle.

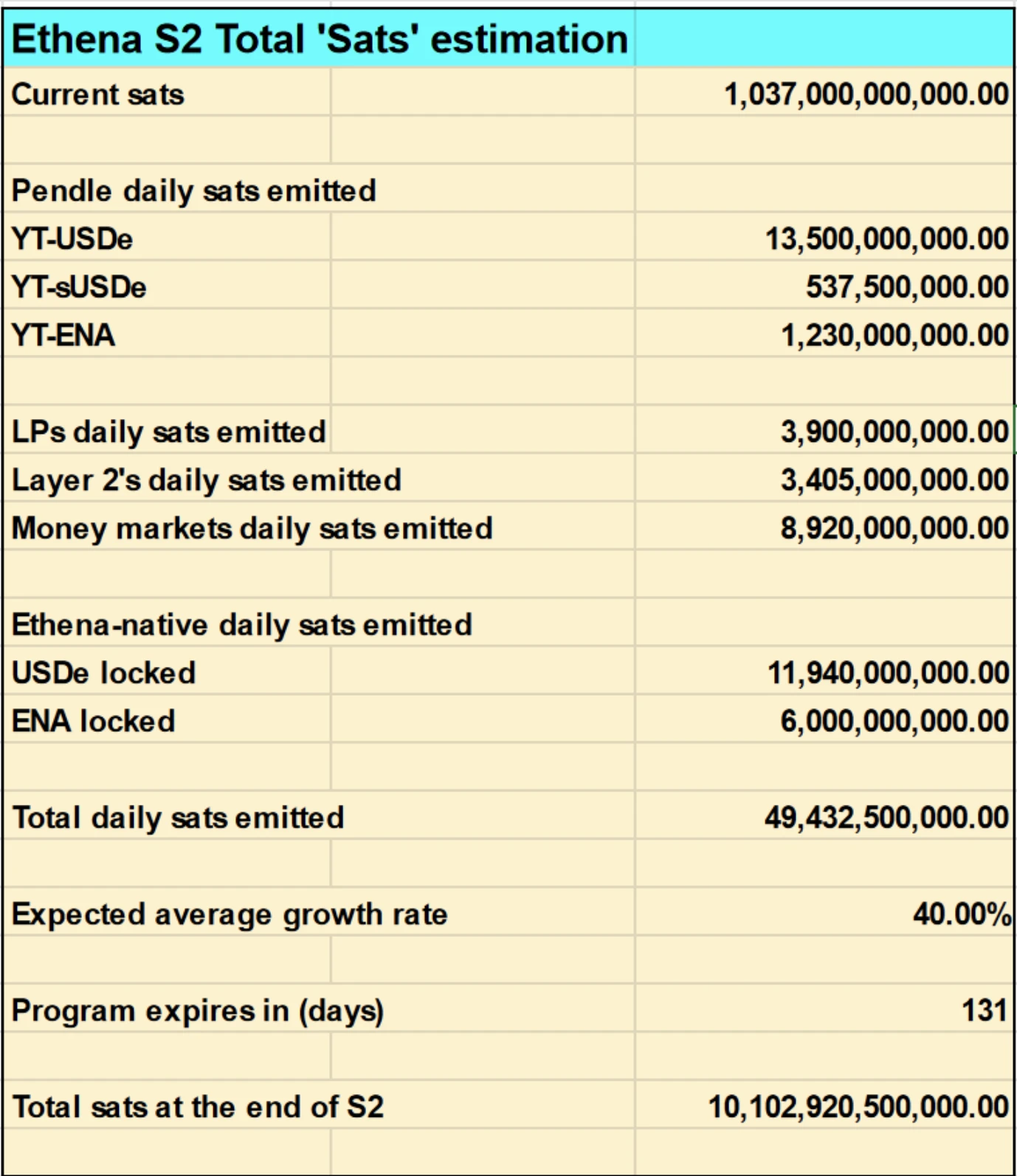

Estimated Total Sats Distribution for Season Two

To calculate specific potential returns, we must first answer a critical question—how many total sats will be distributed by the end of Season Two? Based on this pivotal figure, we can quantify airdrop yields and determine which strategies offer optimal returns within their respective risk tiers.

Note: We have not included积分 awarded to CEX wallets for USDe or ENA holdings.

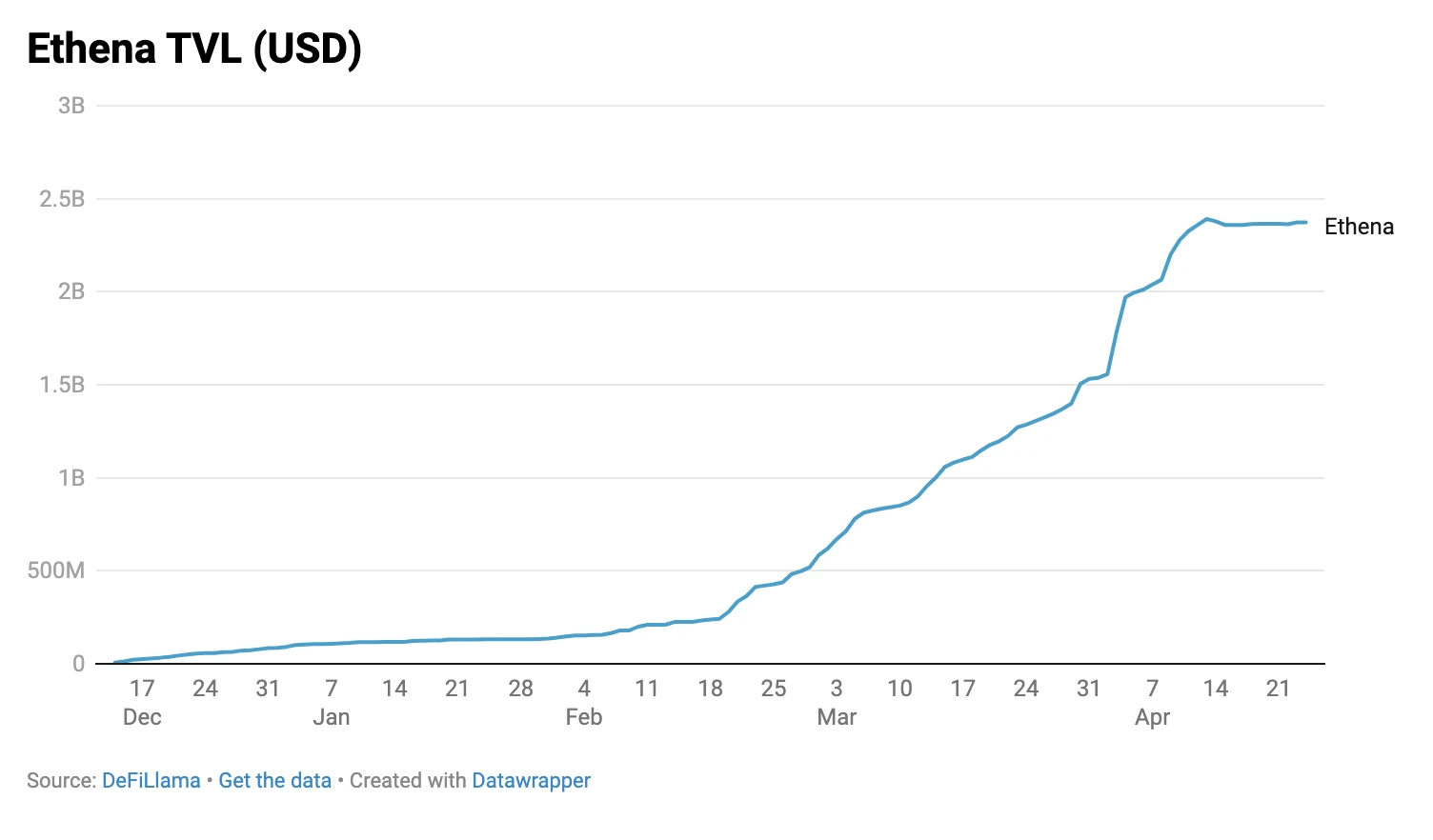

We conservatively estimate a 40% overall growth rate in sats accumulation, implying a total distribution of 10.1 trillion sats by the end of Season Two (September 2, 2024). It’s worth noting that the campaign could conclude earlier if USDe’s supply hits $5 billion—but given the current $2.4 billion supply and growth trajectory, we believe this threshold is unlikely to be reached ahead of schedule.

Note: Data sourced from DeFiLlama

Low-Risk Strategy: Holding and Locking USDe

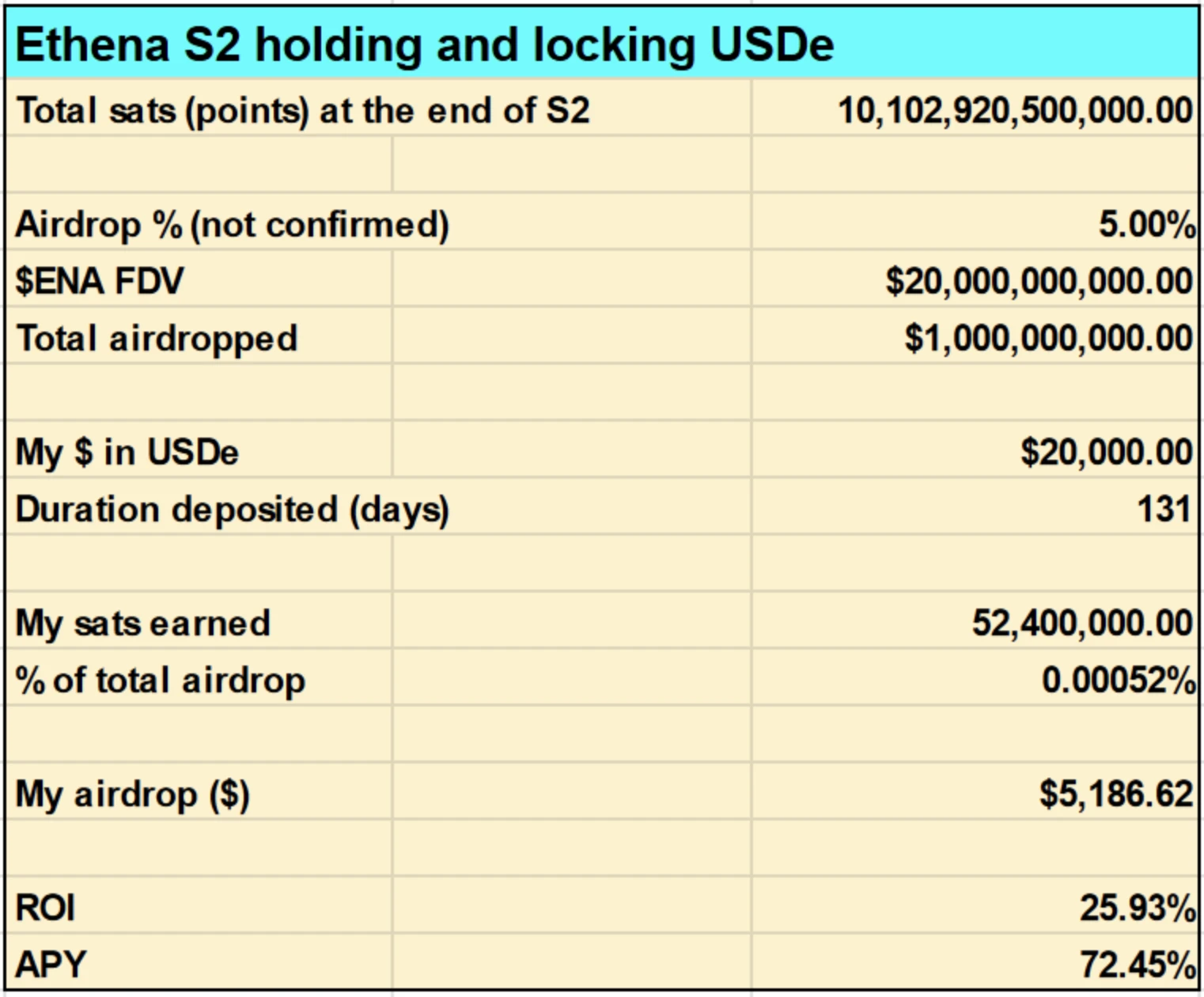

Now let’s calculate the potential return from simply holding and locking USDe—the lowest-risk strategy discussed here. Our assumptions are as follows: Season Two will distribute 5% of total ENA supply (consistent with Season One); and the FDV of ENA at the time of the airdrop will be $20 billion (currently $14.4 billion at the time of writing).

As shown in the table below, if you lock 20,000 USDe today at 20x efficiency (with 130 days remaining in Season Two), you would earn $5,186 in profit. This translates to a 25.93% return on investment (ROI), or an annualized percentage yield (APY) of 72.45%.

Unlike the subsequent strategies, this approach does not involve Pendle—you retain full access to your principal.

Medium-Risk Strategy: Pendle YT

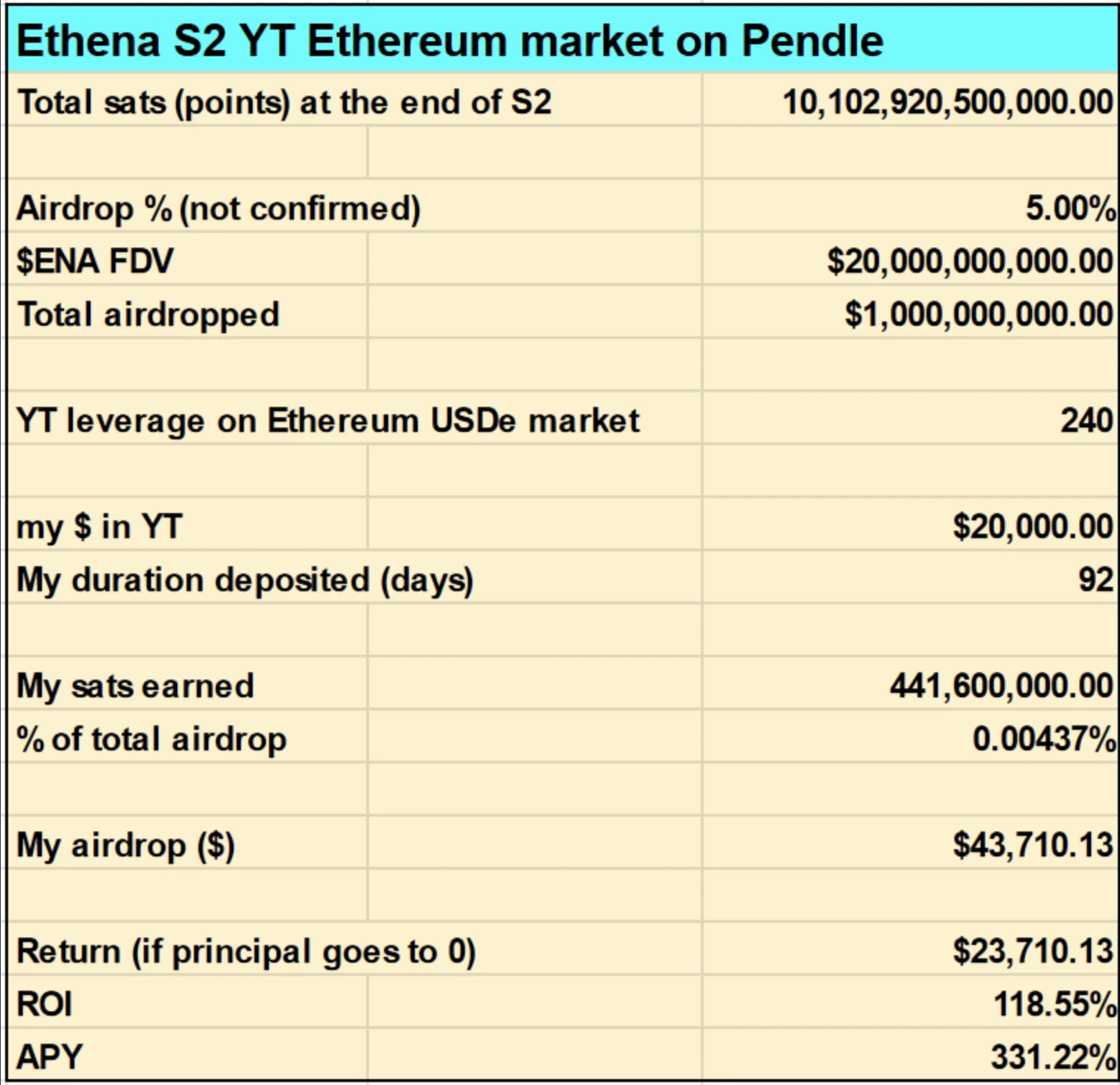

Now let’s examine the medium-risk strategy: using USDe YT on Pendle’s Ethereum mainnet pool to earn sats.

With the same $20,000 capital (though now over a 92-day period, due to Pendle pool maturity), the expected ENA reward is approximately $43,710. After subtracting principal, net profit reaches about $23,710 (since YT value decays to zero at maturity, you lose the $20,000 principal)—roughly four times the return of the first strategy.

Under this strategy, ROI is projected at 118.55%, with APY reaching 331.22%.

Note that the calculations in the table below are based on current leverage levels in the Pendle market. The real-time leverage of YT fluctuates depending on market demand and time to maturity.

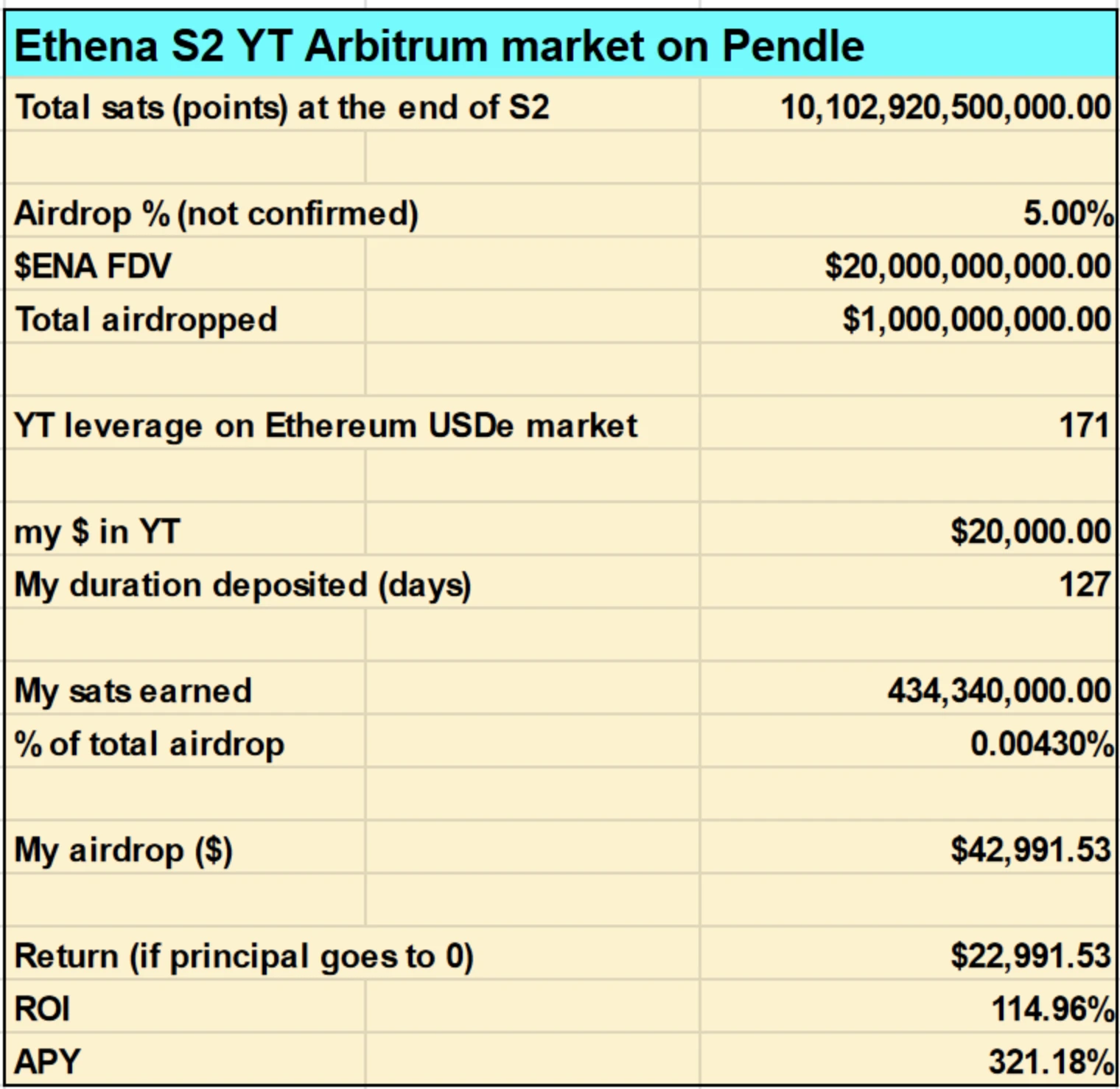

If you choose Arbitrum instead of Ethereum mainnet, expected ROI and APY slightly decrease to 114.96% and 321.18%, respectively. This difference arises due to variations in real-time YT leverage between Ethereum and Arbitrum.

You can execute similar operations on Pendle pools on Mantle or Zircuit, though expected metrics will vary accordingly.

High-Risk Strategy: Lock ENA and Stack YT

Finally, we arrive at the highest-risk and potentially highest-return strategy: splitting capital 50:50—one half to lock ENA, the other to purchase USDe YT on Pendle.

Why go to such lengths? Because Ethena offers additional yield incentives to users who “lock ENA equivalent to 50% of their USDe position value.” By holding both YT-ENA and YT-USDe in the same wallet, your total rewards across both pools increase by 50%.

This may also be the preferred strategy for sophisticated YT traders who maximize their Season One airdrop gains to boost sat accumulation efficiency in Season Two.

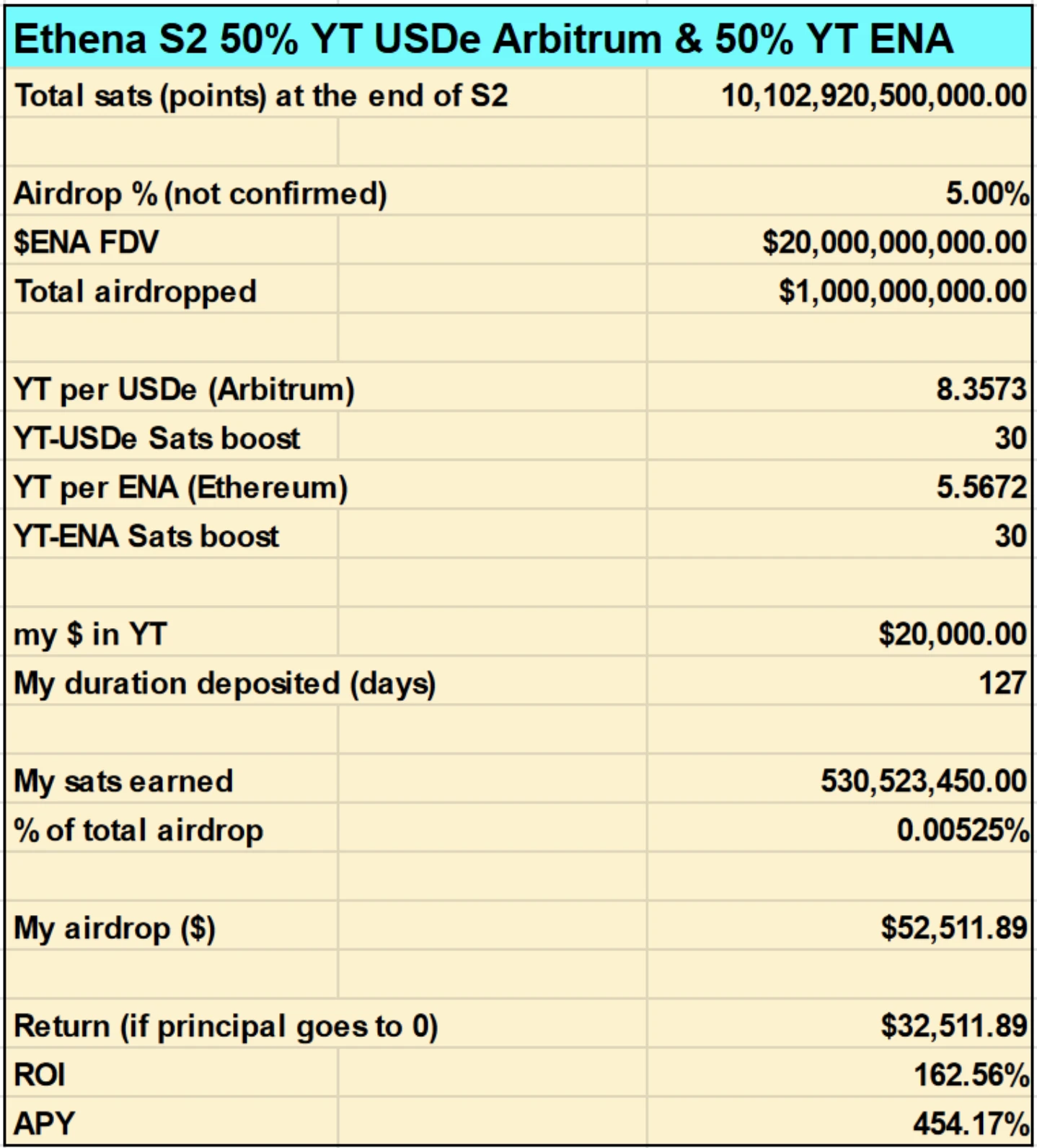

As shown in the table below, this strategy (deployed on Arbitrum) delivers the highest returns—162.56% expected ROI and 454.17% expected APY—while carrying elevated risk due to ENA lockups.

Note: USDe pool on Arbitrum, ENA pool on Ethereum mainnet

One final note: If you opt for a Pendle YT-based strategy, pay close attention to real-time leverage levels. Leverage tends to rise when the market sells off YT (more likely near maturity) and falls otherwise. Although real-time leverage continuously shifts with YT market conditions, once you purchase YT, the leverage applicable to your specific position remains fixed throughout the holding period.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News