Interpreting Binance's Latest Launchpool Project Renzo: Token Economics and Valuation Outlook

TechFlow Selected TechFlow Selected

Interpreting Binance's Latest Launchpool Project Renzo: Token Economics and Valuation Outlook

Rezon's valuation logic is much simpler, as Renzo has a very clear comparable: ether.fi.

Author: Azuma, Odaily Planet Daily

On the evening of April 23, Binance officially announced that Renzo (EZ), a liquid restaking protocol, will be the 53rd project for its new token mining program.

Starting from 8:00 AM Beijing time on April 24, users can stake BNB and FDUSD into Launchpool to earn EZ rewards. The EZ mining campaign will last for six days, and the Launchpool website will be updated prior to the launch of the mining activity.

After the conclusion of Launchpool, Binance will list Renzo (EZ) at 8:00 PM Beijing time on April 30, opening trading pairs EZ/BTC, EZ/USDT, EZ/BNB, EZ/FDUSD, and EZ/TRY. EZ will be subject to Seed Tag trading rules.

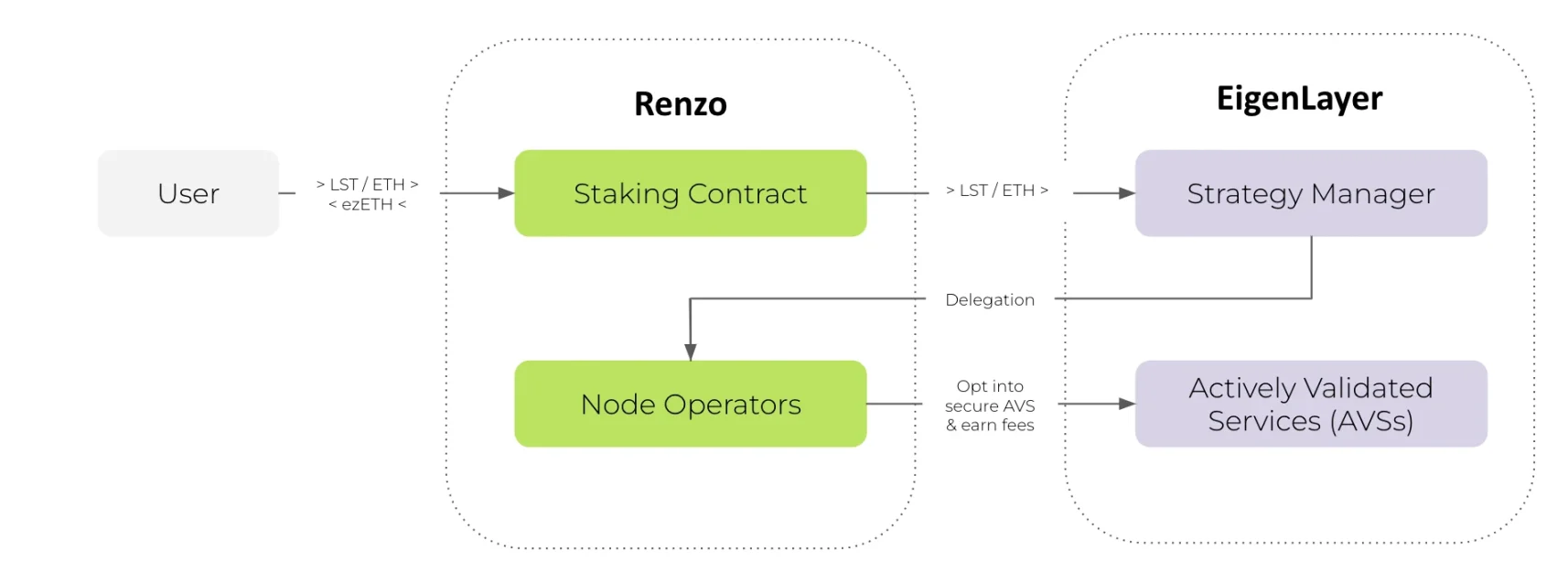

Overview of Renzo’s Business Model

Earlier this year, shortly after Renzo launched, Odaily Planet Daily published an article titled “TVL Increases by $100M in One Month: How Did Renzo Secure a Place in the Restaking Arena?” which detailed Renzo's business model.

In short, Renzo is positioned as a liquidity restaking protocol built on EigenLayer. The project primarily aims to address two key pain points associated with direct restaking via EigenLayer: First, the issue of ETH liquidity being locked after restaking. Renzo solves this by issuing a derivative token, ezETH, to unlock the liquidity of restaked ETH. Second, as the number of EigenLayer Active Validator Services (AVSs) increases, different AVS configuration strategies result in varying risk and return profiles. Renzo uses algorithms to dynamically balance returns and risks, making complex configuration decisions on behalf of users to achieve stable high yields.

EZ Tokenomics

Shortly after Binance officially announced the listing of Renzo, details about EZ's tokenomics were disclosed for the first time.

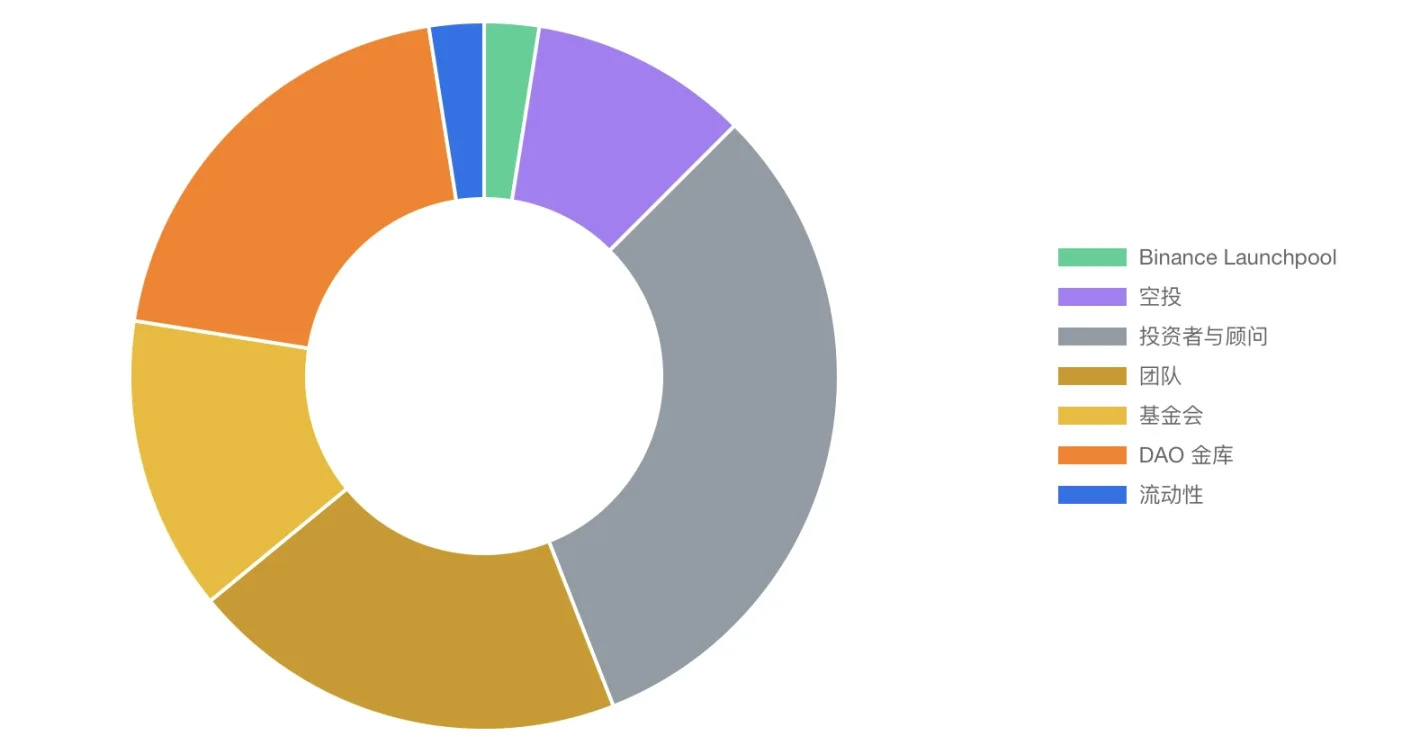

The total supply of EZ will be 10 billion tokens, with a circulating supply of 1.05 billion tokens at launch—approximately 10.50% of the total supply. The specific allocation is as follows:

2.50% allocated to Binance Launchpool;

10.00% allocated to airdrops;

31.56% allocated to investors and advisors;

20.00% allocated to the team;

13.44% allocated to the foundation;

20.00% allocated to the DAO treasury;

2.50% allocated to liquidity incentives.

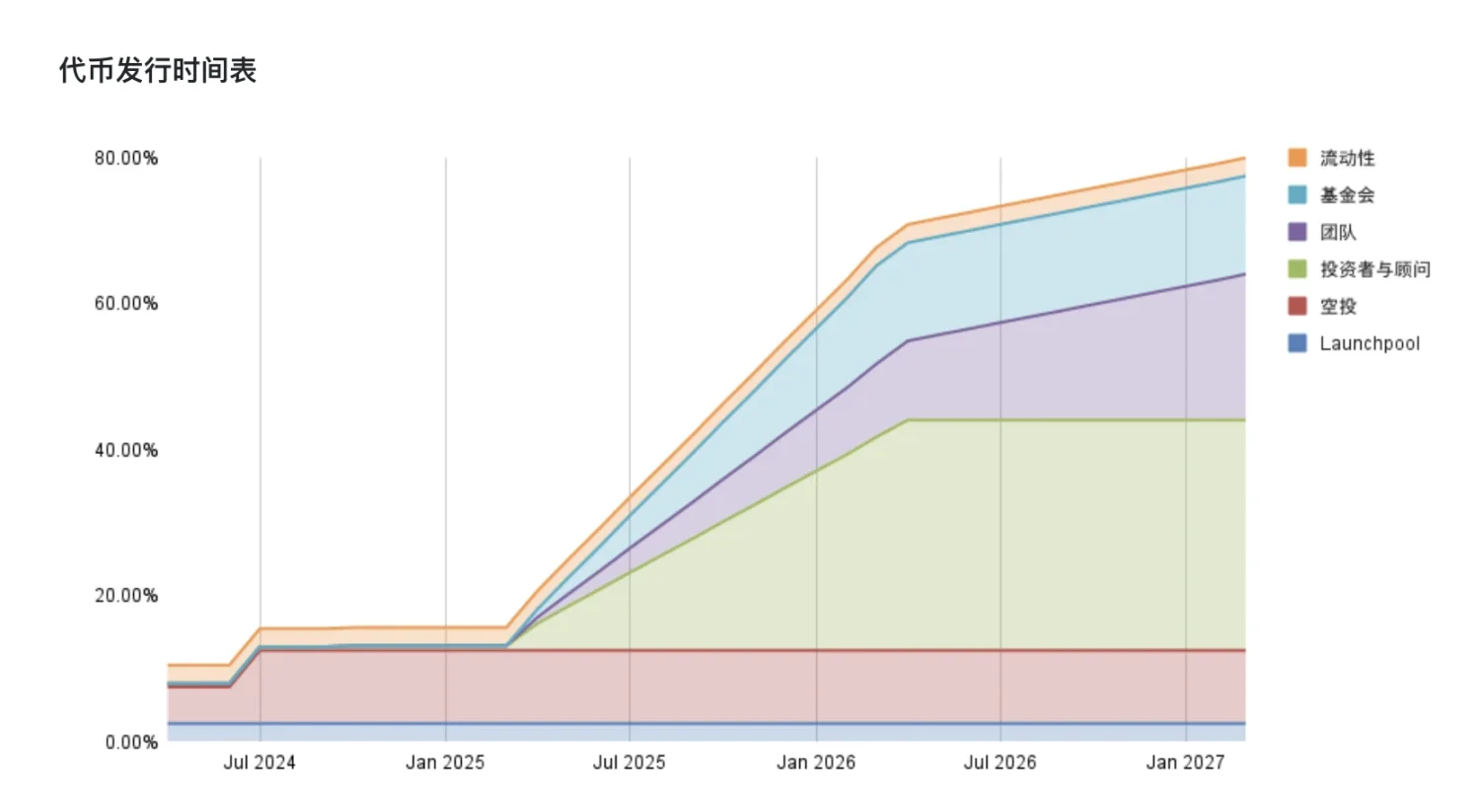

In terms of token unlocking schedule, EZ’s circulating supply will remain relatively low during the first nearly one year after launch, with initial supply mainly coming from Binance Launchpool and airdrop allocations. However, starting at the end of Q1 next year, the circulating supply of EZ will enter an accelerated phase—investors should take note of this timing.

Valuation Overview

Compared to previous Binance Launchpool projects, Renzo’s valuation logic is relatively straightforward due to a clear benchmark—ether.fi.

As two direct competitors in the liquid restaking space, Renzo and ether.fi not only operate in overlapping business areas but also share several similarities:

First, their TVLs are nearly identical. According to Defillama data, ether.fi currently has a TVL of $3.8 billion, ranking first in the LRT sector; Renzo has a TVL of $3.3 billion, ranking second.

Second, the initial circulating supply ratios of their respective tokens ETHFI and EZ are almost the same. ETHFI had an initial circulating supply of 115.2 million tokens, approximately 11.52% of total supply; EZ’s initial circulating supply will be 1.05 billion tokens, around 10.50% of total supply.

Third, both ETHFI and EZ debuted through Binance Launchpool, with ether.fi being the 49th project.

Based on these factors, we can reasonably estimate Renzo’s valuation by referencing ether.fi’s post-listing price performance, as detailed below.

Using ETHFI’s real-time price of $3.9, calculating EZ’s equivalent price at the same FDV results in $0.39, or $0.34 when weighted by FDV difference; calculating at the same market cap (MC) gives an EZ price of $0.43, or $0.37 when weighted by FDV difference.

Of course, the above prices are static estimates based on Renzo’s competitive landscape. Given differences in business focus and variations in market sentiment between the two listings, the definitive price performance of EZ will only become clear after trading begins.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News