Renzo airdrop distribution sparks community backlash, ezETH suffers severe depegging

TechFlow Selected TechFlow Selected

Renzo airdrop distribution sparks community backlash, ezETH suffers severe depegging

The window of opportunity is short and only留给 those who are prepared.

Author: Followin

On April 24, the popular liquid restaking protocol Renzo officially announced its detailed token distribution rules, sparking widespread dissatisfaction within the community. The price of ezETH, Renzo’s ETH deposit receipt token, briefly plunged sharply and severely de-pegged, falling as low as around $1,600.

Selling ezETH Early Results in Zero Points

According to official rules, incentives for Renzo Season 1 will end on April 26. Users who sell their ezETH holdings before this date may become ineligible for the airdrop. Users can claim REZ via the official website starting May 2.

Top Holders Must Lock 50%, Benefiting Retail

Notably, large depositors on Renzo are likely to be the most affected. The team stated that 500 million REZ tokens (5% of total supply) will be distributed linearly based on users’ accumulated ezPoints. Addresses ranked in the top 5% will have 50% of their tokens unlocked immediately at TGE, with the remaining portion released linearly over six months. While this move may upset major holders, it benefits retail investors by significantly reducing selling pressure from whales.

Only 5% Allocated—Depositors Feel “Betrayed”

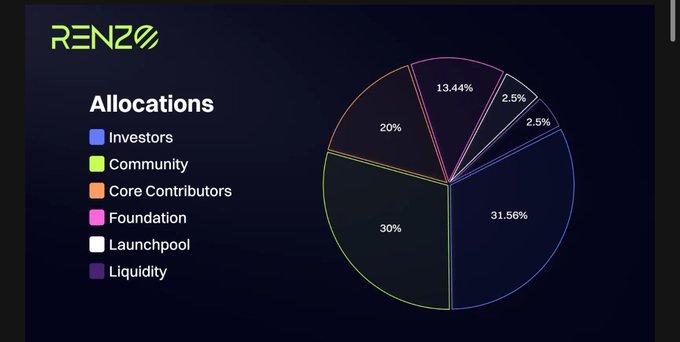

The most controversial aspect of Renzo’s token distribution is the share allocated to protocol depositors.

This is the official allocation chart:

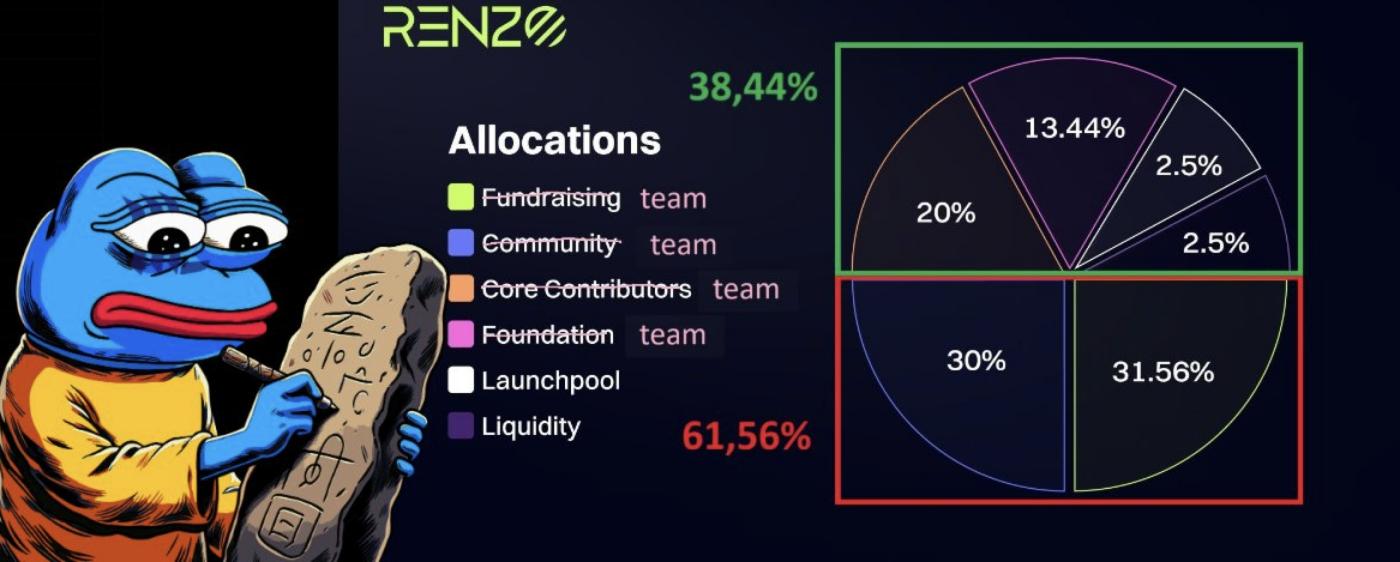

But in reality, it might look like this:

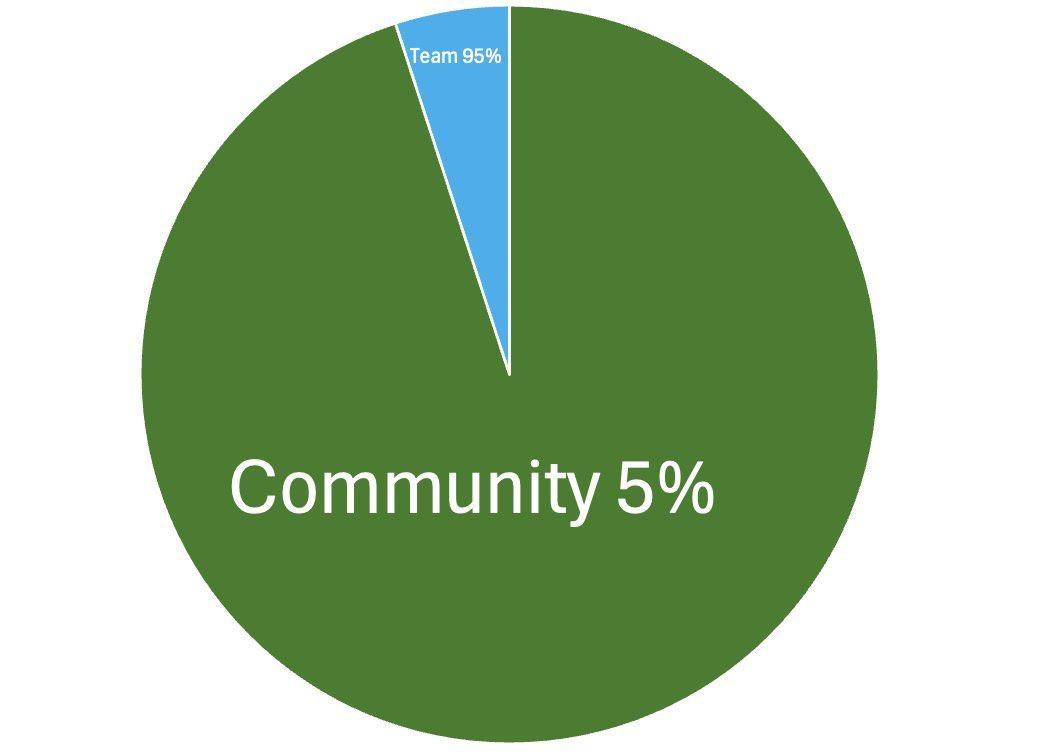

More intuitively, like this:

Crypto KOL @0xCaptainLevi commented that Renzo’s token airdrop is a joke. He pointed out that the entire business is built on depositors, yet customers receive only 5% of the tokens, half of which are locked—meaning the actual effective airdrop is just 2.5%. It’s clear that the 250,000 users who deposited $3.5 billion worth of ETH into Renzo over the past six months will ultimately receive only 2.5% of the tokens—equal to the amount allocated to Binance’s new coin mining program—while the team and investors receive 65%. Additionally, selling ezETH (Renzo’s ETH deposit receipt token, pegged 1:1 to ETH) early disqualifies users from the airdrop. Users took risks by depositing funds into your protocol, yet the community received inadequate rewards.

While the above perspective may not be entirely balanced, community discontent is indeed real. Compounded by shallow liquidity in ezETH trading pools on Uniswap, the token experienced a sharp de-peg shortly after the announcement, plunging nearly 50% to around $1,600.

De-Pegging Creates a Bargain-Hunting Opportunity?

Although the de-pegging event was brief, many traders seized the opportunity to buy the dip successfully. According to on-chain analyst @ai_9684xtpa, a whale purchased 2,499 ezETH using 2,400 ETH during the de-pegging period, worth $6.98 million, netting a profit of 99 ETH.

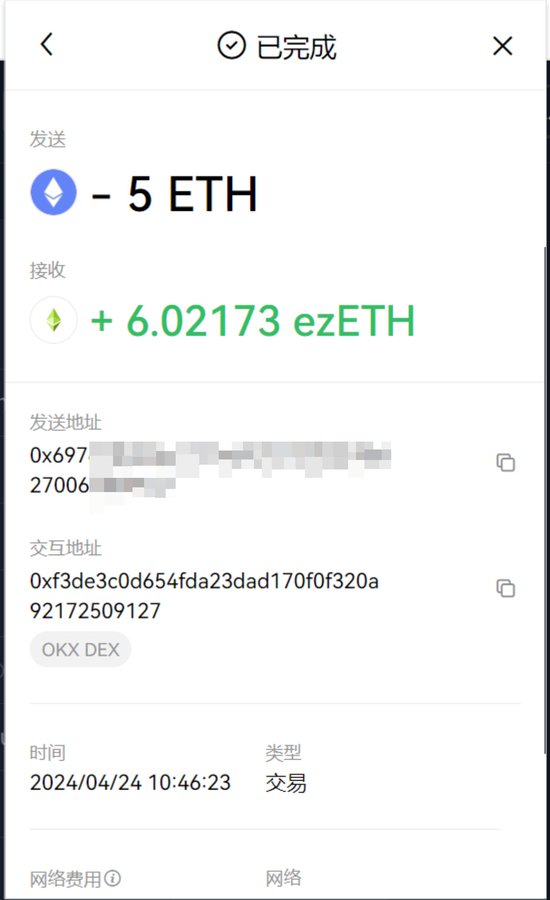

Many others shared their successful bargain-hunting results online.

The opportunity window was short—only available to those prepared. At the time of writing, ezETH’s peg has significantly improved and is nearly restored.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News