An Overview of the BTC-Related Public Chain Ecosystem as Venture Capital Firms Rush In

TechFlow Selected TechFlow Selected

An Overview of the BTC-Related Public Chain Ecosystem as Venture Capital Firms Rush In

The BTC ecosystem landscape has changed dramatically compared to six months ago, with VC firms actively entering the space.

By: dt

With the Bitcoin mining reward halving approaching, this bull market was initially driven by the BTC ETF narrative and is now experiencing a significant pullback as the BTC halving nears completion. Today, the BTC ecosystem looks vastly different from just six months ago. VC firms are actively entering the space, and alongside community-driven, fair-launched meme tokens, numerous public blockchain projects led by venture capital firms or exchanges—such as BTC L2s or restaking chains—are emerging.

This week’s CryptoSnap Dr.DODO introduces five currently popular BTC-related blockchains and the capital backing them.

BounceBit

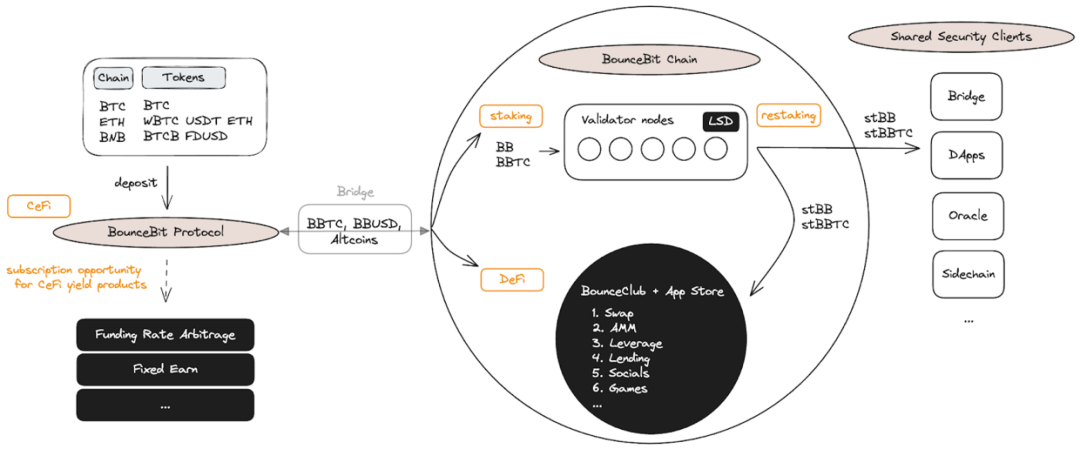

BounceBit is a blockchain that leverages BTC's value as its security foundation, promoting the expansion of Bitcoin's use cases through its Restaking mechanism. Recently, it announced that its token $BB will launch on Binance Web3 Wallet's Megadrop token issuance platform. After receiving public investment from Binance Labs, BounceBit's popularity surged, and the upcoming collaboration with Binance Web3 Wallet positions $BB as one of the few new BTC projects to undergo a Binance launchpad event, attracting more users and capital.

Unlike other BTC L2s that rely on Bitcoin's technological security, BounceBit focuses on building an independent POS public chain anchored in BTC's value. By partnering with CeFi asset management institutions, it enables yield-generating strategies such as fee arbitrage, allowing users who deposit BTC to earn additional returns. The $BBTC receipt tokens earned through staking can be used to operate nodes on the BounceBit Chain or participate in LST protocols to receive $BB token rewards. Additionally, its Restaking mechanism allows other applications within the BounceBit ecosystem to leverage $BBTC held in nodes for validation tasks such as oracles and cross-chain bridges.

Currently, BounceBit is running a points program where users earn points by depositing assets like wBTC and BTCB, which will continue until the start of the Megadrop event.

Source: https://www.binance.com/zh-CN/research/projects/bouncebit

Merlin Chain

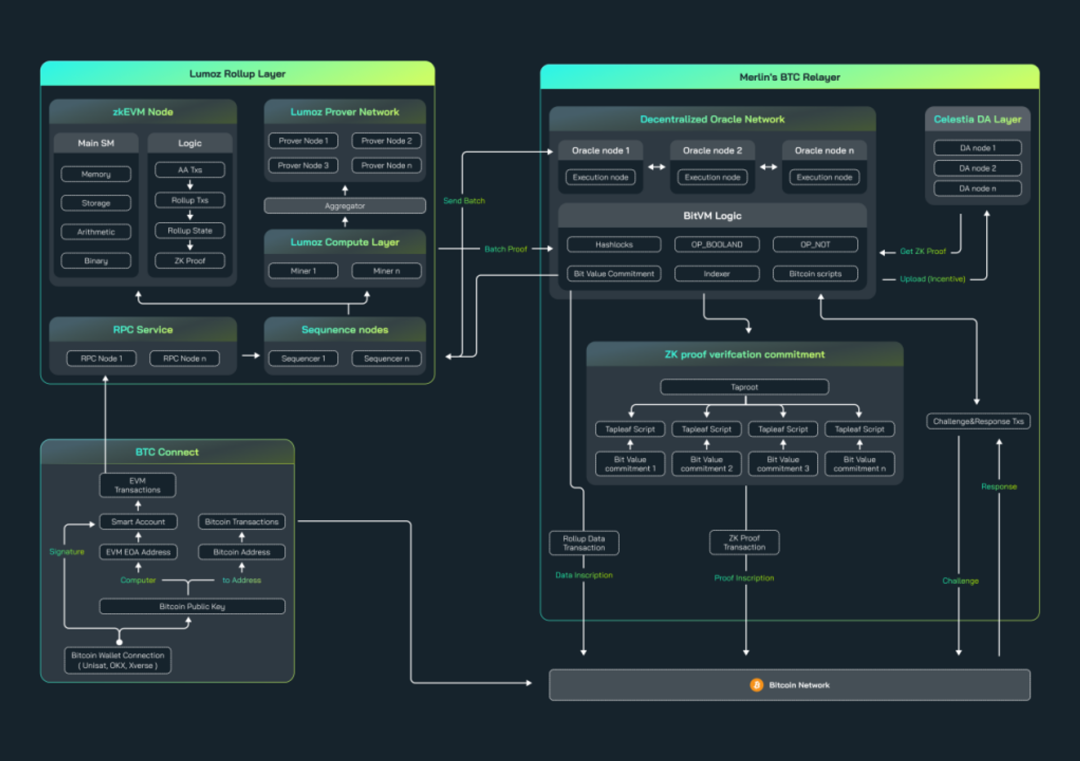

Among the five projects introduced today, Merlin Chain has the highest TVL—currently exceeding $950 million—and was the first to launch its mainnet among BTC EVM L2s. Its token $MERL recently listed on top-tier exchanges including OKX and Bybit, coinciding with the Bitcoin halving event.

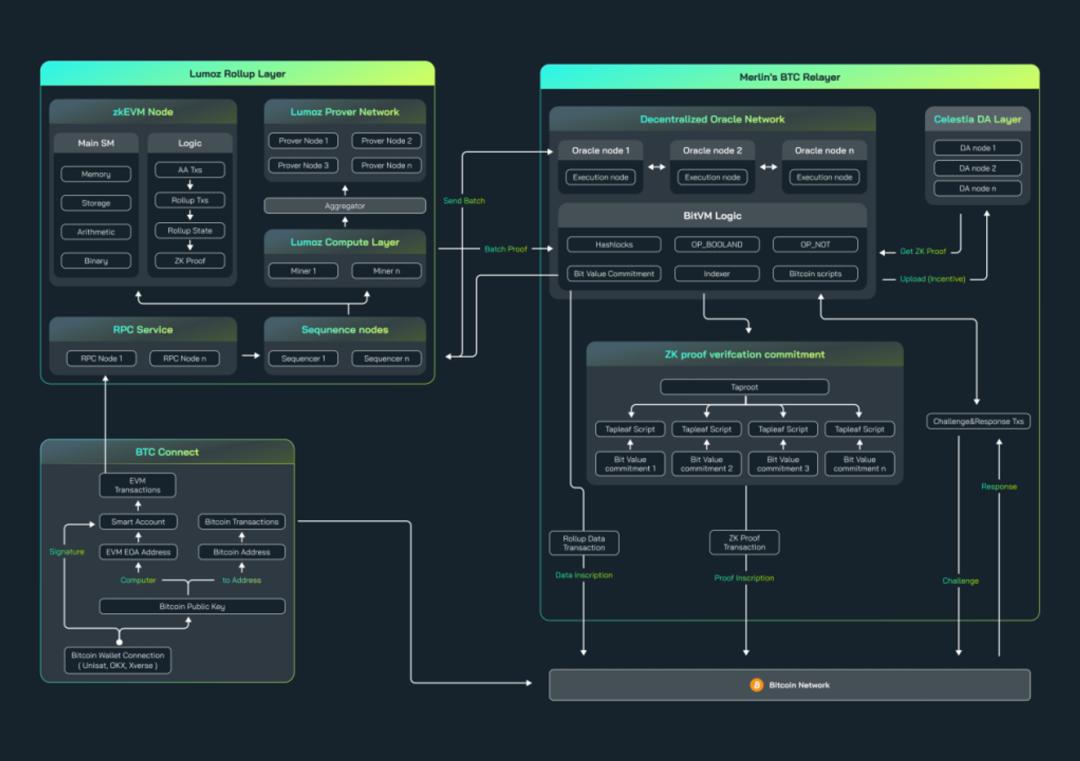

Backed by institutions such as The Sparta Group and OKX Ventures, Merlin Chain is a Layer2 solution built atop Bitcoin, employing a dual architecture combining OP-Rollup and ZK-Rollup, which it calls "Optimistic ZK-Rollup." It uses a decentralized off-chain oracle network (Oracle) as a Data Availability Committee (DAC) to address data availability issues. Specifically, Merlin's sequencer sends transaction data to Oracle nodes and Prover nodes (utilizing lumoz's Prover-as-a-Service), with Oracle nodes verifying ZK proofs and publishing results onto the Bitcoin chain (ZK-Rollup). Since full ZK proof verification isn't feasible on Bitcoin, a fraud-proof mechanism is introduced, allowing challenges to verification processes (OP-Rollup), ensuring network security.

Source: https://docs.merlinchain.io/merlin-docs/architecture

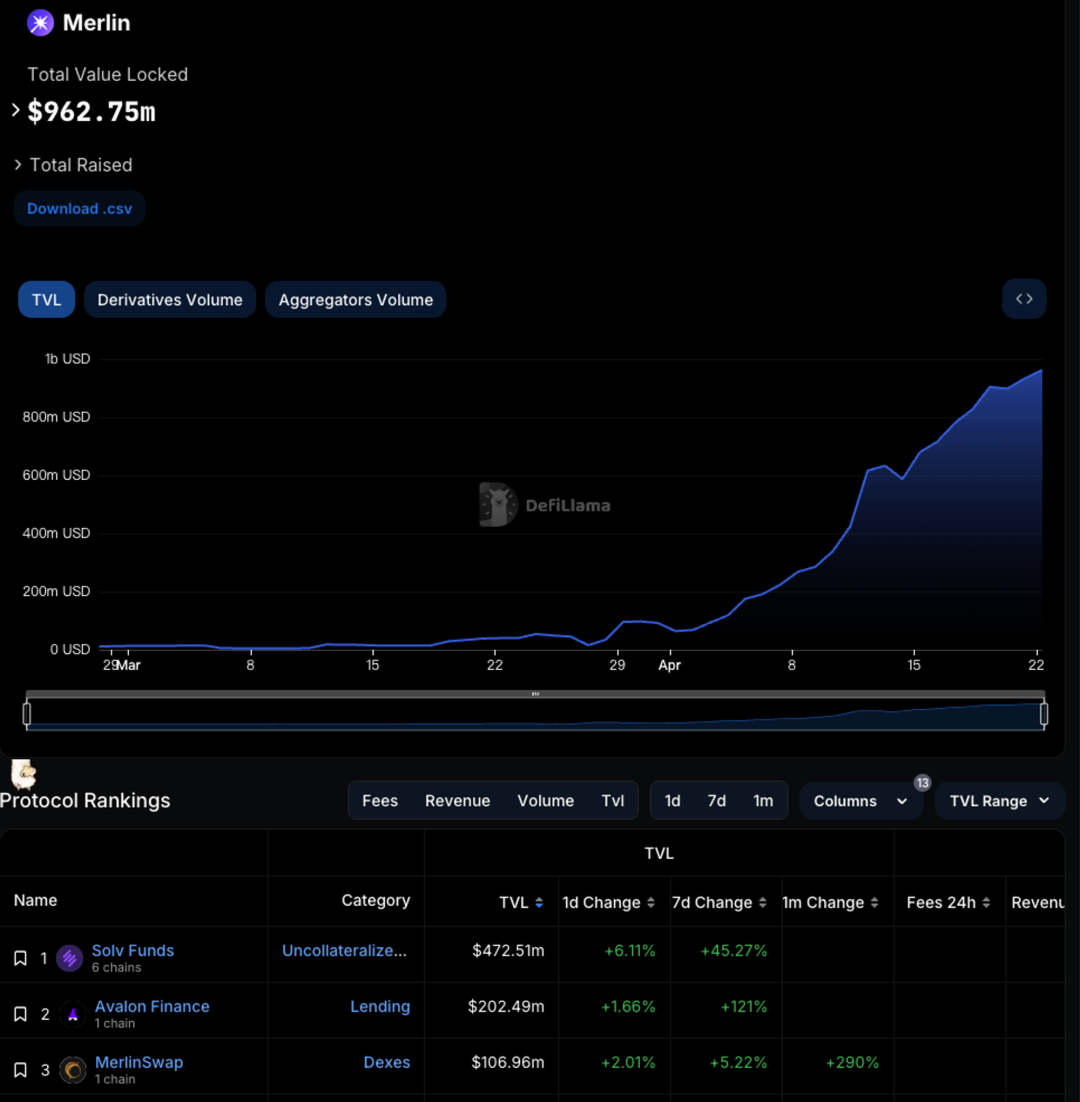

Merlin Chain also hosts the most developed ecosystem among current BTC L2s. Asset management protocol Solv Funds, lending protocol Avalon Finance, and DEX MerlinSwap all surpass $100M in TVL. However, post-$MERL token launch, it remains to be seen whether many airdrop hunters will move their funds elsewhere.

Source: https://defillama.com/chain/Merlin

B² Network

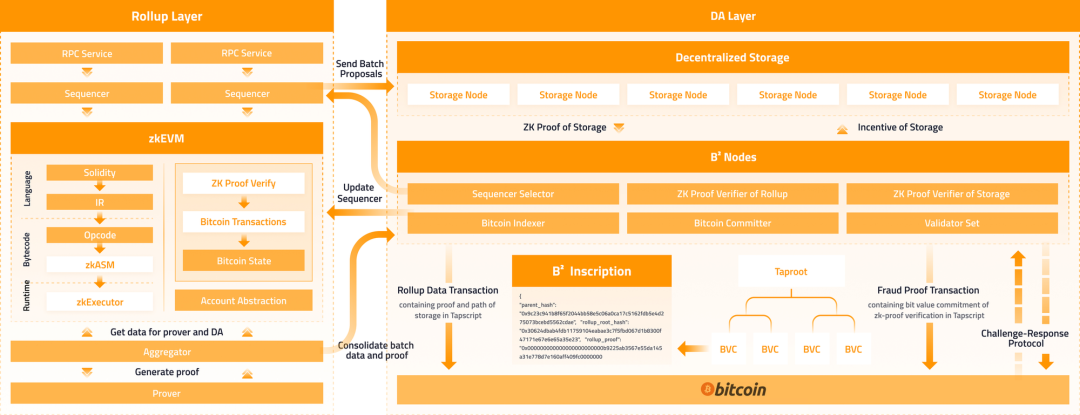

B² Network is another BTC EVM Layer2 project backed by institutions such as Hashkey Capital, OKX Ventures, and Kucoin Lab. Technically, B² shares similarities with Merlin Chain by adopting a hybrid "Optimistic ZK-Rollup" model combining ZK-Rollup and OP-Rollup. In collaboration with Polygon Labs, it implements zkEVM using the Polygon CDK framework extended to BTC. Account abstraction allows users to interact via either EVM wallets or BTC wallets, catering to both ecosystems. Since Bitcoin cannot store large data, B² has built its own DA layer called B² Node, planning to upgrade it into B² Hub—a data availability and state verification system for developers to build their own Bitcoin Rollups using Polygon CDK and B² Hub.

What sets B² Network apart from other BTC Layer2s is its broader vision—not merely being another BTC L2 but aspiring to become a central hub for Bitcoin rollups, akin to Cosmos Hub or Op Stack.

Source: https://docs.bsquared.network/architecture

B² Network launched its mainnet simultaneously with the BTC halving. Phase one of its staking airdrop has concluded, and phase two—a random airdrop—is now active. Users who bridge BTC to the B² Network mainnet may receive token airdrops upon protocol token release. There is no fixed end date; the official team states the campaign could end at any time.

BOB

BOB (Build On Bitcoin) is another BTC EVM Layer2 project funded by institutions including Castle Island and Coinbase Ventures, raising $10 million in its seed round.

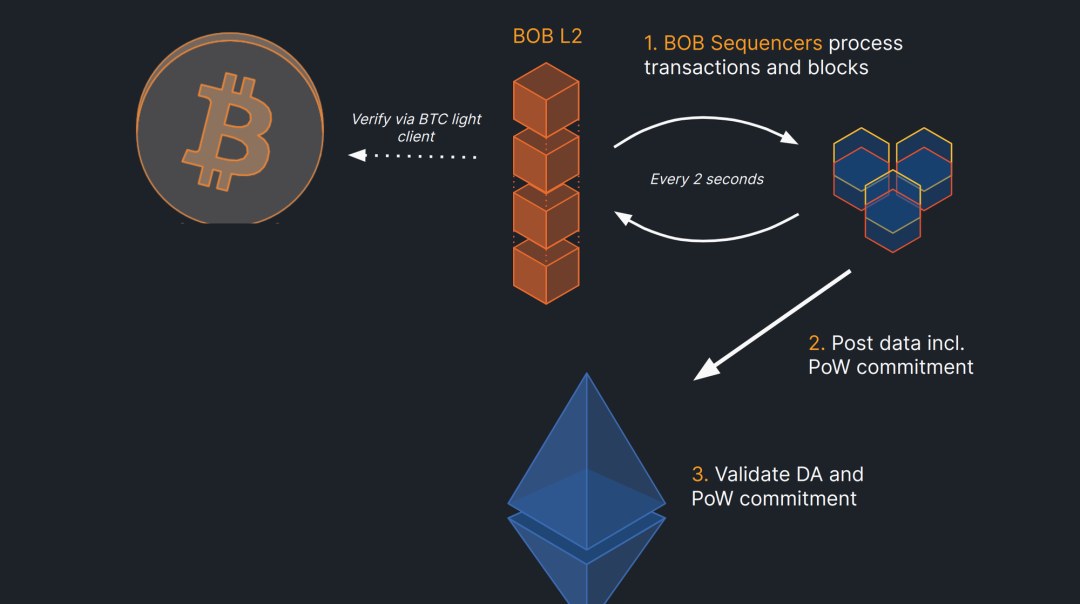

BOB's roadmap divides its technology into three phases. In phase one, the BOB L2 launches as an Ethereum OP Rollup using the OP Stack, with settlement occurring on Ethereum. It tracks Bitcoin's state via lightweight Bitcoin nodes, verifying block headers and accepting transaction inclusion proofs to enable trustless cross-chain operations.

Source: https://docs.gobob.xyz/docs/learn/bob-stack/roadmap

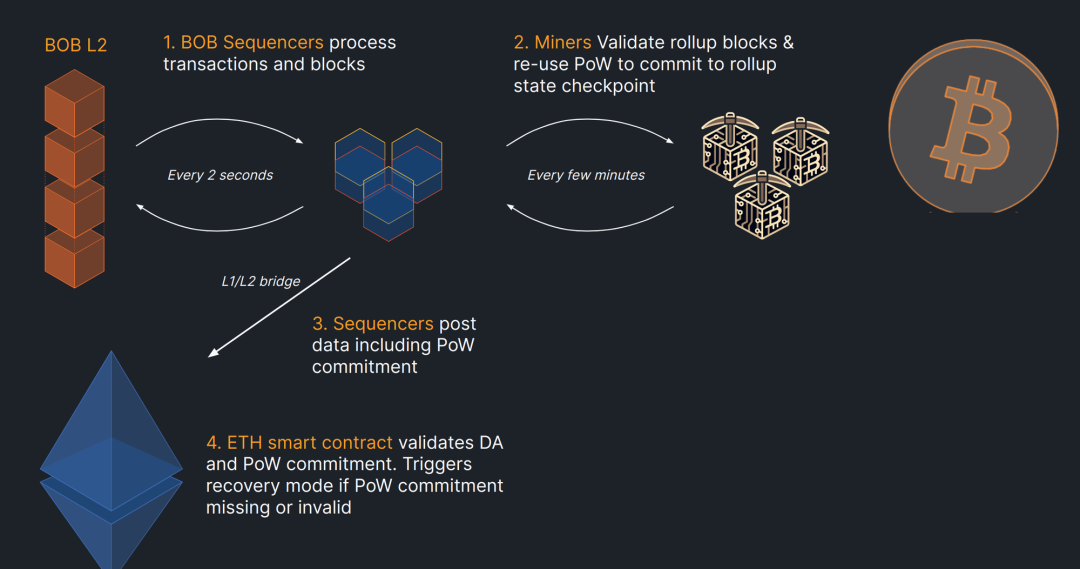

In phase two, Bitcoin's PoW security will be integrated via a new merged-mining protocol called OptiMine, decoupling block production from PoW. After the BOB sequencer processes transactions and blocks, Bitcoin miners verify the BOB Rollup state. Miners only include commitments as part of PoW if state transitions are correct, minimizing trust in the sequencer. Finally, the sequencer submits data containing PoW commitments to Ethereum, using Ethereum as the DA layer to ensure data availability.

Source: https://docs.gobob.xyz/docs/learn/bob-stack/roadmap

Phase three aims to introduce Bitcoin as the settlement layer (currently under research). Potential approaches include integrating ZK compression as part of fraud-proof mechanisms, collaborating with ZK infrastructure providers, designing BOB light clients, building bidirectional bridges, and expanding BitVM programs to achieve full BOB Rollup state verification.

These three phases illustrate BOB's evolution—from an optimistic Ethereum Rollup, to incorporating Bitcoin PoW security, and ultimately leveraging Bitcoin as a settlement layer. Through this incremental hybrid design, BOB seeks to inherit both Bitcoin's security and Ethereum's programmability, offering an innovative Layer-2 solution for the Bitcoin DeFi ecosystem.

Source: https://docs.gobob.xyz/docs/learn/bob-stack/roadmap

Currently, BOB is running its first-season points campaign, where users earn points by depositing tBTC, WBTC, stablecoins, or ETH LSTs. Following the halving event, the team announced the mainnet launch on April 24, after which the first season will end and the second season will begin, though details remain undisclosed.

Mezo

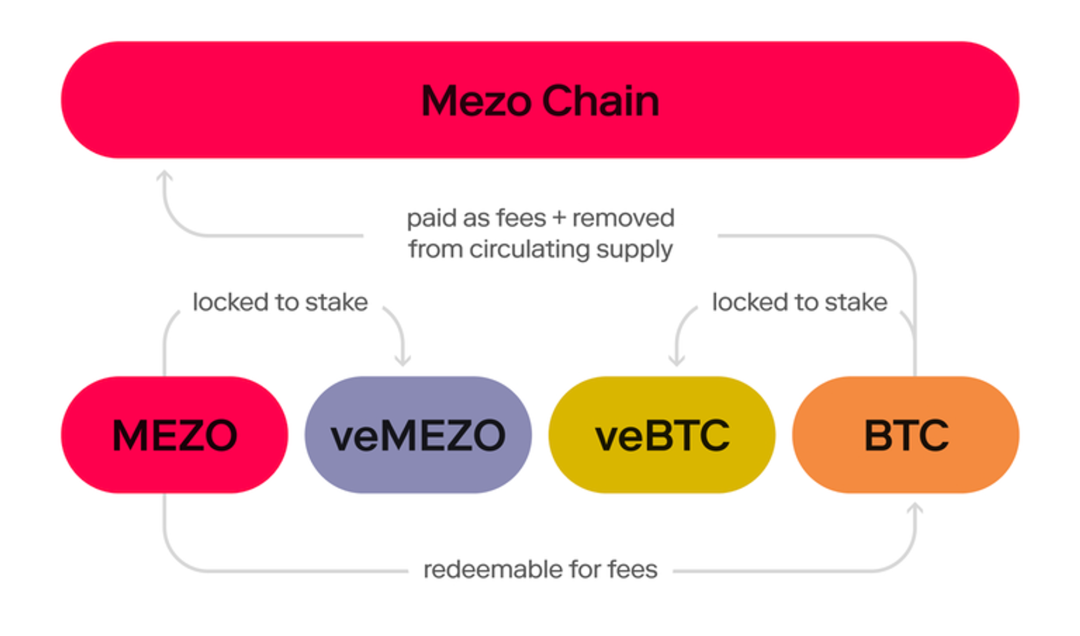

Recently announced Mezo raised $21 million in funding led by Pantera Capital, with participation from top-tier VCs including Multicoin and Hack VC. Developed by Thesis—the team behind tBTC, Bitcoin's wrapped asset—Mezo positions itself as Bitcoin’s “economic layer,” aiming to create an application ecosystem tailored to user economic needs and focusing on expanding BTC use cases. It refers to its consensus mechanism as Proof of HODL, where users secure the network by locking BTC and MEZO tokens and validating transactions via CometBFT consensus.

Similarly, Mezo is currently running a HODL points campaign, allowing users to deposit native BTC, WBTC, or tBTC to earn points. Technical details disclosed so far are limited. All deposits on Mezo are held in lock-up contracts controlled by a team multisig until bridged upon Mezo mainnet launch.

Source: https://info.mezo.org/proof-of-hodl

Author’s View

Public chain narratives have always been the grandest, highest-valued, and best-funded sector in the blockchain ecosystem. Many institutions are keenly watching and unwilling to miss this surge in Bitcoin-related momentum, launching various blockchain projects tied to Bitcoin concepts. Practically speaking, does Bitcoin really need these L2s? Or put differently, do crypto users care whether the underlying chain they use is BTC-based or EVM-based?

From the author’s perspective, the BTC-related blockchain赛道 matters less for technical implementation than for the depth of backing resources—it's essentially a market of institutional capital competition. For retail investors, it simply means another new chain, with typical speculative targets being MEMEs, DEXs, or yield farming.

Therefore, the author suggests that the best way to participate is to assess the quality of capital behind each project and get involved early in activities such as airdrops, staking, or points campaigns to obtain free tokens. Beyond that, one might only monitor whether top-tier Memecoins emerge post-mainnet launch or if there are officially endorsed Meme projects.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News